| |

I, Charlie McCreevy, Minister for Finance, in exercise of the powers conferred on me by section 372B (as amended by

section 26

of the

Finance Act 2004

(No. 8 of 2004)), of the

Taxes Consolidation Act 1997

(No. 39 of 1997), the Minister for the Environment, Heritage and Local Government having made a recommendation to me pursuant to that section, hereby order as follows:

1. This Order may be cited as the Taxes Consolidation Act 1997 (Qualifying Urban Renewal Areas) (Liberties/Coombe, Dublin) Order 2004.

2. (1) In this Order —

|

| |

“Act” means the

Taxes Consolidation Act 1997

(No. 39 of 1997);

|

| |

“classification” shall be construed in accordance with Schedule 3.

|

| |

(2) A classification set out in column (1) of Schedule 3 shall be construed by reference to the matter in column (3) of that Schedule opposite the mention of the classification concerned.

|

| |

(3) In this Order —

|

| |

(a) a reference to a Schedule is to a Schedule to this Order, unless it is indicated that reference to some other Order or enactment is intended, and

|

| |

(b) a reference to a paragraph is a reference to a paragraph of the provision in which the reference occurs, unless indicated that reference to some other provision is intended.

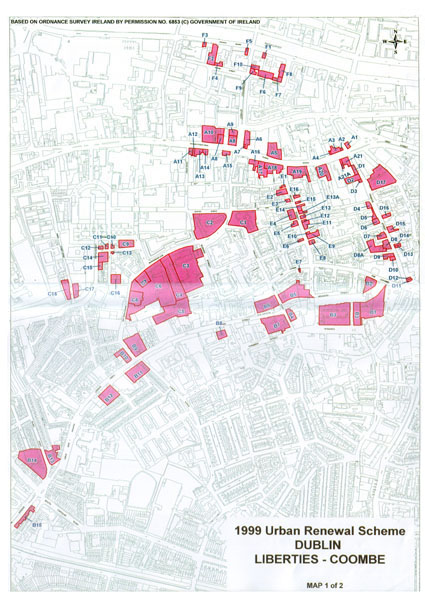

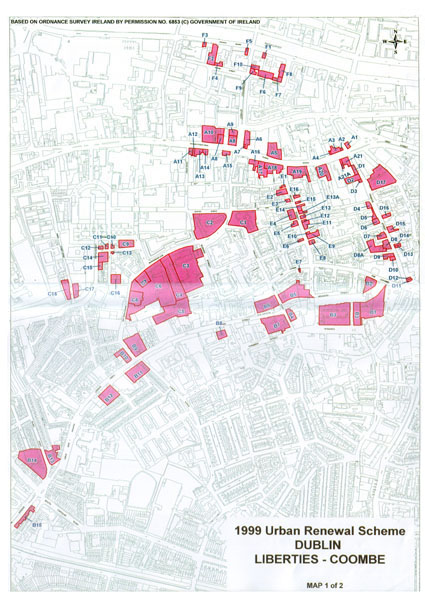

3. (1) Subject to paragraphs (2) and (3), the areas specified in Schedule 1, being areas marked on the map of parts of the City of Dublin annexed to this Order, (thereon marked as Map 1) (which areas are shaded pink and delineated with a red line on that map and are within the boundary of the area to which the Liberties/Coombe Integrated Area Plan relates) are, as respects the buildings and structures within such areas, designated as qualifying areas pursuant to section 372B of the Act.

|

| |

(2) Subject to paragraph (3), the designation of the areas designated by paragraph (1) shall apply only for the purposes of the sections of the Act specified in column (3) of Part 1 of Schedule 2 opposite the mention of the areas concerned.

|

| |

(3) The designation of the areas referred to in paragraphs (1) and (2) shall apply only in respect of the classification of —

|

| |

(a) the purposes,

|

| |

(b) the categories of building or structure, or

|

| |

(c) the type of expenditure

|

| |

specified in column (4) of Part 1 of Schedule 2 opposite the mention of the section concerned of the Act at that reference number.

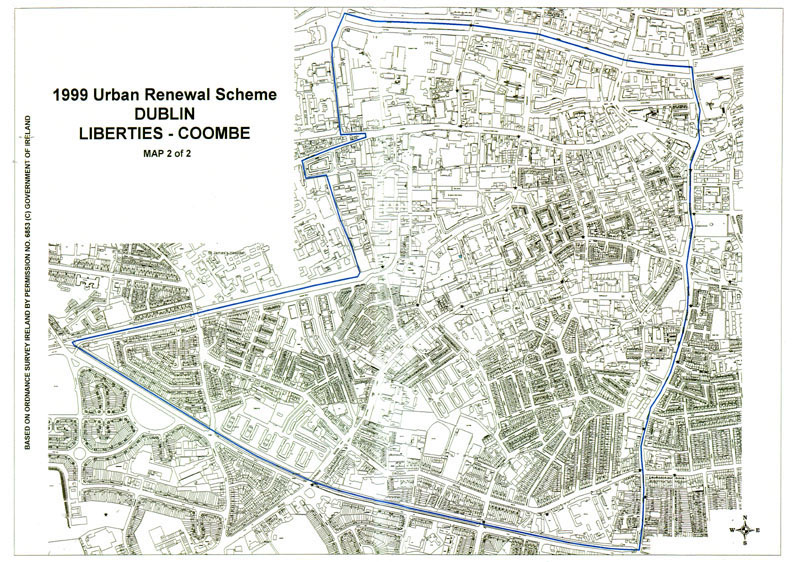

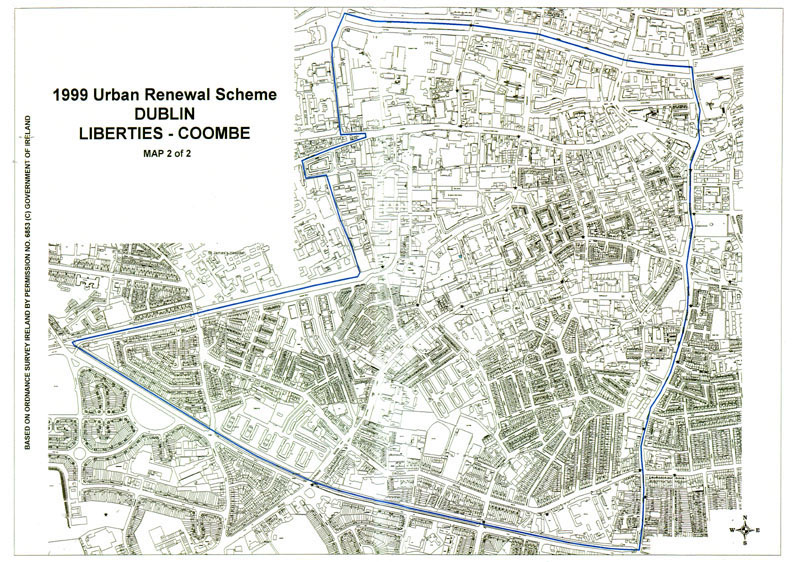

4. (1) Subject to paragraphs (2) and (3), the entire of the area to which the Liberties/Coombe Integrated Area Plan relates, which area is delineated with a blue line on the map of parts of the City of Dublin annexed to this Order, (thereon marked as Map 2) is, as respects the buildings and structures within such area, designated as a qualifying area pursuant to section 372B of the Act.

|

| |

(2) Subject to paragraph (3), the designation of the area designated as a qualifying area by paragraph (1) shall apply only for the purposes of the sections of the Act specified in column (3) of Part 2 of Schedule 2 opposite the mention of the area concerned.

|

| |

(3) The designation of the area referred to in paragraphs (1) and (2) shall apply only in respect of the classification of —

|

| |

(a) the purposes,

|

| |

(b) the categories of building or structure, or

|

| |

(c) the type of expenditure

|

| |

specified in column (4) of Part 2 of Schedule 2 opposite the mention of the section concerned of the Act at that reference number.

5. (1) The qualifying period relating to the areas designated as qualifying areas by this Order shall, as respects sections 372C and 372D, be construed as a reference to the period commencing on 1 July 1999 and ending on 31 December 2002, or where section 372A(1A) applies, ending on 31 July 2006.

|

| |

(2) The qualifying period relating to the areas designated as qualifying areas by this Order shall, as respects section 372AR, be construed as a reference to the period commencing on 1 March 1999 and ending on 31 December 2002, or where section 372AL(2) applies, ending on 31 July 2006.

|

| |

(3) Subject to paragraphs (4) and (5), the qualifying period relating to the areas designated as qualifying areas by this Order shall, as respects section 372AP, be construed as a reference to the period commencing on 1 March 1999 and ending on 31 December 2002, or where section 372AL(2) applies, ending on 31 July 2006.

|

| |

(4) Subject to paragraph (5), the qualifying period relating to the areas designated as qualifying areas by this Order shall, as respects section 372AP, and classifications of expenditure 9A and 9B, (which relate to that section) be construed as a reference to the period —

|

| |

(a) commencing on 5 December 2001 and ending on 31 December 2002, or where section 372AL(2) applies, ending on 31 July 2006,

|

| |

(b) where subsection (9) or (10) of section 372AP applies, commencing on 1 March 1999 and ending on 31 December 2002, or where section 372AL(2) applies, ending on 31 July 2006.

|

| |

(5) Paragraph (4)(b) shall not apply unless —

|

| |

(a) a contract for the purchase of the house had not been evidenced in writing by any person prior to 5 December 2001, but

|

| |

(b) a contract for the purchase of the house was evidenced in writing on or before 1 September 2002.

|

| |

SCHEDULE 1

|

| |

(Areas designated as qualifying areas for purposes specified in Part 1 of Schedule 2)

|

| |

Areas A1, A2, A3, A4, A5, A6, A7, A8, A9, A10, A11, A12, A13, A14, A15, A16, A17, A18, A19, A20, A21, A21A, B1, B2, B3, B4, B5, B6, B7, B8, B9, B10, B11, B12, B13, B14, B15, C1, C2, C3, C4, C5, C6, C7, C8, C9, C10, C11, C12, C13, C14, C15, C16, C17, C18, D1, D2, D3, D4, D5, D6, D7, D8, D8A, D9, D10, D11, D12, D13, D14, D15, D16, D17, E1, E2, E3, E4, E5, E6, E7, E8, E9, E10, E11, E12, E13, E13A, E14, E15, E16, F1, F2, F3, F4, F5, F6, F7, F8, F9 & F10.

|

| |

SCHEDULE 2

|

| |

Part 1

|

| | |

Reference Number

|

Area Reference (2)

|

Provision of Act for which area designated

|

Classification (4)

|

|

(1)

|

|

(3)

|

|

|

1.

|

Area A1

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

2.

|

Area A2

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

3.

|

Area A3

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

4.

|

Area A4

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

5.

|

Area A5

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

6.

|

Area A6

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

7.

|

Area A7

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

8.

|

Area A8

|

Section 372D

|

3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

9.

|

Area A9

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372C

|

4

|

|

10.

|

Area A10

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372C

|

4

|

|

11.

|

Area A11

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

12.

|

Area A12

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

13.

|

Area A13

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

14.

|

Area A14

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

15.

|

Area A15

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

16.

|

Area A16

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

17.

|

Area A17

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

18.

|

Area A18

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

19.

|

Area A19

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

20.

|

Area A20

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5, 6

|

|

|

|

Section 372AP

|

7B

|

|

|

|

Section 372AP

|

9A

|

|

21.

|

Area A21

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

22.

|

Area A21A

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

23.

|

Area B1

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

24.

|

Area B2

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5, 6

|

|

|

|

Section 372AP

|

7B

|

|

|

|

Section 372AP

|

9A

|

|

25.

|

Area B3

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

26.

|

Area B4

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5, 6

|

|

|

|

Section 372AP

|

7B

|

|

|

|

Section 372AP

|

9A

|

|

27.

|

Area B5

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5, 6

|

|

|

|

Section 372AP

|

7B

|

|

|

|

Section 372AP

|

9A

|

|

28.

|

Area B6

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5, 6

|

|

|

|

Section 372AP

|

9A, 9B

|

|

29.

|

Area B7

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

30.

|

Area B8

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

31.

|

Area B9

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

32.

|

Area B10

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

33.

|

Area B11

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

34.

|

Area B12

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

35.

|

Area B13

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

36.

|

Area B14

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

37.

|

Area B15

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

38.

|

Area C1

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

39.

|

Area C2

|

Section 372AR

|

5, 6

|

|

|

|

Section 372AP

|

7B

|

|

|

|

Section 372AP

|

9A

|

|

40.

|

Area C3

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372C

|

4

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

41.

|

Area C4

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372C

|

4

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

42.

|

Area C5

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372C

|

4

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

43.

|

Area C6

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372C

|

4

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

44.

|

Area C7

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372C

|

4

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

45.

|

Area C8

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

46.

|

Area C9

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

47.

|

Area C10

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

48.

|

Area C11

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

49.

|

Area C12

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

50.

|

Area C13

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

51.

|

Area C14

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372C

|

4

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

52.

|

Area C15

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372C

|

4

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

53.

|

Area C16

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

54.

|

Area C17

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

55.

|

Area C18

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

56.

|

Area D1

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

57.

|

Area D2

|

Section 372D

|

3A, 3B

|

|

58.

|

Area D3

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

59.

|

Area D4

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

60.

|

Area D5

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

61.

|

Area D6

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

62.

|

Area D7

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

63.

|

Area D8

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

64.

|

Area D8A

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

65.

|

Area D9

|

Section 372D

|

3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

66.

|

Area D10

|

Section 372D

|

3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

67.

|

Area D11

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

68.

|

Area D12

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

69.

|

Area D13

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

70.

|

Area D14

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

71.

|

Area D15

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

72.

|

Area D16

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

73.

|

Area D17

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

74.

|

Area E1

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

75.

|

Area E2

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

76.

|

Area E3

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

77.

|

Area E4

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

78.

|

Area E5

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

79.

|

Area E6

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

80.

|

Area E7

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

81.

|

Area E8

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

82.

|

Area E9

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

83.

|

Area E10

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

84.

|

Area E11

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

85.

|

Area E12

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

86.

|

Area E13

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

87.

|

Area E13A

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

88.

|

Area E14

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

89.

|

Area E15

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

90.

|

Area E16

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

91.

|

Area F1

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

92.

|

Area F2

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

93.

|

Area F3

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

94.

|

Area F4

|

Section 372C

|

4

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

95.

|

Area F5

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

96.

|

Area F6

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372C

|

4

|

|

|

|

Section 372AR

|

5

|

|

|

|

Section 372AP

|

9A

|

|

97.

|

Area F7

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

98.

|

Area F8

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372C

|

4

|

|

|

|

Section 372AR

|

6

|

|

|

|

Section 372AP

|

7B

|

|

99.

|

Area F9

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372C

|

4

|

|

100.

|

Area F10

|

Section 372D

|

2A, 2B, 3A, 3B

|

|

|

|

Section 372C

|

4

|

|

|

|

|

|

|

| |

Part 2

|

| | |

Reference Number

|

Area Reference

|

Provision of Act for which area designated

|

Classification

|

|

(1)

|

(2)

|

(3)

|

(4)

|

|

1.

|

Area designated by Article 4 (entire area of Liberties/Coombe I.A.P.)

|

Section 372AR

|

6

|

|

|

|

|

|

|

| |

SCHEDULE 3

|

| |

(Explanation of Classifications in column (4) of Schedule 2)

|

| | |

Classification

|

Section of Act

|

Purpose, category or type of expenditure to which classification relates

|

|

(1)

|

(2)

|

(3)

|

|

1A

|

Section 372D

|

The construction of multi-storey car parks.

|

|

1B

|

Section 372D

|

The refurbishment of multi-storey car parks.

|

|

2A

|

Section 372D

|

The construction of buildings or structures which consist of office accommodation.

|

|

2B

|

Section 372D

|

The refurbishment of buildings or structures which consist of office accommodation.

|

|

2C

|

Section 372D

|

The refurbishment of the facade of a building or structure or part of a building or structure which consists of office accommodation.

|

|

3A

|

Section 372D

|

The construction of buildings or structures other than multi-storey car parks and offices, and in respect of which not more than 10 per cent of the capital expenditure incurred in the qualifying period on their construction relates to the construction of office accommodation.

|

|

3B

|

Section 372D

|

The refurbishment of buildings or structures other than multi-storey car parks and offices, and in respect of which not more than 10 per cent of the capital expenditure incurred in the qualifying period on their refurbishment relates to the refurbishment of office accommodation.

|

|

3C

|

Section 372D

|

The refurbishment of the facade of a building or structure or a part of a building or structure other than a multi-storey car park or office, and in respect of which not more than 10 per cent of the capital expenditure incurred in the qualifying period on its refurbishment relates to the refurbishment of office accommodation.

|

|

4

|

Section 372C

|

The construction or refurbishment of a building or structure to which section 372C applies.

|

|

5

|

Section 372AR

|

The construction of a qualifying premises within the meaning of Chapter 11 of Part 10 of the Act.

|

|

6

|

Section 372AR

|

The conversion into, or the refurbishment of, a qualifying premises within the meaning of Chapter 11 of Part 10 of the Act.

|

|

7A

|

Section 372AP

|

Expenditure incurred on the construction of a house.

|

|

7B

|

Section 372AP

|

Conversion expenditure or refurbishment expenditure incurred in relation to a house.

|

|

9A

|

Section 372AP

|

Expenditure incurred on the construction of a house, but only in so far as it relates to expenditure incurred on the construction of a house —

|

|

|

|

(a) on or after 5 December 2001, or

|

|

|

|

(b) where subsection (9) or (10) of section 372AP applies, prior to that date, but only if —

|

|

|

|

(i) a contract for the purchase of the house had not been evidenced in writing by any person prior to that date, but

|

|

|

|

(ii) a contract for the purchase of the house is evidenced in writing on or before 1 September 2002.

|

|

9B

|

Section 372AP

|

Conversion expenditure or refurbishment expenditure incurred on a house, but only in so far as it relates to such expenditure incurred —

|

|

|

|

(a) on or after 5 December 2001, or

|

|

|

|

(b) where subsection (9) or (10) of section 372AP applies, prior to that date, but only if —

|

|

|

|

(i) a contract for the purchase of the house had not been evidenced in writing by any person prior to that date, but

|

|

|

|

(ii) a contract for the purchase of the house is evidenced in writing on or before 1 September 2002.

|

|

|

|

|

|

| |

|

| |

|

| | |

|

GIVEN under my Official Seal,

24th of September 2004.

|

|

|

|

|

|

Charlie McCreevy

Minister for Finance.

|

|

| |

EXPLANATORY NOTE

|

| |

(This note is not part of the Instrument and does not purport to be a legal interpretation).

|

| |

This order provides for the designation of certain areas in Liberties/Coombe, Dublin as qualifying areas for the purposes of the Urban Renewal Scheme.

|

| |

Under this scheme relief is available in respect of expenditure incurred in the qualifying period on the construction or refurbishment of certain industrial and commercial buildings or structures located in qualifying areas. Relief is also available for expenditure incurred in the qualifying period on the construction, conversion or refurbishment of residential accommodation which is situated in such areas. The relief(s) which apply in relation to each area and the qualifying period which applies in relation to each relief is as specified in this order. The numbering system used in the order in relation to classifications of expenditure etc. follows closely the numbering system used in the booklet “Incentives Recommended by Expert Panel on Urban Renewal” previously issued by the Department of the Environment, Heritage and Local Government.

|

| |

The incentives, which were originally introduced in the

Finance Act 1998

, are now contained in Chapters 7 and 11 of Part 10 of the

Taxes Consolidation Act 1997

.

|

| |

Notwithstanding this Order, by virtue of section 372B(4) of the

Taxes Consolidation Act 1997

and

section 11

of the

Urban Renewal Act 1998

, no relief from income tax or corporation tax may be granted under the Urban Renewal Scheme in respect of the construction, conversion or refurbishment of a building, structure or house within a qualifying area unless the relevant local authority, in whose functional area the qualifying area is located, has certified that the construction, conversion or refurbishment is consistent with the objectives of the Integrated Area Plan in relation to that area.

|