| |

Chapter 2

Universal Social Charge

|

|

|

|

Amendment of Part 18D of Principal Act (universal social charge)

|

| |

2. Part 18D of the Principal Act is amended—

|

|

| |

(a) in section 531AL by substituting the following for the definition of “similar type payments”:

|

|

| |

“‘similar type payments’ means payments which are of a similar character to social welfare payments but which are made by—

|

|

| |

(a) the Department of Education and Skills,

|

|

| |

(b) the Department of Agriculture, Food and the Marine,

|

|

| |

(c) the Health Service Executive,

|

|

| |

(d) an education and training board in relation to attendance at a non-craft training course funded by An tSeirbhís Oideachais Leanúnaigh agus Scileanna,

|

|

| |

(e) a sponsor in respect of participation in programmes known as the Community Employment Scheme and the Jobs Initiative Scheme, or

|

|

| |

(f) any other state or territory;”,

|

|

| |

(b) in section 531AM(2) by substituting “€12,012” for “€10,036”,

|

|

| |

(c) in section 531AN—

|

|

| |

(i) in subsection (1)(a) by substituting “column (2) of Part 1 of the Table to this section corresponding to the part of aggregate income specified in column (1) of Part 1 of that Table” for “column (2) of the Table to this section corresponding to the part of aggregate income specified in column (1) of that Table”,

|

|

| |

(ii) in subsection (1)(b) by substituting “column (2) of Part 2 of the Table to this section corresponding to the part of aggregate income specified in column (1) of Part 2 of that Table” for “column (3) of the Table to this section corresponding to the part of aggregate income specified in column (1) of that Table”,

|

|

| |

(iii) in subsection (2) by substituting “column (2) of Part 1 of that Table, be charged on the amount of that excess at the rate of 11 per cent” for “column (2) of that Table, be charged on the amount of that excess at the rate of 10 per cent”,

|

|

| |

(iv) in subsection (3) by substituting “exceeds €17,576 at the rate provided for in column (2) of Part 1 of that Table, be charged on the amount of the excess at the rate of 3.5 per cent” for “exceeds €16,016 at the rate provided for in column (2) of that Table, be charged on the amount of the excess at the rate of 4 per cent”,

|

|

| |

(v) in subsection (3A)(a) by substituting “3.5 per cent” for “4 per cent”,

|

|

| |

(vi) by substituting the following subsection for subsection (4):

|

|

| |

“(4) Subsection (3) shall cease to have effect for the tax year 2018 and subsequent tax years.”,

|

|

| |

and

|

|

| |

(vii) by substituting the following Table for the Table to that section:

|

|

| |

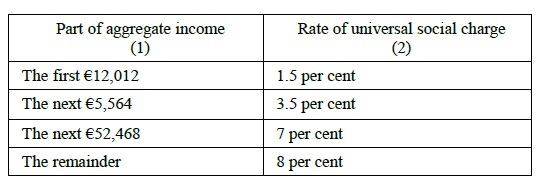

“TABLE

|

|

| |

PART 1

|

|

| |

|

|

| |

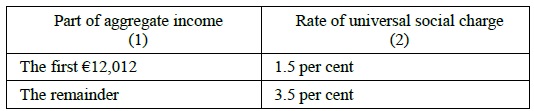

PART 2

|

|

| |

|

|

| |

”,

|

|

| |

and

|

|

| |

(d) in section 531AS(1A)—

|

|

| |

(i) in paragraph (b) by substituting “column (2) of Part 1 or column (2) of Part 2” for “column (2) or (3) ”, and

|

|

| |

(ii) in paragraph (c) by substituting “column (2) of Part 1 or column (2) of Part 2” for “column (2) or (3) ”.

|