Energy (Windfall Gains in the Energy Sector) (Temporary Solidarity Contribution) Act 2023

| ||||||||||||||||||||||||||

Number 23 of 2023 | ||||||||||||||||||||||||||

ENERGY (WINDFALL GAINS IN THE ENERGY SECTOR) (TEMPORARY SOLIDARITY CONTRIBUTION) ACT 2023 | ||||||||||||||||||||||||||

CONTENTS | ||||||||||||||||||||||||||

Preliminary and General | ||||||||||||||||||||||||||

Section | ||||||||||||||||||||||||||

Provisions relating to temporary solidarity contribution | ||||||||||||||||||||||||||

Enforcement | ||||||||||||||||||||||||||

Amendment of other acts | ||||||||||||||||||||||||||

25. Amendment of Ministers and Secretaries (Amendment) Act 2011 | ||||||||||||||||||||||||||

Consequential amendments to Act of 1997 | ||||||||||||||||||||||||||

|

Acts Referred to | ||||||||||||||||||||||||||

Finance (Tax Appeals) Act 2015 (No. 59) | ||||||||||||||||||||||||||

Maritime Jurisdiction Act 2021 (No. 28) | ||||||||||||||||||||||||||

Taxes Consolidation Act 1997 (No. 39) | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

Number 23 of 2023 | ||||||||||||||||||||||||||

ENERGY (WINDFALL GAINS IN THE ENERGY SECTOR) (TEMPORARY SOLIDARITY CONTRIBUTION) ACT 2023 | ||||||||||||||||||||||||||

An Act to give full effect to Articles 14, 15, 16 and 18 of Council Regulation (EU) 2022/1854 of 6 October 2022 1 on an emergency intervention to address high energy prices and for that purpose to make provision for a temporary solidarity contribution to be payable by companies with activities in the fossil fuel sector on taxable profits in the years 2022 and 2023; to provide for obligations on those companies relating to the temporary solidarity contribution; to provide for the administration and collection of the temporary solidarity contribution by the Revenue Commissioners; to provide for enforcement of the temporary solidarity contribution; to amend the Taxes Consolidation Act 1997 to provide for the calculation of the temporary solidarity contribution, the deduction of that contribution for the purposes of corporation tax and certain other consequential amendments; to amend the Ministers and Secretaries (Amendment) Act 2011 and the Finance (Tax Appeals) Act 2015 ; and to provide for related matters. | ||||||||||||||||||||||||||

[17th July, 2023] | ||||||||||||||||||||||||||

Be it enacted by the Oireachtas as follows: | ||||||||||||||||||||||||||

|

PART 1 Preliminary and General | ||||||||||||||||||||||||||

|

Short title and commencement | ||||||||||||||||||||||||||

|

1. (1) This Act may be cited as the Energy (Windfall Gains in the Energy Sector) (Temporary Solidarity Contribution) Act 2023. | ||||||||||||||||||||||||||

(2) This Act shall come into operation on such day or days as the Minister may appoint by order or orders either generally or with reference to any particular purpose or provision, and different days may be so appointed for different purposes or different provisions, including the amendments of the provisions specified in the Schedule effected by section 24 . | ||||||||||||||||||||||||||

|

Interpretation | ||||||||||||||||||||||||||

|

2. (1) In this Act— | ||||||||||||||||||||||||||

“Act of 1997” means the Taxes Consolidation Act 1997 ; | ||||||||||||||||||||||||||

“amended assessment” means a Revenue assessment amended by a Revenue officer under section 959Y(1)(b) of the Act of 1997, as applied by section 10 ; | ||||||||||||||||||||||||||

“Appeal Commissioner” has the same meaning as it has in the Finance (Tax Appeals) Act 2015 ; | ||||||||||||||||||||||||||

“assessment” means an assessment to temporary solidarity contribution that is made under this Act and, unless the context otherwise requires, includes a self assessment; | ||||||||||||||||||||||||||

“average taxable profits in respect of the reference years” has the same meaning as it has in Part 24B of the Act of 1997; | ||||||||||||||||||||||||||

“chargeable period” means the 12 month period commencing on 1 January in each of the years 2022 and 2023; | ||||||||||||||||||||||||||

“Collector-General” means the Collector-General appointed under section 851 of the Act of 1997; | ||||||||||||||||||||||||||

“company” means a body corporate; | ||||||||||||||||||||||||||

“Council Regulation” means Council Regulation (EU) 2022/1854 of 6 October 20222 on an emergency intervention to address high energy prices; | ||||||||||||||||||||||||||

“electronic means” has the same meaning as it has in section 917EA of the Act of 1997; | ||||||||||||||||||||||||||

“energy company” means a company that generates at least 75 per cent of its turnover in a chargeable period from relevant activities; | ||||||||||||||||||||||||||

“Minister” means the Minister for the Environment, Climate and Communications; | ||||||||||||||||||||||||||

“relevant activities” means economic activities, carried on in the State or in a designated area (within the meaning of the Maritime Jurisdiction Act 2021 ), in the field of the extraction, mining or refining of natural gas, coal, petroleum or manufacture of coke oven products as referred to in Regulation (EC) No. 1893/2006 of the European Parliament and of the Council of 20 December 2006 3 ; | ||||||||||||||||||||||||||

“return” means the return that is required to be prepared and delivered to the Revenue Commissioners under section 8; | ||||||||||||||||||||||||||

“Revenue assessment” has the meaning assigned to it by section 11 (1); | ||||||||||||||||||||||||||

“Revenue officer” means an officer of the Revenue Commissioners; | ||||||||||||||||||||||||||

“self assessment” means an assessment by an energy company, or by a person acting under the authority of an energy company, of the amount of temporary solidarity contribution payable by the energy company in respect of a chargeable period; | ||||||||||||||||||||||||||

“specified date” means, as the case may be— | ||||||||||||||||||||||||||

(a) 23 September 2023, in respect of the chargeable period commencing on 1 January 2022, or | ||||||||||||||||||||||||||

(b) 23 September 2024, in respect of the chargeable period commencing on 1 January 2023; | ||||||||||||||||||||||||||

“taxable profits” has the same meaning as it has in Part 24B of the Act of 1997; | ||||||||||||||||||||||||||

“temporary solidarity contribution” has the meaning assigned to it by section 4 (1). | ||||||||||||||||||||||||||

(2) A word or expression which is used in this Act and which is also used in the Council Regulation has, unless the context otherwise requires, the same meaning in this Act as it has in the Council Regulation. | ||||||||||||||||||||||||||

|

Expenses | ||||||||||||||||||||||||||

|

3. The expenses incurred by the Minister in the administration of this Act shall, to such extent as may be approved by the Minister for Public Expenditure, National Development Plan Delivery and Reform, be paid out of moneys provided by the Oireachtas. | ||||||||||||||||||||||||||

|

PART 2 Provisions relating to temporary solidarity contribution | ||||||||||||||||||||||||||

|

Temporary solidarity contribution | ||||||||||||||||||||||||||

|

4. (1) There shall be charged, levied and paid a levy to be known as the “temporary solidarity contribution” on the taxable profits of each energy company in respect of each chargeable period. | ||||||||||||||||||||||||||

(2) The amount of temporary solidarity contribution to be charged in respect of a chargeable period shall be any positive amount calculated as— | ||||||||||||||||||||||||||

(A - (B x 1.2)) x 0.75 | ||||||||||||||||||||||||||

where— | ||||||||||||||||||||||||||

A is the taxable profits in respect of the chargeable period, and | ||||||||||||||||||||||||||

B is the average taxable profits in respect of the reference years. | ||||||||||||||||||||||||||

(3) The temporary solidarity contribution shall be due and payable by an energy company to the Revenue Commissioners on or before the specified date in respect of the chargeable period concerned. | ||||||||||||||||||||||||||

|

Anti-avoidance | ||||||||||||||||||||||||||

|

5. (1) Where there is an arrangement which has the effect of reducing the amount of taxable profits and it is reasonable to consider that— | ||||||||||||||||||||||||||

(a) the arrangement was not made for bona fide commercial reasons, and | ||||||||||||||||||||||||||

(b) the main purpose, or one of the main purposes, of the arrangement is to avoid or reduce the amount of temporary solidarity contribution paid or to be paid under this Act, | ||||||||||||||||||||||||||

then the effect of the arrangement shall not be taken into account for the purposes of calculating taxable profits. | ||||||||||||||||||||||||||

(2) In this section, “arrangement” has the same meaning as it has in section 835A of the Act of 1997. | ||||||||||||||||||||||||||

|

Care and management of temporary solidarity contribution | ||||||||||||||||||||||||||

|

6. (1) The temporary solidarity contribution shall be under the care and management of the Revenue Commissioners. | ||||||||||||||||||||||||||

(2) Part 37 of the Act of 1997 shall apply to the temporary solidarity contribution, subject to the following modifications: | ||||||||||||||||||||||||||

(a) the definition of chargeable period in section 865(1)(a) shall be construed as if “has the same meaning as it has in the Energy (Windfall Gains in the Energy Sector) (Temporary Solidarity Contribution) Act 2023” were substituted for “has the meaning assigned to it by section 321”; | ||||||||||||||||||||||||||

(b) a reference to a chargeable person or a chargeable person (within the meaning of Part 41A) in section 865 shall be construed as a reference to an energy company; | ||||||||||||||||||||||||||

(c) a reference to corporation tax in sections 849, 861, 863, 864, 865, 865B, 872 and 874 shall be construed as including a reference to temporary solidarity contribution; | ||||||||||||||||||||||||||

(d) a reference to the Tax Acts in sections 851, 851A, 852, 856, 858, 859, 860, 861, 864, 865, 865A, 865B, 868, 869, 873, 874 and 874A shall be construed as including a reference to this Act; | ||||||||||||||||||||||||||

(e) a reference to accounting period in section 863 shall be construed as a reference to chargeable period; | ||||||||||||||||||||||||||

(f) the definition of relevant period in section 865B shall be construed as including the following paragraph after paragraph (e): | ||||||||||||||||||||||||||

“(ea) in the case of temporary solidarity contribution (within the meaning of the Energy (Windfall Gains in the Energy Sector) (Temporary Solidarity Contribution) Act 2023), the chargeable period (within the meaning of that Act) in respect of which the repayment arises,”; | ||||||||||||||||||||||||||

(g) in section 870— | ||||||||||||||||||||||||||

(i) a reference to the Capital Gains Tax Acts shall be construed as including a reference to this Act, | ||||||||||||||||||||||||||

(ii) a reference to tax shall be construed as including a reference to temporary solidarity contribution, and | ||||||||||||||||||||||||||

(iii) a reference to assessment shall be construed as a reference to an assessment within the meaning of this Act. | ||||||||||||||||||||||||||

(3) Any act to be performed or function to be discharged by the Revenue Commissioners which is authorised by this Act may be performed or discharged by any one or more Revenue officers acting under their authority. | ||||||||||||||||||||||||||

|

Notice to Revenue Commissioners | ||||||||||||||||||||||||||

|

7. (1) Each energy company shall be required to give notice to the Revenue Commissioners that the company is an energy company in the form and manner specified by the Revenue Commissioners. | ||||||||||||||||||||||||||

(2) A notice under subsection (1) shall contain— | ||||||||||||||||||||||||||

(a) the name of the energy company, | ||||||||||||||||||||||||||

(b) the registered address of the company, | ||||||||||||||||||||||||||

(c) the corporation tax number of the company, and | ||||||||||||||||||||||||||

(d) such other information as the Revenue Commissioners may reasonably require. | ||||||||||||||||||||||||||

(3) The notice referred to in subsection (1) shall be delivered to the Revenue Commissioners on or before— | ||||||||||||||||||||||||||

(a) 30 August 2023, or | ||||||||||||||||||||||||||

(b) 30 August 2024, where the company first becomes an energy company in the chargeable period commencing on 1 January 2023. | ||||||||||||||||||||||||||

(4) An energy company shall not be required to give notice under this section more than once. | ||||||||||||||||||||||||||

(5) A notice referred to in subsection (1) shall be given by electronic means and through such electronic systems as the Revenue Commissioners may make available for the time being for any such purpose, and the relevant provisions of Chapter 6 of Part 38 of the Act of 1997 shall apply. | ||||||||||||||||||||||||||

|

Returns | ||||||||||||||||||||||||||

|

8. (1) Each energy company shall prepare and deliver to the Revenue Commissioners a full and true return for a chargeable period, in the prescribed form, on or before the specified date. | ||||||||||||||||||||||||||

(2) Without prejudice to the generality of subsection (1), the Revenue Commissioners may require the following information to be included in a return: | ||||||||||||||||||||||||||

(a) the amount of taxable profits for the chargeable period; | ||||||||||||||||||||||||||

(b) the amount of average taxable profits in respect of the reference years; | ||||||||||||||||||||||||||

(c) the amount of temporary solidarity contribution payable for the chargeable period; | ||||||||||||||||||||||||||

(d) such further particulars as may be required by the prescribed form. | ||||||||||||||||||||||||||

(3) Every return prepared and delivered under subsection (1) shall include a self assessment. | ||||||||||||||||||||||||||

(4) A self assessment shall be made in, and as part of, the return, by reference to the particulars contained in that return and the self assessment shall include such further particulars as the Revenue Commissioners may require. | ||||||||||||||||||||||||||

(5) A return and a self assessment may be amended in accordance with section 959V of the Act of 1997, as applied by section 10 . | ||||||||||||||||||||||||||

(6) A return (including an amended return referred to in subsection (5)) shall— | ||||||||||||||||||||||||||

(a) be signed by the person who prepares the return, | ||||||||||||||||||||||||||

(b) include a declaration by the person signing it that the return is, to the best of that person’s knowledge and belief, correct and complete, and | ||||||||||||||||||||||||||

(c) be made by electronic means and through such electronic systems as the Revenue Commissioners may make available for the time being for any such purpose, and the relevant provisions of Chapter 6 of Part 38 of the Act of 1997 shall apply. | ||||||||||||||||||||||||||

(7) In this section, “prescribed form” means a form prescribed by the Revenue Commissioners or a form used under the authority of the Revenue Commissioners. | ||||||||||||||||||||||||||

|

Action by person acting under authority | ||||||||||||||||||||||||||

|

9. (1) A return may be prepared and delivered by an energy company or by another person acting under the authority of the energy company. | ||||||||||||||||||||||||||

(2) Where a return is prepared and delivered by a person acting under the authority of an energy company, this Act and the Act of 1997, as applied by this Act, shall apply as if the return had been prepared and delivered by the energy company. | ||||||||||||||||||||||||||

(3) Anything required or allowed to be done by an energy company under this Act or the Act of 1997, as applied by this Act, may be done by a person acting under the authority of an energy company. | ||||||||||||||||||||||||||

|

Assessments and enquiries | ||||||||||||||||||||||||||

|

10. (1) Sections 959V, 959Y, 959Z, 959AA, 959AC, 959AD, 959AE, 959AU and 959AV(1) of the Act of 1997 shall apply to the temporary solidarity contribution, subject to the following modifications: | ||||||||||||||||||||||||||

(a) a reference to a chargeable person shall be construed as a reference to an energy company; | ||||||||||||||||||||||||||

(b) a reference to a chargeable period shall be construed as a reference to a chargeable period within the meaning of this Act; | ||||||||||||||||||||||||||

(c) a reference to income, profits or gains or, as the case may be, chargeable gains shall be construed as a reference to taxable profits; | ||||||||||||||||||||||||||

(d) a reference to a return shall be construed as a reference to a return within the meaning of this Act; | ||||||||||||||||||||||||||

(e) a reference to the specified return date for the chargeable period shall be construed as a reference to the specified date; | ||||||||||||||||||||||||||

(f) a reference to tax shall be construed as including a reference to temporary solidarity contribution; | ||||||||||||||||||||||||||

(g) a reference to assessment, Revenue assessment or self assessment, as the case may be, shall be construed as a reference to an assessment, Revenue assessment or self assessment within the meaning of this Act, as the case may be; | ||||||||||||||||||||||||||

(h) a reference to the Acts shall be construed as including a reference to this Act; | ||||||||||||||||||||||||||

(i) the reference in section 959V(5) to section 959L shall be construed as a reference to section 9 . | ||||||||||||||||||||||||||

(2) Section 959Z of the Act of 1997 shall apply to the temporary solidarity contribution as if— | ||||||||||||||||||||||||||

(a) the following subsection, subject to the modifications referred to in subsection (1), were substituted for subsection (3): | ||||||||||||||||||||||||||

“(3) Subject to subsections (3A) and (4), any enquiries or actions to which either subsection (1) or (2) applies shall not be made in the case of an energy company (within the meaning of the Energy (Windfall Gains in the Energy Sector) (Temporary Solidarity Contribution) Act 2023) for a chargeable period at any time after the expiry of the period of 4 years commencing at the end of the year in which the energy company has delivered a return for the chargeable period.”, | ||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||

(b) the following subsection, subject to the modifications referred to in subsection (1), were inserted after subsection (3): | ||||||||||||||||||||||||||

“(3A) (a) Nothing in this section shall be construed as preventing the making of enquiries or taking of actions regarding the composition or calculation of the average taxable profits in respect of the reference years, included in a return for the chargeable period, within the period of 4 years commencing at the end of the year in which the energy company has delivered that return. | ||||||||||||||||||||||||||

(b) In this subsection, ‘average taxable profits in respect of the reference years’ and ‘energy company’ have the same meaning, respectively, as in the Energy (Windfall Gains in the Energy Sector) (Temporary Solidarity Contribution) Act 2023.”. | ||||||||||||||||||||||||||

|

Revenue assessment | ||||||||||||||||||||||||||

|

11. (1) An assessment under section 959Y of the Act of 1997, as applied by section 10 , of the amount of temporary solidarity contribution payable by an energy company in respect of a chargeable period shall be referred to in this Act as a “Revenue assessment”. | ||||||||||||||||||||||||||

(2) A Revenue assessment shall be made by a Revenue officer and shall involve an assessment of— | ||||||||||||||||||||||||||

(a) the amount of taxable profits for the chargeable period, | ||||||||||||||||||||||||||

(b) the average taxable profits in respect of the reference years, | ||||||||||||||||||||||||||

(c) the amount of temporary solidarity contribution payable by the energy company for the chargeable period, and | ||||||||||||||||||||||||||

(d) the balance of temporary solidarity contribution, taking account of any amount of temporary solidarity contribution paid directly by the energy company to the Collector-General for the chargeable period which under this Act— | ||||||||||||||||||||||||||

(i) is due and payable by the energy company to the Revenue Commissioners for the chargeable period, or | ||||||||||||||||||||||||||

(ii) is overpaid by the energy company for the chargeable period and which, subject to this Act, is available for offset or repayment by the Revenue Commissioners. | ||||||||||||||||||||||||||

(3) A Revenue assessment shall include the amount of any surcharge due for the chargeable period under section 17 (1). | ||||||||||||||||||||||||||

(4) Where a Revenue officer makes a Revenue assessment, any self assessment previously made shall, for the purposes of determining the energy company’s liability to pay temporary solidarity contribution for the chargeable period, be treated as if it had not been made and shall be void for such purposes. | ||||||||||||||||||||||||||

|

Notice of Revenue assessment | ||||||||||||||||||||||||||

|

12. (1) A Revenue officer shall give notice of a Revenue assessment to the energy company. | ||||||||||||||||||||||||||

(2) A notice of a Revenue assessment, under subsection (1), may be given by the Revenue officer in writing or by electronic means. | ||||||||||||||||||||||||||

(3) Where a return is prepared and delivered in accordance with section 8 (1) by another person acting under the authority of the energy company, a copy of the notice of the Revenue assessment shall be given to that other person. | ||||||||||||||||||||||||||

(4) A notice of a Revenue assessment shall include details of— | ||||||||||||||||||||||||||

(a) each matter referred to in paragraphs (a) to (d) of section 11 (2), | ||||||||||||||||||||||||||

(b) the amount of any surcharge which, under section 17 (1), is due for the chargeable period, | ||||||||||||||||||||||||||

(c) the name of the Revenue officer who is giving notice of the Revenue assessment and the address of the Revenue office at which that officer is based, and | ||||||||||||||||||||||||||

(d) the period allowed under section 15 for giving notice of appeal against the assessment to which the notice relates. | ||||||||||||||||||||||||||

|

Amended assessment | ||||||||||||||||||||||||||

|

13. Sections 10 , 11 and 12 shall apply to an amended assessment as they apply to a Revenue assessment, subject to any necessary modifications. | ||||||||||||||||||||||||||

|

Application of expression of doubt | ||||||||||||||||||||||||||

|

14. Where— | ||||||||||||||||||||||||||

(a) an energy company includes a letter of expression of doubt with a return for corporation tax purposes in accordance with section 959P of the Act of 1997, and | ||||||||||||||||||||||||||

(b) by reason of the amendment of an assessment referred to in subsection (5) of that section there is— | ||||||||||||||||||||||||||

(i) an increase in the taxable profits in a chargeable period, or | ||||||||||||||||||||||||||

(ii) a decrease in the average taxable profits in respect of the reference years, | ||||||||||||||||||||||||||

then any additional temporary solidarity contribution that is due under an amended assessment, following the amendment referred to in paragraph (b), shall be due and payable in accordance with section 959AU(2) of the Act of 1997, as applied by section 10. | ||||||||||||||||||||||||||

|

Appeal to Appeal Commissioners | ||||||||||||||||||||||||||

|

15. (1) An energy company aggrieved by a Revenue assessment or an amended assessment made on that company may appeal that assessment or amended assessment, as the case may be, within 30 days after the date of the notice of assessment or the amended assessment, as the case may be, to the Appeal Commissioners in accordance with section 949I of the Act of 1997. | ||||||||||||||||||||||||||

(2) Section 949O of the Act of 1997 shall apply to the temporary solidarity contribution as if the following subparagraphs were substituted for subparagraphs (v) and (vi) in subsection (3)(b): | ||||||||||||||||||||||||||

“(v) section 114 of the Value-Added Tax Consolidation Act 2010 , | ||||||||||||||||||||||||||

(vi) section 149 of the Finance (Local Property Tax) Act 2012 , or | ||||||||||||||||||||||||||

(vii) section 18 of the Energy (Windfall Gains in the Energy Sector) (Temporary Solidarity Contribution) Act 2023,”. | ||||||||||||||||||||||||||

(3) No appeal may be made against— | ||||||||||||||||||||||||||

(a) a surcharge imposed under this Act where that is the energy company’s sole ground for the appeal, other than where the ground for the appeal relates to a matter referred to in section 17 (4), | ||||||||||||||||||||||||||

(b) a self assessment, or | ||||||||||||||||||||||||||

(c) the amount of any taxable profits specified in a self assessment. | ||||||||||||||||||||||||||

|

Obligation to keep certain records | ||||||||||||||||||||||||||

|

16. (1) An energy company shall retain, or cause to be retained on behalf of the energy company, such records as are required to enable a full and true return to be made for the purposes of this Act. | ||||||||||||||||||||||||||

(2) Without prejudice to the generality of subsection (1), the records required to be retained under that subsection shall include, but are not limited to, books, accounts, documents, and any other data relating to— | ||||||||||||||||||||||||||

(a) a notice under section 7 , | ||||||||||||||||||||||||||

(b) a return, and | ||||||||||||||||||||||||||

(c) the calculation of the temporary solidarity contribution. | ||||||||||||||||||||||||||

(3) Records required to be retained under this section shall be retained in an official language of the State— | ||||||||||||||||||||||||||

(a) in written form, or | ||||||||||||||||||||||||||

(b) by means of electronic, photographic or other process in accordance with paragraphs (a) to (d) of section 887(2) of the Act of 1997. | ||||||||||||||||||||||||||

(4) Notwithstanding any other law, records to be retained under this section shall, subject to subsection (5), be retained by or on behalf of the energy company, for the longer of the following periods: | ||||||||||||||||||||||||||

(a) where enquiries into a return are made by a Revenue officer, the period ending on the day on which those enquiries are treated as completed by the officer; | ||||||||||||||||||||||||||

(b) the period of 6 years commencing from the end of the chargeable period to which they relate or, in a case where they relate to more than one chargeable period, the period of 6 years commencing from the end of the later chargeable period. | ||||||||||||||||||||||||||

(5) For the purposes of this section, where the energy company— | ||||||||||||||||||||||||||

(a) is wound up, the liquidator, or | ||||||||||||||||||||||||||

(b) is dissolved without the appointment of a liquidator, the last directors, including any person occupying the position of director by whatever name called, of the company, | ||||||||||||||||||||||||||

shall retain the records required to be retained under this section for a period of 5 years from the date from which the company is wound up or dissolved. | ||||||||||||||||||||||||||

|

PART 3 Enforcement | ||||||||||||||||||||||||||

|

Surcharge for late return | ||||||||||||||||||||||||||

|

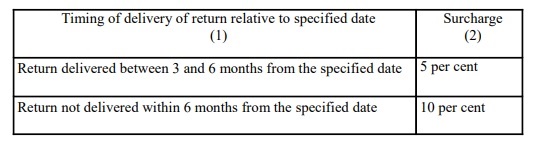

17. (1) Where an energy company fails to deliver a return on or before the specified date, the amount of temporary solidarity contribution which would have been payable if such a return had been delivered on or before that date shall be increased by an amount (in this section referred to as the “surcharge”), equal to the percentage, specified in column (2) of the Table to this section, opposite the timing of the delivery of the return relative to the specified date, specified in column (1) of the Table. | ||||||||||||||||||||||||||

(2) Where subsection (1) applies, the amount of the surcharge shall not exceed— | ||||||||||||||||||||||||||

(a) €12,695, where the surcharge applicable is 5 per cent, or | ||||||||||||||||||||||||||

(b) €63,485, where the surcharge applicable is 10 per cent. | ||||||||||||||||||||||||||

(3) Interest is payable under section 18 on any surcharge as if the surcharge were temporary solidarity contribution, and the surcharge and any interest on that surcharge is chargeable and recoverable as if the surcharge and that interest were temporary solidarity contribution. | ||||||||||||||||||||||||||

(4) For the purposes of subsection (1)— | ||||||||||||||||||||||||||

(a) where an energy company deliberately or carelessly delivers an incorrect return on or before the specified date, that company shall be deemed to have failed to have delivered the return on or before that date unless the error in the return is remedied by the delivery of a correct return on or before that date, | ||||||||||||||||||||||||||

(b) where an energy company delivers an incorrect return on or before the specified date, but does so neither deliberately nor carelessly and it comes to the company’s notice that it is incorrect, the energy company shall be deemed to have failed to have delivered the return on or before the specified date unless the error in the return is remedied by the delivery of a correct return without unreasonable delay, and | ||||||||||||||||||||||||||

(c) where an energy company delivers a return on or before the specified date, but the Revenue Commissioners, by reason of being dissatisfied with any information contained in the return, require that company, by notice in writing, to deliver evidence, or a further return or evidence, as may be required by them, the energy company shall be deemed to have failed to have delivered the return on or before the specified date unless the company delivers the evidence, or further return or evidence, within the period specified in the notice. | ||||||||||||||||||||||||||

(5) In this section, “carelessly” means failure to take reasonable care. | ||||||||||||||||||||||||||

Table | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

|

Interest on overdue amounts | ||||||||||||||||||||||||||

|

18. (1) Any temporary solidarity contribution payable by an energy company shall carry interest from the date when the temporary solidarity contribution becomes due and payable until payment and the amount of that interest shall be determined in accordance with subsection (2). | ||||||||||||||||||||||||||

(2) The interest referred to in subsection (1) shall be determined by the following formula— | ||||||||||||||||||||||||||

L x D x R | ||||||||||||||||||||||||||

where— | ||||||||||||||||||||||||||

L is the temporary solidarity contribution which remains unpaid, | ||||||||||||||||||||||||||

D is the number of days (including part of a day) in the period during which the temporary solidarity contribution remains unpaid, and | ||||||||||||||||||||||||||

R is the rate, represented by P in the formula T x D x P in section 1080(2)(c)(i) of the Act of 1997, that would apply under the formula if the temporary solidarity contribution was tax, within the meaning of that section, and the period during which the temporary solidarity contribution remains unpaid was the period of delay, within the meaning of that section. | ||||||||||||||||||||||||||

(3) Subsections (3) to (5) of section 1080 of the Act of 1997 shall apply to interest payable on the temporary solidarity contribution under subsection (1) as those subsections apply to interest payable on a tax under that section. | ||||||||||||||||||||||||||

|

Penalties for failure to deliver a return etc. | ||||||||||||||||||||||||||

|

19. (1) Where an energy company— | ||||||||||||||||||||||||||

(a) fails to deliver a return on or before the specified date, or | ||||||||||||||||||||||||||

(b) has been required, by notice given under or for the purposes of this Act, to furnish any particulars, to produce any document, or to make anything available for inspection and the energy company fails to comply with that notice, | ||||||||||||||||||||||||||

the energy company shall be liable to a penalty of €3,000. | ||||||||||||||||||||||||||

(2) In proceedings for the recovery of a penalty incurred under this section, a certificate signed by a Revenue officer which certifies that the Revenue officer has examined the relevant records and that it appears from those records that— | ||||||||||||||||||||||||||

(a) a return was not received, or | ||||||||||||||||||||||||||

(b) a stated notice was duly given to the energy company on a stated day and that notice has not been complied with by the energy company, | ||||||||||||||||||||||||||

shall be evidence, unless the contrary is proved, of the matters referred to in paragraph (a) or (b), as the case may be. | ||||||||||||||||||||||||||

|

Penalty for failure to keep records | ||||||||||||||||||||||||||

|

20. An energy company which fails to comply with section 16 in respect of the retention of any records relating to the temporary solidarity contribution is liable to a penalty of €3,000. | ||||||||||||||||||||||||||

|

Other penalties | ||||||||||||||||||||||||||

|

21. (1) Section 1077F of the Act of 1997 shall apply to the temporary solidarity contribution, subject to the following modifications: | ||||||||||||||||||||||||||

(a) a reference to the Acts shall be construed as including a reference to this Act; | ||||||||||||||||||||||||||

(b) a reference to tax shall be construed as including a reference to temporary solidarity contribution; | ||||||||||||||||||||||||||

(c) a reference to income, profits or gains shall be construed as a reference to taxable profits; | ||||||||||||||||||||||||||

(d) a reference to a period shall be construed as a reference to a chargeable period; | ||||||||||||||||||||||||||

(e) a reference to a return shall be construed as a reference to a return within the meaning of this Act. | ||||||||||||||||||||||||||

(2) For the purposes of subsection (1), Schedule 29 to the Act of 1997 shall be construed as including a reference to section 8 (1) in column 1 of that Schedule. | ||||||||||||||||||||||||||

(3) Sections 1094 and 1095 of the Act of 1997 shall apply to the temporary solidarity contribution, subject to the following modifications: | ||||||||||||||||||||||||||

(a) a reference to the Acts shall be construed as including a reference to this Act; | ||||||||||||||||||||||||||

(b) in section 1094— | ||||||||||||||||||||||||||

(i) the reference to taxes in subparagraph (i) of subsection (2) shall be construed as including a reference to temporary solidarity contribution, and | ||||||||||||||||||||||||||

(ii) the reference to tax in paragraph (b) of subsection (7) shall be construed as including a reference to temporary solidarity contribution; | ||||||||||||||||||||||||||

(c) the reference to taxes in subsection (3)(a) of section 1095 shall be construed as including a reference to temporary solidarity contribution. | ||||||||||||||||||||||||||

|

Offences | ||||||||||||||||||||||||||

|

22. Chapter 4 of Part 47 of the Act of 1997 shall apply to the temporary solidarity contribution, subject to the modification that a reference to the Acts in sections 1078 and 1079 shall be construed as including a reference to this Act. | ||||||||||||||||||||||||||

|

PART 4 Amendment of other acts | ||||||||||||||||||||||||||

|

Insertion of new Part 24B in Act of 1997 | ||||||||||||||||||||||||||

|

23. The Act of 1997 is amended by the insertion of the following Part after Part 24A: | ||||||||||||||||||||||||||

“PART 24B | ||||||||||||||||||||||||||

Council Regulation (EU) 2022/1854 of 6 October 20224 as regards temporary solidarity contribution | ||||||||||||||||||||||||||

Interpretation | ||||||||||||||||||||||||||

697R. (1) In this Part— | ||||||||||||||||||||||||||

‘accounting period’ means an accounting period determined in accordance with section 27; | ||||||||||||||||||||||||||

‘Act of 2023’ means the Energy (Windfall Gains in the Energy Sector) (Temporary Solidarity Contribution) Act 2023; | ||||||||||||||||||||||||||

‘average taxable profits in respect of the reference years’ shall be construed in accordance with section 697T(1); | ||||||||||||||||||||||||||

‘chargeable period’ has the same meaning as it has in the Act of 2023; | ||||||||||||||||||||||||||

‘Council Regulation’ has the same meaning as it has in the Act of 2023; | ||||||||||||||||||||||||||

‘energy company’ has the same meaning as it has in the Act of 2023; | ||||||||||||||||||||||||||

‘relevant activities’ has the same meaning as it has in the Act of 2023; | ||||||||||||||||||||||||||

‘taxable profits’ shall be construed in accordance with section 697S(1) ; | ||||||||||||||||||||||||||

‘temporary solidarity contribution’ has the same meaning as it has in the Act of 2023. | ||||||||||||||||||||||||||

(2) A word or expression which is used in this Part and which is also used in the Council Regulation has, unless the context otherwise requires, the same meaning in this Part as it has in the Council Regulation. | ||||||||||||||||||||||||||

Taxable profits for purposes of temporary solidarity contribution | ||||||||||||||||||||||||||

697S. (1) Subject to subsections (2) to (6), for the purpose of calculating the temporary solidarity contribution, taxable profits means so much of the total profits of the energy company for the accounting period, computed under section 76(3), that relate to relevant activities, reduced by— | ||||||||||||||||||||||||||

(a) any charges on income paid by the company in the accounting period relating to relevant activities which are allowed as deductions against those total profits under section 243(2), and | ||||||||||||||||||||||||||

(b) the amount of capital expenditure incurred on the construction or acquisition of a tangible asset— | ||||||||||||||||||||||||||

(i) that is brought into use in the accounting period, where— | ||||||||||||||||||||||||||

(I) the tangible asset is brought into use in any of the years 2018 to 2023, and | ||||||||||||||||||||||||||

(II) the tangible asset is used in the course of carrying on relevant activities, | ||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||

(ii) in respect of which allowances are made under Part 9 or Chapter 2 of Part 24. | ||||||||||||||||||||||||||

(2) Where the tangible asset referred to in subsection (1)(b) ceases to be used in the course of carrying on relevant activities (except for reasonable periods of temporary disuse) at any time during the period of 5 years commencing on the day the tangible asset was first brought into use, then subsection (1)(b) shall not apply and the taxable profits for the accounting period in which the tangible asset was first brought into use shall be recalculated accordingly. | ||||||||||||||||||||||||||

(3) Where a reduction may be made in the calculation of taxable profits for an accounting period under subsection (1)(b) (in this subsection referred to as the ‘first accounting period’) and the taxable profits for the first accounting period are less than zero, the taxable profits in the next accounting period shall be reduced by an amount determined by the following formula— | ||||||||||||||||||||||||||

A-B | ||||||||||||||||||||||||||

where— | ||||||||||||||||||||||||||

A is the amount of capital expenditure referred to in subsection (1)(b) in respect of the first accounting period, and | ||||||||||||||||||||||||||

B is the amount of taxable profits determined, in accordance with subsection (1) in respect of the first accounting period, as if subsection (1)(b) did not apply, but where that amount is less than zero, the amount shall be zero, | ||||||||||||||||||||||||||

and the taxable profits in any subsequent accounting period shall be reduced in a like manner until the amount determined by the above formula has been exhausted. | ||||||||||||||||||||||||||

(4) In ascertaining taxable profits for the purposes of subsection (1), no account shall be taken of any— | ||||||||||||||||||||||||||

(a) relief under section 396(1) in respect of a loss incurred in the carrying on of a trade consisting of relevant activities in an accounting period that ends on or before 31 December 2017 or, where subsection (5)(a) applies, in a deemed accounting period that ends on 31 December 2017, | ||||||||||||||||||||||||||

(b) relief under section 396(2), 396A(3) or 397(1) in respect of a loss incurred in the carrying on of a trade consisting of relevant activities in an accounting period that commences on or after 1 January 2024 or, where subsection (5)(b) applies, in a new accounting period that commences on 1 January 2024, | ||||||||||||||||||||||||||

(c) amounts set off or surrendered under section 420 or 420A in an accounting period that falls wholly or partly within the period commencing on 1 January 2018 and ending on 31 December 2023, or | ||||||||||||||||||||||||||

(d) temporary solidarity contribution incurred under the Act of 2023. | ||||||||||||||||||||||||||

(5) (a) Where an energy company incurs a loss in the carrying on of a trade consisting of relevant activities in an accounting period that commences on or before 31 December 2017 and ends on or after 1 January 2018 (in this paragraph referred to as the ‘original accounting period’), then for the purposes of subsection (4)(a)— | ||||||||||||||||||||||||||

(i) the accounting period of the company shall commence on the day on which the original accounting period began and shall be deemed to end on 31 December 2017 (in this section referred to as the ‘deemed accounting period’), and | ||||||||||||||||||||||||||

(ii) the amount of the loss that shall be regarded as incurred in the carrying on of a trade consisting of relevant activities in the deemed accounting period shall be the amount determined by the following formula— | ||||||||||||||||||||||||||

A x B | ||||||||||||||||||||||||||

C | ||||||||||||||||||||||||||

where— | ||||||||||||||||||||||||||

A is the amount of the loss incurred in the original accounting period, | ||||||||||||||||||||||||||

B is the length of the deemed accounting period, and | ||||||||||||||||||||||||||

C is the length of the original accounting period. | ||||||||||||||||||||||||||

(b) Where an energy company incurs a loss in the carrying on of a trade consisting of relevant activities in an accounting period that commences on or before 31 December 2023 and ends on or after 1 January 2024 (in this paragraph referred to as the ‘original accounting period’), then for the purposes of subsection (4)(b)— | ||||||||||||||||||||||||||

(i) the accounting period of the company shall commence on the day on which the original accounting period began and shall be deemed to end on 31 December 2023, | ||||||||||||||||||||||||||

(ii) a new accounting period shall be deemed to commence on 1 January 2024 and shall be deemed to end on the day on which the original accounting period ends (in this section referred to as the ‘new accounting period’), and | ||||||||||||||||||||||||||

(iii) the amount of the loss that shall be regarded as incurred in the carrying on of a trade consisting of relevant activities in the new accounting period shall be an amount determined by the following formula— | ||||||||||||||||||||||||||

A x B | ||||||||||||||||||||||||||

C | ||||||||||||||||||||||||||

where— | ||||||||||||||||||||||||||

A is the amount of the loss incurred in the original accounting period, | ||||||||||||||||||||||||||

B is the length of the new accounting period, and | ||||||||||||||||||||||||||

C is the length of the original accounting period. | ||||||||||||||||||||||||||

(6) (a) For the purposes of calculating the temporary solidarity contribution, the taxable profits shall be calculated in respect of the calendar year and where an accounting period of an energy company falls wholly or partly within that calendar year, the amount to be included in the taxable profits for the calendar year with reference to that accounting period shall be determined by the following formula— | ||||||||||||||||||||||||||

A x B | ||||||||||||||||||||||||||

C | ||||||||||||||||||||||||||

where— | ||||||||||||||||||||||||||

A is the taxable profits in respect of the accounting period, | ||||||||||||||||||||||||||

B is the length of the period common to the calendar year and the accounting period, and | ||||||||||||||||||||||||||

C is the length of the accounting period. | ||||||||||||||||||||||||||

(b) The formula in paragraph (a) shall be applied to each accounting period that falls wholly or partly within the calendar year and the apportioned amounts shall be aggregated to determine the taxable profits in respect of the calendar year. | ||||||||||||||||||||||||||

Average taxable profits for purposes of temporary solidarity contribution | ||||||||||||||||||||||||||

697T. (1) Subject to subsections (2) and (3), the average taxable profits in respect of the reference years, in relation to relevant activities carried on by an energy company, means— | ||||||||||||||||||||||||||

(a) where the energy company commenced the relevant activities on or before 31 December 2018, the average annual taxable profits in respect of the years commencing on 1 January 2018 and ending on 31 December 2021, | ||||||||||||||||||||||||||

(b) where the energy company commenced the relevant activities on or after 1 January 2019 but before 1 January 2020, the average annual taxable profits in respect of the years commencing on 1 January 2019 and ending on 31 December 2021, | ||||||||||||||||||||||||||

(c) where the energy company commenced the relevant activities on or after 1 January 2020 but before 1 January 2021, the average annual taxable profits in respect of the years commencing on 1 January 2020 and ending on 31 December 2021, or | ||||||||||||||||||||||||||

(d) where the energy company commenced the relevant activities on or after 1 January 2021 but before 1 January 2022, the taxable profits in respect of the year commencing on 1 January 2021 and ending on 31 December 2021, | ||||||||||||||||||||||||||

and where the average taxable profits in respect of the reference years in accordance with paragraph (a), (b), (c) or (d), as the case may be, is less than zero, the average taxable profits in respect of the reference years shall be deemed to be zero. | ||||||||||||||||||||||||||

(2) For the purposes of subsection (1), where in a year commencing on or after 1 January 2018 but before 1 January 2022, an energy company carried on relevant activities for part of a year only, the taxable profits in respect of that year shall be determined by the following formula— | ||||||||||||||||||||||||||

A/B x 12 | ||||||||||||||||||||||||||

where— | ||||||||||||||||||||||||||

A is the taxable profits in the year, and | ||||||||||||||||||||||||||

B is the number of months in that year during which the relevant activities were carried on by the energy company. | ||||||||||||||||||||||||||

(3) (a) Where a company ceases to carry on relevant activities (in this subsection referred to as the ‘predecessor’) in the year commencing on 1 January 2022 or the year commencing on 1 January 2023, as the case may be, and another company begins to carry on those relevant activities (in this subsection referred to as the ‘successor’), for the purpose of determining the temporary solidarity contribution chargeable on the predecessor in the year in which the predecessor ceases to carry on the relevant activities, the average taxable profits in respect of the reference years for the predecessor shall be determined by the following formula— | ||||||||||||||||||||||||||

A x B | ||||||||||||||||||||||||||

C | ||||||||||||||||||||||||||

where— | ||||||||||||||||||||||||||

A is the average taxable profits in respect of the reference years of the predecessor in relation to those relevant activities, | ||||||||||||||||||||||||||

B is the length of the period from the beginning of the year in which the predecessor ceases to carry on those relevant activities to the date the predecessor ceases to carry on those relevant activities, and | ||||||||||||||||||||||||||

C is the length of the year. | ||||||||||||||||||||||||||

(b) Subject to paragraph (c), where the predecessor ceases to carry on relevant activities in the year commencing on 1 January 2022 or the year commencing on 1 January 2023, as the case may be, and the successor begins to carry on those relevant activities, for the purpose of determining the temporary solidarity contribution chargeable on the successor in respect of the year in which the successor commences to carry on the relevant activities, the average taxable profits in respect of the reference years for the successor shall be determined by the following formula— | ||||||||||||||||||||||||||

A x B | ||||||||||||||||||||||||||

C | ||||||||||||||||||||||||||

where— | ||||||||||||||||||||||||||

A is the average taxable profits in respect of the reference years of the predecessor in relation to those relevant activities, | ||||||||||||||||||||||||||

B is the length of the period from the date the successor begins to carry on those relevant activities to the end of the year in which the successor begins to carry on those relevant activities, and | ||||||||||||||||||||||||||

C is the length of the year. | ||||||||||||||||||||||||||

(c) Where the predecessor ceases to carry on relevant activities in the year commencing on 1 January 2022 and the successor begins to carry on those relevant activities in that year, for the purpose of determining the temporary solidarity contribution chargeable on the successor for the year 2023, the average taxable profits in respect of the reference years shall be the average taxable profits in respect of the reference years of the predecessor in relation to those relevant activities determined in accordance with this section and no apportionment shall be required under paragraph (b). | ||||||||||||||||||||||||||

Deductibility of temporary solidarity contribution for corporation tax | ||||||||||||||||||||||||||

697U. (1) In computing the amount of the profits or gains to be charged to tax under Case I of Schedule D, a deduction shall be allowed in respect of the temporary solidarity contribution incurred by an energy company in an accounting period. | ||||||||||||||||||||||||||

(2) No amount shall be deducted under subsection (1) if that amount has been allowed under any other provision of the Tax Acts.”. | ||||||||||||||||||||||||||

|

Consequential amendments to Act of 1997 | ||||||||||||||||||||||||||

|

24. Each provision of the Act of 1997 mentioned in column (2) of the Schedule is amended to the extent specified in column (3) of the Schedule opposite that mention. | ||||||||||||||||||||||||||

|

Amendment of Ministers and Secretaries (Amendment) Act 2011 | ||||||||||||||||||||||||||

|

25. Section 101 (3) of the Ministers and Secretaries (Amendment) Act 2011 is amended, in the definition of “relevant enactment”, by the insertion of the following paragraph after paragraph (ha): | ||||||||||||||||||||||||||

“(hb) the Energy (Windfall Gains in the Energy Sector) (Temporary Solidarity Contribution) Act 2023,”. | ||||||||||||||||||||||||||

|

Amendment of Finance (Tax Appeals) Act 2015 | ||||||||||||||||||||||||||

|

26. Section 2 of the Finance (Tax Appeals) Act 2015 is amended, in the definition of “Taxation Acts”, by the insertion of the following paragraph after paragraph (i): | ||||||||||||||||||||||||||

“(j) the Energy (Windfall Gains in the Energy Sector) (Temporary Solidarity Contribution) Act 2023,”. | ||||||||||||||||||||||||||

|

SCHEDULE Consequential amendments to Act of 1997 | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||