S.I. No. 713/2020 - European Union (Bank Recovery and Resolution) (Amendment) Regulations 2020

Notice of the making of this Statutory Instrument was published in | |||||||||||||||||||||||||||||||||||||||||||||||||

“Iris Oifigiúil” of 5th January, 2021. | |||||||||||||||||||||||||||||||||||||||||||||||||

CONTENTS | |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

I, PASCHAL DONOHOE, Minister for Finance, in exercise of the powers conferred on me by section 3 of the European Communities Act 1972 (No. 27 of 1972) and for the purpose of giving effect to Directive (EU) 2019/879 of the European Parliament and of the Council of 20 May 20191 amending Directive 2014/59/EU2 as regards the loss-absorbing and recapitalisation capacity of credit institutions and investment firms and Directive 98/26/EC3 , hereby make the following regulations: | |||||||||||||||||||||||||||||||||||||||||||||||||

Citation and commencement | |||||||||||||||||||||||||||||||||||||||||||||||||

1. (1) These Regulations may be cited as the European Union (Bank Recovery and Resolution) (Amendment) Regulations 2020. | |||||||||||||||||||||||||||||||||||||||||||||||||

(2) These Regulations come into operation on 28 December 2020. | |||||||||||||||||||||||||||||||||||||||||||||||||

Definition | |||||||||||||||||||||||||||||||||||||||||||||||||

2. In these Regulations “Regulations of 2015” means the European Union (Bank Recovery and Resolution) Regulations 2015 ( S.I. No. 289 of 2015 ). | |||||||||||||||||||||||||||||||||||||||||||||||||

Amendment of Regulation 3 of Regulations of 2015 (interpretation) | |||||||||||||||||||||||||||||||||||||||||||||||||

3. Regulation 3 of the Regulations of 2015 is amended in paragraph (1) — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) in the definition of “aggregate amount”, by the substitution of “bail-inable liabilities” for “eligible securities”, | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) by the substitution of the following definition for the definition of “Bank Recovery and Resolution Directive”: | |||||||||||||||||||||||||||||||||||||||||||||||||

“ ‘Bank Recovery and Resolution Directive’ means Directive 2014/59/EU of the European Parliament and of the Council of 15 May 20144 establishing a framework for the recovery and resolution of credit institutions and investment firms, as amended by Directive (EU) 2017/2399 of the European Parliament and of the Council of 12 December 20175 and Directive (EU) 2019/879 of the European Parliament and of the Council of 20 May 20196 ;”, | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) by the substitution of the following definition for the definition of “eligible liabilities”: | |||||||||||||||||||||||||||||||||||||||||||||||||

“ ‘eligible liabilities’ means bail-inable liabilities that satisfy, as applicable, the conditions of Regulation 80D or 80H(6)(a) and Tier 2 instruments that meet the conditions of point (b) of Article 72a(1) of the Union Capital Requirements Regulation;”, | |||||||||||||||||||||||||||||||||||||||||||||||||

(d) by the substitution of the following for the definition of “subsidiary”: | |||||||||||||||||||||||||||||||||||||||||||||||||

“ ‘subsidiary’ means a subsidiary as defined in point (16) of Article 4(1) of the Union Capital Requirements Regulation, and for the purpose of applying Regulations 14, 21, 28, 29, 80B to 80O, 95 to 98, 155 and 156 to resolution groups referred to in subparagraph (b) of the definition in this paragraph of ‘resolution group’, includes, where and as appropriate, credit institutions that are permanently affiliated to a central body, the central body itself, and their respective subsidiaries, taking into account the way in which such resolution groups comply with Regulation 80G(3);”, | |||||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||||

(e) by the insertion of the following definitions: | |||||||||||||||||||||||||||||||||||||||||||||||||

“ ‘bail-inable liabilities’ means the liabilities and capital instruments that do not qualify as Common Equity Tier 1, Additional Tier 1 instruments or Tier 2 instruments of an institution or entity referred to in Regulation 2(1)(b) to (i) that are not excluded from the scope of the bail-in tool by virtue of Regulation 80(2); | |||||||||||||||||||||||||||||||||||||||||||||||||

‘combined buffer requirement’ has the meaning assigned to it in Regulation 115(g) of the Capital Requirements Regulations; | |||||||||||||||||||||||||||||||||||||||||||||||||

‘Common Equity Tier 1 capital’ means Common Equity Tier 1 capital as calculated in accordance with Article 50 of the Union Capital Requirements Regulation; | |||||||||||||||||||||||||||||||||||||||||||||||||

‘ESMA’ means the European Securities and Markets Authority (established by Regulation (EU) No 1095/20107 ); | |||||||||||||||||||||||||||||||||||||||||||||||||

‘global systemically important institution’ or ‘G-SII’ means a G-SII as defined in point (133) of Article 4(1) of the Union Capital Requirements Regulation; | |||||||||||||||||||||||||||||||||||||||||||||||||

‘material subsidiary’ means a material subsidiary as defined in point (135) of Article 4(1) of the Union Capital Requirements Regulation; | |||||||||||||||||||||||||||||||||||||||||||||||||

‘resolution entity’ means — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) a legal person established in the Union, which, in accordance with Regulation 21, is identified by the resolution authority as an entity in respect of which the resolution plan provides for resolution action, or | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) an institution that is not part of a group that is subject to consolidated supervision pursuant to Articles 111 and 112 of the Capital Requirements Directive, in respect of which the resolution plan drawn up pursuant to Article 10 of the Bank Recovery and Resolution Directive provides for resolution action; | |||||||||||||||||||||||||||||||||||||||||||||||||

‘resolution group’ means — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) a resolution entity and its subsidiaries that are not — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) resolution entities themselves, | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) subsidiaries of other resolution entities, | |||||||||||||||||||||||||||||||||||||||||||||||||

or | |||||||||||||||||||||||||||||||||||||||||||||||||

(iii) entities established in a third country that are not included in the resolution group in accordance with the resolution plan and their subsidiaries, | |||||||||||||||||||||||||||||||||||||||||||||||||

or | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) credit institutions permanently affiliated to a central body and the central body itself when at least one of those credit institutions or the central body is a resolution entity, and their respective subsidiaries; | |||||||||||||||||||||||||||||||||||||||||||||||||

‘subordinated eligible instruments’ means instruments that meet all of the conditions referred to in Article 72a of the Union Capital Requirements Regulation other than paragraphs (3) to (5) of Article 72b of that Regulation;”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Amendment of Regulation 13 of Regulations of 2015 (assessment of recovery plans) | |||||||||||||||||||||||||||||||||||||||||||||||||

4. Regulation 13 of the Regulations of 2015 is amended in paragraph (4) by the substitution of “may examine” for “shall examine”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Amendment of Regulation 17 of Regulations of 2015 (resolution plans) | |||||||||||||||||||||||||||||||||||||||||||||||||

5. Regulation 17 of the Regulations of 2015 is amended — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) by the insertion of the following paragraph after paragraph (7): | |||||||||||||||||||||||||||||||||||||||||||||||||

“(7A) The review of resolution plans referred to in paragraphs (6) and (7) shall be carried out after the implementation of resolution actions or the exercise of powers referred to in Regulation 95.”, | |||||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) by the insertion of the following paragraph after paragraph (11): | |||||||||||||||||||||||||||||||||||||||||||||||||

“(12) When setting the deadline referred to in Regulation 18(2)(o) and the timeline referred to in Regulation 18(2)(p) in the circumstances referred to in paragraph (7A), the resolution authority shall take into account any deadline that may be set to comply with the requirement referred to in Regulation 92B of the Capital Requirements Regulations.”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Amendment of Regulation 18 of Regulations of 2015 (contents of resolution plan) | |||||||||||||||||||||||||||||||||||||||||||||||||

6. Regulation 18(2) of the Regulations of 2015 is amended by the substitution of the following subparagraphs for subparagraphs (o) and (p): | |||||||||||||||||||||||||||||||||||||||||||||||||

“(o) the requirements referred to in Regulations 80G and 80H and a deadline to reach that level in accordance with Regulation 80O; | |||||||||||||||||||||||||||||||||||||||||||||||||

(p) where the resolution authority applies paragraphs (7) to (11), paragraphs (12) and (13), or Regulation 80D(16), a timeline for compliance by the resolution entity in accordance with Regulation 80O;”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Amendment of Regulation 21 of Regulations of 2015 (resolution plans for institutions that are part of a group) | |||||||||||||||||||||||||||||||||||||||||||||||||

7. The following Regulation is substituted for Regulation 21 of the Regulations of 2015: | |||||||||||||||||||||||||||||||||||||||||||||||||

“21. (1) Where the resolution authority is the group-level resolution authority it shall — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) together with the Union resolution authorities of subsidiaries of the group outside the State, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) having consulted with the Union resolution authorities of significant branches of the group outside the State in so far as is relevant to the significant branch, | |||||||||||||||||||||||||||||||||||||||||||||||||

prepare the group resolution plan on the basis of information provided to it in accordance with Regulation 20. | |||||||||||||||||||||||||||||||||||||||||||||||||

(2) A group resolution plan shall identify measures to be taken in respect of — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) the Union parent undertaking, | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) subsidiaries of the group established in the Union, | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) entities referred to in Regulation 2(1)(c) to (i), and | |||||||||||||||||||||||||||||||||||||||||||||||||

(d) subject to Part 6, subsidiaries of the group established outside the Union. | |||||||||||||||||||||||||||||||||||||||||||||||||

(3) The group resolution plan shall, in accordance with the measures referred to in paragraph (2), identify in respect of the group — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) the resolution entities, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) the resolution groups. | |||||||||||||||||||||||||||||||||||||||||||||||||

(4) In addition to the matters set out in Regulation 18, a group resolution plan shall - | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) set out — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) the resolution actions that are to be taken for resolution entities in the scenarios referred to in Regulation 17(9), and | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) the implications of the resolution actions referred to in clause (i) in respect of — | |||||||||||||||||||||||||||||||||||||||||||||||||

(I) other group entities referred to in Regulation 2(1)(b) to (i), | |||||||||||||||||||||||||||||||||||||||||||||||||

(II) the parent undertaking, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(III) subsidiary institutions, | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) where a group comprises more than one resolution group, set out the resolution actions that are to be taken for the resolution entities of each resolution group and the implications of those actions on both of the following: | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) other group entities that belong to the same resolution group; | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) other resolution groups, | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) examine the extent to which the resolution tools could be applied, and the resolution powers exercised, with respect to resolution entities established in the Union in a coordinated manner, including measures to facilitate the purchase by a third party of the group as a whole, of separate business lines or activities that are provided by a number of group entities, or of particular group entities or resolution groups, and identify any potential impediments to a coordinated resolution, | |||||||||||||||||||||||||||||||||||||||||||||||||

(d) where a group includes entities incorporated in third countries, identify — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) the implications for the resolution of group entities within the Union, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) appropriate arrangements for cooperation and coordination with the relevant authorities in those third countries, | |||||||||||||||||||||||||||||||||||||||||||||||||

(e) identify measures, including the legal and economic separation of particular functions or business lines, that are necessary to facilitate group resolution when the conditions for resolution are met, | |||||||||||||||||||||||||||||||||||||||||||||||||

(f) set out any additional actions, not referred to in these Regulations, which the relevant resolution authorities intend to take in relation to the entities within each resolution group, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(g) identify how the group resolution actions could be financed and, where the financing arrangement would be required, set out principles, in accordance with paragraph (5), for sharing responsibility for that financing between sources of funding in different Member States. | |||||||||||||||||||||||||||||||||||||||||||||||||

(5) The principles referred to in paragraph (4)(g) shall be based on equitable and balanced criteria and shall take into account in particular — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) Regulation 172(5), and | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) the impact on financial stability in all Member States concerned. | |||||||||||||||||||||||||||||||||||||||||||||||||

(6) In preparing and assessing a group resolution plan and assessing the resolvability of the group, the resolution authority shall not assume any of the following: | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) any extraordinary public financial support, other than through the use of the Fund; | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) any emergency liquidity assistance provided by the Bank or by another central bank; | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) any liquidity assistance provided by the Bank or by another central bank under non-standard collateralisation, duration and interest rate terms. | |||||||||||||||||||||||||||||||||||||||||||||||||

(7) When drawing up and updating a group resolution plan, the resolution authority shall also carry out an assessment of the resolvability of the group pursuant to Regulation 27 and shall include a detailed description of this assessment of resolvability in the group resolution plan. | |||||||||||||||||||||||||||||||||||||||||||||||||

(8) When preparing a group resolution plan, the resolution authority shall, together with Union resolution authorities of subsidiaries outside the State, have regard to the need to ensure that the group resolution plan does not have a disproportionate impact on any Member State.”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Amendment of Regulation 24 of Regulations of 2015 (assessment of group resolution plan) | |||||||||||||||||||||||||||||||||||||||||||||||||

8. Regulation 24 of the Regulations of 2015 is amended — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) by the insertion of the following paragraph after paragraph (1): | |||||||||||||||||||||||||||||||||||||||||||||||||

“(1A) Where a group is composed of more than one resolution group, the planning of the resolution actions referred to in subparagraph (b) of Regulation 21(4) shall be included in a joint decision referred to in paragraph (1).”, | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) by the substitution of the following paragraph for paragraph (9): | |||||||||||||||||||||||||||||||||||||||||||||||||

“(9) Where the Union resolution authorities and the resolution authority have not made a joint decision within four months under paragraph (8), the resolution authority, where it is responsible for a subsidiary and disagrees with the group resolution plan, shall make its own decision and, where appropriate, identify the resolution entity and draw up and maintain a resolution plan for the resolution group composed of entities under its jurisdiction.”, | |||||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) by the substitution of the following paragraph for paragraph (10): | |||||||||||||||||||||||||||||||||||||||||||||||||

“(10) A decision under paragraph (9) shall — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) be fully substantiated, | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) set out the reasons for the disagreement with the proposed group resolution plan, | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) take into account the views and reservations of the other resolution authorities and competent authorities, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(d) be notified to the other members of the resolution college by the resolution authority.”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Amendment of Regulation 27 of Regulations of 2015 (assessment of resolvability for groups) | |||||||||||||||||||||||||||||||||||||||||||||||||

9. Regulation 27 of the Regulations of 2015 is amended — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) by the substitution of the following paragraph for paragraph (3): | |||||||||||||||||||||||||||||||||||||||||||||||||

“(3) A group shall be considered resolvable if the resolution authority, together with the relevant Union resolution authorities of subsidiaries of the group, assesses that it is feasible and credible that the resolution authorities would be capable of — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) either — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) winding up group entities under normal insolvency proceedings, or | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) taking resolution action in respect of that group by applying resolution tools to, and exercising resolution powers with respect to, resolution entities of that group, | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) avoiding to the maximum extent possible any significant adverse consequences for the financial system of the State or other Member State or the Union, including broader financial instability or system-wide events, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) ensuring the continuity of any critical functions carried out by those group entities, where they can easily be separated in a timely manner, or by other means.”, | |||||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) by the insertion of the following paragraph after paragraph (7): | |||||||||||||||||||||||||||||||||||||||||||||||||

“(8) (a) Where a group is composed of more than one resolution group, the resolution authority shall assess the resolvability of each resolution group in accordance with this Regulation. | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) The resolution authority shall carry out the assessment referred to in subparagraph (a) – | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) in addition to the assessment of the resolvability of the entire group, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) in compliance with the decision-making procedure set out in Regulations 22 to 24.”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Power to prohibit certain distributions | |||||||||||||||||||||||||||||||||||||||||||||||||

10. The following Regulation is inserted after Regulation 27 of the Regulations of 2015: | |||||||||||||||||||||||||||||||||||||||||||||||||

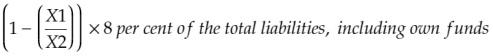

“27A. (1) (a) This paragraph applies where an entity referred to in Regulation 2(1) meets the combined buffer requirement when considered in addition to each of the requirements referred to in Regulation 129A(1)(a), (b) and (c) of the Capital Requirements Regulations, but fails to meet the combined buffer requirement when considered in addition to the requirements referred to in Regulations 80E and 80F, when calculated in accordance with Regulation 80B(2)(a). | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) Where this paragraph applies, the resolution authority, where it is the resolution authority of the entity concerned, may, in accordance with paragraphs (2) and (3), prohibit an entity from distributing more than the Maximum Distributable Amount related to the minimum requirement for own funds and eligible liabilities (in this Regulation referred to as ‘M-MDA’), calculated in accordance with paragraph (4), through any of the following actions: | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) making a distribution in connection with Common Equity Tier 1 capital; | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) creating an obligation to pay variable remuneration or discretionary pension benefits, or to pay variable remuneration if the obligation to pay was created at a time when the entity failed to meet the combined buffer requirement; | |||||||||||||||||||||||||||||||||||||||||||||||||

(iii) making payments on Additional Tier 1 instruments. | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) Where this paragraph applies in respect of an entity, the entity shall immediately notify the resolution authority that this paragraph so applies. | |||||||||||||||||||||||||||||||||||||||||||||||||

(2) (a) Where paragraph (1) applies in respect of an entity, the resolution authority of the entity, after consulting with the competent authority, shall, without unnecessary delay, assess whether to exercise the power referred to in paragraph (1), taking into account all of the following elements: | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) the reason, duration and magnitude of the failure and its impact on the resolvability of the entity; | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) the development of the entity’s financial situation and the likelihood of it satisfying, in the foreseeable future, the condition referred to in Regulation 62(1)(a); | |||||||||||||||||||||||||||||||||||||||||||||||||

(iii) the prospect that the entity will be able to ensure compliance with the requirements referred to in paragraph (1) within a reasonable timeframe; | |||||||||||||||||||||||||||||||||||||||||||||||||

(iv) where the entity is unable to replace liabilities that no longer meet the eligibility or maturity criteria laid down in Articles 72b and 72c of the Union Capital Requirements Regulation, or in Regulation 80D or 80H(6), if that inability is entity-specific or is due to market-wide disturbance; | |||||||||||||||||||||||||||||||||||||||||||||||||

(v) whether the exercise of the power referred to in paragraph (1) is the most adequate and proportionate means of addressing the situation of the entity, taking into account its potential impact on both the financing conditions and resolvability of the entity concerned. | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) The resolution authority shall repeat its assessment of whether to exercise the power referred to in paragraph (1) at least every month for as long as paragraph (1) applies in respect of the entity concerned. | |||||||||||||||||||||||||||||||||||||||||||||||||

(3) (a) If the resolution authority finds that paragraph (1) continues to apply in respect of an entity 9 months after the entity has notified the resolution authority in accordance with paragraph (1)(c), the resolution authority, after consulting with the competent authority, shall exercise the power referred to in paragraph (1), except where the resolution authority finds, following an assessment, that at least two of the following conditions are satisfied: | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) the failure referred to in paragraph (1)(a) is due to a serious disturbance to the functioning of financial markets which leads to broad-based financial market stress across several segments of financial markets; | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) the disturbance referred to in clause (i) not only results in the increased price volatility of the own funds instruments and eligible liabilities instruments of the entity or increased costs for the entity, but also leads to a full or partial closure of markets which prevents the entity from issuing own funds instruments and eligible liabilities instruments on those markets; | |||||||||||||||||||||||||||||||||||||||||||||||||

(iii) the market closure referred to in clause (ii) is observed not only for the concerned entity, but also for several other entities; | |||||||||||||||||||||||||||||||||||||||||||||||||

(iv) the disturbance referred to in clause (i) prevents the concerned entity from issuing own funds instruments and eligible liabilities instruments sufficient to remedy the failure; | |||||||||||||||||||||||||||||||||||||||||||||||||

(v) an exercise of the power referred to in paragraph (1) leads to negative spill-over effects for part of the banking sector, thereby potentially undermining financial stability. | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) Where the exception referred to in subparagraph (a) applies, the resolution authority shall notify the competent authority of its decision and shall explain its assessment in writing. | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) The resolution authority shall, every month, repeat its assessment of whether the exception referred to in subparagraph (a) applies. | |||||||||||||||||||||||||||||||||||||||||||||||||

(4) (a) The M-MDA shall be calculated by multiplying the sum calculated in accordance with paragraph (5) by the factor determined in accordance with paragraph (6). | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) The M-MDA shall be reduced by any amount resulting from any of the actions referred to in clause (i), (ii) or (iii) of paragraph (1)(b). | |||||||||||||||||||||||||||||||||||||||||||||||||

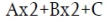

(5) The sum to be multiplied in accordance with paragraph (4) shall consist of — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) any interim profits not included in Common Equity Tier 1 capital pursuant to Article 26(2) of the Union Capital Requirements Regulation, net of any distribution of profits or any payment resulting from the actions referred to in clause (i), (ii) or (iii) of paragraph (1)(b), | |||||||||||||||||||||||||||||||||||||||||||||||||

plus | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) any year-end profits not included in Common Equity Tier 1 capital pursuant to Article 26(2) of the Union Capital Requirements Regulation, net of any distribution of profits or any payment resulting from the actions referred to in clause (i), (ii) or (iii) of paragraph (1)(b), | |||||||||||||||||||||||||||||||||||||||||||||||||

minus | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) amounts which would be payable by tax if the items specified in subparagraphs (a) and (b) were to be retained. | |||||||||||||||||||||||||||||||||||||||||||||||||

(6) (a) The factor referred to in paragraph (4) shall be determined as follows: | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) where the Common Equity Tier 1 capital maintained by the entity which is not used to meet any of the requirements set out in Article 92a of the Union Capital Requirements Regulation and in Regulations 80E and 80F, expressed as a percentage of the total risk exposure amount calculated in accordance with Article 92(3) of the Union Capital Requirements Regulation, is within the first (that is, the lowest) quartile of the combined buffer requirement, the factor shall be 0; | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) where the Common Equity Tier 1 capital maintained by the entity which is not used to meet any of the requirements set out in Article 92a of the Union Capital Requirements Regulation and in Regulations 80E and 80F, expressed as a percentage of the total risk exposure amount calculated in accordance with Article 92(3) of the Union Capital Requirements Regulation, is within the second quartile of the combined buffer requirement, the factor shall be 0.2; | |||||||||||||||||||||||||||||||||||||||||||||||||

(iii) where the Common Equity Tier 1 capital maintained by the entity which is not used to meet the requirements set out in Article 92a of the Union Capital Requirements Regulation and in Regulations 80E and 80F, expressed as a percentage of the total risk exposure amount calculated in accordance with Article 92(3) of the Union Capital Requirements Regulation, is within the third quartile of the combined buffer requirement, the factor shall be 0.4; | |||||||||||||||||||||||||||||||||||||||||||||||||

(iv) where the Common Equity Tier 1 capital maintained by the entity which is not used to meet the requirements set out in Article 92a of the Union Capital Requirements Regulation and in Regulations 80E and 80F, expressed as a percentage of the total risk exposure amount calculated in accordance with Article 92(3) of the Union Capital Requirements Regulation, is within the fourth (that is, the highest) quartile of the combined buffer requirement, the factor shall be 0.6. | |||||||||||||||||||||||||||||||||||||||||||||||||

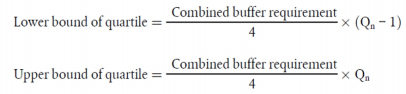

(b) The lower and upper bounds of each quartile of the combined buffer requirement shall be calculated as follows: | |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

where “Qn” = the ordinal number of the quartile concerned.”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Amendment of Regulation 28 of Regulations of 2015 (powers to address or remove impediments to resolvability) | |||||||||||||||||||||||||||||||||||||||||||||||||

11. The following Regulation is substituted for Regulation 28 of the Regulations of 2015: | |||||||||||||||||||||||||||||||||||||||||||||||||

“28. (1) When, pursuant to an assessment of resolvability for an entity carried out in accordance with Regulations 26 and 27, the resolution authority, after consulting with the competent authority, determines that there are substantive impediments to the resolvability of that entity, that resolution authority shall notify, in writing, that determination to the entity concerned, to the competent authority and to the resolution authorities of the jurisdictions in which significant branches are located. | |||||||||||||||||||||||||||||||||||||||||||||||||

(2) The entity shall, within four months of the date of receipt of a notification made in accordance with paragraph (1), propose to the resolution authority possible measures to address or remove the substantive impediments identified in the notification. | |||||||||||||||||||||||||||||||||||||||||||||||||

(3) (a) The entity shall, within 2 weeks of the date of receipt of a notification made in accordance with paragraph (1), propose to the resolution authority possible measures and the timeline for their implementation to ensure that the entity complies with Regulation 80G or 80H and the combined buffer requirement, where a substantive impediment to resolvability is due to either of the following situations: | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) the entity meets the combined buffer requirement when considered in addition to each of the requirements referred to in Regulation 129A(1)(a), (b) and (c) of the Capital Requirements Regulations, but it does not meet the combined buffer requirement when considered in addition to the requirements referred to in Regulation 80E and 80F when calculated in accordance with Regulation 80B(2)(a); | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) the entity does not meet the requirements referred to in Articles 92a and 494 of the Union Capital Requirements Regulation or the requirements referred to in Regulations 80E and 80F. | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) The timeline for the implementation of measures proposed by the entity under subparagraph (a) shall take into account the reasons for the substantive impediment. | |||||||||||||||||||||||||||||||||||||||||||||||||

(4) The resolution authority, after consulting with the competent authority, shall assess whether the measures proposed under paragraph (2) or (3)(a), as the case may be, effectively address or remove the substantive impediment concerned. | |||||||||||||||||||||||||||||||||||||||||||||||||

(5) (a) Where the resolution authority finds that the measures proposed by an entity in accordance with paragraph (2) or (3)(a), as the case may be, do not effectively reduce or remove the impediments concerned, it shall, either directly or indirectly through the competent authority, direct the entity to take alternative measures that may achieve that objective, and notify, in writing, those alternative measures to the entity. | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) On receipt of a notification under subparagraph (a), the entity shall propose, within one month of the date of such receipt, a plan in writing to comply with the alternative measures. | |||||||||||||||||||||||||||||||||||||||||||||||||

(6) (a) In identifying the alternative measures referred to in paragraph (5), the resolution authority shall demonstrate — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) how the measures proposed by the entity under paragraph (2) or (3)(a), as the case may be, would not be sufficient to remove the impediments to resolvability, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) how the alternative measures proposed are proportionate in removing those impediments. | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) The resolution authority shall take into account — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) any threat the impediments to resolvability pose to financial stability, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) the effect of the alternative measures proposed on the business of the entity, its stability and its ability to contribute to the economy. | |||||||||||||||||||||||||||||||||||||||||||||||||

(7) Before identifying any alternative measure referred to in paragraph (5), the resolution authority, after consulting with the competent authority and, where appropriate, the national macro-prudential authority, shall duly consider the potential effect of those measures on the particular entity, on the internal market for financial services, and on the financial stability in other Member States and in the Union as a whole. | |||||||||||||||||||||||||||||||||||||||||||||||||

(8) Any determination under paragraph (1) or direction under paragraph (5) shall be supported by reasons for the determination or direction, as the case may be, and, in the case of a direction under paragraph (5), shall indicate how the decision complies with the requirement for proportionate application set out in paragraph (6). | |||||||||||||||||||||||||||||||||||||||||||||||||

(9) The requirement for the resolution authority to prepare resolution plans and reach a joint decision on group resolution plans in Regulations 17(1) to (4) and 24(1) to (3) shall be suspended following a notification referred to in paragraph (1) until either — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) the measures proposed by the entity pursuant to paragraph (2) or (3)(a), as the case may be, are accepted by the resolution authority, or | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) the resolution authority directs, pursuant to paragraph (5), the entity to take alternative measures. | |||||||||||||||||||||||||||||||||||||||||||||||||

(10) For the purposes of paragraph (5), the resolution authority may give a direction requiring the taking of one or more than one of the following measures: | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) that the entity revise any intra-group financing agreement or review the absence thereof; | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) that the entity put in place service agreements, whether with other group entities or third parties, to cover the provision of critical functions; | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) that the entity limit its maximum individual or aggregate exposures; | |||||||||||||||||||||||||||||||||||||||||||||||||

(d) that the entity provide additional information relevant for resolution purposes, including through regular reporting requirements; | |||||||||||||||||||||||||||||||||||||||||||||||||

(e) that the entity divest specific assets; | |||||||||||||||||||||||||||||||||||||||||||||||||

(f) that the entity limit or cease specific existing or proposed activities; | |||||||||||||||||||||||||||||||||||||||||||||||||

(g) that the entity restrict or prevent the development of new or existing business lines or sale of new or existing products; | |||||||||||||||||||||||||||||||||||||||||||||||||

(h) that the entity make changes to legal or operational structures of the entity or any group entity, either directly or indirectly under its control, in order to reduce complexity and ensure that critical functions can be legally and operationally separated from other functions through the application of the resolution tools; | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) that an entity or a parent undertaking establish a parent financial holding company in a Member State or a Union parent financial holding company; | |||||||||||||||||||||||||||||||||||||||||||||||||

(j) that an institution or an entity referred to in Regulation 2(1)(b) to (i) submit a plan to restore compliance with the requirements of Regulation 80G or 80H, expressed as a percentage of the total risk exposure amount calculated in accordance with Article 92(3) of the Union Capital Requirements Regulation and, where applicable, with the combined buffer requirement and with the requirements referred to in Regulations 80G and 80H expressed as a percentage of the total exposure measure referred to in Articles 429 and 429a of the Union Capital Requirements Regulation; | |||||||||||||||||||||||||||||||||||||||||||||||||

(k) that an institution or entity referred to in Regulation 2(1)(b) to (i) issue eligible liabilities to meet the requirements of Regulation 80G or 80H; | |||||||||||||||||||||||||||||||||||||||||||||||||

(l) that an institution or entity referred to in Regulation 2(1)(b) to (i) take other steps to meet the minimum requirement for own funds and eligible liabilities under Regulation 80G or 80H, including in particular to attempt to renegotiate any eligible liability, Additional Tier 1 instrument or Tier 2 instrument it has issued, with a view to ensuring that any decision of the resolution authority to write down or convert that liability or instrument would be effected under the law of the jurisdiction governing that liability or instrument; | |||||||||||||||||||||||||||||||||||||||||||||||||

(m) for the purpose of ensuring ongoing compliance with Regulation 80G or 80H, that an institution or entity referred to in Regulation 2(1)(b) to (i) change the maturity profile of — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) own funds instruments, after having obtained the agreement of the competent authority, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) eligible liabilities referred to in Regulations 80D and 80H(6)(a); | |||||||||||||||||||||||||||||||||||||||||||||||||

(n) where an entity is the subsidiary of a mixed-activity holding company, that the mixed-activity holding company set up a separate financial holding company to control the entity, if necessary in order to facilitate the resolution of the entity and to avoid the application of the resolution tools and the exercise of the powers referred to in Part 4 having an adverse effect on the non-financial part of the group. | |||||||||||||||||||||||||||||||||||||||||||||||||

(11) Each of the following is an appealable decision for the purposes of Part VIIA of the Act of 1942: | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) a determination under paragraph (1); | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) an assessment under paragraph (4); | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) a direction under paragraph (5).”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Amendment of Regulation 29 of Regulations of 2015 (powers to address or remove impediments to resolvability: group treatment) | |||||||||||||||||||||||||||||||||||||||||||||||||

12. The following Regulation is substituted for Regulation 29 of the Regulations of 2015: | |||||||||||||||||||||||||||||||||||||||||||||||||

“29. (1) Where the resolution authority is the group-level resolution authority it shall, together with the relevant Union resolution authorities of subsidiaries, consider the assessment under Regulation 27 within the resolution college and shall take all reasonable steps to reach a joint decision on the application of measures identified in accordance with Regulation 28(5) and (6) in relation to all resolution entities and their subsidiaries that are entities referred to in Regulation 2(1)(b) to (i) and are part of the group. | |||||||||||||||||||||||||||||||||||||||||||||||||

(2) Before considering the assessment of resolvability under paragraph (1), the resolution authority shall, together with the relevant Union resolution authorities, consult with the supervisory college and the Union resolution authorities of any jurisdictions in which significant branches are located in so far as is relevant to the significant branch. | |||||||||||||||||||||||||||||||||||||||||||||||||

(3) (a) Where the resolution authority is the group-level resolution authority, it shall, subject to subparagraph (b) and paragraph (13), prepare a report analysing — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) the substantive impediments to the effective application of the resolution tools, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) the exercise of the resolution powers in relation to the group and also in relation to resolution groups where a group is composed of more than one resolution group. | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) Where an impediment to the resolvability of the group is due to a situation of a group entity referred to in Regulation 28(3), the resolution authority shall notify its assessment of that impediment to the parent undertaking after consulting with the resolution authority of the resolution entity and the resolution authorities of its subsidiary institutions. | |||||||||||||||||||||||||||||||||||||||||||||||||

(4) The report referred to in paragraph (3) shall consider the impact on the group’s business model and recommend any proportionate and targeted measures that, in the resolution authority’s opinion, are necessary or appropriate to remove those impediments. | |||||||||||||||||||||||||||||||||||||||||||||||||

(5) The resolution authority shall prepare the report referred to in paragraph (3) in cooperation with the consolidating supervisor and the European Banking Authority in accordance with Article 25(1) of Regulation (EU) No 1093/2010, after consulting the Union competent authorities concerned. | |||||||||||||||||||||||||||||||||||||||||||||||||

(6) The resolution authority shall submit the report referred to in paragraph (3) to — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) the parent undertaking of the group concerned, | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) the Union resolution authorities of subsidiaries to be provided by them to the subsidiaries under their remit, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) the Union resolution authorities of any jurisdictions in which significant branches are located. | |||||||||||||||||||||||||||||||||||||||||||||||||

(7) Where the resolution authority is the resolution authority of a subsidiary for the purposes of the Bank Recovery and Resolution Directive, and a group-level resolution authority submits a report to the resolution authority in accordance with Article 18(2) of the Bank Recovery and Resolution Directive, the resolution authority shall transmit that report to the subsidiary. | |||||||||||||||||||||||||||||||||||||||||||||||||

(8) Within four months of the date of receipt of the report referred to in paragraph (3), the parent undertaking may — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) submit observations, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) propose alternative measures to remedy the impediments identified in the report, to the resolution authority. | |||||||||||||||||||||||||||||||||||||||||||||||||

(9) Where the impediments identified in the report are due to a situation of a group entity referred to in Regulation 28(3), the parent undertaking shall, within 2 weeks of the date of receipt of a notification under paragraph (3)(b), propose to the resolution authority possible measures and the timeline for their implementation to ensure that the group entity complies — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) with the requirements referred to in Article 45e or 45f of the Bank Recovery and Resolution Directive expressed as a percentage of the total risk exposure amount calculated in accordance with Article 92(3) of the Union Capital Requirements Regulation, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) where applicable, with the combined buffer requirement, and with the requirements referred to in Article 45e and 45f of the Bank Recovery and Resolution Directive expressed as a percentage of the total exposure measure referred to in Articles 429 and 429a of the Union Capital Requirements Regulation. | |||||||||||||||||||||||||||||||||||||||||||||||||

(10) (a) The timeline for the implementation of measures proposed under paragraph (9) shall take into account the reasons for the substantive impediment. | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) The resolution authority, after consulting with the competent authority, shall assess whether the measures proposed under paragraph (9) effectively address or remove the substantive impediment. | |||||||||||||||||||||||||||||||||||||||||||||||||

(11) The resolution authority shall communicate any measure proposed by the parent undertaking under paragraph (8)(b) or (9), as the case may be, to — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) the competent authority, | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) the European Banking Authority, | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) the Union resolution authorities of subsidiaries of the group, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(d) the Union resolution authorities of any jurisdictions in which significant branches are located in so far as is relevant to the significant branch. | |||||||||||||||||||||||||||||||||||||||||||||||||

(12) Following consultation with the Union competent authorities of subsidiaries and the Union resolution authorities of any jurisdictions in which significant branches are located, in so far as is relevant to the significant branch, the resolution authority shall, subject to paragraph (13), do everything within its power to reach a joint decision with the Union resolution authorities of the subsidiaries within the resolution college regarding the identification of substantive impediments and, if necessary, the assessment of the measures proposed by the parent undertaking and the measures required by the authorities to address or remove the impediments, which shall take into account the potential impact of the measures in all Member States where the group operates. | |||||||||||||||||||||||||||||||||||||||||||||||||

(13) (a) The joint decision referred to in paragraph (12) shall be reached within four months of the submission of any observations by the parent undertaking in accordance with paragraph (8)(a). | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) Where the parent undertaking has not submitted any observations, the joint decision shall be reached within one month from the expiry of the period referred to in paragraph (8). | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) The joint decision referred to in paragraph (12) concerning the impediment to resolvability due to a situation referred to in Regulation 28(3) shall be reached within 2 weeks of the submission of any observations by the parent undertaking in accordance with paragraph (8)(a). | |||||||||||||||||||||||||||||||||||||||||||||||||

(14) Where a joint decision referred to in paragraph (12) is reached, the resolution authority shall provide the decision and reasons for the decision, in writing, to the parent undertaking. | |||||||||||||||||||||||||||||||||||||||||||||||||

(15) The resolution authority, whether in its role as — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) a group-level resolution authority, or | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) a resolution authority for a subsidiary for the purposes of the Bank Recovery and Resolution Directive, | |||||||||||||||||||||||||||||||||||||||||||||||||

may request the European Banking Authority to assist — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) in reaching a joint decision referred to in paragraph (12) in accordance with point (c) of the second paragraph of Article 31 of Regulation (EU) No 1093/2010, or | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) where the joint decision referred to in subparagraph (a) concerns any measure referred to in subparagraph (h), (i) or (l) of Regulation 28(10), under Article 19 of Regulation (EU) No 1093/2010. | |||||||||||||||||||||||||||||||||||||||||||||||||

(16) Where the resolution authority is the group-level resolution authority and it has not reached a joint decision referred to in paragraph (12) within the period referred to in paragraph (13)(a), (b) or (c), as the case may be, it shall make its own decision on the appropriate measures to be taken under Regulation 28(5) at the group level. | |||||||||||||||||||||||||||||||||||||||||||||||||

(17) The resolution authority’s decision under paragraph (16) shall — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) be fully reasoned and take into account the views and reservations of the relevant Union resolution authorities, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) be provided by the resolution authority to the Union parent undertaking. | |||||||||||||||||||||||||||||||||||||||||||||||||

(18) Where, at the end of the period referred to in paragraph (13)(a), (b) or (c), as the case may be, a matter referred to in Article 18(9) of the Bank Recovery and Resolution Directive has been referred to the European Banking Authority in accordance with Article 19 of Regulation (EU) No 1093/2010, then, where the resolution authority is the group-level resolution authority, it shall defer its decision and await any decision that the European Banking Authority may take in accordance with Article 19(3) of that Regulation, and shall take its decision in accordance with the decision of the European Banking Authority. | |||||||||||||||||||||||||||||||||||||||||||||||||

(19) (a) The period referred to in paragraph (13)(a), (b) or (c), as the case may be, shall be deemed to be the conciliation period within the meaning of Regulation (EU) No 1093/2010. | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) The resolution authority shall not refer a matter to the European Banking Authority, under paragraph (15), after the end of the period referred to in paragraph (13)(a), (b) or (c), as the case may be, or after a joint decision referred to in paragraph (12) has been reached. | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) In the absence of a decision from the European Banking Authority, the decision of the resolution authority shall apply. | |||||||||||||||||||||||||||||||||||||||||||||||||

(20) Where the resolution authority is the resolution authority of the relevant resolution entity and it has not reached a joint decision referred to in paragraph (12) within the period referred to in paragraph (13)(a), (b) or (c), as the case may be, it shall make its own decision on the appropriate measures to be taken under Regulation 28(5) at the resolution group level. | |||||||||||||||||||||||||||||||||||||||||||||||||

(21) The resolution authority’s decision under paragraph (20) shall — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) be fully reasoned and take into account the views and reservations of the relevant resolution authorities of other entities of the same resolution group and the group-level resolution authority, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) be provided by the resolution authority to the resolution entity. | |||||||||||||||||||||||||||||||||||||||||||||||||

(22) Where, at the end of the period referred to in paragraph (13)(a), (b) or (c), as the case may be, a matter referred to in Article 18(9) of the Bank Recovery and Resolution Directive has been referred to the European Banking Authority in accordance with Article 19 of Regulation (EU) No 1093/2010, then, where the resolution authority is the resolution authority of the resolution entity, it shall defer its decision and await any decision that the European Banking Authority may take in accordance with Article 19(3) of that Regulation, and shall take its decision in accordance with the decision of the European Banking Authority. | |||||||||||||||||||||||||||||||||||||||||||||||||

(23) (a) The period referred to in paragraph (13)(a), (b) or (c), as the case may be, shall be deemed to be the conciliation period within the meaning of Regulation (EU) No 1093/2010. | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) The resolution authority shall not refer a matter to the European Banking Authority, under paragraph (15), after the end of the period referred to in paragraph (13)(a), (b) or (c), as the case may be, or after a joint decision referred to in paragraph (12) has been reached. | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) In the absence of a decision from the European Banking Authority, the decision of the resolution authority of the resolution entity shall apply. | |||||||||||||||||||||||||||||||||||||||||||||||||

(24) Where the resolution authority is the resolution authority of a subsidiary that is not a resolution entity and it has not reached a joint decision referred to in paragraph (12), it shall make its own decision on the appropriate measures to be taken by subsidiaries under Regulation 28(5) at individual level. | |||||||||||||||||||||||||||||||||||||||||||||||||

(25) The resolution authority’s decision under paragraph (24) shall — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) be fully reasoned and take into account the views and reservations of the relevant resolution authorities, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) be provided by the resolution authority to the relevant subsidiary, the resolution entity of the same resolution group, the resolution authority of that resolution entity and, where different, the group-level resolution authority. | |||||||||||||||||||||||||||||||||||||||||||||||||

(26) Where, at the end of the period referred to in paragraph (13)(a), (b) or (c), as the case may be, a matter referred to in Article 18(9) of the Bank Recovery and Resolution Directive has been referred to the European Banking Authority in accordance with Article 19 of Regulation (EU) No 1093/2010, then, where the resolution authority is the resolution authority of a subsidiary that is not a resolution entity, it shall defer its decision and await any decision that the European Banking Authority may take in accordance with Article 19(3) of that Regulation, and shall take its decision in accordance with the decision of the European Banking Authority. | |||||||||||||||||||||||||||||||||||||||||||||||||

(27) (a) The period referred to in paragraph (13)(a), (b) or (c), as the case may be, shall be deemed to be the conciliation period within the meaning of Regulation (EU) No 1093/2010. | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) The resolution authority shall not refer a matter to the European Banking Authority, under paragraph (15), after the end of the period referred to in paragraph (13)(a), (b) or (c), as the case may be, or after a joint decision referred to in paragraph (12) has been reached. | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) In the absence of a decision from the European Banking Authority, the decision of the resolution authority shall apply. | |||||||||||||||||||||||||||||||||||||||||||||||||

(28) Any joint decision referred to in paragraph (12) or decision taken by a Union resolution authority in the absence of a joint decision shall be recognised as conclusive and applied by the resolution authority. | |||||||||||||||||||||||||||||||||||||||||||||||||

(29) A decision by the resolution authority under paragraph (16), (20) or (24) is an appealable decision for the purposes of Part VIIA of the Act of 1942.”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Amendment of Regulation 62 of Regulations of 2015 (conditions for resolution) | |||||||||||||||||||||||||||||||||||||||||||||||||

13. Regulation 62(1) of the Regulations of 2015 is amended in subparagraph (b) by the insertion of “and eligible liabilities” after “relevant capital instruments”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Conditions for resolution with regard to a central body and credit institutions permanently affiliated to a central body | |||||||||||||||||||||||||||||||||||||||||||||||||

14. The following Regulation is inserted after Regulation 62 of the Regulations of 2015: | |||||||||||||||||||||||||||||||||||||||||||||||||

“62A. The resolution authority may make a proposed resolution order in relation to a central body and all credit institutions permanently affiliated to it that are part of the same resolution group when that resolution group complies as a whole with the conditions set out in Regulation 62(1)(a), (b) and (c).”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Insolvency proceedings in respect of institutions and entities that are not subject to resolution action | |||||||||||||||||||||||||||||||||||||||||||||||||

15. The following Regulation is inserted after Regulation 62A (inserted by Regulation 14) of the Regulations of 2015: | |||||||||||||||||||||||||||||||||||||||||||||||||

“62B. Where, in relation to an institution or entity referred to in Regulation 2(1)(b) to (i), the resolution authority considers that the conditions in Regulation 62(1)(a) and (b) are met, but that a resolution action would not be in the public interest in accordance with Regulation 62(1)(c), the institution or entity, as the case may be, shall be wound up in an orderly manner under normal insolvency proceedings.”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Amendment of Regulation 63 of Regulations of 2015 (conditions for resolution with regard to financial institutions and holding companies) | |||||||||||||||||||||||||||||||||||||||||||||||||

16. Regulation 63 of the Regulations of 2015 is amended — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) by the substitution of the following paragraphs for paragraphs (2) to (4): | |||||||||||||||||||||||||||||||||||||||||||||||||

“(2) The resolution authority shall, subject to Regulation 9(2), make a proposed resolution order in relation to an entity referred to in Regulation 2(1)(c) to (i) where the conditions set out in Regulation 62(1)(a), (b) and (c) are met with regard to that entity. | |||||||||||||||||||||||||||||||||||||||||||||||||

(3) Where any subsidiary institutions of a mixed-activity holding company are held directly or indirectly by an intermediate financial holding company – | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) the resolution plan shall provide that the intermediate financial holding company is identified as a resolution entity, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) the resolution authority — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) shall only make a proposed resolution order for the purposes of group resolution in relation to the intermediate financial holding company, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) shall not make a proposed resolution order for the purposes of group resolution in relation to the mixed-activity holding company. | |||||||||||||||||||||||||||||||||||||||||||||||||

(4) Subject to paragraph (3) and notwithstanding the fact that an entity referred to in Regulation 2(1)(c) to (i) does not meet the conditions set out in Regulation 62(1)(a), (b) and (c), the resolution authority may make a proposed resolution order in relation to the entity concerned where — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) the entity is a resolution entity, | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) one or more of the subsidiaries of the entity that are institutions, but not resolution entities, comply with the conditions laid down in Regulation 62(1)(a), (b) and (c), and | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) the assets and liabilities of the subsidiaries referred to in subparagraph (b) are such that the failure of those subsidiaries threatens the resolution group as a whole, and resolution action with regard to the entity is necessary either for the resolution of such subsidiaries which are institutions or for the resolution of the relevant resolution group as a whole.”, | |||||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) by the deletion of paragraph (5). | |||||||||||||||||||||||||||||||||||||||||||||||||

Power to suspend certain obligations | |||||||||||||||||||||||||||||||||||||||||||||||||

17. The following Regulation is inserted after Regulation 63 of the Regulations of 2015: | |||||||||||||||||||||||||||||||||||||||||||||||||

“63A. (1) The resolution authority, after consulting with the competent authority which shall reply in a timely manner, may suspend any payment or delivery obligations pursuant to any contract to which an institution or an entity referred to in Regulation 2(1)(b) to (i) is a party, where all of the following conditions are met: | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) a determination that the institution or entity is failing or likely to fail has been made under Regulation 62(1)(a); | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) there is no immediately available private sector measure referred to in Regulation 62(1)(b) that would prevent the failure of the institution or entity; | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) the exercise of the power to suspend is deemed necessary to avoid the further deterioration of the financial conditions of the institution or entity; | |||||||||||||||||||||||||||||||||||||||||||||||||

(d) the exercise of the power to suspend is either — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) necessary to reach the determination provided for in Regulation 62(1)(c), or | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) necessary to choose the appropriate resolution actions or to ensure the effective application of one or more resolution tools. | |||||||||||||||||||||||||||||||||||||||||||||||||

(2) (a) The power referred to in paragraph (1) shall not apply to payment or delivery obligations to the following: | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) systems and operators of systems designated in accordance with Directive 98/26/EC; | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) central counterparties (in these Regulations referred to as ‘CCPs’) authorised in the Union pursuant to Article 14 of Regulation (EU) No 648/2012 and third-country CCPs recognised by the ESMA pursuant to Article 25 of that Regulation; | |||||||||||||||||||||||||||||||||||||||||||||||||

(iii) central banks. | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) The resolution authority shall — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) exercise the power referred to in paragraph (1) having regard to the circumstances of each case, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) in particular, carefully assess the appropriateness of extending the suspension to eligible deposits, especially to covered deposits held by natural persons and micro, small and medium-sized enterprises. | |||||||||||||||||||||||||||||||||||||||||||||||||

(3) Where the power to suspend payment or delivery obligations pursuant to paragraph (1) is exercised in respect of eligible deposits, the resolution authority shall direct any institution or entity in respect of whom that power is exercised to ensure that the depositors concerned have access to an appropriate daily amount (in this Regulation referred to as the ‘appropriate daily amount’) from those deposits determined by the resolution authority in accordance with paragraphs (4) and (5). | |||||||||||||||||||||||||||||||||||||||||||||||||

(4) For the purposes of paragraph (3), the resolution authority — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) shall determine the appropriate daily amount having regard to all or any of the factors set out in paragraph (5), and | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) may direct the entity to provide the resolution authority with such information as the resolution authority considers reasonably necessary for the purpose of determining the appropriate daily amount. | |||||||||||||||||||||||||||||||||||||||||||||||||

(5) The factors referred to in paragraph (4) are as follows: | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) the balance sheet position of the institution or entity concerned, including its liquidity position; | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) the total amount of eligible deposits held by the institution or entity concerned; | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) the total number of depositors of the institution or entity concerned; | |||||||||||||||||||||||||||||||||||||||||||||||||

(d) the period of the suspension pursuant to paragraph (1); | |||||||||||||||||||||||||||||||||||||||||||||||||

(e) the amount which is likely to be required by different classes of depositors to meet reasonable daily expenses under the economic conditions prevailing in the State when the power of suspension pursuant to paragraph (1) is exercised; | |||||||||||||||||||||||||||||||||||||||||||||||||

(f) such further information as may be provided to the resolution authority pursuant to a direction under paragraph (4)(b). | |||||||||||||||||||||||||||||||||||||||||||||||||

(6) (a) The period of the suspension pursuant to paragraph (1) — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) shall be as short as possible, | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) shall not exceed the minimum period that the resolution authority considers necessary for the purposes indicated in paragraph (1)(c) and (d), and | |||||||||||||||||||||||||||||||||||||||||||||||||

(iii) in any event shall not last longer than the period from the publication of a notice of suspension pursuant to paragraph (11) to midnight at the end of the business day next following that publication. | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) On the expiry of the period of suspension referred to in subparagraph (a), the suspension shall cease to have effect. | |||||||||||||||||||||||||||||||||||||||||||||||||

(7) (a) When exercising the power referred to in paragraph (1), the resolution authority shall — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) have regard to the impact the exercise of that power might have on the orderly functioning of financial markets, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) consider the existing rules, and supervisory and judicial powers, to safeguard creditors’ rights and equal treatment of creditors in normal insolvency proceedings. | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) The resolution authority shall, in particular, have regard to the potential application of normal insolvency proceedings to the institution or entity as a result of the determination in Regulation 62(1)(c) and shall make the arrangements it deems appropriate to ensure adequate coordination with the administrative authorities of the State or with the Court, as the case may be. | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) For the purposes of subparagraph (b), ‘administrative authorities’ means – | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) the Minister, | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) the Investor Compensation Company DAC (otherwise known as the Investor Compensation Company Limited), and | |||||||||||||||||||||||||||||||||||||||||||||||||

(iii) the Insurance Compensation Fund. | |||||||||||||||||||||||||||||||||||||||||||||||||

(8) When payment or delivery obligations under a contract are suspended pursuant to paragraph (1), the payment or delivery obligations of any counterparties to that contract shall be suspended for the same period as provided for under paragraph (6)(a). | |||||||||||||||||||||||||||||||||||||||||||||||||

(9) A payment or delivery obligation under a contract that would have been due during the period of the suspension provided for under paragraph (6)(a) shall be due immediately upon expiry of that period. | |||||||||||||||||||||||||||||||||||||||||||||||||

(10) The resolution authority shall notify the institution or the entity referred to in Regulation 2(1)(c) to (i) and the authorities referred to in Regulation 145(1)(a) to (f) without delay when exercising the power referred to in paragraph (1) after a determination has been made that the institution is failing or likely to fail pursuant to Regulation 62(1)(a) and before the resolution decision is taken. | |||||||||||||||||||||||||||||||||||||||||||||||||

(11) The resolution authority shall publish or ensure the publication of such direction or other instrument by which obligations are suspended under this Regulation and the terms and period of suspension, by the means referred to in Regulation 145(4). | |||||||||||||||||||||||||||||||||||||||||||||||||

(12) (a) This Regulation is without prejudice to any powers under any enactment (other than these Regulations) to suspend payment or delivery obligations — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) of – | |||||||||||||||||||||||||||||||||||||||||||||||||

(I) the institutions and entities referred to in paragraph (1) before a determination is made that those institutions or entities are failing or likely to fail under Regulation 62(1)(a), or | |||||||||||||||||||||||||||||||||||||||||||||||||

(II) institutions or entities which are to be wound up under normal insolvency proceedings, | |||||||||||||||||||||||||||||||||||||||||||||||||

and | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) that exceed the scope and duration provided for in this Regulation. | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) The conditions provided for in this Regulation shall be without prejudice to the conditions related to the exercise of any such powers to suspend payment or delivery obligations referred to in subparagraph (a). | |||||||||||||||||||||||||||||||||||||||||||||||||

(13) When the resolution authority exercises the power to suspend payment or delivery obligations pursuant to paragraph (1) with respect to an institution or an entity referred to in Regulation 2(1)(b) to (i), the resolution authority may also, for the duration of that suspension, exercise the power to — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) restrict secured creditors of the institution or entity from enforcing security interests in relation to any of the assets of that institution or entity for the same duration, in which case Regulations 124(2)(d) and 130(2) and (3) shall apply, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) suspend the termination rights of any party to a contract with that institution or entity for the same duration, in which case Regulations 124(2)(e) and (3) and 131 shall apply. | |||||||||||||||||||||||||||||||||||||||||||||||||

(14) Where, after making a determination that an institution or entity is failing or likely to fail pursuant to Regulation 62(1)(a), the resolution authority has exercised the power to suspend payment or delivery obligations in the circumstances set out in paragraph (1) or (13), and resolution action is subsequently taken with respect to that institution or entity, the resolution authority shall not exercise its powers, with respect to that institution or entity, under — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) Regulation 129(1), and | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) in the case of the exercise of its powers pursuant to paragraph (13)(a) and (b) or Regulation 130(1) or 131(1).”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Amendment of Regulation 65 of Regulations of 2015 (valuation for the purposes of resolution) | |||||||||||||||||||||||||||||||||||||||||||||||||

18. Regulation 65 of the Regulations of 2015 is amended — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) in paragraphs (1), by the substitution of “capital instruments and eligible liabilities in accordance with Regulation 95” for “capital instruments, under these Regulations”, | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) in paragraphs (5)(a), (5)(c), (5)(g), (6)(b), (11) and (12)(a), by the substitution of “capital instruments and eligible liabilities in accordance with Regulation 95” for “capital instruments” in each place, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(c) in paragraph (5)(d), by the substitution of “bail-inable liabilities” for “eligible liabilities”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Amendment of Regulation 68 of Regulations of 2015 (general principles of resolution tools) | |||||||||||||||||||||||||||||||||||||||||||||||||

19. Regulation 68 of the Regulations of 2015 is amended in paragraph (1) by the substitution of “capital instruments and eligible liabilities” for “capital instruments”. | |||||||||||||||||||||||||||||||||||||||||||||||||

Amendment of regulation 80 of Regulations of 2015 (scope of bail-in tool) | |||||||||||||||||||||||||||||||||||||||||||||||||

20. Regulation 80 of the Regulations of 2015 is amended — | |||||||||||||||||||||||||||||||||||||||||||||||||

(a) in paragraph (2) — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) by the substitution of the following for subparagraph (g): | |||||||||||||||||||||||||||||||||||||||||||||||||

“(g) liabilities with a remaining maturity of less than 7 days, owed to — | |||||||||||||||||||||||||||||||||||||||||||||||||

(i) systems or operators of systems designated in accordance with Directive 98/26/EC or their participants and arising from the participation in such a system, or | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) CCPs authorised in the Union pursuant to Article 14 of Regulation (EU) No 648/2012 and third-country CCPs recognised by ESMA pursuant to Article 25 of that Regulation;”, | |||||||||||||||||||||||||||||||||||||||||||||||||

(ii) in subparagraph (k), by the substitution of “Directive 2014/49/EU;” for “Directive 2014/49/EU.”, and | |||||||||||||||||||||||||||||||||||||||||||||||||

(iii) by the insertion of the following subparagraph after subparagraph (k): | |||||||||||||||||||||||||||||||||||||||||||||||||

“(l) liabilities to institutions or entities referred to in Regulation 2(1)(b) to (i) that are part of the same resolution group without being themselves resolution entities, regardless of their maturities, except where those liabilities rank below ordinary unsecured liabilities as provided for in section 1428A of the Act of 2014.”, | |||||||||||||||||||||||||||||||||||||||||||||||||

(b) by the insertion of the following paragraph after paragraph (3): | |||||||||||||||||||||||||||||||||||||||||||||||||