Finance Act 2020

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Number 26 of 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FINANCE ACT 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CONTENTS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Universal Social Charge, Income Tax, Corporation Tax and Capital Gains Tax | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interpretation | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Section | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Universal Social Charge | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2. Amendment of section 531AN of Principal Act (rate of charge) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Chapter 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Income Tax | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

5. Amendment of section 466 of Principal Act (dependent relative tax credit) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

9. Amendment of section 472AB of Principal Act (earned income tax credit) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

10. Amendment of section 472BB of Principal Act (sea-going naval personnel credit) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Chapter 4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Income Tax, Corporation Tax and Capital Gains Tax | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

17. Acceleration of wear and tear allowances for farm safety equipment | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Chapter 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Corporation Tax | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

18. Amendment of section 288 of Principal Act (balancing allowances and balancing charges) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

19. Amendment of section 481 of Principal Act (relief for investment in films) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

20. Amendment of Part 35B of Principal Act (controlled foreign companies) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

21. Amendment of Part 35C of Principal Act (hybrid mismatches) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

22. Amendment of section 769Q of Principal Act (application) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Chapter 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Capital Gains Tax | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

24. Amendment of section 597AA of Principal Act (revised entrepreneur relief) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

25. Amendment of section 629 of Principal Act (deferral of exit tax) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

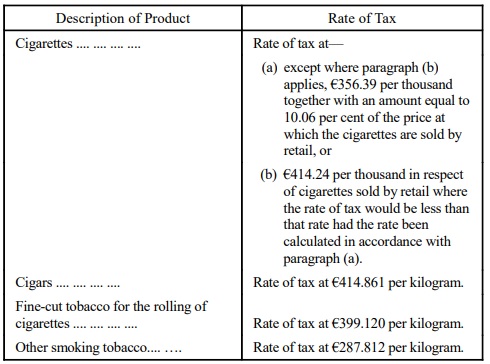

Excise | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

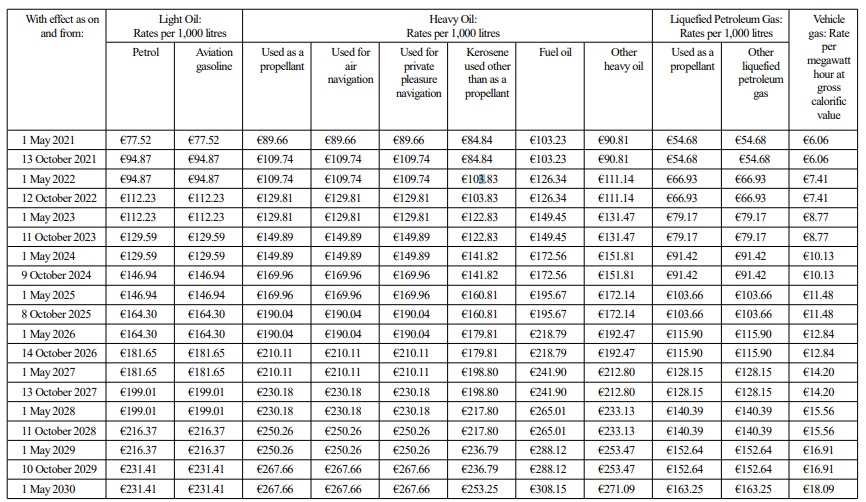

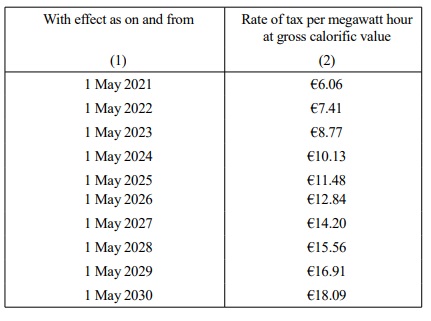

28. Amendment of section 67 of Finance Act 2010 (natural gas carbon tax) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

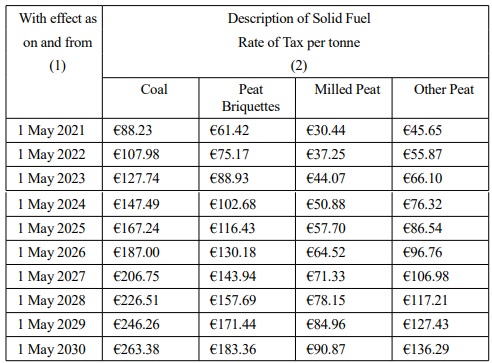

29. Amendment of Chapter 3 of Part 3 of, and Schedule 1 to, Finance Act 2010 (solid fuel carbon tax) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

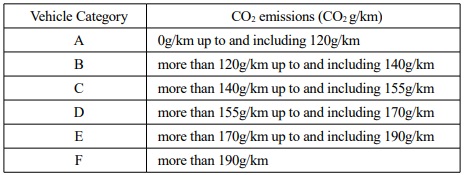

32. Amendment of section 96 of Finance Act 2001 (interpretation (Part 2)) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

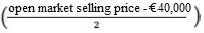

33. Amendment of section 132 of Finance Act 1992 (charge of excise duty) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Value-Added Tax | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

38. Amendment of section 2 of Principal Act (interpretation - general) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

42. Amendment of section 24, Schedule 1 and Schedule 2 of Principal Act | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

45. Amendment of section 120 and Schedules 1 and 3 to Principal Act (accommodation) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Stamp Duties | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

49. Amendment of section 81C of Principal Act (further farm consolidation relief) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

52. Amendment of section 126AA of Principal Act (further levy on certain financial institutions) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

53. Amendment of Schedule 1 to Principal Act (stamp duties on instruments) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Capital Acquisitions Tax | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

55. Amendment of section 46 of Principal Act (delivery of returns) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Miscellaneous | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

58. Amendment of Principal Act (appeals to Appeals Commissioners) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

61. Returns of certain payment card transactions by payment card providers | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

62. Amendments consequential on migration of shares to EU central securities depository | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

63. Amendment of Part 7 of Emergency Measures in the Public Interest (Covid-19) Act 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

64. Amendment of Emergency Measures in the Public Interest (Covid-19) Act 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

65. Covid-19: special warehousing and interest provisions (income tax) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

69. Repayment or refund of payment made in excess of liability to tax assessed by taxpayer | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

72. Amendment of Part 3 of Schedule 26A to Principal Act (approval of body as eligible charity) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

73. Amendment of section 908E of Principal Act (order to produce documents or provide information) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Miscellaneous Technical Amendments in Relation to Tax | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Acts Referred to | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Central Bank Act 1971 (No. 24) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Child Care Act 1991 (No. 17) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Companies Act 2014 (No. 38) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Customs Act 2015 (No. 18) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Customs Consolidation Act 1876 (39 & 40 Vict., c.36.) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Electricity Regulation Act 1999 (No. 23) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Emergency Measures in the Public Interest (Covid-19) Act 2020 (No. 2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance (1909-10) Act 1910 (10 Edw. 7, c. 8) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 1980 (No. 14) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 1989 (No. 10) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 1992 (No. 9) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 1999 (No. 2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2000 (No. 3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2001 (No. 7) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2005 (No. 5) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2010 (No. 5) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2019 (No. 45) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Health Act 1947 (No. 28) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Health Act 1970 (No. 1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Intoxicating Liquor (Breweries and Distilleries) Act 2018 (No. 17) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Intoxicating Liquor (National Concert Hall) Act 1983 (No. 34) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Intoxicating Liquor (National Conference Centre) Act 2010 (No. 9) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Intoxicating Liquor Act 2003 (No. 31) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Post Office Savings Bank Act 1861 (24 & 25 Vict., c. 14) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Public Dance Halls Act 1935 (No. 2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Registration of Clubs (Ireland) Act 1904 (4 Edw. 7, c. 9) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Stamp Duties Consolidation Act 1999 (No. 31) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Taxes Consolidation Act 1997 (No. 39) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Number 26 of 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FINANCE ACT 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

An Act to provide for the imposition, repeal, remission, alteration and regulation of taxation, of stamp duties and of duties relating to excise and otherwise to make further provision in connection with finance including the regulation of customs; to amend Part 7 of the Emergency Measures in the Public Interest (Covid-19) Act 2020 and otherwise make provision for supports to certain sectors of the economy; and to provide for related matters. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

[19th December, 2020] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Be it enacted by the Oireachtas as follows: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

PART 1 Universal Social Charge, Income Tax, Corporation Tax and Capital Gains Tax | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Chapter 1 Interpretation | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Interpretation (Part 1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

1. In this Part “Principal Act” means the Taxes Consolidation Act 1997 . | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Chapter 2 Universal Social Charge | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 531AN of Principal Act (rate of charge) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

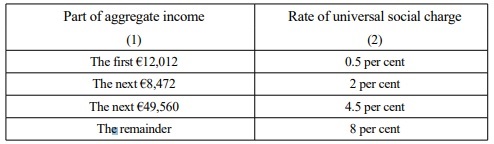

2. (1) Section 531AN of the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) by substituting the following for subsection (3): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“(3) Notwithstanding subsection (1) and the Table to this section, where an individual is in receipt of aggregate income which does not exceed €60,000, is aged under 70 years and has full eligibility for services under Part IV of the Health Act 1970 , by virtue of sections 45 and 45A of that Act or Council Regulation (EC) No. 883/2004 of 29 April 20041 , the individual shall, instead of being charged to universal social charge on the part of aggregate income for the tax year concerned that exceeds €20,484 at the rate provided for in column (2) of Part 1 of that Table, be charged on the amount of the excess at the rate of 2 per cent.”, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) in subsection (4), by the substitution of “2022” for “2021”, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(c) by substituting the following for Part 1 of the Table to that section: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“Part 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

”. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Paragraphs (a) and (c) of subsection (1) apply for the year of assessment 2020. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

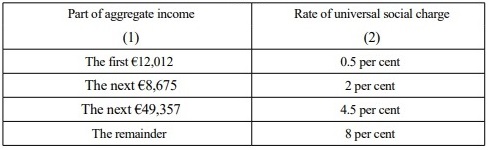

(3) Section 531AN of the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) by substituting the following for subsection (3): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“(3) Notwithstanding subsection (1) and the Table to this section, where an individual is in receipt of aggregate income which does not exceed €60,000, is aged under 70 years and has full eligibility for services under Part IV of the Health Act 1970 , by virtue of sections 45 and 45A of that Act or Council Regulation (EC) No. 883/2004 of 29 April 20042 , the individual shall, instead of being charged to universal social charge on the part of aggregate income for the tax year concerned that exceeds €20,687 at the rate provided for in column (2) of Part 1 of that Table, be charged on the amount of the excess at the rate of 2 per cent.”, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) by substituting the following for Part 1 of the Table to that section: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“Part 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

”. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(4) Subsection (3) applies for the year of assessment 2021 and each subsequent year of assessment. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Chapter 3 Income Tax | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 126 of Principal Act (tax treatment of certain benefits payable under Social Welfare Acts) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

3. (1) Section 126 of the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) in subsection (3)(a) — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) by inserting the following subparagraph after subparagraph (iia): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“(iib) the payments, commonly known as the pandemic unemployment payments, made under section 202 of the Act of 2005 on and after 13 March 2020 to the relevant date (within the meaning of section 7 of that Act),”, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) by inserting the following subparagraph after subparagraph (iib) (inserted by subparagraph (i)): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“(iic) Covid-19 pandemic unemployment payment (within the meaning of the Act of 2005),”, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) in column (1) of the Table to that section, by inserting “(other than the payments referred to in subsection (3)(a)(iib))” after “Urgent needs payment”. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Paragraphs (a)(i) and (b) of subsection (1) shall be deemed to have come into operation on and from 13 March 2020. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Paragraph (a)(ii) of subsection (1) shall be deemed to have come into operation on and from 5 August 2020. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 192BA of Principal Act (exemption of certain payments made or authorised by Child and Family Agency) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

4. (1) Section 192BA of the Principal Act is amended, in subsection (1) — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) in the definition of “carer” by inserting “or the Health Service Executive” after “the Child and Family Agency”, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) in the definition of “qualifying payment” by substituting the following for all the words beginning with “means” down to and including “or” where it appears immediately after paragraph (a)(iii): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“means a payment— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) which either— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) is— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(I) described in column (1) of the Table to this section, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(II) paid on a basis specified in column (2) of that Table, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(III) made or authorised by the Child and Family Agency on behalf of the Minister, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

or | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) is made by or on behalf of the Health Service Executive to a carer in respect of what is generally referred to and commonly known as a Home Sharing Host Allowance, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

or”. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Subsection (1) applies for the year of assessment 2020 and each subsequent year of assessment. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 466 of Principal Act (dependent relative tax credit) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

5. (1) Section 466 of the Principal Act is amended in subsection (2) by substituting “€245” for “€70”. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Subsection (1) shall apply for the year of assessment 2021 and each subsequent year of assessment. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Exemption in respect of Mobility Allowance | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

6. Chapter 1 of Part 7 of the Principal Act is amended by inserting the following section after section 192G: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“192H. (1) This section applies to a payment made under section 61 of the Health Act 1970 , generally referred to and commonly known as a Mobility Allowance, by or on behalf of the Health Service Executive to a person who satisfies the conditions of the Mobility Allowance scheme as administered by the Health Service Executive. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) A payment to which this section applies, which is made on or after 1 January 2021, shall be exempt from income tax and shall not be reckoned in computing total income for the purposes of the Income Tax Acts. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) A payment to which this section applies, which is made before 1 January 2021, shall be treated as if it was exempt from income tax in the year of assessment in which it was made and shall not be reckoned in computing total income for the purposes of the Income Tax Acts.”. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 477C of Principal Act (help to buy) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

7. Section 477C of the Principal Act is amended, in subsection (5A), by substituting “December 2021” for “December 2020”. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Share scheme reporting | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

8. (1) Section 897B of the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) in subsection (2), by substituting the following for paragraph (a): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“(a) Where in any year of assessment an employer or other person awards shares, or a cash equivalent of shares, to a director or employee, and income tax under Schedule D or Schedule E may be chargeable on the director or employee in respect of that award, the employer or other person, as the case may be, shall deliver particulars thereof to the Revenue Commissioners in an electronic format approved by them, on or before 31 March in the year of assessment following that year.”, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) by inserting the following paragraph after paragraph (a): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“(aa) The provisions of paragraph (a) shall also apply to the value of discounts on shares awarded to a director or employee by an employer or other person.”. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) The Principal Act is amended in Chapter 5 of Part 5— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) in section 128C(15), by inserting “in an electronic format approved by them” after “Revenue Commissioners”, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) in section 128D(8), by inserting “in an electronic format approved by them” after “Revenue Commissioners”, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(c) in section 128E(9), by inserting “in an electronic format approved by them” after “Revenue Commissioners”. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 472AB of Principal Act (earned income tax credit) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

9. (1) Section 472AB of the Principal Act is amended, in subsection (2), by substituting “€1,650” for “€1,500” in each place where it occurs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Subsection (1) shall apply for the year of assessment 2020 and each subsequent year of assessment. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 472BB of Principal Act (sea-going naval personnel credit) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

10. Section 472BB of the Principal Act is amended by inserting the following subsection after subsection (2): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“(3) Where for the year of assessment 2021 an individual is a qualifying individual— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) he or she shall be entitled to a sea-going naval personnel credit of €1,500, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) relief shall not be given under section 472B or 472BA in respect of that year.”. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Chapter 4 Income Tax, Corporation Tax and Capital Gains Tax | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Covid Restrictions Support Scheme | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

11. (1) The Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) by inserting the following sections after section 483: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“Objectives of section 485, purposes for which its provisions are enacted and certain duty of Minister for Finance respecting those provisions’ operation | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

484. (1) (a) The objectives of section 485 are to— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) provide the necessary stimulus to the economy (in addition to that provided by Part 7 of the Emergency Measures in the Public Interest (Covid-19) Act 2020 and the Financial Provisions (Covid-19) (No. 2) Act 2020 ) so as to mitigate the effects, on the economy, of Covid-19, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) if, as of 1 January 2021, no agreement stands entered into between the European Union and the United Kingdom (with respect to the future relations between them on the relevant matters), mitigate the effects on the economy which are apprehended may arise therefrom. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) In paragraph (a) ‘relevant matters’ means the matters described in Part II of the Political declaration setting out the framework for the future relationship between the European Union and the United Kingdom3 . | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(c) The purposes for which the several provisions of section 485 (in this section referred to as the ‘Covid Restrictions Support Scheme’) are, in furtherance of the foregoing objectives, enacted are: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) in addition to the provision of basic mechanisms to fulfil those objectives, to ensure the efficient use of the Covid Restrictions Support Scheme so as to minimise the cost to the Exchequer of the scheme (so far as consistent with fulfilment of those objectives); | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) to avoid, where possible, allocation of resources to sectors of the economy that are not in need of direct stimulus by means of the Covid Restrictions Support Scheme (and which sectors may reasonably be expected to be restored to financial viability and an eventual growth path by the indirect effects of the scheme); | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(iii) to protect the public finances through mechanisms for the discontinuance or amendment of one or more of the payments under the Covid Restrictions Support Scheme (or for their variation) in defined circumstances; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(iv) to take account of the need to reflect changes in circumstances of persons who, as businesses, are persons in respect of whom payments under the Covid Restrictions Support Scheme are being made, in cases where such persons avail themselves of other financial supports provided by the State; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(v) to take account of changes in the State’s economic circumstances and the demands on its financial resources which may occur in the remainder of the current financial year and thereafter. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(d) It shall be the duty of the Minister for Finance to monitor and superintend the administration of the Covid Restrictions Support Scheme (but this paragraph does not derogate from the function of the care and management conferred on the Revenue Commissioners by section 485(21)). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(e) Without prejudice to the generality of paragraph (d), the Minister for Finance shall cause an assessment, at such intervals as he or she considers appropriate but no less frequently than every 3 months beginning on 13 October 2020, of the following, and any other relevant matters, to be made— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) up-to-date data compiled by the Department of Finance relating to the State’s receipts and expenditure, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) up-to-date data from the register commonly referred to as the ‘Live Register’ and data related to that register supplied to the Department of Finance by the Department of Business, Enterprise and Innovation (whether data compiled by that last-mentioned Department of State from its own sources or those available to it from sources maintained elsewhere in the Public Service), | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(iii) such other data as the Minister for Finance may consider relevant in relation to the impact from, and effects of, Covid-19 or the fact (should that be so) of there not being an agreement of the kind referred to in paragraph (a)(ii), | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and, if the following is commissioned, by reference to an assessment, on economic grounds, of the Covid Restrictions Support Scheme that may be commissioned by the Minister for Finance and any opinion as to the sustainability of the scheme expressed therein. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(f) Following an assessment under paragraph (e), it shall be the duty of the Minister for Finance, after consultation with the Minister for Public Expenditure and Reform, to determine whether it is necessary to exercise any or all of the powers under subparagraphs (i) to (vi) of subsection (2)(a) so, as appropriate, to— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) fulfil, better, the objectives specified in paragraph (a), or | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) facilitate the furtherance of any of the purposes specified in paragraph (c), | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and, if the Minister for Finance determines that such is necessary, the powers under one, or more than one, as provided in that subsection (2)(a), of those subparagraphs (i) to (vi) shall become and be exercisable by the Minister for Finance. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) (a) Where the Minister for Finance makes a determination of the kind lastly referred to in subsection (1)(f), the Minister for Finance shall, as he or she deems fit and necessary— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) make an order that the reference in the definition of ‘Covid restrictions’ in section 485(1) to restrictions provided for in regulations made under sections 5 and 31A of the Health Act 1947 that are for the purpose of preventing, or reducing the risk of, the transmission of Covid-19 and which have the effect of restricting the conduct of certain business activity during the specified period shall be limited in such respects as are specified in the order (including, if the Minister for Finance considers appropriate, by the specification of a requirement, with respect to the restriction of certain business activity, that particular business activity must be affected by the restriction to a specified extent) and an order under this subparagraph shall make such additional modifications to the provisions of section 485 as the Minister for Finance may consider necessary and appropriate in consequence of the foregoing limitation, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) make an order that the day referred to in the definition of ‘specified period’ in section 485(1) as the day on which the period there referred to shall expire shall be such day as is later than 31 March 2021 (but not later than 31 December 2021) as the Minister for Finance considers appropriate and specifies in the order, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(iii) make an order that the percentage specified in section 485(4)(b)(i) shall be such a percentage, that is greater or lower than the percentage specified in that provision, as the Minister for Finance— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(I) considers necessary to— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(A) fulfil, better, the objectives specified in subsection (1)(a), or | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(B) facilitate the furtherance of any of the purposes specified in subsection (1)(c), | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(II) specifies in the order, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(iv) make an order that the percentage specified in subparagraph (i)(I) or subparagraph (ii)(I) of section 485(7)(a) shall be such a percentage, that is greater or lower than the percentage specified in that subparagraph (i)(I) or subparagraph (ii)(I), as the Minister for Finance— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(I) considers necessary to— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(A) fulfil, better, the objectives specified in subsection (1)(a), or | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(B) facilitate the furtherance of any of the purposes specified in subsection (1)(c), | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(II) specifies in the order, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(v) make an order that the percentage referred to in subparagraph (i)(II) or subparagraph (ii)(II) of section 485(7)(a) shall be such a percentage, that is greater or lower than that percentage specified in that subparagraph (i)(II) or subparagraph (ii)(II), as the Minister for Finance— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(I) considers necessary to— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(A) fulfil, better, the objectives specified in subsection (1)(a), or | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(B) facilitate the furtherance of any of the purposes specified in subsection (1)(c), | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(II) specifies in the order, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(vi) make an order either that subsection (8) of section 485 shall cease to be in operation on and from such day, or that the election referred to in paragraph (b) of that subsection, which that subsection enables a qualifying person to make, shall not be exercisable save in such circumstances, as the Minister for Finance— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(I) considers necessary to— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(A) fulfil, better, the objectives specified in subsection (1)(a), or | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(B) facilitate the furtherance of any of the purposes specified in subsection (1)(c), | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(II) specifies in the order, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and any matter that is provided for in the preceding subparagraphs is referred to in section 485(3) as a ‘modification’. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) Where an order under subparagraph (i), (ii), (iii), (iv), (v) or (vi) of paragraph (a) is proposed to be made, a draft of the order shall be laid before Dáil Éireann and the order shall not be made unless a resolution approving of the draft has been passed by that House. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Covid Restrictions Support Scheme | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

485. (1) In this section— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘applicable business restrictions provisions’ shall be construed in the manner provided for in the definition of ‘Covid restrictions period’ in this subsection; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘business activity’, in relation to a person carrying on a trade either solely or in partnership, means— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) where customers of the trade acquire goods or services from that person from one business premises, the activities of the trade, or | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) where customers of the trade acquire goods or services from that person from more than one business premises, the activities of the trade relevant to each business premises, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and where customers of the trade acquire goods or services from that person other than through attending at a business premises, that portion of the trade which relates to transactions effected in that manner shall be deemed to relate to the business premises or, where there is more than one business premises, shall be apportioned between such business premises on a just and reasonable basis; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘business premises’, in relation to a business activity, means a building or other similar fixed physical structure from which a business activity is ordinarily carried on; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘chargeable period’ has the same meaning as in section 321(2); | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘claim period’ means a Covid restrictions period, or a Covid restrictions extension period, as the context requires; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘Covid-19’ has the same meaning as it has in the Emergency Measures in the Public Interest (Covid-19) Act 2020 ; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘Covid restrictions’ means restrictions provided for in regulations made under sections 5 and 31A of the Health Act 1947 , being restrictions for the purpose of preventing, or reducing the risk of, the transmission of Covid-19 and which have the effect of restricting the conduct of certain business activity during the specified period; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘Covid restrictions extension period’ has the meaning assigned to it in subsection (2); | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘Covid restrictions period’, in relation to a relevant business activity carried on by a person, means a period for which the person is required by provisions of Covid restrictions to prohibit, or significantly restrict, members of the public from having access to the business premises in which the relevant business activity is carried on (referred to in this section as ‘applicable business restrictions provisions’) and is a period which commences on the Covid restrictions period commencement date and ends on the Covid restrictions period end date; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘Covid restrictions period commencement date’, in relation to a relevant business activity, means the later of— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) 13 October 2020, or | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) the day on which applicable business restrictions provisions come into operation (not having been in operation on the day immediately preceding that day); | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘Covid restrictions period end date’, in relation to a relevant business activity, means the earlier of— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) the day which is three weeks after the Covid restrictions period commencement date, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) the day that is specified in the Covid restrictions (being those restrictions in the terms as they stood on the Covid restrictions period commencement date) to be the day on which the applicable business restrictions provisions shall expire, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(c) the day preceding the first day following the Covid restrictions period commencement date, on which the applicable business restrictions cease to be in operation (by reason of the terms in which the Covid restrictions stand being different from how they stood as referred to in paragraph (b)), or | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(d) 31 March 2021, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and, for the purposes of paragraph (c) — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) the fact (if such is the case) that regulations made under sections 5 and 31A of the Health Act 1947 are revoked and replaced by fresh regulations thereunder (but the applicable business restrictions provisions continue to apply to the relevant business activity) is immaterial, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) the first reference in that paragraph to the terms in which the Covid restrictions stand is a reference to their terms as provided for in those fresh regulations; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘partnership trade’ has the same meaning as in section 1007; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘precedent partner’, in relation to a partnership and a partnership trade, has the same meaning as in section 1007; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘relevant business activity’ has the meaning assigned to it in subsection (4); | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘relevant geographical region’ means a geographical location for which Covid restrictions are in operation; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘specified period’ means the period commencing on 13 October 2020 and expiring on 31 March 2021; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘tax’ means income tax or corporation tax; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘trade’ means a trade any profits or gains arising from which is chargeable to tax under Case I of Schedule D. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) (a) Subject to subsection (8), where, in relation to a relevant business activity carried on by a person, applicable business restrictions provisions continue to apply, by reason of regulations made or amended under sections 5 and 31A of the Health Act 1947 , to the relevant business activity on the day after the end of a Covid restrictions period, the period for which those restrictions continue to so apply is referred to in this section as a ‘Covid restrictions extension period’, which period commences on the foregoing day (referred to in this section as a ‘Covid restrictions extension period commencement date’) and ends on the Covid restrictions extension period end date. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) In this section, ‘Covid restrictions extension period end date’, in relation to a relevant business activity, means the earlier of— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) the day which is three weeks after the Covid restrictions extension period commencement date, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) the day that is specified in the Covid restrictions (being those restrictions in the terms as they stood on the Covid restrictions extension period commencement date) to be the day on which the applicable business restrictions provisions shall expire, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(iii) the day preceding the first day, following the Covid restrictions extension period commencement date, on which the applicable business restrictions provisions cease to be in operation (by reason of the terms in which the Covid restrictions stand being different from how they stood as referred to in subparagraph (ii) ), or | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(iv) 31 March 2021, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and, for the purposes of subparagraph (iii) — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) the fact (if such is the case) that regulations made under sections 5 and 31A of the Health Act 1947 are revoked and replaced by fresh regulations thereunder (but the applicable business restrictions provisions continue to apply to the relevant business activity) is immaterial, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) the first reference in that subparagraph to the terms in which the Covid restrictions stand is a reference to their terms as provided for in those fresh regulations. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(c) Where, in relation a relevant business activity carried on by a person, applicable business restrictions provisions continue to apply, by reason of regulations made or amended under sections 5 and 31A of the Health Act 1947 , to the relevant business activity on the day after the end of a Covid restrictions extension period, the period for which those restrictions continue to so apply is also referred in this subsection as a ‘Covid restrictions extension period’ which period commences on the foregoing day and ends on the Covid restrictions extension period end date. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) The following provisions made in this section, namely: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) the reference in the definition of ‘Covid restrictions’ in subsection (1) to restrictions provided for in regulations made under sections 5 and 31A of the Health Act 1947 that are for the purpose of preventing, or reducing the risk of, the transmission of Covid-19 and which have the effect of restricting the conduct of certain business activity during the specified period; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) the specification of 31 March 2021 in the definition of ‘specified period’ in subsection (1) as the date on which the period there referred to shall expire; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(c) the specification of 25 per cent in subsection (4)(b)(i); | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(d) the specification of 10 per cent in subsection (7)(a)(i)(I) or (ii)(I); | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(e) the specification of 5 per cent in subsection (7)(a)(i)(II) or (ii)(II); | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(f) subsection (8) and the election referred to in paragraph (b) of it which a qualifying person is, by virtue of that subsection, enabled to make, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

shall, together with any other provision of this section that the following modification relates to, be construed and operate subject to any modification that is provided for in an order made under section 484(2)(a) and which is in force. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(4) (a) In this section— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘average weekly turnover from the established relevant business activity’ means the average weekly turnover of the person, carrying on the activity, in respect of the established relevant business activity for the period commencing on 1 January 2019 and ending on 31 December 2019; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘average weekly turnover from the new relevant business activity’, means the average weekly turnover of the person, carrying on the activity, in respect of the new relevant business activity in the period commencing on the date on which the person commenced the business activity and ending on 12 October 2020; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘established relevant business activity’ means, in relation to a person, a relevant business activity commenced by that person before 26 December 2019; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘new relevant business activity’ means, in relation to a person, a relevant business activity commenced by that person on or after 26 December 2019 and before 13 October 2020; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘relevant business activity’, in relation to a person, means a business activity which is carried on by that person in a business premises located wholly in a relevant geographical region; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

‘relevant turnover amount’ means— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) where a person carries on an established relevant business activity, an amount determined by the formula— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A x B | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

where— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A is the average weekly turnover from the established relevant business activity, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B is the total number of full weeks in the claim period, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

or | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) where a person carries on a new relevant business activity, an amount determined by the formula— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A x B | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

where— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A is the average weekly turnover from the new relevant business activity, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B is the total number of full weeks that comprise the claim period. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) Subject to subsections (5) and (6), this section shall apply to a person who carries on a relevant business activity and who— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) in accordance with guidelines published by the Revenue Commissioners under subsection (22), demonstrates to the satisfaction of the Revenue Commissioners that, in the claim period, because of applicable business restrictions provisions that prohibit, or significantly restrict, members of the public from having access to the business premises in which the relevant business activity of the person is carried on— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(I) the relevant business activity of the person is temporarily suspended, or | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(II) the relevant business activity of the person is disrupted, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

such that the turnover of the person in respect of the relevant business activity in the claim period will be an amount that is 25 per cent (or less) of the relevant turnover amount, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) satisfies the conditions specified in subsection (5), | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(hereafter referred to in this section as a ‘qualifying person’). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(5) The conditions referred to in subsection (4)(b)(ii) are— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) the person has logged on to the online system of the Revenue Commissioners (in this section referred to as ‘ROS’) and applied on ROS to be registered as a person to whom this section applies and as part of that registration provides such particulars as the Revenue Commissioners consider necessary and appropriate for the purposes of registration and which particulars shall include those specified in subsection (14), | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) for the claim period, the person completes an electronic claim form on ROS containing such particulars as the Revenue Commissioners consider necessary and appropriate for the purposes of determining the claim and which particulars shall include those specified in subsection (14), | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(c) for the claim period, the person makes a declaration to the Revenue Commissioners through ROS that the person satisfies the conditions in this section to be regarded as a qualifying person for that claim period, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(d) the person has complied with any obligations that apply to that person in respect of the registration for, and furnishing of returns relating to, value-added tax, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(e) the person is throughout the claim period eligible for a tax clearance certificate, within the meaning of section 1095, to be issued to the person, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(f) the person would, but for the Covid restrictions, carry on the business activity, that is a relevant business activity, at the business premises in a relevant geographical region, and intends to carry on that activity when applicable business restrictions provisions cease to be in operation in relation to that relevant business activity. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(6) Where a relevant business activity of a qualifying person does not constitute a whole trade carried on by that person, then, for the purposes of determining whether the requirements in subsection (4)(b)(i) are met, the relevant business activity shall be treated as if it were a separate trade and the turnover of the whole trade shall be apportioned between the separate trade and the other part of the trade on a just and reasonable basis, and the amount of turnover attributed to the separate trade during the claim period shall not be less than the amount that would be attributed to the separate trade if it were carried on by a distinct and separate person engaged in that relevant business activity. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(7) Subject to subsections (10) and (11), on making a claim under this section, a qualifying person shall, in respect of each full week comprised within the claim period, be entitled to an amount equal to the lower of— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) (i) where the qualifying person carries on an established relevant business activity, an amount equal to the sum of— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(I) 10 per cent of so much of the average weekly turnover from the established relevant business activity as does not exceed €20,000, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(II) 5 per cent of any amount of the average weekly turnover from the established relevant business activity as exceeds €20,000, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

or | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) where the qualifying person carries on a new relevant business activity, an amount equal to the sum of— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(I) 10 per cent of so much of the person’s average weekly turnover from the new relevant business activity as does not exceed €20,000, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(II) 5 per cent of any amount of the person’s average weekly turnover from the new relevant business activity as exceeds €20,000, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) €5,000 per week, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and any amount payable under this section is referred to in this section as an ‘advance credit for trading expenses’. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(8) (a) Where, in relation to a relevant business activity carried on by a person— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) applicable business restrictions provisions were in operation such that a qualifying person made a claim under this section in respect of a claim period and that claim, taken together with any claims made by the person immediately preceding that claim, is in respect of a continuous period of not less than three weeks, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) those applicable business restrictions provisions cease to be in operation, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

then, where that qualifying person, within a reasonable period of time from the date on which the applicable business restrictions provisions cease to be in operation, resumes or continues, as the case may be, supplying goods or services to customers from the business premises in which the qualifying person’s relevant business activity is carried on, that qualifying person may make an election under paragraph (b). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) Where no part of the week immediately following the date on which the applicable business restrictions provisions ceased to be in operation in respect of a relevant business activity would otherwise form part of a Covid restrictions period or a Covid restrictions extension period, a qualifying person to whom paragraph (a) applies may elect to treat that week as a Covid restrictions extension period and may make a claim under this section in respect of that period. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(9) A claim made under this section in respect of an advance credit for trading expenses shall be made— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) subject to paragraph (b), no later than— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) eight weeks from the date on which the claim period, to which the claim relates, commences, or | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) if the date on which the qualifying person is registered as a person to whom this section applies (following an application which is made in accordance with subsection (5)(a) and within the period of eight weeks specified in subparagraph (i)) falls on a date subsequent to the expiry of the period of eight weeks so specified, three weeks from the date on which the person is so registered, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) in the case of a claim made under this section that is referred to in subsection (8), no later than eight weeks from the date on which the applicable business restrictions provisions concerned cease to be in operation. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(10) Where, for any week comprised within a claim period, a person is a qualifying person in relation to more than one relevant business activity carried on from the same business premises, and a claim is made in relation to each relevant business activity, the amount the qualifying person shall be entitled to claim under this section in respect of all of those relevant business activities for any weekly period shall not exceed the amount specified in subsection (7)(b) and subsection (7) shall apply with any necessary modifications to give effect to this subsection. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(11) (a) Where a relevant business activity in respect of which a person is a qualifying person is carried on as the whole or part of a partnership trade, then any claim made under this section for an advance credit for trading expenses in respect of the relevant business activity shall be made by the precedent partner on behalf of the partnership and each of the partners in that partnership and the maximum amount of any such claim made in respect of the relevant business activity in any weekly period shall not exceed the lower of the amounts specified in subsection (7)(a)(i) or (a)(ii), as the case may be. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) Where a claim is made under this section by a precedent partner for an advance credit for trading expenses in respect of a relevant business activity carried on as the whole or part of a partnership trade then— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) for the purposes of subsections (15) and (16), each partner shall be deemed to have claimed, in respect of that partner’s several trade, a portion of the advance credit for trading expenses calculated as— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A x B | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

where— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A is the advance credit for trading expenses claimed by the precedent partner, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B is the partnership percentage at the commencement of the claim period, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) the precedent partner shall, in respect of each such claim, provide a statement to each partner in the partnership containing the following particulars— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(I) the partnership name and its business address, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(II) the amount of advance credit for trading expenses claimed by the precedent partner on behalf of the partnership and each partner, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(III) the profit percentage for each partner, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(IV) the portion of the advance credit for trading expenses allocated to each partner, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(V) the commencement and cessation date of the claim period, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(VI) the chargeable period of the partnership trade in which the claim period commences, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(iii) for the purposes of subsections (17) and (18), references to a person making a claim shall be taken as references to the precedent partner making the claim on behalf of the partnership and each of its partners, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(iv) for the purposes of subsection (19), section 1077E shall apply as if references to a person were references to each partner and the references to a claim were a reference to a claim deemed to have been made by each partner under subparagraph (i). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(12) Any reference to ‘turnover’ in this section means any amount recognised as turnover in a particular period of time in accordance with the correct rules of commercial accounting, except for any amount recognised as turnover in that particular period of time due to a change in accounting policy. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(13) Where a person makes a claim for an advance credit for trading expenses under this section, in computing the amount of the profits or gains of the trade, to which the relevant business activity relates, for the chargeable period in which the claim period commences, the amount of any disbursement or expense which is allowable as a deduction, having regard to section 81, shall be reduced by the amount of the advance credit for trading expenses and the advance credit for trading expenses shall not otherwise be taken into account in computing the amount of the profits or gains of the trade for that chargeable period. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(14) (a) The particulars referred to in paragraphs (a) and (b) of subsection (5) are those particulars the Revenue Commissioners consider necessary and appropriate for the purposes of determining a claim made under this section, including— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) in relation to a qualifying person— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(I) name, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(II) address, including Eircode, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(III) tax registration number, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) in relation to a relevant business activity— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(I) name under which the business activity is carried on, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(II) a description of the business activity, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(III) address, including Eircode, of the business premises where the business activity is carried on, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(IV) where the business activity was commenced prior to 26 December 2019, the average weekly turnover of the qualifying person in respect of the business activity in the period commencing on 1 January 2019 and ending on 31 December 2019, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(V) where a trade is carried on in more than one business premises, the turnover of the qualifying person in respect of the business premises, to which the relevant business activity relates, in the period commencing on 1 January 2019 and ending on 31 December 2019, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(VI) where a business activity is a new relevant business activity, the date of commencement of the activity and the amount of turnover in respect of the new business activity beginning on the date of commencement and ending on 12 October 2020, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(VII) the average weekly turnover in respect of an established relevant business activity or a new relevant business activity, as the case may be, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(VIII) in respect of tax, within the meaning of section 2 of the Value-Added Tax Consolidation Act 2010 , for the taxable periods comprised within the period of time referred to in clauses (IV) and (VI) the amount of tax that became due in accordance with section 76 (1)(a)(i) of the Value-Added Tax Consolidation Act 2010 , | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(IX) such other total income excluding the relevant business turnover in respect of the total tax returned in respect of section 76(1)(a)(i) of the Value-Added Tax Consolidation Act 2010 , for the taxable periods comprised within the period of time referred to in clause (IV) or (VI), | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(X) expected percentage reduction in turnover of the qualifying person in respect of the business activity in the claim period, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(XI) such other particulars, as the Revenue Commissioners may require. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) Subsequent to receiving the information requested under this section, the Revenue Commissioners may seek further particulars or evidence for the purposes of determining the claim. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(15) Where a company makes a claim under this section in respect of a claim period and it subsequently transpires that the claim was not one permitted by this section to be made, and the company has not repaid the amount as required by subsection (17)(a)(II) — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) the company shall be charged to tax under Case IV of Schedule D for the chargeable period in which the claim period commences, on an amount equal to 4 times so much of the amount under this section as was not so permitted to be made, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) an amount chargeable to tax under this subsection shall be treated as income against which no loss, deficit, credit, expense or allowance may be set off, and shall not form part of the income of a company for the purposes of calculating a surcharge under section 440. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(16) (a) Where an individual makes a claim under this section in respect of a claim period and it subsequently transpires that the claim was not one permitted by this section to be made, and the individual has not repaid the amount as required by subsection (17)(a)(II), the individual shall be deemed to have received an amount of income equal to 5 times so much of the amount under this section as was not so permitted to be made (referred to in this subsection as the ‘unauthorised amount’). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) The unauthorised amount shall, notwithstanding any other provision of the Tax Acts, be deemed to be an amount of income, arising on the first day of the claim period that is chargeable to income tax under Case IV of Schedule D. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(c) Where the taxable income of an individual includes an amount pursuant to paragraph (b), the part of the taxable income equal to that amount shall be chargeable to income tax at the standard rate in force at the time of the payment of the advance credit for trading expenses but shall not— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) form part of the reckonable earnings chargeable to an amount of Pay Related Social Insurance Contributions under the Social Welfare Acts, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) be an amount on which a levy or charge is required, by or under Part 18D. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(d) Notwithstanding section 458 or any other provision of the Tax Acts, in calculating the tax payable (within the meaning of Part 41A) on the unauthorised amount under this subsection, there shall be allowed no deduction, relief, tax credit or reduction in tax. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(e) In applying section 188 or Chapter 2A of Part 15, no account shall be taken of any income deemed to arise under this subsection or any income tax payable on that income. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(17) (a) Where, subsequent to a person making a claim under this section, it transpires that— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||