S.I. No. 485/2015 - European Union (Insurance and Reinsurance) Regulations 2015.

CONTENTS | ||

Part 1 | ||

PRELIMINARY | ||

1. Citation and commencement | ||

2. Object of Regulations | ||

3. Interpretation | ||

4. Exclusion of small undertakings | ||

5. Exclusion of mutual undertakings | ||

6. Exclusions: insurance forming part of social security system | ||

7. Exclusions: non-life operations | ||

8. Exclusions: assistance activity | ||

9. Exclusions: life operations and organisations | ||

10. Exclusions: reinsurance | ||

11. Exclusion of insurance and reinsurance undertakings closing their activity | ||

Part 2 | ||

AUTHORISATION | ||

12. Prohibition against carrying on insurance etc. without authorisation | ||

13. Deemed authorisation for existing undertakings | ||

14. Authorisation | ||

15. Scope of authorisation | ||

16. Ancillary risks | ||

17. Conditions for authorisation | ||

18. Close links | ||

19. Policy conditions and scales of premiums | ||

20. Economic requirements of the market | ||

21. Scheme of operations | ||

22. Shareholders and members with qualifying holdings | ||

23. Prior consultation with authorities of other Member States | ||

24. Decision on application for authorisation | ||

25. Notification of authorisation to EIOPA | ||

26. Power to impose conditions | ||

Part 3 | ||

SUPERVISION | ||

27. Main objective of supervision | ||

28. Financial stability and pro-cyclicality | ||

29. General principles of supervision | ||

30. Scope of supervision | ||

31. Transparency and accountability | ||

32. Prohibition of refusal of reinsurance and retrocession contracts | ||

33. Supervision of branches established in another Member State | ||

34. Information to be provided for supervisory purposes | ||

35. Annual and quarterly information etc.: transitional deadlines | ||

36. Directors’ accuracy certificates | ||

37. Auditor’s report | ||

38. Supervisory review process | ||

39. Capital add-on | ||

40. Supervision of outsourced functions and activities | ||

41. Transfer of insurance portfolio | ||

42. Transfer of reinsurance portfolio | ||

Part 4 | ||

CONDITIONS GOVERNING BUSINESS | ||

Chapter 1 | ||

Responsibilities of board of directors | ||

43. Responsibility of board of directors | ||

Chapter 2 | ||

System of governance | ||

44. General governance requirements | ||

45. Fit and proper requirements | ||

46. Risk management | ||

47. Own risk and solvency assessment | ||

48. Internal control | ||

49. Internal audit | ||

50. Actuarial function | ||

51. Outsourcing | ||

Chapter 3 | ||

Public disclosure | ||

52. Report on solvency and financial condition: contents | ||

53. Report on solvency and financial condition: transitional deadlines | ||

54. Information for EIOPA | ||

55. Report on solvency and financial condition: applicable principles | ||

56. Report on solvency and financial condition: updates and additional voluntary information | ||

57. Report on solvency and financial condition: policy and approval | ||

58. Annual reports | ||

Chapter 4 | ||

Qualifying holdings | ||

59. Interpretation | ||

60. Acquisitions | ||

61. Disposals | ||

62. Insurance and reinsurance undertakings to provide information on certain acquisitions and disposals | ||

63. Period for assessment of proposed acquisition | ||

64. Assessment of proposed acquisitions | ||

65. Bank to co-operate with other authorities | ||

66. Bank may fix period for completion of acquisition | ||

67. Notice of Bank’s decision | ||

68. Bank may oppose certain acquisitions | ||

69. Decision to oppose proposed acquisition to be appealable | ||

70. Circumstances in which proposed acquisition may not be completed | ||

71. Effect of Companies Act 2014 | ||

72. Insurance and reinsurance undertakings to provide information about shareholdings etc | ||

73. Power of Court to make certain orders | ||

74. Determination of voting rights for certain purposes | ||

75. Notifications submitted before 1 January 2016 | ||

Part 5 | ||

EXCHANGE OF INFORMATION AND PROMOTION OF SUPERVISORY CONVERGENCE | ||

76. Co-operation with EIOPA | ||

77. Exchange of information with other authorities | ||

Part 6 | ||

DUTIES OF AUDITORS | ||

78. Duties of auditors | ||

Part 7 | ||

PURSUIT OF LIFE AND NON-LIFE ACTIVITY | ||

79. Pursuit of life and non-life insurance activity | ||

80. Separation of life and non-life insurance management | ||

81. Linked life insurance and non-life insurance undertakings | ||

Part 8 | ||

VALUATION OF ASSETS AND LIABILITIES, TECHNICAL PROVISIONS, OWN FUNDS, SOLVENCY CAPITAL REQUIREMENT, MINIMUM CAPITAL REQUIREMENT AND INVESTMENT RULES | ||

Chapter 1 | ||

Valuation of assets and liabilities | ||

82. Valuation of assets and liabilities | ||

Chapter 2 | ||

Technical provisions | ||

83. General provisions | ||

84. Calculation of technical provisions | ||

85. Extrapolation of relevant risk-free interest rate term structure | ||

86. Matching adjustment to relevant risk-free interest rate term structure | ||

87. Calculation of matching adjustment | ||

88. Volatility adjustment to relevant risk-free interest rate term structure | ||

89. Technical information produced by EIOPA | ||

90. Review of long-term guarantee measures and measures on equity risk | ||

91. Other elements to be taken into account in calculation of technical provisions | ||

92. Valuation of financial guarantees and contractual options included in insurance and reinsurance contracts | ||

93. Segmentation | ||

94. Recoverables from reinsurance contracts and special purpose vehicles | ||

95. Data quality and application of approximations, including case-by-case approaches, for technical provisions | ||

96. Comparison against experience | ||

97. Appropriateness of level of technical provisions | ||

98. Increase of technical provisions | ||

99. Transitional measure on risk-free interest rates | ||

100. Transitional deduction | ||

101. Phasing-in plan on transitional measures | ||

Chapter 3 | ||

Own funds | ||

Determination of own funds | ||

102. Own funds | ||

103. Basic own funds | ||

104. Ancillary own funds | ||

105. Supervisory approval of ancillary own funds | ||

106. Surplus funds | ||

Classification of own funds | ||

107. Characteristics and features used to classify own funds into tiers | ||

108. Main criteria for classification into tiers | ||

109. Transitional provision for own funds | ||

110. Classification of own funds into tiers | ||

111. Classification of specific insurance own-fund items | ||

Eligibility of own funds | ||

112. Eligibility and limits applicable to Tiers 1, 2 and 3 | ||

Chapter 4 | ||

Solvency Capital Requirement | ||

General provisions | ||

113. General | ||

114. Calculation of Solvency Capital Requirement | ||

115. Frequency of calculation etc. | ||

Standard formula | ||

116. Structure of standard formula | ||

117. Design of Basic Solvency Capital Requirement | ||

118. Transitional provisions on standard parameters | ||

119. Calculation of Basic Solvency Capital Requirement | ||

120. Calculation of equity risk sub-module: symmetric adjustment mechanism | ||

121. Capital requirement for operational risk | ||

122. Adjustment for loss-absorbing capacity of technical provisions and deferred taxes | ||

123. Simplifications in standard formula | ||

124. Significant deviations from assumptions underlying standard formula calculation | ||

Internal model | ||

125. General provisions for approval of full and partial internal models | ||

126. Specific provisions for approval of partial internal models | ||

127. Policy for changing full and partial internal models | ||

128. Responsibilities of board of directors | ||

129. Reversion to standard formula | ||

130. Non-compliance | ||

131. Significant deviations from assumptions underlying standard formula calculation | ||

132. Use test | ||

133. Statistical quality standards | ||

134. Calibration standards | ||

135. Profit and loss attribution | ||

136. Validation standards | ||

137. Documentation standards | ||

138. External models and data | ||

Chapter 5 | ||

Minimum Capital Requirement | ||

139. General provisions | ||

140. Calculation of Minimum Capital Requirement | ||

Part 9 | ||

INVESTMENTS | ||

141. Prudent person principle | ||

142. Limits on freedom of investment | ||

143. Investment in tradable securities or other financial instruments based on repackaged loans | ||

Part 10 | ||

UNDERTAKINGS IN DIFFICULTY OR IN IRREGULAR SITUATION | ||

144. Identification and notification of deteriorating financial conditions by undertaking | ||

145. Non-compliance with technical provisions | ||

146. Non-compliance with Solvency Capital Requirement | ||

147. Derogation from non-compliance with Solvency Capital Requirement | ||

148. Non-compliance with Minimum Capital Requirement | ||

149. Transitional arrangements regarding compliance with Minimum Capital Requirement | ||

150. Prohibition of free disposal of assets located within the State | ||

151. Supervisory powers in deteriorating financial conditions | ||

152. Recovery plan and finance scheme | ||

153. Withdrawal of authorisation | ||

Part 11 | ||

RIGHT OF ESTABLISHMENT AND FREEDOM TO PROVIDE SERVICES | ||

Chapter 1 | ||

Establishment by insurance undertakings | ||

154. Branch establishment in another Member State | ||

155. Communication of information to other Member State | ||

156. Change of particulars where the State is home Member State | ||

157. Branch establishment in the State | ||

158. Change of particulars where the State is host Member State | ||

159. Rights acquired by existing branches | ||

Chapter 2 | ||

Freedom of insurance undertakings to provide services | ||

General | ||

160. Prior notification of intention to do business in another Member State | ||

161. Changes in nature of risks or commitments | ||

162. Carrying on business in the State | ||

163. Rights acquired by existing insurance undertakings | ||

Third party motor vehicle liability | ||

164. Compulsory insurance on third party motor vehicle liability | ||

Chapter 3 | ||

Competencies of supervisory authorities of host Member State | ||

Insurance | ||

165. Language | ||

166. Prior notification and prior approval | ||

167. Non-compliant insurance undertakings authorised in another Member State | ||

168. Non-compliant insurance undertakings authorised by Bank | ||

169. Advertising | ||

170. Taxes on premiums | ||

Reinsurance | ||

171. Non-compliant reinsurance undertakings authorised in another Member State | ||

172. Non-compliance by reinsurance undertaking authorised by Bank | ||

Chapter 4 | ||

Statistical information | ||

173. Statistical information on cross-border activities | ||

Chapter 5 | ||

Winding-up proceedings | ||

174. Winding-up of insurance undertakings | ||

175. Winding-up of reinsurance undertakings | ||

Part 12 | ||

BRANCHES OF UNDERTAKINGS ESTABLISHED OUTSIDE EUROPEAN UNION | ||

Chapter 1 | ||

Taking up of business | ||

176. Principle of authorisation and conditions | ||

177. Scheme of operations of branch | ||

178. Transfer of portfolio | ||

179. Technical provisions | ||

180. Solvency Capital Requirement and Minimum Capital Requirement | ||

181. Advantages to undertakings authorised in more than one Member State | ||

182. Accounting, prudential and statistical information and undertakings in difficulty | ||

183. Separation of non-life and life business | ||

184. Withdrawal of authorisation for undertakings authorised in more than one Member State | ||

Chapter 2 | ||

Reinsurance | ||

185. Equivalence | ||

186. Principle and conditions for conducting reinsurance activity | ||

Chapter 3 | ||

Subsidiaries | ||

187. Information from Member States to Commission and EIOPA | ||

188. Third-country treatment of Community insurance and reinsurance undertakings | ||

Part 13 | ||

APPLICABLE LAW AND CONDITIONS OF DIRECT INSURANCE CONTRACTS | ||

Chapter 1 | ||

Compulsory insurance | ||

189. Related obligations | ||

Chapter 2 | ||

Conditions of insurance contracts and scales of premiums | ||

190. Non-life insurance | ||

191. Life insurance | ||

Chapter 3 | ||

Information for policy holders | ||

Non-life insurance | ||

192. General information for policy holders | ||

193. Additional information in case of non-life insurance offered under right of establishment or freedom to provide services | ||

Life insurance | ||

194. Cancellation period | ||

Part 14 | ||

PROVISIONS SPECIFIC TO NON-LIFE INSURANCE | ||

Chapter 1 | ||

General provision | ||

195. Policy conditions | ||

Chapter 2 | ||

Community co-insurance | ||

196. Community co-insurance operations | ||

197. Rules that are to apply only to leading insurance undertaking | ||

198. Participation in Community co-insurance | ||

199. Technical provisions | ||

200. Statistical data | ||

201. Treatment of co-insurance contracts in winding-up proceedings | ||

202. Exchange of information between supervisory authorities | ||

203. Co-operation on implementation | ||

Chapter 3 | ||

Legal expenses insurance | ||

204. Scope of Chapter | ||

205. Separate contracts | ||

206. Management of claims | ||

207. Free choice of lawyer | ||

208. Exception to free choice of lawyer | ||

209. Arbitration | ||

210. Conflict of interest | ||

Chapter 4 | ||

Health insurance | ||

211. Health insurance as an alternative to social security | ||

Part 15 | ||

PROVISIONS SPECIFIC TO LIFE INSURANCE | ||

212. Premiums for new business | ||

Part 16 | ||

PROVISIONS SPECIFIC TO REINSURANCE | ||

213. Finite reinsurance | ||

214. Special purpose vehicles | ||

Part 17 | ||

SUPERVISION OF INSURANCE AND REINSURANCE UNDERTAKINGS IN A GROUP | ||

Chapter 1 | ||

Definitions and scope | ||

215. Definitions | ||

216. Cases of application of group supervision | ||

217. Scope of group supervision | ||

218. Ultimate parent undertaking at EU level | ||

219. Ultimate parent undertaking at national level | ||

220. Parent undertaking covering several Member States | ||

Chapter 2 | ||

Financial position | ||

Group solvency | ||

221. Supervision of group solvency | ||

222. Frequency of calculation | ||

223. Choice of method of calculation | ||

224. Inclusion of proportional share | ||

225. Elimination of double use of eligible own funds | ||

226. Elimination of the intra-group creation of capital | ||

227. Valuation | ||

228. Related insurance undertakings and reinsurance undertakings | ||

229. Intermediate insurance holding companies | ||

230. Equivalence concerning related third-country insurance undertakings and reinsurance undertakings | ||

231. Related credit institutions, investment firms and financial institutions | ||

232. Non-availability of necessary information | ||

233. Calculation method 1 (default method): accounting consolidation-based method | ||

234. Group internal model | ||

235. Transitional measure on partial internal group model | ||

236. Group capital add-on | ||

237. Calculation method 2 (alternative method): deduction and aggregation method | ||

238. Group solvency of insurance holding company or mixed financial holding company | ||

239. Subsidiaries of insurance or reinsurance undertaking: conditions | ||

240. Subsidiaries of insurance or reinsurance undertaking: decision on application | ||

241. Subsidiaries of insurance or reinsurance undertaking: determination of Solvency Capital Requirement | ||

242. Subsidiaries of an insurance or reinsurance undertaking: non-compliance with the Solvency and Minimum Capital Requirements | ||

243. Subsidiaries of insurance or reinsurance undertaking: end of derogations for subsidiary | ||

244. Subsidiaries of an insurance holding company or mixed financial holding company | ||

Risk concentration and intra-group transactions | ||

245. Supervision of risk concentration | ||

246. Supervision of intra-group transactions | ||

Risk management and internal control | ||

247. Supervision of system of governance | ||

Chapter 3 | ||

Measures to facilitate group supervision | ||

248. Group supervisor | ||

249. Rights and duties of group supervisor and other supervisors | ||

250. Co-operation and exchange of information between supervisory authorities | ||

251. Consultation between supervisory authorities | ||

252. Requests from group supervisor to other supervisory authorities | ||

253. Co-operation with authorities responsible for credit institutions and investment firms | ||

254. Professional secrecy and confidentiality | ||

255. Access to information | ||

256. Annual and quarterly information: transitional deadlines | ||

257. Verification of information | ||

258. Group solvency and financial condition report | ||

259. Group solvency and financial condition report: transitional deadlines | ||

260. Group structure | ||

261. Persons running insurance holding companies and mixed financial holding companies to be fit and proper | ||

262. Qualifications, reputation and experience of persons running insurance holding companies and mixed financial holding companies | ||

263. Enforcement measures | ||

Chapter 4 | ||

Third countries | ||

264. Parent undertakings outside EU: verification of equivalence | ||

265. Parent undertakings outside EU: equivalence | ||

266. Parent undertakings outside EU: absence of equivalence | ||

267. Parent undertakings outside EU: levels | ||

Chapter 5 | ||

Mixed-activity insurance holding companies | ||

268. Intra-group transactions | ||

Part 18 | ||

REORGANISATION AND WINDING-UP OF INSURANCE UNDERTAKINGS | ||

Chapter 1 | ||

Scope and definitions | ||

269. Scope of Part | ||

270. Definitions | ||

Chapter 2 | ||

Reorganisation measures | ||

271. Adoption of reorganisation measures — applicable law | ||

272. Information to supervisory authorities | ||

273. Publication of decisions on reorganisation measures | ||

274. Information to known creditors — right to lodge claims | ||

Chapter 3 | ||

Winding-up proceedings | ||

275. Commencement of winding-up proceedings | ||

276. Information to supervisory authorities | ||

277. Treatment of insurance claims | ||

278. Provisions supplementary to Regulation 277 | ||

279. Withdrawal of authorisation | ||

280. Publication of decisions on winding-up proceedings | ||

281. Information to known creditors | ||

282. Right to lodge claims | ||

283. Languages and form | ||

284. Regular information to creditors | ||

Chapter 4 | ||

Common provisions | ||

285. Effects on certain contracts and rights | ||

286. Rights in rem of third parties | ||

287. Reservation of title | ||

288. Set-off | ||

289. Regulated markets | ||

290. Regulations 286 to 289: savings | ||

291. Detrimental acts | ||

292. Protection of third-party purchasers | ||

293. Lawsuits pending | ||

294. Administrators and liquidators: proof of appointment | ||

295. Administrators and liquidators: exercise of powers in other Member States | ||

296. Administrators and liquidators: exercise of powers in the State | ||

297. Registration in public register | ||

298. Professional secrecy | ||

299. Treatment of branches of third-country insurance undertakings | ||

Part 19 | ||

OTHER PROVISIONS | ||

Chapter 1 | ||

Offences | ||

300. Offence of making false or misleading application for authorisation | ||

301. Advertising offence | ||

302. Offence of providing false or misleading information | ||

303. Liability of officers of undertaking for offences committed by undertaking | ||

304. Summary proceedings | ||

305. Penalties for offences | ||

306. Continuing contravention | ||

Chapter 2 | ||

Co-operation, fees and notices | ||

307. Co-operation between Member States and Commission | ||

308. Bank’s power to charge fees | ||

309. Service of notice or other document by Bank | ||

Chapter 3 | ||

Amendments | ||

310. Insurance Act 1936 | ||

311. Amendments of Central Bank Act 1942 | ||

312. Amendment of Insurance Act 1964 | ||

313. Amendment of Insurance (No. 2) Act 1983 | ||

314. Amendments of Insurance Act 1989 | ||

315. Amendment of Central Bank Act 1997 | ||

316. Amendment of Companies Act 2014 | ||

317. Amendment of European Communities (Fourth Motor Insurance Directive) Regulations 2003 | ||

318. Transitional provisions | ||

SCHEDULE 1 | ||

Classes of non-life insurance | ||

Part 1 | ||

Classes | ||

Part 2 | ||

Authorisations for more than one class of insurance | ||

SCHEDULE 2 | ||

Classes of non-life insurance | ||

SCHEDULE 3 | ||

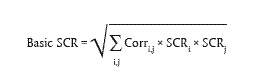

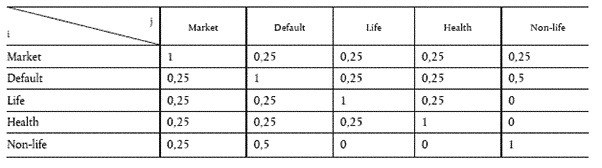

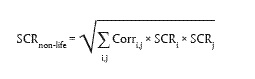

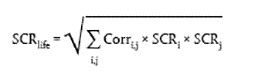

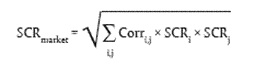

Solvency Capital Requirement (SCR) Standard Formula | ||

Part 1 | ||

Calculation of Basic Solvency Capital Requirement | ||

Part 2 | ||

Calculation of non-life underwriting risk module | ||

Part 3 | ||

Calculation of life underwriting risk module | ||

Part 4 | ||

Calculation of market risk module | ||

S.I. No. 485 of 2015 | ||

EUROPEAN UNION (INSURANCE AND REINSURANCE) REGULATIONS 2015 | ||

Notice of the making of this Statutory Instrument was published in | ||

“Iris Oifigiúil” of 10th November, 2015. | ||

I, MICHAEL NOONAN, Minister for Finance, in exercise of the powers conferred on me by section 3 of the European Communities Act 1972 (No. 27 of 1972) and for the purpose of giving effect to Directive 2009/138/EC of the European Parliament and of the Council of 25 November 20091 as amended by Directive 2011/89/EU of the European Parliament and of the Council of 16 November 20112 , Directive 2012/23/EU of the European Parliament and of the Council of 12 September 20123 , Council Directive 2013/23/EU of 13 May 20134 , Directive 2013/58/EU of the European Parliament and of the Council of 11 December 20135 and Directive 2014/51/EU of the European Parliament and of the Council of 16 April 20146 , hereby make the following Regulations: | ||

Part 1 | ||

PRELIMINARY | ||

Citation and commencement | ||

1. (1) These Regulations may be cited as the European Union (Insurance and Reinsurance) Regulations 2015. | ||

(2) Subject to paragraph (3), these Regulations come into operation on 1 January 2016. | ||

(3) So far as is necessary to secure compliance by the State with the obligations imposed by Article 308a of the Directive, and for the purposes of Regulation 4(7), these Regulations come into operation on the day after they are made. | ||

Object of Regulations | ||

2. The object of these Regulations is to give effect to the Directive. | ||

Interpretation | ||

3. In these Regulations, unless the context otherwise requires— | ||

“Act of 1942” means the Central Bank Act 1942 (No. 22 of 1942); | ||

“Act of 2010” means the Central Bank Reform Act 2010 (No. 23 of 2010); | ||

“Act of 2013” means the Central Bank (Supervision and Enforcement) Act 2013 (No. 26 of 2013); | ||

“Act of 2014” means the Companies Act 2014 (No. 38 of 2014); | ||

“annual quantitative templates” mean the annual templates referred to in Article 304(1)(d) of Commission Delegated Regulation (EU) 2015/35; | ||

“annual summary of the regular supervisory report” means the summary report referred to in Article 312(3) of Commission Delegated Regulation (EU) 2015/35; | ||

“authorisation” means an authorisation granted (or deemed to be granted) by the Bank under these Regulations or (but only where the context requires) an authorisation granted (or deemed to be granted) by a supervisory authority of a Member State other than the State in accordance with Article 14 of the Directive, and “authorised” shall be construed accordingly; | ||

“Bank” means Central Bank of Ireland; | ||

“board of directors” includes a committee of management or other directing body of a society registered under the Industrial and Provident Societies Acts 1893 to 2014 or the Friendly Societies Acts 1896 to 2014; | ||

“branch” means an agency or a branch of an insurance undertaking or reinsurance undertaking which is located in the territory of a Member State other than its home Member State, and any permanent presence of an undertaking in a Member State other than its home Member State shall be treated in the same way as a branch, even where that presence does not take the form of a branch but consists merely of an office managed by the staff of the undertaking or by a person who is independent but has permanent authority to act for the undertaking as an agency would; | ||

“captive insurance undertaking” means an insurance undertaking owned either by— | ||

(a) a financial undertaking other than an insurance undertaking or reinsurance undertaking or a group of insurance undertakings or reinsurance undertakings, or | ||

(b) an undertaking which is not a financial undertaking, | ||

the purpose of which is to provide insurance cover exclusively for the risks of the undertaking or undertakings to which it belongs or of an undertaking or undertakings of the group of which it is a member; | ||

“captive reinsurance undertaking” means a reinsurance undertaking owned either by— | ||

(a) a financial undertaking other than an insurance undertaking or reinsurance undertaking or a group of insurance undertakings or reinsurance undertakings, or | ||

(b) an undertaking which is not a financial undertaking, | ||

the purpose of which is to provide reinsurance cover exclusively for the risks of the undertaking or undertakings to which it belongs or of an undertaking or undertakings of the group of which it is a member; | ||

“close links” means a situation in which 2 or more natural or legal persons are linked by control or participation, or a situation in which 2 or more natural or legal persons are permanently linked to one and the same person by a control relationship; | ||

“Commission” means European Commission; | ||

“Commission Delegated Regulation (EU) 2015/35” means Commission Delegated Regulation (EU) 2015/35 of 10 October 2014 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II)7 ; | ||

“concentration risk” means all risk exposures with a loss potential which is large enough to threaten the solvency or the financial position of insurance undertakings and reinsurance undertakings; | ||

“control” means the relationship between a parent undertaking and a subsidiary undertaking, as set out in Article 1 of Directive 83/349/EEC, or a similar relationship between any natural or legal person and an undertaking; | ||

“Court” means High Court; | ||

“credit institution” has the meaning given by Article 4(1) of Directive 2006/48/EC; | ||

“credit risk” means the risk of loss or of adverse change in the financial situation, resulting from fluctuations in the credit standing of issuers of securities, counterparties and any debtors to which insurance undertakings or reinsurance undertakings are exposed, in the form of counterparty default risk, or spread risk, or market risk concentrations; | ||

“the Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking up and pursuit of the business of Insurance and Reinsurance (Solvency II) as amended by Directive 2011/89/EU of the European Parliament and of the Council of 16 November 20111, Directive 2012/23/EU of the European Parliament and of the Council of 12 September 20122, Council Directive 2013/23/EU of 13 May 20133, Directive 2013/58/EU of the European Parliament and of the Council of 11 December 20134 and Directive 2014/51/EU of the European Parliament and of the Council of 16 April 20145; | ||

“Directive 73/239/EEC” means the First Council Directive 73/239/EEC of 24 July 1973 on the coordination of laws, regulations and administrative provisions relating to the taking-up and pursuit of the business of direct insurance other than life assurance8 ; | ||

“Directive 78/660/EEC” means the Fourth Council Directive of 25 July 1978 based on Article 54(3)(g) of the Treaty on the annual accounts of certain types of companies9 ; | ||

“Directive 83/349/EEC” means the Seventh Council Directive 83/349/EEC of 13 June 1983 based on Article 54(3)(g) of the Treaty on consolidated accounts10 ; | ||

“Directive 84/5/EEC” means the Second Council Directive 84/5/EEC of 30 December 1983 on the approximation of the laws of the Member States relating to insurance against civil liability in respect of the use of motor vehicles11 ; | ||

“Directive 85/611/EEC” means Council Directive 85/611/EEC of 20 December 1985 on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in transferable securities (UCITS)12 ; | ||

“Directive 98/78/EC” means Directive 98/78/EC of the European Parliament and of the Council of 27 October 1998 on the supplementary supervision of insurance undertakings in an insurance group13 ; | ||

“Directive 2000/26/EC” means Directive 2000/26/EC of the European Parliament and of the Council of 16 May 2000 on the approximation of the laws of the Member States relating to insurance against civil liability in respect of the use of motor vehicles and amending Council Directives 73/239/EEC and 88/357/EEC (Fourth motor insurance Directive)14 ; | ||

“Directive 2002/13/EC” means Directive 2002/13/EC of the European Parliament and of the Council of 5 March 2002 amending Council Directive 73/239/EEC as regards the solvency margin requirements for non-life insurance undertakings15 ; | ||

“Directive 2002/83/EC” means Directive 2002/83/EC of the European Parliament and of the Council of 5 November 2002 concerning life assurance16 ; | ||

“Directive 2002/87/EC” means Directive 2002/87/EC of the European Parliament and of the Council of 16 December 2002 on the supplementary supervision of credit institutions, insurance undertakings and investment firms in a financial conglomerate and amending Council Directives 73/239/EEC, 79/267/EEC, 92/49/EEC, 92/96/EEC, 93/6/EEC and 93/22/EEC, and Directives 98/78/EC and 2000/12/EC of the European Parliament and of the Council17 ; | ||

“Directive 2004/39/EC” means Directive 2004/39/EC of the European Parliament and of the Council of 21 April 2004 on markets in financial instruments, amending Council Directives 85/611/EEC and 93/6/EEC and Directive 2000/12/EC of the European Parliament and of the Council and repealing Council Directive 93/22/EEC18 ; | ||

“Directive 2004/109/EC” means Directive 2004/109/EC of the European Parliament and of the Council of 15 December 2004 on the harmonisation of transparency requirements in relation to information about issuers whose securities are admitted to trading on a regulated market and amending Directive 2001/34/EC19 ; | ||

“Directive 2005/68/EC” means Directive 2005/68/EC of the European Parliament and of the Council of 16 November 2005 on reinsurance and amending Council Directives 73/239/EEC, 92/49/EEC as well as Directives 98/78/EC and 2002/83/EC20 ; | ||

“Directive 2006/48/EC” means Directive 2006/48/EC of the European Parliament and of the Council of 14 June 2006 relating to the taking-up and pursuit of the business of credit institutions21 ; | ||

“diversification effects” means the reduction in the risk exposure of insurance undertakings and reinsurance undertakings and groups related to the diversification of their business, resulting from the fact that the adverse outcome from one risk can be off-set by a more favourable outcome from another risk, where those risks are not fully correlated; | ||

“EBA” means the European Supervisory Authority (European Banking Authority) established by Regulation (EU) No 1093/2010 of the European Parliament and of the Council of 24 November 2010 establishing a European Supervisory Authority (European Banking Authority), amending Decision No 716/2009/EC and repealing Commission Decision 2009/78/EC22 ; | ||

“EIOPA” means the European Supervisory Authority (European Insurance and Occupational Pensions Authority) established by Regulation (EU) No 1094/2010; | ||

“ESRB” means the European Systemic Risk Board established by Regulation (EU) No 1092/2010 of the European Parliament and of the Council of 24 November 2010 on European Union macro-prudential oversight of the financial system and establishing a European Systemic Risk Board23 ; | ||

“establishment”, in relation to an insurance undertaking or a reinsurance undertaking, means its head office or any of its branches; | ||

“external credit assessment institution” means a credit rating agency that is registered or certified in accordance with Regulation (EC) No 1060/2009 of the European Parliament and of the Council or a central bank issuing credit ratings which are exempt from that Regulation24 ; | ||

“financial services legislation” has the meaning assigned to it by section 3(1) of the Act of 2013; | ||

“financial undertaking” means any of the following entities: | ||

(a) a credit institution, or a financial institution or an ancillary services undertaking within the meaning of Article 4(5) and (21) of Directive 2006/48/EC respectively; | ||

(b) an insurance undertaking or a reinsurance undertaking, or an insurance holding company within the meaning of Regulation 215(1); | ||

(c) an investment firm; | ||

(d) a mixed financial holding company within the meaning of Article 2(15) of Directive 2002/87/EC; | ||

“financial year”, in relation to an undertaking, means the period in respect of which the accounts of the undertaking are made up, whether the period is a year or not; | ||

“function”, within a system of governance, means an internal capacity to undertake practical tasks and includes the risk management function, the compliance function, the internal audit function and the actuarial function; | ||

“group” has the meaning given by Regulation 215(1); | ||

“home Member State” means— | ||

(a) for non-life insurance, the Member State in which the head office of the insurance undertaking covering the risk is situated; | ||

(b) for life insurance, the Member State in which the head office of the insurance undertaking covering the commitment is situated; | ||

(c) for reinsurance, the Member State in which the head office of the reinsurance undertaking is situated; | ||

“host Member State” means the Member State, other than the home Member State, in which an insurance undertaking or reinsurance undertaking has a branch or provides services; and for this purpose, in relation to life and non-life insurance, the Member State in which an insurance undertaking “provides services” means, respectively, the Member State of the commitment or the Member State in which the risk is situated, where that commitment or risk is covered by the insurance undertaking, or a branch, situated in another Member State; | ||

“industrial assurance business” has the meaning assigned to it by section 3 of the Insurance Act 1936 (No. 45 of 1936); | ||

“the Insurance Acts” means the Insurance Acts 1909 to 2009, regulations made under those Acts and regulations relating to insurance made under the European Communities Act 1972 (No. 27 of 1972); | ||

“insurance undertaking” means a person who has received authorisation to carry on non-life insurance or life insurance and references to “non-life insurance undertaking” and “life insurance undertaking” shall be construed accordingly; | ||

“intra-group transaction” means any transaction by which an insurance undertaking or reinsurance undertaking relies either directly or indirectly on other undertakings within the same group or on any natural or legal person linked to the undertakings within that group by close links, for the fulfilment of an obligation, whether or not contractual, and whether or not for payment; | ||

“investment firm” has the meaning given by Article 4(1)(1) of Directive 2004/39/EC; | ||

“large risks” means— | ||

(a) risks classified under classes 4, 5, 6, 7, 11 and 12 in Part 1 of Schedule 1; | ||

(b) risks classified under classes 14 and 15 in Part 1 of Schedule 1, where the policy holder is engaged professionally in an industrial or commercial activity or in one of the liberal professions, and the risks relate to such activity; | ||

(c) risks classified under classes 3, 8, 9, 10, 13 and 16 in Part 1 of Schedule 1 and risks insured for professional associations, joint ventures or temporary groupings in so far as the policy holder exceeds the limits of at least 2 of the following criteria: | ||

(i) a balance-sheet total of €6.2 million in assets; | ||

(ii) a net turnover, within the meaning of Fourth Council Directive 78/660/EEC of 25 July 1978 based on Article 54(3)(g) of the Treaty on the annual accounts of certain types of companies25 , of €12.8 million; | ||

(iii) an average number of 250 employees during the financial year; | ||

and if the policy holder belongs to a group of undertakings for which consolidated accounts within the meaning of Directive 83/349/EEC are drawn up, the criteria set out in paragraph (c) shall be applied on the basis of the consolidated accounts; | ||

“legal expenses insurance undertaking” shall be construed in accordance with Regulation 204; | ||

“life insurance” means activities of the classes in Schedule 2; | ||

“liquidity risk” means the risk that an insurance undertaking or reinsurance undertaking is unable to realise investments and other assets in order to settle its financial obligations when they fall due; | ||

“market risk” means the risk of loss or of adverse change in the financial situation, resulting, directly or indirectly, from fluctuations in the level and in the volatility of market prices of assets, liabilities and financial instruments; | ||

“Member State” means a Member State of the European Union and, where relevant, includes a contracting party to the Agreement on the European Economic Area signed at Oporto on 2 May 1992 (as adjusted by the Protocol signed at Brussels on 17 March 1993), as amended; | ||

“Member State in which the risk is situated” means any of the following: | ||

(a) the Member State in which the property is situated, where the insurance relates either to buildings or to buildings and their contents, in so far as the contents are covered by the same insurance policy; | ||

(b) the Member State of registration, where the insurance relates to vehicles of any type; | ||

(c) the Member State where the policy holder took out the policy in the case of policies of a duration of 4 months or less covering travel or holiday risks, whatever the class concerned; | ||

(d) in all cases not explicitly covered by paragraph (a), (b) or (c), the Member State in which either of the following is situated: | ||

(i) the habitual residence of the policy holder; | ||

(ii) if the policy holder is a legal person, that policy holder’s establishment to which the contract relates; | ||

“Member State of the commitment” means the Member State in which either of the following is situated: | ||

(a) the habitual residence of the policy holder; | ||

(b) if the policy holder is a legal person, that policy holder’s establishment, to which the contract relates; | ||

“Minister” means Minister for Finance; | ||

“national bureau” means a national insurers’ bureau as defined in Article 1(3) of Council Directive 72/166/EEC of 24 April 1972 on the approximation of the laws of Member States relating to insurance against civil liability in respect of the use of motor vehicles, and to the enforcement of the obligation to insure against such liability26 ; | ||

“national guarantee fund” means the body referred to in Article 1(4) of Second Council Directive 84/5/EEC of 30 December 1983 on the approximation of the laws of the Member States relating to insurance against civil liability in respect of the use of motor vehicles27 ; | ||

“non-life insurance” means activities of the classes in Part 1 of Schedule 1; | ||

“operational risk” means the risk of loss arising from inadequate or failed internal processes, or from personnel and systems, or from external events; | ||

“outsourcing” means an arrangement of any form between an insurance undertaking or reinsurance undertaking and a service provider, whether a supervised entity or not, by which that service provider performs a process, a service or an activity, whether directly or by sub outsourcing, which would otherwise be performed by the insurance undertaking or reinsurance undertaking itself; | ||

“own risk and solvency assessment report” means the report submitted in accordance with Regulation 47(9); | ||

“parent undertaking” means a parent undertaking within the meaning of Article 1 of Directive 83/349/EEC; | ||

“participation”, in relation to an undertaking, means the ownership, direct or by way of control, of 20% or more of the voting rights or capital of the undertaking; | ||

“probability distribution forecast” means a mathematical function that assigns to an exhaustive set of mutually exclusive future events a probability of realisation; | ||

“qualifying holding”, in relation to an undertaking, means a direct or indirect holding in the undertaking which represents 10% or more of the capital or of the voting rights or which makes it possible to exercise a significant influence over the management of the undertaking; | ||

“quarterly quantitative templates” mean the quarterly templates referred to in Article 304(1)(d) of Commission Delegated Regulation (EU) 2015/35; | ||

“regular supervisory report” means the report referred to in Article 304(1)(b) of Commission Delegated Regulation (EU) 2015/35; | ||

“regulated market” means either of the following: | ||

(a) in the case of a market situated in a Member State, a regulated market /as defined in Article 4(1)(14) of Directive 2004/39/EC; or | ||

(b) in the case of a market situated in a third country, a financial market which fulfils the following conditions: | ||

(i) it is recognised by the home Member State of the insurance undertaking and meets requirements comparable to those under Directive 2004/39/EC; | ||

(ii) the financial instruments dealt in on that market are of a quality comparable to that of the instruments dealt in on the regulated market or markets of the home Member State; | ||

“Regulation (EC) No 593/2008” means Regulation (EC) No 593/2008 of the European Parliament and of the Council of 17 June 2008 on the law applicable to contractual obligations (Rome I)28 ; | ||

“Regulation (EU) No 1094/2010” means Regulation (EU) No 1094/2010 of the European Parliament and of the Council of 24 November 2010 establishing a European Supervisory Authority (European Insurance and Occupational Pensions Authority), amending Decision No 716/2009/EC and repealing Commission Decision 2009/79/EC29 ; | ||

“reinsurance” means— | ||

(a) the activity consisting in accepting risks ceded by an insurance undertaking or third-country insurance undertaking, or by another reinsurance undertaking or third-country reinsurance undertaking, or | ||

(b) in the case of the association of underwriters known as Lloyd’s, the activity consisting in accepting risks, ceded by any member of Lloyd’s, by an insurance undertaking or reinsurance undertaking other than the association of underwriters known as Lloyd’s; | ||

“reinsurance undertaking” means a person who has received authorisation to carry on reinsurance only; | ||

“risk measure” means a mathematical function which assigns a monetary amount to a given probability distribution forecast and increases monotonically with the level of risk exposure underlying that probability distribution forecast; | ||

“risk-mitigation techniques” means all techniques which enable insurance undertakings and reinsurance undertakings to transfer part or all of their risks to another party; | ||

“special purpose vehicle” means any undertaking, whether incorporated or not, other than an existing insurance undertaking or reinsurance undertaking, which assumes risks from insurance undertakings or reinsurance undertakings and which fully funds its exposure to such risks through the proceeds of a debt issuance or any other financing mechanism where the repayment rights of the providers of such debt or financing mechanism are subordinated to the reinsurance obligations of such an undertaking; | ||

“subsidiary undertaking” means any subsidiary undertaking within the meaning of Article 1 of Directive 83/349/EEC, including subsidiaries of such an undertaking; | ||

“supervisory authority” means a national authority empowered by law to supervise insurance undertakings or reinsurance undertakings; | ||

“supervisory review process” shall be construed in accordance with Regulation 38(7); | ||

“third country” means a country that is not a Member State; | ||

“third-country insurance undertaking” means an undertaking which has its head office in a third country but would require authorisation as an insurance undertaking in accordance with Article 14 of the Directive if it had its head office in a Member State; | ||

“third-country reinsurance undertaking” means an undertaking which has its head office in a third country but would require authorisation as a reinsurance undertaking in accordance with Article 14 of the Directive if it had its head office in a Member State; | ||

“underwriting risk” means the risk of loss or of adverse change in the value of insurance liabilities, due to inadequate pricing and provisioning assumptions. | ||

Exclusion of small undertakings | ||

4. (1) Without prejudice to Regulations 5 to 9 and subject to paragraphs (2), (3) and (5), these Regulations do not apply to an undertaking (other than an undertaking carrying on reinsurance only) which meets all of the following conditions: | ||

(a) the annual gross written premium income of the undertaking does not exceed €5 million; | ||

(b) the total of the undertaking’s technical provisions, gross of the amounts recoverable from reinsurance contracts and special purpose vehicles, as referred to in Regulation 83 does not exceed €25 million; | ||

(c) where the undertaking belongs to a group, the total of the technical provisions of the group, gross of the amounts recoverable from reinsurance contracts and special purpose vehicles, does not exceed €25 million; | ||

(d) the business of the undertaking does not include insurance or reinsurance activities covering liability, credit and suretyship insurance risks, other than any that constitute ancillary risks within the meaning of Regulation 16; | ||

(e) the business of the undertaking does not include reinsurance operations exceeding €0.5 million of its gross written premium income or €2.5 million of its technical provisions gross of the amounts recoverable from reinsurance contracts and special purpose vehicles, or more than 10% of its gross written premium income or more than 10% of its technical provisions gross of the amounts recoverable from reinsurance contracts and special purpose vehicles. | ||

(2) In the case of an undertaking to which, by virtue of paragraph (1), these Regulations do not apply— | ||

(a) if any of the amounts set out in paragraph (1) is exceeded for 3 consecutive years these Regulations apply to the undertaking from the beginning of the next year, and | ||

(b) if the condition set out in paragraph (1)(d) ceases to be met and for as long as it is not met, these Regulations apply. | ||

(3) By way of derogation from paragraph (1), these Regulations apply to an undertaking seeking authorisation to pursue insurance or reinsurance activities in respect of which the annual gross written premium income or technical provisions gross of the amounts recoverable from reinsurance contracts and special purpose vehicles are expected to exceed the amounts in paragraph (1) within the next 5 years. | ||

(4) These Regulations cease to apply to an undertaking if the Bank verifies that— | ||

(a) the conditions set out in paragraph (1) have been met for the previous 3 consecutive years, and | ||

(b) those conditions are expected to be met for the next 5 years. | ||

(5) Paragraph (1) does not apply to an undertaking which conducts business outside the State through a branch or pursuant to the freedom to provide services under Regulations 154 to 163. | ||

(6) Paragraphs (1) to (5) do not prevent any undertaking from applying for authorisation or continuing to be authorised under these Regulations. | ||

(7) The Bank may require an undertaking which expects to meet the conditions in this Regulation to notify the Bank accordingly in such manner, and at such time, as may be determined by the Bank and published on its website. | ||

Exclusion of mutual undertakings | ||

5. (1) These Regulations do not apply to a mutual undertaking (in this Regulation referred to as the “ceding undertaking”) which pursues non-life insurance activities and which has concluded with another mutual undertaking (in this Regulation referred to as the “accepting undertaking”) an agreement which provides for the full reinsurance of the insurance policies issued by the ceding undertaking or under which the accepting undertaking is to meet the liabilities arising under such policies in the place of the ceding undertaking. | ||

(2) These Regulations do apply to the accepting undertaking. | ||

Exclusions: insurance forming part of social security system | ||

6. These Regulations do not apply to insurance forming part of a statutory system of social security. | ||

Exclusions: non-life operations | ||

7. As far as non-life insurance is concerned, these Regulations do not apply to the following operations: | ||

(a) capital redemption operations; | ||

(b) operations of provident and mutual benefit institutions whose benefits vary according to the resources available and in which the contributions of the members are determined on a flat rate basis; | ||

(c) operations carried out by organisations not having a legal personality with the purpose of providing mutual cover for their members without there being any payment of premiums or constitution of technical reserves; | ||

(d) export credit insurance operations for the account of or guaranteed by the State, or where the State is the insurer. | ||

Exclusions: assistance activity | ||

8. These Regulations do not apply to an assistance activity which meets the conditions set out in Article 6 of the Directive. | ||

Exclusions: life operations and organisations | ||

9. As far as life insurance is concerned, these Regulations do not apply to the following operations and organisations: | ||

(a) operations of provident and mutual-benefit institutions whose benefits vary according to the resources available and which require each of their members to contribute at the appropriate flat rate; | ||

(b) operations carried out by organisations, other than insurance undertakings or reinsurance undertakings, whose object is to provide benefits for employed or self-employed persons belonging to an undertaking or group of undertakings, or a trade or group of trades, in the event of death or survival or of discontinuance or curtailment of activity, whether or not the commitments arising from such operations are fully covered at all times by mathematical provisions; | ||

(c) organisations which undertake to provide benefits solely in the event of death, where the amount of such benefits does not exceed the average funeral costs for a single death or where the benefits are provided in kind. | ||

Exclusions: reinsurance | ||

10. (1) As far as reinsurance is concerned, these Regulations do not apply to the activity of reinsurance conducted or fully guaranteed by the government of a Member State when that government is acting, for reasons of substantial public interest, in the capacity of reinsurer of last resort, including in circumstances where such a role is required by a situation in the market in which it is not feasible to obtain adequate commercial cover. | ||

(2) These Regulations do not apply to reinsurance undertakings which by 10 December 2007 ceased to conduct new reinsurance contracts and exclusively administer their existing portfolio in order to terminate their activity. | ||

Insurance and reinsurance undertakings closing their activity | ||

11. (1) Without prejudice to Regulation 10(2), an insurance undertaking or reinsurance undertaking to which this paragraph applies and which before 1 January 2016 ceases to conduct new insurance or reinsurance contracts and exclusively administers its existing portfolio in order to terminate its activity shall not be subject to Regulations 12 and 14 to 268 until the date arrived at under paragraph (2) or (3) where either— | ||

(a) the undertaking has satisfied the Bank that it will terminate its activity before 1 January 2019, or | ||

(b) the undertaking is subject to reorganisation measures set out in Regulations 271 to 274 and an administrator has been appointed before 1 January 2016. | ||

(2) An insurance undertaking or reinsurance undertaking which falls within paragraph (1)(a) shall be subject to Regulations 12 and 14 to 268 from 1 January 2019 or from an earlier date notified by the Bank if the Bank is not satisfied with the progress that has been made towards terminating the undertaking’s activity. | ||

(3) An insurance undertaking or reinsurance undertaking which falls within paragraph (1)(b) shall be subject to Regulations 12 and 14 to 268 from 1 January 2021 or from an earlier date notified by the Bank if the Bank is not satisfied with the progress that has been made towards terminating the undertaking’s activity. | ||

(4) Paragraph (1) applies to an insurance undertaking or reinsurance undertaking if— | ||

(a) it is not part of a group, or if it is, all undertakings that are part of the group cease to conduct new insurance or reinsurance contracts before 1 January 2016, | ||

(b) the undertaking provides the Bank with an annual report setting out what progress has been made in terminating its activity, and | ||

(c) the undertaking has notified the Bank that paragraph (1) applies to it. | ||

(5) The Bank shall draw up a list of the insurance undertakings and reinsurance undertakings to which paragraph (1) applies and communicate that list to all the other Member States. | ||

(6) This Regulation does not preclude any insurance undertaking or reinsurance undertaking from operating in accordance with Regulations 12 and 14 to 268. | ||

Part 2 | ||

AUTHORISATION | ||

Prohibition against carrying on insurance etc. without authorisation | ||

12. (1) A person shall not— | ||

(a) carry on the business of insurance of any class, or any reinsurance activity, in the State unless the person holds an authorisation covering the class of insurance or the reinsurance activity, or | ||

(b) claim to be, or represent itself as, an insurance undertaking or reinsurance undertaking in the State unless the person holds an authorisation covering insurance or reinsurance. | ||

(2) Paragraph (1) does not apply to persons, activities or operations excluded from the application of these Regulations. | ||

(3) A person who contravenes paragraph (1) commits an offence. | ||

Deemed authorisation for existing undertakings | ||

13. (1) A person who, immediately before 1 January 2016, is authorised to carry on life insurance, non-life insurance or reinsurance shall be deemed on and after that date to hold an authorisation under these Regulations to carry on the same kind of insurance or reinsurance business that it had a right to carry on immediately before that date (but subject to the provisions of these Regulations). | ||

(2) Paragraph (1) does not include a person excluded from the application of these Regulations. | ||

Authorisation | ||

14. (1) An application for authorisation may be made to the Bank by— | ||

(a) any undertaking which has established or is establishing its head office in the State, or | ||

(b) any insurance undertaking which is the holder of an authorisation relating to the whole or any part of a particular class or classes of insurance and which proposes to extend its business to the whole of the class or to other classes of insurance. | ||

(2) An application for authorisation shall be in such form, and contain such particulars, as the Bank may from time to time determine. | ||

Scope of authorisation | ||

15. (1) An authorisation of an insurance undertaking or reinsurance undertaking under these Regulations shall be valid in all Member States and shall permit the undertaking to carry on business in all Member States, by way of establishment and by way of the provision of services. | ||

(2) An authorisation of an insurance undertaking shall be granted for a particular class of insurance in Part 1 of Schedule 1 or in Schedule 2 and shall cover the entire class, unless the applicant wishes to cover only some of the risks pertaining to that class. | ||

(3) The risks included in a class shall not be included in any other class except in the cases referred to in Regulation 16. | ||

(4) Where appropriate the Bank may grant authorisation for 2 or more of the classes of insurance. | ||

(5) An authorisation may be restricted to industrial assurance business and an insurance undertaking may not carry on industrial assurance business by virtue of an authorisation unless the authorisation expressly extends to such business. | ||

(6) As far as non-life insurance is concerned, the Bank may grant authorisation for the groups of classes in Part 2 of Schedule 1; and the Bank may limit authorisation requested for one of the classes to the operations set out in the scheme of operations referred to in Regulation 21. | ||

(7) Without prejudice to Regulation 16(1), an insurance undertaking may engage in the assistance activity referred to in Regulation 8 only if it has been granted authorisation for class 18 in Part 1 of Schedule 1 and, if it does so these Regulations shall apply to that activity. | ||

(8) As far as reinsurance is concerned, authorisation may be granted for non-life reinsurance activity, life reinsurance activity or both and an application for authorisation as a reinsurance undertaking shall be considered in the light of the scheme of operations to be submitted pursuant to Regulation 17(4)(c). | ||

Ancillary risks | ||

16. (1) An insurance undertaking which has obtained an authorisation for a principal risk belonging to one class or a group of classes in Schedule 1 may also insure ancillary risks included in another class without the need to obtain authorisation in respect of such risks provided that the ancillary risks meet all of the following conditions: | ||

(a) they are connected with the principal risk; | ||

(b) they concern the object which is covered against the principal risk; | ||

(c) they are covered by the contract insuring the principal risk. | ||

(2) The risks included in classes 14, 15 and 17 in Part 1 of Schedule 1 shall not be regarded as risks ancillary to other classes but legal expenses insurance as set out in class 17 may be regarded as a risk ancillary to class 18 in that Part of that Schedule, where all of the conditions in paragraph (1) and either of the following conditions is met: | ||

(a) the main risk relates solely to the assistance provided for persons who fall into difficulties while travelling, while away from their home or habitual residence; | ||

(b) the insurance concerns disputes or risks arising out of, or in connection with, the use of sea going vessels. | ||

Conditions for authorisation | ||

17. (1) An undertaking applying for authorisation shall comply with the following provisions: | ||

(a) it shall be a designated activity company, a public limited company, a company limited by guarantee, an unlimited company or a European Company (SE); | ||

(b) its head office and registered office shall be in the State. | ||

(2) Despite paragraph (1)(a), an undertaking applying for authorisation in relation to life insurance may be a society registered under the Industrial and Provident Societies Acts 1893 to 2014 or the Friendly Societies Acts 1896 to 2014. | ||

(3) An undertaking set up in any public law form may apply for an authorisation provided that it has as its object insurance or reinsurance operations, under conditions equivalent to those under which undertakings governed by private law operate. | ||

(4) An undertaking applying for authorisation shall also comply with the following provisions: | ||

(a) where the application is for authorisation as an insurance undertaking, its objects shall be limited to the business of insurance and operations arising directly from insurance to the exclusion of all other commercial business; | ||

(b) where the application is for authorisation as a reinsurance undertaking, its objects shall be limited to the business of reinsurance and related operations (which may include a holding company function or activities with respect to financial sector activities within the meaning of Article 2(8) of Directive 2002/87/EC); | ||

(c) it shall submit to the Bank a scheme of operations in accordance with Regulation 21; | ||

(d) it shall hold the eligible basic own funds to cover the absolute floor of the Minimum Capital Requirement provided for in Regulation 140(2); | ||

(e) it shall submit to the Bank evidence that it will be, and will continue to be, in a position to hold eligible own funds to cover the Solvency Capital Requirement, as provided for in Regulation 113; | ||

(f) it shall submit to the Bank evidence that it will be, and will continue to be, in a position to hold eligible basic own funds to cover the Minimum Capital Requirement, as provided for in Regulation 139; | ||

(g) it shall submit to the Bank evidence that it will be in a position to comply with the system of governance referred to in Regulations 44 to 51; | ||

(h) it shall submit to the Bank a copy of the undertaking’s memorandum and articles of association; | ||

(i) where the application is for authorisation as a non-life insurance undertaking and the risks to be covered are those included in class 10 in Part 1 of Schedule 1, other than carrier’s liability, it shall communicate to the Bank the name and address of the claims representative appointed or to be appointed pursuant to Article 4 of Directive 2000/26/EC in each Member State other than the State. | ||

(5) An insurance undertaking seeking authorisation to extend its business to other classes or to extend an authorisation covering only some of the risks pertaining to one class shall submit to the Bank— | ||

(a) a scheme of operations in accordance with Regulation 21; and | ||

(b) evidence that it possesses the eligible own funds to cover the Solvency Capital Requirement and Minimum Capital Requirement provided for in Regulations 113 and 139. | ||

(6) An insurance undertaking shall not be authorised to pursue life and non-life insurance activities simultaneously except in the circumstances specified in Regulation 79. | ||

(7) A life insurance undertaking seeking authorisation to extend its business to the risks included in class 1 or 2 in Part 1 of Schedule 1 as referred to in Regulation 79 shall demonstrate to the Bank that it— | ||

(a) possesses the eligible own funds to cover the absolute floor of the Minimum Capital Requirement for life insurance undertakings and the absolute floor of the Minimum Capital Requirement for non-life insurance undertakings provided for in Regulation 140(2), and | ||

(b) undertakes to cover, and continue to cover, the minimum financial obligations referred to in Regulation 80(3). | ||

Close links | ||

18. (1) Where close links exist between an insurance undertaking or reinsurance undertaking and other natural or legal persons, the Bank shall grant authorisation only if those links do not prevent the effective exercise of its supervisory functions. | ||

(2) The Bank shall refuse authorisation if the laws, regulations or administrative provisions of a third country governing one or more natural or legal persons with which the insurance undertaking or reinsurance undertaking has close links, or difficulties involved in their enforcement, would prevent the effective exercise of its supervisory functions. | ||

(3) The Bank shall, in the exercise of its powers under financial services legislation, require an insurance undertaking or reinsurance undertaking to provide it with the information the Bank requires to monitor compliance with the condition referred to in paragraph (1) on a continuous basis. | ||

Policy conditions and scales of premiums | ||

19. (1) The Bank shall not require the prior approval or systematic notification of general and special policy conditions, of scales of premiums, of the technical bases used in particular for calculating scales of premiums and technical provisions, or of forms and other documents which an undertaking intends to use in its dealings with policyholders or ceding or retro ceding undertakings. | ||

(2) Despite paragraph (1), in relation to life insurance the Bank may, for the sole purpose of verifying compliance with rules concerning actuarial principles, require systematic notification of the technical bases used for calculating scales of premiums and technical provisions but such a requirement does not constitute a prior condition for authorisation. | ||

(3) The Bank shall not retain or introduce prior notification or approval of proposed increases in premium rates except as part of general price control systems. | ||

(4) The Bank, in the exercise of its powers under financial services legislation, may subject undertakings seeking or having obtained authorisation for class 18 in Part 1 of Schedule 1 to checks on their direct or indirect resources in staff and equipment, including the qualification of their medical teams and the quality of the equipment available to such undertakings to meet their commitments arising out of that class. | ||

Economic requirements of the market | ||

20. The Bank shall not consider any application for authorisation in terms of the economic requirements of the market. | ||

Scheme of operations | ||

21. (1) The scheme of operations referred to in Regulation 17(4)(c) shall include particulars or evidence of the following: | ||

(a) the nature of the risks or commitments which the insurance undertaking or reinsurance undertaking proposes to cover; | ||

(b) the kind of reinsurance arrangements which the reinsurance undertaking proposes to make with ceding undertakings; | ||

(c) the guiding principles as to reinsurance and to retrocession; | ||

(d) the basic own fund items constituting the absolute floor of the Minimum Capital Requirement; | ||

(e) estimates of the costs of setting up the administrative services and the organisation for securing business; the financial resources intended to meet those costs and, if the risks to be covered are classified in class 18 in Part 1 of Schedule 1, the resources at the disposal of the insurance undertaking for the provision of the assistance promised. | ||

(2) In addition to the requirements set out in paragraph (1), for the first 3 financial years the scheme shall include the following: | ||

(a) a forecast balance sheet; | ||

(b) estimates of the future Solvency Capital Requirement, as provided for in Regulations 113 to 115, on the basis of the forecast balance sheet, as well as the calculation method used to derive those estimates; | ||

(c) estimates of the future Minimum Capital Requirement, as provided for in Regulations 139 and 140, on the basis of the forecast balance sheet, as well as the calculation method used to derive those estimates; | ||

(d) estimates of the financial resources intended to cover technical provisions, the Minimum Capital Requirement and the Solvency Capital Requirement; | ||

(e) in regard to non-life insurance and reinsurance— | ||

(i) estimates of management expenses other than installation costs, in particular current general expenses and commissions; | ||

(ii) estimates of premiums or contributions and claims; | ||

(f) in regard to life insurance, a plan setting out detailed estimates of income and expenditure in respect of direct business, reinsurance acceptances and reinsurance cessions. | ||

Shareholders and members with qualifying holdings | ||

22. (1) The Bank shall not grant an authorisation to an undertaking to take up the business of insurance or reinsurance before it has been informed of the identities of the shareholders or members, direct or indirect, whether natural or legal persons, who have qualifying holdings in that undertaking and of the amounts of those holdings. | ||

(2) The Bank shall not grant an authorisation to an undertaking if, taking into account the need to ensure the sound and prudent management of the undertaking, it is not satisfied as to the qualifications of the shareholders or members. | ||

(3) For the purposes of paragraph (1) the voting rights referred to in Articles 9 and 10 of Directive 2004/109/EC, as well as the conditions regarding aggregation laid down in Article 12(4) and (5) of that Directive, shall be taken into account. | ||

(4) The Bank shall not take into account voting rights or shares which investment firms or credit institutions may hold as a result of providing the underwriting of financial instruments or placing of financial instruments on a firm commitment basis included under point 6 of Section A of Annex I to Directive 2004/39/EC, provided that those rights are not exercised or otherwise used to intervene in the management of the issuer and are disposed of within one year of the acquisition. | ||

Prior consultation with authorities of other Member States | ||

23. (1) The Bank shall consult the supervisory authority of another Member State before the granting of an authorisation to— | ||

(a) a subsidiary undertaking of an insurance undertaking or reinsurance undertaking authorised in the other Member State, | ||

(b) a subsidiary undertaking of the parent undertaking of an insurance undertaking or reinsurance undertaking authorised in the other Member State, or | ||

(c) an undertaking controlled by the same person, whether natural or legal, who controls an insurance undertaking or reinsurance undertaking authorised in the other Member State. | ||

(2) The Bank shall consult the authority of the other Member State involved which is responsible for the supervision of credit institutions or investment firms prior to the granting of an authorisation to an insurance undertaking or reinsurance undertaking which is— | ||

(a) a subsidiary undertaking of a credit institution or investment firm authorised in the European Union, | ||

(b) a subsidiary undertaking of the parent undertaking of a credit institution or investment firm authorised in the European Union, or | ||

(c) an undertaking controlled by the same person, whether natural or legal, who controls a credit institution or investment firm authorised in the European Union. | ||

(3) The Bank shall consult with the authorities referred to in paragraphs (1) and (2) in particular when assessing the suitability of the shareholders and the fit and proper requirements of all persons who effectively run the undertaking or have other key functions involved in the management of another entity which is a member of the same group. | ||

(4) Information regarding the suitability of shareholders and the fit and proper requirements of all persons who effectively run the undertaking or have other key functions shall be exchanged between the Bank and the authorities referred to in paragraphs (1) and (2) where it is of relevance to the other authority for the granting of an authorisation as well as for the ongoing assessment of compliance with operating conditions. | ||

Decision on application for authorisation | ||

24. (1) Where the Bank is satisfied as to all the matters which it needs to consider for the purposes of the preceding Regulations it shall grant an authorisation. | ||

(2) Where the Bank decides to refuse an application for authorisation it shall notify its decision to the applicant and shall in the notification specify the grounds for its decision. | ||

(3) A decision of the Bank refusing an application for an authorisation is an appealable decision for the purposes of Part VIIA of the Act of 1942. | ||

(4) A failure by the Bank to deal with a complete application for an authorisation within the period of 6 months beginning with the date on which it received the application is an appealable decision for the purposes of Part VIIA of the Act of 1942, and for this purpose an application is “complete” if it fully complies with Regulation 14(2). | ||

Notification of authorisation to EIOPA | ||

25. The Bank shall notify EIOPA of every authorisation granted. | ||

Power to impose conditions | ||

26. (1) When granting an authorisation to an insurance undertaking or reinsurance undertaking, or at any time while an authorisation has effect in relation to an insurance undertaking or reinsurance undertaking, the Bank may, by notice in writing, impose such conditions as it considers appropriate with respect to the conduct of insurance business or reinsurance business by the undertaking with a view to ensuring that the undertaking carries out in a proper manner the responsibilities imposed by or under these Regulations. | ||

(2) The Bank may, from time to time, by notice in writing given to an insurance undertaking or reinsurance undertaking, vary or revoke a condition imposed on the undertaking under paragraph (1) (including one previously varied under this paragraph). | ||

(3) In imposing or varying a condition under this Regulation, the Bank shall ensure that the condition, or the condition as varied, is consistent with the objects of these Regulations. | ||

(4) A decision of the Bank imposing or varying a condition under this Regulation is an appealable decision for the purposes of Part VIIA of the Act of 1942. | ||

Part 3 | ||

SUPERVISION | ||

Main objective of supervision | ||

27. The main objective of supervision is the protection of policy holders and beneficiaries. | ||

Financial stability and pro-cyclicality | ||

28. (1) Without prejudice to the main objective of supervision, the Bank shall, in the exercise of its general duties, duly consider the potential impact of its decisions on the stability of the financial systems concerned in the European Union, in particular in emergency situations, taking into account the information available at the relevant time. | ||

(2) In times of exceptional movements in the financial markets, the Bank shall take into account the potential pro-cyclical effects of its actions. | ||

General principles of supervision | ||

29. (1) The Bank shall take a prospective and risk-based approach to its supervisory duties. | ||

(2) The Bank shall verify on a continuous basis the proper operation of insurance business or reinsurance business and compliance with supervisory provisions by insurance undertakings and reinsurance undertakings. | ||

(3) The supervision of insurance undertakings and reinsurance undertakings by the Bank shall comprise an appropriate combination of off site activities and on site inspections. | ||

(4) The Bank shall apply the requirements laid down in these Regulations in a manner which is proportionate to the nature, scale and complexity of the risks inherent in the business of any insurance undertaking or reinsurance undertaking. | ||

Scope of supervision | ||

30. (1) The Bank shall have the sole responsibility for the financial supervision of insurance undertakings and reinsurance undertakings, including that of the business they pursue either through branches or under the freedom to provide services. | ||

(2) For the purposes of paragraph (1) financial supervision shall include verification, with respect to the entire business of an insurance undertaking or reinsurance undertaking, of its state of solvency, of the establishment of technical provisions, of its assets and of the eligible own funds, in accordance with these Regulations and other laws applicable in the State. | ||