Finance Act 2015

|

Amendment of Part 29 of Principal Act (patents, scientific and certain other research, know-how and certain training) | ||

|

32. (1) The Principal Act is amended— | ||

(a) in Part 29 by inserting the following Chapter after Chapter 4: | ||

“Chapter 5 | ||

Taxation of Companies Engaged in Knowledge Development | ||

Interpretation and general | ||

769G. (1) In this Chapter— | ||

‘accounting period’ in relation to a company, means an accounting period determined in accordance with section 27; | ||

‘acquisition costs’, in relation to expenditure incurred on a qualifying asset, means the expenditure incurred on the acquisition of intellectual property, or rights over intellectual property, where that intellectual property is reflected in the value of the qualifying asset, but where expenditure incurred on acquiring the intellectual property is incurred otherwise than by means of a bargain made at arm’s length, that acquisition shall, for the purposes of this Chapter, be deemed to be for a consideration equal to the open market value of the intellectual property; | ||

‘group’ means a company and all of its 51 per cent subsidiaries; | ||

‘group outsourcing costs’, in relation to a qualifying asset, means any amount incurred in carrying on research and development activities which results in a qualifying asset, where that amount is not qualifying expenditure but would be qualifying expenditure on a qualifying asset— | ||

(a) if the research and development activities were carried on in a Member State, or | ||

(b) but for subsection (2)(b)(iii) or (vi), | ||

and shall not include any amount of qualifying expenditure or acquisition costs; | ||

‘intellectual property’, other than for the purposes of the definition of ‘acquisition costs’ or ‘marketing-related intellectual property’ in this subsection and without prejudice to section 769R, means— | ||

(a) a computer program, within the meaning of the Copyright and Related Rights Act 2000 , but, where a computer program is a derivative work or adaptation, the portion of the computer program that represents the derivative work or the adaptation of the original work and the original work shall be treated as two separate computer programs, or | ||

(b) an invention protected by— | ||

(i) a qualifying patent, | ||

(ii) any supplementary protection certificate issued under Council Regulation (EC) No. 469/2009 of 6 May 200923 concerning protection for medicinal products or any such certificate extended in accordance with Article 36 of Regulation (EC) 1901/2006, | ||

(iii) any supplementary protection certificate issued under Regulation (EC) No. 1610/96 of the European Parliament and of the Council of 23 July 199624 concerning protection for plant protection products, or | ||

(iv) any plant breeders’ rights within the meaning of section 4 of the Plant Varieties (Proprietary Rights) Act 1980 ; | ||

‘interest’, unless the context otherwise requires, includes any interest payable on a debt instrument, any discount on the issue of such an instrument, and any premiums paid or payable on redemption of such an instrument, or on the capital represented by such an instrument; | ||

‘marketing-related intellectual property’ includes trademarks, brands, image rights and other intellectual property used to market goods or services; | ||

‘Member State’ has the same meaning as ‘relevant Member State’ has in section 766; | ||

‘overall expenditure on the qualifying asset’, means— | ||

(a) the qualifying expenditure incurred in relation to that qualifying asset, and | ||

(b) the aggregate of the acquisition costs and the group outsourcing costs relating to that qualifying asset, incurred in any accounting period; | ||

‘overall income from the qualifying asset’ means the following amounts arising in respect of an accounting period— | ||

(a) any royalty or other sums in respect of the use of that qualifying asset, | ||

(b) where the sales price of a product or service, excluding both duty due or payable and any amount of value-added tax charged in the sales price, includes an amount which is attributable to a qualifying asset, such portion of the income from those sales as, on a just and reasonable basis, is attributable to the value of the qualifying asset, | ||

(c) any amount for the grant of a licence to exploit that qualifying asset, and | ||

(d) any amount of insurance, damages or compensation in relation to the qualifying asset, | ||

where that amount is taken into account in computing, for the purposes of assessment to corporation tax, the profits of a trade, and overall income from qualifying assets shall be construed accordingly; | ||

‘qualifying asset’ means an asset which is intellectual property, other than marketing-related intellectual property, and which is the result of research and development activities; | ||

‘qualifying expenditure on the qualifying asset’ has the meaning assigned to it in subsection (2) and qualifying expenditure in relation to all qualifying assets shall be construed accordingly; | ||

‘qualifying patent’ means— | ||

(a) a patent granted following substantive examination for novelty and inventive step, or | ||

(b) a patent, other than a short term patent within the meaning of section 63 of the Patents Act 1992 , or an equivalent provision in another jurisdiction, where— | ||

(i) the Patents Office in the State, or equivalent Office elsewhere, has caused a search to be undertaken in relation to the invention and a search report (within the meaning of section 29 of the Patents Act 1992 ) prepared, and | ||

(ii) either— | ||

(I) the patent was granted prior to 1 January 2016, or | ||

(II) the patent was granted on or after 1 January 2016 and before 1 January 2017 and a patent agent, within the meaning of section 106 of the Patents Act 1992 , certifies that in his or her opinion such a patent meets the patentability criteria, in that the invention is susceptible of industrial application, new and involves an inventive step, | ||

but this paragraph is subject to section 769I(6)(a)(i)(VII); | ||

‘relevant company’ means a company which carries on a specified trade and is within the charge to tax in the State, and where two or more companies carry on that specified trade in partnership then each company that is within the charge to tax in the State shall be a relevant company; | ||

‘research and development activities’ has the meaning assigned to it in section 766; | ||

‘specified trade’ has the meaning assigned to it in subsection (3); | ||

‘up-lift expenditure’, in relation to a qualifying asset, is the lower of— | ||

(a) 30 per cent of the amount of the qualifying expenditure on the qualifying asset, or | ||

(b) the aggregate of acquisition costs and group outsourcing costs. | ||

(2) (a) Subject to paragraph (b), for the purposes of this Chapter, qualifying expenditure in relation to the qualifying asset, in respect of a company, means expenditure incurred by a relevant company, in any accounting period, wholly and exclusively in the carrying on by it of research and development activities in a Member State where such activities lead to the development, improvement or creation of the qualifying asset, being an amount— | ||

(i) which is allowable as a deduction in computing the profits or gains from a trade (otherwise than by virtue of section 307), or would be so allowable but for the fact that for accounting purposes it is brought into account in determining the value of an asset, | ||

(ii) expended on machinery or plant (other than specified intangible assets within the meaning of section 291A treated as machinery or plant by virtue of subsection (2) of that section where the specified intangible asset was acquired directly or indirectly from a member of the group) which qualifies for any allowance under Part 9, | ||

and for the purposes of this section, where a company engages a person who is not a member of the group, to carry on research and development activities on behalf of that company, then any sum payable to that person in respect of those activities shall be treated as if it were expenditure incurred by the company in the carrying on by it of research and development activities in a Member State. | ||

(b) Qualifying expenditure on the qualifying asset shall not include— | ||

(i) any amount of acquisition costs in relation to the qualifying asset, | ||

(ii) any amount of interest paid or payable, | ||

(iii) an amount paid or payable directly or indirectly to a member of the group to carry on research and development activities, whether under a cost sharing arrangement or otherwise, | ||

(iv) expenditure incurred under a cost sharing arrangement with another company to the extent that such expenditure exceeds an amount that would be determined by means of a bargain made at arm’s length, | ||

(v) any additional amount, agreed between members of the group, on an expense paid or payable indirectly through a group member to a person who is not a member of the group to carry on research and development activities, where that additional amount is to be retained by the group member, or | ||

(vi) any amount incurred if that amount— | ||

(I) may be taken into account as an expense in computing income of the company, | ||

(II) is expenditure in respect of which an allowance for capital expenditure may be made to the company, or | ||

(III) may otherwise be allowed or relieved in relation to the company, | ||

for the purposes of tax in a territory other than the State. | ||

(3) (a) Subject to paragraph (b), for the purposes of this Chapter, specified trade means a trade or part of a trade, other than an excepted trade within the meaning of section 21A, consisting of or including one or more of the following categories of activities— | ||

(i) the managing, developing, maintaining, protecting, enhancing or exploiting of intellectual property, | ||

(ii) the researching, planning, processing, experimenting, testing, devising, developing or other similar activity leading to an invention or creation of intellectual property, or | ||

(iii) the sale of goods or the supply of services that derive part of their value from activities described in subparagraphs (i) and (ii), where those activities were carried on by the relevant company. | ||

(b) In the case of a trade consisting partly of the carrying on of such activities, as described in paragraph (a), and partly of the carrying on of other activities, that part of the trade consisting solely of the carrying on of activities described in paragraph (a) shall be a specified trade. | ||

(4) Where a relevant company incurs expenditure for the purposes of a specified trade before the time that trade has been set up and commenced, then for the purposes of this Chapter other than section 769O, that expenditure shall be deemed to have been incurred in the first accounting period of that company. | ||

Families of products and assets | ||

769H. (1) This section has effect where— | ||

(a) a relevant company has a number of qualifying assets, and | ||

(b) owing to the interlinked nature of the qualifying assets and their use in the specified trade, it would be reasonable to conclude that it would not be possible for the relevant company to identify the overall expenditure on each qualifying asset or the overall income from each qualifying asset. | ||

(2) In subsection (3) ‘family of assets’ means the smallest grouping of assets referred to in subsection (1) for which the expenditure and income referred to in that subsection can reasonably be identified. | ||

(3) Where— | ||

(a) this section has effect, and | ||

(b) the relevant company opts for this Chapter to so apply, | ||

then this Chapter shall apply, in relation to the relevant company, as if references to qualifying assets were references to a family of assets. | ||

Corporation tax referable to a specified trade | ||

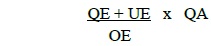

769I.(1) For the purposes of this section qualifying profits, in relation to a qualifying asset, shall be the amount determined by the formula— | ||

| ||

where— | ||

QE is the qualifying expenditure on the qualifying asset, | ||

UE is the uplift expenditure, | ||

OE is the overall expenditure on the qualifying asset, and | ||

QA is the profit of the specified trade relevant to the qualifying asset before taking account of any allowance available under subsection (5). | ||

(2) (a) Where qualifying profits in respect of a qualifying asset arise in the course of a specified trade, then a relevant company may make a claim in respect of that qualifying asset under this section, in the return required to be filed pursuant to section 959I. | ||

(b) Subject to section 769P, any claim under this section shall be made once in respect of each qualifying asset and shall be made within 24 months from the end of the accounting period to which the claim relates. | ||

(c) Where under this section a claim is made to include the overall income from the qualifying asset in the income of a specified trade in any accounting period, then all amounts of income and expenditure related to that qualifying asset shall be taken to continue to relate to that specified trade until such time as the qualifying asset is disposed of or ceases to be used. | ||

(3) Where during an accounting period a relevant company, which has made a claim under this section, carries on a specified trade, those activities shall be treated for the purposes of this Chapter, Chapter 2 of Part 8, Chapter 3 of Part 12 and Part 41A, as a separate trade distinct from any other trade carried on by the company. | ||

(4) (a) Subject to paragraph (b), in order to determine the profits or gains of the specified trade to be charged to tax under Case I of Schedule D— | ||

(i) the income of the trade shall be the overall income from qualifying assets in respect of which a claim has been made under this section, and | ||

(ii) any necessary apportionment shall be made so that expenses laid out or expended in earning the income referred to in subparagraph (i) shall be attributed to the specified trade on a just and reasonable basis and the amount of the expenses shall be an amount which would be attributed to a distinct and separate company, engaged in the same activities, if it were independent of, and dealing at arm’s length with the relevant company. | ||

(b) Where a relevant company has carried on a specified trade for one or more previous accounting periods, then the method or methods of apportionment used for the purposes of this section shall be applied consistently between accounting periods, unless there has been a significant change in the conduct of the relevant company’s trade or business. | ||

(5) In computing for the purposes of corporation tax the profits of a relevant company’s specified trade for an accounting period, insofar as the profits are referable to qualifying profits from a qualifying asset in respect of which a claim was made under this section, there shall be made an allowance equal to 50 per cent of the qualifying profits and that allowance shall be treated as a trading expense of the trade in that period. | ||

(6) (a) The Revenue Commissioners may, in relation to a claim by a relevant company that a profit is a qualifying profit— | ||

(i) consult with any person (in this subsection referred to as an ‘expert’) who in their opinion may be of assistance in ascertaining the extent to which: | ||

(I) expenditure is qualifying expenditure on the qualifying asset; | ||

(II) expenditure is overall expenditure on the qualifying asset; | ||

(III) income is overall income from the qualifying asset; | ||

(IV) intellectual property is, or forms part of, a qualifying asset; | ||

(V) any apportionment is done on a just and reasonable basis; | ||

(VI) arm’s length values have been correctly determined; or | ||

(VII) a patent, referred to in paragraph (b) of the definition of ‘qualifying patent’ in section 769G(1), meets the patentability criteria set out in that paragraph, | ||

and | ||

(ii) notwithstanding any obligation as to secrecy or other restriction on the disclosure of information imposed by, or under, the Tax Acts or any other statute or otherwise, but subject to paragraph (b), disclose to the expert any detail in the company’s claim under this section which they consider necessary for the purposes of such consultation. | ||

(b) (i) Before disclosing information to any expert under paragraph (a), the officer of the Revenue Commissioners shall give the company a notice in writing of— | ||

(I) the officer’s intention to disclose information to an expert, | ||

(II) the information that the officer intends to disclose, | ||

(III) the identity of the expert whom the officer intends to consult, | ||

and shall allow the company a period of 30 days after the date of the notice to show to the officer’s satisfaction that disclosure of such information to that expert could prejudice the company’s trade or business. | ||

(ii) Where, on the expiry of the period referred to in subparagraph (i), it is not shown to the satisfaction of the officer that disclosure could prejudice the company’s trade or business, the officer may disclose the information on the expiry of a further period of 30 days after giving notice in writing of the officer’s decision to disclose the information. | ||

(iii) A company aggrieved by an officer’s decision made under subparagraph (ii) in respect of it may appeal the decision to the Appeal Commissioners, in accordance with section 949I, within the period of 30 days after the date of that decision. | ||

Interaction with sections 766, 766A and 766B | ||

769J. For the purposes of determining the amount of any claim made pursuant to section 766(4B)(a), the excess referred to in that section shall be calculated as if this Chapter did not apply. | ||

Adaptation of provisions relating to relief for relevant trading losses and relevant charges on income | ||

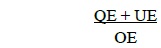

769K. (1) For the purposes of this section relevant trading losses and relevant trading charges relating to a specified trade relevant to a qualifying asset which was the subject of a claim under section 769I(2) shall be the amount of such losses or charges as reduced by— | ||

| ||

where— | ||

QE is the qualifying expenditure on the qualifying asset, | ||

UE is the uplift expenditure, and | ||

OE is the overall expenditure on the qualifying asset. | ||

(2) Notwithstanding any other provision of the Tax Acts, where a relevant company makes a claim for relief under— | ||

(a) section 243A, that section shall apply, with any necessary modifications, as if the amount of relevant trading charges on income relating to a specified trade were reduced by 50 per cent, | ||

(b) section 396A or 420A, the section shall apply, with any necessary modifications, as if the amount of a relevant trading loss arising in the course of a specified trade were reduced by 50 per cent, or | ||

(c) section 243B, 396B or 420B, the section shall apply, with any necessary modification, as if the reference in the formula to ‘R’ were a reference to ‘R as reduced by 50 per cent’. | ||

Documentation | ||

769L. (1) (a) A relevant company in relation to all qualifying assets in respect of which a claim was made under section 769I(2) shall have available such records as may reasonably be required for the purposes of determining whether, in relation to such an asset, the qualifying profits has been computed in accordance with this Chapter. | ||

(b) The records shall demonstrate that— | ||

(i) overall income from the qualifying asset, | ||

(ii) qualifying expenditure on the qualifying asset, and | ||

(iii) overall expenditure on the qualifying asset, | ||

have been tracked, and the relevant company shall have available documentation on this tracking which shows how such expenditures and income are linked to the qualifying asset. | ||

(c) If the relevant company has opted under subsection (3) of section 769H for this Chapter to apply in the manner specified in that subsection, then, in relation to any family of assets referred to in that subsection, the relevant company shall also have available records that support the reasonableness of the company having opted as mentioned in this paragraph, including such records as are required to support— | ||

(i) the commonality of scientific, technological or engineering challenges underlying the research and development activities which were undertaken and which resulted in the qualifying assets, | ||

(ii) the consistency of the chosen method of grouping with the organisation of research and development activities carried on by the relevant company, | ||

(iii) the creation of a nexus between expenditures and a family of assets, or | ||

(iv) the choice of a family of assets with which to create that nexus, | ||

as may be relevant in each case. | ||

(d) A relevant company in claiming that a derivative work or an adaptation represents a qualifying asset shall have available records which— | ||

(i) identify the original work and the derivation or adaptation therefrom, | ||

(ii) the costs associated with both the original work and the derivative work or the adaptation, and | ||

(iii) support any method of apportionment of income between the original work and the derivative work or adaptation. | ||

(2) The requirements of this section shall not apply to expenditures incurred prior to 1 January 2016. | ||

(3) The records referred to in subsection (1) shall be prepared on a timely basis and, subject to subsection (4), the obligations contained in subsections (3) and (4) of section 886 to keep and retain records and linking documents apply to all records, documents or other data created or maintained manually or by any electronic means for the purposes of this Chapter. | ||

(4) For the purposes of this section, section 886(4) (a) shall apply as if for subparagraphs (i) and (ii) there were substituted: | ||

‘in respect of each qualifying asset, for a period of 6 years from the end of the accounting period in which a return has been delivered in respect of the last accounting period in which that asset was a qualifying asset and’. | ||

(5) An officer of the Revenue Commissioners may by notice in writing require a relevant company to furnish the officer with such information or particulars as may be necessary for the purposes of giving effect to this Chapter. | ||

(6) (a) The Revenue Commissioners may make regulations for the purposes of this section and those regulations may contain such incidental, supplemental or consequential provisions as appear to the Revenue Commissioners to be necessary or expedient— | ||

(i) to enable persons to fulfil their obligations under this Chapter or under regulations made under this section, or | ||

(ii) to facilitate the operation of the provisions of this Chapter or regulations made under this section in an efficient manner. | ||

(b) Regulations made under this section shall be laid before Dáil Éireann as soon as may be after they are made, and if a resolution annulling those regulations is passed by Dáil Éireann within the next 21 days on which Dáil Éireann has sat after the regulations are laid before it, the regulations shall be annulled accordingly, but without prejudice to the validity of anything previously done under them. | ||

(7) Failure to have available such documentation as is required under this section shall, notwithstanding anything else in this Chapter, result in a company not being a relevant company for the purposes of this Chapter in respect of the accounting period to which the failure relates. | ||

Anti-avoidance | ||

769M. Qualifying expenditure on the qualifying asset and overall income from the qualifying asset shall not include any amount unless that amount is expended or received for bona fide commercial purposes and is not part of a scheme or arrangement the main purpose, or one of the main purposes, of which is the avoidance of tax. | ||

Application of Part 35A | ||

769N. Where a relevant company is a company to which Part 35A applies, then section 835D shall apply, with any necessary modifications, to: | ||

(a) determining the market value of the intellectual property, as required by the definition of acquisition costs; | ||

(b) apportioning income, as required in the definition of ‘overall income from the qualifying asset’; | ||

(c) apportionments of research and development activities as required in the definition of ‘qualifying expenditure on the qualifying asset’; | ||

(d) any apportionments required under section 769I; and | ||

(e) any apportionments required under section 769O. | ||

Transitional measures | ||

769O. (1) Subject to subsection (4) for the purposes of determining the qualifying profits in relation to a qualifying asset for accounting periods beginning on or after 1 January 2016 but on or before 31 December 2019— | ||

(a) acquisition costs in relation to a qualifying asset shall include any acquisition costs incurred prior to 1 January 2016, | ||

(b) group outsourcing costs in relation to a qualifying asset shall include any group outsourcing costs incurred prior to 1 January 2016 and where group outsourcing costs incurred prior to 1 January 2016 related to more than one qualifying asset, those costs shall be apportioned on a just and reasonable basis, and | ||

(c) qualifying expenditure on the qualifying asset shall— | ||

(i) be calculated with reference to qualifying expenditure in relation to all qualifying assets in the 48 month period ending on the last day of the accounting period, and | ||

(ii) be— | ||

(I) calculated in accordance with this Chapter, and | ||

(II) calculated as a portion of the total qualifying expenditure on qualifying assets, where the expenditure is incurred prior to 1 January 2016. | ||

(2) Subject to subsection (4), for the purposes of determining the qualifying profits in relation to a qualifying asset for accounting periods beginning on or after 1 January 2020— | ||

(a) acquisition costs in relation to a qualifying asset shall include any acquisition costs incurred prior to 1 January 2016. | ||

(b) group outsourcing costs in relation to a qualifying asset shall include any group outsourcing costs incurred prior to 1 January 2016 and where such group outsourcing costs incurred prior to 1 January 2016 related to more than one qualifying asset, those costs shall be apportioned on a just and reasonable basis. | ||

(c) qualifying expenditure on the qualifying asset shall not include any amount incurred prior to 1 January 2016. | ||

(3) A relevant company in relation to all qualifying assets to which this section applies shall have available such records as may reasonably be required for the purposes of determining whether, in relation to such an asset, the qualifying profit has been computed in accordance with this Chapter and section 769L shall apply to these records. | ||

(4) Where, in advance of first making a claim under section 769I, a company has documentation in respect of— | ||

(a) group outsourcing costs in relation to a qualifying asset, or | ||

(b) qualifying expenditure on the qualifying asset, | ||

incurred prior to 1 January 2016 which satisfies the requirements of section 769L(1) then notwithstanding subsections (1) and (2) that company may use amounts calculated with reference to that documentation in applying section 769I. | ||

Time limits | ||

769P. (1) Where a company has submitted an application to a Patents Office which would result in a qualifying asset if the patent or protection sought were granted, then the company may make a claim under section 769I(2) — | ||

(a) in the accounting period in which the application is submitted, and if the application is subsequently refused then the company shall amend each return, within the meaning of section 959A, in which a deduction under section 769I(5) was claimed, and pay any additional tax and interest due accordingly, or | ||

(b) subject to subsection (2), in the accounting period in which the application is granted, and notwithstanding anything to the contrary in section 959AA or section 865, a Revenue officer shall amend an assessment for each accounting period in which overall income from a qualifying asset arose, and any tax to be repaid shall be repaid accordingly and for the purposes of section 865A any such claim shall not be a valid claim on any date before the return, within the meaning of section 959A, for the accounting period in which the application is granted is filed. | ||

(2) Where a company intends to make a claim pursuant to subsection (1) (b), then in respect of each accounting period prior to the accounting period in which the application is granted the company shall make a claim (a ‘protective claim’) for the amount of the allowance that may be claimed upon the application being granted, and any subsequent claim pursuant to subsection (1) (b) shall not exceed the amount of those protective claims. | ||

Application | ||

769Q. This Chapter shall apply to accounting periods which commence on or after 1 January 2016 and before 1 January 2021.”, | ||

(b) in Chapter 5 of Part 29 by inserting the following after section 769Q (inserted by paragraph (a)): | ||

“Companies with income arising from intellectual property of less than €7,500,000 | ||

769R. (1) In this section— | ||

‘average overall income from intellectual property’ in respect of an accounting period means the lower of — | ||

(a) the overall income from intellectual property for an accounting period, or | ||

(b) an amount calculated as: | ||

A x N | ||

where — | ||

A is the average monthly overall income from intellectual property for the last 60 months, and | ||

N is the number of months in the accounting period; | ||

‘company threshold amount’ means €7,500,000 and where an accounting period is shorter than 12 months, this amount shall be reduced proportionately; | ||

‘intellectual property for small companies’ means inventions that are certified by the Controller of Patents, Designs and Trade Marks as being novel, non-obvious and useful; | ||

‘overall income from intellectual property’ means the following amounts arising to the company in respect of an accounting period— | ||

(a) any royalty or other sums in respect of the use of intellectual property, | ||

(b) where the sales price of a product or service, excluding both duty due or payable and any amount of value-added tax charged in the sales price, includes an amount which is attributable to a qualifying asset, such portion of the income from those sales as, on a just and reasonable basis, is attributable to the value of the qualifying asset, | ||

(c) any amount for the grant of a licence to exploit intellectual property, and | ||

(d) any amounts of insurance, damages or compensation in relation to intellectual property, | ||

where that amount is taken into account in computing, for the purposes of assessment to corporation tax, the profits of a trade; | ||

‘turnover threshold amount’ means €50,000,000 and where an accounting period is shorter than 12 months, this amount shall be reduced proportionately. | ||

(2) (a) This section shall apply to a relevant company and an accounting period, where the relevant company satisfies the conditions set out in paragraph (b). | ||

(b) The conditions required by this paragraph are— | ||

(i) the company has average overall income from intellectual property not in excess of the company threshold amount, | ||

(ii) where that company is a member of a group, the group has turnover not in excess of the turnover threshold amount, and | ||

(iii) the company is a micro, small or medium-sized enterprise within the meaning of the Annex to Commission Recommendation 2003/361/EC of 6 May 200325 concerning the definition of micro, small and medium-sized enterprises. | ||

(3) In relation to a relevant company and an accounting period to which this section applies, this Chapter shall apply as if the definition of ‘intellectual property’ in section 769G(1) also included intellectual property for small companies. | ||

(4) A company claiming to be a relevant company to which this section applies shall have available such records as may reasonably be required for the purposes of determining whether it is a relevant company to which this section applies and section 769L shall apply to those documents.”, | ||

and | ||

(c) in paragraph (I)(A) of the definition of “expenditure on research and development” in section 766(1) (a) by substituting “is part of overall income from a qualifying asset within the meaning of section 769G” for “is income from a qualifying patent within the meaning of section 234”. | ||

(2) Paragraph (b) of subsection (1) shall come into operation on such day or days as the Minister for Finance may by order or orders appoint. | ||