Finance Act 2023

| ||

Number 11 of 2023 | ||

Finance Act 2023 | ||

CONTENTS | ||

Section | ||

2. Amendment of section 121A of Taxes Consolidation Act 1997 | ||

|

Acts Referred to | ||

Finance Act 1999 (No. 2) | ||

Finance Act 2022 (No. 44) | ||

Stamp Duties Consolidation Act 1999 (No. 31) | ||

Taxes Consolidation Act 1997 (No. 39) | ||

| ||

Number 11 of 2023 | ||

Finance Act 2023 | ||

An Act to provide for the imposition, repeal, remission, alteration and regulation of taxation, of stamp duties and of duties relating to excise and otherwise to make further provision in connection with finance; to amend the Finance Act 2022 with regard to the Temporary Business Support Scheme and otherwise make provision for supports to certain sectors of the economy; and to provide for related matters. | ||

[15th May, 2023] | ||

Be it enacted by the Oireachtas as follows: | ||

|

Amendment of section 121 of Taxes Consolidation Act 1997 | ||

|

1. Section 121 of the Taxes Consolidation Act 1997 is amended in subsection (4A)— | ||

(a) in paragraph (aa)(i), by the insertion of “subject to paragraph (ab),” before “€35,000”, | ||

(b) by the insertion of the following paragraph after paragraph (aa): | ||

“(ab) Notwithstanding paragraph (a), the cash equivalent of the benefit of a car ascertained under paragraph (a), for the year of assessment 2023, shall— | ||

(i) where paragraph (aa)(i) applies, be computed on the original market value of the car reduced by— | ||

(I) the amount specified in paragraph (aa)(i), and | ||

(II)€10,000, | ||

and | ||

(ii) where subparagraph (ab)(i) does not apply, for the vehicle categories A, B, C and D set out in column (1) of Table B to this subsection, be computed on the original market value of the car reduced by €10,000.”, | ||

and | ||

(c) by the insertion of the following paragraph after paragraph (b): | ||

“(ba) For the year of assessment 2023, Table A to this subsection shall apply as if— | ||

(i) the lower limit of “52,001” shown in column (1) were replaced by “48,001”, and | ||

(ii) the upper limit of “52,000” shown in column (2) were replaced by “48,000”. | ||

|

Amendment of section 121A of Taxes Consolidation Act 1997 | ||

|

2. Section 121A of the Taxes Consolidation Act 1997 is amended, in subsection (2)(b)— | ||

(a) in subparagraph (vi), by the substitution of “€50,000,” for “€50,000, and”, | ||

(b) in subparagraph (vii)— | ||

(i) in clause (I), by the insertion of “subject to subparagraph (viii),” before “€35,000”, and | ||

(ii) in clause (III), by the substitution of “2025, and” for “2025.”, | ||

and | ||

(c) by the insertion of the following subparagraph after subparagraph (vii): | ||

“(viii) the cash equivalent of the benefit of a van ascertained under subsection (3), for the year of assessment 2023, shall— | ||

(I) where subparagraph (vii)(I) applies, be computed on the original market value of the van reduced by— | ||

(A) the amount specified in subparagraph (vii)(I), and | ||

(B) €10,000, | ||

and | ||

(II) in any other case, be computed on the original market value of the van reduced by €10,000.”. | ||

|

Amendment of Taxes Consolidation Act 1997 | ||

|

3. (1) The Taxes Consolidation Act 1997 is amended— | ||

(a) in section 285D— | ||

(i) in subsection (1), in the definition of “SME”, by the substitution of “Commission Regulation (EU) 2022/2472 of 14 December 20221 ” for “Commission Regulation (EU) No. 702/2014 of 25 June 20142 ”, and | ||

(ii) in subsection (17), by the substitution of “€10,000” for “€60,000”, | ||

(b) in section 604B(1), in the definition of “relevant period”, by the substitution of “31 December 2025” for “30 June 2023”, | ||

(c) in section 658A— | ||

(i) in subsection (1), in the definition of “relevant period”, by the substitution of “31 December 2025” for “30 June 2023”, | ||

(ii) in subsection (4)(c), by the substitution of “Commission Regulation (EU) 2022/2472 of 14 December 20223 ” for “Commission Regulation (EU) No. 702/2014 of 25 June 20144 ”, and | ||

(iii) in subsection (6), by the substitution of “€10,000” for “€60,000”, | ||

(d) in section 667B— | ||

(i) in subsection (5)(b), by the substitution of “31 December 2024” for “30 June 2023”, and | ||

(ii) in subsection (7), by the substitution of “Commission Regulation (EU) 2022/2472 of 14 December 20225 ” for “Commission Regulation (EU) No. 702/2014 of 25 June 20146 ”, | ||

and | ||

(e) in section 667C— | ||

(i) in subsection (2), by the substitution of the following paragraph for paragraph (b): | ||

“(b) the following was substituted for subsection (4): | ||

‘(4) (a) A deduction shall not be allowed under this section in computing a company’s trading income for any accounting period which ends after 31 December 2024. | ||

(b) Any deduction allowed by virtue of this section in computing the profits or gains of a trade of farming for an accounting period of a person other than a company shall not apply for any purpose of the Income Tax Acts for any year of assessment later than the year 2024.’.”, | ||

and | ||

(ii) in subsection (4), by the substitution of “31 December 2024” for “30 June 2023”. | ||

(2) (a) The amendments effected by paragraphs (a)(ii) and (c)(iii) of subsection (1) shall apply in respect of a chargeable period where a return for that chargeable period is delivered in accordance with Part 41A of the Taxes Consolidation Act 1997 on or after the date of the passing of this Act. | ||

(b) In this subsection, “chargeable period” and “return” have the same meaning as they have respectively in Part 41A of the Taxes Consolidation Act 1997 . | ||

|

Amendment of Schedule 2 to Finance Act 1999 | ||

|

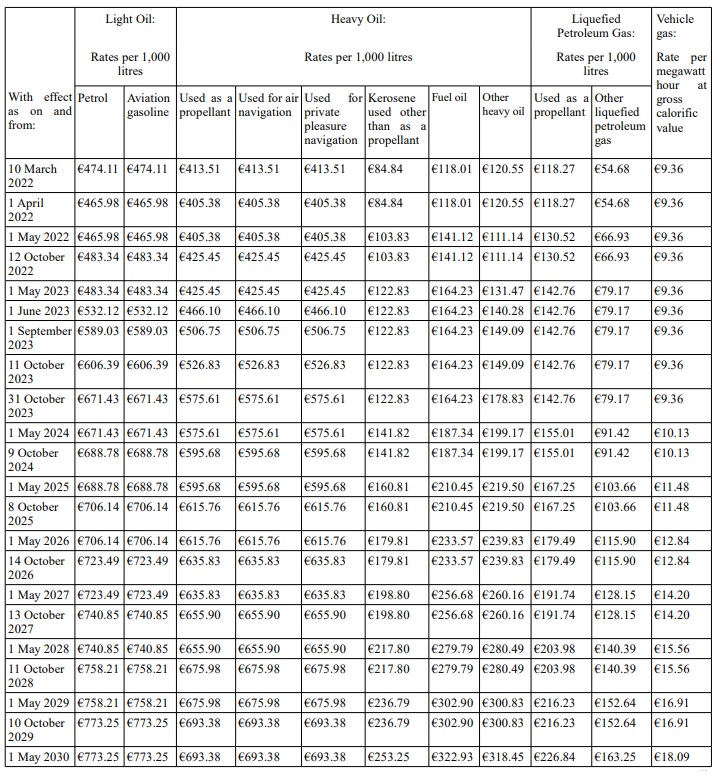

4. The Finance Act 1999 is amended with effect as on and from 23 February 2023 by the substitution of the following Schedule for Schedule 2: | ||

“SCHEDULE 2 | ||

RATES OF MINERAL OIL TAX | ||

| ||

”. | ||

|

Amendment of Value-Added Tax Consolidation Act 2010 | ||

|

5. The Value-Added Tax Consolidation Act 2010 is amended— | ||

(a) with effect as on and from 23 February 2023, in section 46(1)— | ||

(i) in paragraph (caa), by the substitution of “31 October 2023” for “28 February 2023”, and | ||

(ii) in paragraph (cb), by the substitution of “31 August 2023” for “28 February 2023”, | ||

(b) with effect as on and from 1 January 2023, in Part 2 of Schedule 2, in paragraph 11(5), by the substitution of the following clause for clause (a): | ||

“(a) The supply of Covid-19 in vitro diagnostic medical devices where those devices comply with the requirements of European Union legislation (or the law of a Member State giving effect to such legislation) applicable to such devices, including Directive 98/79/EC of the European Parliament and of the Council of 27 October 19987 and Regulation (EU) 2017/746 of the European Parliament and of the Council of 5 April 20178 .”, | ||

and | ||

(c) with effect as on and from 1 May 2023— | ||

(i) in Part 2 of Schedule 2, by the insertion of the following paragraph after paragraph 13: | ||

“Solar panels | ||

14. The supply and installation of solar panels on or adjacent to immovable goods, being private dwellings.”, | ||

and | ||

(ii) in Part 2 of Schedule 3, in paragraph 9(1), by the insertion of “other than the supply and installation of solar panels as specified in paragraph 14 of Schedule 2,” after “fixtures,”. | ||

|

Amendment of Stamp Duties Consolidation Act 1999 | ||

|

6. (1) The Stamp Duties Consolidation Act 1999 is amended— | ||

(a) in section 81AA— | ||

(i) in subsection (1), by the substitution of the following definition for the definition of “EU Regulation”: | ||

“‘EU Regulation’ means Commission Regulation (EU) 2022/2472 of 14 December 20229 declaring certain categories of aid in the agricultural and forestry sectors and in rural areas compatible with the internal market in application of Articles 107 and 108 of the Treaty on the Functioning of the European Union as that Regulation may be revised from time to time;”, | ||

(ii) in subsection (11)(c)(i), by the substitution of “3 years” for “4 years”, and | ||

(iii) in subsection (16), by the substitution of “31 December 2025” for “30 June 2023”, | ||

and | ||

(b) in section 81C— | ||

(i) in subsection (1)(a), in the definition of “relevant period”, by the substitution of “31 December 2025” for “30 June 2023”, and | ||

(ii) in subsection (12), by the substitution of “31 December 2025” for “30 June 2023”. | ||

(2) Notwithstanding the amendments effected by paragraph (a) of subsection (1), subparagraph (ii) of that paragraph shall not have effect as respects instruments executed before the date of the passing of this Act. | ||

|

Amendment of Finance Act 2022 | ||

|

7. (1) The Finance Act 2022 is amended— | ||

(a) in section 100(2)— | ||

(i) with effect as on and from 1 March 2023, in paragraph (a)(i), by the substitution of “later than 31 May 2023 (but not later than 31 July 2023)” for “later than 28 February 2023 (but not later than 30 April 2023)”, and | ||

(ii) by the insertion of the following paragraph after paragraph (b): | ||

“(c) An order under paragraph (a)(i) may, if the order so provides, have retrospective effect.”, | ||

and | ||

(b) in section 101— | ||

(i) with effect as on and from 1 March 2023, in subsection (1), in the definition of “specified period”, by the substitution of “31 May 2023” for “28 February 2023”, | ||

(ii) with effect as on and from 1 September 2022, in subsection (5)— | ||

(I) in paragraph (b), by the substitution of “30 per cent” for “50 per cent”, and | ||

(II) in paragraph (c), by the substitution of “30 per cent” for “50 per cent”, | ||

(iii) with effect as on and from 1 March 2023, by the substitution of the following subsection for subsection (7): | ||

“(7) Subject to subsection (9), on making a claim under this section, a qualifying business shall, in respect of a relevant electricity bill or a relevant gas bill, as the case may be, be entitled— | ||

(a) to an amount equal to 40 per cent of the eligible cost as determined in accordance with paragraph (c) or (d) of subsection (6), in respect of claim periods falling within the period beginning on 1 September 2022 and ending on 28 February 2023, and | ||

(b) to an amount equal to 50 per cent of the eligible cost as determined in accordance with paragraph (c) or (d) of subsection (6), in respect of claim periods falling within the period beginning on 1 March 2023 and ending at the end of the specified period, | ||

and any amount payable under this section is referred to in this section as a ‘temporary business energy payment’.”, | ||

(iv) with effect as on and from 1 September 2022, by the substitution of the following subsection for subsection (10): | ||

“(10) A claim made under this section in respect of a temporary business energy payment shall be made no later than 2 months from the end of the specified period.”, | ||

and | ||

(v) with effect as on and from 1 March 2023, in subsection (30)(a), by the substitution of “31 May 2023” for “28 February 2023”. | ||

(2) The Finance Act 2022 (Temporary Business Energy Support Scheme) (Specified Period) Order 2023 ( S.I. No. 75 of 2023 ) shall be deemed to have been revoked with effect as on and from 1 March 2023. | ||

(3) This section shall come into operation on such day or days as the Minister for Finance may by order or orders appoint either generally or with reference to any particular purpose or provision and different days may be so appointed for different purposes or different provisions. | ||

|

Short title | ||

|

8. This Act may be cited as the Finance Act 2023. | ||

1 OJ No. L327, 21.12.2022, p. 1 3 OJ No. L327, 21.12.2022, p. 1 5 OJ No. L327, 21.12.2022, p. 1 7 OJ No. L331, 7.12.1998, p. 1 |