Central Bank (Individual Accountability Framework) Act 2023

| ||

Number 5 of 2023 | ||

CENTRAL BANK (INDIVIDUAL ACCOUNTABILITY FRAMEWORK) ACT 2023 | ||

CONTENTS | ||

Preliminary | ||

Section | ||

Individual accountability and standards | ||

Responsibility of persons performing pre-approval controlled functions | ||

Power of Bank to prescribe business standards | ||

Duty of responsibility and standards for individuals | ||

Amendment of Part 3 of Act of 2010 | ||

31. Agreement for prohibition notice to have effect without confirmation | ||

Amendment of Act of 1942 | ||

Amendment of Part IIIC of Act of 1942 | ||

42. Application of Part to holding companies under Part 3 of Central Bank Reform Act 2010 | ||

44. Bank may hold inquiry into suspected commission of or participation in prescribed contravention | ||

45. Notice of inquiry, submissions, attendance and adjournment | ||

51. Observance of directions imposing disqualification or conditions | ||

53. Appeal, confirmation and taking effect of decisions under this Part | ||

59. Power to order information about proceedings not to be disclosed | ||

60. Confidential information provided for purposes of inquiry not to be disclosed | ||

Insertion of Part IIID in Act of 1942 | ||

Amendment of Part VIIA of Act of 1942 | ||

Miscellaneous amendments to Act of 1942 | ||

Privileged legal material | ||

Miscellaneous amendments | ||

Savings and transitional provisions | ||

89. Investigations and suspension notices under Chapter 3 of Part 3 of Act of 2010 | ||

97. Application of section 33BI of Act of 1942 to existing panel | ||

|

Acts Referred to | ||

Central Bank (Supervision and Enforcement) Act 2013 (No. 26) | ||

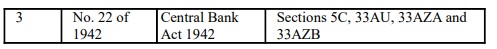

Central Bank Act 1942 (No. 22) | ||

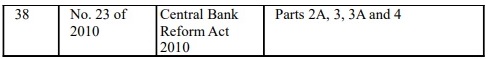

Central Bank Reform Act 2010 (No. 23) | ||

Freedom of Information Act 2014 (No. 30) | ||

| ||

Number 5 of 2023 | ||

CENTRAL BANK (INDIVIDUAL ACCOUNTABILITY FRAMEWORK) ACT 2023 | ||

An Act to amend the Central Bank Act 1942 to extend the application of the administrative sanctions procedure to persons performing controlled functions and to certain holding companies, to provide for the appointment of a panel from which appointments may be made for the purposes of certain decisions, to provide for the admissibility of business records at an inquiry, to provide for disclosure agreements, and to provide for an application for confirmation by the High Court of a decision of an inquiry under Part IIIC and a decision of the Irish Financial Services Appeals Tribunal under Part VIIA of that Act; to amend the Central Bank Reform Act 2010 to extend the regulation and supervision of financial service providers and persons performing controlled functions and pre-approval controlled functions through the introduction of business standards, conduct standards and the duty of responsibility, to provide for the independence of persons carrying out an investigation in the performance of their functions, to provide for the independence of persons to whom a function of the Head of Financial Regulation, the Central Bank or the Governor is delegated in the performance of their functions, to provide for a right of appeal to the Irish Financial Services Appeals Tribunal of a decision of the Head of Financial Regulation to confirm a suspension notice, to increase the period for which the High Court may extend the duration of a suspension notice, and to provide for an application for confirmation by the High Court of a decision of the Central Bank or the Governor to issue a prohibition notice; to amend the Central Bank (Supervision and Enforcement) Act 2013 to extend the regulation‑making power of the Central Bank to provide for arrangements that financial service providers shall adopt in relation to the allocation of responsibilities and compliance with obligations under financial services legislation; to amend the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011 ( S.I. No. 352 of 2011 ); and to provide for related matters. | ||

[9th March, 2023] | ||

Be it enacted by the Oireachtas as follows: | ||

|

PART 1 Preliminary | ||

|

Short title and commencement | ||

|

1. (1) This Act may be cited as the Central Bank (Individual Accountability Framework) Act 2023. | ||

(2) This Act shall come into operation on such day or days as the Minister for Finance may appoint by order or orders either generally or with reference to any particular purpose or provision and different days may be so appointed for different purposes or different provisions. | ||

|

Definitions | ||

|

2. In this Act— | ||

“Act of 1942” means the Central Bank Act 1942 ; | ||

“Act of 2010” means the Central Bank Reform Act 2010 ; | ||

“Act of 2013” means the Central Bank (Supervision and Enforcement) Act 2013 . | ||

|

PART 2 Individual accountability and standards | ||

|

Chapter 1 Responsibility of persons performing pre-approval controlled functions | ||

|

Amendment of section 48 of Act of 2013 | ||

|

3. Section 48 of the Act of 2013 is amended— | ||

(a) in subsection (2), by the insertion of the following paragraphs after paragraph (b): | ||

“(ba) provision specifying the aspects of a regulated financial service provider’s affairs for which a PCF holder has inherent responsibility for the purposes of section 53B of the Central Bank Reform Act 2010 ; | ||

(bb) provision specifying the aspects of a regulated financial service provider’s affairs for which responsibility is to be allocated by the regulated financial service provider to a PCF holder for the purposes of section 53B of the Central Bank Reform Act 2010 ; | ||

(bc) provision as to the arrangements described in subsection (2A) that a regulated financial service provider is to adopt;”, | ||

(b) by the insertion of the following subsection after subsection (2): | ||

“(2A) The arrangements referred to in subsection (2)(bc) are: | ||

(a) arrangements for the regulated financial service provider to allocate to PCF holders for the purposes of section 53B of the Central Bank Reform Act 2010 responsibility for aspects of its affairs specified in regulations under subsection (2)(bb); | ||

(b) arrangements for the regulated financial service provider, so as to ensure the proper conduct of its affairs, to allocate to a PCF holder for the purposes of section 53B of the Central Bank Reform Act 2010 responsibility for aspects of its affairs for which no PCF holder has inherent responsibility under regulations under subsection (2)(ba) or responsibility allocated under arrangements described in paragraph (a); | ||

(c) arrangements for the regulated financial service provider to monitor the performance of pre-approval controlled functions in relation to it; | ||

(d) arrangements to make clear the management structure that identifies the lines of authority and accountability, and specifies roles and responsibilities, in relation to the management of PCF holders and of other persons by PCF holders; | ||

(e) arrangements to make clear the governance structure determining how the regulated financial service provider and PCF holders relate to persons concerned in the ownership or control of the regulated financial service provider or representing its customers or other stakeholders; | ||

(f) arrangements for documenting arrangements referred to in paragraphs (a) to (e).”, | ||

and | ||

(c) by the insertion of the following subsection after subsection (3): | ||

“(4) In this section— | ||

‘PCF holder’ means a person performing a pre-approval controlled function in relation to the regulated financial service provider concerned; | ||

‘pre-approval controlled function’ has the meaning given by section 18 of the Central Bank Reform Act 2010 .”. | ||

|

Amendment of section 51 of Act of 2013 | ||

|

4. Section 51 of the Act of 2013 is amended, in subsection (1), by the insertion of “pre‑approval controlled functions,” after “providers,” in each place where it occurs. | ||

|

Chapter 2 Power of Bank to prescribe business standards | ||

|

Insertion of Part 2A in Act of 2010 | ||

|

5. The Act of 2010 is amended by the insertion of the following Part after Part 2: | ||

“PART 2A | ||

Powers of Bank in relation to financial service providers | ||

Business standards | ||

17A. (1) A regulated financial service provider shall comply with any standards prescribed by the Bank under subsection (2) (in this section referred to as the ‘business standards’). | ||

(2) The Bank may make regulations prescribing standards for the purpose of ensuring that in the conduct of its affairs a regulated financial service provider— | ||

(a) acts in the best interests of customers and of the integrity of the market, | ||

(b) acts honestly, fairly and professionally, and | ||

(c) acts with due skill, care and diligence. | ||

(3) The business standards shall, in particular, include standards requiring that in the conduct of its affairs the regulated financial service provider— | ||

(a) does not mislead a customer as to the advantages or disadvantages of any financial service, | ||

(b) maintains adequate financial resources, | ||

(c) controls and manages its affairs and systems (including risk management systems, internal control mechanisms and governance arrangements) sustainably, responsibly, and in a sound and prudent manner, | ||

(d) prevents, or identifies and appropriately manages, conflicts of interest, | ||

(e) arranges adequate protection for assets held by the regulated financial service provider on behalf of a customer, | ||

(f) engages and cooperates in good faith and without delay with the Bank, and with authorities that perform functions in a jurisdiction other than the State that are comparable to one or more of the functions performed by the Bank under financial services legislation, and | ||

(g) discloses to the Bank promptly, and in a manner appropriate to the circumstances, any matter relating to the regulated financial service provider of which the Bank would reasonably expect notice. | ||

(4) The Bank may prescribe in regulations under this section the systems and controls, processes, policies and procedures that regulated financial service providers are to adopt for the purpose of ensuring that they comply with the business standards. | ||

(5) Before making regulations under this section, the Bank— | ||

(a) shall consult with the Minister, and | ||

(b) may consult with such other persons as the Bank considers appropriate in the circumstances. | ||

(6) When making regulations under this section, the Bank shall have regard to the need to ensure that the business standards are effective and proportionate having regard to the nature, scale and complexity of the activities of regulated financial service providers or the class or classes of regulated financial service providers to whom the regulations apply. | ||

(7) Regulations made under this section may— | ||

(a) apply either generally or to a specified class or classes of regulated financial service providers, customers or financial services, and | ||

(b) include different provisions in relation to different classes of regulated financial service providers, customers or financial services. | ||

(8) The Bank shall give to the Minister a copy of any regulations made by it under this section as soon as practicable after the regulations are made. | ||

(9) Sections 61C and 61D of the Act of 1942 apply to regulations made under this section.”. | ||

|

Chapter 3 Duty of responsibility and standards for individuals | ||

|

Insertion of Part 3A in Act of 2010 | ||

|

6. The Act of 2010 is amended by the insertion of the following Part after Part 3: | ||

“PART 3A | ||

Duty of responsibility and conduct standards | ||

Interpretation (Part 3A) | ||

53A. For the purposes of this Part— | ||

‘common conduct standards’ shall be construed in accordance with section 53C(1); | ||

‘additional conduct standards’ shall be construed in accordance with section 53C(2). | ||

Duty of responsibility | ||

53B. (1) For the purposes of this section— | ||

(a) a person has inherent responsibility for an aspect of the affairs of a regulated financial service provider if— | ||

(i) the person performs a pre-approval controlled function in relation to the regulated financial service provider, and | ||

(ii) the aspect of its affairs is specified in relation to that function by regulations made under section 48 (2)(ba) of the Central Bank (Supervision and Enforcement) Act 2013 , | ||

and | ||

(b) a person has allocated responsibility for an aspect of the affairs of a regulated financial service provider if— | ||

(i) the person performs a pre-approval controlled function in relation to the regulated financial service provider, and | ||

(ii) responsibility for the aspect of its affairs has been allocated to the person performing that function under arrangements adopted by the regulated financial service provider in accordance with regulations made under section 48 (2)(bc) of the Central Bank (Supervision and Enforcement) Act 2013 . | ||

(2) A person who has inherent or allocated responsibility for an aspect of the affairs of a regulated financial service provider shall take any steps that it is reasonable in the circumstances for the person to take to secure that, while the person has that responsibility, the aspect of the affairs of the regulated financial service provider is conducted so as to avoid contravention by it of its obligations under financial services legislation. | ||

(3) For the purposes of subsection (2), avoiding contravention includes avoiding continuation of a contravention. | ||

Duty to take steps to meet conduct standards | ||

53C. (1) A person who performs a controlled function in relation to a regulated financial service provider shall take any steps that it is reasonable in the circumstances for the person to take to ensure that the standards set out in section 53E (referred to in this Part as the ‘common conduct standards’) are met. | ||

(2) A person who performs a pre-approval controlled function in relation to a regulated financial service provider or any other function by which the person may exercise a significant influence on the conduct of the regulated financial service provider’s affairs shall take any steps that it is reasonable in the circumstances for the person to take to ensure that the standards set out in section 53F (referred to in this Part as the ‘additional conduct standards’) are met. | ||

Relevant circumstances for purposes of sections 53B and 53C | ||

53D. In determining the circumstances that are relevant for the purposes of subsection (2) of section 53B and subsections (1) and (2) of section 53C, as they apply in the case of any person performing functions in relation to a regulated financial service provider, matters to be considered include— | ||

(a) the nature of the business of the regulated financial service provider, including its scale and complexity, | ||

(b) the functions of the person in relation to the regulated financial service provider, and the level of knowledge and experience that a person with such functions could reasonably be expected to have, | ||

(c) the level of knowledge and experience of the person, | ||

(d) the existence and application (or otherwise) of— | ||

(i) appropriate and effective systems (including risk management systems, internal control mechanisms and governance arrangements), | ||

(ii) effective oversight of any delegation of responsibilities and effective safeguards against any inappropriate delegation, and | ||

(iii) appropriate and effective procedures for identifying and remedying problems, | ||

(e) the extent to which any matter referred to in paragraph (d) was within the control or influence of the person, and | ||

(f) in the case of subsections (1) and (2) of section 53C, any guidelines published by the Bank under section 53G. | ||

Common conduct standards | ||

53E. (1) The standards referred to in section 53C(1), in the case of a person who performs a controlled function in relation to a regulated financial service provider, are— | ||

(a) that the person acts with honesty and integrity, including— | ||

(i) having regard to the legitimate interests of the regulated financial service provider, its staff, customers and other persons with whom it engages, | ||

(ii) operating without bias and preventing, or identifying and appropriately managing, conflicts of interest, | ||

(iii) not exerting pressure or influence on a customer so as to limit his or her ability to make an informed choice in relation to any financial service, | ||

(iv) not misusing or misappropriating any assets or information of the regulated financial service provider or its customers, and | ||

(v) reporting appropriately, and not impeding others from reporting, to the management of the regulated financial service provider— | ||

(I) information relevant to, or giving rise to a suspicion of, the commission of a prescribed contravention or contravention of any other legal obligation or standard imposed on the regulated financial service provider, and | ||

(II) any matter otherwise adversely affecting the activities or interests of customers, the regulated financial service provider, its related undertakings, or the financial system in the State, | ||

(b) that the person acts with due skill, care and diligence, including— | ||

(i) having appropriate knowledge of the business activities of the regulated financial service provider relevant to the controlled function, and the associated risks of those activities, | ||

(ii) having appropriate knowledge of the legal and regulatory framework, including any legal obligation or standard imposed on the regulated financial service provider, relevant to the controlled function, | ||

(iii) operating in compliance with the systems and controls, processes, policies and procedures of the regulated financial service provider and any legal obligation or standard imposed on the regulated financial service provider, | ||

(iv) acting without detriment to customers, the regulated financial service provider, its related undertakings, or the financial system in the State, | ||

(v) ensuring that any communication, including any record, provided to a customer or other person is clear, accurate, up to date and not misleading, | ||

(vi) acting appropriately in any decision-making, including collective decision-making, ensuring decisions are properly informed and exercising sound judgement, and | ||

(vii) monitoring the performance of any delegated tasks and ensuring that those tasks are appropriately performed, | ||

(c) that the person cooperates in good faith and without delay with the Bank, and with authorities that perform functions in a jurisdiction other than the State that are comparable to one or more of the functions performed by the Bank under financial services legislation, including— | ||

(i) responding to requests and requirements under financial services legislation in an open and timely manner, | ||

(ii) disclosing information or records when required to do so under financial services legislation, | ||

(iii) attending meetings and interviews when required to do so under financial services legislation, | ||

(iv) not providing false, inaccurate or misleading information, records or explanations, | ||

(v) not destroying, hiding or putting beyond reach information or records that it is reasonable for the person to expect to be required to be disclosed under financial services legislation, and | ||

(vi) not engaging in evasive, misleading or obstructive conduct, | ||

(d) that the person acts in the best interests of customers and treats them fairly and professionally, including— | ||

(i) ensuring that customers are informed in a clear manner of relevant information relating to financial services of which they ought to be aware, and not impeding the provision of relevant information to customers, | ||

(ii) communicating with customers in a timely manner having regard to the urgency of any matter and the time required by the customer to consider the relevant information, | ||

(iii) assessing the needs and circumstances of customers, including their level of knowledge and experience of financial services, their financial circumstances and the range of options available to them, and ensuring that any advice or recommendation provided to customers is appropriate and tailored to their needs and circumstances, | ||

(iv) ensuring that customers are not misled as to the advantages of any financial service, | ||

(v) acknowledging and seeking to resolve any complaints received from customers, | ||

(vi) resolving errors or mistakes affecting customers, and disclosing errors or mistakes to the customers affected in a timely manner, and | ||

(vii) not acting in a manner that is unfair to customers, | ||

and | ||

(e) that the person operates in compliance with standards of market conduct and trading venue rules to which the regulated financial service provider is subject by law and any market codes that apply to the affairs of the regulated financial service provider. | ||

(2) Nothing referred to in a subparagraph of any paragraph of subsection (1), as included in that paragraph, limits the scope of that paragraph or any other paragraph of that subsection. | ||

(3) In subsection (1), ‘related undertaking’ has the meaning given by section 3 (1) of the Central Bank (Supervision and Enforcement) Act 2013 . | ||

Additional conduct standards | ||

53F. The standards referred to in section 53C(2), in the case of a person who performs a pre-approval controlled function in relation to a regulated financial service provider or any other function by which the person may exercise a significant influence on the conduct of a regulated financial service provider’s affairs, are— | ||

(a) that the business of the regulated financial service provider is controlled effectively, | ||

(b) that the business of the regulated financial service provider is conducted in accordance with its obligations under financial services legislation, | ||

(c) that any delegated tasks are assigned to an appropriate person with effective oversight, and | ||

(d) that any information of which the Bank would reasonably expect notice in respect of the business of the regulated financial service provider is disclosed promptly and appropriately to the Bank, including information relevant to, or giving rise to a suspicion or expectation of, any of the following: | ||

(i) commission of an offence by the regulated financial service provider or a person performing a controlled function in relation to it; | ||

(ii) commission of a prescribed contravention or any other breach of obligations under financial services legislation by the regulated financial service provider or a person performing a controlled function in relation to it; | ||

(iii) concealment or deliberate destruction of evidence relating to a matter referred to in subparagraph (i) or (ii); | ||

(iv) provision of false or misleading information to the Bank relating to a matter referred to in subparagraph (i) or (ii); | ||

(v) obstruction or impeding of an investigation relating to a matter referred to in subparagraph (i) or (ii); | ||

(vi) commencement of legal proceedings by or against the regulated financial service provider arising from its obligations under financial services legislation; | ||

(vii) commencement of legal proceedings against the regulated financial service provider which may impact on its ability to continue to trade; | ||

(viii) anything that may otherwise interfere significantly with the operation of the regulated financial service provider or its compliance with its obligations under financial services legislation; | ||

(ix) a decision by the regulated financial service provider to cease to provide financial services of a particular description. | ||

Guidelines on conduct standards | ||

53G. (1) The Bank shall prepare, in such form and manner as it considers appropriate, guidelines for the purpose of providing practical guidance for persons to whom subsection (1) or (2) of section 53C applies relating to the application and operation of this Part. | ||

(2) The guidelines may include different provisions in respect of different classes of persons to whom subsection (1) or (2) of section 53C applies. | ||

(3) The Bank shall publish guidelines prepared under subsection (1)— | ||

(a) by notice in Iris Oifigiúil, and | ||

(b) on a website maintained by or on behalf of the Bank. | ||

(4) A person to whom subsection (1) or (2) of section 53C applies shall have regard to any guidelines published by the Bank under this section. | ||

Notification and training for persons subject to conduct standards | ||

53H. (1) A regulated financial service provider shall for the purpose of ensuring compliance with the common conduct standards and additional conduct standards— | ||

(a) notify persons performing a controlled function in relation to the regulated financial service provider of the common conduct standards and how they apply to a person performing that function, | ||

(b) provide training to persons performing a controlled function in relation to the regulated financial service provider to ensure that such persons have appropriate knowledge of the common conduct standards and how they apply to a person performing that function, | ||

(c) notify persons performing a pre-approval controlled function in relation to the regulated financial service provider or any other function by which the person may exercise a significant influence on the conduct of the regulated financial service provider’s affairs of the additional conduct standards and how they apply to a person performing that function, | ||

(d) provide training to persons performing a pre-approval controlled function in relation to the regulated financial service provider or any other function by which the person may exercise a significant influence on the conduct of the regulated financial service provider’s affairs to ensure that such persons have appropriate knowledge of the additional conduct standards and how they apply to a person performing that function, and | ||

(e) establish, maintain and give effect to policies on how the common conduct standards are integrated into the conduct of the affairs of the regulated financial service provider. | ||

(2) The Bank shall prepare, in such form and manner as it considers appropriate, guidelines for the purpose of providing practical guidance for regulated financial service providers relating to each of the matters referred to in subsection (1). | ||

(3) The Bank shall publish guidelines prepared under subsection (2)— | ||

(a) by notice in Iris Oifigiúil, and | ||

(b) on a website maintained by or on behalf of the Bank. | ||

Limitation of requirements to produce documents, give information or answer questions | ||

53I. Nothing in this Part requires a person— | ||

(a) to produce a document that the person could not have been compelled to produce to a court, | ||

(b) to give information that the person could not have been compelled to give to a court, | ||

(c) to answer a question that the person could not have been compelled to answer in a court, or | ||

(d) to do anything that might tend to incriminate the person.”. | ||

|

PART 3 Amendment of Part 3 of Act of 2010 | ||

|

Amendment of section 18 of Act of 2010 | ||

|

7. Section 18 of the Act of 2010 is amended— | ||

(a) in subsection (1)— | ||

(i) by the substitution of the following definition for the definition of “controlled function”: | ||

“‘controlled function’— | ||

(a) in relation to a regulated financial service provider, means a function prescribed in regulations made under section 20 as a controlled function in relation to a regulated financial service provider, and | ||

(b) in relation to a holding company, means a function prescribed in regulations made under section 20 as a controlled function in relation to a holding company;”, | ||

(ii) by the substitution of the following definition for the definition of “pre‑approval controlled function”: | ||

“‘pre-approval controlled function’— | ||

(a) in relation to a regulated financial service provider, shall be construed in accordance with section 22(1), and | ||

(b) in relation to a holding company, shall be construed in accordance with section 22(1A);”, | ||

and | ||

(iii) by the insertion of the following definitions: | ||

“‘holding company’ means any of the following established in the State: | ||

(a) a financial holding company, within the meaning given by point (20) of Article 4(1) of the Capital Requirements Regulation; | ||

(b) a mixed financial holding company, within the meaning given by point (21) of Article 4(1) of the Capital Requirements Regulation; | ||

(c) an insurance holding company, within the meaning given by Regulation 215(1) of the European Union (Insurance and Reinsurance) Regulations 2015 ( S.I. No. 485 of 2015 ); | ||

(d) an investment holding company, within the meaning of the European Union (Investment Firms) Regulations 2021 (S.I. No. 355 of 2021); | ||

‘prohibition notice’ means a notice under section 43;”, | ||

and | ||

(b) by the deletion of subsections (2) and (3). | ||

|

Definition (Chapter 2) | ||

|

8. The Act of 2010 is amended by the substitution of the following section for section 19: | ||

“19. In this Chapter, ‘relevant obligations’, in relation to a regulated financial service provider or holding company, means the obligations of the regulated financial service provider or holding company under— | ||

(a) all designated enactments and all designated statutory instruments that apply to it, | ||

(b) all codes, guidelines and notices issued by the Bank that apply to it, and | ||

(c) all other enactments and statutory instruments with which it must comply.”. | ||

|

Amendment of section 20 of Act of 2010 | ||

|

9. Section 20 of the Act of 2010 is amended— | ||

(a) in subsection (1), by the insertion of “in relation to regulated financial service providers or in relation to holding companies” after “controlled functions”, | ||

(b) in subsection (2), by the insertion of “to be a controlled function in relation to a regulated financial service provider” after “subsection (1)”, | ||

(c) by the insertion of the following subsection after subsection (2): | ||

“(2A) The Bank may prescribe a function under subsection (1) to be a controlled function in relation to a holding company if and only if the function— | ||

(a) is likely to enable the person responsible for its performance to exercise a significant influence on the conduct of the affairs of the holding company, or | ||

(b) is related to ensuring, controlling or monitoring compliance by the holding company with its relevant obligations.”, | ||

(d) in subsection (3), by the substitution of “A function that is prescribed under subsection (1) as a controlled function in relation to a regulated financial service provider and” for “A controlled function that”, | ||

(e) in subsection (4)— | ||

(i) by the substitution of “A function that is prescribed under subsection (1) as a controlled function in relation to a regulated financial service provider or in relation to a holding company” for “A controlled function”, | ||

(ii) in paragraph (b), by the insertion of “or holding company” after “provider”, and | ||

(iii) by the substitution of the following paragraph for paragraph (c): | ||

“(c) it relates to affairs of a regulated financial service provider or holding company established in the State conducted by the regulated financial service provider or holding company outside the State.”, | ||

and | ||

(f) in subsection (5), by the insertion of “or holding companies” after “providers” in both places where it occurs. | ||

|

Application of standards of fitness and probity | ||

|

10. The Act of 2010 is amended by the substitution of the following section for section 21: | ||

“21. (1) A regulated financial service provider shall not permit a person to perform a controlled function in relation to it unless a certificate of compliance with standards of fitness and probity, given by the regulated financial service provider in accordance with this section, is in force in relation to the person. | ||

(2) A holding company shall not permit a person to perform a controlled function in relation to it unless a certificate of compliance with standards of fitness and probity, given by the holding company in accordance with this section, is in force in relation to the person. | ||

(3) A certificate may be given for the purposes of subsection (1) or (2) only if— | ||

(a) the regulated financial service provider or holding company giving the certificate is satisfied on reasonable grounds that the person concerned complies with any standard of fitness and probity in a code issued under section 50, and | ||

(b) the person has agreed in writing to comply with any such standard. | ||

(4) A regulated financial service provider or holding company that has given a certificate for the purposes of subsection (1) or (2) shall revoke the certificate if it ceases to be satisfied on reasonable grounds that the person concerned complies with any standard of fitness and probity referred to in subsection (3). | ||

(5) The Bank may take into account standards of fitness and probity referred to in subsection (3) when performing its functions and exercising its powers. | ||

(6) The Bank may make regulations— | ||

(a) as to the giving of certificates for the purposes of subsections (1) and (2), and | ||

(b) as to the making of reports to the Bank by regulated financial service providers or holding companies in connection with their obligations under this section (including, in particular, reports on disciplinary action relevant to compliance with standards of fitness and probity). | ||

(7) Without prejudice to the generality of subsection (6)(a), regulations under subsection (6) may make provision as to— | ||

(a) the form and content of a certificate, | ||

(b) the period of validity of a certificate, | ||

(c) procedures, systems and checks to be adopted by regulated financial service providers or holding companies for the purposes of subsections (3)(a) and (4) or otherwise in connection with the giving or revoking of a certificate, and | ||

(d) the form and content of the agreement required by subsection (3)(b). | ||

(8) The Bank shall give to the Minister a copy of any regulations made by it under subsection (6) as soon as practicable after the regulations are made.”. | ||

|

Amendment of section 22 of Act of 2010 | ||

|

11. Section 22 of the Act of 2010 is amended— | ||

(a) in subsection (1), by the insertion of “in relation to a regulated financial service provider” after “is a pre-approval controlled function”, | ||

(b) by the insertion of the following subsection after subsection (1): | ||

“(1A) A function is a pre-approval controlled function in relation to a holding company if it is prescribed as such in regulations made pursuant to subsection (2A).”, | ||

(c) by the substitution of the following subsections for subsection (2): | ||

“(2) The Bank may by regulations prescribe a function that is a controlled function in relation to a regulated financial service provider as a pre‑approval controlled function in relation to a regulated financial service provider, if the function is one by which a person may exercise a significant influence on the conduct of a regulated financial service provider’s affairs. | ||

(2A) The Bank may by regulations prescribe a function that is a controlled function in relation to a holding company as a pre-approval controlled function in relation to a holding company, if the function is one by which a person may exercise a significant influence on the conduct of a holding company’s affairs. | ||

(2B) In prescribing a function as a pre-approval controlled function pursuant to subsection (2) or (2A), the Bank may describe or identify the function by reference to a title commonly used for a person who performs the function.”, | ||

and | ||

(d) by the substitution of the following subsections for subsections (3) and (4): | ||

“(3) Without prejudice to the generality of subsections (2) and (2A), the Bank may prescribe a controlled function as a pre-approval controlled function in relation to a regulated financial service provider, pursuant to subsection (2), or in relation to a holding company, pursuant to subsection (2A), if— | ||

(a) the person who performs the function reports directly to— | ||

(i) a person who holds an office or position mentioned in a subparagraph of subsection (4)(a) in the regulated financial service provider or holding company, or | ||

(ii) in the case of a regulated financial service provider, a person referred to in paragraph (b) or (c) of subsection (4), | ||

and | ||

(b) the Bank is satisfied that the prescription of the function as a pre‑approval controlled function— | ||

(i) is warranted on the grounds of the size or complexity of the regulated financial service provider or holding company or its business, and | ||

(ii) is necessary or prudent in order to verify the compliance by the regulated financial service provider or holding company with its relevant obligations. | ||

(4) For the purposes of subsections (2) and (2A), each of the following shall be taken to exercise a significant influence on the conduct of the affairs of the regulated financial service provider or holding company concerned (in this subsection referred to as ‘the entity’): | ||

(a) where the entity is a body corporate of a prescribed class, a person who holds, or performs the duties of, any of the following offices or positions in the entity: | ||

(i) the office of director; | ||

(ii) the office of chief executive; | ||

(iii) the office of secretary; | ||

(iv) subject to subsection (3), an office or position the holder of which reports directly to— | ||

(I) a person who holds an office referred to in subparagraph (i), (ii) or (iii) in the entity, or | ||

(II) where the entity is a regulated financial service provider, a person referred to in paragraph (b) or (c); | ||

(b) where the entity is a partnership that is a regulated financial service provider of a prescribed class, each member of the partnership; | ||

(c) where the entity is a natural person that is a regulated financial service provider of a prescribed class, that person.”. | ||

|

Amendment of section 23 of Act of 2010 | ||

|

12. Section 23 of the Act of 2010 is amended— | ||

(a) in subsection (1)— | ||

(i) by the insertion of “or holding company” after “provider”, and | ||

(ii) by the insertion of “in relation to it” after “controlled function”, | ||

(b) in subsection (2)— | ||

(i) by the insertion of “the appointment of” after “approve”, | ||

(ii) by the insertion of “or holding company” after “provider”, and | ||

(iii) by the insertion of “pre-approval” before “controlled”, | ||

(c) in subsection (6)(a), by the insertion of “or holding company” after “provider”, and | ||

(d) by the insertion of the following subsection after subsection (7): | ||

“(8) Where— | ||

(a) the Bank is considering under subsection (1) whether to approve an appointment, | ||

(b) the appointment will be to perform a pre-approval controlled function in relation to a regulated financial service provider, and | ||

(c) the person proposing to make the appointment is not yet a regulated financial service provider, | ||

subsection (2) applies as if references in that subsection to a regulated financial service provider were references to that person.”. | ||

|

Amendment of section 23A of Act of 2010 | ||

|

13. Section 23A of the Act of 2010 is amended— | ||

(a) by the substitution of the following subsection for subsection (1): | ||

“(1) A significant supervised entity (within the meaning of the SSM Framework Regulation) which is a regulated financial service provider or holding company shall not— | ||

(a) appoint a person to its management body (within the meaning of the European Union (Capital Requirements) Regulations 2014 ( S.I. No. 158 of 2014 )), or | ||

(b) make any other appointment the approval of which is subject to the exclusive competence of the ECB under Article 4(1)(e) of the SSM Regulation, | ||

unless the entity has been notified in writing by the ECB that it has approved the appointment.”, | ||

(b) in subsection (3)— | ||

(i) by the insertion of “the appointment of” after “approve”, and | ||

(ii) by the deletion of “to the management body”, | ||

and | ||

(c) by the deletion of subsection (7). | ||

|

Amendment of section 25 of Act of 2010 | ||

|

14. Section 25 of the Act of 2010 is amended— | ||

(a) in subsection (2)— | ||

(i) in paragraph (a), by the insertion of “or holding company” after “provider”, | ||

(ii) by the insertion of the following paragraph after paragraph (a): | ||

“(aa) subject to subsection (2A), if the person has performed a controlled function in relation to a regulated financial service provider or holding company within the period of 6 years immediately preceding the commencement of the investigation referred to in subsection (1),”, | ||

(iii) in paragraph (b)— | ||

(I) by the insertion of “or holding company” after “provider”, and | ||

(II) by the insertion of “in relation to it” after “function)”, | ||

and | ||

(iv) in paragraph (c)— | ||

(I) by the insertion of “or holding company” after “provider”, and | ||

(II) by the insertion of “in relation to it” after “function)”, | ||

(b) by the insertion of the following subsection after subsection (2): | ||

“(2A) Where the period from the date of commencement of paragraph (aa) of subsection (2) to the beginning of an investigation under subsection (1) is less than 6 years, that paragraph applies as if the reference to the period of 6 years were a reference to that shorter period.”, | ||

and | ||

(c) in subsection (3)— | ||

(i) in paragraph (a), by the deletion of “the part of a controlled function or any controlled function, as the case may be,”, | ||

(ii) by the substitution of the following paragraph for paragraph (c): | ||

“(c) the person has committed or participated in serious misconduct in relation to the affairs of a regulated financial service provider or holding company,”, | ||

and | ||

(iii) in paragraph (f), by the insertion of “or holding company” after “provider”. | ||

|

Notice of investigation | ||

|

15. The Act of 2010 is amended by the insertion of the following section after section 25: | ||

“25A. (1) As soon as practicable after a decision is made by the Head of Financial Regulation to conduct an investigation in accordance with this Chapter, the Head of Financial Regulation shall serve on the person to whom the investigation relates notice in writing of the investigation. | ||

(2) A notice under subsection (1) shall include— | ||

(a) a statement of the reasons for holding the opinion referred to in section 25(1)(a), | ||

(b) a copy of such material on which that opinion is based as the Head of Financial Regulation considers appropriate, and | ||

(c) a statement that a response to the contents of the notice will be taken into account if made by the person in writing within the period stated in the notice, which shall be— | ||

(i) 7 days from the date on which the notice is served, or | ||

(ii) such longer period as the Head of Financial Regulation considers necessary to provide an opportunity to respond. | ||

(3) The Head of Financial Regulation shall take such steps as he or she considers reasonable to keep the person to whom an investigation relates informed as to the progress of the investigation. | ||

(4) If an investigation is discontinued, the Head of Financial Regulation shall, as soon as practicable, serve on the person to whom the investigation relates notice in writing which— | ||

(a) states that the investigation has been discontinued, and | ||

(b) gives one or more of the following reasons for the discontinuance: | ||

(i) that the Head of Financial Regulation is no longer of the opinion that there is reason to suspect the person’s fitness and probity to perform the relevant controlled function; | ||

(ii) that the Head of Financial Regulation is no longer of the opinion that any reason to suspect the person’s fitness and probity to perform the relevant controlled function is sufficient to warrant an investigation; | ||

(iii) that the investigation has been discontinued for reasons of resources; | ||

(iv) that the investigation has been discontinued for policy reasons; | ||

(v) that the investigation has been discontinued for reasons of any other description stated in the notice.”. | ||

|

Amendment of section 26 of Act of 2010 | ||

|

16. Section 26 of the Act of 2010 is amended— | ||

(a) by the substitution of the following subsections for subsection (1): | ||

“(1) The Head of Financial Regulation may issue a notice (in this Part called a ‘suspension notice’) in relation to a person if— | ||

(a) subject to subsection (1A), the person’s fitness and probity is or has been the subject of an investigation under section 25, or | ||

(b) the Bank or the Governor has imposed a prohibition on the person under section 43 (whether or not there has been any investigation under section 25), | ||

and the Head of Financial Regulation is satisfied that it is necessary in the interests of the proper regulation of a regulated financial service provider or holding company that the person not perform the relevant controlled function, a part of the relevant controlled function, or any controlled function, while the Head of Financial Regulation, the Bank or the Governor, as the case may be, is carrying out any function in relation to the person under this Chapter or Chapter 4. | ||

(1A) In paragraph (a) of subsection (1), the reference to an investigation under section 25 does not include an investigation in the circumstances referred to in paragraph (aa) of section 25(2), unless any other paragraph of section 25(2) also applies. | ||

(1B) Where paragraph (b) of subsection (1) applies, the reference in that subsection to the relevant controlled function, or a part of the relevant controlled function, is a reference to a controlled function, or a part of a controlled function, to which the prohibition applies.”, | ||

(b) in subsection (3)— | ||

(i) by the substitution of “provider or holding company concerned” for “provider concerned”, and | ||

(ii) by the insertion of “or holding company” before “confirms”, | ||

(c) in subsection (4)— | ||

(i) in paragraph (b), by the substitution of “section 25(1)(a) or, where subsection (1)(b) of this section applies, details of the prohibition” for “section 25(1)”, | ||

(ii) by the substitution of the following paragraph for paragraph (d): | ||

“(d) shall require the suspended person and any regulated financial service provider or holding company on which a copy of the notice is served to show cause, in writing, within 5 days after service of the notice, why the suspension notice should not be confirmed, and”, | ||

and | ||

(iii) by the substitution of the following paragraph for paragraph (e): | ||

“(e) shall set out, for any regulated financial service provider or holding company on which any terms and conditions are imposed under subsection (8), the terms and conditions imposed.”, | ||

(d) in subsection (5)— | ||

(i) in paragraph (b), by the insertion of “or holding company” after “provider”, and | ||

(ii) in paragraph (c), by the insertion of “or holding company” after “provider”, | ||

(e) by the deletion of subsection (6), | ||

(f) in subsection (7), by the insertion of “or holding company” after “provider”, | ||

(g) in subsection (8)— | ||

(i) by the substitution of “any regulated financial service provider or holding company on which a copy of the notice is served” for “any regulated financial service provider concerned”, | ||

(ii) by the substitution of “including any terms and conditions” for “including any condition”, and | ||

(iii) by the substitution of “its business until it complies with the notice” for “the business of the regulated financial service provider concerned until the regulated financial service provider complies with the notice”, | ||

and | ||

(h) in subsection (9)— | ||

(i) by the insertion of “or holding company” after “provider”, and | ||

(ii) by the substitution of “as to why the suspension notice should not be confirmed” for “in relation to the fitness and probity of the suspended person concerned”. | ||

|

Amendment of section 27 of Act of 2010 | ||

|

17. Section 27 of the Act of 2010 is amended— | ||

(a) by the insertion of “or holding company” after “provider” in each place where it occurs, and | ||

(b) in subsection (2), by the substitution of “terms and conditions” for “condition”. | ||

|

Amendment of section 28 of Act of 2010 | ||

|

18. Section 28 of the Act of 2010 is amended, in paragraph (a), by the insertion of “or holding company” after “provider”. | ||

|

Amendment of section 29 of Act of 2010 | ||

|

19. Section 29 of the Act of 2010 is amended— | ||

(a) in subsection (1)— | ||

(i) by the insertion of “or holding company” after “regulated financial service provider”, | ||

(ii) by the substitution of “satisfied” for “satisfied that”, and | ||

(iii) by the substitution of the following paragraphs for paragraphs (a) to (c): | ||

“(a) (except where the suspension notice was issued in the circumstances mentioned in section 26(1)(b)) that there is still reason to suspect the person’s fitness and probity to perform the relevant controlled function, and | ||

(b) that it is necessary in the interests of the proper regulation of the regulated financial service provider or holding company that the person not perform the controlled function, the part of the controlled function, or any controlled function, while the Head of Financial Regulation, the Bank or the Governor is carrying out a function in relation to the person under this Chapter or Chapter 4,”, | ||

(b) in subsection (2), by the insertion of “or holding company” after “provider”, | ||

(c) in subsection (3)(b), by the substitution of “the condition in paragraph (a) of subsection (1), where it applies, or paragraph (b) of that subsection” for “any condition in paragraph (a), (b) or (c) of subsection (1)”, | ||

(d) by the substitution of the following subsection for subsection (4): | ||

“(4) A suspension notice that has been confirmed in accordance with subsection (1) has effect until— | ||

(a) the end of the period of 6 months from the date on which the suspension notice would otherwise have ceased to have effect under section 28(b), or | ||

(b) if sooner, the revocation of the notice or, where the suspension notice was issued in the circumstances mentioned in section 26(1)(b), the time when an application under section 45 for confirmation of the prohibition notice has been disposed of.”, | ||

(e) by the insertion of the following subsection after subsection (5): | ||

“(5A) A notice served under subsection (5) shall state that the decision to confirm the suspension notice is an appealable decision for the purposes of Part VIIA of the Act of 1942.”, | ||

(f) by the substitution of the following subsection for subsection (6): | ||

“(6) The Head of Financial Regulation may revoke a suspension notice at any time if he or she considers that it is no longer necessary in the interests of the proper regulation of the regulated financial service provider or holding company concerned that the person not perform the relevant controlled function, the relevant part of a controlled function, or any controlled function, while the Head of Financial Regulation, the Bank or the Governor is carrying out a function in relation to the person under this Chapter or Chapter 4.”, | ||

and | ||

(g) by the insertion of the following subsection after subsection (6): | ||

“(7) A decision by the Head of Financial Regulation to confirm a suspension notice is an appealable decision for the purposes of Part VIIA of the Act of 1942, and the Appeals Tribunal shall have particular regard to the need for expedition in hearing an appeal against such a decision.”. | ||

|

Amendment of section 30 of Act of 2010 | ||

|

20. Section 30 of the Act of 2010 is amended— | ||

(a) in paragraph (b)— | ||

(i) by the insertion of “or holding company” after “provider”, and | ||

(ii) by the insertion of “in relation to it” after “function” in the second place where it occurs, | ||

and | ||

(b) by the substitution of “or the regulated financial service provider or holding company” for “or regulated financial service provider”. | ||

|

Amendment of section 31 of Act of 2010 | ||

|

21. Section 31 of the Act of 2010 is amended— | ||

(a) in subsection (1), by the insertion of “or holding company” after “provider”, | ||

(b) in subsection (2), by the substitution of “6 months” for “3 months”, and | ||

(c) by the insertion of the following subsections after subsection (2): | ||

“(2A) The making of an order under subsection (2) does not prevent the making of a further order. | ||

(2B) Subject to subsection (2C), orders under subsection (2) shall not in total extend a suspension notice for more than 24 months from the end of the period of 6 months referred to in section 29(4). | ||

(2C) Where a prohibition is imposed on the suspended person under section 43, or where the suspension notice was issued following the imposition of a prohibition under section 43, subsection (2B) does not apply, but orders under subsection (2) shall not extend the suspension notice beyond the time when an application under section 45 for confirmation of the prohibition notice has been disposed of.”. | ||

|

Amendment of section 32 of Act of 2010 | ||

|

22. Section 32 of the Act of 2010 is amended in subsection (2)— | ||

(a) in paragraph (a), by the insertion of “or holding company” after “provider”, | ||

(b) in paragraph (b), by the insertion of “or former holding company” after “provider”, and | ||

(c) in paragraph (c)— | ||

(i) by the insertion of “or holding company” after “provider” in the first place where it occurs, and | ||

(ii) by the insertion of “or former holding company” after “provider” in the second place where it occurs. | ||

|

Amendment of section 39 of Act of 2010 | ||

|

23. Section 39 of the Act of 2010 is amended in subsection (2)(b)— | ||

(a) by the insertion of “or holding company” after “provider” in the first place where it occurs, and | ||

(b) by the insertion of “or former holding company” after “provider” in the second place where it occurs. | ||

|

Amendment of section 40 of Act of 2010 | ||

|

24. Section 40 of the Act of 2010 is amended by the insertion of the following subsection after subsection (3): | ||

“(4) Where the person concerned claims to be entitled to refuse to produce a document, to provide information, or to answer a question, on the grounds of legal professional privilege, the Court may, without prejudice to the generality of subsection (2), give directions as to the appointment of a person with suitable legal qualifications, possessing the level of experience, and the independence from any interest falling to be determined between the parties concerned, that the Court considers to be appropriate for the purpose of— | ||

(a) examining the material for which the person claims legal professional privilege, and | ||

(b) preparing a report for the Court with a view to assisting or facilitating the Court in deciding what action to take under this section.”. | ||

|

Head of Financial Regulation to prepare report | ||

|

25. The Act of 2010 is amended by the substitution of the following section for section 41: | ||

“41. (1) Where the Head of Financial Regulation has completed an investigation under this Chapter, he or she shall, after considering— | ||

(a) the notice under section 25A(1), | ||

(b) any relevant information or evidence gathered or received by the Head of Financial Regulation in the course of the investigation, and | ||

(c) any response made by the person to whom the investigation relates in accordance with a statement referred to in section 25A(2)(c), and any other relevant submission or statement made by the person in the course of the investigation, | ||

as soon as practicable prepare a draft report of the investigation. | ||

(2) The Head of Financial Regulation shall, as soon as practicable after preparing the draft report, serve on the person whose fitness and probity was the subject of the investigation, and any regulated financial service provider or holding company concerned— | ||

(a) a copy of the draft report, | ||

(b) a copy of this section, and | ||

(c) a notice in writing stating that the person, and any regulated financial service provider or holding company concerned, may make submissions in writing to the Head of Financial Regulation on the draft report within the period stated in the notice, which shall be— | ||

(i) 7 days from the date on which the notice is served, or | ||

(ii) such longer period as the Head of Financial Regulation considers necessary to provide an opportunity to respond. | ||

(3) The Head of Financial Regulation shall, as soon as practicable after the end of the period referred to in paragraph (c) of subsection (2), and having considered any submissions made in accordance with that paragraph, make any revisions to the draft report that in the opinion of the Head of Financial Regulation are warranted, and finalise the report. | ||

(4) The Head of Financial Regulation shall not make any recommendation, or express any opinion, in a draft report under subsection (1) or in a final report under subsection (3), as to whether any prohibition (or, if so, what prohibition) should be imposed under section 43 if the Bank or the Governor forms the opinion referred to in subsection (1) of that section. | ||

(5) The Head of Financial Regulation shall, as soon as practicable after the report has been finalised under subsection (3), provide to the Bank and the Governor, and serve on the person whose fitness and probity was the subject of the investigation, and any regulated financial service provider or holding company concerned a copy of— | ||

(a) the final report, and | ||

(b) any submissions made in accordance with paragraph (c) of subsection (2).”. | ||

|

Amendment of section 42 of Act of 2010 | ||

|

26. Section 42 of the Act of 2010 is amended— | ||

(a) by the substitution of the following definition for the definition of “prohibited person”: | ||

“‘prohibited person’ means a person who is the subject of a prohibition imposed under section 43(1).”, | ||

and | ||

(b) by the deletion of the definition of “prohibition notice”. | ||

|

Amendment of section 43 of Act of 2010 | ||

|

27. Section 43 of the Act of 2010 is amended— | ||

(a) by the substitution of the following subsection for subsection (1): | ||

“(1) If the Bank or the Governor has reasonably formed the opinion that a person is not of such fitness and probity as is appropriate to perform a particular controlled function, a specified part of a controlled function, or any controlled function, the Bank or the Governor, as the case may be, may, subject to subsections (3) and (4), impose on the person a prohibition that, as respects the controlled function, the specified part of a controlled function, or any controlled function— | ||

(a) forbids the person— | ||

(i) to carry out the function or part at all, or | ||

(ii) to carry it out otherwise than in accordance with a specified condition or conditions, | ||

(b) forbids the person— | ||

(i) to carry out the function or part in relation to a specified regulated financial service provider or holding company or specified regulated financial service providers or holding companies, | ||

(ii) to carry it out in relation to a specified class or specified classes of regulated financial service providers or holding companies, or | ||

(iii) to carry it out in relation to any regulated financial service provider or holding company, | ||

and | ||

(c) is imposed indefinitely or for a specified period.”, | ||

(b) in subsection (2)— | ||

(i) by the substitution of the following paragraph for paragraph (c): | ||

“(c) the person has committed or participated in serious misconduct in relation to the affairs of a regulated financial service provider or holding company,”, | ||

and | ||

(ii) in paragraph (f), by the insertion of “or holding company” after “provider”, | ||

(c) by the insertion of the following subsection after subsection (2): | ||

“(2A) Any finding of fact made by the Bank or the Governor for the purpose of forming the opinion referred to in subsection (1) shall be made on the balance of probabilities.”, | ||

(d) in subsection (3)— | ||

(i) by the substitution of “impose a prohibition on a person under subsection (1)” for “issue a prohibition notice in relation to a person”, | ||

(ii) in paragraph (a)(i)(I), by the substitution of “Chapter 3” for “this Chapter”, | ||

(iii) in paragraph (a)(i)(III), by the substitution of “in accordance with paragraph (c) of section 41(2)” for “(within the period specified pursuant to section 41(4)) to the Head of Financial Regulation in relation to any matter in the report”, | ||

(iv) in paragraph (a)(ii), by the substitution of “, and any person to whom subsection (3A) applies,” for “and any regulated financial service provider concerned”, and | ||

(v) by the substitution of the following paragraphs for paragraphs (b) and (c): | ||

“(b) the person and any person to whom subsection (3A) applies— | ||

(i) have access to any material taken into account by the Bank or the Governor for the purpose of ensuring that the proposed decision is consistent and proportionate, having regard to other decisions under subsection (1), and | ||

(ii) have been afforded such a hearing in relation to the proposed decision as is necessary to do justice in the circumstances, | ||

and | ||

(c) the Bank or the Governor, as the case may be, is satisfied that the imposition of the prohibition is necessary in the circumstances.”, | ||

(e) by the insertion of the following subsection after subsection (3): | ||

“(3A) In relation to the imposition of a prohibition on any person, this subsection applies— | ||

(a) where the person is subject to a suspension notice, to any regulated financial service provider or holding company on which the Head of Financial Regulation is required by section 26(5) to serve a copy of the notice, | ||

(b) to any regulated financial service provider or holding company in relation to which, to the knowledge of the Bank or the Governor, as the case may be, the person performs a controlled function to which the prohibition would apply, | ||

(c) to any regulated financial service provider or holding company which, to the knowledge of the Bank or the Governor, as the case may be, proposes to appoint the person to perform in relation to it a controlled function to which the prohibition would apply, and | ||

(d) to any regulated financial service provider or holding company which the Bank or the Governor, as the case may be, has reason to believe is considering the appointment of the person to perform in relation to it a controlled function to which the prohibition would apply.”, | ||

(f) in subsection (4), by the substitution of “impose a prohibition under subsection (1)” for “issue a prohibition notice”, | ||

(g) by the insertion of the following subsections after subsection (4): | ||

“(4A) A prohibition under subsection (1) shall be imposed by a notice in writing (in this Part referred to as a ‘prohibition notice’). | ||

(4B) Where more than one prohibition is imposed under subsection (1) on the same person, they may be imposed by the same prohibition notice. | ||

(4C) A prohibition notice— | ||

(a) shall be served on the prohibited person, and | ||

(b) may be served on a regulated financial service provider or holding company. | ||

(4D) Subject to section 46, a prohibition notice does not take effect unless confirmed on an application under section 45.”, | ||

(h) by the deletion of subsections (5) to (7), | ||

(i) by the substitution of the following subsection for subsection (9): | ||

“(9) A regulated financial service provider or holding company shall not permit a prohibited person to perform a controlled function in relation to it if doing so would require the person to contravene a prohibition notice served on it.”, | ||

and | ||

(j) by the deletion of subsection (12). | ||

|

Repeal of section 44 of Act of 2010 | ||

|

28. Section 44 of the Act of 2010 is repealed. | ||

|

Amendment of section 45 of Act of 2010 | ||

|

29. Section 45 of the Act of 2010 is amended— | ||

(a) by the substitution of the following subsections for subsection (1): | ||

“(1) As soon as practicable after the service of a prohibition notice on the prohibited person, the Bank or the Governor, as the case may be, shall, subject to section 46, make an application to the Court for confirmation of the notice. | ||

(1A) An application under subsection (1) may be made on an ex parte basis provided that the prohibited person informs the Bank or the Governor, as the case may be, in writing that he or she agrees to the application being made ex parte.”, | ||

(b) in subsection (3), by the substitution of “this section” for “subsection (1)”, | ||

(c) in subsection (4), by the substitution of “this section” for “subsection (1)”, | ||

(d) in subparagraph (ii) of subsection (5)(a), by the substitution of “regulated financial service provider or holding company” for “regulated financial institution”, | ||

(e) in subsection (6)— | ||

(i) by the substitution of the following paragraph for paragraph (a): | ||

“(a) a serious and significant error, or a series of errors which, taken together, are serious and significant,”, | ||

and | ||

(ii) in paragraph (c), by the substitution of “opinion” for “finding”, | ||

and | ||

(f) in subsection (10), by the insertion of “or the Governor” after “the Bank”. | ||

|

Application to vary or revoke prohibition notice | ||

|

30. The Act of 2010 is amended by the insertion of the following section after section 45: | ||

“45A. (1) An application for an order varying or setting aside a prohibition notice confirmed under section 45 may be made to the Court— | ||

(a) by the Bank or the Governor, as the case may be, or | ||

(b) by the prohibited person. | ||

(2) An application made by the Bank or the Governor under subsection (1) may be made on an ex parte basis provided that the prohibited person informs the Bank or the Governor, as the case may be, in writing that he or she agrees to the application being made ex parte. | ||

(3) If on an application under this section the Court is satisfied that— | ||

(a) since the confirmation of the prohibition notice under section 45, there has been a change in circumstances, and | ||

(b) the change is such that, if an application for confirmation were made at the time of the application under subsection (1), a different decision would be taken in relation to the application for confirmation, | ||

the Court may make an order setting aside or, subject to subsection (4), varying the prohibition notice as it thinks fit. | ||

(4) An order under this section may not vary a prohibition notice in a way that, in the opinion of the Court, would make it more onerous to the prohibited person. | ||

(5) Subsections (2), (3), (7) and (11) of section 45 shall apply for the purposes of an application or the making of an order under this section subject to any necessary modifications.”. | ||

|

Agreement for prohibition notice to have effect without confirmation | ||

|

31. The Act of 2010 is amended by the substitution of the following section for section 46: | ||

“46. (1) Where the Bank or the Governor has issued a prohibition notice, the prohibited person and any person to whom subsection (2) applies may agree in writing with the Bank or the Governor, as the case may be, to comply with the prohibition notice for such period as is agreed. | ||

(2) Where the prohibited person is performing a controlled function at the time of issue of the prohibition notice, this subsection applies to the regulated financial service provider or holding company in relation to which that person is at that time performing the controlled function. | ||

(3) Where a prohibition notice is the subject of an agreement under this section— | ||

(a) the prohibition notice has effect for the period agreed in the agreement, | ||

(b) sections 43(4D) and 45 do not apply (and section 43(8) and (9) apply accordingly), and | ||

(c) if the prohibited person performs a controlled function in contravention of the prohibition notice, or if a person to whom subsection (2) applies who is a party to the agreement permits the prohibited person to perform a controlled function in contravention of the prohibition notice, the Head of Financial Regulation may apply ex parte to the Court for an order directing the person concerned to comply with the notice. | ||

(4) If the Bank or the Governor, as the case may be, considers that there is no further need to continue a prohibition notice that is the subject of an agreement under this section, the Bank or the Governor, as the case may be, may terminate the agreement by written notice to the other parties. | ||

(5) On termination of an agreement under subsection (4) the prohibition notice ceases to have effect.”. | ||

|

Amendment of section 48 of Act of 2010 | ||

|

32. Section 48 of the Act of 2010 is amended, in subsection (2), by the insertion of “or a holding company” after “provider”. | ||

|

Service of notices and other documents | ||

|

33. The Act of 2010 is amended by the insertion of the following section after section 49: | ||

“49A. For the purposes of the giving or service of notices or other documents under this Part, section 61G of the Act of 1942 applies as if references in that section to the Bank included references to the Governor and the Head of Financial Regulation.”. | ||

|

Amendment of section 51 of Act of 2010 | ||

|

34. Section 51 of the Act of 2010 is amended, in subsection (1), by the insertion of “or holding companies” after “providers”. | ||

|

Amendment of section 52 of Act of 2010 | ||

|

35. Section 52 of the Act of 2010 is amended— | ||

(a) in subsection (1), by the insertion of “, subject to subsection (4),” after “discretion”, | ||

(b) in subsection (2), by the insertion of “, subject to subsection (4),” after “discretion”, | ||

(c) in subsection (2A), by the insertion of “, subject to subsection (4),” after “discretion”, and | ||

(d) by the insertion of the following subsections after subsection (3): | ||

“(4) The powers conferred by subsections (1), (2) and (2A) shall be exercised so as to secure the following: | ||

(a) that the function of conducting an investigation in accordance with Chapter 3 where a person has formed the opinion referred to in section 25(1), and any function exercisable under that Chapter for or in connection with the conducting of such an investigation, is not performed by the person who forms that opinion; | ||

(b) that any function under section 29(1) to (3) in relation to a suspension notice is not performed by a person who performed a function under section 26 in relation to the notice; | ||

(c) that any function under section 43 in connection with the imposition of a prohibition in circumstances to which subparagraph (i) of subsection (3)(a) of that section applies is not performed by a person involved in the investigation referred to in that subparagraph. | ||

(5) Paragraph (a) of subsection (4) does not prevent the person who forms the opinion referred to in that paragraph from exercising functions, of management, advice or otherwise, that do not affect the independence of the investigation.”. | ||

|

Independence of decision-makers | ||

|

36. The Act of 2010 is amended by the insertion of the following section after section 52: | ||

“52A.(1) This section applies to the following functions: | ||

(a) deciding whether to issue a suspension notice; | ||

(b) deciding whether to confirm a suspension notice; | ||

(c) deciding whether to impose a prohibition under section 43. | ||

(2) The Bank shall not rely on any contract of service or contract for services with a person exercising a function to which this section applies in any way that may affect the person’s independence in the exercise of that function.”. | ||

|

PART 4 Amendment of Act of 1942 | ||

|

Chapter 1 Amendment of Part IIIC of Act of 1942 | ||

|

Amendment of section 33AN of Act of 1942 | ||

|

37. Section 33AN of the Act of 1942 is amended— | ||

(a) in subsection (1)— | ||

(i) by the insertion of the following definitions: | ||

“‘authorised officer’ means, subject to subsection (1A), a person appointed under section 24 of the Central Bank (Supervision and Enforcement) Act 2013 ; | ||

‘controlled function’ has the meaning given by section 18 (1) of the Central Bank Reform Act 2010 ; | ||

‘relevant controlled function’ in relation to participation in the commission by a regulated financial service provider of a prescribed contravention, means a controlled function in relation to the regulated financial service provider;”, | ||

(ii) by the deletion of the definition of “decision of the Bank”, and | ||

(iii) by the deletion of the definition of “disqualification direction”, | ||

and | ||

(b) by the insertion of the following subsections after subsection (1): | ||

“(1A) Where, under a provision of a designated enactment other than section 24 of the Central Bank (Supervision and Enforcement) Act 2013 , or under a designated statutory instrument, the Bank has power to appoint authorised officers with powers exercisable in relation to a prescribed contravention, references in this Part to an authorised officer include, in relation to that prescribed contravention, references to an authorised officer so appointed. | ||

(1B) For the purposes of this Part, a person is concerned in the management of a body corporate or other entity if the person is in any way involved in directing, managing or administering the affairs of the body or other entity.”. | ||

|

Amendment of section 33ANC of Act of 1942 | ||

|

38. Section 33ANC of the Act of 1942 is amended— | ||

(a) in subsection (1)(b), by the substitution of “participation by a person, while concerned” for “participation, by a person concerned”, | ||

(b) in subsection (2), by the substitution of the following paragraph for paragraph (c): | ||

“(c) a reference in this Part to performing a controlled function in relation to a regulated financial service provider includes a reference to being concerned in the management of a financial holding company, mixed-financial holding company or mixed‑activity holding company.”, | ||

(c) by the insertion of the following subsection after subsection (2): | ||

“(2A) References in subsections (1) and (2) to a financial holding company, mixed financial holding company or mixed-activity holding company do not include references to a regulated financial service provider which is such a company.”, | ||

(d) by the deletion of subsection (3), and | ||

(e) in subsection (4), by the deletion of paragraph (b). | ||

|

Amendment of section 33ANE of Act of 1942 | ||

|

39. Section 33ANE of the Act of 1942 is amended— | ||

(a) in subsection (1), by the insertion of “shall not include any regulated financial service provider but, subject to that,” after “ ‘designated entity’ ”, | ||

(b) in subsection (2), by the substitution of the following paragraph for paragraph (b): | ||

“(b) participation by a person, while concerned in the management of a designated entity, in the commission by the designated entity of such a contravention.”, | ||

(c) in subsection (3), by the substitution of the following paragraph for paragraph (c): | ||