Finance Act 2021

| ||||||||||||||||||||||||||||||||||||||||||||

Number 45 of 2021 | ||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2021 | ||||||||||||||||||||||||||||||||||||||||||||

CONTENTS | ||||||||||||||||||||||||||||||||||||||||||||

Universal Social Charge, Income Tax, Corporation Tax and Capital Gains Tax | ||||||||||||||||||||||||||||||||||||||||||||

Interpretation | ||||||||||||||||||||||||||||||||||||||||||||

Section | ||||||||||||||||||||||||||||||||||||||||||||

Universal Social Charge | ||||||||||||||||||||||||||||||||||||||||||||

2. Amendment of section 531AN of Principal Act (rate of charge) | ||||||||||||||||||||||||||||||||||||||||||||

Income Tax | ||||||||||||||||||||||||||||||||||||||||||||

3. Deduction in respect of certain expenses of remote working | ||||||||||||||||||||||||||||||||||||||||||||

7. Amendment of section 118 of Principal Act (benefits in kind: general charging provision) | ||||||||||||||||||||||||||||||||||||||||||||

10. Amendment of section 472BB of Principal Act (sea-going naval personnel credit) | ||||||||||||||||||||||||||||||||||||||||||||

12. Retirement benefits: amendment of death-in-service provision | ||||||||||||||||||||||||||||||||||||||||||||

14. Retirement benefits: removal of Approved Minimum Retirement Fund (AMRF) | ||||||||||||||||||||||||||||||||||||||||||||

Income Tax, Corporation Tax and Capital Gains Tax | ||||||||||||||||||||||||||||||||||||||||||||

17. Amendment of section 261 of Principal Act (taxation of relevant interest, etc.) | ||||||||||||||||||||||||||||||||||||||||||||

19. Amendment of certain tax exemption provisions of Principal Act | ||||||||||||||||||||||||||||||||||||||||||||

24. Amendment of Part 23 of Principal Act (farming and market gardening) | ||||||||||||||||||||||||||||||||||||||||||||

25. Amendment of section 886 of Principal Act (obligation to keep certain records) | ||||||||||||||||||||||||||||||||||||||||||||

26. Amendment of Part 16 of Principal Act (relief for investment in corporate trades) | ||||||||||||||||||||||||||||||||||||||||||||

27. Amendment of Part 35A of Principal Act (transfer pricing) | ||||||||||||||||||||||||||||||||||||||||||||

Corporation Tax | ||||||||||||||||||||||||||||||||||||||||||||

29. Amendment of section 129A of Principal Act (dividends paid out of foreign profits) | ||||||||||||||||||||||||||||||||||||||||||||

32. Amendment of section 481 of Principal Act (relief for investment in films) | ||||||||||||||||||||||||||||||||||||||||||||

34. Amendment of section 486C of Principal Act (relief from tax for certain start-up companies) | ||||||||||||||||||||||||||||||||||||||||||||

Capital Gains Tax | ||||||||||||||||||||||||||||||||||||||||||||

37. Amendment of section 604 of Principal Act (disposals of principal private residence) | ||||||||||||||||||||||||||||||||||||||||||||

38. Transfers arising from certain mergers under Companies Act 2014 | ||||||||||||||||||||||||||||||||||||||||||||

39. Amendment of section 630 of Principal Act (interpretation (Part 21)) | ||||||||||||||||||||||||||||||||||||||||||||

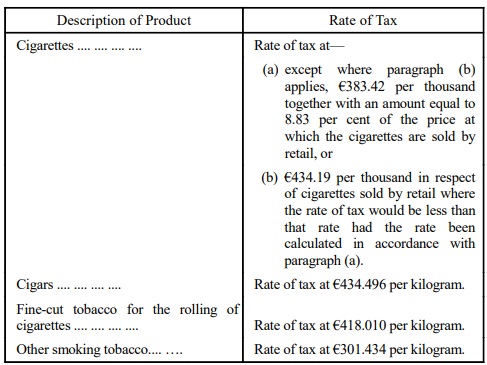

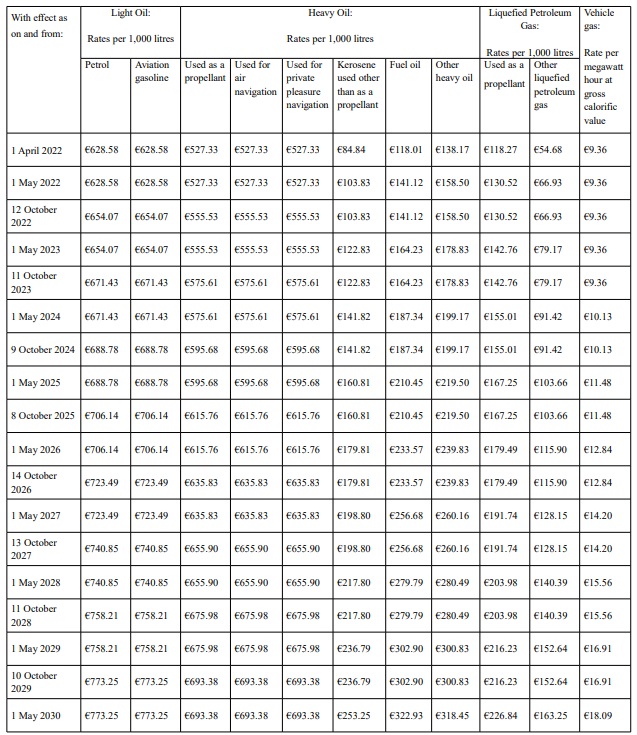

Excise | ||||||||||||||||||||||||||||||||||||||||||||

41. Amendment of Chapter 1 of Part 2 of Finance Act 1999 (mineral oil tax) | ||||||||||||||||||||||||||||||||||||||||||||

42. Amendment of Schedule 2 to Finance Act 1999 (mineral oil tax) | ||||||||||||||||||||||||||||||||||||||||||||

43. Amendment of Chapter 1 of Part 2 of Finance Act 2003 (alcohol products tax) | ||||||||||||||||||||||||||||||||||||||||||||

44. Amendment of section 78A of Finance Act 2003 (relief for small breweries) | ||||||||||||||||||||||||||||||||||||||||||||

48. Amendment of section 132 of Finance Act 1992 (charge of excise duty) | ||||||||||||||||||||||||||||||||||||||||||||

Value-Added Tax | ||||||||||||||||||||||||||||||||||||||||||||

52. Amendment of section 56 of Principal Act (zero-rating scheme for qualifying businesses) | ||||||||||||||||||||||||||||||||||||||||||||

55. Amendment of section 103 of Principal Act (Ministerial refund orders) | ||||||||||||||||||||||||||||||||||||||||||||

Stamp Duties | ||||||||||||||||||||||||||||||||||||||||||||

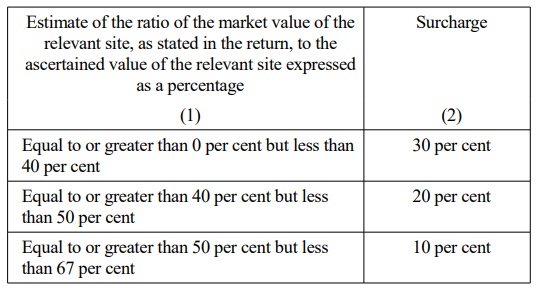

58. Stamp duty on certain acquisitions of residential property | ||||||||||||||||||||||||||||||||||||||||||||

59. Amendment of section 81AA of Principal Act (transfers to young trained farmers) | ||||||||||||||||||||||||||||||||||||||||||||

60. Amendment of section 126AA of Principal Act (further levy on certain financial institutions) | ||||||||||||||||||||||||||||||||||||||||||||

Capital Acquisitions Tax | ||||||||||||||||||||||||||||||||||||||||||||

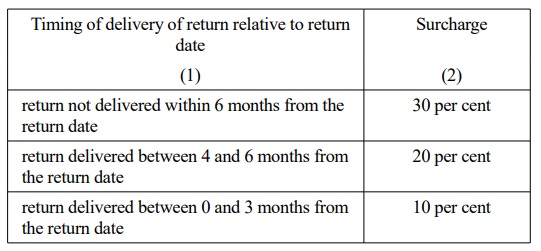

65. Amendment of section 46 of Principal Act (delivery of returns) | ||||||||||||||||||||||||||||||||||||||||||||

66. Amendment of section 82 of Principal Act (exemption of certain receipts) | ||||||||||||||||||||||||||||||||||||||||||||

Miscellaneous | ||||||||||||||||||||||||||||||||||||||||||||

68. Repeal of section 857 of and Schedule 27 to, and amendment of section 867 of, Principal Act | ||||||||||||||||||||||||||||||||||||||||||||

69. Amendment of section 949AQ of Principal Act (case stated for High Court) | ||||||||||||||||||||||||||||||||||||||||||||

70. Amendment of Part 7 of Emergency Measures in the Public Interest (Covid-19) Act 2020 | ||||||||||||||||||||||||||||||||||||||||||||

71. Amendment of section 959AM of Principal Act (interpretation and miscellaneous (Chapter 7)) | ||||||||||||||||||||||||||||||||||||||||||||

73. Covid-19: interest charge on relevant person under section 1080B | ||||||||||||||||||||||||||||||||||||||||||||

77. Amendment of section 1086 of Principal Act (publication of names of tax defaulters) | ||||||||||||||||||||||||||||||||||||||||||||

79. Amendment of Part 3 of Schedule 26A to Principal Act (donations to approved bodies, etc.) | ||||||||||||||||||||||||||||||||||||||||||||

Amendment of Taxes Consolidation Act 1997 | ||||||||||||||||||||||||||||||||||||||||||||

Amendment of Value-Added Tax Consolidation Act 2010 | ||||||||||||||||||||||||||||||||||||||||||||

Amendment of Finance Act 2001 | ||||||||||||||||||||||||||||||||||||||||||||

|

Acts Referred to | ||||||||||||||||||||||||||||||||||||||||||||

Building Control Act 1990 (No. 3) | ||||||||||||||||||||||||||||||||||||||||||||

Companies Act 2014 (No. 38) | ||||||||||||||||||||||||||||||||||||||||||||

Criminal Justice (Money Laundering and Terrorist Financing) Act 2010 (No. 6) | ||||||||||||||||||||||||||||||||||||||||||||

Customs Act 2015 (No. 18) | ||||||||||||||||||||||||||||||||||||||||||||

Data Protection Act 2018 (No. 7) | ||||||||||||||||||||||||||||||||||||||||||||

Derelict Sites Act 1990 (No. 14) | ||||||||||||||||||||||||||||||||||||||||||||

Electricity Regulation Act 1999 (No. 23) | ||||||||||||||||||||||||||||||||||||||||||||

Emergency Measures in the Public Interest (Covid-19) Act 2020 (No. 2) | ||||||||||||||||||||||||||||||||||||||||||||

Finance (1909-1910) Act 1910 (10 Edw. 7, c.8) | ||||||||||||||||||||||||||||||||||||||||||||

Finance (No. 2) Act 2008 (No. 25) | ||||||||||||||||||||||||||||||||||||||||||||

Finance Act 1980 (No. 14) | ||||||||||||||||||||||||||||||||||||||||||||

Finance Act 1983 (No. 15) | ||||||||||||||||||||||||||||||||||||||||||||

Finance Act 1989 (No. 10) | ||||||||||||||||||||||||||||||||||||||||||||

Finance Act 1992 (No. 9) | ||||||||||||||||||||||||||||||||||||||||||||

Finance Act 1999 (No. 2) | ||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2000 (No. 3) | ||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2001 (No. 7) | ||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2003 (No. 3) | ||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2005 (No. 5) | ||||||||||||||||||||||||||||||||||||||||||||

Intoxicating Liquor (Breweries and Distilleries) Act 2018 (No. 17) | ||||||||||||||||||||||||||||||||||||||||||||

Intoxicating Liquor (National Concert Hall) Act 1983 (No. 34) | ||||||||||||||||||||||||||||||||||||||||||||

Intoxicating Liquor (National Conference Centre) Act 2010 (No. 9) | ||||||||||||||||||||||||||||||||||||||||||||

Intoxicating Liquor Act 1927 (No. 15 of 1927) | ||||||||||||||||||||||||||||||||||||||||||||

Intoxicating Liquor Act 2003 (No. 31) | ||||||||||||||||||||||||||||||||||||||||||||

Investment Funds, Companies and Miscellaneous Provisions Act 2005 (No. 12) | ||||||||||||||||||||||||||||||||||||||||||||

Limited Partnerships Act 1907 (7 Edw. 7, c.24) | ||||||||||||||||||||||||||||||||||||||||||||

Local Government Act 2001 (No. 37) | ||||||||||||||||||||||||||||||||||||||||||||

Medical Practitioners Act 2007 (No. 25) | ||||||||||||||||||||||||||||||||||||||||||||

Nurses and Midwives Act 2011 (No. 41) | ||||||||||||||||||||||||||||||||||||||||||||

Planning and Development (Housing) and Residential Tenancies Act 2016 (No. 17) | ||||||||||||||||||||||||||||||||||||||||||||

Planning and Development Act 2000 (No. 30) | ||||||||||||||||||||||||||||||||||||||||||||

Public Dance Halls Act 1935 (No. 2) | ||||||||||||||||||||||||||||||||||||||||||||

Registration of Clubs (Ireland) Act 1904 (4 Edw. 7, c.9) | ||||||||||||||||||||||||||||||||||||||||||||

Registration of Title Act 1964 (No. 16) | ||||||||||||||||||||||||||||||||||||||||||||

Roads Act 1993 (No. 14) | ||||||||||||||||||||||||||||||||||||||||||||

Stamp Duties Consolidation Act 1999 (No. 31) | ||||||||||||||||||||||||||||||||||||||||||||

State Authorities (Public Private Partnership Arrangements) Act 2002 (No. 1) | ||||||||||||||||||||||||||||||||||||||||||||

Taxes Consolidation Act 1997 (No. 39) | ||||||||||||||||||||||||||||||||||||||||||||

Video Recordings Act 1989 (No. 22) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

Number 45 of 2021 | ||||||||||||||||||||||||||||||||||||||||||||

FINANCE ACT 2021 | ||||||||||||||||||||||||||||||||||||||||||||

An Act to provide for the imposition, repeal, remission, alteration and regulation of taxation, of stamp duties and of duties relating to excise and otherwise to make further provision in connection with finance including the regulation of customs; to amend Part 7 of the Emergency Measures in the Public Interest (Covid-19) Act 2020 and otherwise make provision for supports to certain sectors of the economy; and to provide for related matters. | ||||||||||||||||||||||||||||||||||||||||||||

[21st December, 2021] | ||||||||||||||||||||||||||||||||||||||||||||

Be it enacted by the Oireachtas as follows: | ||||||||||||||||||||||||||||||||||||||||||||

|

PART 1 Universal Social Charge, Income Tax, Corporation Tax and Capital Gains Tax | ||||||||||||||||||||||||||||||||||||||||||||

|

Chapter 1 Interpretation | ||||||||||||||||||||||||||||||||||||||||||||

|

Interpretation (Part 1) | ||||||||||||||||||||||||||||||||||||||||||||

|

1. In this Part, “Principal Act” means the Taxes Consolidation Act 1997 . | ||||||||||||||||||||||||||||||||||||||||||||

|

Chapter 2 Universal Social Charge | ||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 531AN of Principal Act (rate of charge) | ||||||||||||||||||||||||||||||||||||||||||||

|

2. (1) Section 531AN of the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||

(a) in subsection (3), by the substitution of “€21,295” for “€20,687”, | ||||||||||||||||||||||||||||||||||||||||||||

(b) in subsection (4), by the substitution of “2023” for “2022”, and | ||||||||||||||||||||||||||||||||||||||||||||

(c) by the substitution of the following for Part 1 of the Table to that section: | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

“Part 1 | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

”. | ||||||||||||||||||||||||||||||||||||||||||||

(2) Subsection (1) applies for the year of assessment 2022 and each subsequent year of assessment. | ||||||||||||||||||||||||||||||||||||||||||||

|

Chapter 3 Income Tax | ||||||||||||||||||||||||||||||||||||||||||||

|

Deduction in respect of certain expenses of remote working | ||||||||||||||||||||||||||||||||||||||||||||

|

3. (1) Chapter 2 of Part 5 of the Principal Act is amended by the insertion of the following section after section 114: | ||||||||||||||||||||||||||||||||||||||||||||

“114A. (1) In this section— | ||||||||||||||||||||||||||||||||||||||||||||

‘qualifying residence’ means a residential premises that is also used by a remote worker to perform the duties of his or her office or employment; | ||||||||||||||||||||||||||||||||||||||||||||

‘relevant expenses’, in relation to a remote worker, means expenses incurred and defrayed by the remote worker in respect of the provision of electricity, heating or an internet service in his or her qualifying residence; | ||||||||||||||||||||||||||||||||||||||||||||

‘remote worker’ means a person who is the holder of an office or employment of profit and who performs the duties of his or her office or employment— | ||||||||||||||||||||||||||||||||||||||||||||

(a) by working from his or her residential premises on a full-time or part-time basis, or | ||||||||||||||||||||||||||||||||||||||||||||

(b) by working some of his or her normal working time from his or her residential premises, with the remainder of that normal working time being spent in his or her normal place of employment or in some other place; | ||||||||||||||||||||||||||||||||||||||||||||

‘residential premises’ means, a dwelling or part of a dwelling which is occupied by an individual as his or her residence; | ||||||||||||||||||||||||||||||||||||||||||||

‘specified amount’, in relation to a year of assessment, means the amount of expenditure which qualifies for income tax relief in accordance with this section. | ||||||||||||||||||||||||||||||||||||||||||||

(2) Where in any year of assessment a remote worker, having made a claim in that behalf, proves that he or she has incurred and defrayed relevant expenses out of the emoluments of the office or employment of profit, he or she shall be entitled to claim a deduction (in this section referred to as ‘remote working relief’) from the emoluments to be assessed in respect of the specified amount determined in accordance with subsection (4). | ||||||||||||||||||||||||||||||||||||||||||||

(3) Subject to this section, where, for a year of assessment, an individual (in this section referred to as the ‘claimant’), on making a claim in that behalf, proves that relevant expenses were incurred by— | ||||||||||||||||||||||||||||||||||||||||||||

(a) in a case in which the claimant is a married person assessed to tax for the year of assessment in accordance with section 1017 or a civil partner assessed to tax for the year of assessment in accordance with section 1031C, the claimant or his or her spouse or civil partner, or | ||||||||||||||||||||||||||||||||||||||||||||

(b) in any other case, the claimant, | ||||||||||||||||||||||||||||||||||||||||||||

then the claimant shall be entitled to remote working relief. | ||||||||||||||||||||||||||||||||||||||||||||

(4) The specified amount, in relation to relevant expenses incurred by a remote worker in any year of assessment, shall be 30 per cent of an amount determined by the following formula: | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

where— | ||||||||||||||||||||||||||||||||||||||||||||

A is the amount of the relevant expenses incurred and defrayed by the remote worker in the year of assessment, | ||||||||||||||||||||||||||||||||||||||||||||

B is the number of days in the year of assessment the remote worker performed the duties of his or her office or employment of profit from his or her qualifying residence, | ||||||||||||||||||||||||||||||||||||||||||||

C is the number of days in the year of assessment, and | ||||||||||||||||||||||||||||||||||||||||||||

D is any amount reimbursed or to be reimbursed, directly or indirectly to the remote worker in relation to those expenses by his or her employer. | ||||||||||||||||||||||||||||||||||||||||||||

(5) Where the cost of incurring and defraying relevant expenses is shared by 2 or more persons (other than a person referred to in subsection (3)(a)) residing in a qualifying residence in a year of assessment, then, for the purposes of any claim for relief under this section, the total cost of incurring and defraying those expenses in the year of assessment shall be apportioned between each of the persons concerned by reference to the amount of those expenses that were defrayed by each such person. | ||||||||||||||||||||||||||||||||||||||||||||

(6) On making a claim under this section, a claimant shall provide to the Revenue Commissioners, through such electronic means as the Revenue Commissioners make available, full particulars of the relevant expenses, including— | ||||||||||||||||||||||||||||||||||||||||||||

(a) a copy of the statement issued by the service provider in respect of the service provided to the qualifying residence that constitutes the relevant expenses, and | ||||||||||||||||||||||||||||||||||||||||||||

(b) any other relevant information that may reasonably be required by the Revenue Commissioners to determine whether the requirements of this section are met. | ||||||||||||||||||||||||||||||||||||||||||||

(7) Where relief is given under this section to any individual in respect of relevant expenses, no relief or deduction under any other provision of the Income Tax Acts shall be given or allowed in respect of those relevant expenses.”. | ||||||||||||||||||||||||||||||||||||||||||||

(2) This section shall have effect for the year of assessment 2022 and each subsequent year of assessment. | ||||||||||||||||||||||||||||||||||||||||||||

|

Exemption in respect of Pandemic Placement Grant | ||||||||||||||||||||||||||||||||||||||||||||

|

4. Chapter 1 of Part 7 of the Principal Act is amended by the insertion of the following section after section 192H: | ||||||||||||||||||||||||||||||||||||||||||||

“192I. (1) In this section— | ||||||||||||||||||||||||||||||||||||||||||||

‘Minister’ means the Minister for Health; | ||||||||||||||||||||||||||||||||||||||||||||

‘qualifying grant’ means a grant, generally referred to and commonly known as the Pandemic Placement Grant, which is made periodically by or on behalf of the Minister to a qualifying student; | ||||||||||||||||||||||||||||||||||||||||||||

‘qualifying student’ means an undergraduate student who is registered on the candidate register maintained by the Nursing and Midwifery Board of Ireland and who is undertaking what is generally referred to and commonly known as a Supernumerary Clinical Placement or an Internship Clinical Placement as part of a qualifying course; | ||||||||||||||||||||||||||||||||||||||||||||

‘qualifying course’ means an undergraduate programme in nursing or midwifery, approved by the Nursing and Midwifery Board of Ireland under section 85 (2) of the Nurses and Midwives Act 2011 . | ||||||||||||||||||||||||||||||||||||||||||||

(2) Subject to subsection (3), a qualifying grant made to a qualifying student on or after 1 January 2021 and on or before 31 December 2022 shall be exempt from income tax and shall not be reckoned in computing the total income of the qualifying student for the purposes of the Income Tax Acts. | ||||||||||||||||||||||||||||||||||||||||||||

(3) This exemption shall apply to a maximum amount of €2,100 for each qualifying student in the year of assessment to which it relates.”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 477C of Principal Act (Help to Buy) | ||||||||||||||||||||||||||||||||||||||||||||

|

5. Section 477C of the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||

(a) in subsection (1), by the substitution in the definition of “qualifying period” of “2022” for “2021”, | ||||||||||||||||||||||||||||||||||||||||||||

(b) in subsection (5A), by the substitution of “2022” for “2021”, | ||||||||||||||||||||||||||||||||||||||||||||

(c) in subsection (8)(b), by the substitution of “2022” for “2021”, | ||||||||||||||||||||||||||||||||||||||||||||

(d) in subsection (16)(a)— | ||||||||||||||||||||||||||||||||||||||||||||

(i) by the substitution in subparagraph (ii) of “2022” for “2021”, and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) by the substitution in subparagraph (iii) of “2022” for “2021”, | ||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||

(e) in subsection (25), by the substitution of “2022” for “2021”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Rate of charge and personal tax credits | ||||||||||||||||||||||||||||||||||||||||||||

|

6. As respects the year of assessment 2022 and subsequent years of assessment, the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||

(a) in section 15— | ||||||||||||||||||||||||||||||||||||||||||||

(i) in subsection (3)(i), by the substitution of “€27,800” for “€26,300”, and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) by the substitution of the following Table for the Table to that section: | ||||||||||||||||||||||||||||||||||||||||||||

“TABLE | ||||||||||||||||||||||||||||||||||||||||||||

PART 1 | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

PART 2 | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

PART 3 | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

”, | ||||||||||||||||||||||||||||||||||||||||||||

(b) in section 461— | ||||||||||||||||||||||||||||||||||||||||||||

(i) in paragraph (a), by the substitution of “€3,400” for “€3,300”, | ||||||||||||||||||||||||||||||||||||||||||||

(ii) in paragraph (b), by the substitution of “€3,400” for “€3,300”, and | ||||||||||||||||||||||||||||||||||||||||||||

(iii) in paragraph (c), by the substitution of “€1,700” for “€1,650”, | ||||||||||||||||||||||||||||||||||||||||||||

(c) in section 472, in subsection (4), by the substitution of “€1,700” for “€1,650” in each place where it occurs, and | ||||||||||||||||||||||||||||||||||||||||||||

(d) in section 472AB— | ||||||||||||||||||||||||||||||||||||||||||||

(i) in subsection (2), by the substitution of “€1,700” for “€1,650” in each place where it occurs, and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) in subsection (3), by the substitution of “€1,700” for “€1,650” in each place where it occurs. | ||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 118 of Principal Act (benefits in kind: general charging provision) | ||||||||||||||||||||||||||||||||||||||||||||

|

7. (1) Section 118 of the Principal Act is amended by the insertion of the following subsections after subsection (5H): | ||||||||||||||||||||||||||||||||||||||||||||

“(5I) (a) Subject to paragraph (b), subsection (1) shall not apply to expense incurred by the body corporate in or in connection with the provision for a director or employee of a qualifying medical check-up, where— | ||||||||||||||||||||||||||||||||||||||||||||

(i) qualifying medical check-ups are made available generally by the body corporate to all directors and employees of that body corporate, or | ||||||||||||||||||||||||||||||||||||||||||||

(ii) the director or employee is required by the terms of his or her office or employment to undergo the qualifying medical check-up. | ||||||||||||||||||||||||||||||||||||||||||||

(b) A director or employee shall not, by virtue of this subsection, be relieved from a charge to income tax under subsection (1) more than once in any year of assessment, unless subparagraph (ii) of paragraph (a) applies. | ||||||||||||||||||||||||||||||||||||||||||||

(c) In this subsection— | ||||||||||||||||||||||||||||||||||||||||||||

‘medical practitioner’ means a person who is registered in the register established under section 43 of the Medical Practitioners Act 2007 ; | ||||||||||||||||||||||||||||||||||||||||||||

‘qualifying medical check-up’ means a medical examination carried out by a medical practitioner to test a person’s state of health. | ||||||||||||||||||||||||||||||||||||||||||||

(5J) (a) Subsection (1) shall not apply to health expenses incurred by the body corporate in or in connection with the provision for a director or employee of health care, where health care is made available generally by the body corporate to all directors and employees of that body corporate. | ||||||||||||||||||||||||||||||||||||||||||||

(b) In this subsection, ‘health care’ and ‘health expenses’ have the same meanings respectively as they have in section 469. | ||||||||||||||||||||||||||||||||||||||||||||

(5K) (a) Subsection (1) shall not apply to expense incurred by the body corporate in or in connection with the provision for a director or employee of a Covid-19 test where— | ||||||||||||||||||||||||||||||||||||||||||||

(i) the test is necessary for the performance of the duties of the office or employment of the director or employee, and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) Covid-19 tests are made available by the body corporate to all directors and employees of that body corporate where necessary for the performance of the duties of the office or employment of those directors and employees. | ||||||||||||||||||||||||||||||||||||||||||||

(b) In this subsection— | ||||||||||||||||||||||||||||||||||||||||||||

‘Covid-19’ means a disease caused by infection with the virus SARS-CoV-2 and specified as an infectious disease in accordance with Regulation 6 of, and the Schedule to, the Infectious Diseases Regulations 1981 ( S.I. No. 390 of 1981 ) or any variant of the disease so specified as an infectious disease in those Regulations; | ||||||||||||||||||||||||||||||||||||||||||||

‘Covid-19 test’ means a relevant test, administered in accordance with the instructions of the manufacturer of the test, the purpose of which is to detect the presence of Covid-19 in the person to whom the test is administered; | ||||||||||||||||||||||||||||||||||||||||||||

‘rapid antigen test’ means a test that relies on detection of viral proteins (antigens) using a lateral flow immunoassay that gives results in less than 30 minutes; | ||||||||||||||||||||||||||||||||||||||||||||

‘relevant test’ means— | ||||||||||||||||||||||||||||||||||||||||||||

(a) an RT-PCR test, | ||||||||||||||||||||||||||||||||||||||||||||

(b) a rapid antigen test of a kind— | ||||||||||||||||||||||||||||||||||||||||||||

(i) included, for the time being, in the common list of Covid-19 rapid antigen tests agreed in accordance with the Council Recommendation of 21 January 20211 , and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) that complies with the requirements of Directive 98/79/EC of the European Parliament and of the Council of 27 October 19982 or, as appropriate, Regulation (EU) 2017/746 of the European Parliament and of the Council of 5 April 20173 , | ||||||||||||||||||||||||||||||||||||||||||||

or | ||||||||||||||||||||||||||||||||||||||||||||

(c) a rapid antigen test of a kind that complies with regulatory requirements under the laws of a state other than a Member State that are equivalent to the requirements referred to in paragraph (b)(ii); | ||||||||||||||||||||||||||||||||||||||||||||

‘RT-PCR test’ means a reverse transcription polymerase chain reaction test. | ||||||||||||||||||||||||||||||||||||||||||||

(5L) (a) Subsection (1) shall not apply to expense incurred by the body corporate, or incurred by a director or employee and reimbursed by the body corporate, in or in connection with the provision for a director or employee of an influenza vaccine, where influenza vaccines are made available generally by the body corporate to all directors and employees of that body corporate. | ||||||||||||||||||||||||||||||||||||||||||||

(b) In this subsection, ‘influenza vaccine’ means an influenza vaccine specified in column 1 of the Eighth Schedule to the Medicinal Products (Prescription and Control of Supply) Regulations 2003 ( S.I. No. 540 of 2003 ) and administered in accordance with the requirements specified in columns 2 to 6 of that Schedule opposite the mention of the product concerned. | ||||||||||||||||||||||||||||||||||||||||||||

(c) Relief shall not be given under section 469 in respect of the expense referred to in paragraph (a) incurred by a director or employee and reimbursed by the body corporate.”. | ||||||||||||||||||||||||||||||||||||||||||||

(2) Subsection (1) shall be deemed to have come into operation on 1 January 2021. | ||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 127B of Principal Act (tax treatment of flight crew in international traffic) | ||||||||||||||||||||||||||||||||||||||||||||

|

8. Section 127B of the Principal Act is amended by the insertion of the following subsection after subsection (1): | ||||||||||||||||||||||||||||||||||||||||||||

“(1A) Subsection (1) shall not apply for the year of assessment 2022 or any subsequent year of assessment where, for that year of assessment an individual— | ||||||||||||||||||||||||||||||||||||||||||||

(a) is not resident in the State, | ||||||||||||||||||||||||||||||||||||||||||||

(b) is resident for the purposes of tax, by virtue of the law of the territory next-mentioned in this paragraph, in a territory with the government of which arrangements are for the time being in force by virtue of section 826(1), and | ||||||||||||||||||||||||||||||||||||||||||||

(c) is subject to tax on the income referred to in subsection (1) in a territory with the government of which arrangements are for the time being in force by virtue of section 826(1).”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Benefit-in-kind: emissions-based calculations | ||||||||||||||||||||||||||||||||||||||||||||

|

9. (1) Section 121 of the Principal Act is amended, in subsection (4A), by the insertion of the following paragraph after paragraph (a): | ||||||||||||||||||||||||||||||||||||||||||||

“(aa) Notwithstanding paragraph (a), where a car in respect of which this subsection applies is an electric vehicle, the cash equivalent of the benefit of the car ascertained under paragraph (a) shall be computed on the original market value of the car reduced by: | ||||||||||||||||||||||||||||||||||||||||||||

(i) €35,000 in respect of a car made available in the period 1 January 2023 to 31 December 2023; | ||||||||||||||||||||||||||||||||||||||||||||

(ii) €20,000 in respect of a car made available in the period 1 January 2024 to 31 December 2024; | ||||||||||||||||||||||||||||||||||||||||||||

(iii) €10,000 in respect of a car made available in the period 1 January 2025 to 31 December 2025.”. | ||||||||||||||||||||||||||||||||||||||||||||

(2) Section 121A of the Principal Act is amended in subsection (2)(b)— | ||||||||||||||||||||||||||||||||||||||||||||

(a) in subparagraph (v)(III), by the substitution of “employment,” for “employment, and”, | ||||||||||||||||||||||||||||||||||||||||||||

(b) in subparagraph (vi), by the substitution of “€50,000, and” for “€50,000.”, and | ||||||||||||||||||||||||||||||||||||||||||||

(c) by the insertion of the following subparagraph after subparagraph (vi): | ||||||||||||||||||||||||||||||||||||||||||||

“(vii) where a van is an electric vehicle, the cash equivalent of the benefit of the van ascertained under subsection (3) shall be computed on the original market value of the van reduced by: | ||||||||||||||||||||||||||||||||||||||||||||

(I) €35,000 in respect of a van made available in the period 1 January 2023 to 31 December 2023; | ||||||||||||||||||||||||||||||||||||||||||||

(II) €20,000 in respect of a van made available in the period 1 January 2024 to 31 December 2024; | ||||||||||||||||||||||||||||||||||||||||||||

(III) €10,000 in respect of a van made available in the period 1 January 2025 to 31 December 2025.”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 472BB of Principal Act (sea-going naval personnel credit) | ||||||||||||||||||||||||||||||||||||||||||||

|

10. Section 472BB of the Principal Act is amended in subsection (3)— | ||||||||||||||||||||||||||||||||||||||||||||

(a) by the substitution of “2021 or 2022” for “2021”, and | ||||||||||||||||||||||||||||||||||||||||||||

(b) by the substitution, in paragraph (a), of “credit of €1,500 in relation to that year of assessment” for “credit of €1,500”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of Schedule 13 to Principal Act (accountable persons for purposes of Chapter 1 of Part 18) | ||||||||||||||||||||||||||||||||||||||||||||

|

11. Schedule 13 to the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||

(a) by the deletion of paragraphs 56 and 122, | ||||||||||||||||||||||||||||||||||||||||||||

(b) by the insertion of the following paragraph after paragraph 204: | ||||||||||||||||||||||||||||||||||||||||||||

“205. Data Protection Commission.”, | ||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||

(c) by the substitution— | ||||||||||||||||||||||||||||||||||||||||||||

(i) in paragraph 39, of “Rásaíocht Con Éireann” for “Bord na gCon”, and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) in paragraph 179, of “Office of the Financial Services and Pensions Ombudsman” for “Financial Services Ombudsman’s Bureau”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Retirement benefits: amendment of death-in-service provision | ||||||||||||||||||||||||||||||||||||||||||||

|

12. Section 772 of the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||

(a) in subsection (3), by the substitution of the following paragraph for paragraph (b): | ||||||||||||||||||||||||||||||||||||||||||||

“(b) that any pension or benefit for any widow, widower, surviving civil partner, children or dependants, or children of the surviving civil partner, of an employee who dies before retirement shall be provided for as either— | ||||||||||||||||||||||||||||||||||||||||||||

(i) a pension or pensions payable on the employee’s death of an amount that does not or, as the case may be, do not in aggregate exceed any pension or pensions which, consonant with the condition in paragraph (a), could have been provided for the employee on retirement on attaining the specified age, if the employee had continued to serve until the employee attained that age at an annual rate of remuneration equal to the employee’s final remuneration, or | ||||||||||||||||||||||||||||||||||||||||||||

(ii) benefits transferred to an approved retirement fund on the employee’s death of an amount that does not or, as the case may be, do not in aggregate exceed any benefit which, consonant with the condition in paragraph (a), could have been provided for the employee on retirement on attaining the specified age, if the employee had continued to serve until the employee attained that age at an annual rate of remuneration equal to the employee’s final remuneration;”, | ||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||

(b) by the insertion of the following subsection after subsection (3I): | ||||||||||||||||||||||||||||||||||||||||||||

“(3J) Where benefits are provided in accordance with subsection (3)(b)(ii), sections 784A and 784B shall apply— | ||||||||||||||||||||||||||||||||||||||||||||

(a) as if the transfer of the benefits were the exercise of an option in accordance with section 784(2A), and | ||||||||||||||||||||||||||||||||||||||||||||

(b) with any necessary modifications, as if— | ||||||||||||||||||||||||||||||||||||||||||||

(i) any reference in those sections to the person lawfully carrying on in the State the business of granting annuities on human life were a reference to the trustees of the retirement benefit scheme, and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) any reference in those sections to the annuity contract were references to the retirement benefit scheme.”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Retirement benefits: removal of 15 year rule | ||||||||||||||||||||||||||||||||||||||||||||

|

13. Section 772 of the Principal Act is amended in subsection (3D) by the substitution of the following paragraph for paragraph (a): | ||||||||||||||||||||||||||||||||||||||||||||

“(a) a member’s entitlements under the scheme, other than an amount referred to in paragraph (b), may, either on the member’s changing employment or on the scheme being wound up, be transferred to one or more than one PRSA to which that member is the contributor if benefits have not become payable to the member under the scheme,”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Retirement benefits: removal of Approved Minimum Retirement Fund (AMRF) | ||||||||||||||||||||||||||||||||||||||||||||

|

14. (1) Chapter 1 of Part 30 of the Principal Act is amended in section 772— | ||||||||||||||||||||||||||||||||||||||||||||

(a) by the substitution, in subsection (3A)(a), of the following for the construction of “B”: | ||||||||||||||||||||||||||||||||||||||||||||

“B is the amount or value of assets which the trustees, administrators or other person charged with the management of the scheme (in this section referred to as ‘the trustees’) would, if the assumptions in paragraph (b) were made, apply in purchasing an annuity payable to the relevant individual with effect from the date of the exercise of the option.”, | ||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||

(b) in subsection (3B)(a)— | ||||||||||||||||||||||||||||||||||||||||||||

(i) by the deletion of “, 784C, 784D”, | ||||||||||||||||||||||||||||||||||||||||||||

(ii) by the substitution, in subparagraph (i), of “scheme, and” for “scheme,”, | ||||||||||||||||||||||||||||||||||||||||||||

(iii) by the substitution, in subparagraph (ii), of “scheme.” for “scheme,” and | ||||||||||||||||||||||||||||||||||||||||||||

(iv) by the deletion of subparagraph (iia). | ||||||||||||||||||||||||||||||||||||||||||||

(2) Chapter 2 of Part 30 of the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||

(a) by the substitution, in section 784(2A), of the following for the construction of “B”: | ||||||||||||||||||||||||||||||||||||||||||||

“B is the amount or value of assets which the person with whom the contract is made is to apply in purchasing an annuity payable to the individual with effect from the date of the exercise of the said option.”, | ||||||||||||||||||||||||||||||||||||||||||||

(b) in section 784C— | ||||||||||||||||||||||||||||||||||||||||||||

(i) by the deletion of subsections (2) to (7), and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) by the insertion of the following subsection after subsection (7): | ||||||||||||||||||||||||||||||||||||||||||||

“(7A) On 1 January 2022 an approved minimum retirement fund shall, thereupon, become an approved retirement fund and section 784A and subsections (1) and (5) of section 784B shall apply accordingly.”, | ||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||

(c) in section 784D— | ||||||||||||||||||||||||||||||||||||||||||||

(i) by the deletion of subsections (1) to (3), and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) by the insertion of the following subsection after subsection (5): | ||||||||||||||||||||||||||||||||||||||||||||

“(6) On or after 1 January 2022, a qualifying fund manager shall not accept any assets into an approved minimum retirement fund.”. | ||||||||||||||||||||||||||||||||||||||||||||

(3) Chapter 2A of Part 30 of the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||

(a) in section 787H— | ||||||||||||||||||||||||||||||||||||||||||||

(i) by the substitution of the following subsection for subsection (2): | ||||||||||||||||||||||||||||||||||||||||||||

“(2) The assets that a PRSA administrator shall transfer to an approved retirement fund in accordance with subsection (1) shall be the assets available in the PRSA at the time the election under that subsection is made less any lump sum the PRSA administrator is permitted to pay without deduction of tax in accordance with section 787G(3)(a).”, | ||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) by the substitution, in subsection (3), of “sections 784A and 784B” for “sections 784A to 784D”, | ||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||

(b) in section 787K(1)(c)(i)— | ||||||||||||||||||||||||||||||||||||||||||||

(i) by the substitution, in clause (II), of “section 787G(3)(a), or” for “section 787G(3)(a),”, | ||||||||||||||||||||||||||||||||||||||||||||

(ii) by the substitution of the following clause for clause (III): | ||||||||||||||||||||||||||||||||||||||||||||

“(III) assets transferred to an approved retirement fund in accordance with section 787H(1),”, | ||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||

(iii) by the deletion of clause (IV). | ||||||||||||||||||||||||||||||||||||||||||||

(4) (a) Subject to paragraph (b), this section shall come into operation on and from the date of the passing of this Act. | ||||||||||||||||||||||||||||||||||||||||||||

(b) Paragraphs (b)(i) and (c)(i) of subsection (2) shall come into operation on 1 January 2022. | ||||||||||||||||||||||||||||||||||||||||||||

|

Retirement benefits: amendment of section 774 of Principal Act (certain approved schemes: exemptions and reliefs) | ||||||||||||||||||||||||||||||||||||||||||||

|

15. Section 774 of the Principal Act is amended, in subsection (6)(aa)(iii), by the insertion of “or of a company for the benefit of whose employees the contributions are paid under the terms of that agreement” after “parties to that agreement”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Chapter 4 Income Tax, Corporation Tax and Capital Gains Tax | ||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 97A of Principal Act (pre-letting expenditure in respect of vacant premises) | ||||||||||||||||||||||||||||||||||||||||||||

|

16. Section 97A of the Principal Act is amended, in subsection (2), by the substitution of “31 December 2024” for “31 December 2021”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 261 of Principal Act (taxation of relevant interest, etc.) | ||||||||||||||||||||||||||||||||||||||||||||

|

17. Section 261 of the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||

(a) by the substitution, in paragraph (c)(i), of “person (other than a company)” for “person (being an individual)”, | ||||||||||||||||||||||||||||||||||||||||||||

(b) by the substitution, in paragraph (c)(ii)(I), of “paragraph (d)” for “section 59”, and | ||||||||||||||||||||||||||||||||||||||||||||

(c) by the substitution of the following paragraph for paragraph (d): | ||||||||||||||||||||||||||||||||||||||||||||

“(d) where relevant interest is to be taken into account in computing the total income of a person (other than a company) for any year of assessment, then, for the purpose of charging that total income to tax at the rate or rates of tax charged for that year of assessment, the following provisions shall apply— | ||||||||||||||||||||||||||||||||||||||||||||

(i) the relevant interest shall be regarded as income chargeable to tax under Case IV of Schedule D and shall be charged accordingly, and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) in determining the amount of tax payable on that relevant interest, credit shall be given for the appropriate tax deducted from the relevant interest and the amount of the credit shall be the amount of such appropriate tax.”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Non-resident landlords | ||||||||||||||||||||||||||||||||||||||||||||

|

18. The Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||

(a) in section 25— | ||||||||||||||||||||||||||||||||||||||||||||

(i) in subsection (1), by the substitution of “Subject to subsection (2A), a company not resident” for “A company not resident”, and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) by the insertion of the following subsection after subsection (2): | ||||||||||||||||||||||||||||||||||||||||||||

“(2A) (a) Where a company not resident in the State is chargeable to tax under Case V of Schedule D in respect of any profits or gains, that company shall be chargeable to corporation tax on those profits or gains. | ||||||||||||||||||||||||||||||||||||||||||||

(b) Where a company not resident in the State disposes of an asset in respect of which the company was chargeable to tax under Case V of Schedule D on any profits or gains therefrom, or would have been but for an insufficiency of such profits or gains, the company shall, subject to section 649, not be chargeable to capital gains tax in respect of gains accruing to it on the disposal so that it is chargeable in respect of them to corporation tax. | ||||||||||||||||||||||||||||||||||||||||||||

(c) This subsection shall apply to profits and gains accruing on or after 1 January 2022.”, | ||||||||||||||||||||||||||||||||||||||||||||

(b) in section 308, by the insertion of the following subsections after subsection (2): | ||||||||||||||||||||||||||||||||||||||||||||

“(2A) Where a company not resident in the State— | ||||||||||||||||||||||||||||||||||||||||||||

(a) pursuant to section 25(2A), comes within the charge to corporation tax under Case V of Schedule D on 1 January 2022, and | ||||||||||||||||||||||||||||||||||||||||||||

(b) was entitled, immediately prior to that date, under section 305(1)(a), to carry forward an amount of an allowance to a year of assessment subsequent to the year of assessment for which the allowance was made, | ||||||||||||||||||||||||||||||||||||||||||||

then— | ||||||||||||||||||||||||||||||||||||||||||||

(i) subsection (3) shall apply to the amount of the allowance referred to in paragraph (b) as if it were an amount of allowance unallowed from an accounting period ending on 31 December 2021, and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) section 305(1)(a) shall not apply to the amount of allowance to which subsection (3) shall apply in accordance with paragraph (i). | ||||||||||||||||||||||||||||||||||||||||||||

(2B) Where— | ||||||||||||||||||||||||||||||||||||||||||||

(a) a company not resident in the State comes within the charge to corporation tax under Case V of Schedule D pursuant to section 25(2A) on 1 January 2022, and | ||||||||||||||||||||||||||||||||||||||||||||

(b) a balancing allowance or balancing charge is made to or on, as the case may be, the company in respect of an allowance made to the company in a chargeable period ending on or before 31 December 2021, | ||||||||||||||||||||||||||||||||||||||||||||

the amount of the balancing allowance or balancing charge, as the case may be, shall be adjusted as follows: | ||||||||||||||||||||||||||||||||||||||||||||

Badj = (B x 0. 2) / R | ||||||||||||||||||||||||||||||||||||||||||||

where— | ||||||||||||||||||||||||||||||||||||||||||||

Badj is the adjusted amount of the balancing allowance or balancing charge, as the case may be, | ||||||||||||||||||||||||||||||||||||||||||||

B is the balancing allowance or balancing charge, as the case may be, and | ||||||||||||||||||||||||||||||||||||||||||||

R is the rate specified in section 21A(3)(a).”, | ||||||||||||||||||||||||||||||||||||||||||||

(c) in section 399, by the insertion of the following subsection after subsection (2): | ||||||||||||||||||||||||||||||||||||||||||||

“(2A) Where a company not resident in the State— | ||||||||||||||||||||||||||||||||||||||||||||

(a) pursuant to section 25(2A), comes within the charge to corporation tax under Case V of Schedule D on 1 January 2022, | ||||||||||||||||||||||||||||||||||||||||||||

(b) was entitled, prior to that date, under section 384(2), to carry forward an excess to a year of assessment subsequent to the year of assessment in which the excess arose, and | ||||||||||||||||||||||||||||||||||||||||||||

(c) an amount of that excess has not, on 1 January 2022, been deducted or set off under section 384(2), | ||||||||||||||||||||||||||||||||||||||||||||

then— | ||||||||||||||||||||||||||||||||||||||||||||

(i) subsection (2) shall apply to the amount of excess referred to in paragraph (c) as if it were a portion of excess for which relief had not been given under that subsection for a previous accounting period ending on 31 December 2021, and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) section 384(2) shall not apply to the amount of excess to which subsection (2) shall apply in accordance with paragraph (i).”, | ||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||

(d) in section 959AS— | ||||||||||||||||||||||||||||||||||||||||||||

(i) in subsection (1), by the substitution of “Subject to subsection (1A), preliminary tax appropriate to an accounting period” for “Preliminary tax appropriate to an accounting period”, and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) by the insertion of the following subsection after subsection (1): | ||||||||||||||||||||||||||||||||||||||||||||

“(1A) Where a company, that comes within the charge to corporation tax under Case V of Schedule D pursuant to section 25(2A) on or after 1 January 2022, has an accounting period ending on or before 30 June 2022, preliminary tax appropriate to that accounting period is due and payable— | ||||||||||||||||||||||||||||||||||||||||||||

(a) not later than 21 June 2022, or | ||||||||||||||||||||||||||||||||||||||||||||

(b) where payment of preliminary tax is made by such electronic means as are required by the Revenue Commissioners, not later than 23 June 2022.”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of certain tax exemption provisions of Principal Act | ||||||||||||||||||||||||||||||||||||||||||||

|

19. (1) The Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||

(a) in Schedule 4, by the insertion of the following paragraph after paragraph 1: | ||||||||||||||||||||||||||||||||||||||||||||

“1A. The Approved Housing Bodies Regulatory Authority.”, | ||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||

(b) in Part 1 of Schedule 15, by the insertion of the following paragraph after paragraph 46: | ||||||||||||||||||||||||||||||||||||||||||||

“47. Western Development Commission.”. | ||||||||||||||||||||||||||||||||||||||||||||

(2) Subsection (1)(a) shall be deemed to have come into operation on 1 February 2021. | ||||||||||||||||||||||||||||||||||||||||||||

(3) Subsection (1)(b) shall be deemed to have come into operation on 1 February 1999. | ||||||||||||||||||||||||||||||||||||||||||||

|

Certain profits of micro-generation of electricity | ||||||||||||||||||||||||||||||||||||||||||||

|

20. Chapter 1 of Part 7 of the Principal Act is amended by the insertion of the following section after section 216C: | ||||||||||||||||||||||||||||||||||||||||||||

“216D. (1) In this section— | ||||||||||||||||||||||||||||||||||||||||||||

‘Act of 1999’ means the Electricity Regulation Act 1999 ; | ||||||||||||||||||||||||||||||||||||||||||||

‘generate’ has the same meaning as in the Act of 1999; | ||||||||||||||||||||||||||||||||||||||||||||

‘micro-generation of electricity’ means the use of renewable, sustainable or alternative forms of energy to generate electricity at a qualifying residence; | ||||||||||||||||||||||||||||||||||||||||||||

‘qualifying person’ means an individual who purchases electricity for own use; | ||||||||||||||||||||||||||||||||||||||||||||

‘qualifying residence’, in relation to a qualifying person for a year of assessment, means a residential premises situated in the State which is occupied by the qualifying person as his or her sole or main residence during the year of assessment and land which the qualifying person has for his or her own occupation and enjoyment with that residence as its garden or grounds; | ||||||||||||||||||||||||||||||||||||||||||||

‘residential premises’ means a building or part of a building used as a dwelling; | ||||||||||||||||||||||||||||||||||||||||||||

‘renewable, sustainable or alternative forms of energy’ has the same meaning as in the Act of 1999; | ||||||||||||||||||||||||||||||||||||||||||||

‘relevant period’ means the period commencing on 1 January 2022 and ending on 31 December 2024. | ||||||||||||||||||||||||||||||||||||||||||||

(2) This subsection applies to profits or gains, chargeable to income tax under Case IV of Schedule D, arising to a qualifying person, in the relevant period, from the micro-generation of electricity. | ||||||||||||||||||||||||||||||||||||||||||||

(3) So much of the profits or gains to which subsection (2) applies, arising to a qualifying person in a year of assessment, as do not exceed €200 shall be exempt from income tax and shall not be reckoned in computing total income for the purposes of the Income Tax Acts.”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 285A of Principal Act (acceleration of wear and tear allowances for certain energy-efficient equipment) | ||||||||||||||||||||||||||||||||||||||||||||

|

21. (1) Section 285A of the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||

(a) in subsection (1), by the insertion of the following definition: | ||||||||||||||||||||||||||||||||||||||||||||

“ ‘fossil fuel’ means coal, oil, natural gas, peat or any derivative thereof intended for use in the production of energy by combustion;”, | ||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||

(b) in subsection (3)— | ||||||||||||||||||||||||||||||||||||||||||||

(i) in paragraph (a), by the deletion of “and”, | ||||||||||||||||||||||||||||||||||||||||||||

(ii) in paragraph (b), by the substitution of “the Table, and” for “the Table.”, and | ||||||||||||||||||||||||||||||||||||||||||||

(iii) by the insertion of the following paragraph after paragraph (b): | ||||||||||||||||||||||||||||||||||||||||||||

“(c) does not operate on fossil fuel, other than equipment that operates on electricity generated from using such fuel.”. | ||||||||||||||||||||||||||||||||||||||||||||

(2) Subsection (1) shall apply to capital expenditure incurred on or after 1 January 2022. | ||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 285C of Principal Act (acceleration of wear and tear allowances for gas vehicles and refuelling equipment) | ||||||||||||||||||||||||||||||||||||||||||||

|

22. (1) Section 285C of the Principal Act is amended in subsection (1)— | ||||||||||||||||||||||||||||||||||||||||||||

(a) in the definition of “gas refuelling station”, by the substitution of “gaseous fuel or hydrogen fuel is supplied to a gas-powered vehicle” for “gaseous fuel is supplied to a gas vehicle”, | ||||||||||||||||||||||||||||||||||||||||||||

(b) by the substitution of the following definition for the definition of “gas vehicle”: | ||||||||||||||||||||||||||||||||||||||||||||

“ ‘gas-powered vehicle’ means a mechanically propelled road vehicle which is fuelled by gaseous fuel or hydrogen fuel;”, | ||||||||||||||||||||||||||||||||||||||||||||

(c) by the insertion of the following definitions after the definition of “gaseous fuel”: | ||||||||||||||||||||||||||||||||||||||||||||

“ ‘hydrogen’ means the chemical element falling within CN code 2804 10 00; | ||||||||||||||||||||||||||||||||||||||||||||

‘hydrogen fuel’ means gaseous or cryogenic liquid hydrogen of a fuel quality that complies with ISO 14687:2019 or SAE J2719;”, | ||||||||||||||||||||||||||||||||||||||||||||

(d) by the insertion of the following definition after the definition of “liquefied natural gas”: | ||||||||||||||||||||||||||||||||||||||||||||

“ ‘pre-cooling device’ means equipment, which complies with ISO 19880-1:2020, used for the process of cooling hydrogen fuel prior to dispensing of the fuel;”, | ||||||||||||||||||||||||||||||||||||||||||||

(e) in the definition of “qualifying vehicle”, by the substitution of “gas-powered vehicle” for “gas vehicle”, | ||||||||||||||||||||||||||||||||||||||||||||

(f) by the substitution of the following definition for the definition of “refuelling equipment”: | ||||||||||||||||||||||||||||||||||||||||||||

“ ‘refuelling equipment’ means— | ||||||||||||||||||||||||||||||||||||||||||||

(a) a storage tank for gaseous fuel or hydrogen fuel, | ||||||||||||||||||||||||||||||||||||||||||||

(b) a compressor, pump, control or meter used for the purposes of refuelling gas-powered vehicles, | ||||||||||||||||||||||||||||||||||||||||||||

(c) a pre-cooling device, or | ||||||||||||||||||||||||||||||||||||||||||||

(d) equipment for supplying gaseous fuel or hydrogen fuel to the fuel tank of a gas-powered vehicle;”, | ||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||

(g) in the definition of “relevant period”, by the substitution of “31 December 2024” for “31 December 2021”. | ||||||||||||||||||||||||||||||||||||||||||||

(2) Subsection (1) shall apply to qualifying expenditure incurred on or after 1 January 2022. | ||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 285D of Principal Act (acceleration of wear and tear allowances for farm safety equipment) | ||||||||||||||||||||||||||||||||||||||||||||

|

23. Section 285D of the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||

(a) in subsection (1) by the insertion of the following definition after the definition of “SME”: | ||||||||||||||||||||||||||||||||||||||||||||

“ ‘tax reference number’ has the same meaning as it has in section 891B(1);”, | ||||||||||||||||||||||||||||||||||||||||||||

(b) in subsection (3)— | ||||||||||||||||||||||||||||||||||||||||||||

(i) in paragraph (b), by the substitution of “applicant;” for “applicant; and”, and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) by the insertion of the following paragraph after paragraph (b): | ||||||||||||||||||||||||||||||||||||||||||||

“(ba) the tax reference number of the applicant;”, | ||||||||||||||||||||||||||||||||||||||||||||

(c) in subsection (6)— | ||||||||||||||||||||||||||||||||||||||||||||

(i) in paragraph (c), by the substitution of “issued;” for “issued; and”, and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) by the insertion of the following paragraph after paragraph (c): | ||||||||||||||||||||||||||||||||||||||||||||

“(ca) the tax reference number of the applicant;”, | ||||||||||||||||||||||||||||||||||||||||||||

(d) in subsection (7), by the substitution of “qualifying certificates issued under subsection (4) and all qualifying certificates deemed to be cancelled under subsection (13A)” for “qualifying certificates issued”, | ||||||||||||||||||||||||||||||||||||||||||||

(e) by the insertion of the following subsection after subsection (13): | ||||||||||||||||||||||||||||||||||||||||||||

“(13A) Where two or more certificates stand issued under subsection (4) to a person in respect of an item of qualifying equipment then— | ||||||||||||||||||||||||||||||||||||||||||||

(a) only the certificate issued in respect of the first application made by the person under subsection (2) in respect of the item of qualifying equipment shall be treated as a qualifying certificate for the purposes of subsection (14), and | ||||||||||||||||||||||||||||||||||||||||||||

(b) any other certificate standing issued under subsection (4) to that person in respect of that item of qualifying equipment is deemed to be cancelled in so far as it relates to that item of qualifying equipment and shall not be treated as a qualifying certificate for the purposes of subsection (14).”, | ||||||||||||||||||||||||||||||||||||||||||||

(f) in subsection (14), by the substitution of “Subject to subsections (13A), (15) and (16)” for “Subject to subsections (15) and (16)”, and | ||||||||||||||||||||||||||||||||||||||||||||

(g) in subsection (17), by the substitution of “relief granted under this section” for “relief granted”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of Part 23 of Principal Act (farming and market gardening) | ||||||||||||||||||||||||||||||||||||||||||||

|

24. Part 23 of the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||

(a) in section 657(7), by the deletion of all of the words from and including“; but where in the case of an individual” to the end of that subsection, | ||||||||||||||||||||||||||||||||||||||||||||

(b) in section 666(4), by the substitution of “2024” for “2021” in each place where it occurs, | ||||||||||||||||||||||||||||||||||||||||||||

(c) in section 667B(5)(b), by the substitution of “31 December 2022” for “31 December 2021”, and | ||||||||||||||||||||||||||||||||||||||||||||

(d) in section 667C— | ||||||||||||||||||||||||||||||||||||||||||||

(i) in subsection (2), by the substitution of the following paragraph for paragraph (b): | ||||||||||||||||||||||||||||||||||||||||||||

“(b) the following was substituted for subsection (4)— | ||||||||||||||||||||||||||||||||||||||||||||

‘(4) (a) A deduction shall not be allowed under this section in computing a company’s trading income for any accounting period which ends after 31 December 2022. | ||||||||||||||||||||||||||||||||||||||||||||

(b) Any deduction allowed by virtue of this section in computing the profits or gains of a trade of farming for an accounting period of a person other than a company shall not apply for any purpose of the Income Tax Acts for any year of assessment later than the year 2022.’,”, | ||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) in subsection (4), by the substitution of “31 December 2022” for “31 December 2021”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 886 of Principal Act (obligation to keep certain records) | ||||||||||||||||||||||||||||||||||||||||||||

|

25. Section 886 of the Principal Act is amended, in subsection (2), by the insertion of the following paragraph after paragraph (a): | ||||||||||||||||||||||||||||||||||||||||||||

“(aa) Without prejudice to the generality of paragraph (a) and subsection (4)— | ||||||||||||||||||||||||||||||||||||||||||||

(i) the records shall include records and linking documents relating to any allowance, deduction, relief or credit (referred to in this paragraph as a ‘relevant amount’) taken into account in computing the amount of tax payable (within the meaning of section 959A), for the year of assessment or accounting period concerned, | ||||||||||||||||||||||||||||||||||||||||||||

(ii) the transactions, acts or operations giving rise to a relevant amount shall, for the purposes of subsection (4)(a)(i), be treated as transactions, acts or operations that were completed at the end of the year of assessment or accounting period for which a relevant amount is taken into account in computing the amount of tax payable (within the meaning aforesaid) for the year of assessment or accounting period concerned, and | ||||||||||||||||||||||||||||||||||||||||||||

(iii) the transactions, acts or operations giving rise to a relevant amount shall, for the purposes of subsection (4)(a)(ii), be treated as transactions, acts or operations that were completed at the end of the year of assessment or accounting period in which the return, in which the relevant amount is taken into account in computing the amount of tax payable (within the meaning aforesaid), has been delivered.”. | ||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of Part 16 of Principal Act (relief for investment in corporate trades) | ||||||||||||||||||||||||||||||||||||||||||||

|

26. (1) Part 16 of the Principal Act is amended— | ||||||||||||||||||||||||||||||||||||||||||||

(a) in section 489, in paragraph (a) of the definition of “RICT group”, by the deletion of “but has since been disposed of”, | ||||||||||||||||||||||||||||||||||||||||||||

(b) in section 502, by the insertion of the following subsection after subsection (4): | ||||||||||||||||||||||||||||||||||||||||||||

“(5) In respect of shares issued on or after 1 January 2022, an amount equal to ten fortieths of the relief granted under subsection (2A) shall be withdrawn, unless in relation to a qualifying company and its qualifying subsidiaries— | ||||||||||||||||||||||||||||||||||||||||||||

(a) (i) the employment relevant number exceeds the employment threshold number by at least one qualifying employee, and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) the relevant amount exceeds the threshold amount by at least the total emoluments of one qualifying employee in the year of assessment in which the subsequent period ends, | ||||||||||||||||||||||||||||||||||||||||||||

or | ||||||||||||||||||||||||||||||||||||||||||||

(b) the amount of expenditure on R&D+I incurred in the year of assessment in which the subsequent period ends exceeds the amount of expenditure on R&D+I incurred in the year of assessment prior to the year of assessment in which the subscription for eligible shares was made.”, | ||||||||||||||||||||||||||||||||||||||||||||

(c) in section 505, by the substitution of the following subsection for subsection (2): | ||||||||||||||||||||||||||||||||||||||||||||

“(2) The individual, in each of the 3 years of assessment preceding the year of assessment that precedes the year of assessment in which that individual makes a relevant investment (being that individual’s first such investment), may have been in receipt of income other than income chargeable to tax under— | ||||||||||||||||||||||||||||||||||||||||||||

(a) Schedule E, or | ||||||||||||||||||||||||||||||||||||||||||||

(b) Case III of Schedule D in respect of profits or gains from an office or employment held or exercised outside the State, | ||||||||||||||||||||||||||||||||||||||||||||

not in excess of the lesser of— | ||||||||||||||||||||||||||||||||||||||||||||

(i) the aggregate of the amounts, if any, of that individual’s income chargeable to tax under Schedule E and Case III of Schedule D in respect of the profits or gains referred to in paragraphs (a) and (b), and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) €50,000.”, | ||||||||||||||||||||||||||||||||||||||||||||

(d) in section 508(1), by the substitution of the following paragraph for paragraph (a): | ||||||||||||||||||||||||||||||||||||||||||||

“(a) makes a qualifying investment or has an amount of relief carried forward under this section in excess of— | ||||||||||||||||||||||||||||||||||||||||||||

(i) €100,000 in respect of which relief is available under section 507, or | ||||||||||||||||||||||||||||||||||||||||||||

(ii) the limits set out in section 502(3) in any other case, | ||||||||||||||||||||||||||||||||||||||||||||

or”, | ||||||||||||||||||||||||||||||||||||||||||||

(e) in section 508A— | ||||||||||||||||||||||||||||||||||||||||||||

(i) in subsection (1), by the insertion of “or qualifying investment fund,” after “designated fund”, | ||||||||||||||||||||||||||||||||||||||||||||

(ii) in subsection (3)(a)— | ||||||||||||||||||||||||||||||||||||||||||||

(I) by the substitution of the following for subparagraph (iv): | ||||||||||||||||||||||||||||||||||||||||||||

“(iv) where the investment is made through a designated fund or qualifying investment fund, the name, address and tax reference number of the designated fund or the qualifying investment fund, as the case may be,”, | ||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||

(II) by the deletion of subparagraph (v), | ||||||||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||||||||

(iii) by the substitution of the following subsection for subsection (4): | ||||||||||||||||||||||||||||||||||||||||||||

“(4) A qualifying company may not issue a statement of qualification in respect of a qualifying investment more than 4 months after the end of the year of assessment in which the shares were issued.”, | ||||||||||||||||||||||||||||||||||||||||||||

(f) in section 508C— | ||||||||||||||||||||||||||||||||||||||||||||

(i) in subsection (3)(a), by the deletion of subparagraph (iv), and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) by the substitution of the following subsection for subsection (4): | ||||||||||||||||||||||||||||||||||||||||||||

“(4) A qualifying company may not issue a statement of qualification (SURE) in respect of a relevant investment more than 4 months after the end of the year of assessment in which the shares were issued.”, | ||||||||||||||||||||||||||||||||||||||||||||

(g) in section 508E(2), by the substitution of “not more than 4 months after the end of the year of assessment in which the shares were issued” for “within 60 days of the date referred to in section 508A(3)(a)(v)”, | ||||||||||||||||||||||||||||||||||||||||||||

(h) in section 508F(2), by the substitution of the following paragraph for paragraph (d): | ||||||||||||||||||||||||||||||||||||||||||||

“(d) where section 502(2)(b) applies, the date the conditions set out in section 508B(4)(a) are satisfied.”, | ||||||||||||||||||||||||||||||||||||||||||||

(i) in section 508G(2)— | ||||||||||||||||||||||||||||||||||||||||||||

(i) in paragraph (c), by the substitution of “investment.” for “investment;”, and | ||||||||||||||||||||||||||||||||||||||||||||

(ii) by the deletion of paragraph (d), | ||||||||||||||||||||||||||||||||||||||||||||

(j) by the substitution of the following title for the title to Chapter 7: | ||||||||||||||||||||||||||||||||||||||||||||

“Investment Funds”, | ||||||||||||||||||||||||||||||||||||||||||||

(k) by the insertion of the following section after section 508I: | ||||||||||||||||||||||||||||||||||||||||||||

“Qualifying investment funds | ||||||||||||||||||||||||||||||||||||||||||||

508IA. (1) In this Part— | ||||||||||||||||||||||||||||||||||||||||||||

‘alternative investment fund manager’ has the meaning assigned to it by the European Union (Alternative Investment Fund Managers) Regulations 2013 ( S.I. No. 257 of 2013 ); | ||||||||||||||||||||||||||||||||||||||||||||

‘investment limited partnership’ means a partnership authorised in accordance with the Investment Limited Partnerships Act 1994 ; | ||||||||||||||||||||||||||||||||||||||||||||

‘limited partnership’ means a limited partnership registered in accordance with the Limited Partnerships Act 1907 and managed by an alternative investment fund manager in accordance with the European Union (Alternative Investment Fund Managers) Regulations 2013; | ||||||||||||||||||||||||||||||||||||||||||||

‘partnership agreement’ means any valid written agreement of the partners governed by the law of the State and subject to the exclusive jurisdiction of the courts of the State as to the affairs of a limited partnership or an investment limited partnership that is a qualifying investment fund for the purposes of this Part and the conduct of its business as may be amended, supplemented or restated from time to time; | ||||||||||||||||||||||||||||||||||||||||||||

‘qualifying investment fund’ means an investment limited partnership or a limited partnership that meets the requirements of subsection (2). | ||||||||||||||||||||||||||||||||||||||||||||

(2) A limited partnership or an investment limited partnership, as the case may be, shall be a qualifying investment fund for the purposes of this Part if— | ||||||||||||||||||||||||||||||||||||||||||||

(a) it is established under a partnership agreement and has as its principal business, to be expressed in the partnership agreement establishing the qualifying investment fund, the investment of its funds in accordance with a defined investment policy for the benefit of its investors, and | ||||||||||||||||||||||||||||||||||||||||||||

(b) under the terms of the partnership agreement it is provided that— | ||||||||||||||||||||||||||||||||||||||||||||

(i) the funds to be invested in eligible shares are to be invested without undue delay, | ||||||||||||||||||||||||||||||||||||||||||||

(ii) pending investment in eligible shares, any moneys subscribed for the purchase of shares are to be placed on deposit in a separate account with a bank licensed to transact business in the State, | ||||||||||||||||||||||||||||||||||||||||||||

(iii) any amounts received by means of dividends or interest are, subject to a commission in respect of management expenses at a rate not exceeding a rate which shall be specified in the partnership agreement under which the qualifying investment fund has been established, to be paid without undue delay to the partners, | ||||||||||||||||||||||||||||||||||||||||||||

(iv) any charges to be made by means of management or other expenses in connection with the establishment, running, winding down or termination of the qualifying investment fund shall be at a rate not exceeding a rate which shall be specified in the partnership agreement under which the qualifying investment fund is established, | ||||||||||||||||||||||||||||||||||||||||||||

(v) audited accounts of the qualifying investment fund are prepared annually and submitted to the Revenue Commissioners when requested, | ||||||||||||||||||||||||||||||||||||||||||||

(vi) the alternative investment fund manager, and any associate of that manager is not for the time being connected either directly or indirectly with any company whose shares comprise part of the qualifying investment fund, | ||||||||||||||||||||||||||||||||||||||||||||

(vii) any discounts on eligible shares received by the alternative investment fund manager of the qualifying investment fund are accepted solely for the benefit of the partners, | ||||||||||||||||||||||||||||||||||||||||||||

(viii) if a limit is placed on the size of the qualifying investment fund or a minimum amount for investment is stipulated, any subscriptions not accepted are to be returned without undue delay, and | ||||||||||||||||||||||||||||||||||||||||||||

(ix) no partner is allowed to have any eligible shares in any company in which the qualifying investment fund has invested transferred into his or her name until 4 years have elapsed from the date of the issue of the shares to the fund.”, | ||||||||||||||||||||||||||||||||||||||||||||

(l) in section 508J— | ||||||||||||||||||||||||||||||||||||||||||||

(i) in subsection (1)(a), by the substitution of “or by a person or persons having the management of a qualifying investment fund for the purposes of this Chapter (in this section referred to as the ‘fund managers’)” for “for the purposes of this Chapter (in this Part referred to as the ‘managers of a designated fund’)”, | ||||||||||||||||||||||||||||||||||||||||||||

(ii) in subsections (2), (3) and (4)(a), by the substitution of “fund managers” for “managers of a designated fund” in each place where it occurs, and | ||||||||||||||||||||||||||||||||||||||||||||

(iii) in subsection (4), by the insertion of “or the qualifying investment fund” after “designated fund” in each place where it occurs, | ||||||||||||||||||||||||||||||||||||||||||||

(m) in section 508P, by the insertion of the following subsection after subsection (8): | ||||||||||||||||||||||||||||||||||||||||||||

“(9) Where during a compliance period in respect of a qualifying investor’s investment in a qualifying company, that company redeems shares of that individual, where the compliance period for that share issue has ended, or purchases shares from that individual, where the compliance period for that share issue has ended (either of which is referred to in this subsection as ‘the redemption’), then, notwithstanding subsection (7), the relief that individual is entitled to, other than pursuant to section 503 or 507, shall not be reduced where— | ||||||||||||||||||||||||||||||||||||||||||||

(a) the most recent qualifying investment, in respect of which a claim for relief under this Part is made, in a company in the RICT group was more than 18 months prior to the date of the redemption, | ||||||||||||||||||||||||||||||||||||||||||||

(b) there is no qualifying investment, in respect of which a claim for relief under this Part is made, in a company in the RICT group within the period of 12 months after the date of the redemption, and | ||||||||||||||||||||||||||||||||||||||||||||