S.I. No. 539/2012 - The Solicitors Acts 1954 to 2011 Solicitors (Practising Certificate 2013) Regulations 2012.

Notice of the making of this Statutory Instrument was published in | ||

“Iris Oifigiúil” of 1st January, 2013. | ||

The Law Society of Ireland, in exercise of the powers conferred on them by Section 47 of the Solicitors Act, 1954 (as substituted by Section 54 of the Solicitors (Amendment) Act 1994 ), Section 82 of the Solicitors Act, 1954 and Section 22 of the Solicitors (Amendment) Act 1960 (as substituted by Section 30 of the Solicitors (Amendment) Act 1994 ) HEREBY MAKE the following Regulations: | ||

Citation and commencement | ||

1. (a) These Regulations may be cited as The Solicitors Acts 1954 to 2011 Solicitors (Practising Certificate 2013) Regulations 2012. | ||

(b) These Regulations shall come into operation on the 1st day of January 2013. | ||

Definitions | ||

2. (a) In these Regulations, unless the context otherwise requires: | ||

“Act of 1954” means the Solicitors Act 1954 [No.36 of 1954]; | ||

“Act of 1960” means the Solicitors (Amendment) Act 1960 [No.37 of 1960]; | ||

“Act of 1994” means the Solicitors (Amendment) Act 1994 [No.27 of 1994]; | ||

“applicant solicitor” means the solicitor the subject matter of an application; | ||

“application” means an application delivered to the Registrar by an applicant solicitor for a practising certificate for the practice year, pursuant to Regulation 3 of these Regulations; | ||

“Compensation Fund” means the fund maintained by the Society pursuant to Sections 21 and 22 (as substituted, respectively, by Sections 29 and 30 of the Act of 1994) of the Act of 1960; | ||

“practice year” means the calendar year ending on the 31st day of December 2013; | ||

“practising certificate” means the certificate issued by the Registrar certifying that the solicitor named therein is entitled to practise as a solicitor during the practice year as and from the date of the certificate; | ||

“Registrar” means the registrar of solicitors for the time being appointed pursuant to Section 8 of the Act of 1954; | ||

“Registration Fee” means the fee payable by a solicitor admitted to the Roll of Solicitors for three years or more on the 1st day of January 2013 or the fee payable by a solicitor admitted to the Roll for less than three years on the 1st day of January 2013; | ||

“Regulation of Practice Committee” means the committee to whom functions of the Society pursuant to Part V of the Act of 1954, as amended and extended by Part VI of the Act of 1994, have been delegated by the Council of the Society; | ||

“Roll” means the roll of solicitors maintained by the Registrar under Section 9 (as substituted by Section 65 of the Act of 1994) of the Act of 1954; | ||

“Society” means the Law Society of Ireland. | ||

(b) Other words and phrases in these Regulations shall have the meanings assigned to them by the Solicitors Acts 1954 to 2011. | ||

(c) The Interpretation Act 2005 applies to the interpretation of these Regulations as it applies to the interpretation of an Act of the Oireachtas. | ||

Application for practising certificate | ||

3. (a) An applicant solicitor shall deliver or cause to be delivered to the Registrar at the Society’s premises at George’s Court, George’s Lane, Dublin 7, on or before the 1st day of February 2013, an application which: | ||

(i) shall be in one of the forms as set out in the First Schedule to these Regulations; | ||

and | ||

(ii) shall be duly completed and shall be signed by the applicant solicitor personally. | ||

(b) The Registrar shall, on receipt of an application pursuant to clause (a) of this Regulation and on the Registrar being of the opinion that there is or are no appropriate and reasonable ground or grounds for not doing so, cause to be issued to the applicant solicitor concerned a practising certificate which shall be dated either— | ||

(i) the 1st day of January 2013, where issued during the period beginning on the 1st day of January 2013 and ending on the 1st day of February 2013, or | ||

(ii) the date on which it is issued, where issued after the 1st day of February 2013. | ||

(c) An application pursuant to clause (a) of this Regulation shall be deemed to have effect subject to and having regard to the terms of the guidance notes as set out in the Third Schedule to these Regulations. | ||

Where confirmation is required as to content of an application | ||

4. (a) The Registrar, at any time following delivery of an application to the Registrar by an applicant solicitor (whether or not a practising certificate has been issued by the Registrar to the applicant solicitor pursuant to Regulation 3(b) of these Regulations), may, where the Registrar deems it appropriate and reasonable to do so, require the applicant solicitor to confirm in writing to the Society the accuracy of all or any specified part or parts of the application. | ||

(b) Where, on receipt by the Society of a confirmation in writing from an applicant solicitor required by the Registrar pursuant to clause (a) of this Regulation, the Registrar deems it appropriate and reasonable to do so, the Registrar may require the applicant solicitor to attend before a meeting of the Regulation of Practice Committee to further confirm the accuracy of all or any specified part or parts of his or her application. | ||

Misconduct of knowingly furnishing false and misleading information | ||

5. An applicant solicitor who, in an application delivered to the Registrar, knowingly furnishes information that is false or misleading in a material respect shall be guilty of misconduct. | ||

Registration Fee, contribution to Compensation Fund and contribution for Solicitors Mutual Defence Fund Limited | ||

6. As and from the coming into operation of these Regulations, the Registration Fee together with the contribution to the Compensation Fund and the contribution for the Solicitors Mutual Defence Fund Limited, as specified in the Second Schedule to these Regulations, shall be paid to the Society by an applicant solicitor on delivery to the Registrar of his or her application. | ||

Fee for copy of entry on File A or File B | ||

7. The fee payable to the Society by a person who applies to the Registrar, pursuant to Section 17 of the Act of 1960, for a copy of an entry on File A or File B shall be as specified in the Second Schedule to these Regulations. | ||

Issue of duplicate practising certificate | ||

8. Where a solicitor, to whom a practising certificate for the practice year has been issued pursuant to Regulation 3(b) of these Regulations, certifies to the Registrar that his or her practising certificate has been inadvertently destroyed, lost or mislaid, such solicitor may apply to the Society for a duplicate original of such practising certificate on duly discharging the fee specified in the Second Schedule to these Regulations and on duly undertaking to the Registrar that, in the event of the practising certificate as originally issued being subsequently found in the course of the practice year, that same practising certificate would forthwith be returned to the Registrar. | ||

Where conditions attached to practising certificate | ||

9. (a) Where a practising certificate for the practice year is caused to be issued by the Registrar to a solicitor subject to a specified condition or conditions, the practising certificate shall be endorsed with the words (adapted as appropriate): “Issued subject to [a] specified condition[s] as annexed” and the Registrar at the same time shall cause to be issued to the solicitor concerned a separate document (deemed to be part of the practising certificate) headed with the Society’s crest and title and with the words (adapted as appropriate): “Annexe to practising certificate of [name of solicitor] of [a] specified condition[s] attached thereto and applicable as and from [date of commencement of applicability of the specified condition or conditions]” and setting out the text of each specified condition. | ||

(b) Where the Society gives a direction pursuant to Section 59 of the Act of 1994 that the practising certificate already issued to a solicitor for the practice year should, from a date that is 21 days after the date of receipt by the solicitor concerned of notification in writing by the Society of the giving of such direction, have effect subject to a specified condition or conditions, the solicitor shall (subject to the provisions of the said Section 59 of the Act of 1994 as to the solicitor’s right of appeal to the High Court), within such period of 21 days, surrender his or her current practising certificate, and the Society shall, as soon as possible, reissue the practising certificate endorsed with the words (adapted as appropriate): “Issued subject to [a] specified condition[s] as annexed” and the Registrar at the same time shall cause to be issued to the solicitor concerned a separate document (deemed to be part of the practising certificate) headed with the Society’s crest and title and with the words (adapted as appropriate): “Annexe to practising certificate of [name of solicitor] of [a] specified condition[s] attached thereto and applicable as and from [date of commencement of applicability of the specified condition or conditions]” and setting out the text of each specified condition. | ||

(c) Where a practising certificate issued or reissued to a solicitor for the practice year is subject to a specified condition or conditions as referred to in clause (a) or (b) of this Regulation: | ||

(i) the solicitor concerned shall comply with the specified condition or each of the specified conditions, as the case may be, and shall ensure that he or she does not provide legal services to any client of the solicitor in breach of such specified condition or conditions, whether or not any such client is made aware of such specified condition or conditions, and | ||

(ii) the solicitor concerned, in any display by him or her of his or her practising certificate, shall display with equal prominence adjacent thereto, the annexe thereto setting out the specified condition or conditions to which his or her practising certificate is subject. | ||

Dated this 20th day of December 2012 | ||

Signed on behalf of the Law Society of Ireland pursuant to Section 79 of the Solicitors Act 1954 . | ||

| ||

JAMES B. McCOURT | ||

President of the Law Society of Ireland | ||

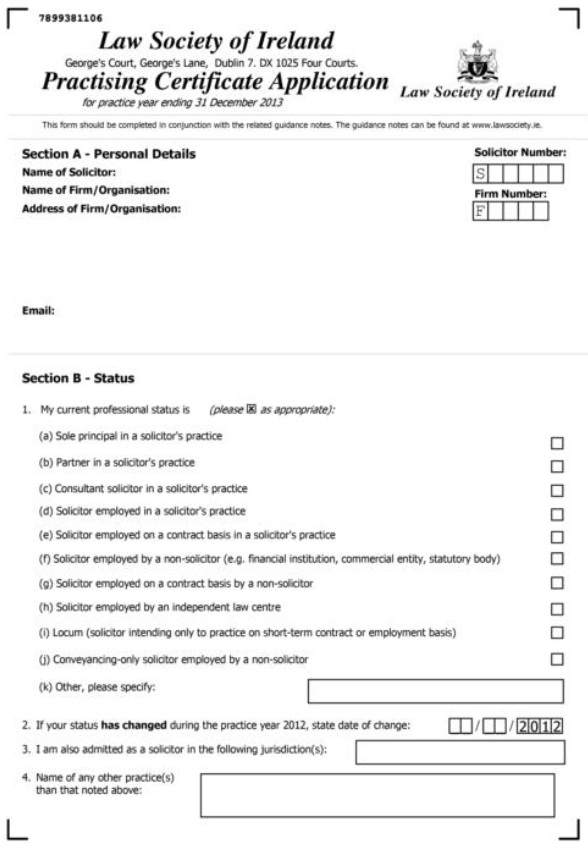

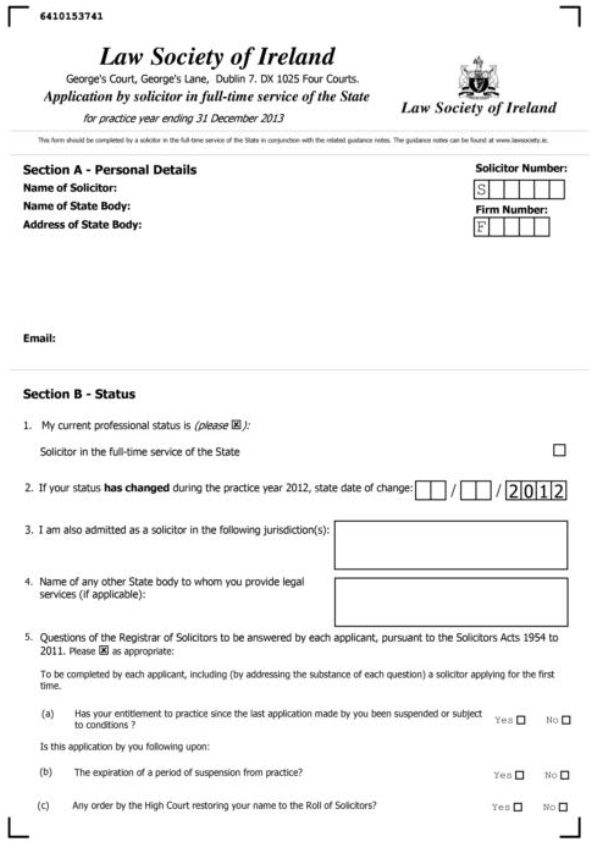

FIRST SCHEDULE | ||

within referred to | ||

FORM OF APPLICATION FOR PRACTISING CERTIFICATE FOR PRACTICE YEAR ENDING 31ST DECEMBER 2013 | ||

And | ||

FORM OF APPLICATION BY A SOLICITOR IN THE FULL-TIME SERVICE OF THE STATE FOR YEAR ENDING 31ST DECEMBER 2013 | ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

SECOND SCHEDULE | ||

within referred to | ||

| ||

THIRD SCHEDULE | ||

within referred to | ||

Law Society of Ireland | ||

Practising Certificate Application | ||

for the practice year ending 31 December 2013 | ||

GUIDANCE NOTES | ||

GENERAL | ||

Why you need a practising certificate | ||

It is misconduct and a criminal offence for a solicitor (other than a solicitor in the full-time service of the State) to practise without a practising certificate. A solicitor shall be deemed to practise as a solicitor if he or she engages in the provision of legal services. ‘Legal services’ are services of a legal or financial nature arising from that solicitor’s practice as a solicitor. | ||

It should be noted that it is not permissible for a firm to classify a solicitor employed by a firm as a ‘legal executive’ or ‘paralegal’ with a view to avoiding the requirement to hold a practising certificate if the solicitor is engaged in the provision of legal services. | ||

The actions that can be taken against a solicitor found to be practising without a practising certificate include a referral to the Solicitors Disciplinary Tribunal, an application to the High Court, and a report to An Garda Síochána. | ||

Practising certificate application forms | ||

Application forms will be issued after 19th December 2012. Application forms for solicitors in private practice will be forwarded to the principal or the managing partner in each practice, rather than to each solicitor. | ||

When you must apply | ||

A practising certificate must be applied for on or before 1 February in each year in order to be dated 1 January of that year and thereby operate as a qualification to practise from the commencement of the year. It is therefore a legal requirement for a practising solicitor to deliver or cause to be delivered to the Registrar of Solicitors, on or before 1 February 2013, an application in the prescribed form correctly completed and signed by the applicant solicitor personally, together with the appropriate fee. The onus is on each solicitor to ensure that his or her application form and fee is delivered by 1 February 2013. Applications should be delivered to: Regulation Department, Law Society of Ireland, George’s Court, George’s Lane, Dublin 7; DX 1025. | ||

What happens if you apply late? | ||

Any applications for practising certificates that are received after 1 February 2013 will result in the practising certificates being dated the date of actual receipt by the Registrar of Solicitors, rather than 1 January 2013. There is no legal power to allow any period of grace under any circumstances whatsoever. | ||

Please note that, as mentioned above, you cannot provide legal services as a solicitor without a practising certificate in force. Therefore, solicitors whose practising certificate application forms are received after 1 February 2013 and whose practising certificates are therefore dated after 1 February 2013, who have provided legal services before that date, are advised to make an application to the President of the High Court to have their practising certificates backdated to 1 January 2013. | ||

The Regulation of Practice Committee is the regulatory committee of the Society that has responsibility for supervising compliance with practising certificate requirements. A special meeting of this committee will be held on a date after 1 February 2013, to be decided at a later date, to consider any late or unresolved applications for practising certificates. At this meeting, any practising solicitors who have not applied by that date for a practising certificate will be considered for referral forthwith to the Solicitors Disciplinary Tribunal and will be informed that the Society reserves the right to take proceedings for an order under section 18 of the Solicitors (Amendment) Act 2002 to prohibit them from practising illegally. | ||

If you are an employed solicitor | ||

Solicitors who are employed should note that it is the statutory obligation of every solicitor who requires a practising certificate to ensure that he or she has a practising certificate in force from the commencement of the year. Employed solicitors cannot absolve themselves from this responsibility by relying on their employers to procure their practising certificates. However, it is the Society’s recommendation that all employers should pay for the practising certificate of solicitors employed by them. | ||

If you are a solicitor in the full-time service of the State | ||

There is a specially adapted form for solicitors in the full-time service of the State. | ||

Some of your details are already on the application form | ||

The practising certificate application form will be issued with certain information relating to each solicitor’s practice already completed. Such information will include the relevant fees due by each solicitor and where applicable, provided date of birth has been notified to the Society, will include allowance for those solicitors of 70 years or over, to take account of the fact that they will not be covered under the provisions of the Solicitors’ Group Life Cover Scheme. | ||

Payment by electronic funds transfer (EFT) | ||

All practising certificate application forms sent out will include an EFT payment form. Any solicitor wishing to pay the practising certificate fee by EFT must complete and return the EFT payment form with their practising certificate application form. Failure to do so will result in the application form being returned as incomplete. | ||

Each EFT payment must have an easily identifiable specific reference, such as the firm or company name, the solicitor’s name or the solicitor’s number. General references, such as ‘Law Society’ or ‘practising certificate’ will not be accepted and may result in a significant delay in the issuing of the practising certificate. The payment reference used must be included in the EFT form. Failure to include this information will result in the application form being returned as incomplete. | ||

The Society’s bank account details are included in the EFT payment form. The Society cannot be held responsible for any delay which occurs in processing applications to obtain a practising certificate where payment has been forwarded to another Law Society account which does not deal with practising certificate/membership fees. You are required to ensure that the monies have been sent to the correct account as listed in the EFT payment form. | ||

Law Directory 2013 | ||

It is intended that the Law Directory 2013 will note all solicitors who have been issued with a practising certificate by 22nd February 2013. Practising certificates can only be issued following receipt of a properly completed application form together with full payment, with no outstanding queries raised thereon. It should be noted that only those solicitors with practising certificates issued by 22nd February 2013 will be included in the Law Directory, not every solicitor who has submitted an application form by 22nd February 2013. | ||

Therefore, in order to ensure that your practising certificate issues by 22nd February 2013 to enable you to be included in the Law Directory, you should ensure that the application form you return to the Society is completed correctly and includes full payment of fees due. If the form is not completed correctly, or fees have not been paid in full, it will be necessary for the Society to return the form, which may result in delaying the issue of your practising certificate, despite the fact that you had applied for the practising certificate prior to 22nd February 2013. | ||

The details of any solicitor whose practising certificate issues after 22nd February 2013 will not be included in the Law Directory, but will be included in a supplementary list of solicitors which will be published at a later date on the Society’s website. | ||

What you can access on the website (www.lawsociety.ie) | ||

Your individual pre-populated application form and a blank editable application form will also become available on the members’ area of the Law Society website after 19 December 2012, which you can complete online prior to printing a copy for signing and returning to the Society with the appropriate fee. This area is accessible by using your username and password. If you require assistance, please visit www.lawsociety.ie/help. In addition, you may request a form to be emailed to you by emailing: pcrenewals@lawsociety.ie. | ||

If you are ceasing practice | ||

If you have recently ceased practice or are intending to cease practice in the coming year, please notify the Society accordingly. | ||

Acknowledgement of application forms | ||

Please note that it is not the Society’s policy to acknowledge receipt of application forms. If in doubt that your application form will arrive on time, or at all, send by registered post, tracked DX or courier. | ||

Issuing a practising certificate | ||

Please note that acceptance of an application form and fees by the Society is no guarantee that a practising certificate will be issued. There are a number of factors that may result in the Society deciding not to issue a solicitor with a practising certificate, including matters arising under section 49 of the Solicitors Act 1954 , as substituted by section 61 of the Solicitors (Amendment) Act 1994 , as amended by section 2 of the Solicitors (Amendment) Act 2002 . If a practising certificate is not issued to a solicitor, the relevant fees will be refunded. | ||

Duplicate practising certificate | ||

Please note that a fee of €50 will be payable in respect of each duplicate practising certificate issued for any purpose. | ||

PRACTISING CERTIFICATE APPLICATION FORM | ||

Completion of the application form | ||

The application form must be properly completed and dated and signed personally by the applicant. If any details are omitted from the application form, it may be returned to the applicant for proper completion and re-submission, which could result in delay in issuing a practising certificate to the applicant. | ||

The application form must be properly completed by a solicitor engaged (or intending to engage) during the practice year ending 31 December 2013 in the provision of legal services, whether as a sole practitioner or as a partner in a solicitor’s practice or as an employee (whether of a solicitor(s) or of any other person or body), including a solicitor who does not require a practising certificate by reason of being a solicitor in the full-time service of the State [within the meaning of section 54 of the Solicitors Act, 1954 , as substituted by section 62 of the Solicitors (Amendment) Act 1994 ] (in such cases by completing the special application form for such cases) or by reason of being a solicitor employed full-time in the State to provide conveyancing services only to and for his/her non-solicitor employer [ section 56 of the Solicitors (Amendment) Act 1994 ]. | ||

The practice year coincides with the calendar year. The application form must be received by the Registrar at the Society’s premises, George’s Court, George’s Lane, Dublin 7, on or before 1 February 2013 in order for the practising certificate to be dated 1 January 2013 and thereby to operate as a qualification to practise from the commencement of the practice year 2013. A practising certificate issued after 1 February 2013 must [under Section 48 (as amended by Section 55 of the Solicitors (Amendment) Act 1994 ), of the Solicitors Act 1954 ] bear the date on which the application is actually received by the Registrar. | ||

Section A — Personal Details | ||

If any details in this section are incorrect, please either amend the form or enclose an explanatory letter with the form. | ||

Section B — Status | ||

Please complete this Section as indicated on the application form. | ||

Notes in relation to particular parts of this Section: | ||

1(h) For the purposes of this option “independent law centre” has the meaning provided for in The Solicitors Acts 1954 to 2002 (Independent Law Centres) Regulations 2006 ( S.I. No. 103 of 2006 ), as amended. | ||

1(j) A solicitor to whom this option applies is not required to hold a practising certificate, but should complete the form as if applying for a practising certificate. No fee will be charged for a practising certificate and no practising certificate will be issued. | ||

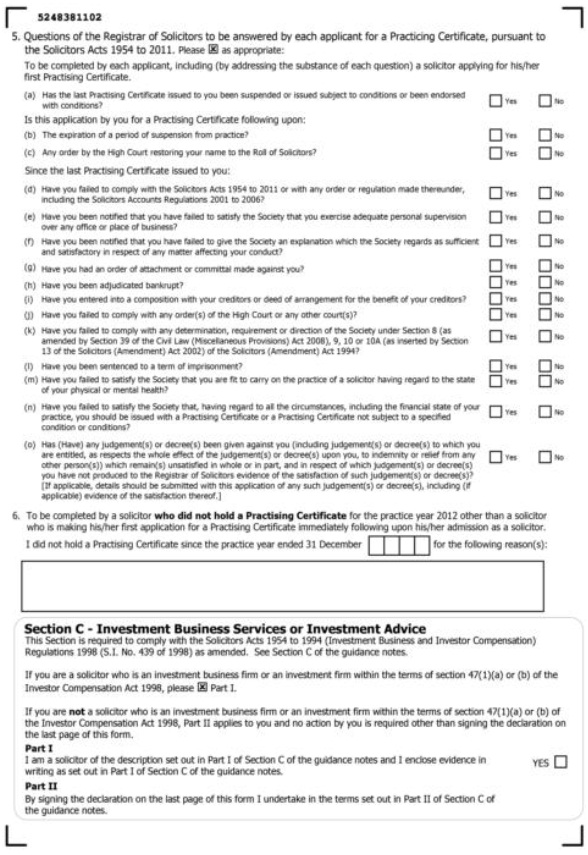

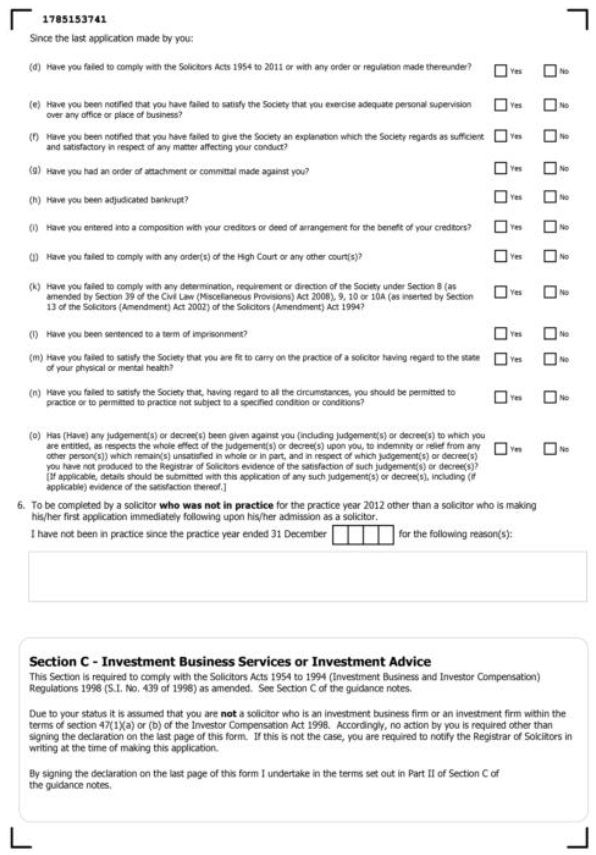

5. The questions of the Registrar of Solicitors are to be answered by each applicant, including a solicitor in the full-time service of the State and a conveyancing-only solicitor employed by a non-solicitor. Replies to these questions should also include any matters than have arisen in another jurisdiction. | ||

Section C — Investment Business Services or Investment Advice | ||

This Section is required to comply with The Solicitors Acts 1954 to 1994 (Investment Business and Investor Compensation) Regulations 1998 ( S.I. No. 439 of 1998 ) as amended. | ||

Part I of this Section applies to a solicitor who is an investment business firm or an investment firm within the terms of Section 47 (1)(a) or (b) of the Investor Compensation Act 1998 . | ||

Part II of this Section applies to all other solicitors. In the form for solicitors in the full-time service of the State this Section is not divided into parts. | ||

Text of Investor Compensation Act 1998 Section 47(1)(a) and (b) | ||

(a)A solicitor in respect of whom a practising certificate (within the meaning of the Solicitors Acts 1954 to [1994]) is in force shall be an investment business firm— | ||

(i)where the solicitor provides investment business services or investment advice in a manner which is not incidental to the provision of legal services, or | ||

(ii)where the solicitor holds himself or herself out as being an investment business firm, or | ||

(iii)where, when acting as an investment product intermediary in a manner incidental to the provision of legal services, the solicitor holds an appointment in writing other than from— | ||

(I)an investment firm authorised in accordance with the Investment Services Directive by a competent authority of another Member State, or an authorised investment business firm (not being a restricted activity investment product intermediary or a certified person), or a member firm within the meaning of the Stock Exchange Act 1995 , or | ||

(II)a credit institution authorised in accordance with Directives 77/780/EEC of 12 December 1977 and 89/646/EEC of 15 December 1989, or | ||

(III)a manager of a collective investment undertaking authorised to market units in collective investments to the public, | ||

which is situate in the State or the relevant branch of which is situate in the State, | ||

and shall be required to be authorised as an authorised investment business firm pursuant to the provisions of the [Investment Intermediaries Act] 1995. | ||

(b)A solicitor, in respect of whom a practising certificate (within the meaning of the Solicitors Acts 1954 to [1994]) is in force, who is an insurance intermediary or who holds himself [or herself] out to be an insurance intermediary shall be an investment firm for the purposes of this Act and shall inform the [Irish Financial Services Regulatory Authority] and [The Investor Compensation Company Limited] that he or she is an investment firm for the purposes of this Act. | ||

Section C, Part I | ||

The terms of the description referred to in Part I of this Section and the terms of the evidence in writing referred to in Part I of this Section are as follows: | ||

1. I am a solicitor who— | ||

(a) provides investment business services (including acting as an insurance intermediary) or investment advice in a manner which is not incidental to the provision of legal services, or | ||

(b) holds himself/herself out as being an investment business firm, or | ||

(c) when acting as an investment product intermediary in a manner incidental to the provision of legal services, holds an appointment in writing other than from | ||

(i) an investment firm authorised in accordance with the Investment Services Directive by a competent authority of another Member State, or an authorised investment business firm (not being a restricted activity investment product intermediary or a certified person), or a member firm within the meaning of the Stock Exchange Act 1995 , or | ||

(ii) a credit institution authorised in accordance with Directives 77/780/EEC of 12 December 1977 and 89/646/EEC of 15 December 1989, or | ||

(iii) a manager of a collective investment undertaking authorised to market units in collective investments to the public, | ||

which is situate in the State or the relevant branch of which is situate in the State, | ||

and am therefore an investment business firm required to be authorised as an authorised investment business firm pursuant to the provisions of the Investment Intermediaries Act 1995 (as amended by the Investor Compensation Act 1998 ), or am an insurance intermediary and/or have held myself out as an insurance intermediary who is required to inform the Central Bank of Ireland and The Investor Compensation Company Limited of that fact. | ||

2. I attach to my application form evidence in writing: | ||

(a) either— | ||

(i) of having been authorised by the Central Bank of Ireland as an authorised investment business firm; or | ||

(ii) of having informed the Central Bank of Ireland and The Investor Compensation Company Limited that I am an insurance intermediary and/or that I have held myself out as an insurance intermediary; | ||

(b) of the fact of the payment by me (or on my behalf) of such contribution to the fund established and maintained pursuant to section 19 of the Investor Compensation Act 1998 as may be required by The Investor Compensation Company Limited under section 21 of that Act; | ||

(c) of having in place, valid and irrevocable for at least the duration of the practice year ending on 31 December 2013, a bond or bank guarantee and a policy of insurance, each acceptable to the Society, by way of providing indemnity against losses that may be suffered by a client in respect of default (whether arising from dishonesty or from breach of contract, negligence or other civil wrong) on my part, or any employee, agent or independent contractor engaged by me, as shall, in the opinion of the Society (taking into account the maximum amount of compensation for default that would be payable to a client secured by reason of the payment made by me referred to in (b) above), be equivalent to the indemnity against losses that would be provided to a client of a solicitor (in respect of whom a practising certificate is in force) in the provision of legal services by means of— | ||

(i) the Compensation Fund as provided for in accordance with section 21 (as substituted by section 29 of the Solicitors (Amendment Act 1994) of the Solicitors (Amendment) Act 1960 , and | ||

(ii) the minimum level of cover as provided for in accordance with The Solicitors Acts 1954 to 2008 (Professional Indemnity Insurance) Regulations 2011 ( S.I. No. 409 of 2011 ), as amended. | ||

Section C, Part II | ||

The terms of the undertaking referred in Part II of this Section are as follows: | ||

I hereby undertake that: | ||

(a) I will not provide investment business services (including acting as an insurance intermediary) or investment advice to clients or, if I do so, I will do so only when incidental to the provision of legal services to such clients; | ||

(b) I will not hold myself out as being an investment business firm or an insurance intermediary; | ||

(c) If I provide investment business services or investment advice to clients incidental to the provision of legal services to such clients and when acting as an investment product intermediary, I will not hold an appointment in writing other than from: | ||

(i) an investment firm authorised in accordance with Directive 93/22/EEC of 10 May 1993 by a competent authority of another Member State, or an authorised investment business firm (not being a restricted activity investment product intermediary or a certified person), or a member firm within the meaning of the Stock Exchange Act 1995, or | ||

(ii) a credit institution authorised in accordance with Directives 77/780/EEC of 12 December 1977 and 89/646/EEC of 15 December 1989, or | ||

(iii) a manager of a collective investment undertaking authorised to market units in collective investments to the public, which is situate in the State or the relevant branch of which is situate in the State; and | ||

(d) if at any time during the course of the practice year ending on 31 December 2013 I propose to become an investment business firm or an investment firm in one or more of the circumstances set forth in Section 47 (1)(a) or (b) of the Investor Compensation Act 1998 , I will notify the Society in writing of that fact at least seven days before such proposed event and shall, within fourteen days of such notification, comply with the provisions of Regulation 6 of The Solicitors Acts 1954 to 1994 (Investment Business and Investor Compensation) Regulations 1998 ( S.I. No. 439 of 1998 ), as amended. | ||

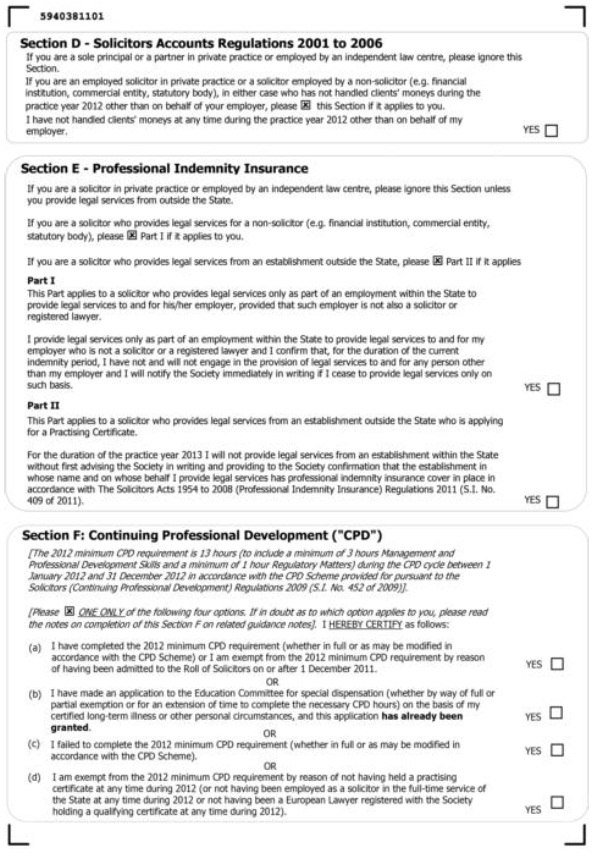

Section D — Solicitors Accounts Regulations 2001 to 2006 | ||

This Section should completed only by an employed solicitor in private practice or by a solicitor employed by a non-solicitor (e.g. financial institution, commercial entity, statutory body), in either case who has not handled clients’ moneys during the practice year 2012 other than on behalf of the employer. | ||

Section E — Professional Indemnity Insurance | ||

This Section should be completed only by a solicitor who provides legal services for a non-solicitor (e.g. financial institution, commercial entity, statutory body) or a solicitor who provides legal services from an establishment outside the State. If either status applies to you, please complete either Part I or Part II, as appropriate. In the form for solicitors in the full-time service of the State this Section is not divided into parts. | ||

For the purposes of this Section words and phrases which are assigned meanings by The Solicitors Acts 1954 to 2008 (Professional Indemnity Insurance) Regulations 2011 ( S.I. No. 409 of 2011 ) shall have the meanings so assigned. | ||

Section F — Continuing Professional Development (CPD) | ||

Completion of Section F of this application is the initial means of verifying compliance with the 2012 minimum CPD requirement. The CPD requirement for 2012 applies to a solicitor who held a practising certificate, and/or a solicitor in the full-time service of the State, and/or a European lawyer registered with the Society holding a qualifying certificate, at any time during 2012. A solicitor who does not fall into any of these categories should tick option (d). | ||

Solicitors who have completed the 2012 minimum CPD requirement in accordance with the Scheme should tick option (a). The 2012 CPD Scheme allows for the minimum CPD requirement to be modified in certain limited circumstances, including for (i) a newly admitted solicitor, (ii) a senior practitioner, (iii) maternity/parental/carers/adoptive leave, (iv) part-year practice, (v) unemployment, (vi) part-time practice. The limited circumstances in which these modifications may be claimed and the method of calculating the modified CPD requirement are set out in the current CPD Scheme booklet. No application to the Education Committee is required to claim such a modification. A solicitor who is entitled to modify his/her minimum CPD requirement under the Scheme and who completed that modified CPD requirement should tick option (a). A solicitor who is entitled to modify his/her minimum CPD requirement under the Scheme but who failed to complete that modified CPD requirement should tick option (c). | ||

A solicitor who was admitted to the Roll of Solicitors on or after 1 December 2011 is exempt from the full 2012 minimum CPD requirement and should tick option (a). A solicitor who was admitted to the Roll of Solicitors between January 2011 and November 2011 is entitled to modify his/her minimum CPD requirement in accordance with the Scheme (see above). Any such solicitor should tick option (a) if they completed that modified CPD requirement or option (c) if they failed to do so. | ||

A solicitor may make an individual application to the Education Committee for special dispensation from the minimum CPD requirement (whether by way of full or partial exemption or for an extension of time to complete the necessary CPD hours) in cases of certified long-term illness or other personal circumstances. Only a solicitor who has made such an application to the Education Committee which has already been granted should tick option (b). | ||

A solicitor who has failed to complete the 2012 minimum CPD requirement (in full or as may be modified under the Scheme) and who has not made an application to the Education Committee for special dispensation should tick option (c). A solicitor to whom option (c) applies and who now wishes to make an application to the Education Committee for special dispensation should separately write to the CPD Scheme Unit. | ||

The current CPD Scheme booklet and S.I. No. 452 of 2009 are available to download from the CPD Scheme section in the Members’ Area of the Society’s website (www.lawsociety.ie). For further information, contact the CPD Scheme Unit (tel: 01 6724802, post: CPD Scheme Unit, Law Society of Ireland, Blackhall Place, Dublin 7 or email: cpdscheme@lawsociety.ie). | ||

An applicant should not return his/her CPD record card with this practising certificate application. The Society may subsequently request sight of an applicant’s record card and proof of completion of the CPD during the 2012 CPD cycle as part of the Society’s CPD audit review process. | ||

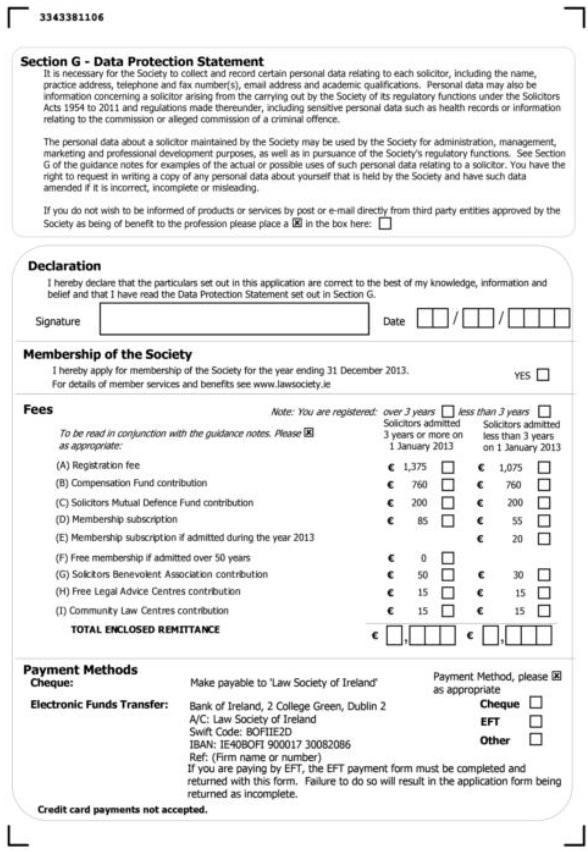

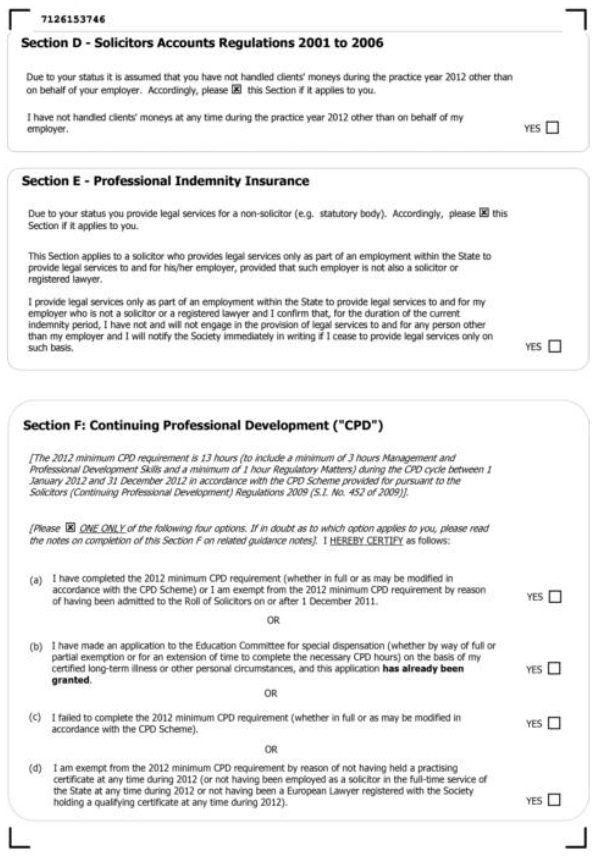

Section G — Data Protection Statement | ||

Examples of the actual or possible uses of personal data relating to a solicitor include the following: | ||

• the provision of data to insurers providing professional indemnity insurance cover and brokers arranging such cover and to the SPF manager; | ||

• the circulation of the Society’s Gazette to a solicitor member of the Society, which may include or be accompanied by commercially-related material; | ||

• publication in the annual Law Directory or any on line solicitor search facility; | ||

• the reference to a solicitor on the Roll of Solicitors and/or on the Register of Practising Solicitors and/or in the records of professional indemnity insurance cover of solicitors maintained by the Society; | ||

• the reference to a solicitor on the Society’s website; | ||

• the provision by the Society to a solicitor candidate for the Society’s annual elections or a solicitor candidate for a Dáil or Seanad election of the practice address and/or e-mail address of a solicitor; | ||

• the furnishing of information relating to the good standing of a solicitor, including information recorded on the Roll of Solicitors and on the Register of Practising Solicitors or in the records of professional indemnity insurance cover maintained by the Society, when requested, to Irish governmental agencies (e.g. Judicial Appointments Advisory Board) or to foreign governmental agencies (including governmental agencies outside the European Union) or to commercial entities or to individual members of the public; | ||

• the provision by the Society to a specific commercial entity of the practice address and/or e-mail address pursuant to an expressly recorded decision of the Society that it is beneficial to do so for defined marketing or professional or practice development purposes; | ||

• the provision by the Society of the practice address and/or e-mail address of a solicitor to third party non-commercial entities, e.g. Bar Associations, Courts Service etc which provide useful information to the profession; | ||

• the provision by the Society to a firm of solicitors or another body employing solicitors of information both electronically and in hard copy form, as to the attendance record of individual solicitors within the firm or body relating to Continuing Professional Development; and | ||

• the furnishing of information to the Solicitors Benevolent Association in relation to contributions made to them through the Practising Certificate fee. | ||

Declaration | ||

Please sign and date as indicated on the application form. | ||

Membership of the Society | ||

Please tick the box if you wish to be a member of the Society for the year ending 31 December 2013. | ||

Fees | ||

1. The registration fee (A), the Compensation Fund contribution (B) and the Solicitors Mutual Defence Fund contribution (C) are required to be paid by each applicant for a practising certificate. | ||

2. A solicitor admitted during the practice year commencing 1 January 2013, if applying for his/her first practising certificate during the practice year 2013, may calculate the registration fee, the Compensation Fund contribution and the Solicitors Mutual Defence Fund contribution payable by him/her on the basis of the number of full calendar months remaining in that practice year following the month of his/her admission, and the solicitor’s membership subscription in respect of the year (or part thereof) of his/her admission shall be at the reduced rate of €20. | ||

A solicitor admitted to the Roll for at least 50 years on 1 January 2013 is entitled to be a member of the Society without payment of a membership subscription. Therefore it is not necessary for such a solicitor to pay the €85 membership subscription when applying for a practising certificate. | ||

3. Payment of the annual membership subscription and/or the Solicitors Benevolent Association contribution and/or the Free Legal Advice Centres contribution and/or Community Law Centres contribution is/are not a condition(s) precedent to the issuing to a solicitor of a Practising Certificate. However, unless a solicitor pays the annual membership subscription, he/she cannot enjoy the benefits of being a member of the Society as provided for in the Society’s Bye-Laws, including the right to vote in annual and provincial elections and the right to receive the Society’s Gazette. The voluntary contribution to Community Law Centres will be allocated to the Ballymun Community Law Centre and the Northside Community Law Centre. | ||

Payment Methods | ||

Please pay the fees due by cheque or electronic funds transfer as indicated on the application form. | ||

If paying by electronic funds transfer (EFT), it is mandatory to complete and enclose the EFT payment form with the practising certificate application form. Failure to do so will result in the application form being returned as incomplete, notwithstanding that the fees due may actually have been received by the Society. EFT payments are more fully described in the general section of these guidance notes. | ||

If paying by cheque, failure to include a completed valid cheque will result in the application form being returned as incomplete. | ||

There is no discretion to waive the requirement for solicitors to pay in full for the practising certificate before the practising certificate is issued to the solicitor. In this regard, attention is drawn to the deadline of 22nd February 2013 for inclusion in the Law Directory 2013 which is more fully described in the general section of these guidance notes. | ||

| ||