Finance Act 2020

|

Amendment of Chapter 3 of Part 3 of, and Schedule 1 to, Finance Act 2010 (solid fuel carbon tax) | ||

|

29. The Finance Act 2010 is amended with effect as on and from 1 May 2021— | ||

(a) by substituting the following section for section 78: | ||

“78. (1) Subject to the provisions of this Chapter and any regulations made under it, a duty of excise, to be known as solid fuel carbon tax, shall be charged, levied and paid at the rate specified in column (2) of Schedule 1 with effect as on and from the date specified in column (1) of that Schedule in respect of each description of solid fuel specified in Schedule 1 supplied in the State by a supplier. | ||

(2) The rate of tax per tonne for each description of solid fuel specified in Schedule 1 is in proportion to the emissions of CO2 from the combustion of the solid fuel concerned.”, | ||

and | ||

(b) by substituting the following schedule for Schedule 1: | ||

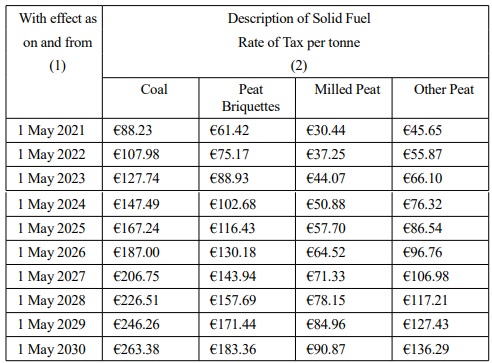

“SCHEDULE 1 | ||

Rates of Solid Fuel Carbon Tax | ||

| ||

”, |