Finance Act, 1908

FINANCE ACT 1908 [8 Edw. 7. Ch. 16.] | |||||||||||||||||||||||||||||||||||||||||||||||||||

ARRANGEMENT OF SECTIONS. A.D. 1908. | |||||||||||||||||||||||||||||||||||||||||||||||||||

Part I. | |||||||||||||||||||||||||||||||||||||||||||||||||||

Customs and Excise. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

Stamps. | |||||||||||||||||||||||||||||||||||||||||||||||||||

Local Taxation Licences. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

Taxes. | |||||||||||||||||||||||||||||||||||||||||||||||||||

National Debt. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

General. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

CHAPTER 16. | |||||||||||||||||||||||||||||||||||||||||||||||||||

An Act to grant certain duties of Customs and Inland Revenue, to alter other duties, and to amend the Law relating to Customs and Inland Revenue and the National Debt, and to make other provisions for the financial arrangements of the year. [1st August 1908.] | |||||||||||||||||||||||||||||||||||||||||||||||||||

Most Gracious Sovereign, | |||||||||||||||||||||||||||||||||||||||||||||||||||

WE, Your Majesty's most dutiful and loyal subjects the Commons of the United Kingdom of Great Britain and Ireland in Parliament assembled, towards raising the necessary supplies to defray Your Majesty's public expenses, and making an addition to the public revenue, have freely and voluntarily resolved to give and grant unto Your Majesty the several duties herein-after mentioned; and do therefore most humbly beseech Your Majesty that it may be enacted, and be it enacted by the King's most Excellent Majesty, by and with the advice and consent of the Lords Spiritual and Temporal, and Commons, in this present Parliament assembled, and by the authority of the same, as follows:— | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part I. Customs and Excise. | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Duty on tea. 7 Edw. 7. c. 13. |

1. The duty of Customs payable on tea until the first day of July nineteen hundred and eight, under the Finance Act, 1907, shall be deemed to have been continued as from that date and shall continue to be charged, levied, and paid until the first day of July nineteen hundred and nine, on the importation thereof into Great Britain or Ireland (that is to say):— | ||||||||||||||||||||||||||||||||||||||||||||||||||

Tea, the pound - - - fivepence. | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Reduction of sugar duty. 1 Edw. 7. c. 7. |

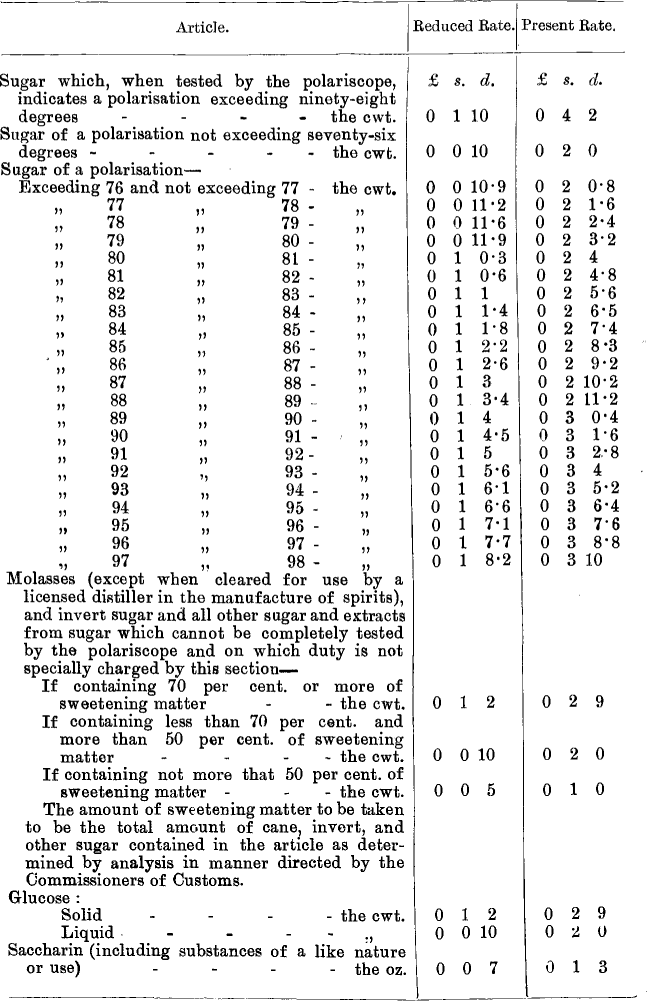

2. The duties, drawbacks, and allowance in respect of sugar, molasses, glucose, and saccharin set out in the Schedule to this Act shall, as from the eighteenth day of May nineteen hundred and eight, be at the reduced rates set out in the second column of that Schedule, instead of at the rates set out in the third column of that Schedule (being the rates previously in force): | ||||||||||||||||||||||||||||||||||||||||||||||||||

Provided that the reduction shall be deemed not to have taken effect until the first day of July nineteen hundred and eight, as respects any such duty charged on manufactured or prepared goods under section seven of the Finance Act, 1901, and as respects the drawback allowed on any such goods in respect of which it is shown to the satisfaction of the Commissioners of Customs that the duty was paid on the sugar, molasses, glucose, or saccharin used in the manufacture or preparation at the rates charged before the eighteenth day of May nineteen hundred and eight. | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Duty on tobacco produced in Ireland. Bringing into operation and re-enactment of the Irish Tobacco Act, 1907. 26 & 27 Vict. c. 7. 1 & 2 Will. 4. c. 13. 7 Edw. 7. c. 3. |

3.—(1) There shall be charged, levied, and paid, on and after the first day of January nineteen hundred and nine, on tobacco grown in Ireland, the following Excise duties, namely:— | ||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

and there shall be charged, on and after the same date, on a licence to be taken out annually by every person growing, cultivating, or curing tobacco, in Ireland, an excise duty of five shillings. | |||||||||||||||||||||||||||||||||||||||||||||||||||

(2) The Commissioners of Inland Revenue may make regulations generally for securing and collecting the excise duties payable under this section and for prohibiting the growth or cultivation of tobacco in Ireland, and the curing of tobacco so grown, except by persons holding a licence and having made entry for the purpose, and on land or premises approved by the Commissioners for the purpose, and for regulating the removal of tobacco so grown and enabling a licensed manufacturer of tobacco to receive any such tobacco. | |||||||||||||||||||||||||||||||||||||||||||||||||||

The Commissioners may, by any such regulations, apply any provision of the law of excise, whether relating to excise duties generally or to any special article on which an excise duty is payable, and any provision of the Manufactured Tobacco Act, 1863, or any Act amending the same. | |||||||||||||||||||||||||||||||||||||||||||||||||||

If any person acts in contravention of, or fails to comply with, any such regulation, the article in respect of which the offence is committed shall be forfeited, and the person committing the offence shall be liable in respect of each offence to an excise penalty of fifty pounds. | |||||||||||||||||||||||||||||||||||||||||||||||||||

(3) The Commissioners of Inland Revenue may, notwithstanding anything in this section, permit any person to grow tobacco in Ireland for experimental purposes only, subject to any special regulations and conditions they think fit, and with the benefit of any allowance in respect of the duty for the time being payable as may be sanctioned by the Treasury. | |||||||||||||||||||||||||||||||||||||||||||||||||||

(4) So much of the Tobacco Cultivation Act, 1831, and any other Act, as prohibits or restrains the setting, planting, or improving to grow, making, or curing tobacco either in seed or plant or otherwise in the Kingdom of Ireland, and section four of the Tobacco Cultivation Act, 1831, so far as it relates to tobacco grown in Ireland upon which the duty under this section has been paid, and the Irish Tobacco Act, 1907, are hereby repealed as from the first day of January nineteen hundred and nine. | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Power to transfer management of Excise duties from Inland Revenue to Customs. |

4.—(1) His Majesty may by Order in Council transfer from the Commissioners of Inland Revenue to the Commissioners of Customs the management of any Excise duties which are under the management of the Commissioners of Inland Revenue at the time the Order is made, and any powers and duties of the Commissioners of Inland Revenue which it appears necessary or expedient to transfer in consequence of or in connection with the transfer of the management of excise duties, and all powers and duties so transferred shall become powers and duties of the Commissioners of Customs. | ||||||||||||||||||||||||||||||||||||||||||||||||||

(2) If an Order is made under this section, the Commissioners of Customs shall, as from the date fixed by the Order, be styled the Commissioners of Customs and Excise. | |||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Such provisions may be made by the Order in Council under this section as it appears necessary or expedient to make in order to give full effect to any transfer, or in consequence of any change of name, effected under this section, and, for the purpose of making the provisions as to the action and procedure of the Commissioners of Customs and Excise under the Acts relating to customs and excise respectively uniform, the Order may provide that as to the action or procedure of the Commissioners any provisions of the Acts relating to excise shall have effect to the exclusion of similar provisions of the Acts relating to customs, or that any provisions of the Acts relating to customs shall have effect to the exclusion of similar provisions of the Acts relating to excise. | |||||||||||||||||||||||||||||||||||||||||||||||||||

(4) The stamp duties on medicines and playing cards shall, for the purposes of this section and for all other purposes, be deemed to be excise duties. | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part II. Stamps. | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Reduction of stamp duty on marine policies for a voyage. 54 & 55 Vict. c. 39. |

5. As from the first day of January nineteen hundred and nine, a penny shall be substituted for threepence as the stamp duty chargeable under paragraph (2) (a) of the heading Policy of Sea Insurance in the First Schedule to the Stamp Act, 1891, on a policy of sea insurance for or upon any voyage in respect of every full sum of one hundred pounds, and also any fractional part of a hundred pounds, insured by the policy. | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part III. Local Taxation Licences. | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Collection of duties on certain local taxation licences by county councils. 7 Edw. 7. c. 13. 51 & 52 Vict. c. 41. 59 & 60 Vict. c. 36. |

6.—(1) The power to levy the duties on local taxation licences to which this section applies shall, as from the date to be fixed by Order in Council under this section, be transferred in England and Wales to county councils, and section seventeen of the Finance Act, 1907, shall, as from the date of the transfer, cease to apply to or in respect of any such duties or the proceeds thereof. | ||||||||||||||||||||||||||||||||||||||||||||||||||

(2) His Majesty may, by Order in Council, fix the date of the transfer under this section, and make any such further provisions as it appears necessary or expedient to make in order to give full effect to the transfer, and may make provision for the furnishing by county councils of returns to the Local Government Board as to the amounts levied under the power transferred by this section. | |||||||||||||||||||||||||||||||||||||||||||||||||||

The transfer under this section shall not affect any equitable adjustment respecting the distribution of the proceeds of the local taxation licences made under the Local Government Act, 1888, or otherwise, but provision may be made by Order in Council under this section for any alteration which it appears necessary or expedient to make in consequence of the transfer in the procedure for making any payments, or otherwise giving effect to any such adjustment. | |||||||||||||||||||||||||||||||||||||||||||||||||||

Subsections (3) (4) and (5) of section twenty of the Local Government Act, 1888, and any other provisions of that Act relating to the levy of the duties on local taxation licences by county councils shall, as respects the duties to which this section applies, have effect as if the power to levy those duties had been transferred under subsection (3) of section twenty of that Act. | |||||||||||||||||||||||||||||||||||||||||||||||||||

(3) When the transfer under this section takes effect there shall be charged on and paid annually out of the Consolidated Fund or the growing produce thereof to the Local Taxation Account a sum of forty thousand pounds, and the sum so paid shall be distributed amongst the county councils in England and Wales in proportion to the proceeds of the duties to which this section applies collected in each county during the preceding year. | |||||||||||||||||||||||||||||||||||||||||||||||||||

(4) The duties on local taxation licences to which this section applies are the duties on licences to deal in game, licences for dogs, killing game, guns, carriages (including duties charged under subsection (1) of section eight of the Locomotives on Highways Act, 1896), armorial bearings, and male servants: | |||||||||||||||||||||||||||||||||||||||||||||||||||

Provided that if the rate of any such duty is altered, that duty shall, unless Parliament makes provision to the contrary, cease to be a duty to which this section applies. | |||||||||||||||||||||||||||||||||||||||||||||||||||

(5) The expressions “county” and “county council” in this section respectively include a county borough and the council of a county borough. | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part IV. Taxes. | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Income tax for 1908–9. 16 & 17 Vict. c. 34. 32 & 33 Vict. c. 67. |

7.—(1) Income tax for the year beginning on the sixth day of April nineteen hundred and eight shall be charged at the rate of one shilling. | ||||||||||||||||||||||||||||||||||||||||||||||||||

(2) All such enactments relating to income tax as were in force on the fifth day of April nineteen hundred and eight shall have full force and effect with respect to the duty of income tax hereby granted. | |||||||||||||||||||||||||||||||||||||||||||||||||||

(3) The annual value of any property which has been adopted for the purpose either of income tax under Schedules A. and B. in the Income Tax Act, 1853, or of inhabited house duty, during the year ending on the fifth day of April nineteen hundred and eight, shall be taken as the annual value of such property for the same purpose during the next subsequent year; provided that this subsection— | |||||||||||||||||||||||||||||||||||||||||||||||||||

(a) so far as respects the duty on inhabited houses in Scotland, shall be construed with the substitution of the twenty-fourth day of May for the fifth day of April; and | |||||||||||||||||||||||||||||||||||||||||||||||||||

(b) shall not apply to the Metropolis as defined by the Valuation (Metropolis) Act, 1869. | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Remuneration of assessors. 54 & 55 Vict. c. 13. |

8. Section three of the Taxes (Regulation of Remuneration) Act, 1891 (which relates to allowances to assessors), shall be amended by the substitution of the words “such sum as the “Commissioners of Inland Revenue, with the approval of the “Treasury, may direct, not being less than” for the words “the same amount as” in paragraphs (a) and (b) of that section. | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part V. National Debt. | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Partial application of surplus for erection of buildings for public offices. 38 & 39 Vict. c. 45. |

9. Such sum as is shown by the account certified by the Comptroller and Auditor-General under section four of the Sinking Fund Act, 1875, to be the surplus of income over expenditure for the financial year ended the thirty-first day of March nineteen hundred and eight, shall, to the extent of six hundred thousand pounds, instead of being issued and applied as provided by that Act, be issued by the Treasury at such times as they direct to the Commissioners of Works and applied in defraying any expenses incurred by those Commissioners in erecting buildings and executing other works for, or in connection with, public offices on land at Westminster acquired or, to be acquired for the purpose. | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

Part VI. General. | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Construction and short title. 39 & 40 Vict. c. 36. 54 & 55 Vict. c. 39. |

10.—(1) Part I. of this Act so far as it relates to duties of Customs shall be construed together with the Customs Consolidation Act, 1876, and the Acts amending that Act, and so far as it relates to duties of Excise shall be construed together with the Acts which relate to the duties of Excise and the management of those duties. | ||||||||||||||||||||||||||||||||||||||||||||||||||

Part II. of this Act shall be construed together with the Stamp Act, 1891. | |||||||||||||||||||||||||||||||||||||||||||||||||||

(2) This Act may be cited as the Finance Act, 1908. | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

SCHEDULE. | |||||||||||||||||||||||||||||||||||||||||||||||||||

1. Customs Duties under Section 2 of the Finance Act, 1901. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

2. Excise Duties under Section 5 of the Finance Act, 1901. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

3. Drawbacks under Second and Third Schedules of the Finance Act, 1901. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||

4. Allowance under Section 1 (2) of the Revenue Act, 1903. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||