Bankers (Ireland) Act, 1845

BANKERS (IRELAND) ACT 1845 | ||||||||||||||||||||||||||||||||||||||

CHAPTER XXXVII. | ||||||||||||||||||||||||||||||||||||||

An Act to regulate the Issue of Bank Notes in Ireland, and to regulate the Repayment of certain Sums advanced by the Bank of Ireland for the Public Service. [1] [21st July 1845.] | ||||||||||||||||||||||||||||||||||||||

[Preamble recites 21 & 22 Geo. 3. (I.) c. 16; 48 Geo. 3. c. 103; 1 & 2 Geo. 4. c. 72; 6 Geo. 4. c. 42; 11 Geo. 4. & 1 Will 4. c. 32; 3 & 4 Vict. c. 75; 7 & 8 Vict. c. 32. s. 10; and advances by the Bank of Ireland for the public service amounting to 2,630,769l.4s. 8d.] | ||||||||||||||||||||||||||||||||||||||

|

Banking copartnerships, &c. may carry on business in Dublin or within 50 miles thereof. Members to be individually liable. |

[1.] . . . it shall and may be lawful for any persons exceeding six in number united or to be united in societies or partnerships, or for any bodies politic or corporate, to transact or carry on the business of bankers in Ireland at Dublin, and at every place within fifty miles thereof, as freely as persons exceeding six in number united as aforesaid may lawfully carry on the same business at any place in Ireland beyond the distance of fifty miles from Dublin: Provided always, that every member of any such society, partnership, bodies politic or corporate, shall be liable and responsible for the due payment of all the debts and liabilities of the corporation or co-partnership of which such person shall be a member, any agreement, covenant, or contract to the contrary notwithstanding. | |||||||||||||||||||||||||||||||||||||

|

Repayment of advances by Bank of Ireland charged on consolidated fund, &c. |

2. The repayment of the said sum of two million six hundred and thirty thousand seven hundred and sixty nine pounds four shillings and eight pence shall be and the same is hereby made chargeable upon the consolidated fund of the United Kingdom of Great Britain and Ireland until Parliament shall otherwise provide . . . | |||||||||||||||||||||||||||||||||||||

[S. 3 rep. 28 & 29 Vict. c. 16. s. 1.] | ||||||||||||||||||||||||||||||||||||||

|

Bank of Ireland may be dissolved on 12 months notice after 1st of January 1855, and repayment of capital sum advanced, and arrears of annuity. |

4. Upon twelve months notice, to be published in the Dublin Gazette by order of the lord-lieutenant, that the said corporation of the Bank is to be disolved, and upon repayment by Parliament to the Bank of Ireland, or their successors, of the said sum of two million six hundred and thirty thousand seven hundred and sixty-nine pounds four shillings and eight-pence, together with all arrears of interest or annuity due in respect thereof, then and in such case the said interest or annuity shall, from and after the expiration of twelve months after such notice published, cease and determine, and the said corporation shall be dissolved. [S. 5 rep. 38 & 39 Vict. c. 66. (S.L.R)] | |||||||||||||||||||||||||||||||||||||

|

3 & 4 Will, c. 98. s. 6. Bank of England notes not a legal tender in Ireland. Proviso. |

6. And whereas by the Bank of England Act, 1833, it was enacted, that from and after the first day of August one thousand eight hundred and thirty-four, unless and until Parliament should otherwise direct, a tender of a note or notes of the Bank of England, expressed to be payable to bearer on demand, should be a legal tender to the amount expressed in such note or notes, and should be taken to be valid as a tender to such amount for all sums above five pounds on all occasions on which any tender of money may be legally made, so long as the Bank of England should continue to pay on demand their said notes in legal coin; provided always, that no such note or notes should be deemed a legal tender of payment by the Bank of England, or any branch bank: of the said governor and company: And whereas doubts have arisen as to the extent of the said enactment: For removal whereof, be it enacted and declared, that nothing in the said last-recited Act contained shall extend or be construed to extend to make the tender of a note or notes of the Bank of England a legal tender in Ireland: Provided also, that nothing in this Act shall be construed to prohibit the circulation in Ireland of the notes of the Bank of England as heretofore. | |||||||||||||||||||||||||||||||||||||

|

Oaths to be taken by directors, &c. of the Bank of Ireland. |

7. It shall not be necessary for any governor, deputy-governor, or director of the said Bank, before acting in the said several offices or trusts, . . . to take any other oaths than the oath of allegiance, the oath of qualification by possession of stock, and the oath of fidelity to the corporation, prescribed in and by the charter of incorporation of the said Bank, and it shall not be necessary for any member of the said corporation, before voting in any general court . . . to take any other oaths than the oaths of allegiance, the oath of qualification by the possession of stock, and the oath of fidelity to the said corporation, provided in the said charter of incorporation: Provided always, that in case any of the persons called Quakers shall at any time be chosen governor, deputy-governor, or director, or shall be or become a member of the said corporation, it shall be sufficient for such person or persons to make his or their solemn affirmation, to the purport and effect of the oaths prescribed by the said charter and by this Act to be taken by governors, deputy governors, directors, or members respectively of the said corporation. | |||||||||||||||||||||||||||||||||||||

|

Existing banks of issue may continue to issue. Prohibition of issue by uncertified bankers. |

8. [Provision authorising commissioners of stamps to certify existing banks of issue and limitation of issue, rep. 54 & 55 Vict. c 67. (S.L.R.)] it shall be lawful for every such banker to continue to issue his own bank notes, to the extent of the amount so certified, and of the amount of the gold and silver coin held by such banker, in the proportion and manner hereinafter mentioned, but not to any further extent; and it shall not be lawful for any banker to make or issue bank notes in Ireland, save and except only such bankers as shall have obtained such certificate from the commissioners of stamps and taxes. | |||||||||||||||||||||||||||||||||||||

|

Provision for banks united within 12 months before 1st May, 1845. |

9. Provided always, that if it shall be made to appear to the commissioners of stamps and taxes that any two or more banks have, by written contract or agreement, (which contract or agreement shall be produced to the said commissioners,) become united within the year next preceding such first day of May one thousand eight hundred and forty-five, it shall be lawful for the said commissioners to ascertain the average amount of the notes of each such bank in the manner herein-before directed, and to certify a sum equal to the average amount of the notes of the two or more banks so united as the amount which the united bank shall thereafter be authorized to issue, subject to the regulations of this Act. | |||||||||||||||||||||||||||||||||||||

|

Duplicate of certificate to be published in the Gazette. Gazette to be evidence. |

10. The commissioners of stamps and taxes shall, at the time of certifying to any banker such particulars as they are herein-before required to certify, also publish a duplicate of their certificate thereof in the next succeeding Dublin Gazette in which the same may be conveniently inserted; and the Gazette in which such publication shall be made shall be conclusive evidence in all courts whatsoever of the amount of bank notes which the banker named in such certificate or duplicate is by law authorized to issue and to have in circulation as aforesaid, exclusive of an amount equal to the monthly average amount of the gold and silver coin held by such banker, as herein provided. | |||||||||||||||||||||||||||||||||||||

|

In case banks become united, commissioners to certify the amount of bank notes which each bank was authorized to issue; and united bank may issue the aggregate amount. |

11. In case it shall be made to appear to the commissioners of stamps and taxes, at any time hereafter, that any two or more banks have, by written contract or agreement, (which contract or agreement shall be produced to the said commissioners,) become united, it shall be lawful to the said commissioners, upon the application of such united bank, to certify, in manner herein-before mentioned, the aggregate of the amount of bank notes which such separate banks were previously authorized to issue under the separate certificates previously delivered to them, and so from time to time; and every such certificate shall be published in manner herein-before directed; and from and after such publication the amount therein stated shall be and be deemed to be the limit of the amount of bank notes which such united bank may have in circulation, exclusive of an amount equal to the monthly average amount of the gold and silver coin held by such banker, as herein provided. | |||||||||||||||||||||||||||||||||||||

|

Banks entitled to the privilege of issuing notes may. agree with Bank of Ireland to relinquish the same; and issue of Bank of Ireland may thereupon be increased. |

12. It shall be lawful for any banker in Ireland who under the provisions of this Act is entitled to issue bank notes to contract and agree with the governor and company of the Bank of Ireland, by an agreement in writing, for the relinquishment of the privilege of issuing such notes in favour of the said governor and company; and in each such case a copy of such agreement shall be transmitted to the commissioners of stamps and taxes; and the said commissioners shall thereupon certify, in manner herein-before mentioned, the aggregate of the amount of bank notes which the Bank of Ireland and the banker with whom such agreement shall have been made were previously authorized to issue under the separate certificates previously delivered to them; and every such certificate shall be published in manner herein-before directed; and from and after such publication the amount therein stated shall be the limit of the amount of bank notes which the Bank of Ireland may have in circulation exclusive of an amount equal to the amount of the gold and silver coin held by the Bank of Ireland, as herein provided. | |||||||||||||||||||||||||||||||||||||

|

Banks relinquishing not to resume the issue. |

13. It shall not be lawful for any banker who shall have so agreed to relinquish the privilege of issuing bank notes at any time thereafter to issue any such notes. | |||||||||||||||||||||||||||||||||||||

|

Limitation of bank notes which bankers may have in circulation. |

14. It shall not be lawful for any banker in Ireland to have in circulation, upon the average of a period of four weeks, to be ascertained as herein-after mentioned, a greater amount of notes than an amount composed of the sums certified by the commissioners of stamps and taxes as aforesaid, and the monthly average amount of gold and silver coin held by such banker during the same period of four weeks, to be ascertained in manner herein-after mentioned. | |||||||||||||||||||||||||||||||||||||

|

Issue of notes for fractional parts of a pound prohibited. |

15. All bank notes to be issued or re-issued in Ireland after the sixth day of December one thousand eight hundred and forty-five shall be expressed to be for payment of a sum in pounds sterling, without any fractional parts of a pound; and if any banker in Ireland shall from and after that day make, sign, issue, or re-issue any bank note for the fractional part of a pound sterling or for any sum together with the fractional part of a pound sterling, every such banker so making, signing, issuing, or re-issuing any such note as aforesaid shall for each note so made, signed, issued, or re-issued forfeit or pay the sum of twenty pounds. | |||||||||||||||||||||||||||||||||||||

|

Issuing banks to render accounts weekly of notes in circulation, and of coin held; and to strike averages every four weeks. Accounts to be in form in schedule (A.) |

16. Every banker who after the sixth day of December one thousand eight hundred and forty-five shall issue bank notes in Ireland shall, on some one day in every week (such day to be fixed by the commissioners of stamps and taxes,) transmit to the said commissioners a just and true account of the amount of bank notes of such banker in circulation at the close of the business on the next preceding Saturday, distinguishing the notes of five pounds and upwards, and the notes below five pounds, and also an account of the total amount of gold and silver coin held by such banker at each of the head offices or principal places of issue in Ireland of such banker at the close of business on each day of the week ending on that Saturday, and also an account of the total amount of gold and silver coin in Ireland held by such banker at the close of business on that day; and on completing the first period of four weeks, and so on completing each successive period of four weeks, every such banker shall annex to such account the average amount of bank notes of such banker in circulation during the said four weeks, distinguishing the bank notes of five pounds and upwards, and the notes below five pounds, and the average amount of gold and silver coin respectively held by such banker at each of the head offices or principal places of issue in Ireland of such banker during the said four weeks, and also the amount of bank notes which such banker is, by the certificate published as aforesaid, authorized to issue under the provisions of this Act; and every such account shall be verified by the signature of such banker or his chief cashier, or in the case of a company or partnership by the signature of the chief cashier or other officer duly authorized by the directors of such company or partnership, and shall, be made in the form to this Act annexed marked (A.); and if any such banker shall neglect or refuse to render any such account in the form and at the time required by this Act, or shall at any time render a false account, such banker shall forfeit the sum of one hundred pounds for every such offence. | |||||||||||||||||||||||||||||||||||||

|

What shall be deemed to be bank notes in circulation. |

17. All bank notes shall be deemed to be in circulation from the time the same shall have been issued by any banker, or any servant or agent of such banker, until the same shall have been actually returned to such banker, or some servant or agent of such banker. | |||||||||||||||||||||||||||||||||||||

|

Commissioners of stamps to make monthly returns in form in schedule(B.) |

18. From the returns so made by each banker to the commissioners of stamps and taxes the said commissioners shall, at the end of the first period of four weeks after the said sixth day of December one thousand eight hundred and forty-five, and so at the end of each successive period of four weeks, make out a general return in the form to this Act annexed marked (B.) of the monthly average amount of bank notes in circulation of each banker in Ireland during the last preceding four weeks, and of the average amount of all the gold and silver coin held by such banker during the same period, and certifying, under the hand of any officer of the said commissioners duly authorized for that purpose, in the case of each such banker, whether such banker has held the amount of coin required by law during the period to which the said return shall apply, and shall publish the same in the next succeeding Dublin Gazette in which the same can be conveniently inserted. | |||||||||||||||||||||||||||||||||||||

|

Mode of ascertaining the average amount of bank notes of each banker in circulation, and coin held, during each period of four weeks after 6th December 1845. |

19. For the purpose of ascertaining the monthly average amount of bank notes of each banker in circulation, the aggregate of the amount of bank notes of each such banker in circulation at the close of the business on the Saturday in each week during the first complete period of four weeks next after the sixth day of December one thousand eight hundred and forty-five shall be divided by the number of weeks, and the average so ascertained shall be deemed to be the average of bank notes of each such banker in circulation during such period of four weeks, and so in each successive period of four weeks; and the monthly average amount of gold and silver coin respectively held as aforesaid by such banker shall be ascertained in like manner from the amount of gold and silver coin held by such banker at the head offices or principal places of issue of such banker in Ireland, as after mentioned, at the close of business on such day in each week; and the monthly average amount of bank notes of each such banker in circulation during any such period of four weeks is not to exceed a sum made up by adding the amount certified by the commissioners of stamps and taxes as aforesaid and the monthly average amount of gold and silver coin held by such banker as aforesaid during the same period. | |||||||||||||||||||||||||||||||||||||

|

What shall be taken in the account of coin held by any banker, in respect of which notes may be issued. Silver coin not to exceed the proportion of one quarter of gold. |

20. In taking account of the coin held by any banker in Ireland with respect to which bank notes to a further extent than the sum certified as aforesaid by the commissioners of stamps and taxes may, under the provisions of this Act, be made and issued, there shall be included only the gold and silver coin held by such banker at the several head offices or principal places of issue in Ireland of such banker, such head offices or principal places of issue not exceeding four in number, of which not more than two shall be situated in the same province; and every banker shall give notice in writing to the said commissioners, on or before the sixth day of December next, of such head offices or principal places of issue at which the account of gold and silver coin held by him is to be taken as aforesaid; and no amount of silver coin exceeding one fourth part of the gold coin held by such banker as aforesaid shall be taken into account, nor shall any banker be authorized to make and issue bank notes in Ireland on any amount of silver coin held by such banker exceeding the proportion of one fourth part of the gold coin held by such banker as aforesaid. | |||||||||||||||||||||||||||||||||||||

|

Commissioners of stamps and taxes may cause the books of bankers, containing accounts of their bank notes in circulation, and of coin held, to be inspected. Penalty for refusing to allow such inspection. |

21. [Recital.] All and every the book and books of any banker who shall issue bank notes under the provisions of this Act, in which shall be kept, contained, or entered any account, minute, or memorandum of or relating to the bank notes issued or to be issued by such bank, of or relating to the amount of such notes in circulation from time to time, or of or relating to the gold or silver coin held by such banker from time to time, or any account, minute, or memorandum the sight or inspection whereof may tend to secure the rendering of true accounts of the average amount of such notes in circulation and gold or silver coin held as directed by this Act, or to test the truth of any such account, shall be open for the inspection and examination at all seasonable times of any officer of stamp duties authorized in that behalf by writing signed by the commissioners of stamps and taxes, or any two of them; and every such officer shall be at liberty to take copies of or extracts from any such book or account as aforesaid, and to inspect and ascertain the amount of any gold or silver coin held by such banker; and if any banker or other person keeping any such book, or having the custody or possession thereof or power to produce the same, shall, upon demand made by any such officer showing (if required) his authority in that behalf, refuse to produce any such book to such officer for his inspection and examination, or to permit him to inspect and examine the same, or to take copies thereof or extracts therefrom, or of or from any such account, minute, or memorandum as aforesaid, kept, contained, or entered therein, or if any banker or other person having the custody or possession of any coin belonging to such banker shall refuse to permit or prevent the inspection of such gold and silver coin as aforesaid every such banker or other person so offending shall for every such offence forfeit the sum of one hundred pounds: Provided always, that the said commissioners shall not exercise the powers aforesaid without the consent of the Treasury. | |||||||||||||||||||||||||||||||||||||

|

All bankers in Ireland to return their names, &c. once a year to the stamp office in Dublin. Returns to be published. |

22. Every banker in Ireland, other than the Bank of Ireland, who is now carrying on or shall hereafter carry on business as such, shall, on the first day of January in each year, or within fifteen days thereafter, make a return to the commissioners of stamps and taxes, at their office in Dublin, of his name, residence, and occupation, or, in the case of a company or partnership, of the name, residence, and occupation of every person composing or being a member of such company or partnership, and also the name of the firm under which such banker, company, or partnership carry on the business of banking, and of every place where such business is carried on; and if any such banker shall omit or refuse to make such return within fifteen days after the said first day of January, or shall wilfully make other than a true return of the persons as herein required, every banker so offending shall forfeit or pay the sum of fifty pounds; and the said commissioners of stamps and taxes shall on or before the first day of March in every year publish in the Dublin Gazette a copy of the return so made by every banker. | |||||||||||||||||||||||||||||||||||||

|

Penalty on banks issuing in excess. |

23. If the monthly average circulation of bank notes of any banker, taken in the manner herein directed, shall at any time exceed the amount which such banker is authorized to issue and to have in circulation under the provisions of this Act, such banker shall in every such case forfeit a sum equal to the amount by which the average monthly circulation taken as aforesaid, shall have exceeded the amount which such banker was authorized to issue and to have in circulation as aforesaid. | |||||||||||||||||||||||||||||||||||||

[S. 24 rep. 45 & 46 Vict. c. 61. s. 96. S. 25 rep. 27 & 28 Vict. c. 20. s. 1 (temp.)] | ||||||||||||||||||||||||||||||||||||||

|

Penalty on persons, other than bankers hereby authorized, issuing notes payable on demand for less than 5l. |

26. If any body politic or corporate or any person or persons shall from and after the said first day of January one thousand eight hundred and forty-six make, sign, issue, or re-issue in Ireland any promissory note payable on demand to the bearer thereof for any sum of money less than the sum of five pounds, except the bank notes of such bankers as are hereby authorized to continue to issue bank notes as aforesaid, then and in either of such cases every such body politic or corporate or person or persons so making, signing, issuing, or re-issuing any such promissory note as aforesaid, except as aforesaid, shall for every such note so made, signed, issued, or re-issued forfeit the sum of twenty pounds. | |||||||||||||||||||||||||||||||||||||

[S. 27 rep. 27 & 28 Vict. c. 20. s. 1. (temp.)] | ||||||||||||||||||||||||||||||||||||||

|

Act not to prohibit checks on bankers. |

28. Provided always, that nothing herein contained shall extend to prohibit any draft or order drawn by any person on his banker, or on any person acting as such banker, for the payment of money held by such banker or person to the use of the person by whom such draft or order shall be drawn. | |||||||||||||||||||||||||||||||||||||

|

Mode of enforcing penalties. Application of penalties. |

29. All pecuniary penalties under this Act may be sued or prosecuted for and recovered for the use of her Majesty, in the name of her Majesty’s attorney general or solicitor general in Ireland, or of the solicitor of stamps in Ireland, or of any person authorized to sue or prosecute for the same by writing under the hands of the commissioners of stamps and taxes, or in the name of any officer of stamp duties, by action of debt, bill, plaint, or information, in the Court of Exchequer in Dublin, or by civil bill in the court of the recorder, chairman, or assistant barrister within whose local jurisdiction any offence shall have been committed, in respect of any such penalty, or, in respect of any penalty not exceeding twenty pounds, by information or complaint before one or more justice or justices of the peace in Ireland, in such and the same manner as any other penalties imposed by any of the laws now in force relating to the duties under the management of the commissioners of stamps; and it shall be lawful in all cases for the commissioners of stamps and taxes, either before or after any proceedings commenced for recovery of any such penalty, to mitigate or compound any such penalty, as the said commissioners shall think fit, and to stay any such proceedings after the same shall have been commenced and whether judgment may have been obtained for such penalty or not, on payment of part only of any such penalty, with or without costs, or on payment only of the costs incurred in such proceedings, or of any part thereof, or on such other terms as such commissioners shall judge reasonable: Provided always, that all pecuniary penalties imposed by or incurred under this Act, by whom or in whose name soever the same shall be sued or prosecuted for or recovered, shall go and be applied to the use of her Majesty, and shall be deemed to be and shall be accounted for as part of her Majesty’s revenue arising from stamp duties, any thing in any Act contained, or any law or usage, to the contrary in anywise notwithstanding | |||||||||||||||||||||||||||||||||||||

|

Banking companies within 50 miles of Dublin may sue and be sued in the names of their officers, in manner provided as to companies beyond that distance by 6 Geo. 4. c. 42. Returns, &c. to be made under that Act. |

30. Every company or copartnership of more than six persons established before the passing of this Act, for the purpose of carrying on the trade or business of bankers within the distance of fifty miles from Dublin, shall have the same powers and privileges of suing and being sued, and of presenting petitions to found sequestrations or fiats in bankruptcy, in the name of any one of the public officers of such company or copartnership, as the nominal plaintiff petitioner, or defendant, on behalf of such company or copartnership, as are provided with respect to companies carrying on the said trade or business at any place in Ireland exceeding the distance of fifty miles from Dublin, under the provisions of an Act passed in the sixth year of the reign of King George the Fourth, intituled “An Act for the better regulation of copartnerships of certain bankers in Ireland”; and all judgments, decrees, and orders made and obtained in any action, suit, or other proceeding brought, instituted, or carried on by or against any such company or copartnership carrying on business within the distance of fifty miles from Dublin, in the name of their public officer, shall have the same effect and operation, and may be enforced in like manner in all respects, as is provided in and by the last-mentioned Act with respect to the judgments, decrees, and orders therein mentioned; provided that every such company or copartnership as last aforesaid shall make out and deliver from time to time to the commissioners of stamps and taxes the several accounts or returns required by the last-mentioned Act; and all the provisions of the last-mentioned Act as to such accounts or returns shall be taken to apply to the accounts or returns so made out and delivered by the said last-mentioned companies, as if they had been originally included in the provisions of the last-mentioned Act. | |||||||||||||||||||||||||||||||||||||

[S. 31 rep. 38 & 39 Vict. c. 66. (S.L.B.)] | ||||||||||||||||||||||||||||||||||||||

|

Interpretation of terms. |

32. . . . in this Act . . . the term “banker” shall, when the bank of Ireland be not specially excepted, extend and apply to the Bank of Ireland, and to all other corporations, societies, partnerships, and persons, and every individual person carrying on the business of banking, whether by the issue of bank notes or otherwise; and the word “coin” shall be construed to mean the coin of this realm; and the word “person” used in this Act shall include corporations; and the singular number used in this Act shall include the plural number, and the plural number the singular, except where there is any thing in the context repugnant to such construction; and the masculine gender in this Act shall include the feminine, except where there is any thing in the context repugnant to such construction. | |||||||||||||||||||||||||||||||||||||

[S. S3 rep. 38 $ 39 Vict. c. 66. (S.L.R.)] | ||||||||||||||||||||||||||||||||||||||

|

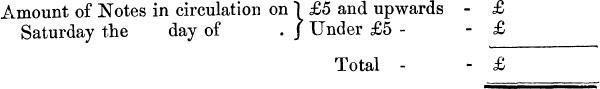

SCHEDULES referred to in the foregoing Act. Schedule (A.). | ||||||||||||||||||||||||||||||||||||||

Sect. 16 . | ||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

Amount of Gold and Silver Coin held at the Head Office or principal Place of Issue at the close of business on— | ||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

Total amount of Coin held at the close of business on Saturday the day of 18 | ||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

[To be inserted in the account at the end of each period of four weeks] | ||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

I, being the [banker, chief cashier, director, or partner, as the case may be], do hereby certify, that the above is a true account of the notes in circulation, and of the coin held by the said bank, as required under the Act 8 and 9 Vict. c. 37. | ||||||||||||||||||||||||||||||||||||||

(Signed)____________ | ||||||||||||||||||||||||||||||||||||||

Dated this day of 18 . | ||||||||||||||||||||||||||||||||||||||

|

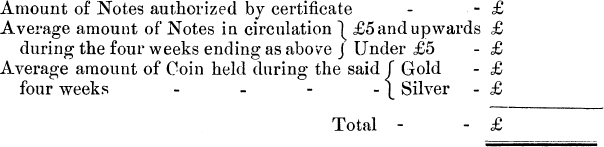

Schedule (B.) Sect. 18. | ||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

I hereby certify, that each of the bankers named in the above return who have in circulation an amount of notes beyond that authorized in their certificate [with the exception of A.B. or CD., as the case may be,] have held an amount of gold and silver coin not less than that which they are required to hold during the period to which this return relates. | ||||||||||||||||||||||||||||||||||||||

(Signed)___________Officer of Stamp Duties. | ||||||||||||||||||||||||||||||||||||||

Dated this day of 18 . | ||||||||||||||||||||||||||||||||||||||

[Scheds. D., E. rep. 27 & 28 Vict. c. 20. s. 1. (temp.)] | ||||||||||||||||||||||||||||||||||||||

[1Short title, “The Bankers (Ireland) Act, 1845.” See 55 & 56 Vict. c. 10.] | ||||||||||||||||||||||||||||||||||||||