Finance Act, 1919

FINANCE ACT 1919 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CHAPTER 32. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

An Act to grant certain duties of Customs and Inland Revenue, including Excise, to alter other duties, and to amend the Law relating to Customs and Inland Revenue, including Excise, and the National Debt. and to make further provisions in connection with Finance [31st July 1919.] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Most Gracious Sovereign. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

We Your Majesty's most dutiful and loyal subjects, the Commons of the United Kingdom of Great Britain and Ireland in Parliament assembled, towards raising the necessary supplies to defray Your Majesty's public expenses, and making an addition to the public revenue, have freely and voluntarily resolved to give and grant unto Your Majesty the several duties hereinafter mentioned; and do therefore most humbly beseech Your Majesty that it may be enacted; and be it enacted by the King's most Excellent Majesty, by and with the advice and consent of the Lords Spiritual and Temporal, and Commons, in this present Parliament assembled, and by the authority of the same, as follows: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part I. Customs and Excise. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Continuation of customs duties imposed under 5 & 6 Geo. 5. c. 89. |

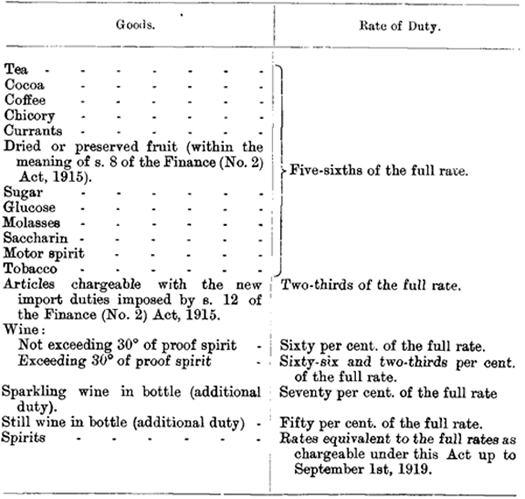

1. The following duties of customs, imposed by Part 1. of the Finance (No. 2) Act, 1915 , shall, subject as hereinafter provided, continue to be charged, levied, and paid, in the case of the new import duties until the first day of May nineteen hundred and twenty, and in the case of any other duties until the first day of August nineteen hundred and twenty, that is to say:— | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Continuation of increased medicine duties. |

2. The additional duties of excise imposed by section eleven of the Finance (No. 2) Act, 1915 , upon medicine liable to duty shall continue to be charged, levied and paid until the first day of August nineteen hundred and twenty. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Increased customs duties on beer. |

3.—(1) In lieu of the duties of customs payable on spirits imported into Great Britain or Ireland, there shall, as from the first day of May nineteen hundred and nineteen, be charged, levied and paid, subject as hereinafter provided, the duties specified in Part I. of the First Schedule to this ACt, together with the additional duties specified in Part II. of that Schedule. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) In lieu of the excise duty payable for every gallon computed at proof of spirits distilledin Great Britain or Ireland there shall, as from the first day of May nineteen hundred and nineteen, be charged, levied and paid an excise duty of two pounds and ten shillings,together with the additional duties specified in Part III. of the First Schedule to this Act. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

And so in proportion for any less quantity. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Increased customs duties on beer. |

4.—(1) In lieu of the duties of customs payable on beer of the descriptions called or similar to mum, spruce or black beer, or Berlin white beer, or other preparations, whether fermented or not fermented, of a similar character imported into Great Britain or Ireland, there shall, as from the first day of May nineteen hundred and nineteen, be charged, levied and paid the following duties (that is to say):— | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) In lieu of the duties of customs payable on every description of beer other than that specified inthe preceding subsection imported into Great Britain or Ireland there shall, as from the first day of May nineteen hundred and nineteen, be charged, levied and paid the following duty (that is to say):— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) In lieu of the customs drawback now payable thee shall be allowed and paid on the exportation, shipment for use as stores, or removal to the Isle of Man of beer imported into Great Britain or Ireland, on which it is shown that the increased customs duty charged by this Act has been paid, a drawback calculated according to the original gravity thereof (that is to say):— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(4) In the case of beer which is of a gravity different from the gravity aforesaid, the duty or the drawback, as the case may be, shall be varied proportionately. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Increased excise duty on beer. |

5. In lieu of the dutyof excise payable in respect of beer brewed in Great Britain or Ireland there shall, as from the first day of May nineteen hundred and nineteen, be charged, levied and paid— | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and in lieu of the drawback of excise payable in respect of beer exported from Great Britain or Ireland, as merchandise or for use as ship's stores, there shall be allowed and paid in respect of beer on which it is shown that the increased excise duty charged by this Act has been paid a drawback calculated according to the original gravity thereof (that is to say):— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and so, as to both duty and drawback, in proportion for any difference in quantityor gravity. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Increase in duty on private brewers licences. |

6.—(1) In lieu of the existing duties upon licences to be taken out annually by brewers of beer other than brewers for sale there shall, on and after the first day of October nineteen hundred and nineteen, be charged, levied and paid the following duties of excise (that is to say):— | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Provided that, where the brewer is the occupier of a house of an annual value of eight pounds or less, he may between the thirtieth day of April and the thirty-first day of Augst in any year obtain without payment of duty a licence to brew a quantity not exceeding two bushels of malt, or the equivalent thereof, for his own use in the course of his employment on harvest work. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) If the annual value of the house occupied by a brewer of beer other than a brewer for sale does not exceed ten pounds, duty shall not be charged on beer brewed by him, and if the annual value of the house occupied by him exceeds ten pounds and does not exceed fifteen pounds, duty shall not be charged upon beer brewed by him provided that he brews solely for his own domestic use. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Alteration of entertainment duty. 6 & 7 Geo. 5. c. 11. 7 & 8 Geo. 5. c. 31. 8 & 9 Geo. 5. c. 15. |

7. On and after the first day of October nineteen hundred and nineteen, section one of the Finance (New Duties) Act, 1916, as amended by section three of the Finance Act, 1917, and section eleven of the Finance Act, 1918, shall have effect as if for the words— | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Imperial preference. |

8.—(1) With a view to conferring a preference in the case of Empire products, the duties of customs onthe goods specified in the Second Schedule to this Act shall, on and after the dates provided for in that schedule, be charged at the reduced rates (hereinafter referred to as “preferencial rates”) shown in the second column of that schedule, where the goods are shown to the satisfaction of the Commissioners of Customs and Excise to have been consigned from and grown, produced or manufactured in the British Empire. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

For the purposes of this section— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“The British Empire” means any of His Majesty's dominions outside Great Britain and Ireland, and any territories under His Majesty's protection, and includes India: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Provided that, where any territory becomes a territory under His Majesty's protection, or is a territory in respect of which a mandate of the League of Nations is exercised by the Government of any part of His Majesty's dominions, His Majesty may by Order in Council direct that that territory shall be included within the definition of the British Empire for the purposes of this section, and this section shall have effect accordingly. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Goods shall not be deemed to have been manufactured in the British Empire as aforesaid unless such proportion of their value as is prescribed by regulations made by the Board of Tradeis the result of labour within the British Empire. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Where the Board of Tradeis satisfied as respects any class of goods to which the preferential rates apply that those articles are to a considerable extent manufactured in the British Empire from material which is not wholly grown or produced in the Empire, the Board may by order direct that the preferential rate shall be charged only in respect of such proportion of those goods as corresponds to the proportion of dutiable material used in their manufacture which is shown to have been grown or produced in the Empire. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Where goods are manufactured in a bonded factory in Great Britain or Ireland from dutiable material shown to the satisfaction of the Commissioners of Customs and Excise to have been consigned from and grown or produced in the British Empire,the duty on the manufactured goods shall, to the extent to which they are shown to have been manufactured out of such material, be charged at the preferential rate. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(4) Any Order in Council or regulations made under this section shall be laid before each House of Parliament forthwith, and, if an Address is presented to His Majesty by either House of Parliament within the next subsequent twenty-one days on which that House has sat next after the Order or the regulations are laid before it, praying that the Order or regulations may be annulled, His Majesty in Council may annul the Order or regulations, and the order or regulations shall thenceforth be void, but without prejudice to the validity of anything previously done thereunder. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Reduced excise duties. |

9. On and after the first day of September nineteen hundred and nineteen the following excise duties shall be reduced by one-sixth, that is to say, the excise duties payable on tobacco, sugar, molasses, glucose,, saccharin and chicory. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Modifications of drawbacks. |

10. Where the dutyof customs or excise on any chicory, coffee, tobacco or molasses, or in respect of the material from which any molasses is produced, is payable under this Act at a reduced rate, any drawback or allowance payable in respect thereof shall be reduced to an amount bearing to such drawback or allowance the same proportion as the rate payable under this Act bears to the full rate or the former rate (as the case may be). | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Spirits used in medical preparations or for scientific purposes. |

11. Sections four of the Finance Act, 1918 (which provides for the reduction and allowance of duty in respect of spirits used in medical preparations or for scientific purposes), shall apply to the duties on spirits imposed by this Act as it applies to duties on spirits imposed by that Act as though it were herein set out and expressly made applicable thereto, with the substitution for the sums specified in that section as the amount of reduction of duty or repayment of duty of such sums as will reduce the amount of duty payable under this Act to the amount of duty which was payable immediately before the increase of duties on spirits provided for by the Finance Act, 1918. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Repeal of excise duties on motor spirit and motor spirit licence duties. 6 & 7 Geo. 5. c. 24. |

12.—(1) As from the first day of May nineteen hundred and nineteen, the excise duties pon motor spirit made in Great Britain or Ireland, and on the licence to be taken out annually by a manufacturer of motor spirit, shall cease to be chargeable. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) As from the seventeenth day of May nineteen hundred and nineteen, sections fifteen and sixteen of the Finance Act, 1916, which relate to motor spirit licence duty shall cease to have effect. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Nothing in this subsection shall affect the right of any person to obtain a repayment of duty under the said section fifteen, if he claims repayment before the seventeenth day of August nineteen hundred and nineteen. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Restriction on delivery of goods from bonds. |

13. The powers of the Treasury under section fifteen of the Finance (No. 2) Act, 1915 (which relates tothe restriction on the delivery of goods from bond), shall be exerciseable without any limit of time, and accordingly in that section the words “During the continuance of the present war and for a period of twelve months thereafter” shall cease to have effect. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part II. Income Tax. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Income tax for 1919–20. 8 & 9 Geo. 5. c. 40. 32 & 33 Vict. c. 67. |

14.—(1) Income tax for the year 1919–20 shall be charged at the rate of six shillings, and the rates of super-tax for the purposes of section four of the Income Tax Act, 1918, and the rates of tax for the purposes of sections fourteen and fifteen of that Act (which relate respectively to relief in respect of earned income where the income does not exceed two thousand five hundred pounds, and relief in respect of unearned income where the income does not exceed two thousand pounds), shall be the same for that year as for the year 1918–19. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) The annual value of any property which has been adopted for the purpose either of income tax under Schedules A. and B., or of inhabited house duty, for the year 1918–19, shall be taken as the annual value of that property for the same purpose for the year 1919–20; provided that this subsection— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) So far as respects the duty on inhabited houses in Scotland, shall be construed by reference to a year of assessment ending on the twenty-fourth day of May instead of on the fifth day of April; and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) shall not apply to lands, tenements, and hereditaments in the administrative county of London with respect to which the valuation list under the Valuation (Metropolise) Act, 1869, is, by that Act, made conclusive for the purposes of income tax and inhabited house duty. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Continuation of relief. |

15. The following sections of the Income Tax Act, 1918, are hereby continued in force as respects the year 1919–20, that is to say:— | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Exemption in respect of wounds and disability pensions. 4 & 5 Geo. 5. c. 30. 5 Geo. 5. c. 18. 5 Geo. 5. c. 24. |

16.—(1) Income from wounds and disability pensions to which this section applies shall be exempt from income tax (including super-tax) and shall not be reckoned in computing income for any of the purposes of the Income Tax Acts, for the year 1918–19, or any succeeding year of assessment. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) The section applies to— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) wounds pensions granted to members of the naval, military, or air forces of the Crown; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) retired pay of disabled officers granted on account of medical unfitness attributable to or aggravated by naval, military or air-force service; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(c) disablement or disability pensions granted to members, other than commissioned officers, of the naval, military, or air forces of the Crown on account of medical unfitness attributable to or aggravated by naval, military or air-force service; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(d) disablement pensions granted to persons who have been employed in thenursing services of any of the naval, military, or air forces of the Crown on account of medical unfitness attributable to or aggravated by naval, military or air-force service; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(e) injury and disablement pensions payable under any scheme made under the Injuries in War (Compensation) Act, 1914, the Injuries in War Compensation Act, 1914 (Session 2), and the Injuries in War (Compensation) Act, 1915, or under any War Risks Compensation Scheme for the Mercantile Marine: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Provided that, where the amount of any retired pay or pension to which this section applies is not solely attributable to disablement or disability, the relief conferred by this section shall extend only to such part as is certified by the Minister of Pensions, after consultation with the approprite Government Department, to be attributable to disablement or disability. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) If any person has paid income tax or super-tax of an amount exceeding that which he would have been liable to pay if this section had been in force, he shall, on proof of the facts to the satisfaction of the Commissioners having jurisdiction in the matter, be entitled to repayment of the excess. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Exemption in respect of certain war gratuities. |

17.—(1) War gratuities to which this section applies shall be exempt and shall be deemed to have been exempt since the fourth day of August nineteen hundred and fourteen, from income tax (including super-tax), and shall not be reckoned in computing income for any of the purposes of the Income Tax Acts. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) This section applies to gratuities paid in respect of service in connection with the present war to members of any of the naval, military, or air forces of the crown, or to persons who have been employed in the nursing services of any of those forces; and benefits on demobilisation paid to officers and members of Queen Mary's Auxiliary Army Corps, the Women's Royal Naval Service and the Women's Royal Air Force; and demobilisation payments to employees of the Joint War Committee of the British Red Cross Society and the Order of St. John of Jerusalem in England. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) If any person has paid income tax or super-tax of an amount exceeding that which he would have beenliable to pay if this section had been in force, he shall, on proof of the facts to the satisfaction of the Commissioners having jurisdiction in the matter, be entitled to repayment of the excess notwithstanding anything in section forty-one of the Income Tax Act, 1918. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Allowance in respect of mills, factories, &c. |

18.—(1) In estimating the amount of annual profits or gains arising or accruing from any trade the profits of which are chargeable to tax under Case I. of Schedule D, there shall, notwithstanding anything in Rule 5 of the rules applicable to Cases I. and II. of Schedule D, be allowed tobe deducted, as expenses incurred in any year, on account of any mills, factories, or similar premises owned by the person carrying on such trade and occupied by him for the purposes of the said trade, and situate ourside the United Kingdom, a deduction equal to one-sixth of the annual value of those premises. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) In estimating the profits for any year of any of the concerns enumerated in Rules 1, 2, and 3 of No. III. of the rules applicable to Schedule A, there shall be allowed to be deducted, as expenses incurred in any year, on account of any mills, factories, or similar premises owned by the person carrying on the concern, and occupied by him for the purposes of such concern, a deduction equal to one-sixth of the annual value of those premises. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Annual value for the purposes of this section shall be estimated according to the principles governing the estimation of the annual value for the purposes of Schedule A of mills, factories and similar premises in the United Kingdom. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Further provision as to allowances for repairs. |

19. The houses to which Rule 8 of No. V. in Schedule A (which confers relief in certain cases in respect of the cost of maintenance, repairs, insurance, and management of houses) applies, shall be any house the annual value of which, as adopted under Schedule A, does not exceed— | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) where the house is situate in the Metropolitan police district, including the City of London, seventy pounds; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) where the house is situate in Scotland, sixty pounds; and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(c) where the house is situate elsewhere, fifty-two pounds; and subsection (3) ofthe said Rule 8 shall be amended accordingly: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Provided that no repayment of tax shall be made under the said Rule 8 in respect of the cost of maintenance, repairs, insurance, or management, if or to such extent as the said cost has been otherwise allowed as a deduction in computing income for the purposes of income tax. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Extension of relief in respect of colonial income tax. |

20. Section fifty-five of the Income Tax Act, 1918, and (so far as still applicable) section forty-three of the Finance Act, 1916 (which provide for certain relief in respect of Colonial income tax) shall have effect, and shall be deemed always to have had effect, as though references to “any British possession” included references to any territory under His Majesty's protection. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Extension of relief in respect of children, &c. |

21.—(1) An individual who claims and proves in the manner prescribed by the Income Tax Acts— | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) that his total income from all sources for the year of assessment, estimated in accordance with the provisions of those Acts, although exceeding one hundred and thirty pounds does not exceed eight hundred pounds; and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) that he is unmarried and has living with him either his mother (being a widow or living apart from her husband), or some other female relative, maintained by him at his own expense, for the purpose of having the charge and care of any brother or sister of his, being a child in respect of whom relief is given under section twelve of the Income Tax Act, 1918; and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(c) that no other individual is entitled to relief from income tax in respect of the same person under this section, and that neither he nor any other individual is entitled to relief in respect of the same person under section twelve or section thirteen of the Income Tax Act, 1918, or if any other individual is entitled to any such relief that the other individual has relinquished his claim thereto; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

shall be entitled in respect of his mother or such female relative to relief from tax upon fifty pounds. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) The relief conferred in respect of children by section twelve of the Income Tax Act, 1918, shall be extended— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) so as to include relief in respect of any child over the age of sixteen at the commencement of the year of assessment who is proved to be receiving full-time instruction at any university, college, school, or other educational establishment; and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) so as provide relief in respect of one child from tax upon forty pounds and in respect of any child in excess of one from tax upon twenty-five pounds: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and that section and section thirteen of that Acat and this section shall have effect accordingly: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Provided that, in cases of doubt as to the application of paragraph (a) of this subsection, it shall be competent for the Commissioners of Inland Revenue, on the request of the Income Tax Commissioners concerned, to consult the Board of Education. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In the application of his subsectionto Scotland and Ireland, the Scottish Education Department and the Lord Lieutenant, respectively, shall be substituted for the Board of Education. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) All claims under this section shall be made and proved in accordance with section twenty-eight or (in Ireland) section two hundred and two of the Income Tax Act, 1918. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Relief in respect of houses occupied by ministers of religion. |

22. Where a clergyman or minister of any religious denomination occupies a dwelling house rent from by virtue of his office in such circumstances that the annual value of the house does not fall to be regarded as part of his income, he shall be entitled, on giving notice to the surveyor of taxes not later than the thirtieth day of September in any year, or, where the occupation of such clergyman or minister commenced after the thirtieth day of June, before the expiration of three months after the date of the commencement of such occupation, to require that the annual value of the house, after deducting therefrom the amount of any annual sum payable in respect of such house, shall for all purposes of income tax for that year be treated as earned income of such clergyman or minister. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In this section the expression “annual sum” has the same meaning as in Rule 4 (2) of No. VIII. of the rules applicable to Schedule A. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of s. 26 of 6 & 9 Geo. 5. c. 40. |

23. The proviso to section twenty-six of the Income Tax Act, 1918 (which provides for the cases in which an individual, though not resident in the United Kingdom,is to receive relief from income tax), shall have effect as though for the words “any widow who is in receipt of a pension chargeable with tax “anx granted to her in consideration of the employment of her “late husband in the service of the Crown” there were substituted the words “any widow whose late husband was in the service of the Crown.” | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Income tax on war savings certificates. |

24. Subsection (2) of section forty-seven of the Income Tax Act, 1918 (which provides for relief from income tax in the case “any Act” were substituted for “section forty-one of the Finance Act. 1918.” | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Tax on income from converted Government securities. |

25. Where the income which any individual is required under the Income Tax Acts to include in a statement of his total income from all sources for the purposes of income tax or super-tax for any year includes both— | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(i) interest received without deduction of income tax in respect of securities (in this section referred to as “original securities”) which have been accepted as the equivalent of cash in payment for fully-paid allotments of Four Pounds per Cent. Victory Bonds or Four Pounds per Cent. Funding Loan, 1960–90 (in this section referred to as “substituted securities”); and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(ii) interest taxed by deduction in respect of such substituted securities; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

and the amount of the interest so included exceeds the full amount of the interest for a complete year on the original securities; then, if that individual so requries, the excess— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) shall not be taken into account in ascertaining the total income from all sources of that individual for that year for the purposes of income tax or super-tax; but | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) shall nevertheless be chargeable toincome tax or super-tax for that year at such rate or rates and subject to such reliefs, if any, as would be applicable if such excess constituted the highest part of an income equal in amount to the amount of the total income of that individual exclusive of such excess. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of law as to separate assessment of husband and wife. |

26. This sixth day of July shall be substituted for the sixth day of May in section eight of the Income Tax Act, 1918 and in rule seventeen of the general rules as the date before which an application for separate assessment of husband and wife must be made under those provisions; and an application for the purposes of those provisions may in the case of persons marrying during the course of a year of assessment be made as regards that year at any time before the sixth day of July in the following year; and those provisions shall have effect accordingly. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Extension of relief in respect of wife and other releatives. |

27.—(1) Fifty pounds shall be substituted for twenty-five pounds in section thirteen of the Income Tax Act, 1918, as the amount upon which relief shall be granted uner that section in respect of a wife, or a female relative of a widower or of his deceased wife. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) The relief conferred by the said section thirteen, as amended by this Act, in respect of the female relative of a widower, or of his deceased wife, who resides with him for the purpose of having the charge and care of any child of his, shall be extended so as to confer relief in respect of any such female relative who resides with him in the capacity of housekeeper and not for the purpose of having the charge or care of any child of his: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Provided that any relief in respect of a femala relative under the saids ection shall be conditional on proof being given that no other individual is entitled to relief from income tax in respect of the same person under the said section thirteen, or under section twelve of the same Act, or under this Act, or if any other individual is entitled to any such relief that the other individual has relinquished his claim thereto. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Interpretation. |

28. In this Part of this Act, and in any subsequent enactment relating to income tax, except where otherwise expressly provided— | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

References to Schedule A, B, C, D, or E (respectively) shall be construed as references to those Schedules in the Income Tax Act, 1918, as amended by any subsequent enactment; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The expression “the general rules” means the general rules applicable to Schedules A, B, C, D, and E, set out in the First Schedule to the Income Tax Act, 1918, as amended by any subsequent enactment; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The expression “the year 1919–20” means the year of assessment beginning on the sixth day of April nineteen hundred and nineteen, and any corresponding expression in which two years are similarly mentioned means the year of assessment beginning on the sixth day of April in the first mentioned of those years; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The expression “earned income” has the meaning assigned to it in section fourteen of the Income Tax Act, 1918; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The expression “the Income Tax Acts” means the Income Tax Act, 1918, and any other enactments relating to income tax. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part III. Death Duties. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Amended rates of estate duty. 4 & 5 Geo. 5. c. 10. 57 & 58 Vict. c. 30. |

29. The scale set out in the Third Schedule to this Act shall,in the case of persons dying after the commencement of this Act, be substituted for the scale set out in the First Schedule to the Finance Act, 1914, as the scale of rates of estate duty: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Provided that, where an interest in expectancy within the meaning of Part I. of the Finance Act, 1894 , in any property has, before the thirtieth day of April nineteen hundred and nineteen been bonâ fide sold or mortgaged for full consideration in money or money's worth, then no other duty on that property shall be payable by the purchaser or mortgagee when the interest falls into possession than would have been payable if this Part of this Act had not passed, and in the case of a mortgage any higher duty payable by the mortgagor shall rank as a charge subsequent to that of the mortgage. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Interest on death duties 59 & 60 Vict. c. 28. |

30. Section eighteen of the Finance Act, 1896 (which determines the rate of interest on death duties) shall, in its application to interest accruing due after the commencement of this Act, have effect as though four per cent. were substituted for three per cent. as the rate of interest per annum. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Extension of relief from death duties in case of persons killed in the war. 63 & 64 Vict. c. 7. |

31. Section fourteen of the Finance Act, 1900 (which relates to the remission of death duties in case of persons killed in war), and any enactment amending or extending that section, shall, in their application to the present war, have effect and be deemed always to have had effect as though— | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) three years were substituted for twelve months whereever that expression occurs; and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) in the said saction fourteen the expression “wounds “inflicted. accident occuring or disease contracted “while on active service against an enemy” included wounds inflicted, accident occuring or disease contracted in the course of operations arising directly out of the present war, but after its termination. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part IV. Excess Profit Duty. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Continuance of excess profits duty at decreased rate. |

32.—(1) The Finance (No. 2). Act, 1915 (in this Part of this Act referred to as “the principal Act”), shall, so far as it relates to excess profits duty, apply, unless Parliament otherwise determines, to any accounting period ending on or after the first day of August nineteen hundred and nineteen, and before the fifth day of August nineteen hundred and twenty, as it applies to accounting periods ended after the fourth day of August nineteen hundred and fourteen, and before the first day of August nineteen hundred and nineteen. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Section thirty-eight of the principal Act shall, as respects excess profits arising in any accounting period commencing on or after the first day of January nineteen hundred and nineteen, have effect as if forty per cent. of the excess were substituted as the rate of duty for eighty per cent. of the excess, or, in the case of an accounting period which commenced before that date but ends after that date, as if forty per cent. were substituted for eighty per cent. as respects so much of the excess as may be apportioned under the Part of this Act to the part commencing on that date. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In calculating any repayment or set off under subsection (3) of section thirty-eight of the principal Act, any amount to be repaid or set off on account of a deficiency or loss arising in any accounting period commencing on or after the first day of January, nineteen hundred and nineteen, or, in the case of an accounting period which has commenced before that date but ends after that date, on account of so much of the deficiency or loss as may be apportioned under this Part of this Act to the part commencing on that date, shall be calculated by reference to duty at the rate of forty per cent. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Decrease of rate of excess mineral rights duty. |

33.—(1) Section forty-three of the principal Act (which relates to excess mineral rights duty) shall have effect as if forty per cent. of the excess were substituted as the rate of duty for eighty per cent. for any accounting year commencing on or after the first day of January, nineteen hundred and nineteen, or, in the case of an accounting year which commenced before that date but ends after that date, as if forty per cent. were substituted for eighty per cent. as respects so much of the excess as may be apportioned under this Part of this Act to the part commencing on that date. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) The proviso to section twenty-one of the Finance Act, 1917, shall apply to any accounting year in respect of which or any part of which excess mineral rights duty is payable at the rate of forty per cent., as it applies where the said duty is payable at the rate of eighty per cent. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Extension of relief in respect of Colonial excess profits duty. |

34. Section twenty-three of the Finance Act, 1917 (which provides for relief in respect of Colonial excess profits duty), shall have effect, and shall be deemed always to have had effect, as though references to His Majesty's possessions included references to any territory under His Majesty's protection. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Apportionment of accounting periods and years. |

35. Where part of an accounting period or of an accounting year is after, and part before, the beginning of the first day of January nineteen hundred and nineteen, the total excess profits and any deficiencies or losses arising in any such accounting period, and the total excess rent for any such accounting year, shall be apportioned between the time up to, and the time after, that date in proportion to the number of months or fractions of months before and after that date respectively. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Interpretation. |

36. In this Part of this Act references to the principal Act, or to any provisions of that Act, shall be construed as references to that Act, or those provisions, as amended or extended by any subsequent enactment. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part V. General. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Suspension of new sinking fund. 50 & 51 Vict. c. 16. |

37. In the financial year ending the thirty-first day of March nineteen hundred and twenty, that portion of the permanent annual charge for the national debt which is not required for the annual charge directed by the National Debt and Local Loans Act, 1887 , or any other Act to be paid out of that charge, shall not be paid. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Construction, short title, and repeal. 39 & 40 Vict. c. 46. 57 & 58 Vict. c. 30. |

38.—(1) Part I. of this Act, so far as it relates to duties of customs, shall be construed together with the Customs Consolidation Act, 1876, and any enactments amending that Act, and so far as it relates to duties of excise shall be construed together with the Acts which relate to the duties of excise and the management of those duties. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Part II. of this Act shall be construed totgether with the Income Tax Acts. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Part III. of this Act shall be construed together with the Finance Act, 1894 . | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Part IV. of this Act shall be construed together with Part III. of the Finance (No. 2) Act, 1915 . | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) This Act may be cited as the Finance Act, 1919 . | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) The Acts set out in the Fourth Schedule of this Act are hereby repealed to the extent mentioned in the third column of that schedule. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SCHEDULES. FIRST SCHEDULE. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part I. Ordinary Customs Duties on Spirits. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part II Additional Customs Duties in respect of Immature Spirits. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part III. Additional Excise Duties in respect of Immature Spirits. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SECOND SCHEDULE. Preferential Rates | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The preferential rates shall be charged— | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) in the case of tea, on and after the second day of June nineteen hundred and nineteen; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) in the case of any other goods, on and after the first day of September nineteen hundred and nineteen. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

THIRD SCHEDULE. Scala of Rates of Estate Duty. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

FOURTH SCHEDULE. Enactments repealed. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||