S.I. No. 367/2022 - Childcare Support Act 2018 (Calculation of Amount of Financial Support) (Amendment No. 2) Regulations 2022

Notice of the making of this Statutory Instrument was published in | ||

“Iris Oifigiúil” of 22nd July, 2022. | ||

I, RODERIC O GORMAN, Minister for Children, Equality, Disability, Integration and Youth, in the exercise of the powers conferred on me by section 13 of the Childcare Support Act 2018 (No. 11 of 2018), and with the consent of the Minister for Public Expenditure and Reform, hereby make the following regulations: | ||

Citation and commencement | ||

These Regulations may be cited as the Childcare Support Act 2018 (Calculation of amount of financial support) (Amendment No. 2) Regulations 2022. | ||

These Regulations shall come into operation on 29 August 2022. | ||

Interpretation | ||

In these Regulations — | ||

“Principal Regulations” means the Childcare Support Act 2018 (Calculation of amount of financial support) Regulations 2019 (S.I. 378 of 2019). | ||

Amendment of Principal Regulations | ||

The Principal Regulations are amended by the substitution of – | ||

(a) Schedule 1 for Schedule 1 of the Principal Regulations, | ||

(b) Schedule 3 for Schedule 3 of the Principal Regulations, and | ||

(c) Schedule 4 for Schedule 4 of the Principal Regulations. | ||

“SCHEDULE 1 | ||

Amounts per hour of non-income related financial support | ||

Non-income related financial support shall be calculated at the following rate: | ||

€0.50 per hour in the case of a child who is older than 24 weeks of age and under 15 years of age.” | ||

“SCHEDULE 3 | ||

Methodology in accordance with which the amount per hour (if any) of income-related financial support shall be calculated | ||

(a) The base income threshold shall be €26,000. | ||

(b) If an applicant qualifies for income-related financial support, the scheme administrator shall determine the amount per hour of income-related financial support as follows: | ||

(i) where an applicant’s reckonable income is below or equal to the base income threshold, the maximum amount per hour will apply; | ||

(ii) where an applicant’s reckonable income is at or exceeds the income limit, the amount per hour shall be zero; | ||

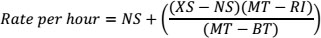

(iii) where an applicant’s reckonable income is between the base income threshold and the income limit, the amount per hour shall be determined by the following formula: | ||

| ||

where– | ||

NS is the minimum amount of financial support per hour, | ||

XS is the maximum amount of financial support per hour, | ||

MT is the income limit, | ||

BT is the base income threshold, and | ||

RI is the reckonable income. | ||

(c) In determining the amount per hour, if any, of income-related financial support, a Multiple Child Discount shall be applied to net income by the scheme administrator in relation to children under the age of 15 years - | ||

(1) who reside with the applicant or with his or her partner, and | ||

(2) where the applicant or his or her partner is a parent of the child. | ||

The discount which shall be applied to net income to determine the amount per hour of income related financial support shall be: | ||

(i) €4,300 in relation to two children; | ||

(ii) €8,600 in relation to more than two children.” | ||

“SCHEDULE 4 | ||

Maximum number of hours in respect of which an applicant may qualify for financial support | ||

Maximum number of hours for non-income related financial support | ||

In the case of an application for non-income related financial support, the maximum number of hours of financial support for which an applicant may qualify shall be: | ||

(a) 45 hours per week where the child is under 15 years of age. | ||

Maximum number of hours for income-related financial support | ||

In the case of an application for income-related financial support, the maximum number of hours of financial support for which an applicant may qualify shall be: | ||

(a) where the applicant and his or her partner both satisfy one or more of the following - | ||

i) are engaged in work or study, | ||

ii) are transitioning into or out of work or study, or | ||

iii) are unavailable to care for the child who is the subject of the application, | ||

the maximum number of hours per week of income-related financial support for which the applicant qualifies, is: | ||

- 45 hours | ||

(b) Where the criteria specified in paragraph (a) above are not met, then the maximum number of hours per week of financial support for which an applicant qualifies is: | ||

- 20 hours.” | ||

The Minister for Public Expenditure and Reform consents to the making of the foregoing Regulations. | ||

| ||

GIVEN under my Official Seal of the Minister for Public Expenditure and Reform, | ||

14 July, 2022. | ||

MICHAEL MCGRATH, | ||

Minister for Public Expenditure and Reform. | ||

| ||

GIVEN under my Official Seal, | ||

14 July, 2022. | ||

RODERIC O’GORMAN, | ||

Minister for Children, Equality, Disability, Integration and Youth. | ||

EXPLANATORY NOTE | ||

(This note is not part of the Instrument and does not purport to be a legal interpretation.) | ||

These Regulations are made pursuant to powers conferred on the Minister for Children and Youth Affairs under section 13 of the Childcare Support Act 2018 with the consent of the Minister for Public Expenditure and Reform. | ||

The Regulations amend the Regulations previously made under section 13 of the Childcare Support Act 2018 ( S.I. 378/2019 ), ( S.I. 33/2020 ) and ( S.I. 198/2022 ) to extend the universal subsidy to children under 15 years of age. |