S.I. No. 203/2012 - Occupational Pension Schemes (Disclosure of Information) (Amendment) (No. 3) Regulations, 2012.

Notice of the making of this Statutory Instrument was published in | ||

“Iris Oifigiúil” of 15th June, 2012. | ||

I, JOAN BURTON, Minister for Social Protection, in exercise of the powers conferred on me by section 5 and section 54 (amended by section 36 of the Social Welfare and Pensions Act 2011 (No.9 of 2011)), 55 (amended by section 38 of the Social Welfare and Pensions Act 2012 (No.12 of 2012)) and 56 (amended by section 38 of the Social Welfare and Pensions Act 2011 (No.9 of 2011)) of the Pensions Act 1990 (No. 25 of 1990), hereby make the following Regulations: | ||

Citation | ||

1. (1) These Regulations may be cited as the Occupational Pension Schemes (Disclosure of Information) (Amendment) (No. 3) Regulations, 2012. | ||

(2) These Regulations shall be included in the collective citation of the Occupational Pension Schemes (Disclosure of Information) Regulations 2006 to 2012. | ||

Definitions | ||

2. In these Regulations | ||

“Act” means the Pensions Act, 1990 (No. 25 of 1990); | ||

Amendment of Occupational Pension Schemes Disclosure Regulations | ||

3. The Occupational Pension Scheme (Disclosure of Information) Regulations 2006 ( S.I. No. 301 of 2006 ) are amended— | ||

(a) in article 4, by inserting the following after the definition of “scheme year”: | ||

““section 53B policy” means a policy or contract of assurance the form of which has been certified by the Board under section 53B of the Act;”, | ||

(b) In article 7— | ||

(i) in paragraph (5)(a)(iii) by inserting “and, unless it is a regulatory own funds scheme, a copy of the latest funding standard reserve certificate” after “latest actuarial funding certificate”, and | ||

(ii) by inserting the following paragraph after paragraph (5)(b): | ||

“(c) The annual report in respect of a relevant scheme to which section 44 of the Act applies shall contain the information specified in paragraphs 24 and 25 of Schedule B in addition to the information specified in paragraph (a) of this sub-article in respect of any scheme year ending on or after 1 January 2013.”, | ||

(c) In article 8, by inserting the following sub-article, after sub-article (4A): | ||

“(4B) Based on information provided to and reasonable enquiries having been made by the preparer of an annual report for a defined benefit scheme to which both this article 8 and section 44 of the Act applies, that report shall contain the information specified in paragraphs 24 and 25 of Schedule B in addition to the matters referred to in sub-article (4A) in respect of any scheme year ending on or after 1 January 2013.”, | ||

(d) In article 11— | ||

(i) by substituting “paragraphs 1 to 22 of Schedule C” for “Schedule C” in each of sub-articles (1), (2) and (3); | ||

(ii) in sub-article 4(a) by inserting “and, on or after 1 January 2013, paragraph 23 of Schedule C” after “Schedule C”; and | ||

(iii) by inserting the following sub-article after sub-article (5): | ||

“(6) The trustees of a defined benefit scheme to which section 44 of the Act applies shall furnish the information specified in paragraph 23 of Schedule C | ||

(a) to every person who becomes a member of the scheme on or after 1 January 2013 within two months of his becoming a member; and | ||

(b) to a relevant person where the relevant person makes a request for the information referred to in sub-article (3) on or after 1 January 2013.”, | ||

(e) in article 13(1) by inserting “and, where the scheme is a defined benefit scheme to which section 44 of the Act applies and the information is being furnished on or after 1 January 2013, the information specified in paragraph 13A of Part I of Schedule D” after “Schedule D”, | ||

(f) in article 14— | ||

(i) in paragraph (1) by inserting “and, where the scheme is a defined benefit scheme to which section 44 of the Act applies and the information is being furnished on or after 1 January 2013, the information specified in paragraph 6A of Part I of Schedule E” after “Schedule E”, | ||

(ii) in paragraph (2) by inserting “and, where the scheme is a defined benefit scheme to which section 44 of the Act applies and the information is being furnished on or after 1 January 2013, the information specified in paragraph 6A of Part I of Schedule E” after “Schedule E”, | ||

(g) in article 15— | ||

(i) by inserting “and, where the scheme is a defined benefit scheme to which section 44 of the Act applies and the information is being furnished on or after 1 January 2013, the information specified in paragraph 6 of Schedule F” after “paragraphs 1, 3, 4 and 5 of Schedule F”, and | ||

(ii) by inserting “and, where the scheme is a defined benefit scheme to which section 44 of the Act applies and the statement is being furnished on or after 1 January 2013,” after ”revised benefits” in sub-article (2), | ||

(h) in article 17(1) by inserting “and where the scheme is a defined benefit scheme to which section 44 of the Act applies and the information is being furnished on or after 1 January 2013, the information specified in paragraph 12 of Schedule H” after “Schedule H”, | ||

(i) by inserting the following articles after article 22: | ||

“23.Annual Actuarial Data Return | ||

(1) The trustees of a scheme described in sub-article (4) shall cause the actuary to complete the form set out in Schedule L no later than 8 months after the end of every scheme year ending on or after 1 July 2012. | ||

(2) The trustees shall submit the form so completed to the Board within 9 months of the end of the scheme year to which it relates. | ||

(3) The form set out in Schedule L may be adapted for filing and use electronically in such manner as the Board may from time to time specify. | ||

(4) This article shall apply to a scheme to which section 44 of the Act applies. | ||

24. Requirements relating to section 42 guidance | ||

(1) In this article, “section 42 guidance” means the guidance issued by the Board from time to time under section 42 of the Act and prescribed by Regulations made under section 42 of the Act. | ||

(2) Where at any time the trustees of a scheme to which section 44 of the Act applies pass a resolution of the type described in the section 42 guidance, the trustees shall— | ||

(a) prior to providing the confirmation in writing to the actuary referred to in the section 42 guidance, provide the notifications referred to in that guidance (which notifications shall comply with the terms of that guidance) to members, other persons and any authorised trade union in accordance with that guidance, and | ||

(b) notify the actuary if the resolution referred to in the section 42 guidance is revoked or has not been confirmed as required by the section 42 guidance as soon as reasonably practicable and in any event prior to whichever of the following dates first occurs— | ||

(i) the date on which the actuary next signs an actuarial funding certificate, | ||

(ii) the date on which the actuary next signs a statement referred to in sub-paragraph (b)(iii)(II) of section 50(3) of the Act, | ||

(iii) the date on which the actuary next signs a statement referred to in sub-sections (3) or (4) of section 55 of the Act, or | ||

(iv) the date on which the actuary next certifies a funding proposal under section 49 of the Act.”, | ||

(j) in Schedule A— | ||

(i) by substituting the following subparagraph for subparagraph 2(a)(i): | ||

“(i) insurance policies which have been purchased which fully match the pension obligations of the scheme in respect of specific members or other persons and for this purpose a section 53B policy shall be capable of matching a pension obligation,”, | ||

(ii) by inserting the following sub-paragraph after subparagraph 2(c): | ||

“(d) where section 53B policies have been purchased, the notes to the accounts shall include a statement of the value of the pension obligations of the scheme which are matched by section 53B policies and, where there has been any reduction in payments under any section 53B policies held by the scheme, a statement detailing particulars of that reduction.”, | ||

(k) in Schedule B— | ||

(i) in paragraph 5(b) by inserting the following after “paragraph 2(a)(i) of Schedule A”: | ||

“but only if such policy matches all of the pension obligations of the scheme in respect of that member or other person.”; | ||

(ii) in paragraph 7 by substituting “latest actuarial funding certificate, latest funding standard reserve certificate” for “latest actuarial funding certificate”; | ||

(iii) in paragraph 21 by inserting “and latest funding standard reserve certificate (if any)” after “latest actuarial funding certificate (if any)”; | ||

(iv) by inserting the following paragraphs after paragraph 23: | ||

“24.Where on the last day of the scheme year to which an annual report relates, the actuary to the scheme is valuing all or any pensions in payment under the scheme on the basis outlined in the guidance issued by the Board in relation to section 42 of the Act, a statement substantially in the form set out in Schedule N. | ||

25. A statement substantially in the form set out in Schedule M which may only be modified if the trustees are of the reasonable opinion that any part of the statement could not apply to the scheme or that the modifications will better explain the nature and effect of the matters referred to in the statement.”, | ||

(l) in Schedule C by inserting the following paragraph, after paragraph 22: | ||

“23.A statement substantially in the form set out in Schedule M which may only be modified if the trustees are of the reasonable opinion that any part of the statement could not apply to the scheme or that the modifications will better explain the nature and effect of the matters referred to in the statement.”, | ||

(m) in Schedule D by inserting the following paragraph, after paragraph 13: | ||

“13AA statement substantially in the form set out in Schedule M which may only be modified if the trustees are of the reasonable opinion that any part of the statement could not apply to the scheme or that the modifications will better explain the nature and effect of the matters referred to in the statement.”, | ||

(n) in Schedule E by inserting the following paragraph, after paragraph 6: | ||

“6AA statement substantially in the form set out in Schedule M which may only be modified if the trustees are of the reasonable opinion that any part of the statement could not apply to the scheme or that the modifications will better explain the nature and effect of the matters referred to in the statement.”, | ||

(o) in Schedule F by inserting the following paragraph after paragraph 5: | ||

“6.A statement substantially in the form set out in Schedule M which may only be modified if the trustees are of the reasonable opinion that any part of the statement could not apply to the scheme or that the modifications will better explain the nature and effect of the matters referred to in the statement.”, | ||

(p) in Schedule H by inserting the following paragraph, after paragraph 11: | ||

“(12) A statement substantially in the form set out in Schedule M which may only be modified if the trustees are of the reasonable opinion that any part of the statement could not apply to the scheme or that the modifications will better explain the nature and effect of the matters referred to in the statement.”, | ||

(q) by inserting the following 3 schedules after Schedule K: | ||

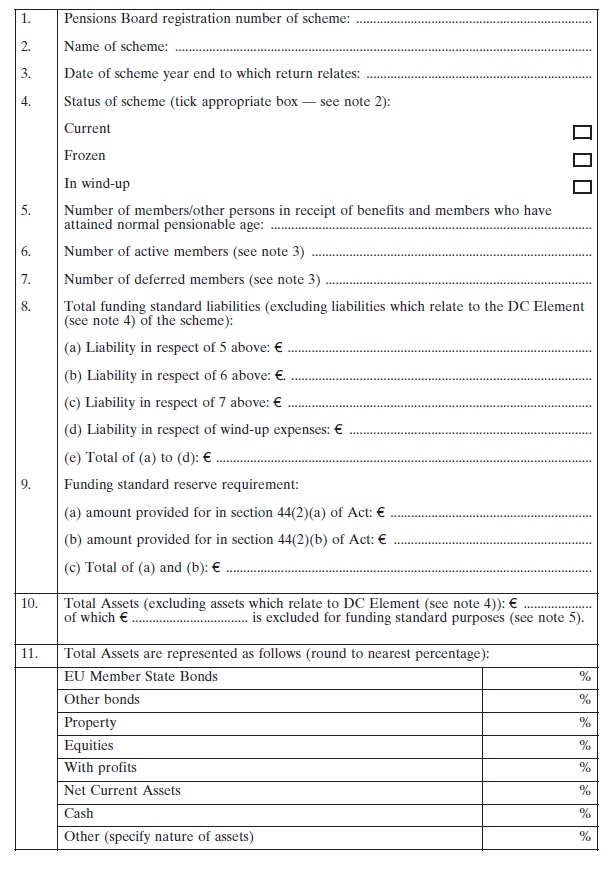

“SCHEDULE L | ||

THE PENSIONS BOARD ANNUAL ACTUARIAL DATA RETURN | ||

| ||

To the best of my knowledge and belief, having made such reasonable enquiries as are appropriate, the information contained in this form is true and complete. | ||

Signature: ______________ | ||

Date: ______________ | ||

Name: ______________ Qualification: ______________ | ||

Name of Actuary’s Employer/Firm: ______________ | ||

Scheme Actuary Certificate No.: ______________ | ||

NOTES ON COMPLETION OF ANNUAL ACTUARIAL DATA RETURN | ||

1. All sections of the form must be competed in full. “None” or “Not Applicable” should be entered where appropriate, but blank spaces or “to be advised” or similar responses may result in the form being rejected as incomplete. | ||

2. A Frozen Scheme is a scheme where there is no further accrual of any long service benefit and the link to final retiring salary has been broken. A current scheme is a scheme that is neither frozen or in wind-up. | ||

3. Exclude members who have attained normal pensionable age. | ||

4. The DC Element of a scheme has the meaning given in the Occupational Pension Schemes (Disclosure of Information) Regulations 2006 to 2012. Broadly, it means contributions or other amounts treated on a defined contribution basis. | ||

5. These are assets which cannot be used to determine if scheme satisfies the funding standard due to restrictions in the Funding Standard Regulations, in particular, due to self-investment/concentration of investment requirements. | ||

6. All information included on the form should be stated as of the date to which the return relates. Where precise liability or reserve requirement figures are not available for date to which return relates, the actuary’s best estimate should be used. | ||

7. This form should be submitted to: The Pensions Board, Regulation Unit, Verschoyle House, 28/30 Lower Mount Street, Dublin 2. The Pensions Board may permit electronic submissions, subject to such requirements as the Board may from time to time stipulate. | ||

For further information visit WWW.PENSIONSBOARD.IE | ||

SCHEDULE M | ||

RISK STATEMENT | ||

The scheme is funded by contributions paid by the employer(s) [and members — delete if not applicable]. Actuarial advice will have been obtained when setting those contributions. However, there is no guarantee that the scheme will have sufficient funds to pay the benefits promised. It is therefore possible that the benefits payable under the scheme may have to be reduced. If the scheme is wound up and there is a deficit, the employer(s) may not be under an obligation to fund the deficit or, even if the employer(s) are under such an obligation, they may not be in a position to fund the deficit. | ||

Further information in relation to this Risk Statement may be obtained from the Trustees [or from —insert details of any other person and delete if not applicable]. | ||

SCHEDULE N | ||

PURCHASE OF SOVEREIGN ANNUITIES | ||

The trustees have confirmed to the scheme actuary that it is their intention, if the scheme winds up and subject to their fiduciary duties at the time of wind-up, to secure [specify level of pensions in payment to which trustees’ intention relates] through the purchase of sovereign annuities. This will include the benefits payable to or in respect of persons who have attained normal pensionable age at the date of wind-up even if those benefits are not yet in payment. | ||

This confirmation may allow the scheme actuary to place a lower value on pensions in payment than would otherwise be the case when assessing whether or not the scheme satisfies the statutory minimum funding standard set out in the Pensions Act. | ||

If the scheme were to wind-up and pensions in payment secured using sovereign annuities, payment of any pension so secured would be dependent upon certain EU Member States fulfilling their payment obligations under the terms of bond(s) which they have issued and not varying the terms of the bond(s) such that anticipated payments under those bond(s) fall. | ||

If the Member State did not fulfil any of its payment obligations or there was a variation to the terms of the bond(s), the insurer providing the sovereign annuity could reduce the pension in payment under the sovereign annuity referenced to those bond(s) to reflect the loss caused to holders of the bond(s). In that event, the person in receipt of a pension through that sovereign annuity would have to bear the loss and would have no recourse to the scheme for that loss.”. | ||

| ||

GIVEN under my Official Seal, | ||

12 June 2012. | ||

JOAN BURTON, | ||

Minister for Social Protection. | ||

EXPLANATORY NOTE | ||

(This note is not part of the Statutory Instrument and does not purport to be a legal interpretation.) | ||

These Regulations contain additional disclosure obligations for occupational pension schemes arising out of matters contained in the Social Welfare and Pensions Act, 2012. | ||

The regulations are amended to require: | ||

(a) an annual report to contain | ||

— a copy of the latest funding standard reserve certificate and, where section 44 of the Act applies to the scheme, a risk statement, and | ||

— a statement explaining the meaning and effect of valuing pensions in payment on the basis of guidance issued by the Board under section 42 of the Act; | ||

(b) the basic information provided to members, in relation to a scheme to which section 44 of the Act applies, on or after 1 January 2013 to include a risk statement; | ||

(c) the information made available— | ||

• to members and prospective members in relevant employment, | ||

• to members on termination of relevant employment, | ||

• on retirement or death of a member or beneficiary and | ||

• in respect of pension adjustment orders | ||

to include a risk statement where that information is provided on or after 1 January 2013; | ||

(d) trustees of a scheme to which section 44 of the Act applies to submit an annual actuarial data return, completed by the actuary, to the Board in respect of scheme years ending on or after 1 July 2012; | ||

(e) trustees of a scheme to comply with certain requirements where some or all of the pensions in payment under the scheme are to be valued on the basis set out in guidance issued by the Board under section 42 of the Act and prescribed by Regulations; | ||

(f) the notes to the accounts to contain certain information in relation to policies the form of which has been certified under section 53B of the Act. | ||

The regulations are also amended to permit the accounts of a scheme to exclude insurance policies the form of which has been certified under section 53B of the Act and which fully match pension obligations. |