| |

PART 3

Pension-related Deductions and Pensions

|

|

|

|

Amendment of Act of 2009

|

| |

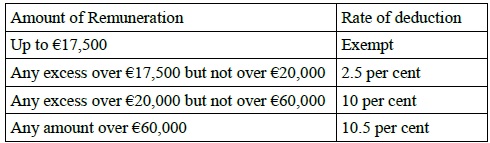

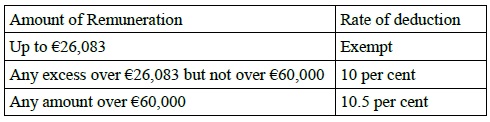

5. (1) Section 2 of the Act of 2009 shall be taken to have effect for the year 2015 as if the following Table were substituted for Table D to subsection (3):

|

|

| |

“TABLE D

|

|

| |

|

|

| |

”.

|

|

| |

(2) Where an amount was deducted from a relevant person (within the meaning of section 2 of the Act of 2009) in the year 2015 in excess of the amount required to be deducted as a result of the operation of subsection (1), the person who is responsible for, or authorises, the payment of remuneration to the relevant person shall repay or cause to be repaid to that relevant person the amount in excess of the amount required to be deducted as a result of the operation of subsection (1).

|

|

| |

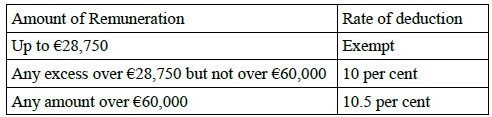

(3) With effect on and from 1 January 2016, section 2 of the Act of 2009 is amended—

|

|

| |

(a) by the substitution of the following for subsection (3):

|

|

| |

“(3) The person who is responsible for, or authorises, the payment of remuneration to a relevant person shall, subject to subsection (3A), deduct or cause to be deducted an amount—

|

|

| |

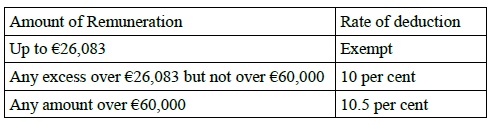

(a) in the case of the year 2016, at the applicable rate or rates specified in Table A to this subsection in respect of that year, and

|

|

| |

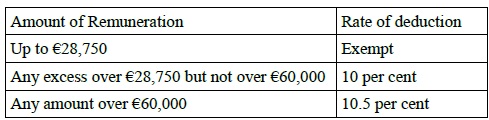

(b) in the case of the year 2017 and each subsequent year, at the applicable rate or rates specified in Table B to this subsection in respect of that year,

|

|

| |

from the remuneration from time to time payable to the relevant person for any such year.

|

|

| |

TABLE A

|

|

| |

|

|

| |

TABLE B

|

|

| |

|

|

| |

”.

|

|

| |

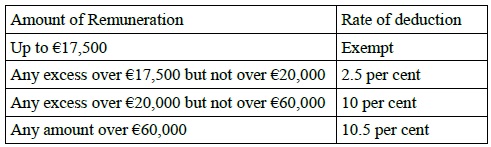

(4) Subsection (3B) of section 2 of the Act of 2009 shall be taken to have effect for the year 2015 as if the following Table were substituted for the Table to that subsection:

|

|

| |

“TABLE

|

|

| |

|

|

| |

”.

|

|

| |

(5) Where an amount was deducted from a public servant referred to in paragraph (e) or (f) of the definition of that term in section 1 of the Act of 2009 in the year 2015 in excess of the amount required to be deducted by virtue of subsection (4), the person who is responsible for, or authorises, the payment of remuneration to the public servant shall repay to the public servant the amount in excess of the amount required to be deducted by virtue of subsection (4).

|

|

| |

(6) With effect on and from 1 January 2016, section 2 of the Act of 2009 is amended by the substitution of the following for subsection (3B):

|

|

| |

“(3B) The person who is responsible for, or authorises, the payment of remuneration to a public servant referred to in paragraph (e) or (f) of the definition of that term in section 1 shall deduct or cause to be deducted an amount—

|

|

| |

(a) in the case of the year 2016, at the applicable rate or rates specified in Table A to this subsection in respect of that year, and

|

|

| |

(b) in the case of the year 2017 and each subsequent year, at the applicable rate or rates specified in Table B to this subsection in respect of that year,

|

|

| |

from the remuneration from time to time payable to the relevant person for any such year.

|

|

| |

TABLE A

|

|

| |

|

|

| |

TABLE B

|

|

| |

|

|

| |

”.

|