S.I. No. 637/2004 - Taxes Consolidation Act 1997 (Living Over The Shop Scheme) (Qualifying Streets) (Cork) Order 2004

Taxes Consolidation Act 1997 (Living Over The Shop Scheme) (Qualifying Streets) (Cork) Order 2004 | ||||||||

I, Charlie McCreevy, Minister for Finance, in exercise of the powers conferred on me by Section 372BA(1) (as amended by section 26 of the Finance Act 2004 (No. 8 of 2004)) of the Taxes Consolidation Act 1997 (No. 39 of 1997), on the recommendation of the Minister for the Environment, Heritage and Local Government, hereby order as follows: 1. This Order may be cited as the Taxes Consolidation Act 1997 (Living Over The Shop Scheme) (Qualifying Streets) (Cork) Order 2004. 2. In this Order - | ||||||||

“the Act” means the Taxes Consolidation Act 1997 (No. 39 of 1997); | ||||||||

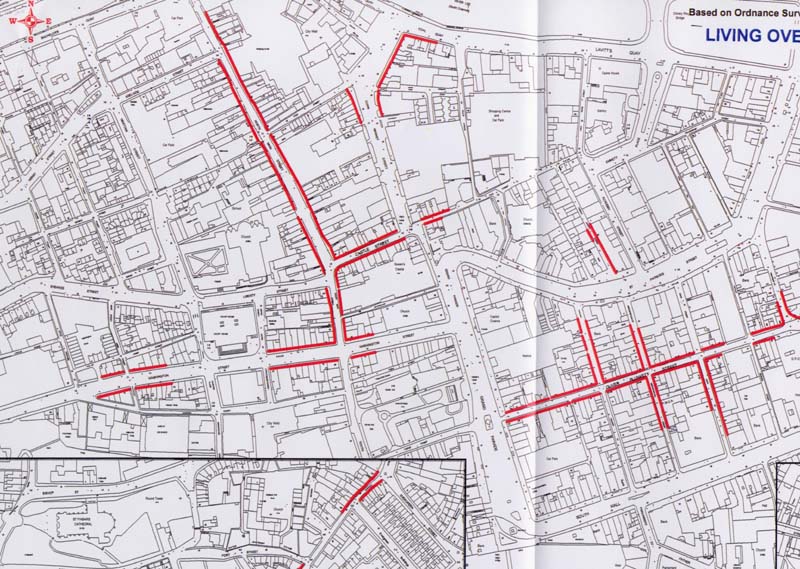

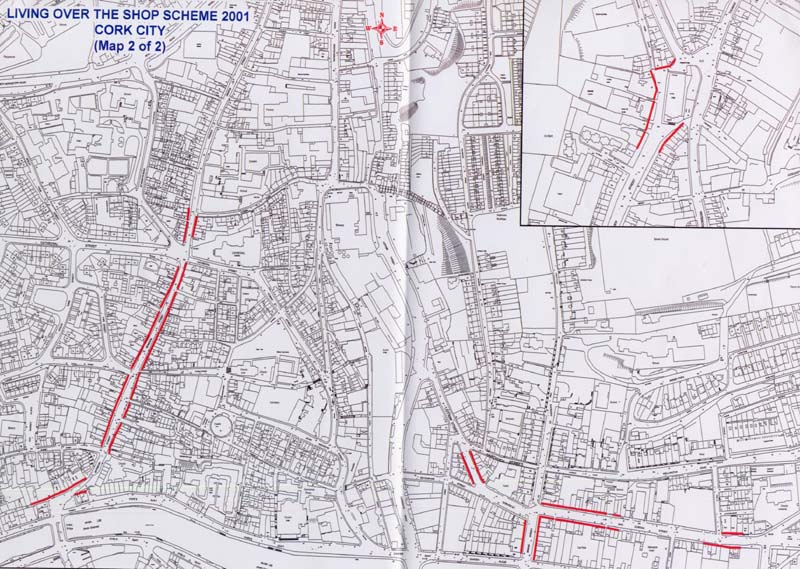

“street” includes part of a street, one side of a street and the whole or part of any road, square, quay or lane. 3. Each of the streets indicated by red lines on the maps attached to this order is hereby declared to be a qualifying street for the purposes of sections 372D, 372AP and 372AR of the Act. 4. It is hereby directed, in relation to each street which is a qualifying street for the purposes of section 372D of the Act, that buildings or structures: | ||||||||

(a) other than those in use for the purposes of the retailing of goods or the provision of services only within the State, | ||||||||

(b) in use as offices, and | ||||||||

(c) in use for the provision of mail order or financial services, | ||||||||

shall not be qualifying premises within the meaning of that section. 5. It is hereby directed, in relation to each street which is a qualifying street for the purposes of section 372D of the Act, that the definition of “qualifying period” contained in section 372A of the Act shall be construed as a reference to the period commencing on 6 April 2001 and ending on 31 December 2004 or where section 372A(1B) applies, 31 July 2006. 6. It is hereby directed, in relation to each street which is a qualifying street for the purposes of sections 372AP and 372AR of the Act, that the definition of “qualifying period” contained in section 372AL of the Act shall be construed as a reference to the period commencing on 6 April 2001 and ending on 31 December 2004 or where section 372AL(1A) applies, 31 July 2006. | ||||||||

| ||||||||

| ||||||||

| ||||||||

|

Explanatory Note | ||||||||

(This note is not part of the Instrument and does not purport to be a legal interpretation) | ||||||||

This Order declares certain streets or parts of streets in Cork to be qualifying streets for the purposes of certain tax incentives under the Living Over The Shop Scheme. | ||||||||

Under this scheme, relief is available for expenditure incurred in the qualifying period on the necessary construction, conversion or refurbishment of residential accommodation which is situated over commercial premises in certain buildings which front on to the qualifying streets. The buildings in question must have been in existence on 13 September 2000 or, in certain cases, may be buildings, which replace such buildings. Relief is also available in respect of expenditure incurred in the qualifying period on the construction or refurbishment of certain commercial premises situated on the ground floor of these buildings, provided that relief is available in respect of at least an equivalent amount of expenditure which has been incurred on the residential element of the existing building or the replacement building. | ||||||||

The incentives, which were introduced in the Finance Act, 2001 , are now contained in Chapters 7 and 11 of Part 10 of the Taxes Consolidation Act 1997 . | ||||||||

Notwithstanding this Order, by virtue of section 372BA(4) of the Taxes Consolidation Act 1997 , no relief from income tax or corporation tax may be granted under the Living Over The Shop Scheme in respect of the construction, conversion or refurbishment of a building, structure or house which fronts on to a qualifying street unless the relevant local authority, in whose functional area the street is situated, has certified that the construction, conversion or refurbishment is consistent with the aims, objectives and criteria for that scheme. |