S.I. No. 682/2005 - Protection of Employees (Employers' Insolvency) (Forms and Procedure) Regulations 2005

REGULATIONS | |||||||||||

entitled | |||||||||||

Protection of Employees (Employers' Insolvency) (Forms and Procedure) Regulations 2005 | |||||||||||

I, Tony Killeen, Minister of State at the Department of Enterprise, Trade and Employment, in exercise of the powers conferred on me by sections 6, 7 and 16 of the Protection of Employees (Employers' Insolvency) Act 1984 (No. 21 of 1984) and the Labour (Transfer of Departmental Administration and Ministerial Functions) Order 1993 ( S.I. No. 18 of 1993 ) (as adapted by the Enterprise and Employment (Alteration of Name of Department and Title of Minister) Order 1997 ( S.I. No. 305 of 1997 )) and the Enterprise, Trade and Employment (Delegation of Ministerial Functions) Order 2004 ( S.I. No. 809 of 2004 ), hereby make the following regulations: 1. These Regulations may be cited as the Protection of Employees (Employers' Insolvency) (Forms and Procedure) Regulations 2005. 2. (1) In these Regulations - | |||||||||||

“Act” means the Protection of Employees (Employers' Insolvency) Act 1984 (No. 21 of 1984) as amended or extended; | |||||||||||

“Department” means the Department of Enterprise, Trade and Employment; | |||||||||||

“PRSA” means a Personal Retirement Savings Account within the meaning of the Pensions Act 1990 (No. 25 of 1990). | |||||||||||

(2) In these Regulations, unless otherwise indicated - | |||||||||||

(a) a reference to any enactment shall be construed as a reference to that enactment as amended by any other enactment, | |||||||||||

(b) a reference to a section is to a section of the Act, and | |||||||||||

(c) a reference to a Regulation or Schedule is to a Regulation of, or Schedule to, these Regulations. 3. The following forms are prescribed as the forms to be used in respect of applications under the Act: | |||||||||||

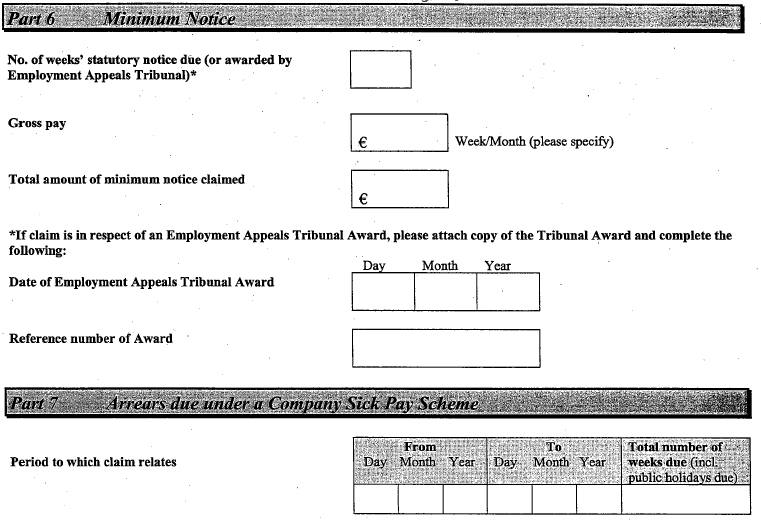

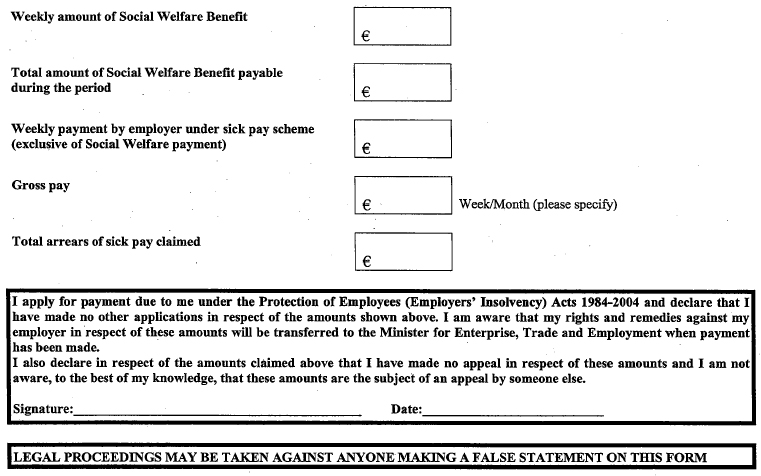

(a) in the case of an application for payment under section 6 in respect of unpaid normal weekly remuneration, entitlements under a sick pay scheme, holiday pay, payment in respect of the relevant statutory period of minimum notice specified under section 4 of the Minimum Notice and Terms of Employment Act 1973 (No. 4 of 1973) or an award by the Employment Appeals Tribunal under section 12 of that Act, Form EIP1 as set out in Part 1 of the Schedule; | |||||||||||

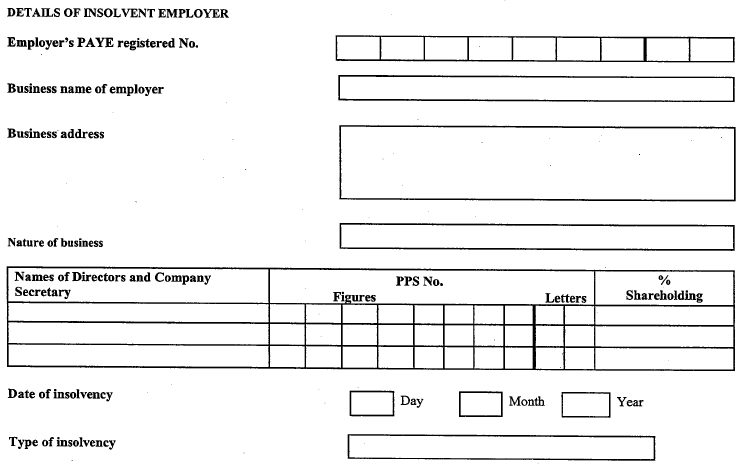

(b) in the case of an application for payment in respect of any other debt to which section 6 applies, Form EIP4 as set out in Part 2 of the Schedule; | |||||||||||

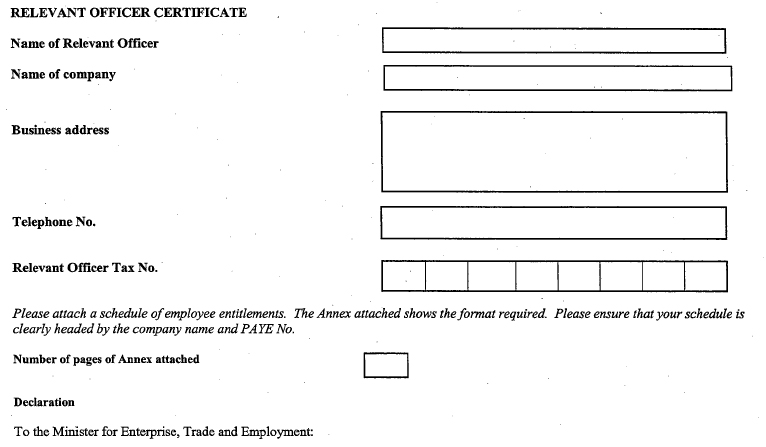

(c) in the case of a statement from a relevant officer under section 6 (6), Form EIP3 as set out in Part 3 of the Schedule; | |||||||||||

(d) in the case of an application for payment in respect of section 7, Form EIP6 as set out in Part 4 of the Schedule; | |||||||||||

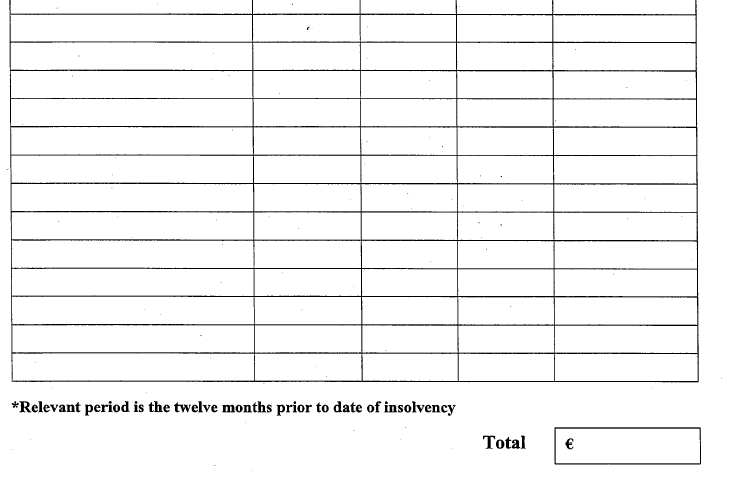

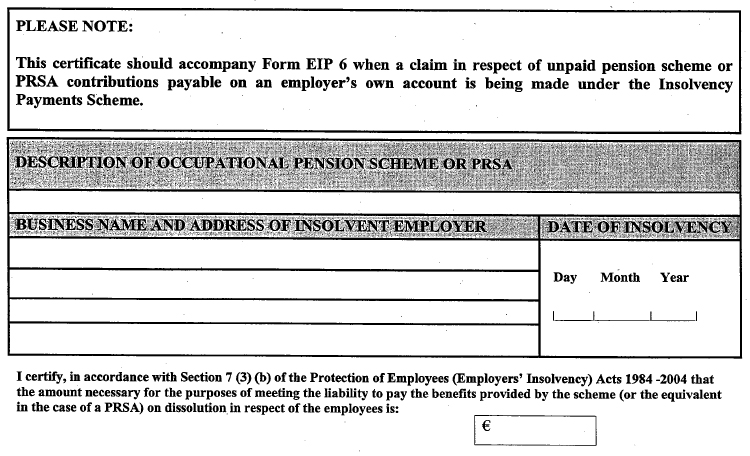

(e) in the case of a certificate given by an actuary for the purposes of section 7(3) Form EIP 7 as set out in Part 5 of the Schedule. 4. (1) An application under section 6 or 7 of the Act shall be made to a relevant officer or person appointed under section 5 who shall examine it and, as soon as may be, forward it, together with Form EIP3 or Form EIP7, as appropriate to the Insolvency Payments Section of the Department. | |||||||||||

(2) Where there is not for the time being in relation to such employer a relevant officer, an application may be sent to the Secretary General of the Department. | |||||||||||

(3) Payments in respect of applications under sections 6 and 7 shall be made to the relevant officer or person appointed under section 5 unless there are particular reasons which require that payment be made directly to the applicant. | |||||||||||

(4) Where a payment has been made on foot of an application under section 6 or 7 to a relevant officer or person appointed under section 5, such relevant officer or person shall make the appropriate payment to the applicant and, as soon as may be, shall confirm the payment in writing to the Insolvency Payments Section of the Department. 5. A person shall be deemed to have complied with any requirements under these Regulations to make an application or to prepare a statement in a form prescribed by these Regulations where the application or statement, as the case may be, is made in a form to like effect to the prescribed form concerned. 6. The Protection of Employees (Employers' Insolvency) (Forms and Procedure Regulations 1984 ( S.I. No. 356 of 1984 ) and the Protection of Employees (Employers' Insolvency) (Occupational Pension Scheme) (Forms and Procedure) Regulations 1990 ( S.I. No. 121 of 1990 ) are revoked. | |||||||||||

|

SCHEDULE | |||||||||||

|

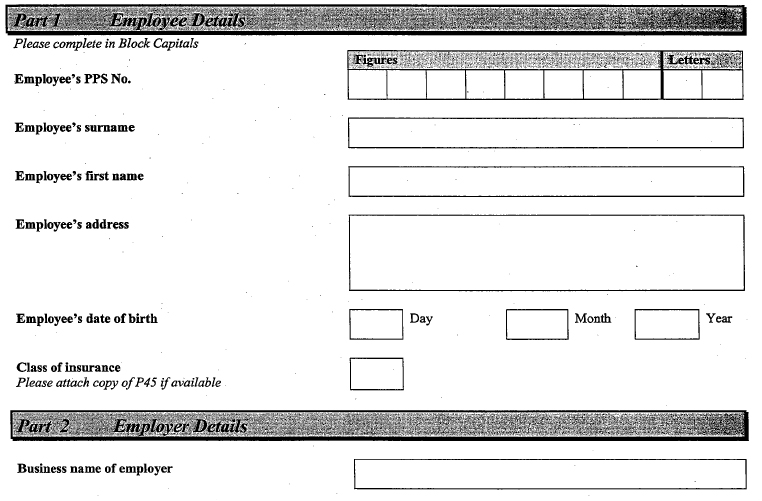

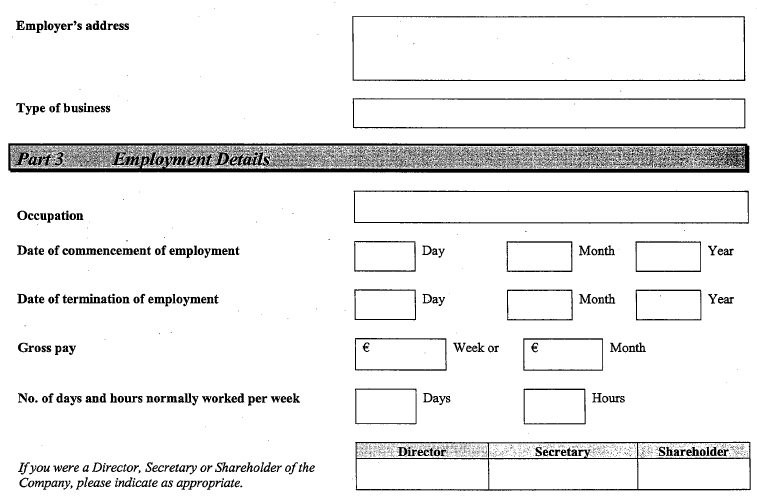

Part 1 | |||||||||||

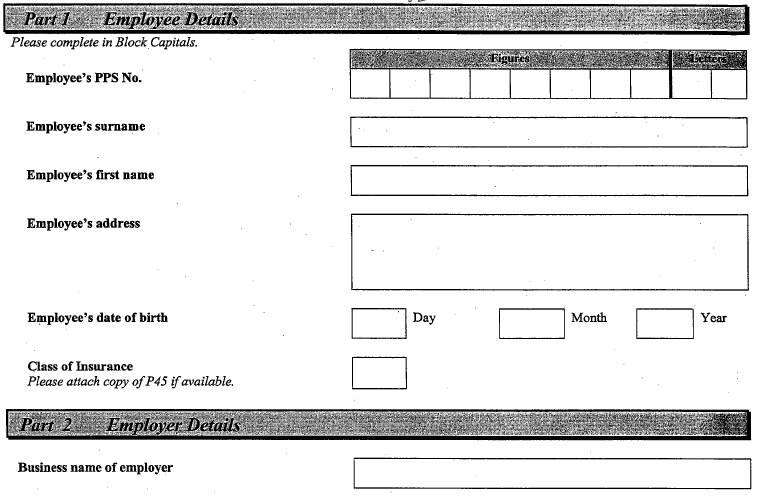

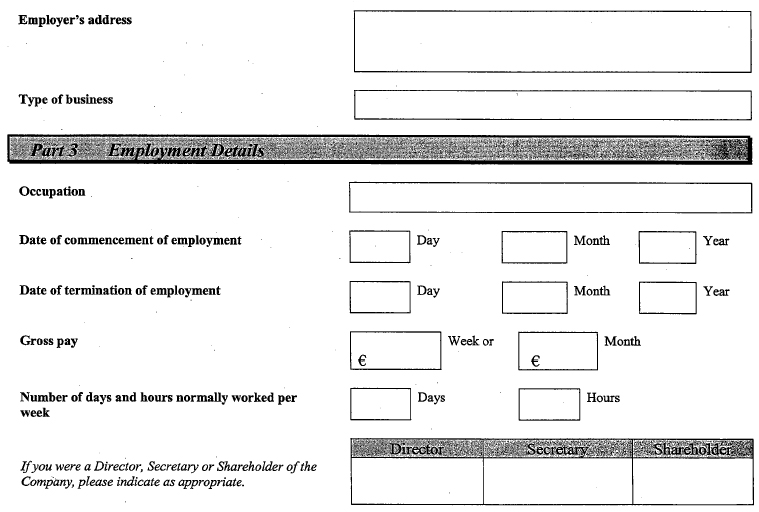

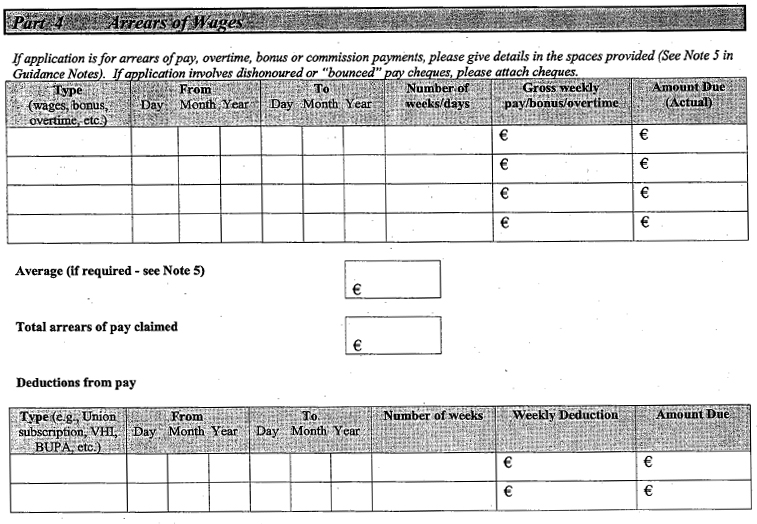

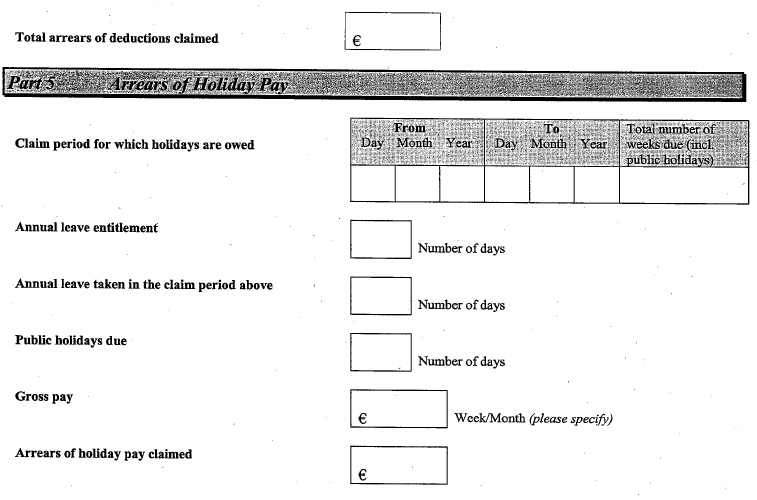

FORM EIP1 | |||||||||||

| |||||||||||

INSOLVENCY PAYMENTS SCHEME | |||||||||||

PROTECTION OF EMPLOYEES (EMPLOYERS' INSOLVENCY) ACTS 1984-2004 | |||||||||||

APPLICATION BY EMPLOYEE FOR PAYMENT OF • WAGES • HOLIDAY PAY • MINIMUM NOTICE • SICK PAY | |||||||||||

FORM EIP1: GUIDANCE NOTES | |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

|

Part 2 | |||||||||||

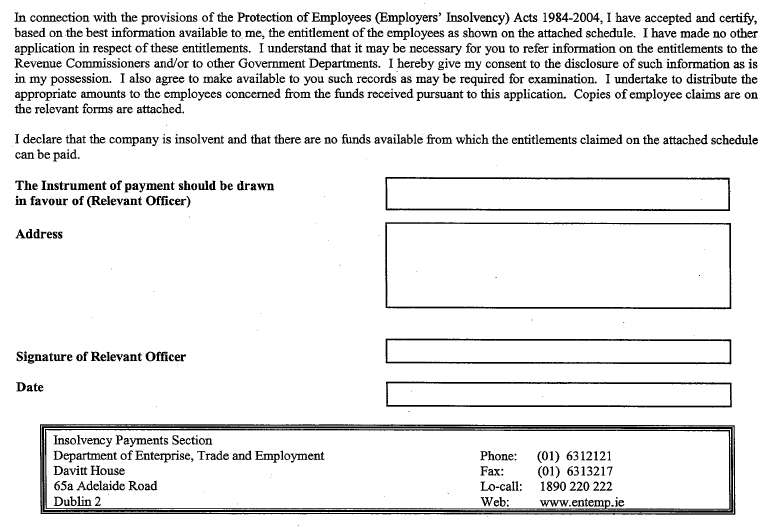

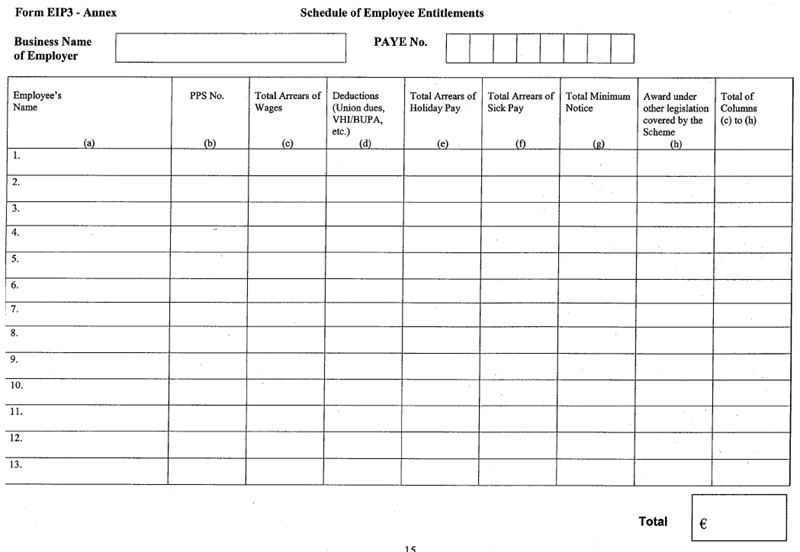

FORM EIP3 | |||||||||||

| |||||||||||

INSOLVENCY PAYMENTS SCHEME | |||||||||||

PROTECTION OF EMPLOYEES (EMPLOYERS' INSOLVENCY) ACTS 1984-2004 | |||||||||||

APPLICATION BY A RELEVANT OFFICER FOR FUNDS IN RESPECT OF EMPLOYEE CLAIMS | |||||||||||

• Arrears of Wages • Holiday Pay • Sick Pay • Minimum Notice Entitlements/Awards • Unfair Dismissals Act 1997 • Common Law in respect of Unfair or Wrongful Dismissal • Employment Equality Act 1998 • National Minimum Wage Act 2000 • Maternity Protection Act 1994 • Adoptive Leave Act 1995 • Parental Leave Act 1998 • Payment of Wages Act 1991 • Terms of Employment (Information) Act 1994 • Protection of Young Persons (Employment) Act 1996 • Organisation of Working Time Act 1997 • Protections for Persons Reporting Child Abuse Act 1998 • European Communities (Protection of Employment Regulations 2000 • Protection of Employees (Part-Time Work) Act 2001 • Competition Act 2002 • Protection of Employees (Fixed-Time Work) Act 2003 • European Communities (Protection of Employees on Transfer of Undertakings) Regulations 2003 • Industrial Relations Acts 1946, 1969 and 1990 (Registered Employment Agreements or Employment Regulation Orders) • Industrial Relations (Miscellaneous Provisions) Act 2004 (concerning victimisation awards). | |||||||||||

FORM EIP3: GUIDANCE NOTES | |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

|

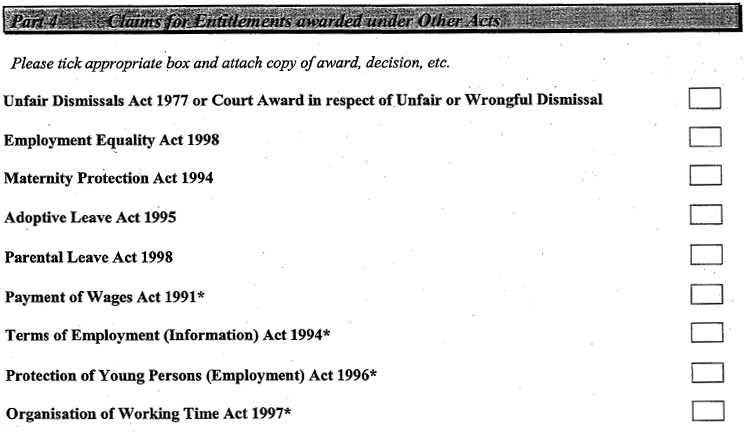

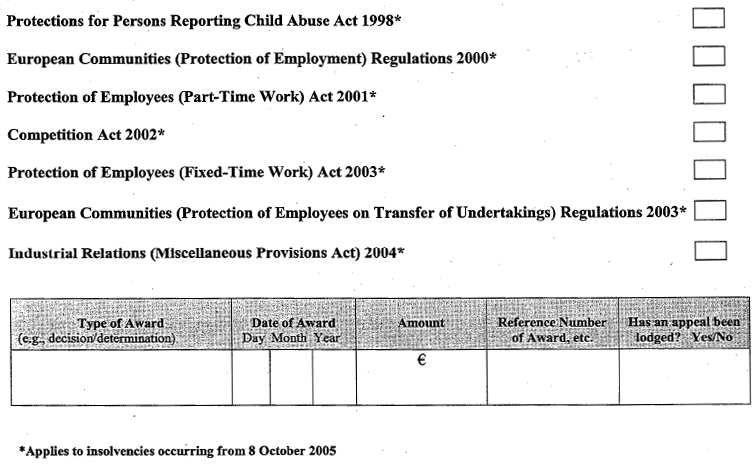

Part 3 | |||||||||||

FORM EIP4 | |||||||||||

| |||||||||||

INSOLVENCY PAYMENTS SCHEME | |||||||||||

PROTECTION OF EMPLOYEES (EMPLOYERS' INSOLVENCY) ACTS 1984-2004 | |||||||||||

APPLICATION BY EMPLOYEE FOR PAYMENT UNDER THE INSOLVENCY PAYMENTS SCHEME FOR ENTITLEMENTS DUE UNDER: | |||||||||||

• Unfair Dismissals Act 1997 • Common Law in respect of Unfair or Wrongful Dismissal • Employment Equality Act 1998 • National Minimum Wage Act 2000 • Maternity Protection Act 1994 • Adoptive Leave Act 1995 • Parental Leave Act 1998 • Payment of Wages Act 1991 • Terms of Employment (Information) Act 1994 • Protection of Young Persons (Employment) Act 1996 • Organisation of Working Time Act 1997 • Protections for Persons Reporting Child Abuse Act 1998 • European Communities (Protection of Employment) Regulations 2000 • Protection of Employees (Part-Time Work) Act 2001 • Competition Act 2002 • Protection of Employees (Fixed-Time Work) Act 2003 • European Communities (Protection of Employees on Transfer of Undertakings) Regulations 2003 • Industrial Relations Acts 1946, 1969 and 1990 (Registered Employment Agreements or Employment Regulation Orders) • Industrial Relations (Miscellaneous Provisions) Act 2004 (concerning victimisation awards) | |||||||||||

FORM EIP4: GUIDANCE NOTES | |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

|

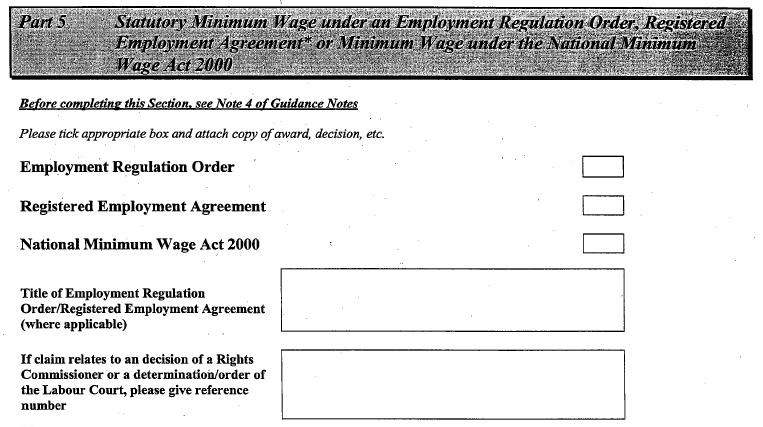

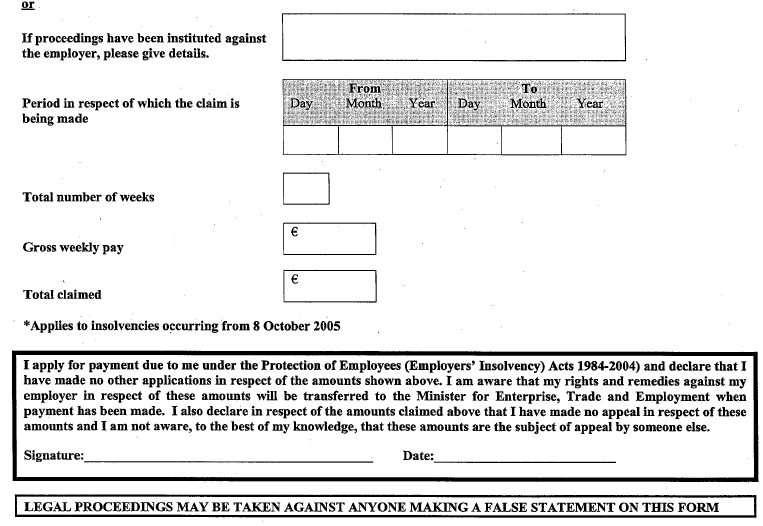

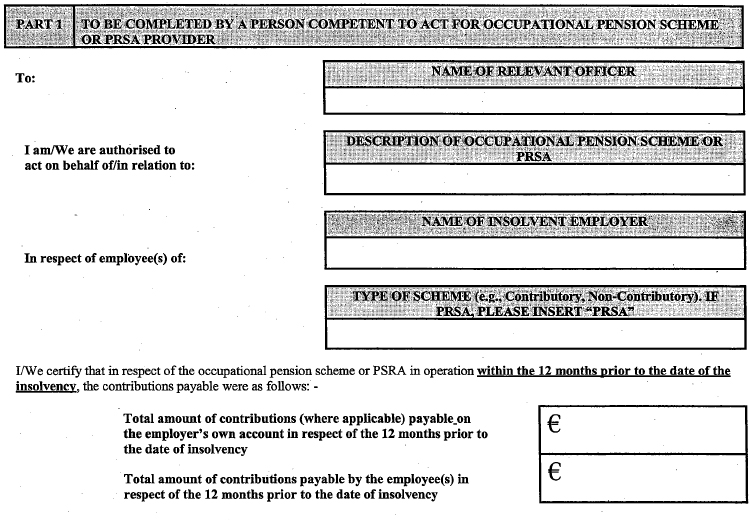

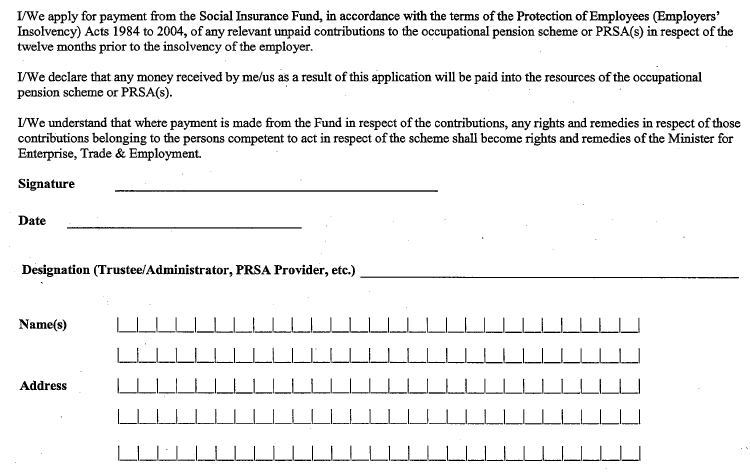

Part 4 | |||||||||||

FORM EIP6 | |||||||||||

| |||||||||||

INSOLVENCY PAYMENTS SCHEME | |||||||||||

PROTECTION OF EMPLOYEES (EMPLOYERS' INSOLVENCY) ACTS 1984-2004 | |||||||||||

APPLICATION FOR PAYMENT OF UNPAID CONTRIBUTIONS TO OCCUPATIONAL PENSION SCHEME OR PERSONAL SAVINGS RETIREMENT ACCOUNT (PRSA) | |||||||||||

FORM EIP6: GUIDANCE NOTES | |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

|

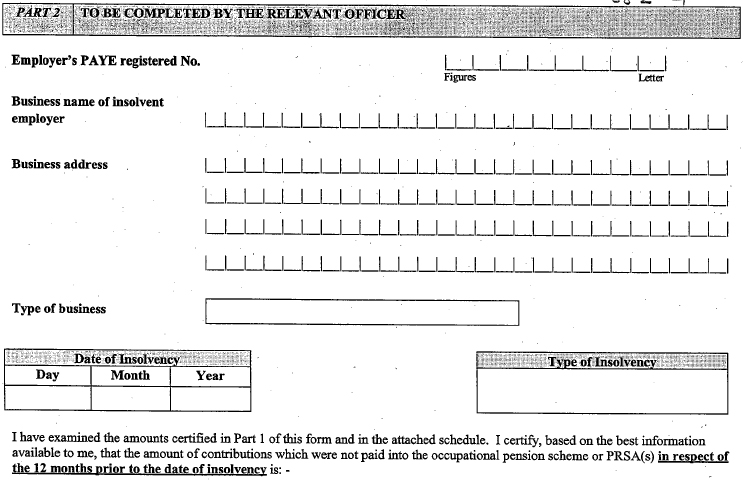

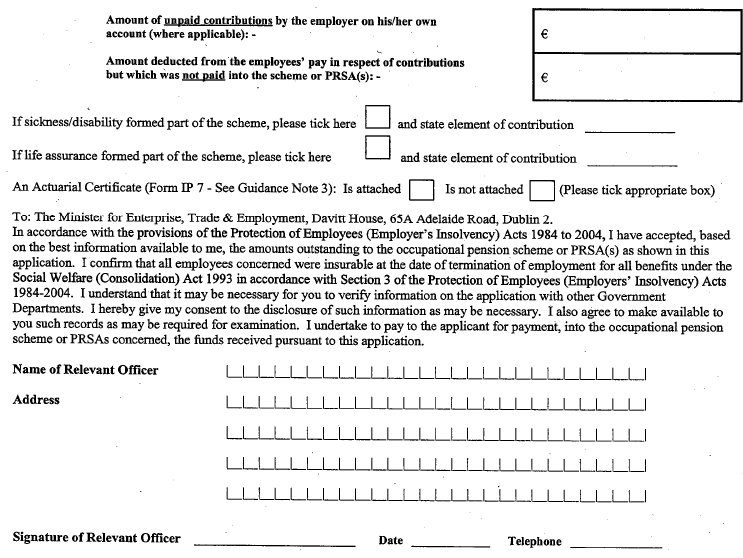

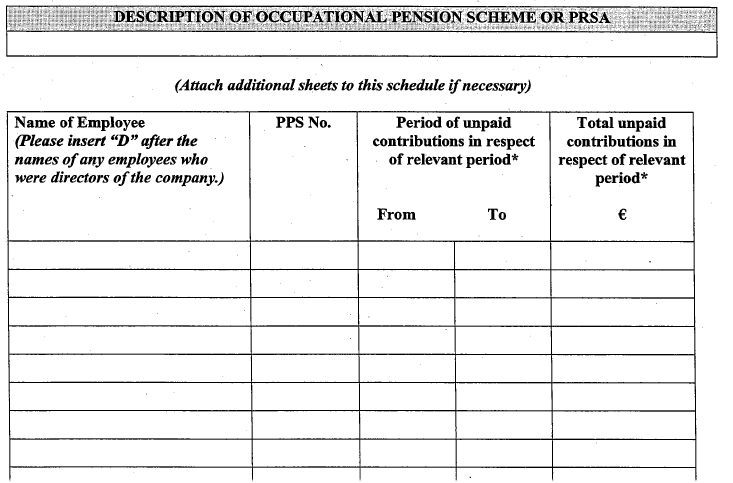

Part 5 | |||||||||||

FORM EIP7 | |||||||||||

| |||||||||||

INSOLVENCY PAYMENTS SCHEME | |||||||||||

PROTECTION OF EMPLOYEES (EMPLOYERS' INSOLVENCY) ACTS 1984-2004 | |||||||||||

OCCUPATIONAL PENSION SCHEME ACTUARIAL CERTIFICATE | |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

|

Explanatory Note | |||||||||||

(This note is not part of the Instrument and does not purport to be a legal interpretation.) | |||||||||||

The purpose of these Regulations is to prescribe revised forms and certificates to be used in relation to claims under Section 6 and Section 7 of the Protection of Employees (Employers' Insolvency) Act 1984 . | |||||||||||

Copies of these Regulations may be purchased from the Government Publications Sales Office, Sun Alliance House, Molesworth Street, Dublin 2, or through any bookseller. | |||||||||||