Finance Act 2019

|

Irish real estate funds | ||

|

30. (1) Chapter 1B of Part 27 of the Principal Act is amended— | ||

(a) in section 739K(1) — | ||

(i) by inserting the following definitions: | ||

“ ‘balance sheet’ means the balance sheet, statement of financial position or equivalent prepared in respect of an investment undertaking or sub-fund, as the case may be, in accordance with international accounting standards or alternatively in accordance with the generally accepted accounting practice specified in the investment undertaking’s prospectus; | ||

‘market value’ shall be construed in accordance with section 548; | ||

‘value of an IREF taxable event’ in relation to an IREF taxable event within the meaning of— | ||

(a) paragraph (a) of the definition of ‘IREF taxable event’, means the value of the relevant payment, | ||

(b) paragraphs (b), (c), (d), (e) and (f) of the definition of ‘IREF taxable event’, means the market value of the unit less any amount subscribed for that unit, and | ||

(c) paragraph (g) of the definition of ‘IREF taxable event’, means the amount of the accrued IREF profits sold or transferred;”, | ||

(ii) in the definition of “IREF assets”, in paragraph (d), by inserting “(within the meaning of section 110(5A))” after “specified mortgages”, and | ||

(iii) in the definition of “IREF excluded profits”, by substituting the following paragraph for paragraph (c): | ||

“(c) in relation to shares, within the meaning of paragraph (b) of the definition of ‘IREF assets’, any profits or gains other than— | ||

(i) property income dividends, or | ||

(ii) distributions in respect of gains accruing on the disposal of assets of the property rental business of the REIT or group REIT concerned, as the case may be, | ||

in relation to those shares;”, | ||

(b) by inserting the following section after section 739K: | ||

“Associated enterprises | ||

739KA. (1) In this section and section 739LC— | ||

‘connected’ has the same meaning as in section 10, subject to the modification that references in section 10 to ‘control’ shall be read as if they were references to control within the meaning of subsection (4) of this section; | ||

‘deposit’ means a sum of money paid to an enterprise on terms under which it, or any part of it, may be repaid with or without interest and either on demand or at a time or in circumstances agreed by or on behalf of the person making the payment and the person to whom it is made, notwithstanding that the amount to be repaid may be to any extent linked to or determined by changes in a stock exchange index or any other financial index; | ||

‘enterprise’ means an entity or an individual; | ||

‘entity’ means— | ||

(a) a person (other than an individual), | ||

(b) an investment undertaking, subject to subsection (2), | ||

(c) a pension scheme, | ||

(d) an offshore fund (within the meaning of section 743(1)), or | ||

(e) any other agreement, undertaking, scheme or arrangement, whether established or created under the law of the State or of a territory other than the State, | ||

that would, for the purposes of the Tax Acts, be regarded as— | ||

(i) carrying on any of the activities referred to in paragraph (b), (c) or (d) of subsection (4), or | ||

(ii) advancing amounts, making funds available or receiving interest as referred to in subsections (3) and (4) of section 739LC; | ||

‘member’, in relation to a pension scheme, means— | ||

(a) an employer or employee, in respect of a scheme referred to in section 774, | ||

(b) an individual referred to in section 784(1)(a), 784A(1)(b), 784C(2) or 785(1), or | ||

(c) a contributor, within the meaning of section 787A, in respect of a PRSA; | ||

‘significant influence in the management of’, in relation to an entity, means the ability to participate in the financial and operating decisions of that entity. | ||

(2) Where the entity referred to in paragraph (b) of the definition of ‘entity’ is an umbrella scheme, regard shall be had to each sub-fund of that umbrella scheme and the unit holders of that sub-fund, as if that sub-fund was an entity in its own right. | ||

(3) For the purposes of this section and section 739LC, an enterprise shall be treated as an associate of another enterprise where— | ||

(a) one of the 2 enterprises has control of the other enterprise, or both enterprises are under the control of the same enterprise or enterprises, | ||

(b) one enterprise is connected with the other enterprise, | ||

(c) those enterprises are associated within the meaning of section 739D(1)(a), where those enterprises are investment undertakings or similar entities established under the laws of a territory other than the State, | ||

(d) one enterprise is a pension scheme and the other enterprise is a member of that scheme, or | ||

(e) one enterprise is a scheme, similar to a pension scheme, that is established under the laws of a territory other than the State and the other enterprise is a member of that scheme. | ||

(4) For the purposes of this section, an enterprise shall be taken to have control of an entity if one or more than one of the following conditions are satisfied: | ||

(a) where the enterprise is an entity, and— | ||

(i) both entities are included in the same consolidated financial statements prepared under— | ||

(I) international accounting standards, or | ||

(II) Irish generally accepted accounting practice, | ||

or | ||

(ii) both entities— | ||

(I) are not included in the same consolidated financial statements, or | ||

(II) are included in consolidated financial statements prepared under an accounting practice referred to in paragraph (a)(i)(I), | ||

but would, if consolidated financial statements were prepared under the accounting practice referred to in paragraph (a)(i)(I), be included in the same consolidated financial statements; | ||

(b) where that enterprise exercises, or is able to exercise or is entitled to acquire, control, whether direct or indirect, over the entity’s affairs and, in particular, but without prejudice to the generality of the foregoing— | ||

(i) if such enterprise possesses or is entitled to acquire (other than in the circumstances described in section 739LC(4))— | ||

(I) not less than 25 per cent of the— | ||

(A) issued share capital of a company, or | ||

(B) units of an investment undertaking, | ||

(II) not less than 25 per cent of the voting power in the entity, or | ||

(III) such rights as would if the whole of the profits of the entity were distributed, entitle the enterprise, directly or indirectly, to receive 25 per cent or more of the profits so distributed, | ||

or | ||

(ii) by virtue of any powers conferred by the constitution, articles of association or other document regulating that or any other entity; | ||

(c) where the enterprise has significant influence in the management of the entity; | ||

(d) where the enterprise holds one or both of the following securities in the entity: | ||

(i) securities convertible directly or indirectly into shares in a company, or units in the investment undertaking, or securities carrying any right to receive units or securities of the entity; | ||

(ii) securities under which the consideration given by the entity for the use of the principal secured— | ||

(I) is to any extent dependent on the results of the entity’s business or any part of the entity’s business, where the entity is not an investment undertaking, or | ||

(II) represents more than a reasonable commercial return for the use of that principal. | ||

(5) Where 2 or more connected enterprises together satisfy the condition set out in subsection (4)(b), they shall each be taken to have control of the entity. | ||

(6) For the purposes of subsection (4)(b), an enterprise shall be treated as entitled to acquire anything which such enterprise is entitled to acquire at a future date or will at a future date be entitled to acquire. | ||

(7) For the purposes of subsections (4)(b) and (5), there shall be attributed to an enterprise any rights or powers of a nominee for such enterprise, that is, any rights or powers which another enterprise possesses on such enterprise’s behalf or may be required to exercise on such enterprise’s direction or behalf. | ||

(8) For the purposes of subsections (4)(b) and (5), there may also be attributed to any enterprise (in this subsection referred to as the ‘first-mentioned enterprise’) all the rights and powers of— | ||

(a) any enterprise of which the first-mentioned enterprise has, or the first-mentioned enterprise and associates of the first-mentioned enterprise have, control, | ||

(b) any 2 or more enterprises of which the first-mentioned enterprise has, or the first-mentioned enterprise and associates of the first-mentioned enterprise have, control, | ||

(c) any associate of the first-mentioned enterprise, or | ||

(d) any 2 or more associates of the first-mentioned enterprise, | ||

including the rights and powers attributed to an enterprise or associate under subsection (7), but excluding those attributed to an associate under this subsection.”, | ||

(c) in section 739L— | ||

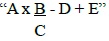

(i) by substituting | ||

for | ||

(ii) by substituting “A is the value of the IREF taxable event which is attributable to the retained profits of the IREF,” for “A is the portion of the IREF taxable event which is attributable to the retained profits of the IREF,”, | ||

(iii) by substituting “IREF,” for “IREF, and”, | ||

(iv) by substituting “by the IREF, and” for “by the IREF.”, | ||

(v) by inserting the following: | ||

“E is an amount calculated as the difference between the value of the IREF taxable event and the value of the unit in accordance with the balance sheet of the IREF, where the IREF taxable event is one referred to in paragraph (b) of the definition of ‘value of an IREF taxable event’ in section 739K(1) and the value of the unit in accordance with the balance sheet of the IREF is less than the value of the IREF taxable event.”, | ||

(vi) by designating the section (as amended by subparagraphs (i) to (v)) as subsection (1), and | ||

(vii) by inserting the following subsection after subsection (1): | ||

“(2) For the purposes of subsection (1), ‘value of the unit in accordance with the balance sheet’ means the net asset value of the IREF, calculated in accordance with the balance sheet of the IREF at the date of the computation of the value of an IREF taxable event, which is attributable to each unit less any amount subscribed for that unit.”, | ||

(d) by inserting the following sections after section 739L: | ||

“Profit: financing cost ratio | ||

739LA. (1) In this section— | ||

‘adjusted property financing costs’ means the property financing costs less any amount of income referred to in subsection (2)(b); | ||

‘property financing costs’ means costs, being costs of debt finance or finance leases, which are taken into account in arriving at the profits of an IREF, including amounts in respect of— | ||

(a) interest, discounts, premiums, or net swap or hedging costs, and | ||

(b) fees or other expenses associated with raising debt finance or arranging finance leases; | ||

‘property financing costs ratio’ means the ratio of the sum of profits of an IREF and the adjusted property financing costs of an IREF to the adjusted property financing costs of the IREF; | ||

‘relevant cost’ means the amount which would be allowable as a deduction for the purposes of the Capital Gains Tax Acts under section 552(1); | ||

‘specified debt’ means any debt incurred by an IREF in respect of monies borrowed by, or advanced to, the IREF. | ||

(2) (a) This subsection applies where the aggregate of the specified debt exceeds an amount equal to 50 per cent of the relevant cost of the IREF assets (and that excess is referred to in this subsection as the ‘excess specified debt’). | ||

(b) Where this subsection applies, the IREF shall be treated for the purposes of the Income Tax Acts as receiving an amount of income determined by the formula— | ||

| ||

where— | ||

A is the property financing costs, | ||

B is the excess specified debt, and | ||

C is the total specified debt. | ||

(3) (a) This subsection applies where the property financing costs ratio of the IREF is less than 1.25:1 for an accounting period. | ||

(b) Where this subsection applies, the IREF shall be treated for the purposes of the Income Tax Acts as receiving an amount of income equal to the amount by which the adjusted property financing costs would have to be reduced for the property financing costs ratio to equal 1.25:1 for that accounting period. | ||

(4) The amount of income referred to in subsections (2) and (3) shall be charged to income tax under Case IV of Schedule D and shall be treated as income— | ||

(a) arising in the year of assessment in which the accounting period in which the amount was taken into account ends, and | ||

(b) against which no loss, deficit, expense or allowance may be set off. | ||

Profit: calculating profits available for distribution | ||

739LB. (1) This section applies to any amount taken into account by an IREF in computing the profits of the IREF, in respect of any disbursement or expense, not being money wholly and exclusively laid out or expended for the purposes of the IREF business (referred to in this section as the ‘disallowed amount’). | ||

(2) The IREF shall be treated as receiving for the purposes of the Income Tax Acts an amount of income equal to the disallowed amount. | ||

(3) The amount of income referred to in subsection (2) shall be charged to income tax under Case IV of Schedule D and shall be treated as income— | ||

(a) arising in the year of assessment in which the accounting period in which the disallowed amount was taken into account ends, and | ||

(b) against which no loss, deficit, expense or allowance may be set off. | ||

Exclusion for third-party debt | ||

739LC.(1) Where— | ||

(a) an amount of income is treated as arising to an IREF under section 739LA or 739LAA, and | ||

(b) some or all of that amount relates to a third-party debt, | ||

the amount of income on which the IREF is charged to income tax shall be reduced by the amount of income that would have been charged to tax had the specified debt consisted solely of third-party debt. | ||

(2) (a) Subject to subsection (4), for the purposes of this section, ‘third-party debt’ means— | ||

(i) a loan advanced to the IREF by an enterprise other than an associate of that IREF, | ||

(ii) where the full amount advanced is employed, subject to paragraph (c), in the purchase, development, improvement or repair of a premises, and | ||

(iii) the loan is not subject to any arrangements of a type referred to in subsection (3), | ||

and includes a loan which satisfies the conditions of subparagraphs (i) and (iii) where the amount advanced is used to repay a loan which satisfied the condition of subparagraph (ii). | ||

(b) References in this section to an amount being advanced to an IREF, or being payable by an IREF, shall be read as including an amount advanced to, or payable by, a partnership in which the IREF is a partner. | ||

(c) For the purposes of paragraph (a)(ii) — | ||

(i) monies borrowed at or about the time of the purchase of the premises shall be treated as having been employed in the purchase of those premises, and | ||

(ii) amounts employed in purchasing a property from an associate of an IREF shall only be treated as third-party debt if immediately prior to the purchase that associate had carried out significant development work on the property, such that the development exceeds 30 per cent of the market value of the property at the date of the commencement of the development, and the property is being acquired by the IREF for the purposes of property rental. | ||

(3) For the purposes of subsection (2)(a)(iii), the arrangements are any of the following: | ||

(a) arrangements pursuant to which— | ||

(i) interest is payable by an IREF to another enterprise such that this section does not apply by virtue only of the fact that the IREF and the enterprise concerned are not associated, and | ||

(ii) interest is payable by some other enterprise not associated with the IREF to an enterprise associated with the IREF; | ||

(b) arrangements pursuant to which— | ||

(i) interest is payable by an IREF to another enterprise (in this paragraph referred to as the ‘first-mentioned enterprise’) where the IREF and the first-mentioned enterprise concerned are not associated, and | ||

(ii) the first-mentioned enterprise— | ||

(I) has been advanced an amount by another enterprise that is an associate of the IREF, or | ||

(II) has received a deposit from another enterprise that is an associate of the IREF, | ||

equal to some or all of the principal amount of the loan in respect of which the interest referred to in subparagraph (i) is payable; | ||

(c) arrangements entered into in relation to an IREF the effect of which is that any amount has been advanced, or funds have been made available, indirectly from an associate of an IREF to the IREF, or interest is payable by an IREF indirectly to an associate of that IREF, in circumstances other than those referred to in paragraph (a) or (b); | ||

(d) arrangements pursuant to which— | ||

(i) associates of an IREF (in this paragraph referred to as the ‘first-mentioned IREF’) advance amounts, or make funds available, directly or indirectly to an IREF with whom they are not associated (in this paragraph referred to as the ‘second-mentioned IREF’), and | ||

(ii) associates of the second-mentioned IREF advance amounts, or make funds available, directly or indirectly to the first-mentioned IREF, | ||

and those IREFs, or those associates, are acting in concert or under arrangements made by any enterprise. | ||

(4) Notwithstanding section 739KA, a loan which is a third-party debt shall not cease to be so treated where the lender becomes an associate of the IREF solely on account of the enforcement of any security granted as a bona fide condition of, or in connection with, the loan.”, | ||

(e) by inserting the following section after section 739LA (inserted by paragraph (d)): | ||

“Profit: financing cost ratio from 1 January 2020 | ||

739LAA. (1) In this section— | ||

‘adjusted property financing costs’ means the property financing costs less any amount of income referred to in subsection (2)(b); | ||

‘annual IREF profits’ means the profits, gains or losses of an IREF business as shown in the income statement of the IREF excluding— | ||

(a) any realised profits, gains or losses in relation to the disposal of an asset, and | ||

(b) any unrealised profits, gains or losses in relation to an asset, | ||

where the disposal of such asset would be a disposal of a chargeable asset for the purposes of capital gains tax or corporation tax on chargeable gains and would otherwise form part of relevant profits of the IREF which are not chargeable to tax under section 739C; | ||

‘property financing costs’ means costs, being costs of debt finance or finance leases, which are taken into account in arriving at the profits of an IREF, including amounts in respect of— | ||

(a) interest, discounts, premiums, or net swap or hedging costs, and | ||

(b) fees or other expenses associated with raising debt finance or arranging finance leases; | ||

‘property financing costs ratio’ means the ratio of the sum of the annual IREF profits and the adjusted property financing costs of an IREF to the adjusted property financing costs of the IREF; | ||

‘relevant cost’ means the amount which would be allowable as a deduction for the purposes of the Capital Gains Tax Acts under section 552 subject to the modification that references in subsection (3) of that section to ‘borrowed money’ shall be read as if they were references only to borrowed money that is third-party debt; | ||

‘specified debt’ means— | ||

(a) any debt incurred by an IREF in respect of monies borrowed by, or advanced to, the IREF, or | ||

(b) a portion of any debt incurred by a partnership in which the IREF is a partner, in respect of monies borrowed by, or advanced to, the partnership, calculated as the higher of— | ||

(i) the portion of the capital of the partnership held by the IREF, or | ||

(ii) the portion of the profits of the partnership to which the IREF is entitled. | ||

(2) (a) This subsection applies where the aggregate of the specified debt exceeds an amount equal to 50 per cent of the relevant cost of the IREF assets (and that excess is referred to in this subsection as the ‘excess specified debt’). | ||

(b) Where this subsection applies, the IREF shall be treated for the purposes of the Income Tax Acts as receiving an amount of income determined by the formula— | ||

| ||

where— | ||

A is the property financing costs, | ||

B is the excess specified debt, and | ||

C is the total specified debt. | ||

(3) (a) This subsection applies where— | ||

(i) the property financing costs ratio of the IREF is less than 1.25:1 for an accounting period and the sum of the annual IREF profits and the adjusted property financing costs of an IREF is greater than zero, or | ||

(ii) the sum of the annual IREF profits and the adjusted property financing costs of an IREF is zero or lower. | ||

(b) Where this subsection applies— | ||

(i) by virtue of paragraph (a)(i), the IREF shall be treated for the purposes of the Income Tax Acts as receiving an amount of income equal to the amount by which the adjusted property financing costs would have to be reduced for the property financing costs ratio to equal 1.25:1 for that accounting period, and | ||

(ii) by virtue of paragraph (a)(ii), the IREF shall be treated for the purposes of the Income Tax Acts as receiving an amount of income equal to the adjusted property financing costs. | ||

(4) The amount of income referred to in subsections (2) and (3) shall be charged to income tax under Case IV of Schedule D and shall be treated as income— | ||

(a) arising in the year of assessment in which the accounting period in which the amount was taken into account ends, and | ||

(b) against which no loss, deficit, expense or allowance may be set off. | ||

(5) In respect of the charge to income tax imposed under this section and section 739LB— | ||

(a) section 76(6) shall not apply to an IREF which is a company, and | ||

(b) the amount so charged shall, for the purposes of Part 35A, not be profits or gains arising from relevant activities. | ||

(6) (a) Section 739LA shall not apply to an accounting period to which this section applies. | ||

(b) This section shall apply to accounting periods commencing on or after 1 January 2020 and where an accounting period commences before 1 January 2020 and ends after that date, it shall be divided into two parts, one beginning on the date on which the accounting period begins and ending on 31 December 2019 and the other beginning on 1 January 2020 and ending on the date on which the accounting period ends, and both parts shall be treated as if they were separate accounting periods of the IREF.”, | ||

(f) in section 739O(1), by substituting “person, or connected persons within the meaning of section 10,” for “person”, and | ||

(g) in section 739R— | ||

(i) in subsection (1), by substituting the following for “IREF withholding tax shall be accounted for and paid”: | ||

“an IREF shall— | ||

(a) file a return referred to in subsection (2), and | ||

(b) account for and pay IREF withholding tax”, | ||

(ii) in subsection (2), by deleting “of the IREF withholding tax”, | ||

(iii) by inserting the following subsection after subsection (3): | ||

“(3A) The return referred to in subsection (2) shall contain the following information: | ||

(a) where the IREF is a sub-fund of an umbrella scheme, details of the umbrella scheme; | ||

(b) details of the unit holdings held by each unit holder of the IREF; | ||

(c) details of the IREF assets held by the IREF; | ||

(d) details of the IREF business carried on by the IREF; | ||

(e) details of any transactions with persons connected with the unit holder; and | ||

(f) details of any IREF taxable events to which section 739T applies.”, | ||

and | ||

(iv) in subsection (4), by inserting “, where one or more than one IREF taxable event occurs in the period to which the return relates,” after “shall”. | ||

(2) Schedule 29 to the Principal Act is amended in Column 1 by inserting “section 739R(2) ” after “section 739F(2) ”. | ||

(3) Section 19 (1)(d) of the Finance Act 2017 is amended by deleting subparagraph (i). | ||

(4) Paragraph (a)(i), paragraph (b), subparagraphs (i), (ii), (iii), (iv) and (v) of paragraph (c) and paragraph (d) of subsection (1) shall apply to accounting periods commencing on or after 9 October 2019 and where an accounting period commences before 9 October 2019 and ends after that date, it shall be divided into two parts, one beginning on the date on which the accounting period begins and ending on 8 October 2019 and the other beginning on 9 October 2019 and ending on the date on which the accounting period ends, and both parts shall be treated as if they were separate accounting periods of the IREF. |

,

,