Financial Emergency Measures in the Public Interest Act 2015

| ||

Number 39 of 2015 | ||

FINANCIAL EMERGENCY MEASURES IN THE PUBLIC INTEREST ACT 2015 | ||

CONTENTS | ||

Preliminary and General | ||

Section | ||

Remuneration - Public Servants Generally | ||

Pension-related Deductions and Pensions | ||

Miscellaneous | ||

12. Amendment of Ministers and Secretaries (Amendment) Act 2011 | ||

|

Acts Referred to | ||

Financial Emergency Measures in the Public Interest (Amendment) Act 2011 (No. 39) | ||

Financial Emergency Measures in the Public Interest (No. 2) Act 2009 (No. 41) | ||

Financial Emergency Measures in the Public Interest Act 2009 (No. 5) | ||

Financial Emergency Measures in the Public Interest Act 2010 (No. 38) | ||

Financial Emergency Measures in the Public Interest Act 2013 (No. 18) | ||

Taxes Consolidation Act 1997 (No. 39) | ||

| ||

Number 39 of 2015 | ||

FINANCIAL EMERGENCY MEASURES IN THE PUBLIC INTEREST ACT 2015 | ||

An Act, in the public interest, to provide for— | ||

(A) the amendment of the Financial Emergency Measures in the Public Interest Act 2009 to effect a reduction in the amount payable under that Act by certain persons in the public service who are members of an occupational pension scheme or pension arrangement (by whatever name called); | ||

(B) an increase in the remuneration (being the remuneration as it stands reduced, before the passing of this Act, in consequence of legislation enacted in 2009 or 2013) of certain persons in the public service and for that purpose to amend the foregoing legislation; | ||

(C) an increase in the amount of pension or other benefits, other than lump sums, (being the amount of pension or other benefits as they stand reduced, before the passing of this Act, in consequence of legislation enacted in 2010 or 2013) payable to or in respect of certain persons who were in the public service under an occupational pension scheme or pension arrangement (by whatever name called) and for that purpose to amend the foregoing legislation; | ||

(D) the variation of the amount payable, or rate of payment, out of money provided by the Oireachtas or the Central Fund or the growing produce of that fund to certain persons for certain services to or on behalf of the State; | ||

(E) the amendment of sections 46 and 46A of the Courts (Supplemental Provisions) Act 1961 ; and | ||

(F) the consequences of the inclusion of unapproved terms and conditions in the contract of employment of public servants; | ||

and to provide for related matters. | ||

[27 th November, 2015] | ||

WHEREAS economic growth has resumed and the State’s international competitiveness has improved and a significant improvement in the fiscal circumstances of the State has occurred; | ||

AND WHEREAS it remains necessary to retain firm control of current Exchequer expenditure so as to ensure ongoing access to international funding and improve competitiveness, while taking into account the continuing risks to the public finances which remain, and the need to meet the State’s commitments to have a prudent fiscal policy under the Stability and Growth Pact and the Fiscal Compact; | ||

AND WHEREAS the reductions in the remuneration and superannuation of public servants and former public servants effected by legislation enacted in the last 6 years have contributed substantially to improvements brought about in the public finances and it is equitable to implement a partial and phased reversal of those reductions— | ||

Be it therefore enacted by the Oireachtas as follows: | ||

|

PART 1 Preliminary and General | ||

|

Short title and commencement | ||

|

1. (1) This Act may be cited as the Financial Emergency Measures in the Public Interest Act 2015. | ||

(2) This Act shall come into operation on such day or days as the Minister for Public Expenditure and Reform may appoint by order or orders either generally or with reference to any particular purpose or provision and different days may be so appointed for different purposes or different provisions. | ||

|

Definitions | ||

|

2. In this Act— | ||

“Act of 2009” means the Financial Emergency Measures in the Public Interest Act 2009 ; | ||

“Act of 2010” means the Financial Emergency Measures in the Public Interest Act 2010 ; | ||

“Act of 2013” means the Financial Emergency Measures in the Public Interest Act 2013 . | ||

|

PART 2 Remuneration - Public Servants Generally | ||

|

Pay restoration | ||

|

3. The Financial Emergency Measures in the Public Interest (No. 2) Act 2009 is amended by the insertion of the following sections after section 6: | ||

“Adjustment to remuneration affected by operation of section 2 | ||

6A. (1) The amount by which the basic salary of a public servant stands reduced by virtue of section 2, being the basic salary the annualised amount of which, as so reduced, does not exceed €24,000, €31,000 or €65,000, as the case may be, shall— | ||

(a) in accordance with this section, and | ||

(b) as regards payment of that salary occurring on or after the relevant date specified in this section, | ||

be restored in part, or (if such is this section’s effect) in whole, to the public servant. | ||

(2) References in subsections (3), (4) and (5) to basic salary are references to basic salary as it stands reduced by virtue of section 2. | ||

(3) The annualised amount of the basic salary of a public servant that is not greater than €24,000 shall, on and from 1 January 2016, be increased by 2.5 per cent. | ||

(4) The annualised amount of the basic salary of a public servant that is greater than €24,000 but not greater than €31,000 shall, on and from 1 January 2016, be increased by 1 per cent. | ||

(5) The annualised amount of the basic salary of a public servant that is not greater than €65,000 (including a public servant referred to in subsections (3) and (4), but excluding a public servant referred to in section 2A(4)) shall, on and from 1 September 2017, be increased by €1,000. | ||

(6) For the avoidance of doubt, where subsection (5) results in the annualised amount of the basic salary of a public servant being greater than €65,000 after 1 September 2017, section 2A does not affect that remuneration. | ||

(7) Where the operation of subsections (3), (4) or (5) results in the basic salary of a public servant being increased above the amount of his or her basic salary as it stood before it was reduced in accordance with section 2, such increase shall have effect, notwithstanding the reference in subsection (1) to an amount of salary being restored. | ||

Correction of anomalies consequential on operation of section 6A | ||

6B. Where the operation of section 6A results in the basic salary of a public servant to whom subsection (3), (4) or (5) of that section applies being higher than the basic salary applicable to the next immediate point, or (if such is the case) any higher point, on the pay scale that applies to the public servant, the Minister may, having taken into account all of the circumstances that relate to the existence of the differential between the points on that scale— | ||

(a) by direction, increase the basic salary applicable to, as the case may be— | ||

(i) that next immediate point, or | ||

(ii) that higher point, and, if appropriate, one or more of the points below that point, | ||

on that scale to such extent as the Minister thinks fit so as to maintain an equitable differential between the points on that scale, or | ||

(b) determine that in respect of certain categories of public servant to whom that scale applies, the basic salary to be paid, for the time being, to those public servants shall, to such extent as the Minister thinks fit so as to maintain an equitable differential between the various salaries payable to the several public servants to whom that scale applies, be greater or less than an amount provided by a particular point on that scale. | ||

Restoration of remuneration affected by operation of section 2A | ||

6C. (1) The amount by which the annual remuneration of a public servant stands reduced by virtue of section 2A, being the annual remuneration the amount of which, as so reduced, is not less than €65,000 or €110,000, as the case may be, shall— | ||

(a) in accordance with this section, and | ||

(b) as regards payment of that remuneration occurring on or after the relevant date specified in this section, | ||

be restored to the public servant. | ||

(2) The amount by which the annual remuneration of a public servant stands reduced by virtue of section 2A, the amount of which, as so reduced, is not less than €65,000 and not more than €110,000, shall— | ||

(a) as to one half of the amount of that reduction, be restored to the public servant on 1 April 2017, and | ||

(b) as to the other half of the amount of that reduction, be restored to the public servant on 1 January 2018. | ||

(3) The amount by which the annual remuneration of a public servant stands reduced by virtue of section 2A, the amount of which, as so reduced, is in excess of €110,000, shall— | ||

(a) as to one third of the amount of that reduction, be restored to the public servant on 1 April 2017, | ||

(b) as to another one third of the amount of that reduction, be restored to the public servant on 1 April 2018, and | ||

(c) as to the remaining one third of that reduction, be restored to the public servant on 1 April 2019. | ||

(4) In this section, “annual remuneration” shall be construed in accordance with section 2A(1)(b).”. | ||

|

Amendment to section 7 of Act of 2013 | ||

|

4. Section 7 of the Act of 2013 is amended in subsection (1) by— | ||

(a) the substitution of “period of 5 years” for “period of 3 years”, and | ||

(b) the substitution of “1 July 2018” for “1 July 2016” in each place where it occurs. | ||

|

PART 3 Pension-related Deductions and Pensions | ||

|

Amendment of Act of 2009 | ||

|

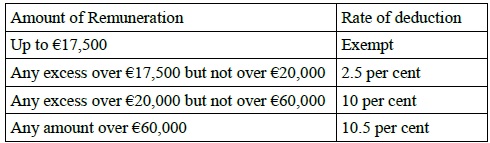

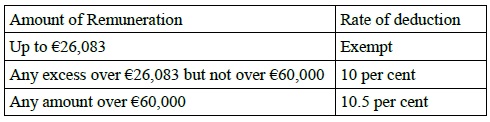

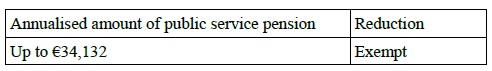

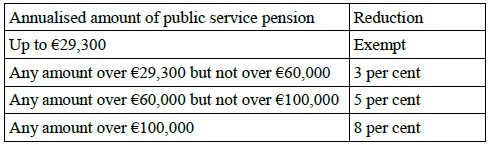

5. (1) Section 2 of the Act of 2009 shall be taken to have effect for the year 2015 as if the following Table were substituted for Table D to subsection (3): | ||

“TABLE D | ||

| ||

”. | ||

(2) Where an amount was deducted from a relevant person (within the meaning of section 2 of the Act of 2009) in the year 2015 in excess of the amount required to be deducted as a result of the operation of subsection (1), the person who is responsible for, or authorises, the payment of remuneration to the relevant person shall repay or cause to be repaid to that relevant person the amount in excess of the amount required to be deducted as a result of the operation of subsection (1). | ||

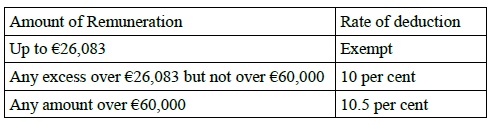

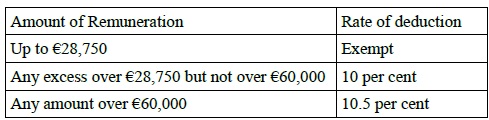

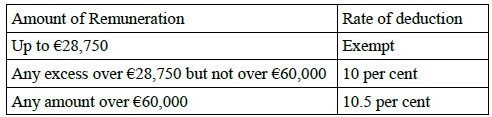

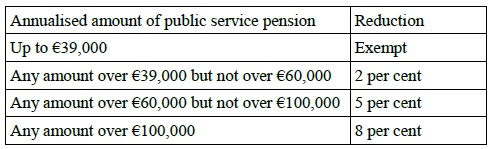

(3) With effect on and from 1 January 2016, section 2 of the Act of 2009 is amended— | ||

(a) by the substitution of the following for subsection (3): | ||

“(3) The person who is responsible for, or authorises, the payment of remuneration to a relevant person shall, subject to subsection (3A), deduct or cause to be deducted an amount— | ||

(a) in the case of the year 2016, at the applicable rate or rates specified in Table A to this subsection in respect of that year, and | ||

(b) in the case of the year 2017 and each subsequent year, at the applicable rate or rates specified in Table B to this subsection in respect of that year, | ||

from the remuneration from time to time payable to the relevant person for any such year. | ||

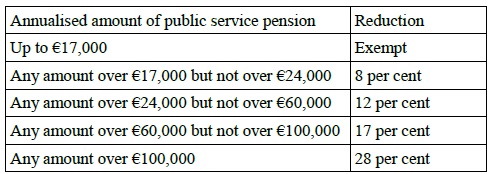

TABLE A | ||

| ||

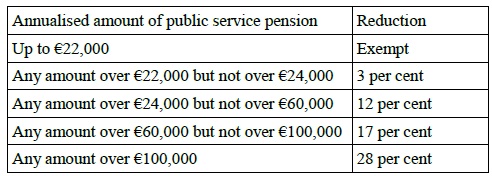

TABLE B | ||

| ||

”. | ||

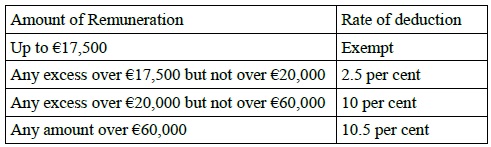

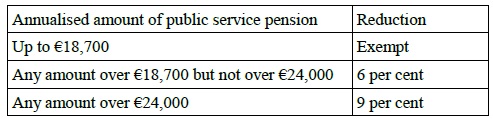

(4) Subsection (3B) of section 2 of the Act of 2009 shall be taken to have effect for the year 2015 as if the following Table were substituted for the Table to that subsection: | ||

“TABLE | ||

| ||

”. | ||

(5) Where an amount was deducted from a public servant referred to in paragraph (e) or (f) of the definition of that term in section 1 of the Act of 2009 in the year 2015 in excess of the amount required to be deducted by virtue of subsection (4), the person who is responsible for, or authorises, the payment of remuneration to the public servant shall repay to the public servant the amount in excess of the amount required to be deducted by virtue of subsection (4). | ||

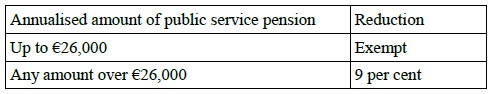

(6) With effect on and from 1 January 2016, section 2 of the Act of 2009 is amended by the substitution of the following for subsection (3B): | ||

“(3B) The person who is responsible for, or authorises, the payment of remuneration to a public servant referred to in paragraph (e) or (f) of the definition of that term in section 1 shall deduct or cause to be deducted an amount— | ||

(a) in the case of the year 2016, at the applicable rate or rates specified in Table A to this subsection in respect of that year, and | ||

(b) in the case of the year 2017 and each subsequent year, at the applicable rate or rates specified in Table B to this subsection in respect of that year, | ||

from the remuneration from time to time payable to the relevant person for any such year. | ||

TABLE A | ||

| ||

TABLE B | ||

| ||

”. | ||

|

Amendment of Act of 2010 | ||

|

6. (1) The Act of 2010 is amended by— | ||

(a) in section 1, the substitution of the following definition for the definition of “aggregation of public service pensions”: | ||

“ ‘aggregation of public service pensions’ means the aggregation under subsection (3) of section 2 or subsection (5) of section 2A of two or more public service pensions payable to a pensioner for the purposes of the application of subsection (1) or (2) of section 2 or subsection (3) of section 2A, as the case may be, in relation to the pensioner;”, and | ||

(b) the substitution of the following section for section 2: | ||

“Reduction in public service pension | ||

2. (1) The annualised amount of a public service pension payable in accordance with his or her entitlement to a person who— | ||

(a) is a pensioner, or | ||

(b) becomes a pensioner on or at any time before the relevant date or, in the case of a pensioner falling under paragraph (c) of the definition of “pensioner” in section 1, at any time after that date, | ||

where the annualised amount payable is not more than €34,132 shall be reduced— | ||

(i) with effect on and from 1 January 2016 and subject to subparagraphs (ii) and (iii), in accordance with Table A to this subsection, | ||

(ii) with effect on and from 1 January 2017 and subject to subparagraph (iii), in accordance with Table B to this subsection, and | ||

(iii) with effect on and from 1 January 2018, in accordance with Table C to this subsection. | ||

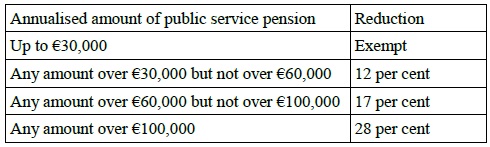

TABLE A | ||

| ||

TABLE B | ||

| ||

TABLE C | ||

| ||

(2) The annualised amount of a public service pension payable in accordance with his or her entitlement to a person who— | ||

(a) is a pensioner, or | ||

(b) becomes a pensioner on or at any time before the relevant date or, in the case of a pensioner falling under paragraph (c) of the definition of “pensioner” in section 1, at any time after that date, | ||

where the annualised amount payable is greater than €34,132 shall be reduced— | ||

(i) with effect on and from 1 January 2016 and subject to subparagraphs (ii) and (iii), in accordance with Table A to this subsection, | ||

(ii) with effect on and from 1 January 2017 and subject to subparagraph (iii), in accordance with Table B to this subsection, and | ||

(iii) with effect on and from 1 January 2018, in accordance with Table C to this subsection. | ||

TABLE A | ||

| ||

TABLE B | ||

| ||

TABLE C | ||

| ||

(3) If— | ||

(a) two or more public service pensions are payable to a person, and | ||

(b) the annualised amount of all such pensions payable in accordance with the person’s entitlements exceeds €32,500, | ||

all such pensions shall be aggregated for the purposes of the application of subsections (1) and (2). | ||

(4) (a) Where the application to a pensioner of subsection (2) would result in the annualised amount of his or her public service pension being lower than would be the case if he or she had been on a pension specified in subsection (1) and that subsection applied to him or her, then subsection (2) shall be deemed to operate, in relation to that pensioner, in such a manner and by reference to the provisions of subsection (1) (the “relevant provisions”), as will result in his or her pension standing at the highest it would have stood at, as a result of that operation of subsection (2) by reference to the relevant provisions, had he or she been on whichever lower amount of pension produces the most beneficial result for him or her in consequence of the relevant provisions. | ||

(b) In this subsection a reference to a subsection or to the provisions of a subsection includes a reference to the Tables in that subsection. | ||

(5) Where a pension adjustment order has been made in relation to a public service pension, the annualised amount of the public service pension shall be reduced under this section before it is paid in accordance with the provisions of the pension adjustment order. | ||

(6) This section has effect notwithstanding— | ||

(a) any provision by or under— | ||

(i) any other enactment, | ||

(ii) any statute or other document to like effect of a university or other third level institution, | ||

(iii) any pension scheme or arrangement, | ||

(iv) any circular or instrument or other document, or | ||

(v) any written agreement or contractual arrangement, or | ||

(b) any verbal agreement, arrangement or understanding or any expectation. | ||

(7) In this section a reference to the annualised amount of a public service pension payable in accordance with a person’s entitlement is a reference to that entitlement not taking into account any reduction imposed by virtue of the operation of this Act whether as enacted or as amended by the Financial Emergency Measures in the Public Interest Act 2013 .”. | ||

(2) Section 5(3) of the Act of 2013 shall cease to have effect on and from 1 January 2016. | ||

|

Amendment to section 2A of Act of 2010 | ||

|

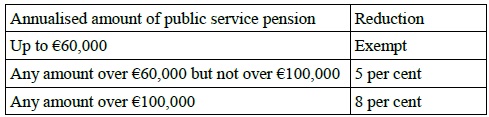

7. Section 2A of the Act of 2010 is amended— | ||

(a) by the substitution of the following subsection for subsection (3) : | ||

“(3) The annualised amount of a public service pension payable in accordance with his or her entitlement to a person who is a relevant (post 29 February 2012) pensioner shall be reduced— | ||

(a) with effect on and from 1 January 2016 and subject to paragraphs (b) and (c), in accordance with Table A to this subsection, | ||

(b) with effect on and from 1 January 2017 and subject to paragraph (c), in accordance with Table B to this subsection, and | ||

(c) with effect on and from 1 January 2018 in accordance with Table C to this subsection. | ||

TABLE A | ||

| ||

TABLE B | ||

| ||

TABLE C | ||

| ||

”. | ||

and | ||

(b) in subsection (4) by the substitution of “and the appropriate Table” for “and the Table”. | ||

|

PART 4 Miscellaneous | ||

|

Amendment to section 9 of Act of 2009 | ||

|

8. Section 9 of the Act of 2009 is amended— | ||

(a) in subsection (1), by the substitution of “vary” for “reduce”, and | ||

(b) in subsection (5), by— | ||

(i) the substitution of the following paragraph for paragraph (e): | ||

“(e) the impact, if any, on the State’s ability to continue to provide health services at existing levels;”, | ||

(ii) the substitution of the following paragraph for paragraph (f): | ||

“(f) the fairness and efficiency of any method of effecting any amendment to payments having regard to the requirements of good and effective administration; and”, | ||

and | ||

(iii) the insertion of the following paragraph after paragraph (f): | ||

“(g) the need to retain firm control of current Exchequer expenditure so as to ensure ongoing access to international funding and improve competitiveness, while taking into account the continuing risks to the public finances which remain, and the need to meet the State’s commitments to have a prudent fiscal policy under the Stability and Growth Pact and the Fiscal Compact.”. | ||

|

Amendment to section 10 of Act of 2009 | ||

|

9. Section 10 of the Act of 2009 is amended in subsection (1) by the substitution of “vary” for “reduce”. | ||

|

Implementation of collective agreement | ||

|

10. Section 5 of the Financial Emergency Measures in the Public Interest (No. 2) Act 2009 is amended by the insertion of the following subsections after subsection (4): | ||

“(5) Notwithstanding section 4 or anything in this section, an existing power to fix terms and conditions of public servants may be exercised so as to effect an increase (whether generally or in respect of a specified class of public servant) in remuneration as provided for in a collective agreement registered for the purposes of section 7 of the Financial Emergency Measures in the Public Interest Act 2013 . | ||

(6) Any subsequent provision of this Act, being a provision inserted by the Financial Emergency Measures in the Public Interest Act 2015, shall have effect notwithstanding anything in this section.”. | ||

|

Amendment of Courts (Supplemental Provisions) Act 1961 | ||

|

11. (1) Section 46 of the Courts (Supplemental Provisions) Act 1961 is amended— | ||

(a) in subsection (3AA), by the substitution of “(9) to (9B)” for “(9A) to (9C)”, | ||

(b) by the substitution of the following subsection for subsection (9): | ||

“(9) (a) The annual sums to be paid by way of remuneration to the several judges of the Supreme Court, the Court of Appeal, the High Court, the Circuit Court and the District Court who were appointed to those judicial offices before the commencement of section 10 of the Financial Emergency Measures in the Public Interest (Amendment) Act 2011 shall be specified in an order made by the Government for the purpose. | ||

(b) In making an order under paragraph (a), the Government shall have regard to the proportions that the annual sums payable by way of remuneration under this Act in respect of the different judicial offices bore to one another before the commencement of section 11 of the Financial Emergency Measures in the Public Interest Act 2015. | ||

(c) The amount that is specified in an order under paragraph (a) as the annual sum payable by way of remuneration in respect of a particular judicial office shall not be less than the amount that stood, immediately before the commencement of section 11 of the Financial Emergency Measures in the Public Interest Act 2015, as the annual sum payable by way of remuneration in respect of that office. | ||

(d) A reference in paragraph (b) to the annual sum payable by way of remuneration in respect of a judicial office shall be construed as a reference to the annual sum payable by way of remuneration in respect of a judicial office, the holder of which was appointed to that office before the commencement of section 10 of the Financial Emergency Measures in the Public Interest (Amendment) Act 2011 . | ||

(e) An order under this subsection may, if so expressed, have retrospective effect.”, | ||

(c) by the substitution of the following subsection for subsection (9A): | ||

“(9A) (a) The annual sums to be paid by way of remuneration to the several judges of the Supreme Court, the Court of Appeal, the High Court, the Circuit Court and the District Court who were appointed to those judicial offices on or after the commencement of section 10 of the Financial Emergency Measures in the Public Interest (Amendment) Act 2011 shall be specified in an order made by the Government for the purpose. | ||

(b) In making an order under paragraph (a), the Government shall have regard to the proportions that the annual sums payable by way of remuneration under this Act in respect of the different judicial offices referred to in paragraph (c) bore to one another before the commencement of section 11 of the Financial Emergency Measures in the Public Interest Act 2015. | ||

(c) In respect of each of the following judicial offices, the specification, in an order under paragraph (a), of the annual sum payable by way of remuneration shall be by means of a pay scale set out in the order: | ||

(i) the Chief Justice; | ||

(ii) the President of the Court of Appeal; | ||

(iii) an ordinary judge of the Supreme Court; | ||

(iv) the President of the High Court; | ||

(v) an ordinary judge of the Court of Appeal; | ||

(vi) the President of the Circuit Court; | ||

(vii) an ordinary judge of the High Court; | ||

(viii) the President of the District Court; | ||

(ix) an ordinary judge of the Circuit Court or a specialist judge of the Circuit Court; | ||

(x) an ordinary judge of the District Court. | ||

(d) A pay scale referred to in paragraph (c) shall provide for the payment of progressively greater amounts of remuneration, within a range specified in the order, (each of which amounts is referred to in paragraphs (e) and (g) as a “point on the pay scale”), by reference to the lapse of specified periods of time since the relevant judge’s appointment (and no matter, other than such lapse of time, shall be specified in the order as a condition for the payment of any such greater amount). | ||

(e) The first point on the pay scale, in respect of the particular judicial office, shall not be less than the amount that stood, immediately before the commencement of section 11 of the Financial Emergency Measures in the Public Interest Act 2015, as the annual sum payable by way of remuneration in respect of that office. | ||

(f) Any reference in paragraph (b) or (e) to the annual sum payable by way of remuneration in respect of a judicial office shall be construed as a reference to the annual sum payable by way of remuneration in respect of a judicial office, the holder of which was appointed to that office on or after the commencement of the provision referred to in paragraph (a). | ||

(g) Where a person appointed to a judicial office on or after the commencement of the provision referred to in paragraph (a) is subsequently appointed to another judicial office and the first point on the pay scale in respect of the second-mentioned office is lower than the amount that stood as the annual sum payable by way of remuneration to the judge prior to his or her appointment to that office (the ‘pre-existing remuneration’), then, instead of the foregoing point on the pay scale being applicable to the judge, the point on the pay scale that stands immediately above the pre-existing remuneration shall apply to the judge. | ||

(h) Section 7 of the Financial Emergency Measures in the Public Interest Act 2013 shall not apply to a pay scale set out in an order made under paragraph (a). | ||

(i) An order under this subsection may, if so expressed, have retrospective effect.”, | ||

(d) in subsection (9B)— | ||

(i) by the substitution of “the application of an order made under subsection (9A)” for “the application of subsection (9A)”, and | ||

(ii) by the substitution of “then that order” for “then that subsection”, | ||

(e) by the deletion of subsection (9C), and | ||

(f) in subsection (10), by the substitution of “subsection (9) or (9A)” for “subsection (9) or (9C)”. | ||

(2) Section 46A(2) of the Courts (Supplemental Provisions) Act 1961 is amended by the substitution of “(9) or (9B)” for “(9) or (9C)”. | ||

|

Amendment of Ministers and Secretaries (Amendment) Act 2011 | ||

|

12. The Ministers and Secretaries (Amendment) Act 2011 is amended by the insertion of the following section after section 16: | ||

“Control of terms and conditions of public servants | ||

16A. (1) Where— | ||

(a) the Minister has approved a term or condition as being a term or condition that shall apply for the time being in respect of the employment of a class or category of public servant (whether that approval takes the form of an approval as such, any other form of sanction or the giving of consent by the Minister to a decision of another person in the matter), and | ||

(b) a contract of employment in respect of a public servant falling within that class or category is entered into that contains a term or condition that corresponds or is equivalent to the term or condition standing so approved but which is more favourable to the public servant than that term or condition, | ||

the contract shall have effect as if the term or condition standing so approved (referred to in subsections (2) and (3) as the ‘approved term or condition’) were substituted for the first-mentioned term or condition in paragraph (b) (referred to in subsections (2) and (3) as the ‘unapproved term or condition’). | ||

(2) Any amount paid to the public servant concerned in purported compliance with the unapproved term or condition that is in excess of the amount payable to the public servant under the approved term or condition shall be disregarded for the purpose of calculating any pension entitlement (including an entitlement to a lump sum and an entitlement to periodic payments of pension) of that public servant. | ||

(3) Where an amount is paid to the public servant concerned in purported compliance with the unapproved term or condition that is in excess of the amount payable to the public servant under the approved term or condition then— | ||

(a) the public servant shall hold the overpayment in trust for the public service body, and | ||

(b) the public service body shall recover the amount of the overpayment from the public servant, either directly or by a deduction taken from remuneration subsequently payable to that public servant or otherwise. | ||

(4) Where— | ||

(a) a contract of employment is entered into in respect of a public servant, and | ||

(b) the contract contains a term or condition in relation to remuneration that does not correspond or is not equivalent to any term or condition standing approved by the Minister in respect of the employment of a class or category of public servant into which the first-mentioned public servant falls (whether that approval takes the form of an approval as such, any other form of sanction or the giving of consent by the Minister to a decision of another person in the matter), | ||

the term or condition shall be void. | ||

(5) Any amount paid to the public servant concerned in purported compliance with a term or condition voided under subsection (4) shall be disregarded for the purpose of calculating any pension entitlement (including an entitlement to a lump sum and an entitlement to periodic payments of pension) of that public servant. | ||

(6) Where an amount is paid to the public servant concerned in purported compliance with a term or condition voided under subsection (4) then— | ||

(a) the public servant shall hold the amount in trust for the public service body, and | ||

(b) the public service body shall recover the amount from the public servant, either directly or by a deduction taken from remuneration subsequently payable to that public servant or otherwise. | ||

(7) Subsections (3) and (6) shall not be taken as limiting the liability under statute of any person to account for such overpayment. | ||

(8) Where an amount to which subsection (3) or (6) relates has not been recovered by the public service body concerned, the Minister may direct in writing that body to recover, by a specified date, the amount in accordance with subsection (3)(b) or (6)(b), as the case may be, and, where that body fails to so recover the amount, the Minister may deduct the amount from any grant or vote of, or other payment to, that body out of money provided directly or indirectly by the Oireachtas or from the Central Fund or the growing produce of that Fund. | ||

(9) This section applies to a term or condition agreed after the commencement of section 12 of the Financial Emergency Measures in the Public Interest Act 2015. | ||

(10) This section has effect notwithstanding— | ||

(a) any other enactment, | ||

(b) any pension scheme or arrangement, | ||

(c) any other agreement or contractual arrangement, or | ||

(d) any understanding, expectation, circular or instrument or other document. | ||

(11) In this section— | ||

“public servant” means a person who is employed by, or who holds any office or other position in, a public service body; | ||

“remuneration” means emoluments to which Chapter 4 of Part 42 of the Taxes Consolidation Act 1997 applies or is applied.”. |