S.I. No. 157/2008 - European Communities (Cross-Border Mergers) Regulations 2008

Notice of the making of this Statutory Instrument was published in | ||

“Iris Oifigiúil” of 30th May, 2008. | ||

I, MARY COUGHLAN, Minister for Enterprise, Trade and Employment, in exercise of the powers conferred on me by section 3 (as amended by section 2 of the European Communities Act 2007 (No. 18 of 2007)) of the European Communities Act 1972 (No. 27 of 1972) and for the purpose of giving effect to Council Directive No. 2005/56/EC of 26 October 2005 1 hereby make the following regulations: | ||

PART 1 | ||

Preliminary and General | ||

Citation and construction | ||

1. (1) These Regulations may be cited as the European Communities (Cross-Border Mergers) Regulations 2008. | ||

(2) Parts 1 and 2 of these Regulations shall be construed as one with the Companies Acts 1963 to 2006. | ||

Interpretation | ||

2. (1) In these Regulations— | ||

“Act of 1963” means the Companies Act 1963 (No. 33 of 1963); | ||

“common draft terms” means the proposed terms of a cross-border merger drawn up and adopted in accordance with Regulation 5; | ||

“company” means an Irish company or an EEA Company; | ||

“Companies Acts” means the Companies Acts 1963 to 2006; | ||

“Companies Register” means the register of companies maintained by the Registrar in accordance with the Companies Acts; | ||

“cross-border merger” means a merger involving at least one Irish company and at least one EEA company, being— | ||

(a) a merger by acquisition, | ||

(b) a merger by formation of a new company, or | ||

(c) a merger by absorption; | ||

“CRO Gazette” means the Companies Registration Office Gazette maintained by the Registrar pursuant to Regulation 4 of the European Communities (Companies) Regulations 2004 ( S.I. No. 839 of 2004 ); | ||

“Directive” means Directive 2005/56/EC on cross-border mergers of limited liability companies 2 ; | ||

“directors’ explanatory report” means a report prepared and adopted in accordance with Regulation 6; | ||

“EEA” means the European Economic Area constituted by the EEA Agreement; | ||

“EEA Agreement” means the Agreement on the European Economic Area signed at Oporto on 2 May 1992, as adjusted by the Protocol signed at Brussels on 17 March 1993 and any subsequent amendments; | ||

“EEA company” means a limited liability company, within the meaning of Article 2 of the Directive, that is governed by the law of an EEA State other than the State; | ||

“EEA State” means a State that is a contracting party to the EEA Agreement; | ||

“effective date” means— | ||

(a) in relation to a cross-border merger in which the successor company is an Irish company, the date specified under Regulation 14(4), or | ||

(b) in relation to a cross-border merger in which the successor company is an EEA company, the date fixed in accordance with the law of the EEA State concerned for the purposes of Article 12 of the Directive; | ||

“expert’s report” means a report prepared in accordance with Regulation 7; | ||

“First Company Law Directive” means First Council Directive No. 68/151/EEC of 9 March 1968 3 as amended by Directive 2003/58/EC of 15 July 2003 4 ; | ||

“holding company” has the meaning assigned by section 155 of the Act of 1963; | ||

“Irish company” means— | ||

(a) a company within the meaning of the Act of 1963 with limited liability (other than a company limited by guarantee), or | ||

(b) a body corporate with limited liability to which section 377(1) of the Act of 1963 applies; | ||

“Irish merging company” means a merging company which is an Irish company; | ||

“Irish successor company” means a successor company which is an Irish company; | ||

“Irish transferor company” means a transferor company which is an Irish company; | ||

“merger” includes a proposed merger; | ||

“merger by absorption” means an operation in which, on being dissolved and without going into liquidation, a company transfers all of its assets and liabilities to a company that is the holder of all the shares or other securities representing the capital of the first-mentioned company; | ||

“merger by acquisition” means an operation in which a company (other than a company formed for the purpose of the operation) acquires all the assets and liabilities of another company that is, or other companies that are, dissolved without going into liquidation in exchange for the issue to the members of that company, or the members of those companies, of securities or shares in the first-mentioned company, with or without any cash payment; | ||

“merger by formation of a new company” means an operation in which 2 or more companies, on being dissolved without going into liquidation, transfer all their assets and liabilities to a company that they form, the new company, in exchange for the issue to their members of securities or shares representing the capital of that new company, with or without any cash payment; | ||

“merging company” means— | ||

(a) in relation to a merger by acquisition or a merger by absorption, a company that is, in relation to that merger, a transferor company or the successor company; and | ||

(b) in relation to a merger by formation of a new company, a company that is, in relation to that merger, a transferor company; | ||

“Merger Control Regulation” means Council Regulation (EC) No 139/2004 of 20 January 2004 on the control of concentrations between undertakings. 5 | ||

“Minister” means the Minister for Enterprise, Trade and Employment; | ||

“pre-merger requirements” means the requirements of Regulations 5 to 13; | ||

“Registrar” means the Registrar of Companies; | ||

“Registry” in relation to an EEA State means the register maintained by that State in accordance with Article 3 of the First Company Law Directive; | ||

“successor company”, in relation to a cross-border merger, means the Irish company or EEA company to which assets and liabilities are to be, or have been, transferred from the transferor companies by way of that cross-border merger; | ||

“transferor company”, in relation to a cross-border merger, means a company, whether an Irish company or an EEA company, the assets and liabilities of which are to be, or have been, transferred by way of that cross-border merger; | ||

“wholly-owned subsidiary”, in relation to a company, means a subsidiary (within the meaning assigned to it by section 155 of the Act of 1963) the entire issued share capital of which is directly or indirectly beneficially owned by the first-mentioned company. | ||

(2) A word or expression used but not defined in these Regulations that is also used in the Directive has the same meaning in these Regulations as it has in the Directive. | ||

Penalties | ||

3. A person convicted of an offence under these Regulations is liable, on summary conviction, to a fine not exceeding €5,000 or imprisonment for a term not exceeding 6 months, or to both. | ||

PART 2 | ||

COMPANY LAW PROVISIONS | ||

CHAPTER 1 | ||

Preliminary | ||

Definition | ||

4. In this Part “Court” means the High Court. | ||

CHAPTER 2 | ||

Pre-merger Requirements | ||

Common draft terms | ||

5. (1) Where a cross-border merger is proposed to be entered into, common draft terms shall be drawn up in writing by all of the merging companies and adopted by the board of directors of each Irish merging company. | ||

(2) The common draft terms of the merging companies shall state, at least— | ||

(a) in relation to each of the transferor companies— | ||

(i) its name, | ||

(ii) its registered office, | ||

(iii) its legal form and the law by which it is governed, | ||

(iv) the register in which it is entered (including details of the relevant State), and | ||

(v) its registration number in that register, | ||

(b) in relation to the successor company— | ||

(i) where the successor company is an existing company, the particulars specified in clauses (i) to (v) of subparagraph (a), or | ||

(ii) where the successor company is a new company yet to be formed, what is proposed as the particulars specified in clauses (i) to (iv) of that subparagraph, | ||

(c) except in the case of a merger by absorption— | ||

(i) the proposed exchange ratio and amount of any cash payment, | ||

(ii) the proposed terms relating to allotment of shares or other securities in the successor company, and | ||

(iii) the date from which the holding of shares or other securities in the successor company will entitle the holders to participate in profits and any special conditions affecting that entitlement, | ||

(d) the likely repercussions of the cross-border merger on employment, | ||

(e) the date from which the transactions of the transferor companies are to be treated for accounting purposes as being those of the successor company, | ||

(f) the rights to be conferred by the successor company on members of the transferor companies enjoying special rights or on holders of securities other than shares representing a transferor company’s capital, and the measures (if any) proposed concerning them, | ||

(g) any special advantages granted to— | ||

(i) any director of a merging company, or | ||

(ii) any person appointed under Regulation 7(2), or under a corresponding provision of a law of an EEA State, in relation to the merger, | ||

(h) the successor company’s articles of association or, if it does not have articles, the instrument constituting the company or defining its constitution, | ||

(i) where appropriate, information on the procedures by which arrangements for the involvement of employees in the definition of their rights to participation in the company resulting from the cross-border merger are determined under Part 3, | ||

(j) information on the evaluation of the assets and liabilities to be transferred to the successor company, and | ||

(k) the dates of the accounts of every merging company which were used for the purpose of preparing the common draft terms. | ||

(3) The common draft terms may include such additional terms as are not inconsistent with these Regulations. | ||

(4) The common draft terms shall not provide for any shares in the successor company to be exchanged for shares in a transferor company held either— | ||

(a) by the successor company itself or its nominee on its behalf; or | ||

(b) by the transferor company itself or its nominee on its behalf. | ||

Directors’ explanatory report | ||

6. (1) The board of directors of an Irish merging company shall— | ||

(a) draw up a directors’ explanatory report for the members of the company, to be made available pursuant to these Regulations, and | ||

(b) make that report available, not less than 1 month before the date of the general meeting referred to in Regulation 10, to— | ||

(i) the members, and | ||

(ii) the representatives of employees or, where there are no representatives, to the employees, in accordance with these Regulations. | ||

(2) The report shall— | ||

(a) explain the implications of the cross-border merger for members, creditors and employees of the company, | ||

(b) state the legal and economic grounds for the draft terms of merger. | ||

Expert’s report | ||

7. (1) In relation to each Irish merging company, a report to the members of the company on the common draft terms shall be drawn up in accordance with this Regulation, unless— | ||

(a) the cross-border merger is a merger by absorption, | ||

(b) the cross-border merger is a merger in which the successor company (not being a company formed for the purpose of the merger) holds 90% or more (but not all) of the shares or other securities carrying the right to vote at general meetings of each transferor company, or | ||

(c) every member of every merging company agrees that such report is not necessary. | ||

(2) The report shall be prepared by a person or persons (in this Regulation referred to as the “expert”), being— | ||

(a) a qualified person appointed for the Irish merging company by its directors, | ||

(b) a qualified person, or qualified persons, appointed by the Court, on the application of all of the merging companies, for all of them, or | ||

(c) a person appointed for all the merging companies for the purposes of Article 8 of the Directive by a competent authority of another EEA State. | ||

(3) A person is a qualified person for the purposes of subparagraphs (a) and (b) of paragraph (2), and of paragraphs (7) and (8), if that person— | ||

(a) is eligible for appointment as an auditor in accordance with section 187 of the Companies Act 1990 , and | ||

(b) is not— | ||

(i) a person who is or, within 12 months of the date of the common draft terms, has been an officer or employee of that company; | ||

(ii) except with the leave of the Court, a parent, spouse, brother, sister or child of an officer of that company; or | ||

(iii) a person who is a partner, or in the employment, of an officer or employee of that company. | ||

(4) The report shall be made available not less than 1 month before the date of the general meeting referred to in Regulation 10 and shall be in writing and shall— | ||

(a) state the method or methods used to arrive at the proposed exchange ratio, | ||

(b) give the opinion of the expert whether the proposed exchange ratio is fair and reasonable, | ||

(c) give the opinion of the expert as to the adequacy of the method or methods used in the case in question, | ||

(d) indicate the values arrived at using each such method, | ||

(e) give the opinion of the expert as to the relative importance attributed to such methods in arriving at the values decided on, and | ||

(f) specify any special valuation difficulties which have arisen. | ||

(5) The expert is entitled to require from each of the merging companies and their officers such information and explanation (whether oral or in writing), and to carry out such investigations, as the expert thinks necessary for the purposes of preparing the report. | ||

(6) Where a company, being an Irish merging company— | ||

(a) fails, on request, to supply to the expert any information or explanation in the power, possession or procurement of that person that the expert thinks necessary for the purposes of the report that company, being an Irish merging company and every officer in default shall be guilty of an offence, or | ||

(b) knowingly or recklessly, makes a statement (whether orally or in writing), or provides a document, to the expert, being a statement or document which— | ||

(i) conveys or purports to convey any information or explanation that the expert requires, or is entitled to require, under paragraph (5), and | ||

(ii) is misleading, false or deceptive in a material particular, | ||

that company, being an Irish merging company and every officer in default shall be guilty of an offence. | ||

(7) If a person appointed under paragraph (a) or (b) of paragraph (2) ceases to be a qualified person, that person— | ||

(a) shall immediately cease to hold office, and | ||

(b) shall give notice in writing of the disqualification to the Company or to the Court (as the case requires) within 14 days of ceasing to be a qualified person, | ||

but without prejudice to the validity of any acts done by the person under this Regulation before ceasing to be a qualified person. | ||

(8) A person who purports to carry out the functions of an expert under this Regulation after ceasing to be a qualified person shall be guilty of an offence. | ||

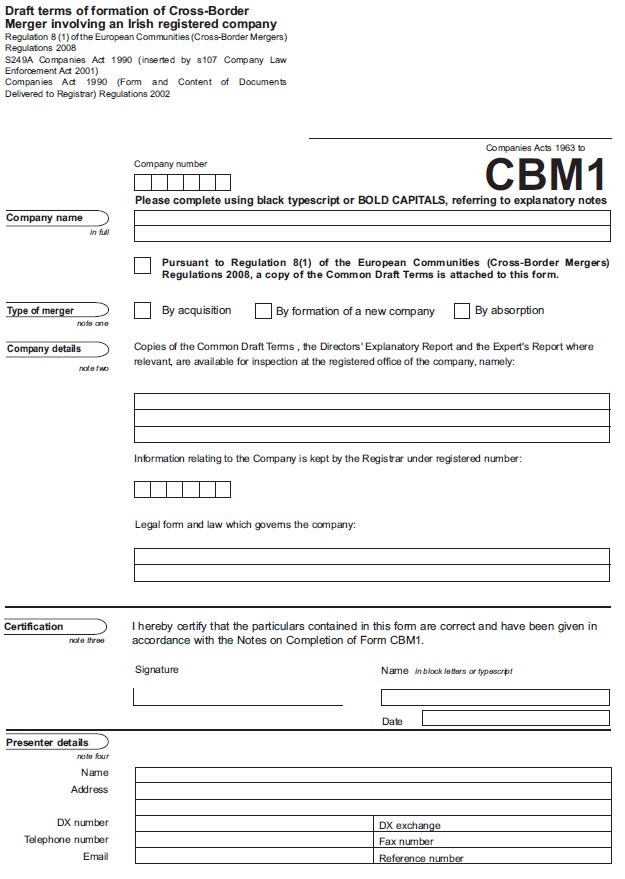

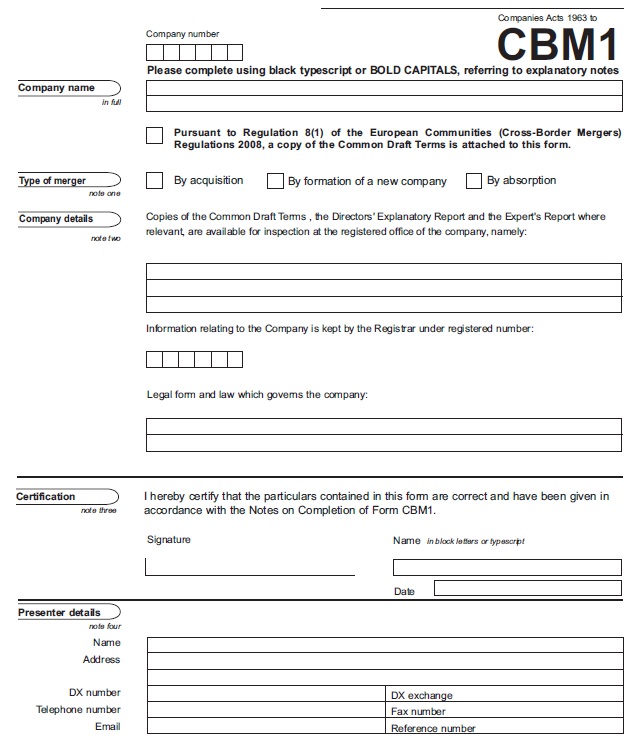

Registration and publication of documents | ||

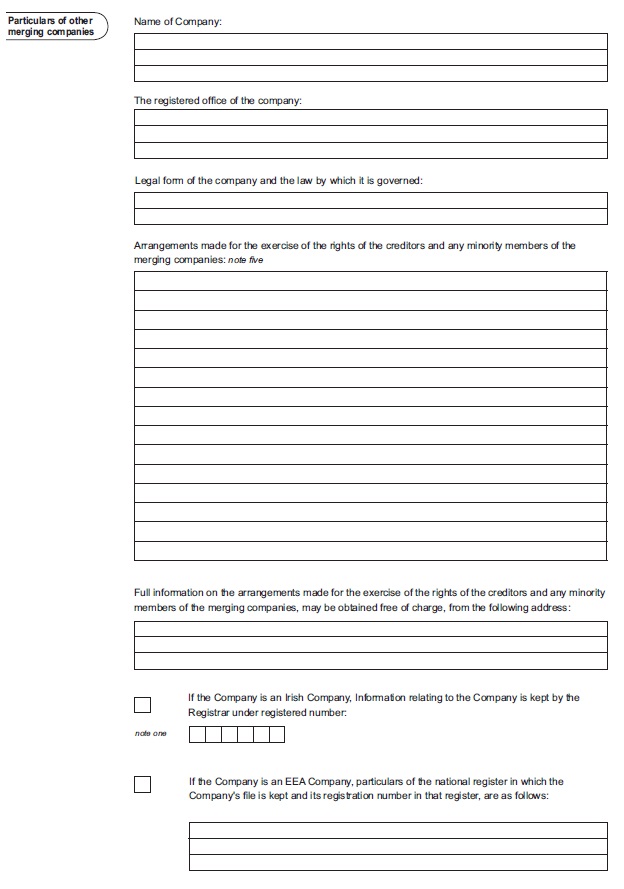

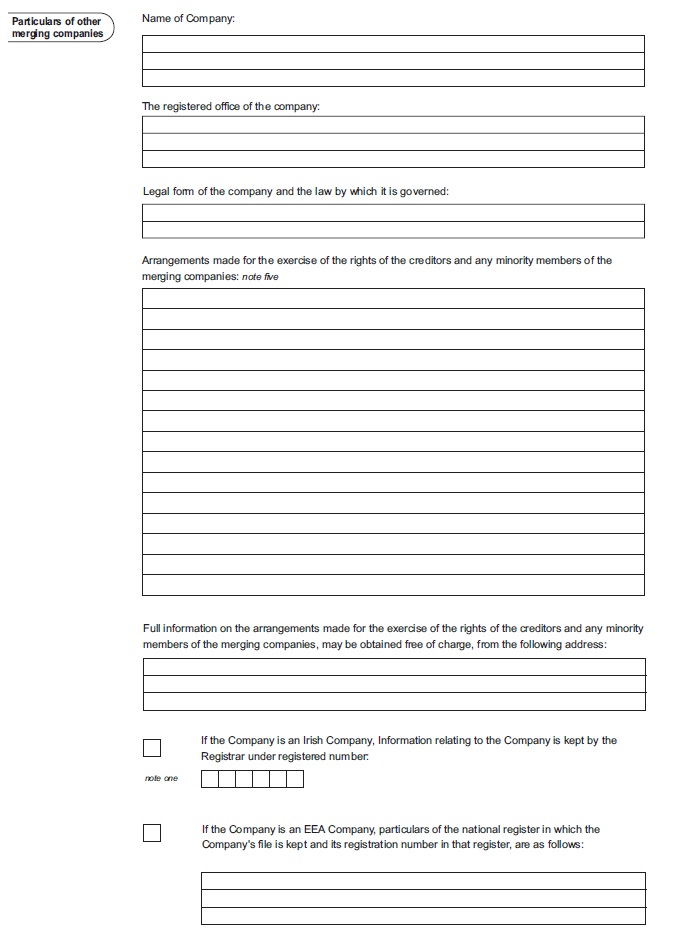

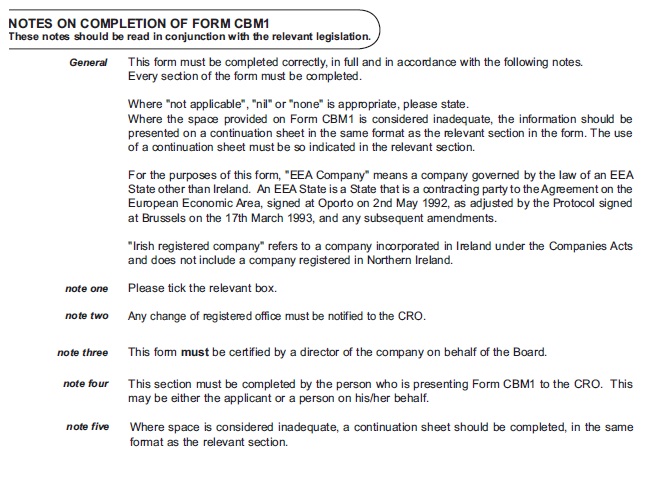

8. (1) Each Irish merging company shall deliver to the Registrar for registration— | ||

(a) a copy of the common draft terms, and | ||

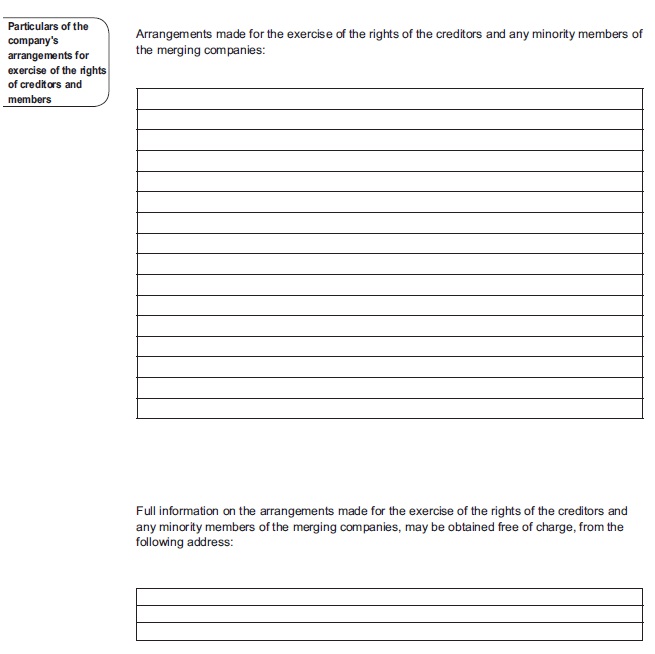

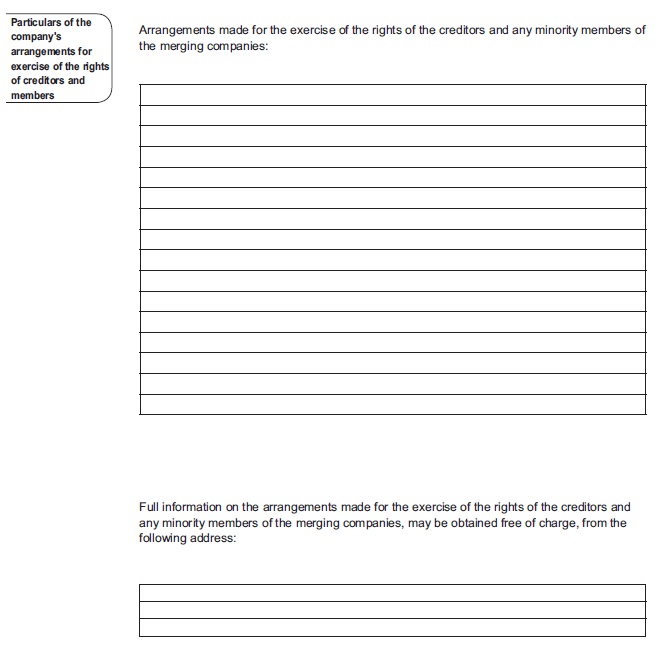

(b) a notice, in the form set out in Schedule 3, specifying in relation to each merging company— | ||

(i) its name, | ||

(ii) its registered office, | ||

(iii) its legal form and the law by which it is governed, | ||

(iv) in the case of an Irish Company, its registered number, | ||

(v) in the case of an EEA Company, particulars of the national register in which that Company’s file is kept and its registration number in that register, and | ||

(vi) arrangements made for the exercise of the rights of creditors and of any minority members of the Merging Companies, and the address at which full information on these arrangements may be obtained free of charge, | ||

(2) Notice of the delivery of the common draft terms to the Registrar pursuant to this Regulation and the notice referred to in paragraph (1)(b) shall, at least 1 month before the general meeting referred to in Regulation 10, be caused to be published— | ||

(a) by the Registrar, in the CRO Gazette, and | ||

(b) by the company, in two national daily newspapers. | ||

(3) The notice published in accordance with paragraph (2) shall include— | ||

(a) the date of delivery of the documentation, | ||

(b) the matters specified in the notice referred to in paragraph (1)(b), | ||

(c) a statement that copies of the common draft terms, the directors’ explanatory report and the expert’s report (where relevant) are available for inspection at the Irish merging company’s registered office, and | ||

(d) a statement that a copy of the common draft terms may be obtained from the Registrar. | ||

Inspection of documents | ||

9. (1) For the period of 1 month immediately preceding the general meeting of an Irish merging company convened in accordance with Regulation 10, the members of that company and its employee representatives (or, if there are no representatives, the employees) shall be permitted, free of charge, to inspect at its registered office during business hours (subject to such reasonable restrictions as the company imposes but so that a period of no less than 2 hours in each day is allowed for inspection)— | ||

(a) the common draft terms, | ||

(b) the directors’ explanatory report together with the opinion thereon, if any, received from the employee representatives, and | ||

(c) the expert’s report, if such a report is required by Regulation 7. | ||

(2) The notice convening the general meeting to be held in accordance with Regulation 10 shall contain a statement of the entitlement of each member to obtain on request, free of charge, full or, if so desired, partial copies of the documents mentioned in paragraph (1). | ||

General meetings of Irish merging companies | ||

10. (1) Subject to Regulation 11, the common draft terms shall be approved by a special resolution passed at a general meeting of each Irish merging company held not earlier than 1 month after the publication of the notice referred to in Regulation 8(2). | ||

(2) The approval of the members may be made subject to— | ||

(a) ratification of the arrangements adopted for employee participation in the successor company in accordance with Part 3, | ||

(b) an order of a competent authority of another EEA State amending the exchange ratio or compensating minority members in accordance with a procedure to which Article 10.3 of the Directive applies, | ||

(c) receipt, where required, of— | ||

(i) merger control approval from the Competition Authority under Part 3 of the Competition Act 2002 (No. 14 of 2002), | ||

(ii) merger control approval from the European Commission under the Merger Control Regulation, or | ||

(iii) merger control approval under the law of any other jurisdiction, | ||

(d) any other regulatory approval, or | ||

(e) such other conditions as they consider appropriate in the circumstances. | ||

(3) The directors of each Irish transferor company shall inform— | ||

(a) the general meeting of that company, and | ||

(b) as soon as practicable, the directors of the successor company, | ||

of any material change in the assets and liabilities of that transferor company between the date of the common draft terms and the date of that general meeting. | ||

(4) The directors of the successor company shall inform the general meeting of that company of all changes of which they have been informed pursuant to paragraph (3). | ||

(5) The special resolution referred to in paragraph (1) may be passed in accordance with section 141(8) of the Act of 1963. | ||

Exemption from requirement to hold general meeting | ||

11. (1) Shareholder approval of the common draft terms is not required— | ||

(a) in the case of any transferor company in a merger by absorption, or | ||

(b) in the case of the successor company in a merger by acquisition, if the conditions specified in paragraph (2) have been satisfied. | ||

(2) The conditions referred to in paragraph (1)(b) are the following: | ||

(a) the notice required to be published under Regulation 8(2) was published in accordance with Regulation 8(2) in respect of the successor company before the commencement of the period (in this paragraph referred to as the “notice period”) of 1 month before the date of the general meeting of the transferor company (or, where there is more than one transferor company, of the first of them to hold such a general meeting); | ||

(b) the members of the successor company were entitled, during the notice period— | ||

(i) to inspect, at the registered office of the successor company, during ordinary hours of business, copies of— | ||

(I) the documents referred to in Regulation 9, | ||

(II) the audited annual accounts for the preceding 3 financial years of each merging company (or, where a merging company has traded for less than 3 financial years before the date of the common draft terms, the audited annual accounts for the financial years for which the company has traded), and | ||

(III) the accounting statement, if any, in relation to each merging company which is required to be prepared pursuant to paragraph (3), | ||

and | ||

(ii) to obtain copies of those documents or any part of them on request; | ||

(c) the right, conferred by paragraph (4), to requisition a general meeting has not been exercised during the notice period. | ||

(3) Where the latest annual accounts of any merging company relate to a financial year that ended more than 6 months before the date of the common draft terms, that company shall prepare an accounting statement in accordance with the following requirements: | ||

(a) the accounting statement shall be drawn up, as at a date not earlier than the first day of the third month preceding the date of the common draft terms— | ||

(i) in the format of the last annual balance sheet, and | ||

(ii) in accordance with— | ||

(I) the Companies Acts in the case of an Irish merging company, or | ||

(II) the law of the relevant EEA State in the case of an EEA merging company, | ||

(b) subject to subparagraph (c), valuations shown in the last annual balance sheet shall only be altered to reflect entries in the books of account, | ||

(c) the following shall be taken into account in preparing the accounting statement— | ||

(i) interim depreciation and provisions, and | ||

(ii) material changes in actual value not shown in books of account, and | ||

(d) the provisions of the Companies Acts relating to the auditor’s report on the last annual accounts apply, with any necessary modifications, to the accounting statement. | ||

(4) One or more members of the successor company who together hold not less than 5% of the paid-up capital of the company which carries the right to vote at general meetings of the company (excluding any shares held as treasury shares) may require the convening of a general meeting of the company to consider the common draft terms, and section 132 of the Act of 1963 applies, with any necessary modifications, in relation to the requisition. | ||

Purchase of minority shares | ||

12. (1) Where a majority of votes cast at the general meeting of a transferor company was in favour of the special resolution proposed pursuant to Regulation 10, a minority shareholder in that company may, not later than 15 days after the relevant date, request the successor company in writing to acquire his or her shares in the transferor company for cash. | ||

(2) Where a request is made by a minority shareholder in accordance with paragraph (1), the successor company shall purchase the shares of the minority shareholder at a price determined in accordance with the share exchange ratio set out in the common draft terms. | ||

(3) Nothing in this Regulation limits the power of the Court to make any order necessary for the protection of the interests of a dissenting minority in a merging company. | ||

(4) In this Regulation— | ||

“minority shareholder”, in relation to a transferor company, means— | ||

(a) in a case where the successor company (not being a company formed for the purpose of the merger) holds 90% or more (but not all) of the shares or other securities carrying the right to vote at general meetings of the transferor company, any other shareholder in the company, or | ||

(b) in any other case, a shareholder in the company who voted against the special resolution; | ||

“relevant date” means— | ||

(a) in relation to a minority shareholder referred to in paragraph (a) of the definition of “minority shareholder”, the date of publication of the notice of delivery of the common draft terms under Regulation 8(2), or | ||

(b) in relation to a minority shareholder referred to in paragraph (b) of the definition of “minority shareholder”, the date on which the general meeting of the transferor company was held. | ||

Certificate of compliance with pre-merger requirements | ||

13. On application by an Irish merging company, the Court shall, if it is satisfied that the company has completed properly the pre-merger requirements, issue a certificate to that effect, and such a certificate is conclusive evidence that the company has properly completed the pre-merger requirements. | ||

CHAPTER 2 | ||

Approval in State of Cross-Border Mergers | ||

Court scrutiny of cross-border merger | ||

14. (1) Where the successor company in a cross-border merger is an Irish company, the Court may, on application made jointly by all the merging companies, make an order confirming scrutiny of the legality of the cross-border merger as regards that part of the procedure which concerns the completion of the cross-border merger and, where appropriate, the formation of an Irish successor company. | ||

(2) The application shall be accompanied by a statement detailing the number and class of shares of each shareholder, if any, who has requested the purchase of his or her shares under Regulation 12 and of the measures which the successor company proposes to take to comply with each such request. | ||

(3) Subject to Regulations 15 and 16, the Court may make an order referred to in paragraph (1) if— | ||

(a) the successor company is an Irish company, | ||

(b) a certificate has been issued under Regulation 13 in relation to each Irish merging company, | ||

(c) in relation to each merging company which is an EEA company, a certificate to the same effect as a certificate issued under Regulation 13 has been issued by the competent authority of the EEA State under the law of which that company is governed, | ||

(d) the application is made not more than 6 months after the issuing of a certificate referred to in subparagraph (b) and (c), | ||

(e) the common draft terms to which each certificate, referred to in subparagraphs (b) and (c), relates are the same terms, | ||

(f) any arrangements for employee participation in the successor company as are required by Part 3 have been determined, | ||

(g) provision has been made for each creditor of any of the merging companies who establishes to the satisfaction of the Court that that creditor would otherwise be unfairly prejudiced by an order under Regulation 14, and | ||

(h) where a request for the purchase of shares, referred to in paragraph (2), has been made, that measures have been proposed to comply with each such request. | ||

(4) The Court shall specify, in an order, referred to in paragraph (1), the date on which the merger is to have effect. | ||

(5) After the cross-border merger has taken effect, an order made under this Regulation is conclusive evidence that— | ||

(a) the conditions set out in paragraph (3) have been satisfied, and | ||

(b) the pre-merger requirements have been complied with. | ||

Protection of creditors | ||

15. A creditor of an Irish merging company who, at the date of publication of the notice under Regulation 8, is entitled to any debt or claim against the company, is entitled to be heard in relation to the confirmation by the Court of the cross-border merger under Regulation 14. | ||

Compliance with other laws relating to mergers and take-overs | ||

16. (1) The Court shall not make an order under Regulation 14 in respect of a cross-border merger that is a merger or acquisition which is referred to in section 16 of the Competition Act 2002 (No. 14 of 2002) and to which paragraph (a) or (b) of section 18(1) of that Act applies or which is referred to in section 18(3) of that Act and which has been notified to the Competition Authority in accordance with that subsection, unless— | ||

(a) the Competition Authority has determined under section 21 or 22 of that Act that the merger may be put into effect, | ||

(b) the Competition Authority has made a conditional determination (within the meaning of that Act) in relation to the merger, | ||

(c) the period specified in subsection (2) of section 21 of that Act has elapsed without the Competition Authority having informed the undertakings which made the notification concerned of the determination (if any) it has made under paragraph (a) or (b) of that subsection in relation to the merger, or | ||

(d) a period of 4 months has elapsed since the appropriate date (within the meaning of that Act) without the Competition Authority having made a determination under section 22 of that Act in relation to the merger. | ||

(2) The Court shall not make an order under Regulation 14 in respect of a cross-border merger that is a concentration with a Community dimension (within the meaning of the Merger Control Regulation) unless— | ||

(a) the European Commission has issued a decision under Article 8 of that Regulation declaring the concentration compatible with the common market, | ||

(b) the concentration is deemed to have been declared compatible with the common market pursuant to Article 10(6) of that Regulation, or | ||

(c) after a referral by the European Commission to the Competition Authority under Article 9 of that Regulation, of one of the events specified in subparagraphs (a) to (d) of paragraph (1), has occurred. | ||

(3) The Court shall not make an order under Regulation 14 in respect of a cross-border merger while any requirement under an enactment for any other authorisation, approval, consent, waiver, licence, permission or agreement that affects the merger remains unsatisfied. | ||

(4) Nothing in these Regulations shall be taken to imply that the satisfaction of a requirement mentioned in paragraph (3) in relation to a merging company is effective in relation to the successor company. | ||

(5) Nothing in this Regulation shall affect any conditions to which a determination by the Competition Authority, a decision of the European Commission or an authorisation of a Regulator is subject. | ||

(6) Nothing in these Regulations limits the jurisdiction of the Irish Takeover Panel under the Irish Takeover Panel Act 1997 (No. 5 of 1997) with respect to a cross-border merger that— | ||

(a) involves a relevant company (within the meaning of that Act), and | ||

(b) constitutes a takeover (within the meaning of that Act), | ||

and, accordingly— | ||

(i) the Irish Takeover Panel has power to make rules under section 8 of that Act in relation to cross-border mergers of that kind, to the same extent and subject to the same conditions, as it has power to make rules under that section in relation to any other kind of takeover, and | ||

(ii) the Court, in exercising its powers under these Regulations, shall have due regard to the exercise of powers under that Act. | ||

(7) In this Regulation “Regulator” means any body or authority constituted by, or pursuant to, the provisions of any enactment and includes the Central Bank and Financial Services Authority of Ireland and any Minister of the Government or Minister of State. | ||

CHAPTER 3 Consequences of Approval of Cross-Border Mergers | ||

Copies of orders to be delivered to the Registrar | ||

17. (1) The Registrar of the Court shall cause an office copy of an order under Regulation 14 to be sent to the Registrar for registration in the Companies Register. | ||

(2) The Registrar shall cause to be published in the CRO Gazette notice of delivery to the Registrar of the order of the Court within 14 days of the delivery referred to in paragraph (1). | ||

(3) Where an order is made by a competent authority of another EEA State in respect of a cross-border merger for the purposes of Article 11 of the Directive, every transferor company which is an Irish company shall— | ||

(a) deliver a copy of that order to the Registrar for registration not more than 14 days after the date on which it was made, and | ||

(b) specify in writing to the Registrar, the date on which the competent authority of that EEA State determined, pursuant to Article 12 of the Directive, the date on which the cross border merger takes effect. | ||

(4) Where a company fails to comply with paragraph (3) the company and every officer in default shall be guilty of an offence. | ||

Action to be taken by Registrar on receipt of orders | ||

18. (1) Where the Registrar receives a copy of an order made under Regulation 14 the Registrar shall— | ||

(a) in relation to each transferor company which is an EEA company, give notice of that order as soon as practicable to the authority responsible for maintaining the register in which the company file for that EEA company is kept pursuant to Article 3 of the First Company Law Directive in the EEA State concerned, and | ||

(b) in relation to an Irish transferor company, register the copy order in respect of that company on, or as soon as practicable after, the effective date in the Companies Register. | ||

(2) Where the Registrar receives from the authority responsible for maintaining the register of another EEA State notice, under Article 13 of the Directive, that the cross-border merger has taken effect the Registrar shall register— | ||

(a) that notice, and | ||

(b) the date of the receipt of that notice. | ||

(3) The deletion of the registration of the company which is the subject of the notice referred to in paragraph (2) shall not be effected until the Registrar has received that notice. | ||

Consequences of a cross-border merger | ||

19. (1) Subject to paragraph (2), the consequences of a cross-border merger are that, on the effective date— | ||

(a) all the assets and liabilities of the transferor companies are transferred to the successor company, | ||

(b) in the case of a merger by acquisition or a merger by formation of a new company, where no application has been made by minority shareholders under Regulation 12, all remaining members of the transferor companies except the successor company (if it is a member of a transferor company) become members of the successor company, | ||

(c) the transferor companies are dissolved, | ||

(d) all legal proceedings pending by or against any transferor company shall be continued with the substitution, for the transferor companies, of the successor company as a party, | ||

(e) the successor company is obliged to make to the members of the transferor companies any cash payment required by the terms of the common draft terms, | ||

(f) the rights and obligations arising from the contracts of employment of the transferor companies are transferred to the successor company, | ||

(g) every contract, agreement or instrument to which a transferor company is a party shall, notwithstanding anything to the contrary contained in that contract, agreement or instrument, be construed and have effect as if— | ||

(i) the successor company had been a party thereto instead of the transferor company, | ||

(ii) for any reference (however worded and whether express or implied) to the transferor company there were substituted a reference to the successor company, and | ||

(iii) any reference (however worded and whether express or implied) to the directors, officers, representatives or employees of the transferor company, or any of them, were, respectively, a reference to the directors, officers, representatives or employees of the successor company or to such director, officer, representative or employee of the successor company as the successor company nominates for that purpose or, in default of nomination, to the director, officer, representative or employee of the successor company who corresponds as nearly as may be to the first-mentioned director, officer, representative or employee, | ||

(h) every contract, agreement or instrument to which a transferor company is a party becomes a contract, agreement or instrument between the successor company and the counterparty with the same rights, and subject to the same obligations, liabilities and incidents (including rights of set-off), as would have been applicable thereto if that contract, agreement or instrument had continued in force between the transferor company and the counterparty, and any money due and owing (or payable) by or to the transferor company under or by virtue of any such contract, agreement or instrument shall become due and owing (or payable) by or to the successor company instead of the transferor company, and | ||

(i) an offer or invitation to treat made to or by a transferor company before the effective date shall be construed and have effect, respectively, as an offer or invitation to treat made to or by the successor company. | ||

(2) The successor company shall comply with filing requirements and any other special formalities required by law (including the law of another EEA State) for the transfer of the assets and liabilities of the transferor companies to be effective in relation to other persons. | ||

Validity | ||

20. A cross-border merger which has taken effect as provided for in Regulation 14(4) may not be declared null and void and the order made under Regulation 14, specifying the date on which the cross-border merger is to have effect, shall constitute conclusive evidence of the effectiveness of the cross-border merger. | ||

Certain provisions of the Companies Acts not to apply | ||

21. (1) Sections 30 and 31 of the Companies (Amendment) Act 1983 (No. 13 of 1983) do not apply to the issue of shares by any company as a consequence of a cross-border merger. | ||

(2) A cross-border merger does not create a subsidiary relationship to which subsection (5) of section 149 of the Act of 1963 applies, and accordingly the restrictions in that subsection have no application to the profits, losses or accounts of an Irish successor company. | ||

(3) Section 41 (1) of the Companies (Amendment) Act 1983 (which restricts the right of a Company to purchase its own shares) does not apply to the purchase of any shares in pursuance of an order of the Court under this Regulation. | ||

PART 3 | ||

Employee Participation | ||

Chapter 1 | ||

Preliminary and General | ||

Interpretation | ||

22. In this Part— | ||

“appointed” means, in the absence of an election, appointed by the employees and the basis on which that appointment is made may, if the employees so determine, be such as is agreed by them with the merging companies, or the successor company, as the case may be; | ||

“consultation” means the establishment of dialogue and exchange of views between the representative body or the employees’ representatives (or both) and the competent organ of the successor company at a time, in a manner and with a content which allows the employees’ representatives, on the basis of the information provided, to express an opinion on measures envisaged by the competent organ which may be taken into account in the decision making process within the successor company; | ||

“Commission” means the Labour Relations Commission; | ||

“Court” means the Labour Court; | ||

“employee” means a person who has entered into or works under a contract of employment and references, in relation to a merging company or a successor company, to an employee shall be read as references to an employee employed by any of them; | ||

“employee participation” means the influence of the representative body or the employees’ representatives (or both) in the affairs of a company by the way of— | ||

(a) the right to elect or appoint some of the members of the company’s supervisory or administrative organ, or | ||

(b) the right to recommend or oppose, or both to recommend and oppose, the appointment of some or all of the members of the company’s supervisory or administrative organ; | ||

“employees’ representative” means a representative elected or appointed for the purposes of these Regulations; | ||

“establishment” means in relation to a company, a division (however described) of the undertaking physically separated from other parts of the company; | ||

“excepted body” has the meaning assigned to it by section 6(3) of the Trade Union Act 1941 (No.22 of 1941, as amended); | ||

“expert” means an individual, and may be the holder from time to time of a named office or position in a body corporate or other body or organisation; | ||

“information” means the informing of the representative body or the employees’ representatives (or both), by the competent organ of the successor company on questions which concern the company itself and any of its subsidiaries or establishments situated in another EEA State or which exceed the powers of the decision-making organs in a single EEA State at a time, in a manner and with a content which allows the employees’ representatives to undertake an in-depth assessment of the possible impact and, where appropriate, prepare consultations with the competent organ of the company; | ||

“involvement of employees” means any mechanism including information, consultation and employee participation, through which employees’ representatives may exercise an influence on decisions to be taken within the company; | ||

“representative body” means the body representative of the employees referred to in Schedule 1 set up for the purpose of informing and consulting the employees of a successor company situated in the EEA and, where applicable, of exercising employee participation rights in relation to the successor company; | ||

“special negotiating body” means the body established in accordance with Regulation 25 to negotiate with the competent body of the merging companies regarding the establishment of arrangements for the involvement of employees within the successor company; | ||

“Standard Rules” means the rules set out in Schedule 1; | ||

“trade union” means a trade union which holds a negotiation licence under Part II of the Trade Union Act 1941 (No. 22 of 1941, as amended); | ||

“wages” has the meaning assigned to it by the Payment of Wages Act 1991 (No. 25 of 1991, as amended). | ||

Requirement for employee participation | ||

23. (1) Arrangements for the participation of employees in every Irish successor company shall be established in accordance with these Regulations. | ||

(2) Without prejudice to paragraph (3), the successor company shall be subject to the rules in force in the State concerning employee participation, if any. | ||

(3) Notwithstanding paragraph (2), the rules in force concerning employee participation in the State, if any, shall not apply, where— | ||

(a) at least one of the merging companies has, in the 6 months before the publication of the common draft terms, an average number of employees that exceeds 500 and is operating under an employee participation system within the meaning of Regulation 2(1) of the European Communities (European Public Limited-Liability Company) (Employee Involvement) Regulations 2006 ( S.I. No. 623 of 2006 ), or | ||

(b) there is no provision in any enactment— | ||

(i) for at least the same level of employee participation as operated in the relevant merging companies, measured by reference to the proportion of employee representatives amongst the members of the administrative or supervisory organ or their committees or of the management group which covers the profit units of the company, subject to employee representation, or | ||

(ii) for employees of establishments of the successor company that are situated in other EEA States of the same entitlement to exercise employee participation rights as is enjoyed by those employees employed in the State. | ||

(4) In the cases referred to in paragraph (3), the participation of employees in the successor company and their involvement in the definition of such rights shall be regulated in accordance with Regulations 24 to 44 and in accordance with Article 12(2), (3) and (4) of Regulation (EC) No 2157/2001 6 as given full effect by the European Communities (European Public Limited Liability Company) Regulations 2007 ( S.I. No. 21 of 2007 ). | ||

Requirement to begin negotiations with employees | ||

24. (1) As soon as possible after the publication of the draft terms of a cross-border merger, the management or administrative organ of each merging company shall take the necessary steps to start negotiations with the representatives of the employees of that company on arrangements for the involvement of those employees in the successor company. | ||

(2) The steps to start negotiations shall include the provision of information about the identity of the merging companies, the number of employees in each (identified according to the EEA State in which they are located), and the number of such employees covered by an employee participation system. | ||

(3) The information referred to in paragraph (2) shall be supplied to the employees’ representative for that merging company or, where there is no such representative, to the employees themselves. | ||

Chapter 2 | ||

Special Negotiating Body | ||

Creation of special negotiating body | ||

25. (1) For the purposes of the negotiations mentioned in Regulation 24, the management or administrative organs of the merging companies shall make arrangements, in accordance with this Regulation, for the establishment of a special negotiating body that is representative of the employees of the merging companies. | ||

(2) The membership of the special negotiating body shall be determined in accordance with paragraphs (3) to (5) and the members shall be elected or appointed— | ||

(a) in the case of members to be elected or appointed to represent employees in the State, in accordance with the procedure specified in Regulations 26 and 27, and | ||

(b) in the case of members to be elected or appointed to represent employees in any other EEA State, in accordance with such procedures specified in laws or measures adopted by that EEA State. | ||

(3) Subject to paragraphs (4) and (5), seats on the special negotiating body shall be distributed in proportion to the number of workers employed in each EEA State by the merging companies by allocating in respect of a relevant EEA State one seat for each portion of employees employed in that EEA State which equals 10%, or a fraction thereof, of the total number of employees employed by the merging companies in all relevant EEA States taken together. | ||

(4) There shall be such further additional members from each EEA State as are necessary to ensure that the special negotiating body includes at least one member representing each transferor company which is registered and has employees in that EEA State, but so that— | ||

(a) the number of additional members does not exceed 20% of the number of members provided for by paragraph (3), and | ||

(b) the addition of members under this paragraph does not result in double representation of the employees concerned. | ||

(5) In the application of paragraph (4), if the number of those transferor companies is greater than the number of additional seats available, those additional seats shall be allocated in relation to those companies in decreasing order of the number of employees they employ. | ||

Representation of Irish employees on special negotiating body | ||

26. (1) The representation on a special negotiating body of the employees in the State of the merging companies is allocated as specified in this Regulation. | ||

(2) Where the number of seats on the special negotiating body allocated to the State is equal to the number of merging companies which have employees in the State, there shall be at least one seat for each of the merging companies, and each member elected or appointed to fill such a seat shall be considered as representing the employees of the merging company that elected or appointed them. | ||

(3) Where the number of seats on the special negotiating body allocated to the State is greater than the number of merging companies which have employees in the State, there shall be one seat for each of the merging companies, and additional seats shall be allocated to merging companies in decreasing order of the number of employees they employ, and each member elected or appointed to fill a seat in accordance with this paragraph shall be taken to represent those employees of the companies that elected or appointed them. | ||

(4) Where the number of seats on the special negotiating body allocated to the State is less than the number of merging companies which have employees in the State, the number of members equal to the number of available seats shall be elected or appointed according to the greatest number of votes won, and the representatives so elected or appointed shall between them represent the employees of the merging companies in the State that elected or appointed them. | ||

(5) The references in paragraphs (2), (3) and (4) to merging companies include the concerned subsidiaries or establishments of a merging company and, where the presence of a merging company in the State is only by virtue of the presence of its concerned subsidiaries or establishments, those entities are to be taken, for the purposes of those paragraphs, to constitute that merging company. | ||

(6) Employees of a merging company in which there are no employees’ representatives shall not, by virtue of that fact alone, be prevented from exercising their right to elect or appoint members of the special negotiating body. | ||

(7) An employee who is employed in the State by a merging company on the day the date or dates for the election of members of the special negotiating body conducted in accordance with Regulation 27 is fixed and who is, on the election day or days, an employee of such a company shall be entitled to vote in the election. | ||

(8) Each of the following is eligible to stand as a candidate in the election of members of the special negotiating body conducted in accordance with Regulation 27, namely: | ||

(a) an employee who has been employed in the State by one or more of the merging companies for a continuous period of not less than one year on the nomination day, | ||

(b) a trade union official, whether or not he or she is an employee, and | ||

(c) an official of an excepted body, whether or not he or she is an employee, | ||

provided that, in each case, he or she is nominated as such a candidate by— | ||

(i) a trade union or an excepted body which is already recognised by the relevant merging companies located in the State for collective bargaining or information and consultation purposes, or | ||

(ii) at least 2 employees. | ||

Conduct of election | ||

27. (1) Where elections of members of a special negotiating body fall to be conducted, being elections by employees in the State of merging companies, the management or administrative organs of the merging companies shall arrange for the conducting of those elections in accordance with this Regulation. | ||

(2) The management or administrative organs of the merging companies shall, in consultation with employees or their representatives (or both), appoint one or more persons as returning officers (referred to collectively in this Regulation as the “returning officer”), whose duties include the organisation and conduct of nominations and the election, and any person so appointed may authorise other persons to assist in the performance of those duties. | ||

(3) Where the number of candidates on the nomination day exceeds the number of members to be elected, a poll or polls shall be taken by the returning officer and voting in the poll shall take place by a secret ballot on a day or days to be decided by the returning officer. | ||

(4) The returning officer shall perform the duties of that office in a fair and reasonable manner and in the interests of an orderly and proper conduct of nomination and election procedures. | ||

(5) As soon as is reasonably practicable after the result of the election is known, the returning officer shall make such arrangements as are necessary to ensure that the result is sent to the candidates, employees and employees’ representatives and to the management or administrative organs of the merging companies. | ||

(6) Once the result of the election is sent by the returning officer in accordance with paragraph (5), the candidates concerned shall be regarded as having been duly elected. | ||

(7) All reasonable costs of the nomination and election procedure in the election shall be borne by the management or administrative organs of the merging companies. | ||

(8) Where, for any reason, a vacancy arises amongst those of the members of the special negotiating body who have been elected in accordance with this Regulation, arrangements shall be made by the competent organs of the merging companies and the special negotiating body for that vacancy to be filled. | ||

(9) Where a member of the special negotiating body whose nomination for election was on the basis of his or her satisfying the requirement contained in Regulation 26(8)(a) ceases to be employed by any of the merging companies, that person shall cease to be a member of the special negotiating body. | ||

(10) Where a member of the special negotiating body whose nomination for election was on the basis of his or her satisfying the requirement contained in Regulation 26(8)(b) or (c) ceases to be an official of the trade union or excepted body concerned, that person shall cease to be a member of the special negotiation body. | ||

Remit of special negotiating body | ||

28. (1) The special negotiating body and the management or administrative organs of the merging companies shall negotiate and determine, by written agreement, arrangements for the involvement of employees within the successor company in accordance with the principles set out in Regulation 32. | ||

(2) With a view to concluding that agreement, the management or administrative organs of the merging companies shall— | ||

(a) convene a meeting with the special negotiating body and shall inform local managements accordingly, and | ||

(b) inform the special negotiating body of the plan, the expected timetable, and the actual process of carrying out the cross-border merger, up to its registration. | ||

(3) The management or administrative organs of the merging companies shall convene regular meetings as necessary with the special negotiating body in order to facilitate the negotiation of a written agreement referred to in paragraph (1). | ||

(4) The agreement referred to in paragraph (1) shall be binding on the entire group of companies within the company resulting from the cross-border merger, irrespective of the EEA State in which it was signed and the location of those companies. | ||

Voting procedure in the special negotiating body | ||

29. (1) Subject to paragraph (2), the special negotiating body shall take its decisions (including the final decision whether to approve the entering into of an agreement under Regulation 28) by both— | ||

(a) an absolute majority of its members, with each member having one vote, and | ||

(b) an absolute majority of the employees represented by those members. | ||

(2) If— | ||

(a) at least 25% of the overall number of employees of the merging companies are covered by employee participation, and | ||

(b) the result of negotiations would lead to a reduction of employee participation rights, | ||

the majority required for a decision to approve the entering into of an agreement under Regulation 28 is the votes of two thirds of the members of the special negotiating body representing at least two thirds of the total number of employees, including the votes of members representing employees employed in at least two EEA States. | ||

(3) For the purposes of paragraph (2), a reduction of employee participation rights occurs when the proportion of members of the organs of the successor company having employee participation rights is lower than the highest proportion existing within the merging companies. | ||

(4) Any decision made in accordance with paragraph (2) shall be brought to the attention of the employees by the special negotiation body as soon as reasonably practicable and, in any event, no later than 14 days after the making of the decision. | ||

Engagement of experts by special negotiating body | ||

30. (1) For the purpose of the negotiations, the special negotiating body may engage experts of its choice to assist with its work. | ||

(2) The experts may be representatives of appropriate EEA-level trade union organisations. | ||

(3) The experts may be present at negotiation meetings in an advisory capacity at the request of the special negotiating body, where appropriate to promote coherence and consistency at EEA level. | ||

(4) The special negotiating body may decide to inform the representatives of appropriate external organisations, including trade unions and excepted bodies, of the start of the negotiations. | ||

Expenses | ||

31. The reasonable expenses relating to the functioning of the special negotiating body and, in general, to negotiations under these Regulations shall be borne by the merging companies so as to enable the special negotiating body to carry out its functions in an appropriate manner. | ||

Chapter 3 Negotiations and Agreement | ||

Spirit of cooperation | ||

32. (1) The parties shall negotiate or work together, as the case may be, in a spirit of cooperation with due regard for their reciprocal rights and obligations, and taking into account the interests both of the successor company and of the employees. | ||

(2) In paragraph (1), “parties” means— | ||

(a) the competent organs of the merging companies and the special negotiating body, in relation to reaching an agreement in accordance with Regulation 28 on arrangements for the involvement of the employees within the successor company; | ||

(b) the competent organ of the successor company and the representative body as set out in Schedule 1; and | ||

(c) the supervisory or administrative organ of the successor company and the employees or their representatives (or both), with regard to a procedure for the information and consultation of employees. | ||

Content of agreement | ||

33. (1) Without prejudice to the autonomy of the parties, the agreement referred to in Regulation 28 shall specify— | ||

(a) the scope of the agreement; | ||

(b) the substance of any arrangements for employee participation that, in the course of the negotiations, the parties decide to establish, including, where applicable— | ||

(i) the number of members of the administrative or supervisory body of the successor company whom the employees will be entitled to elect, appoint, recommend or oppose, | ||

(ii) the procedures as to how the members referred to in clause (i) may be elected, appointed, recommended or opposed by employees, and their rights; and | ||

(c) the date of entry into force of the agreement, its duration, the circumstances requiring renegotiation of the agreement and the procedure for its renegotiation. | ||

(2) Unless it otherwise provides, the agreement is not subject to the Standard Rules. | ||

Duration of negotiations | ||

34. (1) The management or administrative organs of the merging companies and the special negotiating body shall commence negotiations as soon as the special negotiating body is established and those negotiations may continue for up to 6 months from the establishment of that body. | ||

(2) The parties may decide, by joint agreement, to extend negotiations beyond the period referred to in paragraph (1) up to a total of one year from the establishment of the special negotiating body. | ||

(3) The special negotiating body may decide, by a majority of two thirds of its members representing at least two thirds of the employees, including the votes of members representing employees in at least two different EEA States, not to open negotiations or to terminate negotiations already opened and to rely on the rules on employee participation in force in each of the EEA States (including the State) where the successor company has its employees. | ||

(4) A decision under paragraph (3) shall terminate the procedure referred to in Regulation 28 for the conclusion of an agreement, and the provisions of Schedule 1 shall not apply. | ||

Standard Rules | ||

35. (1) In order to ensure the establishment of arrangements for the involvement of employees in the successor company, the Standard Rules apply, from the date of its registration, to the successor company if its registered office is located in the State and— | ||

(a) the parties so agree, or | ||

(b) no agreement has been concluded within the time limit specified in Regulation 34 and— | ||

(i) the management or administrative organs of the merging companies decide to accept the application of the Standard Rules in relation to the successor company and, on that basis, to continue with the merger, and | ||

(ii) the special negotiating body has not made a decision under Regulation 29(2). | ||

(2) Part 3 of Schedule 1 applies to the successor company only if, before registration of the successor company— | ||

(a) one or more forms of employee participation applied to one or more of the merging companies employing at least 33% of the total number of employees in all merging companies in each of the EEA States concerned, or | ||

(b) one or more forms of employee participation applied in one or more of the merging companies employing less than 33% of the total number of employees in all the merging companies in the EEA States and the special negotiating body decides that the rules set out in that Part are to apply. | ||

(3) Where there was more than one form of employee participation within the various merging companies, the special negotiating body shall choose which of those forms shall be established in the company resulting from the cross-border merger. | ||

(4) The special negotiating body shall inform the management or administrative organs of the merging companies of any decisions taken pursuant to paragraph (3). | ||

(5) The relevant organs of the merging companies may choose without any prior negotiation to be directly subject to the Standard Rules and to abide by them from the date of registration of the successor company. | ||

(6) Where, following prior negotiations, the Standard Rules apply, the parties may, notwithstanding those Rules, agree to limit the proportion of employee representatives in the administrative organ of the successor company, but if in one of the merging companies employee representatives constituted at least one third of the administrative or supervisory board, the limitation may not result in a lower proportion of employee representatives in the administrative organ of the successor company than one third. | ||

(7) Where, in accordance with paragraph (6), the parties agree to limit the proportion of employee representatives in the administrative organ, the majority required for such a decision shall be the votes of— | ||

(a) two-thirds of the employees including the votes of employees employed in at least two Member States, or | ||

(b) two-thirds of the members of the representative body representing at least two thirds of the total number of employees, including the votes of members representing employees employed in at least two Member States. | ||

Chapter 4 | ||

Supplementary | ||

Definition | ||

36. In this Chapter “relevant company” means— | ||

(a) a merging company, and | ||

(b) in relation to a merger by formation of a new company, the successor company. | ||

Protection of employee participation rights | ||

37. When the successor company is operating under an employee participation system, that company shall ensure that employees’ participation rights are protected in the event of subsequent domestic mergers for a period of three years after the cross-border merger has taken effect, by applying, mutatis mutandis, the rules laid down in these Regulations. | ||

Confidential information | ||

38. (1) An individual who is or at any time was— | ||

(a) an employee of a relevant company, | ||

(b) a member of— | ||

(i) the special negotiating body, or | ||

(ii) the representative body, | ||

(c) an employees’ representative for the purposes of these Regulations, or | ||

(d) an expert providing assistance, | ||

shall not reveal any information which, in the legitimate interest of any relevant company, has been expressly provided in confidence to him or her or to the body by a relevant company. | ||

(2) The duty of confidentiality imposed by paragraph (1) continues to apply after the cessation of the employment of the individual concerned or the expiry of his or her term of office. | ||

(3) A relevant company may refuse to communicate information to a special negotiating body where the nature of that information is such that, by reference to objective criteria, it would— | ||

(a) seriously harm the functioning of any relevant company, or | ||

(b) be prejudicial to any relevant company. | ||

(4) The Court or any member of the Court or the registrar or any officer or servant of the Court, including any person or persons appointed by the Court as an expert or mediator, shall not disclose any information obtained in confidence in the course of any proceedings before the Court under these Regulations. | ||

Protection of employees’ representatives | ||

39. (1) A relevant company shall not penalise— | ||

(a) a member of the special negotiating body, | ||

(b) a member of the representative body, | ||

(c) an employees’ representative performing functions under these Regulations, or | ||

(d) an employees’ representative in the supervisory or administrative organ of a successor company who is an employee of that company or of a merging company, | ||

for the performance of his or her functions in accordance with these Regulations. | ||

(2) For the purposes of this Regulation, a person referred to in paragraph (1) is penalised if that person— | ||

(a) is dismissed or suffers any unfavourable change to his or her conditions of employment or any unfair treatment (including selection for redundancy), or | ||

(b) is the subject of any other action prejudicial to his or her employment. | ||

(3) Schedule 2 has effect in relation to an alleged contravention of paragraph (1). | ||

(4) Subject to paragraph (6), a person referred to in paragraph (1) shall be afforded any reasonable facilities, including time off, that will enable him or her to perform promptly and efficiently his or her functions as a member of the special negotiating body or representative body or as an employees’ representative, as the case may be. | ||

(5) A person referred to in paragraph (1) shall be paid his or her wages for any period of absence afforded to him or her in accordance with paragraph (4). | ||

(6) The granting of facilities under paragraph (4) shall have regard to the needs, size and capabilities of the relevant company and shall not impair the efficient operation of that company. | ||

(7) This Regulation applies in particular to attendance by representatives at meetings of the special negotiating body or representative body or any other meetings within the framework of an agreement referred to in Regulation 33 or Schedule 1 or any meeting of the administrative or supervisory organ. | ||

(8) Subject to paragraph (9), this Regulation is in addition to, and not in substitution for, any rights enjoyed by an employees’ representative, whether under any enactment or otherwise. | ||

(9) If a penalisation of a person referred to in paragraph (1), in contravention of that paragraph, constitutes a dismissal of that person within the meaning of the Unfair Dismissals Acts 1977 to 2007, relief may not be granted to that person in respect of that penalisation both under Schedule 2 and under those Acts. | ||

Dispute Resolution | ||

40. (1) Subject to paragraph (2), a dispute between any relevant company and employees or their representatives (or both) concerning— | ||

(a) matters provided for in Regulations 25 to 31 relating to the special negotiating body, | ||

(b) the negotiation, interpretation or operation of an agreement in relation to Regulation 24, 33 or 34, | ||

(c) the interpretation or operation of the Standard Rules as provided for in Regulation 35 and Schedule 1, and | ||

(d) a matter provided for in paragraph (4), (5), (6) or (7) of Regulation 39, or | ||

(e) a complaint by an employee or his or her representative (or both) that, in relation to Regulation 37, the company resulting from any subsequent domestic merger is being or will be misused for the purpose of depriving employees of their rights to employee involvement or of withholding those rights, | ||

may be referred by one or more relevant company, employees employed in the State or their representatives (or both) to the Court for investigation. | ||

(2) Such a dispute may be referred to the Court only after— | ||

(a) recourse to the internal dispute resolution procedure (if any) in place in the relevant company concerned has failed to resolve the dispute, and | ||

(b) the dispute has been referred to the Commission, and, having made available such of its services as are appropriate for the purpose of resolving the dispute, the Commission provides a certificate to the Court stating that the Commission is satisfied that no further efforts on its part will advance the resolution of the dispute. | ||

(3) Having investigated a dispute under paragraph (1), the Court may make a recommendation in writing, giving its opinion in the matter. | ||

(4) Where, in the opinion of the Court, a dispute that is the subject of a recommendation under paragraph (3) has not been resolved, the Court may, at the request of— | ||

(a) one or more relevant company, or | ||

(b) one or more employees or their representatives (or both), | ||

and, following a review of all relevant matters make a determination in writing. | ||

(5) Disputes between any relevant company and employees or their representatives (or both) concerning matters of confidential information provided for in Regulation 38 may be referred by— | ||

(a) one or more relevant company, or | ||

(b) any employee of the company or his or her representatives (or both), | ||

to the Court for determination. | ||

(6) In relation to a dispute referred to it under this Regulation, the Court shall— | ||

(a) give the parties an opportunity to be heard by it and to present any evidence relevant to the dispute, | ||

(b) make a recommendation or determination, as the case requires, in writing in relation to the dispute, and | ||

(c) communicate the recommendation or determination to the parties. | ||

(7) The following matters, or procedures to be followed in relation to them, shall be determined by the Court, namely: | ||

(a) the procedure in relation to all matters concerning the initiation and hearing by the Court of a dispute under this Regulation; | ||

(b) the times and places of hearings of such disputes; | ||

(c) the publication and notification of recommendations and determinations of the Court; | ||

(d) any matters consequential on, or incidental to, the matters referred to in subparagraphs (a) to (c). | ||

(8) In deciding what constitutes confidential information, the Court may be assisted by a panel of experts. | ||

(9) A party to a dispute under this Regulation may appeal from a determination of the Court to the High Court on a point of law and the decision of the High Court shall be final and conclusive. | ||

(10) The Court may refer a question of law arising in proceedings before it under this Regulation to the High Court for determination and the decision of the High Court shall be final and conclusive. | ||

Power of Court to administer oaths and compel witnesses | ||

41. (1) The Court shall, on the hearing of a dispute referred to it for recommendation or determination under Regulation 40 or on the hearing of an appeal under Schedule 2, have power to take evidence on oath and for that purpose may cause to be administered oaths to persons attending as witnesses at that hearing. | ||

(2) Any person who, upon examination on oath authorised by this Regulation, wilfully makes any statement which is material for that purpose and which he or she knows to be false or does not believe to be true commits an offence. | ||

(3) The Court may, by giving notice in that behalf in writing to any person, require that person to attend at such time and place as is specified in the notice to give evidence in relation to a dispute referred to the Court for recommendation or determination under Regulation 40 or an appeal under Schedule 2, or to produce any documents in the person’s possession, custody or control which relate to any such matter. | ||

(4) A notice under paragraph (3) may be given either by delivering it to the person to whom it relates or by sending it by post in a prepaid registered letter addressed to that person at the address at which he or she ordinarily resides or, in the case of a relevant company, at the address at which the relevant company ordinarily carries on any profession, business or occupation. | ||

(5) If a person to whom a notice under paragraph (3) has been given refuses or wilfully neglects to attend in accordance with the notice or, having so attended, refuses to give evidence or refuses or wilfully fails to produce any document to which the notice relates, that person commits an offence. | ||

(6) A witness in a hearing of a dispute or appeal before the Court has the same privileges and immunities as a witness before the High Court. | ||

Enforcement | ||

42. (1) If— | ||

(a) a party to a Court determination fails to carry out in accordance with its terms a determination of the Court in relation to a dispute under Regulation 40, or | ||

(b) a party to a complaint under Schedule 2 fails to carry out in accordance with its terms a decision of a rights commissioner or a determination of the Court under that Schedule in relation to the complaint, | ||

within the period specified in the determination or decision or if no such period is so specified within 6 weeks from the date on which the determination or decision is communicated to the parties, the Circuit Court shall, on application to it in that behalf by one or more of the parties to the dispute or complaint, without hearing any evidence (other than in relation to the matters aforesaid) make an order directing the party concerned to carry out the determination or decision in accordance with its terms. | ||

(2) The reference in paragraph (1) to a determination of the Court or a decision of a rights commissioner is a reference to such a determination or decision in relation to which, at the end of the time for bringing an appeal against it, no such appeal has been brought or, if such an appeal has been brought it has been abandoned, and the references to the date on which the determination or decision is communicated to the parties shall, in a case where such an appeal is abandoned, be read as references to the date of that abandonment. | ||

(3) In an order under this Regulation providing for the payment of compensation of the kind referred to in paragraph 2(3)(c) of Schedule 2, the Circuit Court may, if in all the circumstances it considers it appropriate to do so, direct a relevant company to pay to the employee concerned interest on the compensation at the rate referred to in section 22 of the Courts Act 1981 (No.11 of 1981), in respect of the whole or any part of the period beginning 6 weeks after the date on which the determination of the Court or the decision of the rights commissioner is communicated to the parties and ending on the date of the order. | ||

(4) An application under this Regulation to the Circuit Court shall be made to the judge of the Circuit Court for the circuit in which the relevant company concerned has its principal place of business. | ||

Workforce thresholds in other legislation | ||