Finance (Covid-19 and Miscellaneous Provisions) Act 2022

| ||

Number 9 of 2022 | ||

FINANCE (COVID-19 AND MISCELLANEOUS PROVISIONS) ACT 2022 | ||

CONTENTS | ||

Section | ||

3. Exemption in respect of Pandemic Special Recognition Payment | ||

7. Amendment of section 46 of Value-Added Tax Consolidation Act 2010 | ||

8. Amendment of section 114B of Value-Added Tax Consolidation Act 2010 | ||

9. Amendment of section 17C of Social Welfare Consolidation Act 2005 | ||

15. Tax treatment of certain payments to holders of sea-fishing boat licences | ||

16. Funding of Central Bank of Ireland - anti-money laundering functions | ||

|

Acts Referred to | ||

Affordable Housing Act 2021 (No. 25) | ||

Emergency Measures in the Public Interest (Covid-19) Act 2020 (No. 2) | ||

Finance Act 1980 (No. 14) | ||

Finance Act 1999 (No. 2) | ||

Fisheries (Amendment) Act 2003 (No. 21) | ||

Health Act 1947 (No. 28) | ||

Intoxicating Liquor Act 1927 (No. 15) | ||

Stamp Duties Consolidation Act 1999 (No. 31) | ||

Taxes Consolidation Act 1997 (No. 39) | ||

| ||

Number 9 of 2022 | ||

FINANCE (COVID-19 AND MISCELLANEOUS PROVISIONS) ACT 2022 | ||

An Act to provide for the imposition, repeal, remission, alteration and regulation of taxation, of stamp duties and of duties relating to excise; to otherwise make further provision in connection with finance; to make provision for the exemption from income tax of the payment generally referred to and commonly known as the Pandemic Special Recognition Payment and for that purpose to amend the Taxes Consolidation Act 1997 ; to make provision for supports to employers and certain businesses and for that purpose to amend Part 7 of the Emergency Measures in the Public Interest (Covid-19) Act 2020 , the Taxes Consolidation Act 1997 , the Social Welfare Consolidation Act 2005 and the Value-Added Tax Consolidation Act 2010 ; to provide for the repayment of stamp duty on cost rental dwellings and for that purpose to amend the Stamp Duties Consolidation Act 1999 ; to provide for the waiver of excise duty charged on certain special exemption orders granted under section 5 of the Intoxicating Liquor Act 1927 ; to provide for the tax treatment of certain payments to holders of sea-fishing boat licences arising under a scheme to be established by the Minister for Agriculture, Food and the Marine pursuant to Regulation (EU) 2021/1755 of the European Parliament and of the Council of 6 October 20211 and for that purpose to amend the Taxes Consolidation Act 1997 ; to provide for cost recovery mechanisms in relation to the Central Bank of Ireland, as operator of two beneficial ownership registers; and to provide for related matters. | ||

[2nd Jun e, 2022] | ||

Be it enacted by the Oireachtas as follows: | ||

|

Definitions | ||

|

1. In this Act— | ||

“Act of 1997” means the Taxes Consolidation Act 1997 ; | ||

“Act of 2020” means the Emergency Measures in the Public Interest (Covid-19) Act 2020 ; | ||

“Minister” means the Minister for Finance. | ||

|

Amendment of section 28B of Act of 2020 | ||

|

2. (1) Section 28B of the Act of 2020 is amended— | ||

(a) in subsection (1), by the substitution of the following definition for the definition of “qualifying period”: | ||

“‘qualifying period’ means the period commencing on 1 July 2020 and expiring— | ||

(a) in respect of an employer to which subsection (2D) applies, on 31 May 2022, and | ||

(b) in respect of any other employer to which this section applies, on 30 April 2022;”, | ||

(b) in subsection (2B), by the insertion of “in respect of the employer” after “expires”, | ||

(c) by the insertion of the following subsections after subsection (2B): | ||

“(2C) Subject to subsections (4) and (5), this section shall apply to an employer for the period from 1 January 2022 to the date on which the qualifying period expires in respect of the employer where— | ||

(a) in accordance with guidelines published by the Revenue Commissioners under subsection (20)(a), the employer demonstrates to the satisfaction of the Revenue Commissioners that, by reason of Covid-19 and the disruption that is being caused thereby to commerce, there will occur in the period from 1 December 2021 to 31 January 2022— | ||

(i) in the case where the commencement of the operation of the employer’s business occurred before 1 May 2019, at least a 30 per cent reduction, or such other percentage reduction as the Minister may specify in an order made by him or her under subsection (21)(b), in either the turnover of the employer’s business or in the customer orders being received by the employer by reference to the period from 1 December 2019 to 31 January 2020, and | ||

(ii) in the case where the commencement of the operation of the employer’s business occurred on or after 1 May 2019, at least a 30 per cent reduction, or such other percentage reduction as the Minister may specify in an order made by him or her under subsection (21)(b), in either the average monthly turnover of the employer’s business or in the average monthly customer orders being received by the employer by reference to the average monthly turnover of the employer’s business or the average monthly customer orders being received by the employer— | ||

(I) in the period from 1 August 2021 to 30 November 2021 (in this subparagraph referred to as ‘the reference period’), or | ||

(II) in the case where the business of the employer has not operated for the whole of the reference period, in the part of the reference period in which the business has operated, | ||

and | ||

(b) the employer satisfies the conditions specified in subsection (3). | ||

(2D) (a) This subsection shall apply to an employer where— | ||

(i) public health restrictions applied to the business of the employer in the relevant period, and | ||

(ii) the conduct of that business was directly impacted by reason of the terms in which those public health restrictions stood in the relevant period being different from how they stood immediately before that period by virtue of the relevant amendments. | ||

(b) In this subsection— | ||

‘public health restrictions’ means restrictions for the purpose of preventing, or reducing the risk of, the transmission of Covid-19 provided for in the Health Act 1947 (Section 31A - Temporary Restrictions) (Covid-19) (No. 2) Regulations 2021 ( S.I. No. 217 of 2021 ); | ||

‘relevant amendments’ means Regulations 5 to 8 of the Health Act 1947 (Section 31A - Temporary Restrictions) (Covid-19) (No. 2) (Amendment) (No. 22) Regulations 2021 ( S.I. No. 736 of 2021 ); | ||

‘relevant period’ means the period from 20 December 2021 to 22 January 2022.”, | ||

(d) in subsection (3), by the substitution of “subsection (2)(b), (2A)(b), (2B)(b) or (2C)(b) ” for “subsection (2)(b), (2A)(b) or (2B)(b) ”, | ||

(e) by the insertion of the following subsection after subsection (5): | ||

“(5A) Where, by virtue of subsection (2C), an employer is an employer to which this section applies— | ||

(a) the employer shall, if it has not already done so before the date of the passing of the Finance (Covid-19 and Miscellaneous Provisions) Act 2022, as soon as practicable review its business circumstances as they were on 31 January 2022, and | ||

(b) if, based on the result of that review or of such a review carried out before the date of the passing of the Finance (Covid-19 and Miscellaneous Provisions) Act 2022, it is manifest to the employer that the outcome referred to in subparagraph (i) or (ii), as the case may be, of subsection (2C)(a) that had previously been envisaged would occur did not, in fact, occur, | ||

then— | ||

(i) the employer shall, if it has not already done so before the date of the passing of the Finance (Covid-19 and Miscellaneous Provisions) Act 2022, as soon as practicable log on to ROS and declare that, as on and from 1 February 2022, the employer ceased to be an employer to which this section applies, and | ||

(ii) on and from 1 February 2022, the employer shall have ceased to be an employer to which this section applies and shall not represent that its status is otherwise than as referred to in this subparagraph nor cause the Revenue Commissioners to believe it to be so otherwise.”, | ||

(f) by the substitution of the following subsection for subsection (8): | ||

“(8) Subject to subsections (9), (21)(aa) and (21)(c), the wage subsidy payment payable by the Revenue Commissioners to an employer in relation to a qualifying employee shall be— | ||

(a) in the case where— | ||

(i) the employer is not an employer to which subsection (2D) applies and the date of the payment of the emoluments by the employer to the qualifying employee is in the period beginning on 1 July 2020 and ending on 19 October 2020 or the period beginning on 1 February 2022 and ending on 28 February 2022, or | ||

(ii) the employer is an employer to which subsection (2D) applies and the date of the payment of the emoluments by the employer to the qualifying employee is in the period beginning on 1 July 2020 and ending on 19 October 2020 or the period beginning on 1 March 2022 and ending on 31 March 2022, | ||

the sum of— | ||

(I) €151.50 per contribution week, where the employer pays the qualifying employee gross pay of at least €151.50 per week but not more than €202.99 per week, and | ||

(II) €203 per contribution week, where the employer pays the qualifying employee gross pay of at least €203 per week but not more than €1,462 per week, | ||

(b) in the case where— | ||

(i) the employer is not an employer to which subsection (2D) applies and the date of the payment of the emoluments by the employer to the qualifying employee is in the period beginning on 20 October 2020 and ending on 31 January 2022, or | ||

(ii) the employer is an employer to which subsection (2D) applies and the date of the payment of the emoluments by the employer to the qualifying employee is in the period beginning on 20 October 2020 and ending on 28 February 2022, | ||

the sum of— | ||

(I) €203 per contribution week, where the employer pays the qualifying employee gross pay of at least €151.50 per week but not more than €202.99 per week, | ||

(II) €250 per contribution week, where the employer pays the qualifying employee gross pay of at least €203 per week but not more than €299.99 per week, | ||

(III) €300 per contribution week, where the employer pays the qualifying employee gross pay of at least €300 per week but not more than €399.99 per week, and | ||

(IV) €350 per contribution week, where the employer pays the qualifying employee gross pay of at least €400 per week but not more than €1,462 per week, | ||

and | ||

(c) in the case where— | ||

(i) the employer is not an employer to which subsection (2D) applies and the date of the payment of the emoluments by the employer to the qualifying employee is in the period beginning on 1 March 2022 and ending on 30 April 2022, or | ||

(ii) the employer is an employer to which subsection (2D) applies and the date of the payment of the emoluments by the employer to the qualifying employee is in the period beginning on 1 April 2022 and ending on 31 May 2022, | ||

the sum of €100 per contribution week, where the employer pays the qualifying employee gross pay of at least €151.50 per week but not more than €1,462 per week.”, | ||

(g) in subsection (10)— | ||

(i) by the substitution of “in any of the income tax months July 2020 to June 2022” for “for an income tax month”, and | ||

(ii) in paragraph (b), by the substitution of “in any of the income tax months December 2020 to June 2022” for “subsequent to the income tax month December 2020”, | ||

(h) in subsection (17), by the substitution of “(2), (2A), (2B) or (2C)” for “(2), (2A) or (2B)” in both places where it occurs, | ||

(i) in subsection (20)(a), by the substitution of “(2), (2A), (2B) or (2C)” for “(2), (2A) or (2B)”, and | ||

(j) in subsection (21)— | ||

(i) in paragraph (aa), by the substitution of “31 May 2022” for “30 April 2022”, and | ||

(ii) in paragraph (b), by the insertion of “or subparagraphs (i) and (ii) of subsection (2C)(a) ”, after “clauses (I) to (III) of subsection (2)(a)(i), (2A)(a)(i) or (2B)(a)(i) ”. | ||

(2) Subsection (1), other than paragraph (e), shall be deemed to have come into operation on 1 January 2022. | ||

|

Exemption in respect of Pandemic Special Recognition Payment | ||

|

3. The Act of 1997 is amended in Chapter 1 of Part 7 by the insertion of the following section after section 192J: | ||

“192K. (1) In this section— | ||

‘qualifying individual’ means an individual who is in receipt of a qualifying payment; | ||

‘qualifying payment’ means a payment, generally referred to and commonly known as the Pandemic Special Recognition Payment, which is made, by or on behalf of the Minister for Health to a qualifying individual, further to the decision of the Government of 19 January 2022. | ||

(2) Subject to subsection (4), a qualifying payment made to a qualifying individual on or after 1 January 2022 shall be exempt from income tax and shall not be reckoned in computing the total income of the qualifying individual for the purposes of the Income Tax Acts. | ||

(3) A qualifying payment shall be deemed not to be a payment to which Chapter 4 of Part 42 applies. | ||

(4) The exemption provided for in subsection (2) shall apply to a maximum amount of €1,000 for each qualifying individual.”. | ||

|

Amendment of section 485 of Act of 1997 | ||

|

4. (1) Section 485 of the Act of 1997 is amended— | ||

(a) in subsection (1)— | ||

(i) by the substitution of the following definition for the definition of “relevant business activity”: | ||

“‘relevant business activity’, subject to subsection (1A), has the meaning assigned to it in subsection (4);”, | ||

and | ||

(ii) by the insertion of the following definitions: | ||

“ ‘approved body of persons’ has the same meaning as in section 235; | ||

‘charity’ has the same meaning as in section 208;”, | ||

(b) by the insertion of the following subsection after subsection (1): | ||

“(1A) (a) Where a charity carries on a trade, the profits or gains arising from which would be chargeable to tax under Case I of Schedule D but for section 208(2)(b), that trade shall be regarded as a relevant business activity for the purposes of this section. | ||

(b) Where an approved body of persons carries on a trade, the profits or gains arising from which would be chargeable to tax under Case I of Schedule D but for section 235(2), that trade shall be regarded as a relevant business activity for the purposes of this section.”, | ||

(c) in subsection (3)(c), by the substitution of “40” for “25”, | ||

(d) in subsection (4)— | ||

(i) in paragraph (a)— | ||

(I) by the substitution of the following definition for the definition of “average weekly turnover from the new relevant business activity”: | ||

“‘average weekly turnover from the new relevant business activity’ means— | ||

(i) in relation to a category A new relevant business activity, the average weekly turnover of the person, carrying on the activity, in respect of the new relevant business activity in the period commencing on the date on which the person commenced the business activity and ending on 12 October 2020, or | ||

(ii) in relation to a category B new relevant business activity, the average weekly turnover of the person, carrying on the activity, in respect of the new relevant business activity in the period commencing on the date on which the person commenced the business activity and ending on 1 August 2021.”, | ||

(II) by the substitution of the following definition for the definition of “new relevant business activity”: | ||

“‘new relevant business activity’ means a category A new relevant business activity or a category B new relevant business activity, as the case may be;”, | ||

and | ||

(III) by the insertion of the following definitions: | ||

“‘category A new relevant business activity’ means, in relation to a person, a relevant business activity commenced by that person on or after 26 December 2019 and before 13 October 2020; | ||

‘category B new relevant business activity’ means, in relation to a person, a relevant business activity commenced by that person on or after 13 October 2020 and before 27 July 2021;”, | ||

and | ||

(ii) in paragraph (b)(i), by the substitution of “40” for “25”, | ||

(e) in subsection (8)(b)— | ||

(i) in subparagraph (i): | ||

(I) by the substitution of “(referred to in this paragraph and in subsection (8A) as the ‘restart week’)” for “(referred to in this paragraph as the ‘restart week’)”, and | ||

(II) by the substitution of “may, subject to subsection (8A), elect” for “may elect”, | ||

and | ||

(ii) in subparagraph (ii), by the substitution of “Subject to subsection (8A), the period” for “The period”, | ||

(f) by the insertion of the following subsection after subsection (8): | ||

“(8A) The period that a qualifying person may elect to treat as a Covid restrictions extension period for the purposes of paragraph (b)(i) of subsection (8) shall be a period of one week from the date on which the restart week commences in a case where— | ||

(a) the restart week commences on or after 20 December 2021, and | ||

(b) the election is made in respect of— | ||

(i) a trade carried on by the qualifying person which is regarded as a relevant business activity as provided for in subsection (1A), or | ||

(ii) a relevant business activity and the turnover of the qualifying person in respect of the relevant business activity for any claim period commencing on or after 20 December 2021 and ending before the day the restart week commences is greater than 25 per cent (but not greater than 40 per cent) of the relevant turnover amount.”, | ||

(g) in subsection (14)(a)(ii), by the substitution of the following clause for clause (VI): | ||

“(VI) where a business activity is— | ||

(A) a category A new relevant business activity, the date of commencement of the activity and the amount of turnover in respect of the new business activity beginning on the date of commencement and ending on 12 October 2020, or | ||

(B) a category B new relevant business activity, the date of commencement of the activity and the amount of turnover in respect of the new business activity beginning on the date of commencement and ending on 1 August 2021,”, | ||

and | ||

(h) in subsection (22)(b), by the substitution of “40” for “25”. | ||

(2) Subsection (1) shall be deemed to have come into operation on 20 December 2021. | ||

|

Amendment of section 991B of Act of 1997 | ||

|

5. Section 991B of the Act of 1997 is amended— | ||

(a) in subsection (1)— | ||

(i) by the substitution of “Subject to subsection (1A), in this section” for “In this section”, and | ||

(ii) by the insertion of the following definition: | ||

“‘Covid-19 entitlement’ means an entitlement to payment of an amount under— | ||

(a) section 485, | ||

(b) section 28B of the Emergency Measures in the Public Interest (Covid-19) Act 2020 , | ||

(c) any of the following schemes: | ||

(i) the scheme commonly known as the Live Performance Support Scheme Strand II; | ||

(ii) the scheme commonly known as the Live Performance Support Scheme Phase 3; | ||

(iii) the scheme commonly known as the Live Performance Restart Grant Scheme; | ||

(iv) the scheme commonly known as the Live Local Performance Support Scheme; | ||

(v) the scheme commonly known as the Commercial Entertainment Capital Grant Scheme; | ||

(vi) the scheme commonly known as the Music and Entertainment Business Assistance Scheme; | ||

(vii) the scheme commonly known as the Attractions and Activity Tourism Operators Business Continuity Scheme 2022; | ||

(viii) the scheme commonly known as the Strategic Tourism Transport Business Continuity Scheme 2022; | ||

(ix) the scheme commonly known as the Strategic Ireland Based Inbound Agents Tourism Business Continuity Scheme 2022; | ||

(x) the scheme commonly known as the Tourism Accommodation Providers Business Continuity Scheme 2022; | ||

(xi) the scheme commonly known as the Sustaining Enterprise Fund; | ||

(xii) the scheme commonly known as the Accelerated Recovery Fund; | ||

(xiii) the scheme commonly known as the Support for Licensed Outbound Travel Agents and Tour Operators; | ||

(xiv) the scheme commonly known as the Temporary Covid-19 Supports for Commercial Bus Operators, | ||

or | ||

(d) a scheme designated for the purpose of this paragraph by order of the Revenue Commissioners under subsection (1B);”, | ||

(b) by the insertion of the following subsections after subsection (1): | ||

“(1A) Where an employer has a Covid-19 entitlement— | ||

(a) which arises out of circumstances occurring in a period falling between 1 January 2022 and 30 April 2022, or | ||

(b) which arises out of circumstances occurring in a period falling prior to 1 January 2022, resulting in an amount becoming payable to the employer between 1 January 2022 and 30 April 2022, | ||

then, in this section— | ||

‘Period 1’, in relation to the employer, means the period— | ||

(a) beginning on the later of— | ||

(i) the first day of the income tax month immediately preceding the income tax month in which the employer’s business was first adversely affected by Covid-19, and | ||

(ii) 1 February 2020, | ||

and | ||

(b) ending on 30 April 2022; | ||

‘Period 2’, in relation to the employer, means the period beginning on 1 May 2022 and ending on 30 April 2023; | ||

‘Period 3’, in relation to the employer, means the period beginning on 1 May 2023 and ending on the day on which the employer has discharged the Covid-19 liabilities in full. | ||

(1B) The Revenue Commissioners may designate by order a scheme for the purpose of paragraph (d) of the definition of ‘Covid-19 entitlement’ in subsection (1), where they are satisfied that the scheme is similar in nature and objective to a scheme referred to in paragraph (c) of that definition.”, | ||

and | ||

(c) by the substitution of the following subsection for subsection (5): | ||

“(5) An inspector, or such other officer as the Revenue Commissioners have nominated for the purposes of section 990, may make such enquiries as he or she considers necessary to satisfy himself or herself as to whether an employer— | ||

(a) is unable to pay all or part of the employer’s Covid-19 liabilities, or | ||

(b) has a Covid-19 entitlement— | ||

(i) which arises out of circumstances occurring in a period falling between 1 January 2022 and 30 April 2022, or | ||

(ii) which arises out of circumstances occurring in a period falling prior to 1 January 2022, resulting in an amount becoming payable to the employer between 1 January 2022 and 30 April 2022, | ||

as the case may be.”. | ||

|

Amendment of section 1080B of Act of 1997 | ||

|

6. Section 1080B of the Act of 1997 is amended— | ||

(a) in subsection (1)— | ||

(i) by the substitution of “Subject to subsection (1A), in this section” for “In this section”, and | ||

(ii) by the insertion of the following definition: | ||

“‘Covid-19 entitlement’ means an entitlement to payment of an amount under— | ||

(a) section 485, | ||

(b) section 28B of the Emergency Measures in the Public Interest (Covid-19) Act 2020 , | ||

(c) any of the following schemes: | ||

(i) the scheme commonly known as the Live Performance Support Scheme Strand II; | ||

(ii) the scheme commonly known as the Live Performance Support Scheme Phase 3; | ||

(iii) the scheme commonly known as the Live Performance Restart Grant Scheme; | ||

(iv) the scheme commonly known as the Live Local Performance Support Scheme; | ||

(v) the scheme commonly known as the Commercial Entertainment Capital Grant Scheme; | ||

(vi) the scheme commonly known as the Music and Entertainment Business Assistance Scheme; | ||

(vii) the scheme commonly known as the Attractions and Activity Tourism Operators Business Continuity Scheme 2022; | ||

(viii) the scheme commonly known as the Strategic Tourism Transport Business Continuity Scheme 2022; | ||

(ix) the scheme commonly known as the Strategic Ireland Based Inbound Agents Tourism Business Continuity Scheme 2022; | ||

(x) the scheme commonly known as the Tourism Accommodation Providers Business Continuity Scheme 2022; | ||

(xi) the scheme commonly known as the Sustaining Enterprise Fund; | ||

(xii) the scheme commonly known as the Accelerated Recovery Fund; | ||

(xiii) the scheme commonly known as the Support for Licensed Outbound Travel Agents and Tour Operators; | ||

(xiv) the scheme commonly known as the Temporary Covid-19 Supports for Commercial Bus Operators, | ||

or | ||

(d) a scheme designated for the purpose of this paragraph by order of the Revenue Commissioners under subsection (1B);”, | ||

(b) by the insertion of the following subsections after subsection (1): | ||

“(1A) Where a relevant person has a Covid-19 entitlement— | ||

(a) which arises out of circumstances occurring in a period falling between 1 January 2022 and 30 April 2022, or | ||

(b) which arises out of circumstances occurring in a period falling prior to 1 January 2022, resulting in an amount becoming payable to the relevant person between 1 January 2022 and 30 April 2022, | ||

then, in this section— | ||

‘Period 1’, in relation to the relevant person, means the period— | ||

(a) beginning on the date on which— | ||

(i) preliminary tax appropriate to the tax year 2020 for income tax purposes, and | ||

(ii) income tax appropriate to the tax year 2019, | ||

are due and payable, and | ||

(b) ending on 30 April 2022; | ||

‘Period 2’, in relation to the relevant person, means the period beginning on 1 May 2022 and ending on 30 April 2023; | ||

‘Period 3’, in relation to the relevant person, means the period beginning on 1 May 2023 and ending on the day on which the relevant person has discharged the Covid-19 income tax in full. | ||

(1B) The Revenue Commissioners may designate by order a scheme for the purpose of paragraph (d) of the definition of ‘Covid-19 entitlement’ in subsection (1), where they are satisfied that the scheme is similar in nature and objective to a scheme referred to in paragraph (c) of that definition.”, | ||

and | ||

(c) by the substitution of the following subsection for subsection (8): | ||

“(8) An officer of the Revenue Commissioners may make such enquiries as he or she considers necessary to satisfy himself or herself as to whether— | ||

(a) a relevant person’s total income for 2020 or 2021, as the case may be, is less than 75 per cent of the relevant person’s total income for 2019, | ||

(b) where a relevant person was not a relevant person for 2019, the relevant person is unable to pay the relevant person’s Covid-19 income tax in 2020 or 2021, as the case may be, or | ||

(c) the relevant person has a Covid-19 entitlement— | ||

(i) which arises out of circumstances occurring in a period falling between 1 January 2022 and 30 April 2022, or | ||

(ii) which arises out of circumstances occurring in a period falling prior to 1 January 2022, resulting in an amount becoming payable to the relevant person between 1 January 2022 and 30 April 2022, | ||

as the case may be.”. | ||

|

Amendment of section 46 of Value-Added Tax Consolidation Act 2010 | ||

|

7. Section 46 of the Value-Added Tax Consolidation Act 2010 is amended, in subsection (1) by— | ||

(a) the substitution in paragraph (a) of “at any of the rates specified in paragraphs (b), (c), (ca), (caa), (cb) and (d) ” for “at any of the rates specified in paragraphs (b), (c), (ca) and (d) ”, | ||

(b) the substitution in paragraph (c) of “subject to paragraphs (ca), (caa) and (cb) ” for “subject to paragraphs (ca) and (cb) ”, | ||

(c) the insertion of the following paragraph after paragraph (ca): | ||

“(caa) during the period from 1 May 2022 to 31 October 2022, 9 per cent in relation to goods of a kind specified in paragraph 17(2) and (3) of Schedule 3 on which tax would, but for this paragraph, be chargeable in accordance with paragraph (c) ;”, | ||

and | ||

(d) the substitution in paragraph (cb) of “28 February 2023” for “31 August 2022”. | ||

|

Amendment of section 114B of Value-Added Tax Consolidation Act 2010 | ||

|

8. Section 114B of the Value-Added Tax Consolidation Act 2010 is amended— | ||

(a) in subsection (1)— | ||

(i) by the substitution of “Subject to subsection (1A), in this section” for “In this section”, and | ||

(ii) by the insertion of the following definition: | ||

“‘Covid-19 entitlement’ means an entitlement to payment of an amount under— | ||

(a) section 485 of the Taxes Consolidation Act 1997 , | ||

(b) section 28B of the Emergency Measures in the Public Interest (Covid-19) Act 2020 , | ||

(c) any of the following schemes: | ||

(i) the scheme commonly known as the Live Performance Support Scheme Strand II; | ||

(ii) the scheme commonly known as the Live Performance Support Scheme Phase 3; | ||

(iii) the scheme commonly known as the Live Performance Restart Grant Scheme; | ||

(iv) the scheme commonly known as the Live Local Performance Support Scheme; | ||

(v) the scheme commonly known as the Commercial Entertainment Capital Grant Scheme; | ||

(vi) the scheme commonly known as the Music and Entertainment Business Assistance Scheme; | ||

(vii) the scheme commonly known as the Attractions and Activity Tourism Operators Business Continuity Scheme 2022; | ||

(viii) the scheme commonly known as the Strategic Tourism Transport Business Continuity Scheme 2022; | ||

(ix) the scheme commonly known as the Strategic Ireland Based Inbound Agents Tourism Business Continuity Scheme 2022; | ||

(x) the scheme commonly known as the Tourism Accommodation Providers Business Continuity Scheme 2022; | ||

(xi) the scheme commonly known as the Sustaining Enterprise Fund; | ||

(xii) the scheme commonly known as the Accelerated Recovery Fund; | ||

(xiii) the scheme commonly known as the Support for Licensed Outbound Travel Agents and Tour Operators; | ||

(xiv) the scheme commonly known as the Temporary Covid-19 Supports for Commercial Bus Operators, | ||

or | ||

(d) a scheme designated for the purpose of this paragraph by order of the Revenue Commissioners under subsection (1B);”, | ||

(b) by the insertion of the following subsections after subsection (1): | ||

“(1A) Where an accountable person has a Covid-19 entitlement— | ||

(a) which arises out of circumstances occurring in a period falling between 1 January 2022 and 30 April 2022, or | ||

(b) which arises out of circumstances occurring in a period falling prior to 1 January 2022, resulting in an amount becoming payable to the accountable person between 1 January 2022 and 30 April 2022, | ||

then, in this section— | ||

‘Period 1’, in relation to the accountable person, means the period— | ||

(a) beginning on the later of— | ||

(i) the first day of the taxable period immediately preceding the taxable period in which the accountable person’s business was first adversely affected by Covid-19, and | ||

(ii) 1 January 2020, | ||

and | ||

(b) ending on 30 April 2022; | ||

‘Period 2’, in relation to the accountable person, means the period beginning on 1 May 2022 and ending on 30 April 2023; | ||

‘Period 3’, in relation to the accountable person, means the period beginning on 1 May 2023 and ending on the day on which the accountable person has discharged the Covid-19 liabilities in full. | ||

(1B) The Revenue Commissioners may designate by order a scheme for the purpose of paragraph (d) of the definition of ‘Covid-19 entitlement’ in subsection (1), where they are satisfied that the scheme is similar in nature and objective to a scheme referred to in paragraph (c) of that definition.”, | ||

and | ||

(c) by the substitution of the following subsection for subsection (5): | ||

“(5) An inspector of taxes, or such other officer as the Revenue Commissioners have authorised for the purposes of section 111, may make such enquiries as he or she considers necessary to satisfy himself or herself as to whether an accountable person— | ||

(a) is unable to pay all or part of the accountable person’s Covid-19 liabilities, or | ||

(b) has a Covid-19 entitlement— | ||

(i) which arises out of circumstances occurring in a period falling between 1 January 2022 and 30 April 2022, or | ||

(ii) which arises out of circumstances occurring in a period falling prior to 1 January 2022, resulting in an amount becoming payable to the accountable person between 1 January 2022 and 30 April 2022, | ||

as the case may be.”. | ||

|

Amendment of section 17C of Social Welfare Consolidation Act 2005 | ||

|

9. Section 17C of the Social Welfare Consolidation Act 2005 is amended— | ||

(a) in subsection (1)— | ||

(i) by the substitution of “Subject to subsection (1A), in this section” for “In this section”, and | ||

(ii) by the insertion of the following definition: | ||

“‘Covid-19 entitlement’ means an entitlement to payment of an amount under— | ||

(a) section 485 of the Act of 1997, | ||

(b) section 28B of the Emergency Measures in the Public Interest (Covid-19) Act 2020 , | ||

(c) any of the following schemes: | ||

(i) the scheme commonly known as the Live Performance Support Scheme Strand II; | ||

(ii) the scheme commonly known as the Live Performance Support Scheme Phase 3; | ||

(iii) the scheme commonly known as the Live Performance Restart Grant Scheme; | ||

(iv) the scheme commonly known as the Live Local Performance Support Scheme; | ||

(v) the scheme commonly known as the Commercial Entertainment Capital Grant Scheme; | ||

(vi) the scheme commonly known as the Music and Entertainment Business Assistance Scheme; | ||

(vii) the scheme commonly known as the Attractions and Activity Tourism Operators Business Continuity Scheme 2022; | ||

(viii) the scheme commonly known as the Strategic Tourism Transport Business Continuity Scheme 2022; | ||

(ix) the scheme commonly known as the Strategic Ireland Based Inbound Agents Tourism Business Continuity Scheme 2022; | ||

(x) the scheme commonly known as the Tourism Accommodation Providers Business Continuity Scheme 2022; | ||

(xi) the scheme commonly known as the Sustaining Enterprise Fund; | ||

(xii) the scheme commonly known as the Accelerated Recovery Fund; | ||

(xiii) the scheme commonly known as the Support for Licensed Outbound Travel Agents and Tour Operators; | ||

(xiv) the scheme commonly known as the Temporary Covid-19 Supports for Commercial Bus Operators, | ||

or | ||

(d) a scheme designated for the purpose of this paragraph by order of the Revenue Commissioners under subsection (1B);”, | ||

(b) by the insertion of the following subsections after subsection (1): | ||

“(1A) Where an employer has a Covid-19 entitlement— | ||

(a) which arises out of circumstances occurring in a period falling between 1 January 2022 and 30 April 2022, or | ||

(b) which arises out of circumstances occurring in a period falling prior to 1 January 2022, resulting in an amount becoming payable to the employer between 1 January 2022 and 30 April 2022, | ||

then, in this section— | ||

‘Period 1’, in relation to the employer, means the period— | ||

(a) beginning on the later of— | ||

(i) the first day of the income tax month immediately preceding the income tax month in which the employer’s business was first adversely affected by Covid-19, and | ||

(ii) 1 February 2020, | ||

and | ||

(b) ending on 30 April 2022; | ||

‘Period 2’, in relation to the employer, means the period beginning on 1 May 2022 and ending on 30 April 2023; | ||

‘Period 3’, in relation to the employer, means the period beginning on 1 May 2023 and ending on the day on which the employer has discharged the Covid-19 liabilities in full. | ||

(1B) The Revenue Commissioners may designate by order a scheme for the purpose of paragraph (d) of the definition of ‘Covid-19 entitlement’ in subsection (1), where they are satisfied that the scheme is similar in nature and objective to a scheme referred to in paragraph (c) of that definition.”, | ||

and | ||

(c) by the substitution of the following subsection for subsection (5): | ||

“(5) An inspector of taxes, or such other officer as the Revenue Commissioners have nominated for the purposes of section 990 of the Act of 1997, may make such enquiries as he or she considers necessary to satisfy himself or herself as to whether an employer— | ||

(a) is unable to pay all or part of the employer’s Covid-19 liabilities, or | ||

(b) has a Covid-19 entitlement— | ||

(i) which arises out of circumstances occurring in a period falling between 1 January 2022 and 30 April 2022, or | ||

(ii) which arises out of circumstances occurring in a period falling prior to 1 January 2022, resulting in an amount becoming payable to the employer between 1 January 2022 and 30 April 2022, | ||

as the case may be.”. | ||

|

Amendment of section 28C of Act of 2020 | ||

|

10. Section 28C of the Act of 2020 is amended— | ||

(a) in subsection (1)— | ||

(i) by the substitution of “Subject to subsection (1A), in this section” for “In this section”, and | ||

(ii) by the insertion of the following definitions: | ||

“‘Covid-19 entitlement’ means an entitlement to payment of an amount under— | ||

(a) section 485 of the Taxes Consolidation Act 1997 , | ||

(b) section 28B, | ||

(c) any of the following schemes: | ||

(i) the scheme commonly known as the Live Performance Support Scheme Strand II; | ||

(ii) the scheme commonly known as the Live Performance Support Scheme Phase 3; | ||

(iii) the scheme commonly known as the Live Performance Restart Grant Scheme; | ||

(iv) the scheme commonly known as the Live Local Performance Support Scheme; | ||

(v) the scheme commonly known as the Commercial Entertainment Capital Grant Scheme; | ||

(vi) the scheme commonly known as the Music and Entertainment Business Assistance Scheme; | ||

(vii) the scheme commonly known as the Attractions and Activity Tourism Operators Business Continuity Scheme 2022; | ||

(viii) the scheme commonly known as the Strategic Tourism Transport Business Continuity Scheme 2022; | ||

(ix) the scheme commonly known as the Strategic Ireland Based Inbound Agents Tourism Business Continuity Scheme 2022; | ||

(x) the scheme commonly known as the Tourism Accommodation Providers Business Continuity Scheme 2022; | ||

(xi) the scheme commonly known as the Sustaining Enterprise Fund; | ||

(xii) the scheme commonly known as the Accelerated Recovery Fund; | ||

(xiii) the scheme commonly known as the Support for Licensed Outbound Travel Agents and Tour Operators; | ||

(xiv) the scheme commonly known as the Temporary Covid-19 Supports for Commercial Bus Operators, | ||

or | ||

(d) a scheme designated for the purpose of this paragraph by order of the Revenue Commissioners under subsection (1B); | ||

‘inspector of taxes’ means an inspector of taxes appointed under section 852 of the Taxes Consolidation Act 1997 ;”, | ||

(b) by the insertion of the following subsections after subsection (1): | ||

“(1A) Where an employer has a Covid-19 entitlement— | ||

(a) which arises out of circumstances occurring in a period falling between 1 January 2022 and 30 April 2022, or | ||

(b) which arises out of circumstances occurring in a period falling prior to 1 January 2022, resulting in an amount becoming payable to the employer between 1 January 2022 and 30 April 2022, | ||

then, in this section— | ||

‘Period 1’, in relation to the employer, means the period beginning on 26 March 2020 and ending on 30 April 2022; | ||

‘Period 2’, in relation to the employer, means the period beginning on 1 May 2022 and ending on 30 April 2023; | ||

‘Period 3’, in relation to the employer, means the period beginning on 1 May 2023 and ending on the day on which the employer has discharged the employer’s liability in respect of the Covid-19 relevant tax in full. | ||

(1B) The Revenue Commissioners may designate by order a scheme for the purpose of paragraph (d) of the definition of ‘Covid-19 entitlement’ in subsection (1), where they are satisfied that the scheme is similar in nature and objective to a scheme referred to in paragraph (c) of that definition.”, | ||

and | ||

(c) by the substitution of the following subsection for subsection (4): | ||

“(4) An inspector of taxes, or such other officer as the Revenue Commissioners have nominated for the purposes of section 990 of the Taxes Consolidation Act 1997 , may make such enquiries as he or she considers necessary to satisfy himself or herself as to whether an employer— | ||

(a) is unable to pay the employer’s liability in respect of Covid-19 relevant tax, or | ||

(b) has a Covid-19 entitlement— | ||

(i) which arises out of circumstances occurring in a period falling between 1 January 2022 and 30 April 2022, or | ||

(ii) which arises out of circumstances occurring in a period falling prior to 1 January 2022, resulting in an amount becoming payable to the employer between 1 January 2022 and 30 April 2022, | ||

as the case may be.”. | ||

|

Amendment of section 28D of Act of 2020 | ||

|

11. Section 28D of the Act of 2020 is amended— | ||

(a) in subsection (1)— | ||

(i) by the substitution of “Subject to subsection (1A), in this section” for “In this section”, and | ||

(ii) by the insertion of the following definitions: | ||

“‘Covid-19 entitlement’ means an entitlement to payment of an amount under— | ||

(a) section 485 of the Taxes Consolidation Act 1997 , | ||

(b) section 28B, | ||

(c) any of the following schemes: | ||

(i) the scheme commonly known as the Live Performance Support Scheme Strand II; | ||

(ii) the scheme commonly known as the Live Performance Support Scheme Phase 3; | ||

(iii) the scheme commonly known as the Live Performance Restart Grant Scheme; | ||

(iv) the scheme commonly known as the Live Local Performance Support Scheme; | ||

(v) the scheme commonly known as the Commercial Entertainment Capital Grant Scheme; | ||

(vi) the scheme commonly known as the Music and Entertainment Business Assistance Scheme; | ||

(vii) the scheme commonly known as the Attractions and Activity Tourism Operators Business Continuity Scheme 2022; | ||

(viii) the scheme commonly known as the Strategic Tourism Transport Business Continuity Scheme 2022; | ||

(ix) the scheme commonly known as the Strategic Ireland Based Inbound Agents Tourism Business Continuity Scheme 2022; | ||

(x) the scheme commonly known as the Tourism Accommodation Providers Business Continuity Scheme 2022; | ||

(xi) the scheme commonly known as the Sustaining Enterprise Fund; | ||

(xii) the scheme commonly known as the Accelerated Recovery Fund; | ||

(xiii) the scheme commonly known as the Support for Licensed Outbound Travel Agents and Tour Operators; | ||

(xiv) the scheme commonly known as the Temporary Covid-19 Supports for Commercial Bus Operators, | ||

or | ||

(d) a scheme designated for the purpose of this paragraph by order of the Revenue Commissioners under subsection (1B); | ||

‘inspector of taxes’ means an inspector of taxes appointed under section 852 of the Taxes Consolidation Act 1997 ;”, | ||

(b) by the insertion of the following subsections after subsection (1): | ||

“(1A) Where an employer has a Covid-19 entitlement— | ||

(a) which arises out of circumstances occurring in a period falling between 1 January 2022 and 30 April 2022, or | ||

(b) which arises out of circumstances occurring in a period falling prior to 1 January 2022, resulting in an amount becoming payable to the employer between 1 January 2022 and 30 April 2022, | ||

then, in this section— | ||

‘Period 1’, in relation to the employer, means the period beginning on 1 July 2020 and ending on 30 April 2022; | ||

‘Period 2’, in relation to the employer, means the period beginning on 1 May 2022 and ending on 30 April 2023; | ||

‘Period 3’, in relation to the employer, means the period beginning on 1 May 2023 and ending on the day on which the employer has discharged the employer’s liability in respect of the Covid-19 relevant tax in full. | ||

(1B) The Revenue Commissioners may designate by order a scheme for the purpose of paragraph (d) of the definition of ‘Covid-19 entitlement’ in subsection (1), where they are satisfied that the scheme is similar in nature and objective to a scheme referred to in paragraph (c) of that definition.”, | ||

and | ||

(c) by the substitution of the following subsection for subsection (4): | ||

“(4) An inspector of taxes, or such other officer as the Revenue Commissioners have nominated for the purposes of section 990 of the Taxes Consolidation Act 1997 , may make such enquiries as he or she considers necessary to satisfy himself or herself as to whether an employer— | ||

(a) is unable to pay the employer’s liability in respect of Covid-19 relevant tax, or | ||

(b) has a Covid-19 entitlement— | ||

(i) which arises out of circumstances occurring in a period falling between 1 January 2022 and 30 April 2022, or | ||

(ii) which arises out of circumstances occurring in a period falling prior to 1 January 2022, resulting in an amount becoming payable to the employer between 1 January 2022 and 30 April 2022, | ||

as the case may be.”. | ||

|

Amendment of Schedule 2 to Finance Act 1999 | ||

|

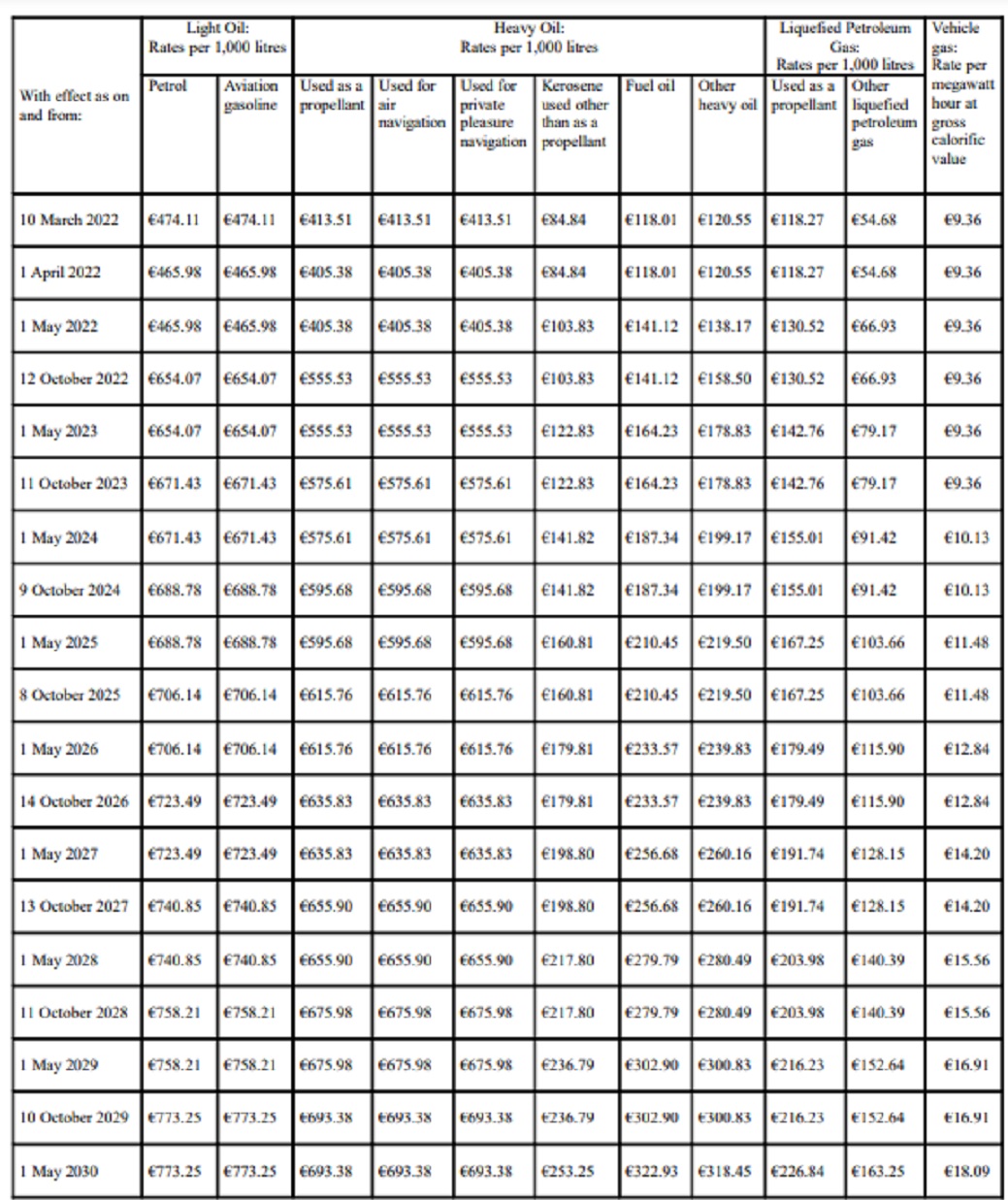

12. (1) The Finance Act 1999 is amended with effect as on and from 10 March 2022 by the substitution of the following Schedule for Schedule 2: | ||

“SCHEDULE 2 | ||

Rates of Mineral Oil Tax | ||

| ||

” | ||

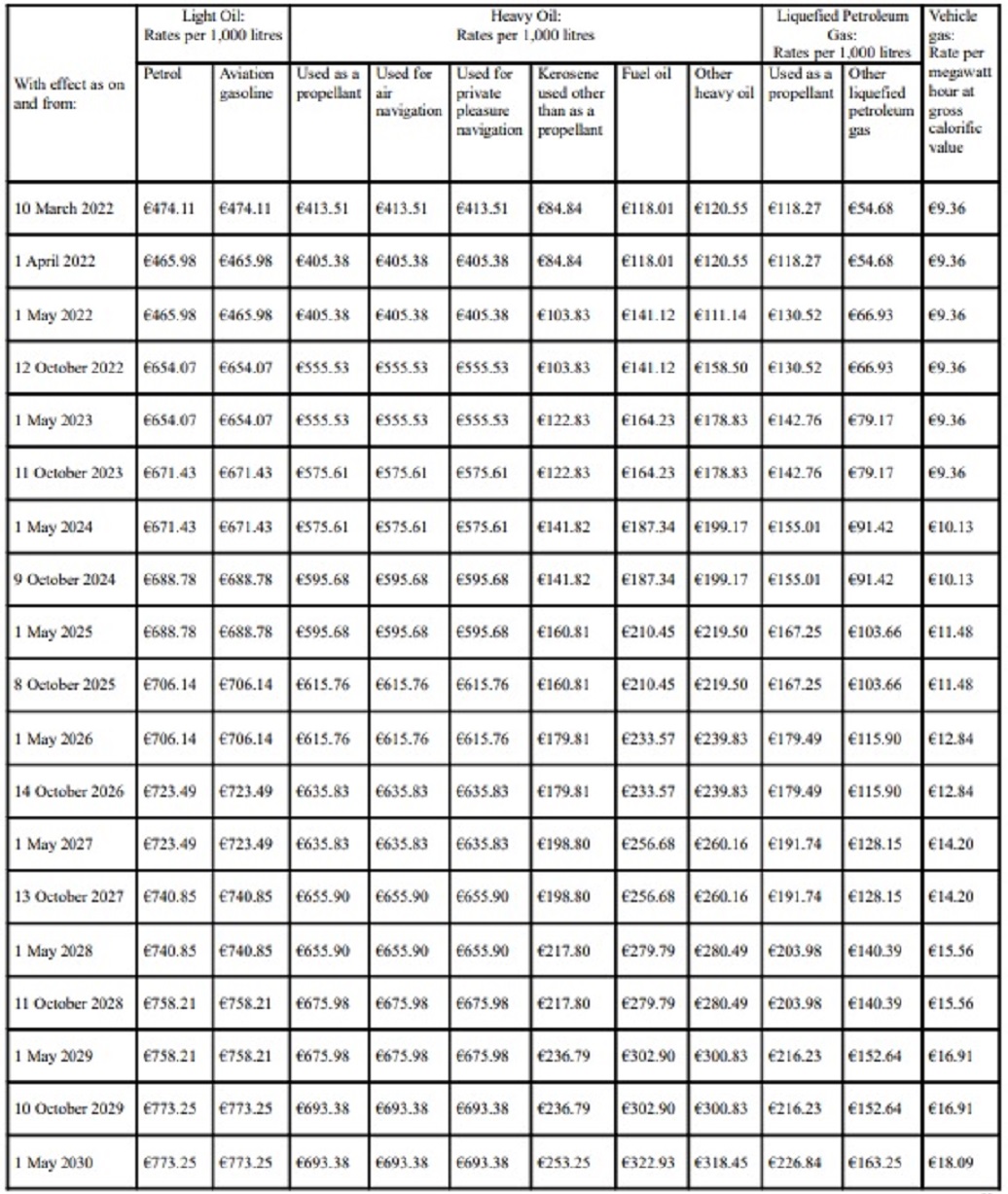

(2) The Finance Act 1999 is further amended with effect as on and from 1 May 2022 by the substitution of the following Schedule for Schedule 2: | ||

“SCHEDULE 2 | ||

Rates of Mineral Oil Tax | ||

| ||

” | ||

|

Waiver of excise duty on special exemption orders | ||

|

13. No duty of excise shall be chargeable, leviable or payable under section 78 (4) of the Finance Act 1980 on a special exemption order granted under section 5 of the Intoxicating Liquor Act 1927, in respect of dates falling within the period beginning on 26 January 2022 and ending on 30 April 2022. | ||

|

Repayment of stamp duty on cost rental dwellings | ||

|

14. (1) The Stamp Duties Consolidation Act 1999 is amended by the insertion of the following section after section 83E: | ||

“83F. (1) In this section— | ||

‘Act of 2021’ means the Affordable Housing Act 2021 ; | ||

‘cost rental dwelling’ has the same meaning as it has in Part 3 of the Act of 2021; | ||

‘qualifying date’, in relation to a relevant residential unit, means the date on which the unit becomes a qualifying relevant residential unit; | ||

‘qualifying relevant residential unit’ has the meaning assigned to it by subsection (3); | ||

‘relevant instrument’ means an instrument executed on or after 20 May 2021 that has been stamped in accordance with— | ||

(a) paragraph (1)(b) of the heading in Schedule 1 titled ‘CONVEYANCE or TRANSFER on sale of any property other than stocks or marketable securities or a policy of insurance or a policy of life insurance’, or | ||

(b) paragraph (3)(a)(i)(II) of the heading in Schedule 1 titled ‘LEASE’, | ||

where the instrument was chargeable, in respect of the whole or part of the consideration under the instrument, to stamp duty at a rate of 10 per cent; | ||

‘relevant residential unit’ has the same meaning as it has in section 31E. | ||

(2) In this section, a reference to acquisition shall include a reference to acquisition by way of a conveyance, transfer, lease, instrument, contract or agreement referred to in section 31E(2). | ||

(3) This subsection applies where, in the 6-month period commencing on the day after the date a relevant instrument effecting the acquisition of a relevant residential unit is executed, the relevant residential unit is designated as a cost rental dwelling under Part 3 of the Act of 2021 (and such a relevant residential unit designated within that period is referred to in this section as a ‘qualifying relevant residential unit’). | ||

(4) Where subsection (3) applies, stamp duty paid on a relevant instrument may be repaid in accordance with this section. | ||

(5) The amount of stamp duty to be repaid, in relation to a relevant instrument and a qualifying relevant residential unit, shall be determined by the formula— | ||

A - B | ||

where— | ||

A is the amount of stamp duty paid on the relevant instrument, that was attributable to the qualifying relevant residential unit, and | ||

B is the amount of stamp duty, attributable to the qualifying relevant residential unit, that would have been chargeable on the execution of the relevant instrument if the qualifying relevant residential unit had not been a relevant residential unit. | ||

(6) A claim for a repayment under this section shall— | ||

(a) be made by an accountable person, | ||

(b) without prejudice to paragraph (d), be made in a form and manner specified by the Commissioners, | ||

(c) include a declaration, in such form as the Commissioners specify, stating that subsection (3) applies, | ||

(d) be made by electronic means and through such electronic systems as the Commissioners may make available for the time being for any such purpose, and the relevant provisions of Chapter 6 of Part 38 of the Taxes Consolidation Act 1997 shall apply, and | ||

(e) not be made before the qualifying date concerned. | ||

(7) Subject to the other provisions of this section, a repayment of stamp duty under this section shall— | ||

(a) be made by the Commissioners pursuant to a claim made in accordance with subsection (6), | ||

(b) not carry interest, and | ||

(c) not be made pursuant to a claim made after the expiry of 4 years after the qualifying date concerned. | ||

(8) Where, in relation to a claim for repayment, the Commissioners are of the opinion that the requirements of this section have not been met, they shall decide to refuse the claim and shall notify the claimant in writing of the decision and the reasons for it. | ||

(9) An accountable person aggrieved by a decision to refuse a claim for repayment, may appeal to the Appeal Commissioners against the decision in accordance with section 949I of the Taxes Consolidation Act 1997 , within the period of 30 days after the date of the notification of the decision. | ||

(10) For the purposes of this section— | ||

(a) section 128A shall apply as if the period of 6 years referred to in subsection (4) of that section commenced on the qualifying date concerned, and | ||

(b) the records referred to in section 128A shall include, in relation to the qualifying relevant residential unit concerned, a copy of the cost rental designation (within the meaning of Part 3 of the Act of 2021). | ||

(11) Where a repayment has been made under this section and it is subsequently found that a declaration made in accordance with subsection (6)— | ||

(a) was untrue in any material particular that would have resulted in a repayment, or part of a repayment, allowed by this section not being made, and | ||

(b) was made knowing same to be untrue or in reckless disregard as to whether or not it was true, | ||

then the person who made such a declaration shall be liable to pay to the Commissioners as a penalty an amount equal to 125 per cent of the stamp duty that would not have been repaid had all the facts been truthfully declared, together with interest charged on that amount as may so become payable, calculated in accordance with section 159D, from the date on which the repayment was made to the date the penalty is paid.”. | ||

(2) Subsection (1) shall come into operation on the day after the date of the passing of this Act. | ||

|

Tax treatment of certain payments to holders of sea-fishing boat licences | ||

|

15. (1) The Act of 1997 is amended— | ||

(a) by the insertion of the following Chapter after section 669K: | ||

“Chapter 5 | ||

Tax treatment of certain payments to holders of sea-fishing boat licences | ||

Definitions | ||

669L. (1) In this Chapter— | ||

‘Brexit compensation sum’ means sums arising to a licence holder made under a scheme to be established for that purpose by the Minister for Agriculture, Food and the Marine, pursuant to Regulation (EU) 2021/1755 in respect of a relevant vessel decommissioned during the period beginning on 1 January 2022 and ending on 31 December 2023, which may comprise one or more of the following: | ||

(a) compensation for the destruction of a relevant vessel; | ||

(b) a crew payment amount; | ||

(c) the catch sum; | ||

(d) compensation for the surrender of a sea-fishing boat licence; | ||

‘catch sum’ means the portion of the Brexit compensation sum that is in respect of the annual gross tonnage of sea-fish stock landed over the periods beginning on 1 January 2018 and ending on 31 December 2018 and beginning on 1 January 2019 and ending on 31 December 2019 as adjusted for the age of the relevant vessel and which takes account of any amount previously paid to the licence holder as a temporary tie up payment; | ||

‘chargeable period’ has the same meaning as in section 321(2) ; | ||

‘crew member’ means an individual who has spent— | ||

(a) at least 90 days at sea on board a relevant vessel in the period beginning on 1 January 2020 and ending on 31 December 2020, and | ||

(b) at least 90 days at sea on board a relevant vessel in the period beginning on 1 January 2021 and ending on 31 December 2021; | ||

‘crew payment amount’ means the portion of the Brexit compensation sum received by a licence holder in respect of crew members; | ||

‘day at sea’ has the same meaning as in Chapter I of the Annex to the Commission Delegated Decision (EU) 2021/1167 of 27 April 20212 establishing the multiannual Union programme for the collection and management of biological, environmental, technical and socioeconomic data in the fisheries and aquaculture sectors from 2022; | ||

‘decommissioned’ means, in respect of a sea-fishing boat, a sea-fishing boat which has been removed from the Register of Fishing Boats; | ||

‘licence holder’ means the holder of a sea-fishing boat licence in respect of a relevant vessel; | ||

‘Register of Fishing Boats’ means the Register of Fishing Boats maintained under section 74 of the Sea-Fisheries and Maritime Jurisdiction Act 2006 ; | ||

‘Regulation (EU) 2021/1755’ means Regulation (EU) 2021/1755 of the European Parliament and of the Council of 6 October 20213 establishing the Brexit Adjustment Reserve; | ||

‘relevant vessel’ means a sea-fishing boat entered in the Register of Fishing Boats and used in the polyvalent and beam trawl segments of the fishing fleet which— | ||

(a) has spent at least 90 days at sea— | ||

(i) in each year in the 2 years preceding the year in which the sea-fishing boat is decommissioned, or | ||

(ii) during each of the periods beginning on 1 January 2018 and ending on 31 December 2018 and beginning on 1 January 2019 and ending on 31 December 2019, | ||

and | ||

(b) was constructed at least 10 years before the date of decommissioning; | ||

‘sea-fishing boat licence’ means a licence granted under the Fisheries (Amendment) Act 2003 ; | ||

‘sea-fish stocks’ means the stocks of sea-fish set out in Annexes 35 and 36 to the Trade and Cooperation Agreement between the European Union and the European Atomic Energy Community, of the one part, and the United Kingdom of Great Britain and Northern Ireland, of the other part, done at Brussels and London on 30 December 20204 ; | ||

‘temporary tie up payment’ means a payment made to a person to temporarily cease all fishing activities and to retain the relevant vessel in port for at least one month during either or both of the following periods: | ||

(a) the period beginning on 1 January 2021 and ending on 31 December 2021 under a scheme established for that purpose by the Minister for Agriculture, Food and the Marine pursuant to Regulation (EU) 2021/1755; | ||

(b) the period beginning on 1 January 2022 and ending on 31 December 2022 under a scheme to be established for that purpose by the Minister for Agriculture, Food and the Marine pursuant to Regulation (EU) 2021/1755. | ||

Exemption for licence holder in respect of certain crew payments | ||

669M. (1) This section shall apply where a licence holder is chargeable to tax under Case IV of Schedule D in respect of the portion of the Brexit compensation sum which comprises the crew payment amount. | ||

(2) Notwithstanding any provision of the Tax Acts, the total crew payment amount paid to the licence holder shall be exempt from income tax and corporation tax and shall not be reckoned in computing total income for the purposes of the Income Tax Acts. | ||

(3) The crew payment amount paid to a licence holder shall not be deductible in computing the amounts of profits or gains chargeable to tax under Case IV of Schedule D. | ||

(4) A licence holder shall not be entitled to an exemption under this section for the chargeable period concerned unless the crew payment amount is paid to the crew member concerned within 3 months of its receipt by the licence holder. | ||

Balancing charges on relevant vessel | ||

669N. (1) In this section, ‘balancing charge’ has the same meaning as in section 288. | ||

(2) This section shall apply to the amount of the Brexit compensation sum which relates to compensation for the destruction of a relevant vessel. | ||

(3) (a) Where, on account of the receipt by a licence holder of a payment or payments to which subsection (2) applies, a balancing charge is to be made on that licence holder for any chargeable period other than by virtue of paragraph (b), then, the amount on which the balancing charge is to be made for that chargeable period shall be an amount equal to one-fifth of the amount (in this subsection referred to as ‘the original amount’) on which the balancing charge would, but for this subsection, have been made. | ||

(b) Notwithstanding paragraph (a), there shall be made on the licence holder for each of the 4 immediately succeeding chargeable periods a balancing charge, and the amount on which that charge is made for each of those periods shall be an amount equal to one-fifth of the original amount. | ||

Exemption in respect of the catch sum | ||

669O. (1) Subject to subsection (2), where a licence holder is chargeable to tax under Schedule D in respect of the portion of the Brexit compensation sum which relates to the catch sum, the profits or gains chargeable in the period concerned shall be reduced by an amount equal to 50 per cent of the catch sum and shall be treated as so reduced for the purpose of computing total income for the purposes of the Tax Acts. | ||

(2) Where a temporary tie up payment is included in the portion of the Brexit compensation sum which relates to the catch sum a licence holder may elect by notice in writing to a Revenue officer to have a deduction equal to 50 per cent of that amount of the temporary tie up payment or a portion of that payment taken into account in determining the profits or gains charged to tax under Schedule D in the preceding chargeable period, and such deduction shall be taken into account for the purpose of computing total income for the Tax Acts. | ||

(3) The total amount of the reduction claimed under subsection (1) and the deduction claimed under subsection (2) shall not in aggregate exceed an amount equal to 50 per cent of the catch sum.”, | ||

and | ||

(b) in section 598, by the insertion of the following subsection after subsection (3A): | ||

“(3B) (a) In this subsection— | ||

‘Brexit compensation sum’, ‘relevant vessel’ and ‘sea-fishing boat licence’ have the same meaning respectively as they have in section 669L. | ||

(b) Relief under subsection (2) shall apply in respect of the following payments arising as a portion of a Brexit compensation sum— | ||

(i) compensation for the destruction of a relevant vessel, and | ||

(ii) compensation for the surrender of a sea-fishing boat licence, as if— | ||

(I) in subsection (1)(a), the period referred to in paragraph (i) of the definition of ‘qualifying assets’ were 6 years, and | ||

(II) in subsection (2)(a), the age attained by an individual were 45 years.”. | ||

(2) Subsection (1) shall come into operation on such day or days as the Minister may appoint by order or orders either generally or with reference to any particular purpose or provision and different days may be so appointed for different purposes or different provisions. | ||

|

Funding of Central Bank of Ireland - anti-money laundering functions | ||

|

16. (1) Where— | ||

(a) in any year, the Bank stands appointed as the Registrar of Beneficial Ownership of Irish Collective Asset-management Vehicles, Credit Unions and Unit Trusts (in this subsection referred to as the “Registrar”) under Regulation 18 of the modified Regulations, and | ||

(b) either— | ||

(i) the Bank reasonably apprehends that it will be unable to defray all of the expenses of the Bank, arising in that year, associated with its functions as the Registrar from moneys received by it by way of the levies referred to in Regulation 31A(3) of the modified Regulations (in this subsection referred to as the “dedicated levies”), or | ||

(ii) notwithstanding the existence of the dedicated levies and, apart from the circumstance referred to in subparagraph (i), for any reason there is an insufficiency in any year of moneys available to the Bank to defray all of its expenses, arising in that year, associated with the foregoing functions, | ||

the Minister shall, on the written request of the Bank, advance to the Bank such sums as he or she thinks proper to enable the Bank to defray all of its expenses, arising in that year, associated with the foregoing functions. | ||

(2) The payments of sums referred to in subsection (1) shall be made on such terms as to repayment, interest and other matters as may be determined by the Minister after consulting the Bank. | ||

(3) Paragraphs (4) to (6) of Regulation 31A of the modified Regulations are revoked. | ||

(4) The Bank shall not provide any funds from its own resources to defray expenses of the Bank incurred by it in the performance of its functions under the Regulations of 2022. | ||

(5) The Minister shall, on the written request of the Bank, advance to the Bank such sums as he or she thinks proper to enable the Bank to defray all of its expenses associated with the functions referred to in subsection (4). | ||

(6) All moneys from time to time required by the Minister to meet sums which may become payable by him or her under this section shall be advanced out of the Central Fund or the growing produce thereof. | ||

(7) In this section— | ||

“Bank” means the Central Bank of Ireland; | ||

“modified Regulations” means the European Union (Anti-Money Laundering: Beneficial Ownership of Corporate Entities) Regulations 2019 ( S.I. No. 110 of 2019 ), as modified by the European Union (Modifications of Statutory Instrument No. 110 of 2019) (Registration of Beneficial Ownership of Certain Financial Vehicles) Regulations 2020 ( S.I. No. 233 of 2020 ); | ||

“Regulations of 2022” means the European Union (Anti-Money Laundering: Central Mechanism for Information on Safe-Deposit Boxes and Bank and Payment Accounts) Regulations 2022 ( S.I. No. 46 of 2022 ). | ||

|

Short title | ||

|

17. This Act may be cited as the Finance (Covid-19 and Miscellaneous Provisions) Act 2022. | ||

1 OJ No. L 357, 8.10.2021, p. 1 2 OJ No. L 253, 16.7.2021, p. 52 |