S.I. No. 522/2015 - European Union (Bank Recovery and Resolution) Resolution Fund Levy Regulations 2015.

Notice of the making of this Statutory Instrument was published in | ||

“Iris Oifigiúil” of 24th November, 2015. | ||

I, PATRICK HONOHAN, Governor of the Central Bank of Ireland (the “Bank”), in the exercise of the powers conferred on the Bank, as designated resolution authority, by Regulation 166 of the European Union (Bank Recovery and Resolution) Regulations 2015 (No. 289 of 2015) (the “Bank Recovery and Resolution Regulations”), hereby make, after having consulted with the Minister for Finance in accordance with Regulation 199 thereof, the following Regulations: | ||

Citation | ||

1. These Regulations may be cited as the European Union (Bank Recovery and Resolution) Resolution Fund Levy Regulations 2015. | ||

Interpretation | ||

2. (1) In these Regulations- | ||

“Act of 1942” means Central Bank Act 1942 (No. 22 of 1942); | ||

“Bank and Investment Firm Resolution Fund” means the fund established pursuant to Regulation 163(1) of the Bank Recovery and Resolution Regulations; | ||

“Commission Delegated Regulation” means Commission Delegated Regulation (EU) 2015/63 of 21 October 2014 supplementing Directive 2014/59/EU of the European Parliament and of the Council with regard to ex ante contributions to resolution financing arrangements1 ; | ||

“IFRS Regulation” means Regulation (EC) No 1606/2002 of the European Parliament and of the Council of 19 July 2002 on the application of international accounting standards2 ; | ||

“Levy period” means the calendar year 2015; | ||

“Limited Activity Investment Firms” means investment firms authorised in the State which fall within the definition of Article 96(1)(a) or (b) of Regulation (EU) No 575/2013 of the European Parliament and of the Council3 or investment firms authorised in the State which carry out activity 8 of Annex I Section A of Directive 2004/39/EC of the European Parliament and of the Council4 but which do not carry out activities 3 or 6 of Annex I Section A of that Directive; | ||

“OTC Regulation” means Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories5 . | ||

(2) In these Regulations, unless otherwise specified, the definitions contained in the Bank Recovery and Resolution Regulations and the Commission Delegated Regulation shall apply. | ||

(3) These Regulations shall be read together with the Commission Delegated Regulation. | ||

Applicability | ||

3. Every person who on 30 November 2015 is an institution within the meaning of Regulation 166 of the Bank Recovery and Resolution Regulations shall pay a levy in respect of the levy period to the Central Bank for the account of the Bank and Investment Firm Resolution Fund. | ||

Basis for contributions from all institutions | ||

4. For the purposes of the Bank Recovery and Resolution Regulations and the Commission Delegated Regulation, the following shall apply: | ||

(a) The annual target level for contributions to the Bank and Investment Firm Resolution Fund, for the levy period, is EUR 76,425,616; | ||

(b) The aggregate liabilities, excluding own funds and covered deposits, of all institutions authorised in the State, for the levy period, is EUR 695,962,526,843. | ||

Determination of additional risk indicators for institutions to which the Commission Delegated Regulation applies | ||

5. The additional risk indicators specified in Article 6(5)(a) to (c) of the Commission Delegated Regulation shall be determined by the resolution authority in accordance with the Schedule. | ||

Risk adjustment of contributions in respect of Union branches and Limited Activity Investment Firms | ||

6. (1) Each Union branch and Limited Activity Investment Firm shall pay EUR 1,000 for each EUR 9,000,000 of its total liabilities, less own funds and covered deposits. | ||

(2) For the purposes of calculating the total liabilities of each Union branch and Limited Activity Investment Firm, the following liabilities shall be excluded: | ||

(a) the intragroup liabilities arising from transactions entered into by a Union branch or Limited Activity Investment Firm with an institution which is part of the same group, provided that all the following conditions are met: | ||

(i) each institution is established in the Union; | ||

(ii) each institution is included in the same consolidated supervision in accordance with Articles 6 to 17 of Regulation (EU) No 575/2013 on a full basis and is subject to an appropriate centralised risk evaluation, measurement and control procedures; and | ||

(iii) there is no current or foreseen material practical or legal impediment to the prompt repayment of the liability when due; | ||

(b) the liabilities created by a Union branch or Limited Activity Investment Firm, which is member of an IPS as referred to in point (8) of Article 2(1) of Directive 2014/59/EU of the European Parliament and of the Council6 and which has been allowed by the competent authority to apply Article 113(7) of Regulation (EU) No 575/2013, through an agreement entered into with another institution which is member of the same IPS; | ||

(c) in the case of a central counterparty established in a Member State having availed itself of the option in Article 14(5) of the OTC Regulation, liabilities related to clearing activities as defined in Article 2(3) of the OTC Regulation, including those arising from any measures the central counterparty takes to meet margin requirements, to set up a default fund and to maintain sufficient pre-funded financial resources to cover potential losses as part of the default waterfall in accordance with the OTC Regulation, as well as to invest its financial resources in accordance with Article 47 of the OTC Regulation; | ||

(d) in the case of a central securities depository, the liabilities related to the activities of a central securities depository, including liabilities to participants or service providers of the central securities depository with a maturity of less than seven days arising from activities for which it has obtained an authorisation to provide banking-type ancillary services in accordance with Title IV of Regulation (EU) No 909/2014 of the European Parliament and of the Council7 , but excluding other liabilities arising from such banking-type activities; | ||

(e) in the case of investment firms, the liabilities that arise by virtue of holding client assets or client money including client assets or client money held on behalf of UCITS as defined in Article 1(2) of Directive 2009/65/EC of the European Parliament and of the Council8 or of AIFs as defined in point (a) of Article 4(1) of Directive 2011/61/EU of the European Parliament and of the Council9 , provided that such a client is protected under the applicable insolvency law; | ||

(f) in case of a Union branch or Limited Activity Investment Firm operating promotional loans, the liabilities of the intermediary institution towards the originating or another promotional bank or another intermediary institution and the liabilities of the original promotional bank towards its funding parties in so far as the amount of these liabilities is matched by the promotional loans of that institution. | ||

(3) The liabilities referred to in paragraph (2)(a) and (b) shall be evenly deducted on a transaction by transaction basis from the amount of total liabilities of the institutions which are parties of the transactions or agreements referred to in paragraph (2)(a) and (b). | ||

(4) For the purpose of this Regulation, the yearly average amount, calculated on a quarterly basis, of liabilities referred to in paragraph (1) arising from derivative contracts shall be valued in accordance with Article 429(6) and (7) of Regulation (EU) No 575/2013. | ||

(5) The value assigned to liabilities arising from derivative contracts may not be less than 75 % of the value of the same liabilities resulting from the application of the accounting provisions applicable to the institution concerned for the purposes of financial reporting. | ||

(6) If, under national accounting standards applying to a Union branch or Limited Activity Investment Firm, there is no accounting measure of exposure for certain derivative instruments because they are held off-balance sheet, the Union branch or Limited Activity Investment Firm concerned shall report to the resolution authority the sum of positive fair values of those derivatives as the replacement cost and add them to its on-balance sheet accounting values. | ||

(7) For the purpose of this Regulation, the total liabilities referred to in paragraph (1) shall exclude the accounting value of liabilities arising from derivative contracts and include the corresponding value determined in accordance with paragraphs (4) to (6). | ||

(8) For verifying whether all conditions and requirements referred to in paragraphs (2) to (7) are met, the resolution authority shall be based on the relevant assessments conducted by competent authorities that are made available in accordance with Article 90 of Directive 2014/59/EU. | ||

Process for raising contributions in respect of Union branches and Limited Activity Investment Firms | ||

7. (1) The date by which the resolution authority shall notify each Union branch and Limited Activity Investment Firm of its decision determining the annual contribution to be paid by them for the levy period shall be the 30 November 2015. | ||

(2) The resolution authority shall notify the decision made in respect of each Union branch and Limited Activity Investment Firm in any of the following ways: | ||

(a) electronically or by other comparable means of communication allowing for an acknowledgment of receipt; | ||

(b) by registered mail with a form of acknowledgment of receipt; | ||

(3) The decision made in respect of each Union branch and Limited Activity Investment Firm shall specify: | ||

(a) the condition and the means by which the annual contribution shall be paid; and | ||

(b) the share of irrevocable payment commitments referred to in Article 103 of Directive 2014/59/EU that each Union branch or Limited Activity Investment Firm can use. | ||

(4) For the purposes of paragraph (3), the resolution authority shall accept collateral only of the kind and under conditions that allow for swift realisability, including in the event of a resolution decision over the weekend, and the collateral should be conservatively valued to reflect significantly deteriorated market conditions. | ||

(5) The date by which each Limited Activity Investment Firm and Union branch is liable to pay the levy for the levy period shall be 31 December 2015. | ||

(6) Without prejudice to any other remedy available to the resolution authority, in the event of partial payment, non-payment or non-compliance with the requirement set out in the decision made in respect of each Union branch and Limited Activity Investment Firm, the Union branch or Limited Activity Firm concerned shall incur a daily penalty on the outstanding amount of the instalment. | ||

(7) The daily penalty interest shall accrue on a daily basis on the amount due at an interest rate applied by the European Central Bank to its principal refinancing operations, as published in the C series of the Official Journal of the European Union, in force on the first calendar day of the month in which the payment deadline falls increased by 8 percentage points from the date on which the instalment was due. | ||

Service of notice on all institutions | ||

8. Regulation 195 of the Bank Recovery and Resolution Regulations shall apply in respect of service of a notice or other document by the resolution authority for the purposes of these Regulations and the Commission Delegated Regulation. | ||

Newly supervised Union branches and Limited Activity Investment Firms | ||

9. (1) Where a Union branch or Limited Activity Investment Firm is a newly supervised institution for only part of the levy period, the partial contribution shall be determined by applying the methodology set out in Regulation 6(1) to the amount of its annual contribution calculated during the subsequent levy period, by reference to the number of full months of the levy period for which that Limited Activity Investment Firm or Union branch is supervised. | ||

(2) Where a Union branch or Limited Activity Investment Firm is a newly supervised institution for only part of the levy period, its partial annual contribution shall be collected together with the annual contribution due for the subsequent levy period. | ||

Provision of evidence concerning lump sum amounts by institutions to which the Commission Delegated Regulation applies | ||

10. Where an institution to which the Commission Delegated Regulation applies intends to provide evidence that the lump sum amount referred to in paragraphs (1) to (6) of Article 10 of the Commission Delegated Regulation is higher than the contribution calculated in accordance with Article 5 of the Commission Delegated Regulation, the institution shall provide such evidence to the resolution authority within 21 days of receipt of the levy notice. | ||

SCHEDULE | ||

Calculation of “Trading activities, off-balance sheet exposures, derivatives, complexity and resolvability” | ||

For the purposes of determining the risk indicator specified in Article 6(5)(a) of the Commission Delegated Regulation, the following sub-indicators shall be determined: | ||

(a) Trading Ratio; | ||

(b) Derivatives Ratio. | ||

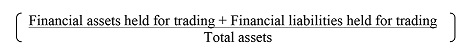

The sub-indicator “Trading Ratio” shall consist of the following calculation: | ||

| ||

| ||

Where, for the purposes of this sub-indicator: | ||

Financial assets held for trading shall mean financial assets held for trading as defined in accordance with the International Financial Reporting Standards referred to in the IFRS Regulation. | ||

Financial liabilities held for trading shall mean financial liabilities held for trading as defined in accordance with the International Financial Reporting Standards referred to in the IFRS Regulation. | ||

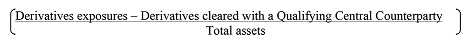

The sub-indicator “Derivatives Ratio” shall consist of the following calculation: | ||

| ||

| ||

Where, for the purposes of this sub-indicator: | ||

Derivatives exposures shall mean the yearly average amount, calculated on a quarterly basis, of liabilities arising from derivatives contracts valued in accordance with Article 429(6) and (7) of Regulation (EU) No 575/2013. | ||

Derivatives cleared with a Qualifying Central Counterparty shall mean the yearly average amount, calculated on a quarterly basis, of liabilities arising from derivatives contracts valued in accordance with Article 429(6) and (7) of Regulation (EU) No 575/2013, cleared through a CCP as defined in Article 2(1) of the OTC Regulation. | ||

The resolution authority shall apply the following signs to the sub-indicators: | ||

Trading Ratio: “+” | ||

Derivatives Ratio: “+” | ||

Each sub-indicator shall have an equal weight. | ||

Calculation of “Membership in an Institutional Protection Scheme” | ||

For the purposes of determining the risk indicator specified in Article 6(5)(b) of the Commission Delegated Regulation, it shall be determined whether the institution is a member of an Institutional Protection Scheme. The maximum value of the range referred to in Step 3 of Annex I of the Commission Delegated Regulation shall be taken for any institution that is a member of an Institutional Protection Scheme. The minimum value of the range referred to in Step 3 of Annex I of the Commission Delegated Regulation shall be taken for all other institutions. | ||

Calculation of “Extent of previous extraordinary public financial support” | ||

For the purposes of determining the risk indicator specified in Article 6(5)(c) of the Commission Delegated Regulation, the methodology specified in Article 6(8) shall apply. | ||

| ||

Signed for and on behalf of the CENTRAL BANK OF IRELAND, | ||

20 November 2015. | ||

PATRICK HONOHAN, | ||

Governor of the Central Bank of Ireland. | ||

6 OJ L 173, 12.6.2014, p. 190. |