Finance Act 2022

| |||||||||||||||||||||||||||||||||||||||||||||||

Number 44 of 2022 | |||||||||||||||||||||||||||||||||||||||||||||||

FINANCE ACT 2022 | |||||||||||||||||||||||||||||||||||||||||||||||

CONTENTS | |||||||||||||||||||||||||||||||||||||||||||||||

Universal Social Charge, Income Tax, Corporation Tax and Capital Gains Tax | |||||||||||||||||||||||||||||||||||||||||||||||

Interpretation | |||||||||||||||||||||||||||||||||||||||||||||||

Section | |||||||||||||||||||||||||||||||||||||||||||||||

Universal Social Charge | |||||||||||||||||||||||||||||||||||||||||||||||

2. Amendment of section 531AN of Principal Act (rate of charge) | |||||||||||||||||||||||||||||||||||||||||||||||

Income Tax | |||||||||||||||||||||||||||||||||||||||||||||||

3. Exemption in respect of incorrect birth registration payment | |||||||||||||||||||||||||||||||||||||||||||||||

7. Amendment of section 112B of Principal Act (granting of vouchers) | |||||||||||||||||||||||||||||||||||||||||||||||

8. Amendment of section 118 of Principal Act (benefits in kind: general charging provision) | |||||||||||||||||||||||||||||||||||||||||||||||

11. Amendment of section 472BB of Principal Act (sea-going naval personnel credit) | |||||||||||||||||||||||||||||||||||||||||||||||

12. Amendment of section 480B of Principal Act (relief arising in special circumstances) | |||||||||||||||||||||||||||||||||||||||||||||||

18. Amendment of section 825C of Principal Act (special assignee relief programme) | |||||||||||||||||||||||||||||||||||||||||||||||

19. Amendment of Part 7 of Principal Act (lump sums from foreign pension arrangements) | |||||||||||||||||||||||||||||||||||||||||||||||

20. Pan-European Personal Pension Product (insertion of new Chapter) | |||||||||||||||||||||||||||||||||||||||||||||||

22. Removal of benefit-in-kind charge from employer contributions to PRSAs and PEPPs | |||||||||||||||||||||||||||||||||||||||||||||||

Income Tax, Corporation Tax and Capital Gains Tax | |||||||||||||||||||||||||||||||||||||||||||||||

25. Amendment of Chapter 13 of Part 10 of Principal Act (Living City Initiative) | |||||||||||||||||||||||||||||||||||||||||||||||

27. Amendment of Chapter 2 of Part 29 of Principal Act (scientific and certain other research) | |||||||||||||||||||||||||||||||||||||||||||||||

30. Farming: accelerated allowances for capital expenditure on slurry storage | |||||||||||||||||||||||||||||||||||||||||||||||

33. Amendment of certain tax exemption provisions of Principal Act | |||||||||||||||||||||||||||||||||||||||||||||||

34. Amendment of Part 16 of Principal Act (relief for investment in corporate trades) | |||||||||||||||||||||||||||||||||||||||||||||||

36. Amendment of section 743 of Principal Act (material interest in offshore funds) | |||||||||||||||||||||||||||||||||||||||||||||||

37. Reporting by exempt unit trusts, common contractual funds and investment limited partnerships | |||||||||||||||||||||||||||||||||||||||||||||||

Corporation Tax | |||||||||||||||||||||||||||||||||||||||||||||||

41. Amendment of section 481 of Principal Act (relief for investment in films) | |||||||||||||||||||||||||||||||||||||||||||||||

42. Amendment of section 481A of Principal Act (relief for investment in digital games) | |||||||||||||||||||||||||||||||||||||||||||||||

Excise | |||||||||||||||||||||||||||||||||||||||||||||||

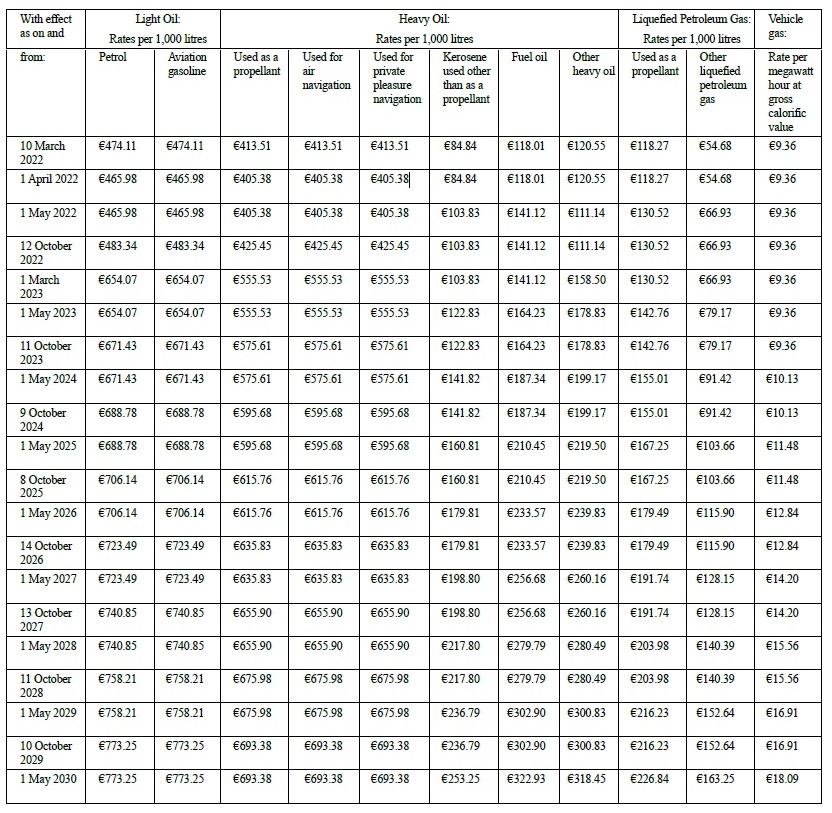

44. Amendment of Schedule 2 to Finance Act 1999 (rates of mineral oil tax) | |||||||||||||||||||||||||||||||||||||||||||||||

45. Amendment of section 98 of Finance Act 1999 (horticultural production) | |||||||||||||||||||||||||||||||||||||||||||||||

46. Amendment of Chapter 2 of Part 3 of Finance Act 2010 (natural gas carbon tax) | |||||||||||||||||||||||||||||||||||||||||||||||

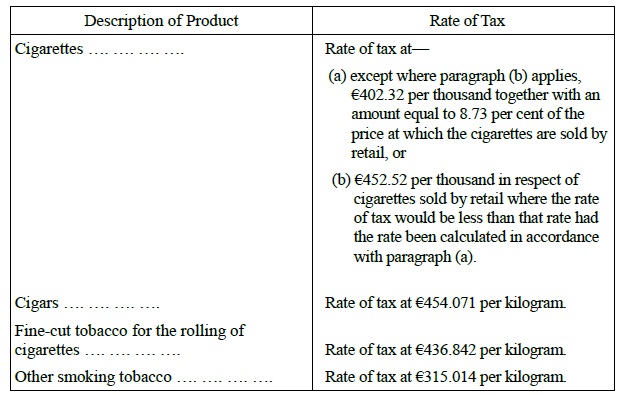

47. Amendment of Schedule 2 to Finance Act 2005 (rates of tobacco products tax) | |||||||||||||||||||||||||||||||||||||||||||||||

48. Amendment of Chapter 1 of Part 2 of Finance Act 2003 (alcohol products tax) | |||||||||||||||||||||||||||||||||||||||||||||||

50. Amendment of section 67 of Finance Act 2002 (betting duty) | |||||||||||||||||||||||||||||||||||||||||||||||

51. Amendment of section 126 of Finance Act 2001 (proceedings in relation to offences) | |||||||||||||||||||||||||||||||||||||||||||||||

Value-Added Tax | |||||||||||||||||||||||||||||||||||||||||||||||

54. Amendment of section 59 of and Schedule 1 to Principal Act | |||||||||||||||||||||||||||||||||||||||||||||||

57. Amendment of Part 13 of Principal Act (administration and general) | |||||||||||||||||||||||||||||||||||||||||||||||

58. Amendment of paragraph 2 of Schedule 1 to Principal Act (medical and related services) | |||||||||||||||||||||||||||||||||||||||||||||||

60. Amendment of paragraph 6(2) of Schedule 1 to Principal Act (financial services - EU funds) | |||||||||||||||||||||||||||||||||||||||||||||||

62. Amendment of paragraph 7 of Schedule 1 to Principal Act (agency services) | |||||||||||||||||||||||||||||||||||||||||||||||

63. Amendment of Schedule 2 to Principal Act (zero-rated goods and services) | |||||||||||||||||||||||||||||||||||||||||||||||

64. Amendment of Schedule 2 and Schedule 3 to Principal Act (zero-rated goods and services) | |||||||||||||||||||||||||||||||||||||||||||||||

Stamp Duties | |||||||||||||||||||||||||||||||||||||||||||||||

66. Stamp duty on certain acquisitions of residential property | |||||||||||||||||||||||||||||||||||||||||||||||

71. Levy on authorised insurers: modernisation and compliance | |||||||||||||||||||||||||||||||||||||||||||||||

72. Amendment of section 126AA of Principal Act (further levy on certain financial institutions) | |||||||||||||||||||||||||||||||||||||||||||||||

Capital Acquisitions Tax | |||||||||||||||||||||||||||||||||||||||||||||||

75. Amendment of Principal Act in relation to section 4B of Succession Act 1965 | |||||||||||||||||||||||||||||||||||||||||||||||

76. Amendment of section 48A of Principal Act (information about a deceased person’s property) | |||||||||||||||||||||||||||||||||||||||||||||||

77. Amendment of section 82 of Principal Act (exemption of certain receipts) | |||||||||||||||||||||||||||||||||||||||||||||||

Miscellaneous | |||||||||||||||||||||||||||||||||||||||||||||||

79. Amendment of section 949AP of Principal Act (appealing against determinations) | |||||||||||||||||||||||||||||||||||||||||||||||

80. Amendment of section 949AQ of Principal Act (case stated for High Court) | |||||||||||||||||||||||||||||||||||||||||||||||

82. Return of certain information by Reporting Platform Operators | |||||||||||||||||||||||||||||||||||||||||||||||

87. Amendment of section 1086A of Principal Act (publication of names and details of tax defaulters) | |||||||||||||||||||||||||||||||||||||||||||||||

89. Amendment of section 134A of Stamp Duties Consolidation Act 1999 (penalties) | |||||||||||||||||||||||||||||||||||||||||||||||

91. Amendment of section 959Z of Principal Act (right of Revenue officer to make enquiries) | |||||||||||||||||||||||||||||||||||||||||||||||

92. Amendment of section 1041 of Principal Act (rents payable to non-residents) | |||||||||||||||||||||||||||||||||||||||||||||||

93. Amendment of Part 1 of Schedule 26A to Principal Act (donations to approved bodies, etc.) | |||||||||||||||||||||||||||||||||||||||||||||||

97. Amendment of section 604B of Principal Act (relief for farm restructuring) | |||||||||||||||||||||||||||||||||||||||||||||||

Miscellaneous Technical Amendments in relation to Tax | |||||||||||||||||||||||||||||||||||||||||||||||

|

Acts Referred to | |||||||||||||||||||||||||||||||||||||||||||||||

Affordable Housing Act 2021 (No. 25) | |||||||||||||||||||||||||||||||||||||||||||||||

Bankruptcy Act 1988 (No. 27) | |||||||||||||||||||||||||||||||||||||||||||||||

British-Irish Agreement Act 1999 (No. 1) | |||||||||||||||||||||||||||||||||||||||||||||||

Building Control Act 2007 (No. 21) | |||||||||||||||||||||||||||||||||||||||||||||||

Central Bank Act 1971 (No. 24) | |||||||||||||||||||||||||||||||||||||||||||||||

Central Bank Act 1997 (No. 8) | |||||||||||||||||||||||||||||||||||||||||||||||

Child Care Act 1991 (No. 17) | |||||||||||||||||||||||||||||||||||||||||||||||

Civil Service Regulation Act 1956 (No. 46) | |||||||||||||||||||||||||||||||||||||||||||||||

Companies Act 2014 (No. 38) | |||||||||||||||||||||||||||||||||||||||||||||||

Criminal Justice (Money Laundering and Terrorist Financing) Act 2010 (No. 6) | |||||||||||||||||||||||||||||||||||||||||||||||

Data Protection Act 2018 (No. 7) | |||||||||||||||||||||||||||||||||||||||||||||||

Electricity Regulation Act 1999 (No. 23) | |||||||||||||||||||||||||||||||||||||||||||||||

Employment Agency Act 1971 (No. 27) | |||||||||||||||||||||||||||||||||||||||||||||||

Finance (Covid-19 and Miscellaneous Provisions) Act 2022 (No. 9) | |||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 1980 (No. 14) | |||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 1983 (No. 15) | |||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 1999 (No. 2) | |||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2001 (No. 7) | |||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2002 (No. 5) | |||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2003 (No. 3) | |||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2005 (No. 5) | |||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2010 (No. 5) | |||||||||||||||||||||||||||||||||||||||||||||||

Finance Act 2021 (No. 45) | |||||||||||||||||||||||||||||||||||||||||||||||

Gas (Interim) (Regulation) Act 2002 (No. 10) | |||||||||||||||||||||||||||||||||||||||||||||||

Gas Act 1976 (No. 30) | |||||||||||||||||||||||||||||||||||||||||||||||

Health Act 2007 (No. 23) | |||||||||||||||||||||||||||||||||||||||||||||||

Higher Education Authority Act 2022 (No. 31) | |||||||||||||||||||||||||||||||||||||||||||||||

Housing (Regulation of Approved Housing Bodies) Act 2019 (No. 47) | |||||||||||||||||||||||||||||||||||||||||||||||

Intoxicating Liquor Act 1927 (No. 15) | |||||||||||||||||||||||||||||||||||||||||||||||

Intoxicating Liquor Act 1962 (No. 21) | |||||||||||||||||||||||||||||||||||||||||||||||

Local Government (Charges) Act 2009 (No. 30) | |||||||||||||||||||||||||||||||||||||||||||||||

Local Government Act 2001 (No. 37) | |||||||||||||||||||||||||||||||||||||||||||||||

Medical Practitioners Act 2007 (No. 25) | |||||||||||||||||||||||||||||||||||||||||||||||

Nurses and Midwives Act 2011 (No. 41) | |||||||||||||||||||||||||||||||||||||||||||||||

Patents Act 1992 (No. 1) | |||||||||||||||||||||||||||||||||||||||||||||||

Pensions Act 1990 (No. 25) | |||||||||||||||||||||||||||||||||||||||||||||||

Planning and Development Act 2000 (No. 30) | |||||||||||||||||||||||||||||||||||||||||||||||

Public Service Superannuation (Miscellaneous Provisions) Act 2004 (No. 7) | |||||||||||||||||||||||||||||||||||||||||||||||

Redundancy Payments Act 1967 (No. 21) | |||||||||||||||||||||||||||||||||||||||||||||||

Registration of Title Act 1964 (No. 16) | |||||||||||||||||||||||||||||||||||||||||||||||

Residential Tenancies Act 2004 (No. 27) | |||||||||||||||||||||||||||||||||||||||||||||||

Stamp Duties Consolidation Act 1999 (No. 31) | |||||||||||||||||||||||||||||||||||||||||||||||

Succession Act 1965 (No. 27) | |||||||||||||||||||||||||||||||||||||||||||||||

Taxes Consolidation Act 1997 (No. 39) | |||||||||||||||||||||||||||||||||||||||||||||||

Unit Trusts Act 1990 (No. 37) | |||||||||||||||||||||||||||||||||||||||||||||||

Waiver of Certain Tax, Interest and Penalties Act 1993 (No. 24) | |||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||

Number 44 of 2022 | |||||||||||||||||||||||||||||||||||||||||||||||

FINANCE ACT 2022 | |||||||||||||||||||||||||||||||||||||||||||||||

An Act to provide for the imposition, repeal, remission, alteration and regulation of taxation, of stamp duties and of duties relating to excise and otherwise to make further provision in connection with finance including the regulation of customs; to make provision for supports to certain sectors of the economy; and to provide for related matters. | |||||||||||||||||||||||||||||||||||||||||||||||

[15th December, 2022] | |||||||||||||||||||||||||||||||||||||||||||||||

Be it enacted by the Oireachtas as follows: | |||||||||||||||||||||||||||||||||||||||||||||||

|

PART 1 Universal Social Charge, Income Tax, Corporation Tax and Capital Gains Tax | |||||||||||||||||||||||||||||||||||||||||||||||

|

Chapter 1 Interpretation | |||||||||||||||||||||||||||||||||||||||||||||||

|

Interpretation (Part 1) | |||||||||||||||||||||||||||||||||||||||||||||||

|

1. In this Part, “Principal Act” means the Taxes Consolidation Act 1997 . | |||||||||||||||||||||||||||||||||||||||||||||||

|

Chapter 2 Universal Social Charge | |||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 531AN of Principal Act (rate of charge) | |||||||||||||||||||||||||||||||||||||||||||||||

|

2. (1) Section 531AN of the Principal Act is amended— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) in subsection (3), by the substitution of “€22,920” for “€21,295”, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) in subsection (4), by the substitution of “2024” for “2023”, and | |||||||||||||||||||||||||||||||||||||||||||||||

(c) by the substitution of the following for Part 1 of the Table to that section: | |||||||||||||||||||||||||||||||||||||||||||||||

“Part 1 | |||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||

”. | |||||||||||||||||||||||||||||||||||||||||||||||

(2) Subsection (1) applies for the year of assessment 2023 and each subsequent year of assessment. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Chapter 3 Income Tax | |||||||||||||||||||||||||||||||||||||||||||||||

|

Exemption in respect of incorrect birth registration payment | |||||||||||||||||||||||||||||||||||||||||||||||

|

3. Chapter 1 of Part 7 of the Principal Act is amended by the insertion of the following section after section 192K: | |||||||||||||||||||||||||||||||||||||||||||||||

“192L. (1) In this section— | |||||||||||||||||||||||||||||||||||||||||||||||

‘Minister’ means the Minister for Children, Equality, Disability, Integration and Youth; | |||||||||||||||||||||||||||||||||||||||||||||||

‘qualifying individual’ means an individual who is the subject of an incorrect birth registration for the purposes of the Birth Information and Tracing Act 2022 which has been confirmed by the Child and Family Agency; | |||||||||||||||||||||||||||||||||||||||||||||||

‘qualifying payment’ means a payment, generally referred to and commonly known as the Ex Gratia Payment in Respect of an Incorrect Birth Registration, which is made by or on behalf of the Minister to a qualifying individual, in furtherance of the decision of the Government of 8 March 2022. | |||||||||||||||||||||||||||||||||||||||||||||||

(2) A qualifying payment made to a qualifying individual which is made on or after 1 January 2023 shall be exempt from income tax and shall not be reckoned in computing the total income of the qualifying individual for the purposes of the Income Tax Acts. | |||||||||||||||||||||||||||||||||||||||||||||||

(3) A qualifying payment made to a qualifying individual which is made before 1 January 2023 shall be treated as if it was exempt from income tax in the year of assessment in which it was made and shall not be reckoned in computing total income of the qualifying individual for the purposes of the Income Tax Acts. | |||||||||||||||||||||||||||||||||||||||||||||||

(4) The exemption provided for in subsections (2) and (3) shall apply to a maximum amount of €3,000 for each qualifying individual.”. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Exemption in respect of payments under Covid-19 Death in Service Ex-Gratia Scheme for Health Care Workers | |||||||||||||||||||||||||||||||||||||||||||||||

|

4. Chapter 1 of Part 7 of the Principal Act is amended by the insertion of the following section after section 192L (inserted by section 3 ): | |||||||||||||||||||||||||||||||||||||||||||||||

“Exemption in respect of payments under Covid-19 Death in Service Ex‑Gratia Scheme for Health Care Workers | |||||||||||||||||||||||||||||||||||||||||||||||

192M. (1) In this section, ‘qualifying payment’ means a payment made by or on behalf of the Minister for Health under the Covid-19 Death in Service Ex-Gratia Scheme for Health Care Workers (that is to say the scheme administered under that title by the Minister for Health in furtherance of a decision of the Government of 8 March 2022). | |||||||||||||||||||||||||||||||||||||||||||||||

(2) A qualifying payment made on or after 1 January 2023 shall be exempt from income tax and shall not be reckoned in computing total income for the purposes of the Income Tax Acts or in computing amounts chargeable to universal social charge in accordance with Part 18D. | |||||||||||||||||||||||||||||||||||||||||||||||

(3) A qualifying payment made before 1 January 2023 shall be treated as if it was exempt from income tax in the year of assessment in which it was made and shall not be reckoned in computing total income for the purposes of the Income Tax Acts or in computing amounts chargeable to universal social charge in accordance with Part 18D.”. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Payments in respect of redundancy | |||||||||||||||||||||||||||||||||||||||||||||||

|

5. (1) The Principal Act is amended by the substitution of the following section for section 203: | |||||||||||||||||||||||||||||||||||||||||||||||

“203. (1) In this section, ‘lump sum’ has the same meaning as in the Redundancy Payments Act 1967 . | |||||||||||||||||||||||||||||||||||||||||||||||

(2) Any lump sum payment made under section 19 or 32 of the Redundancy Payments Act 1967 shall be exempt from income tax under Schedule E. | |||||||||||||||||||||||||||||||||||||||||||||||

(3) Any payment made under section 32A of the Redundancy Payments Act 1967 shall be exempt from income tax under Schedule E.”. | |||||||||||||||||||||||||||||||||||||||||||||||

(2) Subsection (1), in so far as it relates to subsection (3) of section 203 of the Principal Act, shall be deemed to have come into operation on 19 April 2022. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 477C of Principal Act (Help to Buy) | |||||||||||||||||||||||||||||||||||||||||||||||

|

6. Section 477C of the Principal Act is amended— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) in subsection (1)— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) by the insertion of the following definition: | |||||||||||||||||||||||||||||||||||||||||||||||

“‘Act of 2021’ means the Affordable Housing Act 2021 ;”, | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) in the definition of “qualifying period”, by the substitution of “2024” for “2022”, and | |||||||||||||||||||||||||||||||||||||||||||||||

(iii) in the definition of “qualifying residence”— | |||||||||||||||||||||||||||||||||||||||||||||||

(I) in paragraph (a), by the substitution of “dwelling,” for “dwelling, or”, | |||||||||||||||||||||||||||||||||||||||||||||||

(II) in paragraph (b), by the insertion of “or” after “converted for as use as a dwelling,”, and | |||||||||||||||||||||||||||||||||||||||||||||||

(III) by the insertion of the following paragraph after paragraph (b): | |||||||||||||||||||||||||||||||||||||||||||||||

“(c) a building which was not at any time used as a dwelling and was purchased by a first-time purchaser in accordance with an affordable dwelling purchase arrangement (within the meaning of section 12 the Act of 2021) and a direct sales agreement (within the meaning of section 7 of the Act of 2021),”, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) in subsection (5A), by the substitution of “2024” for “2022”, | |||||||||||||||||||||||||||||||||||||||||||||||

(c) in subsection (8)(b), by the substitution of “2024” for “2022”, | |||||||||||||||||||||||||||||||||||||||||||||||

(d) in subsection (16)(a)— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) by the substitution in subparagraph (ii) of “2024” for “2022”, and | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) by the substitution in subparagraph (iii) of “2024” for “2022”, | |||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||

(e) in subsection (25), by the substitution of “2024” for “2022”. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 112B of Principal Act (granting of vouchers) | |||||||||||||||||||||||||||||||||||||||||||||||

|

7. (1) Section 112B of the Principal Act is amended, in subsection (1)— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) by the substitution of the following definition for the definition of “qualifying incentive”: | |||||||||||||||||||||||||||||||||||||||||||||||

“‘qualifying incentive’ means a relevant incentive that is the first or the second relevant incentive given to an employee in a year of assessment where— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) in the case of a first relevant incentive, the value does not exceed €1,000, and | |||||||||||||||||||||||||||||||||||||||||||||||

(b) in the case of a second relevant incentive, the cumulative value of the first and second relevant incentives does not exceed €1,000;”, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) by the insertion of the following definition: | |||||||||||||||||||||||||||||||||||||||||||||||

“‘relevant incentive’ means either a voucher or a benefit that is given to an employee by his or her employer in a year of assessment where the following conditions are satisfied: | |||||||||||||||||||||||||||||||||||||||||||||||

(a) the voucher or the benefit does not form part of a salary sacrifice arrangement; | |||||||||||||||||||||||||||||||||||||||||||||||

(b) the voucher can only be used to purchase goods or services and cannot be redeemed, in full or in part, for cash;”, | |||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||

(c) in the definition of “salary sacrifice arrangement”, by the substitution of “relevant incentive” for “qualifying incentive”. | |||||||||||||||||||||||||||||||||||||||||||||||

(2) Subsection (1) applies for the year of assessment 2022 and each subsequent year of assessment. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 118 of Principal Act (benefits in kind: general charging provision) | |||||||||||||||||||||||||||||||||||||||||||||||

|

8. Section 118 of the Principal Act is amended in subsection (5G)— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) in paragraph (b), by the insertion of the following definition: | |||||||||||||||||||||||||||||||||||||||||||||||

“‘cargo bicycle’ means a bicycle with a special purpose frame which has been designed to carry large or heavy loads, or passengers other than the rider, by means of a bulk storage capacity container or platform integrated into, or affixed to, the frame of the bicycle, in front of or behind the rider;”, | |||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||

(b) by the insertion of the following paragraph after paragraph (d): | |||||||||||||||||||||||||||||||||||||||||||||||

“(e) Notwithstanding paragraphs (a) and (d), where the expense or part thereof, as the case may be, is in connection with the provision of a cargo bicycle, the amount referred to in paragraph (a) shall be €3,000.”. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Returns by employers in relation to reportable benefits | |||||||||||||||||||||||||||||||||||||||||||||||

|

9. (1) Chapter 3 of Part 38 of the Principal Act is amended by the insertion of the following section after section 897B: | |||||||||||||||||||||||||||||||||||||||||||||||

“897C. (1) In this section— | |||||||||||||||||||||||||||||||||||||||||||||||

‘employee’, ‘employer’ and ‘income tax month’ have the same meaning, respectively, as they have in section 983; | |||||||||||||||||||||||||||||||||||||||||||||||

‘remote working daily allowance’ means a payment of not more than €3.20 per day to an employee by his or her employer in relation to the days the employee performs the duties of his or her office or employment from a dwelling or part of a dwelling which is occupied by that employee as his or her residence, where no tax is deducted; | |||||||||||||||||||||||||||||||||||||||||||||||

‘reportable benefit’ means— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) a small benefit, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) a remote working daily allowance, or | |||||||||||||||||||||||||||||||||||||||||||||||

(c) a travel and subsistence payment; | |||||||||||||||||||||||||||||||||||||||||||||||

‘small benefit’ means a benefit provided to an employee by his or her employer to which section 112B applies; | |||||||||||||||||||||||||||||||||||||||||||||||

‘travel and subsistence payment’ means a payment to an employee by his or her employer in respect of expenses of travel or subsistence incurred by the employee, where no tax is deducted. | |||||||||||||||||||||||||||||||||||||||||||||||

(2) Where in any income tax month an employer provides a reportable benefit to an employee, the employer shall deliver to the Revenue Commissioners, in an electronic format approved by them, particulars of the reportable benefit as specified in regulations made under section 986.”. | |||||||||||||||||||||||||||||||||||||||||||||||

(2) Chapter 4 of Part 42 of the Principal Act is amended— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) in section 983, by the insertion of the following definition: | |||||||||||||||||||||||||||||||||||||||||||||||

“‘reportable benefit’ has the same meaning as it has in section 897C;”, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) in section 984, by the insertion of the following subsection after subsection (1): | |||||||||||||||||||||||||||||||||||||||||||||||

“(1A) Without prejudice to subsection (1), sections 984A, 985G(2)(d), 986 and 987 shall apply to reportable benefits, other than reportable benefits to an employee who is in receipt of emoluments in respect of which a notification has been given under subsection (1).”, | |||||||||||||||||||||||||||||||||||||||||||||||

(c) in section 985G(2), by the substitution of “any emoluments or the provision of any reportable benefit” for “any emoluments”, and | |||||||||||||||||||||||||||||||||||||||||||||||

(d) in section 986, by the insertion of the following subsection after subsection (1A): | |||||||||||||||||||||||||||||||||||||||||||||||

“(1B) The Revenue Commissioners shall make regulations in respect of reportable benefits to which this Chapter and section 897C apply requiring any employer who provides a reportable benefit to an employee to provide, within a prescribed period, and on such form as the Revenue Commissioners may approve or prescribe, the particulars of such reportable benefit and such other documents, specified in the regulations, as the Revenue Commissioners deem appropriate.”. | |||||||||||||||||||||||||||||||||||||||||||||||

(3) Subsections (1) and (2) shall come into operation on such day as the Minister for Finance may appoint by order. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Rate of charge and personal tax credits | |||||||||||||||||||||||||||||||||||||||||||||||

|

10. As respects the year of assessment 2023 and subsequent years of assessment, the Principal Act is amended— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) in section 15— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) in subsection (3)(i), by the substitution of “€31,000” for “€27,800”, and | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) by the substitution of the following Table for the Table to that section: | |||||||||||||||||||||||||||||||||||||||||||||||

“TABLE | |||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||

”, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) in section 461— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) in paragraph (a), by the substitution of “€3,550” for “€3,400”, | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) in paragraph (b), by the substitution of “€3,550” for “€3,400”, and | |||||||||||||||||||||||||||||||||||||||||||||||

(iii) in paragraph (c), by the substitution of “€1,775” for “€1,700”, | |||||||||||||||||||||||||||||||||||||||||||||||

(c) in section 466A, in subsection (2), by the substitution of “€1,700” for “€1,600”, | |||||||||||||||||||||||||||||||||||||||||||||||

(d) in section 472, in subsection (4), by the substitution of “€1,775” for “€1,700” in each place where it occurs, and | |||||||||||||||||||||||||||||||||||||||||||||||

(e) in section 472AB— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) in subsection (2), by the substitution of “€1,775” for “€1,700” in each place where it occurs, and | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) in subsection (3), by the substitution of “€1,775” for “€1,700” in each place where it occurs. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 472BB of Principal Act (sea-going naval personnel credit) | |||||||||||||||||||||||||||||||||||||||||||||||

|

11. Section 472BB of the Principal Act is amended, in subsection (3), by the substitution of “2021, 2022 or 2023” for “2021 or 2022”. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 480B of Principal Act (relief arising in special circumstances) | |||||||||||||||||||||||||||||||||||||||||||||||

|

12. (1) Section 480B of the Principal Act is amended— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) in subsection (3), by the substitution of “472B, 472BA and 472BB” for “472B and 472BA”, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) by the insertion of the following subsection after subsection (10): | |||||||||||||||||||||||||||||||||||||||||||||||

“(10A) Subject to subsection (11), where section 466A applies, the amount of the threshold specified in subsection (6)(a) of that section (in this subsection referred to as the ‘monetary threshold’) shall be increased by— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) one fifty-second of the monetary threshold, where the individual concerned is paid weekly and is so paid on the relevant date, or | |||||||||||||||||||||||||||||||||||||||||||||||

(b) one twenty-sixth of the monetary threshold, where the individual concerned is paid fortnightly and is so paid on the relevant date, | |||||||||||||||||||||||||||||||||||||||||||||||

but the amount of any such increase shall not exceed the amount of the emoluments paid to the individual on the relevant date.”, | |||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||

(c) in subsection (11), by the substitution of “subsection (10) or (10A), in a case in which either of those subsections applies,” for “subsection (10)”. | |||||||||||||||||||||||||||||||||||||||||||||||

(2) Subsection (1) applies for the year of assessment 2023 and each subsequent year of assessment. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Rent tax credit | |||||||||||||||||||||||||||||||||||||||||||||||

|

13. The Principal Act is amended— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) in section 458, in Part 2 of the Table, by the insertion of “Section 473B” after “Section 473A”, and | |||||||||||||||||||||||||||||||||||||||||||||||

(b) by the insertion of the following section after section 473A: | |||||||||||||||||||||||||||||||||||||||||||||||

“Rent tax credit | |||||||||||||||||||||||||||||||||||||||||||||||

473B. (1) In this section— | |||||||||||||||||||||||||||||||||||||||||||||||

‘appropriate percentage’, in relation to a year of assessment, means a percentage equal to the standard rate of tax for that year; | |||||||||||||||||||||||||||||||||||||||||||||||

‘approved course’ has the same meaning as it has in section 473A; | |||||||||||||||||||||||||||||||||||||||||||||||

‘child’ means a child of an individual, or a child of the individual’s spouse or civil partner, who has not attained the age of 23 years at the commencement of the year of assessment during which he or she first enters an approved course; | |||||||||||||||||||||||||||||||||||||||||||||||

‘claimant’ has the meaning given to it in subsection (2); | |||||||||||||||||||||||||||||||||||||||||||||||

‘landlord’, in relation to a residential property, means the person for the time being entitled to receive (otherwise than as agent for another person) any payment on account of rent paid under a tenancy in respect of the residential property; | |||||||||||||||||||||||||||||||||||||||||||||||

‘payment on account of rent’ means a payment made in return for the special possession, use, occupation or enjoyment of a residential property, but does not include— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) any portion of such payment which has been, or is to be, reimbursed, or otherwise funded by way of a subsidy provided— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) to the claimant, or | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) where the claimant is assessed to tax in accordance with section 1017 or 1031C in the year of assessment, to his or her spouse or civil partner, | |||||||||||||||||||||||||||||||||||||||||||||||

or | |||||||||||||||||||||||||||||||||||||||||||||||

(b) any itemised payment relating to— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) the cost of maintenance of, or repairs to, the property, | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) the provision of goods or services relating to any right or benefit other than the bare right to special possession, use, occupation or enjoyment of the property, or | |||||||||||||||||||||||||||||||||||||||||||||||

(iii) a security deposit paid on commencement of the tenancy; | |||||||||||||||||||||||||||||||||||||||||||||||

‘PPS Number’, in relation to an individual, means the individual’s Personal Public Service Number within the meaning of section 262 of the Social Welfare Consolidation Act 2005 ; | |||||||||||||||||||||||||||||||||||||||||||||||

‘principal private residence’ means a residential property occupied by an individual as his or her sole residence; | |||||||||||||||||||||||||||||||||||||||||||||||

‘qualifying payment’ means a payment made on account of rent falling due in a year of assessment, where such payment has been made under a tenancy; | |||||||||||||||||||||||||||||||||||||||||||||||

‘relative’ means a lineal ascendent, lineal descendent, brother, sister, uncle, aunt, niece or nephew; | |||||||||||||||||||||||||||||||||||||||||||||||

‘rent tax credit’ has the meaning given to it in subsection (2); | |||||||||||||||||||||||||||||||||||||||||||||||

‘residential property’ means— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) a building or part of a building located in the State which is used or suitable for use as a dwelling, and | |||||||||||||||||||||||||||||||||||||||||||||||

(b) adjoining land which the occupier of a building or part of a building has for his or her own occupation and enjoyment with the building or part of a building as its gardens or grounds of an ornamental nature; | |||||||||||||||||||||||||||||||||||||||||||||||

‘specified amount’, in relation to a year of assessment, means— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) €5,000, in the case of an individual who is assessed to tax in accordance with section 1017 or 1031C in the year of assessment, and | |||||||||||||||||||||||||||||||||||||||||||||||

(b) €2,500 in all other cases; | |||||||||||||||||||||||||||||||||||||||||||||||

‘specified landlord’ means— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) a Minister of the Government, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) the Commissioners of Public Works in Ireland, | |||||||||||||||||||||||||||||||||||||||||||||||

(c) a housing authority within the meaning of the Housing (Miscellaneous Provisions) Act 1992 , or | |||||||||||||||||||||||||||||||||||||||||||||||

(d) an approved housing body within the meaning of the Housing (Regulation of Approved Housing Bodies) Act 2019 ; | |||||||||||||||||||||||||||||||||||||||||||||||

‘supported tenant’ means, in relation to a tenancy, an individual who is— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) in receipt of— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) payment of a supplement towards the amount of rent payable by the individual in respect of his or her residence payable in accordance with regulations made under section 198 of the Social Welfare Consolidation Act 2005 , | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) housing assistance, within the meaning of Part 4 of the Housing (Miscellaneous Provisions) Act 2014 , or | |||||||||||||||||||||||||||||||||||||||||||||||

(iii) social housing support, within the meaning of the Housing (Miscellaneous Provisions) Act 2009 , | |||||||||||||||||||||||||||||||||||||||||||||||

or | |||||||||||||||||||||||||||||||||||||||||||||||

(b) residing in a residential property which has been designated as a cost rental dwelling within the meaning of Part 3 of the Affordable Housing Act 2021 ; | |||||||||||||||||||||||||||||||||||||||||||||||

‘tax reference number’ means— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) in the case of an individual, his or her PPS Number, and | |||||||||||||||||||||||||||||||||||||||||||||||

(b) in the case of a partnership or company, the reference number stated on any return of income, form or notice of assessment issued to the partnership or company, as the case may be, by the Revenue Commissioners; | |||||||||||||||||||||||||||||||||||||||||||||||

‘tenancy’ means— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) any agreement, contract or lease which has been registered under Part 7 of the Residential Tenancies Act 2004 , or | |||||||||||||||||||||||||||||||||||||||||||||||

(b) any licence for the use, as a residence, of a room or rooms in an individual’s principal private residence, where— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) there is no obligation under Part 7 of the Residential Tenancies Act 2004 for such licence to be registered, and | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) the licence has been commenced with the consent of the landlord, but does not include any tenancy— | |||||||||||||||||||||||||||||||||||||||||||||||

(I) which, apart from any statutory extension, is a tenancy for a freehold estate or interest or for a definite period of 50 years or more, or | |||||||||||||||||||||||||||||||||||||||||||||||

(II) in which an agreement or provision exists under which any amount paid may be treated as consideration or part consideration, in whatever form, for the creation of a further or greater estate, tenancy or interest in the property concerned or any other property. | |||||||||||||||||||||||||||||||||||||||||||||||

(2) An individual (referred to in this section as the ‘claimant’) who proves that during the year of assessment he or she made a qualifying payment in respect of a residential property used by him or her as his or her principal private residence in the period to which the payment relates and makes a claim in that regard shall be entitled to a tax credit (to be known as the ‘rent tax credit’) equal to the lesser of— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) an amount equal to the appropriate percentage of the aggregate qualifying payment made in that year of assessment, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) an amount equal to the appropriate percentage of the specified amount, and | |||||||||||||||||||||||||||||||||||||||||||||||

(c) the amount which reduces the claimant’s income tax to nil. | |||||||||||||||||||||||||||||||||||||||||||||||

(3) (a) Where a qualifying payment is made in respect of a period which falls partly in one year of assessment and partly in another year of assessment, the amount of the qualifying payment made in respect of that period shall be apportioned to each year of assessment based on the proportion each part of the period bears to the period as a whole. | |||||||||||||||||||||||||||||||||||||||||||||||

(b) Where an amount of the qualifying payment made has been apportioned to a year of assessment under paragraph (a), the amount shall be deemed for the purposes of this section to have been made in that year of assessment. | |||||||||||||||||||||||||||||||||||||||||||||||

(4) Where a claimant is assessed to tax in accordance with section 1017 or 1031C in a year of assessment, any qualifying payment made by his or her spouse or civil partner in that year of assessment shall, for the purposes of this section, be deemed to have been made by the claimant. | |||||||||||||||||||||||||||||||||||||||||||||||

(5) Where— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) a claimant, or | |||||||||||||||||||||||||||||||||||||||||||||||

(b) in a case where subsection (4) applies, a claimant's spouse or civil partner, | |||||||||||||||||||||||||||||||||||||||||||||||

proves that he or she made a qualifying payment in respect of his or her use of a residential property, other than his or her principal private residence, as a residence to facilitate his or her attendance at or participation in his or her trade, profession, employment, office holding or an approved course during the period to which the qualifying payment relates, the claimant shall, upon making a claim in that regard, be entitled to the same rent tax credit as if the qualifying payment was made in respect of a residential property which was used by the claimant as his or her principal private residence. | |||||||||||||||||||||||||||||||||||||||||||||||

(6) Notwithstanding subsection (2), this section shall not apply to a qualifying payment made in respect of a residential property— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) in any case where— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) the landlord is a specified landlord, or | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) the claimant is a supported tenant, | |||||||||||||||||||||||||||||||||||||||||||||||

or | |||||||||||||||||||||||||||||||||||||||||||||||

(b) subject to subsection (7), where the claimant is a relative of the landlord. | |||||||||||||||||||||||||||||||||||||||||||||||

(7) Notwithstanding subsection (6)(b), in a case where the claimant is a relative of the landlord concerned the relief provided for in this section shall apply where— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) the relationship between the claimant and the landlord is other than that of parent and child, or child and parent, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) the tenancy is of a type which is required to be registered under Part 7 of the Residential Tenancies Act 2004, and | |||||||||||||||||||||||||||||||||||||||||||||||

(c) the tenancy complies with the requirement referred to in paragraph (b). | |||||||||||||||||||||||||||||||||||||||||||||||

(8) Where— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) a claimant, or | |||||||||||||||||||||||||||||||||||||||||||||||

(b) in a case where subsection (4) applies, a claimant's spouse or civil partner, proves that he or she made a qualifying payment in respect of a residential property used by his or her child as his or her principal private residence the claimant shall, upon making a claim in that regard, be entitled to the same rent tax credit as if the qualifying payment was made in respect of a residential property which was used by the claimant as his or her own principal private residence, where— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) neither the individual nor the child is a relative of the landlord, | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) the child was undertaking an approved course and using the property to facilitate his or her participation in that course during the period to which the qualifying payment relates, | |||||||||||||||||||||||||||||||||||||||||||||||

(iii) the tenancy is of a type which is required to be registered under Part 7 of the Residential Tenancies Act 2004 , and | |||||||||||||||||||||||||||||||||||||||||||||||

(iv) the tenancy complies with the requirement referred to in subparagraph (iii). | |||||||||||||||||||||||||||||||||||||||||||||||

(9) In making a claim under this section, a claimant shall provide to the Revenue Commissioners, through such electronic means as the Revenue Commissioners make available, the following information— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) the claimant’s name, address (including the Eircode) and PPS Number, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) the amount of any periodic payment made under a tenancy to the landlord concerned, or to a person acting on behalf of the landlord, by the claimant during the year of assessment concerned, | |||||||||||||||||||||||||||||||||||||||||||||||

(c) the aggregate amount of any payment referred to in paragraph (b), | |||||||||||||||||||||||||||||||||||||||||||||||

(d) the amount of any periodic payment referred to in paragraph (b) which was a qualifying payment, | |||||||||||||||||||||||||||||||||||||||||||||||

(e) the aggregate amount of any payment referred to in paragraph (d), | |||||||||||||||||||||||||||||||||||||||||||||||

(f) where subsection (4) applies— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) the name, address (including the Eircode) and PPS Number of the claimant’s spouse or civil partner, | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) the amount of any periodic payment made under a tenancy to the landlord concerned, or to a person acting on behalf of the landlord, by the claimant’s spouse or civil partner during the year of assessment concerned, | |||||||||||||||||||||||||||||||||||||||||||||||

(iii) the aggregate amount of any payment referred to in subparagraph (ii), | |||||||||||||||||||||||||||||||||||||||||||||||

(iv) the amount of any periodic payment referred to in subparagraph (ii) which was a qualifying payment, and | |||||||||||||||||||||||||||||||||||||||||||||||

(v) the aggregate amount of any payment referred to in subparagraph (iv), | |||||||||||||||||||||||||||||||||||||||||||||||

(g) full particulars of the tenancy under which the qualifying payment was made, including— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) the name and address (including the Eircode) of the individual who uses the residential property to which the tenancy relates as his or her principal private residence, if different to the individual referred to in paragraph (a) or (f)(i), | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) the address (including the Eircode) of the residential property concerned, if different to the address referred to in paragraph (a), | |||||||||||||||||||||||||||||||||||||||||||||||

(iii) where available to the claimant, the unique identification number assigned to the residential property concerned for the purposes of the Finance (Local Property Tax) Act 2012 , | |||||||||||||||||||||||||||||||||||||||||||||||

(iv) where available to the claimant, the unique number assigned to the tenancy concerned in accordance with section 135 of the Residential Tenancies Act 2004 , if applicable, | |||||||||||||||||||||||||||||||||||||||||||||||

(v) the duration of the tenancy, and | |||||||||||||||||||||||||||||||||||||||||||||||

(vi) where the tenancy is a licence, confirmation that the landlord has consented to the commencement of the licence, | |||||||||||||||||||||||||||||||||||||||||||||||

(h) the name and address (including the Eircode) of the person to whom the qualifying payment was made, | |||||||||||||||||||||||||||||||||||||||||||||||

(i) where available to the claimant, the name and address (including the Eircode) of the landlord concerned, if different to the person referred to in paragraph (h), | |||||||||||||||||||||||||||||||||||||||||||||||

(j) where available to the claimant, the tax reference number of the landlord concerned, and | |||||||||||||||||||||||||||||||||||||||||||||||

(k) such other information as may reasonably be required by the Revenue Commissioners to determine whether the requirements of this section are met. | |||||||||||||||||||||||||||||||||||||||||||||||

(10) (a) On being so required by an officer of the Revenue Commissioners the claimant shall, within the period of 30 days of being requested to do so by the Revenue Commissioners, make available to the officer a copy of— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) the tenancy under which the qualifying payment was made, | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) a receipt or statement of any payment made under that tenancy to the landlord concerned, or a person acting on behalf of the landlord, in the year of assessment concerned, and | |||||||||||||||||||||||||||||||||||||||||||||||

(iii) any other information that may reasonably be required by the Revenue Commissioners to determine whether the requirements of this section are met. | |||||||||||||||||||||||||||||||||||||||||||||||

(b) Any receipt or statement required under paragraph (a) shall be in writing and shall contain— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) the name of the individual who made the qualifying payment, | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) the amount of any periodic payment made under a tenancy to the landlord concerned, or to a person acting on behalf of the landlord, by that individual during the relevant year of assessment, | |||||||||||||||||||||||||||||||||||||||||||||||

(iii) the aggregate amount of any payment referred to in subparagraph (ii), | |||||||||||||||||||||||||||||||||||||||||||||||

(iv) the amount of any periodic payment referred to in subparagraph (ii) which was a qualifying payment, | |||||||||||||||||||||||||||||||||||||||||||||||

(v) the aggregate amount of any payment referred to in subparagraph (iv), | |||||||||||||||||||||||||||||||||||||||||||||||

(vi) the name and address (including the Eircode) of the individual who uses the property as his or her principal private residence, if different to the individual referred to in subparagraph (i), | |||||||||||||||||||||||||||||||||||||||||||||||

(vii) the address (including the Eircode) of the residential property in respect of which the payment referred to in subparagraph (ii) was made, | |||||||||||||||||||||||||||||||||||||||||||||||

(viii) the name and address (including the Eircode) of the person to whom the qualifying payment was made, | |||||||||||||||||||||||||||||||||||||||||||||||

(ix) the name and address (including the Eircode) of the landlord, if different to the person referred to in subparagraph (viii), and | |||||||||||||||||||||||||||||||||||||||||||||||

(x) the tax reference number of the landlord. | |||||||||||||||||||||||||||||||||||||||||||||||

(11) Failure to furnish any of the particulars referred to in subsections (9) or (10) shall be grounds for refusal of a claim and, where relief has already been given to a claimant under this section, such relief may be withdrawn by the Revenue Commissioners. | |||||||||||||||||||||||||||||||||||||||||||||||

(12) A person in receipt of a qualifying payment shall, on being so required by an officer of the Revenue Commissioners, furnish or make available to the officer, within the period of 30 days of being requested to do so by the Revenue Commissioners, any of the details set out in subsection (9) or copies of any of the documents referred to in subsection (10) which the officer considers necessary to determine whether the requirements of this section are met. | |||||||||||||||||||||||||||||||||||||||||||||||

(13) Where the claimant is entitled to a rent tax credit under subsection (2), (5), (7) or (8), as the case may be, the aggregate of such credit shall not exceed €500 or, in the case of an individual who is assessed to tax in accordance with section 1017 or 1031C in the year of assessment, €1,000. | |||||||||||||||||||||||||||||||||||||||||||||||

(14) This section shall apply in respect of the years of assessment 2022, 2023, 2024 and 2025.”. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Repeal of section 11 of Finance Act 2019 | |||||||||||||||||||||||||||||||||||||||||||||||

|

14. Section 11 of the Finance Act 2019 is repealed. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Key Employee Engagement Programme | |||||||||||||||||||||||||||||||||||||||||||||||

|

15. Section 128F of the Principal Act is amended— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) in subsection (1)— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) by the insertion of the following definitions: | |||||||||||||||||||||||||||||||||||||||||||||||

“‘qualifying group’ means, subject to subsection (2A), a group of companies that consists of the following (and no other companies): | |||||||||||||||||||||||||||||||||||||||||||||||

(a) a qualifying holding company; | |||||||||||||||||||||||||||||||||||||||||||||||

(b) its qualifying subsidiary or subsidiaries; | |||||||||||||||||||||||||||||||||||||||||||||||

(c) as the case may be, its relevant subsidiary or subsidiaries; | |||||||||||||||||||||||||||||||||||||||||||||||

‘qualifying holding company’ means a company— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) which is not controlled either directly or indirectly by another company, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) which does not carry on a trade or trades, and | |||||||||||||||||||||||||||||||||||||||||||||||

(c) whose business consists wholly or mainly of the holding of shares only in the following (and no other companies), namely, its qualifying subsidiary or subsidiaries and where it has a relevant subsidiary or subsidiaries, in that subsidiary or in each of them; | |||||||||||||||||||||||||||||||||||||||||||||||

‘qualifying subsidiary’, in relation to a qualifying holding company, means a company in respect of which more than 50 per cent of its ordinary share capital is owned directly by the qualifying holding company; | |||||||||||||||||||||||||||||||||||||||||||||||

‘relevant subsidiary’, in relation to the qualifying holding company, means a company in respect of which more than 50 per cent of its ordinary share capital is owned indirectly by the qualifying holding company, but for the purposes of this section a relevant subsidiary in relation to a qualifying holding company shall not be regarded as a qualifying company.”, | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) by the substitution of the following definition for the definition of “qualifying individual”: | |||||||||||||||||||||||||||||||||||||||||||||||

“‘qualifying individual’, in relation to a qualifying share option, means an individual who throughout the entirety of the relevant period is— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) in the case of a qualifying group, an employee or director of a qualifying company within the group, and who is required to work at least 20 hours per week for such a qualifying company or to devote not less than 75 per cent of his or her working time to such a qualifying company, and | |||||||||||||||||||||||||||||||||||||||||||||||

(b) in the case of a qualifying company not being a member of a qualifying group, an employee or director of the qualifying company, and who is required to work at least 20 hours per week for the qualifying company or to devote not less than 75 per cent of his or her working time to the qualifying company;”, | |||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||

(iii) by the substitution of the following definition for the definition of “qualifying share option”: | |||||||||||||||||||||||||||||||||||||||||||||||

“‘qualifying share option’, means a right granted to an employee or director of a qualifying company to purchase a predetermined number of shares in the qualifying company or, in the case of a qualifying group, in the qualifying holding company of the qualifying group, at a predetermined price, by reason of the individual’s employment or office in the qualifying company, where— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) the shares which may be acquired by the exercise of the share option are new ordinary fully paid up shares in the qualifying company or, in the case of a qualifying group, in the qualifying holding company, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) the option price at date of grant is not less than the market value of the same class of shares at that time, | |||||||||||||||||||||||||||||||||||||||||||||||

(c) there is a written contract or agreement in place specifying— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) the number and description of the shares which may be acquired by the exercise of the share option, | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) the option price, and | |||||||||||||||||||||||||||||||||||||||||||||||

(iii) the period during which the share options may be exercised, | |||||||||||||||||||||||||||||||||||||||||||||||

(d) the total market value of all shares, in respect of which qualifying share options have been granted in the qualifying company or, in the qualifying holding company, to an employee or director does not exceed— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) €100,000 in any year of assessment, | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) €300,000 in all years of assessment, or | |||||||||||||||||||||||||||||||||||||||||||||||

(iii) the amount of annual emoluments of the qualifying individual in the year of assessment in which the qualifying share option is granted, | |||||||||||||||||||||||||||||||||||||||||||||||

(e) the share option is exercised by the qualifying individual in the relevant period, | |||||||||||||||||||||||||||||||||||||||||||||||

(f) the shares are in a qualifying company or, in the case of a qualifying group, in the qualifying holding company, and | |||||||||||||||||||||||||||||||||||||||||||||||

(g) the share option cannot be exercised more than 10 years from the date of grant of that option;”, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) in subsection (2)— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) in paragraph (b), by the insertion of “or, in the case of a qualifying group, of the qualifying holding company,” after “qualifying company”, and | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) by the substitution of the following paragraph for paragraph (c): | |||||||||||||||||||||||||||||||||||||||||||||||

“(c) where a qualifying individual is permitted to exercise a qualifying share option despite having ceased to be an employee or director of a qualifying company, the individual shall be deemed to satisfy the requirements as set out in the definition of ‘qualifying individual’ in subsection (1) in respect of the period the individual is not employed by a qualifying company, where the individual exercises the option within 90 days of the individual ceasing to hold the employment or office concerned with the qualifying company.”, | |||||||||||||||||||||||||||||||||||||||||||||||

(c) by the insertion of the following subsection after subsection (2): | |||||||||||||||||||||||||||||||||||||||||||||||

“(2A) For the purposes of this section, a group of companies shall be treated as a qualifying group only where— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) throughout the entirety of the relevant period— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) there is at least one qualifying company in the group which is a qualifying subsidiary, | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) the activities of the qualifying group, excluding the qualifying holding company, consist wholly or mainly of the carrying on of a qualifying trade, | |||||||||||||||||||||||||||||||||||||||||||||||

(iii) each company in the qualifying group is an unquoted company none of whose shares, stock or debentures are listed on the official list of a stock exchange, or quoted on an unlisted securities market of a stock exchange, other than on— | |||||||||||||||||||||||||||||||||||||||||||||||

(I) the market known as the Euronext Growth market operated by the Irish Stock Exchange plc trading as Euronext Dublin, or | |||||||||||||||||||||||||||||||||||||||||||||||

(II) any similar or corresponding market of the stock exchange in— | |||||||||||||||||||||||||||||||||||||||||||||||

(A) a territory, other than the State, with the government of which arrangements having the force of law by virtue of section 826(1) have been made, or | |||||||||||||||||||||||||||||||||||||||||||||||

(B) an EEA state other than the State, | |||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||

(iv) each company in the qualifying group is not regarded as a company in difficulty for the purposes of the Commission Guidelines on State aid for rescuing and restructuring non-inancial undertakings in difficulty1 , | |||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||

(b) at the date of grant of the qualifying share option— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) the qualifying group is a micro, small or medium‑sized enterprise within the meaning of the Annex to Commission Recommendation 2003/361/EC of 6 May 20032 concerning the definition of micro, small and medium‑sized enterprises, and | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) the total market value of the issued, but unexercised, qualifying share options of the qualifying holding company does not exceed €3,000,000.”, | |||||||||||||||||||||||||||||||||||||||||||||||

(d) by the deletion of subsection (4), | |||||||||||||||||||||||||||||||||||||||||||||||

(e) in subsection (5)— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) in paragraph (a), by the insertion of “or, in the case of a qualifying group, of the qualifying holding company,” after “qualifying company”, | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) in paragraph (b), by the insertion of “or, in the case of a qualifying group, in the qualifying holding company” after “company” in both places where it occurs, and | |||||||||||||||||||||||||||||||||||||||||||||||

(iii) in paragraph (c)— | |||||||||||||||||||||||||||||||||||||||||||||||

(I) in subparagraph (ii), by the deletion of “paragraphs (a) and (b) of”, and | |||||||||||||||||||||||||||||||||||||||||||||||

(II) by the substitution of the following subparagraph for subparagraph (iii): | |||||||||||||||||||||||||||||||||||||||||||||||

“(iii) throughout the relevant period, the company is a qualifying company or, in the case of a qualifying group, the holding company is a qualifying holding company.”, | |||||||||||||||||||||||||||||||||||||||||||||||

(f) by the substitution of the following subsection for subsection (7): | |||||||||||||||||||||||||||||||||||||||||||||||

“(7) Where in any year of assessment a qualifying company grants a qualifying share option under this section, allots any shares or transfers any asset in pursuance of such a right, or gives any consideration for the assignment or release in whole or in part of such a right, or receives notice of the assignment of such a right, the qualifying company shall deliver particulars thereof to the Revenue Commissioners, in a format approved by them, not later than 31 March in the year of assessment following that year.”, | |||||||||||||||||||||||||||||||||||||||||||||||

(g) by the insertion of the following subsection after subsection (7): | |||||||||||||||||||||||||||||||||||||||||||||||

“(7A) Where in any year of assessment a company within a qualifying group grants a qualifying share option under this section, allots any shares or transfers any asset in pursuance of such a right, or gives any consideration for the assignment or release in whole or in part of such a right, or receives notice of the assignment of such a right, a qualifying company designated by the qualifying group shall deliver particulars thereof on behalf of the qualifying group to the Revenue Commissioners, in a format approved by them, not later than 31 March in the year of assessment following that year.”, | |||||||||||||||||||||||||||||||||||||||||||||||

(h) in subsection (8)— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) by the insertion of “, or, as the case may be, qualifying groups” after “qualifying companies”, and | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) in paragraph (a), by the insertion of “or, in the case of a qualifying group, of each member of it (and a subsequent reference in this subsection to a ‘company’ shall, as appropriate, in the case of a qualifying group be construed as including a reference to each such member)” after “company”, | |||||||||||||||||||||||||||||||||||||||||||||||

(i) by the substitution of the following subsection for subsection (10): | |||||||||||||||||||||||||||||||||||||||||||||||

“(10) A company or group shall not be regarded as a qualifying company or, as the case may be, a qualifying group for the purposes of this section where the company, or in the case of a qualifying group, the company designated for the purposes of subsection (7A), fails to comply with subsection (7) or (7A), as the case may be.”, | |||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||

(j) in subsection (11), by the substitution of “a qualifying company” for “the qualifying company”. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Share based remuneration | |||||||||||||||||||||||||||||||||||||||||||||||

|

16. (1) Section 128F of the Principal Act is amended— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) in subsection (1)— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) in paragraph (d)(ii) of the definition of “qualifying company”, by the substitution of “€6,000,000” for “€3,000,000”, and | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) in paragraph (a) of the definition of “qualifying share option”, by the substitution of “ordinary fully paid up shares” for “new ordinary fully paid up shares”, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) in paragraph (b)(ii) of subsection (2A) (inserted by section 15 of the Finance Act 2022), by the substitution of “€6,000,000” for “€3,000,000”, | |||||||||||||||||||||||||||||||||||||||||||||||

(c) in subsection (3), by the substitution of “1 January 2026” for “1 January 2024”, and | |||||||||||||||||||||||||||||||||||||||||||||||

(d) by the insertion of the following subsection after subsection (6): | |||||||||||||||||||||||||||||||||||||||||||||||

“(6A) Where— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) shares in a company are acquired on foot of a qualifying share option granted on or after 1 January 2018 and before 1 January 2026, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) those shares are subsequently redeemed, repaid or purchased by the company, and | |||||||||||||||||||||||||||||||||||||||||||||||

(c) subsection (1) of section 176 would apply in respect of the payment made by the company on the redemption, repayment or purchase of those shares, but for paragraph (a)(i)(I) of that subsection not being satisfied, | |||||||||||||||||||||||||||||||||||||||||||||||

subsection (1) of section 176 shall be deemed to apply in respect of the payment, notwithstanding that paragraph (a)(i)(I) of that subsection is not satisfied.”. | |||||||||||||||||||||||||||||||||||||||||||||||

(2) Section 128B of the Principal Act is amended, in paragraph (b) of subsection (9), by the substitution of “0.0219” for “0.0322”. | |||||||||||||||||||||||||||||||||||||||||||||||

(3) Schedule 29 of the Principal Act is amended, in Column 3, by the insertion of “section 128B(4)” before “section 128C(15) ”. | |||||||||||||||||||||||||||||||||||||||||||||||

(4) Subsection (1) shall come into operation on such day or days as the Minister for Finance shall appoint either generally or with reference to any particular purpose or provision and different days may be so appointed for different purposes or different provisions. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 823A of Principal Act (deduction for income earned in certain foreign states) | |||||||||||||||||||||||||||||||||||||||||||||||

|

17. Section 823A of the Principal Act is amended— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) in subsection (1), in the definition of “relevant state”, by the substitution of “2025” for “2022” in each place where it occurs, and | |||||||||||||||||||||||||||||||||||||||||||||||

(b) in subsection (6), by the substitution of “2015 to 2025” for “2015 to 2022”. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of section 825C of Principal Act (special assignee relief programme) | |||||||||||||||||||||||||||||||||||||||||||||||

|

18. Section 825C of the Principal Act is amended— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) by the insertion of the following subsection after subsection (2A): | |||||||||||||||||||||||||||||||||||||||||||||||

“(2AA) In this section, in the case of an individual who arrives in the State in any of the tax years 2023 to 2025, ‘relevant employee’ means an individual— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) who for the whole of the 6 months immediately before his or her arrival in the State was a full time employee of a relevant employer and exercised the duties of his or her employment for that relevant employer outside the State, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) who arrives in the State at the request of his or her relevant employer to— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) perform in the State duties of his or her employment for that employer, or | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) to take up employment in the State with an associated company and to perform duties in the State for that company, | |||||||||||||||||||||||||||||||||||||||||||||||

(c) who performs the duties referred to in paragraph (b) for a minimum period of 12 consecutive months from the date he or she first performs those duties in the State, | |||||||||||||||||||||||||||||||||||||||||||||||

(d) to whom a PPS number has been issued, | |||||||||||||||||||||||||||||||||||||||||||||||

(e) who was not resident in the State for the 5 tax years immediately preceding the tax year in which he or she first arrives in the State for the purposes of performing the duties referred to in paragraph (b), and | |||||||||||||||||||||||||||||||||||||||||||||||

(f) in respect of whom the relevant employer or associated company certifies, in such form as the Revenue Commissioners may require, within 90 days from the employee’s arrival in the State to perform the duties referred to in paragraph (b), that— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) the individual complies with the conditions set out in paragraphs (a) to (d), and | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) the relevant employer or associated company has complied with Regulation 17(2) of the Income Tax (Employments) Regulations 2018 ( S.I. No. 345 of 2018 ).”, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) in subsection (2B)(b)— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) in subparagraph (i)— | |||||||||||||||||||||||||||||||||||||||||||||||

(I) by the substitution of “referred to in subsection (2)(a)(ii), (2A)(b) or (2AA)(b)” for “referred to in subsection (2)(a)(ii) or (2A)(b) ”, and | |||||||||||||||||||||||||||||||||||||||||||||||

(II) in subclause (B), by the substitution of “set out in subsection (2A)(b) or (2AA)(b)” for “set out in subsection (2A)(b)”, | |||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) by the substitution of the following subparagraph for subparagraph (ii): | |||||||||||||||||||||||||||||||||||||||||||||||

“(ii) ‘B’ is €75,000 or, in the case of a relevant employee who arrives in the State in any of the tax years 2023 to 2025, €100,000.”, | |||||||||||||||||||||||||||||||||||||||||||||||

(c) in subsection (3)(a)— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) by the substitution of the following subparagraph for subparagraph (ii): | |||||||||||||||||||||||||||||||||||||||||||||||

“(ii) performs the duties referred to in subsection (2)(a)(ii), (2A)(b) or (2AA)(b), and”, | |||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) by the substitution of the following subparagraph for subparagraph (iii): | |||||||||||||||||||||||||||||||||||||||||||||||

“(iii) has relevant income from his or her relevant employer or from the associated company, the annualised equivalent of which is— | |||||||||||||||||||||||||||||||||||||||||||||||

(I) subject to clause (II) , not less than €75,000, or | |||||||||||||||||||||||||||||||||||||||||||||||

(II) in the case of a relevant employee who arrives in the State in any of the tax years 2023 to 2025, not less than €100,000,”, | |||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||

(d) in subsection (4)(b)— | |||||||||||||||||||||||||||||||||||||||||||||||

(i) by the substitution of “2025” for “2022”, and | |||||||||||||||||||||||||||||||||||||||||||||||

(ii) in subparagraph (i), by the substitution of “set out in subsection (2A)(b) or (2AA)(b)” for “set out in subsection (2A)(b) ”. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Amendment of Part 7 of Principal Act (lump sums from foreign pension arrangements) | |||||||||||||||||||||||||||||||||||||||||||||||

|

19. Part 7 of the Principal Act is amended— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) by the insertion of the following section after section 200: | |||||||||||||||||||||||||||||||||||||||||||||||

“Lump sums from foreign pension arrangements | |||||||||||||||||||||||||||||||||||||||||||||||

200A. (1) (a) In this section— | |||||||||||||||||||||||||||||||||||||||||||||||

‘administrator’, in relation to a foreign pension arrangement, means the person or persons having the management of the foreign pension arrangement; | |||||||||||||||||||||||||||||||||||||||||||||||

‘domestic lump sum’ means a lump sum referred to in paragraph (b) of subsection (1) of section 790AA construed in accordance with paragraph (c) of that subsection; | |||||||||||||||||||||||||||||||||||||||||||||||

‘excess lump sum’ shall be construed in accordance with paragraph (d); | |||||||||||||||||||||||||||||||||||||||||||||||

‘foreign pension arrangement’ means a contract, an agreement, a series of agreements, a trust deed or other arrangement, other than a state social security scheme, which— | |||||||||||||||||||||||||||||||||||||||||||||||

(a) is established in, or entered into under the law of, a territory other than the State, | |||||||||||||||||||||||||||||||||||||||||||||||

(b) is, in good faith, established for the sole purpose of providing benefits of a kind similar to those referred to in Chapter 1, 2, 2A or 2D of Part 30, and | |||||||||||||||||||||||||||||||||||||||||||||||

(c) is not a relevant pension arrangement; | |||||||||||||||||||||||||||||||||||||||||||||||

‘relevant pension arrangement’ has the same meaning as it has in section 790AA; | |||||||||||||||||||||||||||||||||||||||||||||||

‘specified date’ means 1 January 2023; | |||||||||||||||||||||||||||||||||||||||||||||||

‘standard chargeable amount’ has the same meaning as it has in section 790AA; | |||||||||||||||||||||||||||||||||||||||||||||||

‘standard rate’ means the standard rate of income tax in force at the time the foreign lump sum is paid; | |||||||||||||||||||||||||||||||||||||||||||||||

‘tax free amount’ has the same meaning as it has in section 790AA; | |||||||||||||||||||||||||||||||||||||||||||||||

‘tax year’ means a year of assessment within the meaning of the Tax Acts. | |||||||||||||||||||||||||||||||||||||||||||||||