Finance Act 2020

|

Chapter 2 Universal Social Charge | ||

|

Amendment of section 531AN of Principal Act (rate of charge) | ||

|

2. (1) Section 531AN of the Principal Act is amended— | ||

(a) by substituting the following for subsection (3): | ||

“(3) Notwithstanding subsection (1) and the Table to this section, where an individual is in receipt of aggregate income which does not exceed €60,000, is aged under 70 years and has full eligibility for services under Part IV of the Health Act 1970 , by virtue of sections 45 and 45A of that Act or Council Regulation (EC) No. 883/2004 of 29 April 20041 , the individual shall, instead of being charged to universal social charge on the part of aggregate income for the tax year concerned that exceeds €20,484 at the rate provided for in column (2) of Part 1 of that Table, be charged on the amount of the excess at the rate of 2 per cent.”, | ||

(b) in subsection (4), by the substitution of “2022” for “2021”, and | ||

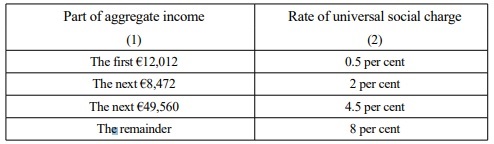

(c) by substituting the following for Part 1 of the Table to that section: | ||

“Part 1 | ||

| ||

”. | ||

(2) Paragraphs (a) and (c) of subsection (1) apply for the year of assessment 2020. | ||

(3) Section 531AN of the Principal Act is amended— | ||

(a) by substituting the following for subsection (3): | ||

“(3) Notwithstanding subsection (1) and the Table to this section, where an individual is in receipt of aggregate income which does not exceed €60,000, is aged under 70 years and has full eligibility for services under Part IV of the Health Act 1970 , by virtue of sections 45 and 45A of that Act or Council Regulation (EC) No. 883/2004 of 29 April 20042 , the individual shall, instead of being charged to universal social charge on the part of aggregate income for the tax year concerned that exceeds €20,687 at the rate provided for in column (2) of Part 1 of that Table, be charged on the amount of the excess at the rate of 2 per cent.”, | ||

and | ||

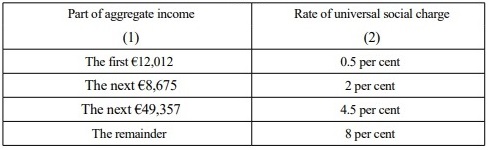

(b) by substituting the following for Part 1 of the Table to that section: | ||

“Part 1 | ||

| ||

”. | ||

(4) Subsection (3) applies for the year of assessment 2021 and each subsequent year of assessment. | ||