| |

SCHEDULE.

|

| |

Section 2.

|

| |

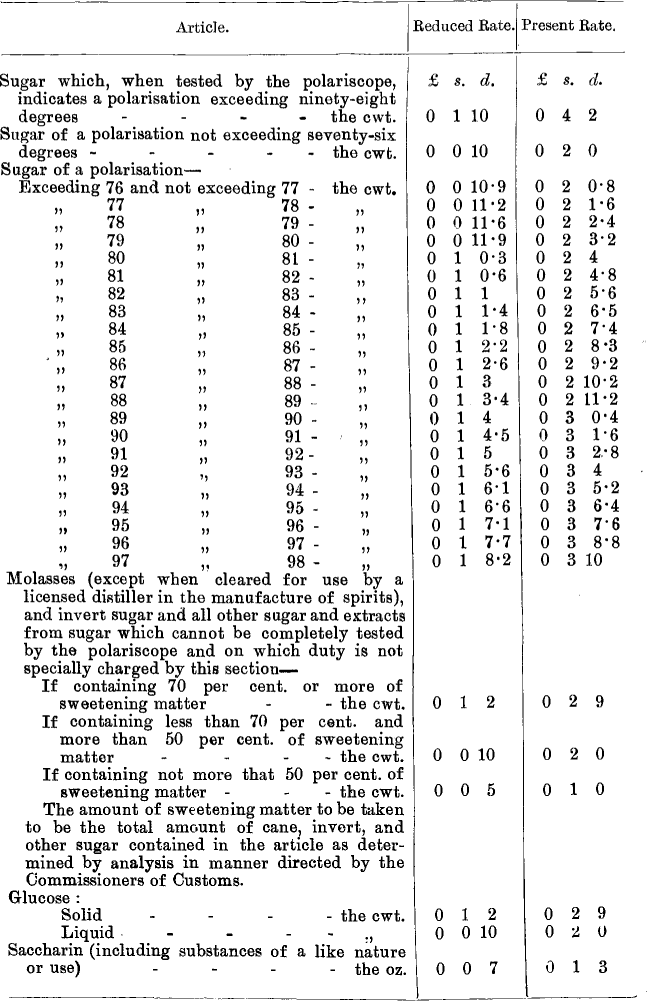

1. Customs Duties under Section 2 of the Finance Act, 1901.

|

| |

|

| |

2. Excise Duties under Section 5 of the Finance Act, 1901.

|

| | |

Article.

|

Reduced Rate

|

Present Rate.

|

|

|

£

|

s.

|

d.

|

£

|

s.

|

d.

|

|

Glucose made in Great Britain or Ireland,—

|

|

|

|

|

|

|

|

Solid - - - - - the cwt.

|

0

|

1

|

2

|

0

|

2

|

9

|

|

Liquid - - - - - ”

|

0

|

0

|

10

|

0

|

2

|

0

|

|

and so in proportion for any less quantity.

|

|

|

|

|

|

|

|

Saccharin (including substances of a like nature or use) made in Great Britain or Ireland - the oz. and so in proportion for any less quantity.

|

0

|

0

|

7

|

0

|

1

|

3

|

|

| |

3. Drawbacks under Second and Third Schedules of the Finance Act, 1901.

|

| | |

|

£

|

s.

|

d.

|

£

|

s.

|

d.

|

|

Drawback to be allowed to a refiner on molasses produced in Great Britain or Ireland, and delivered by him to a licensed distiller for use in the manufacture of spirits - - the cwt.

|

0

|

0

|

5

|

0

|

1

|

0

|

|

Other drawbacks - - -

|

According to the amount of duty paid at the reduced rate.

|

According to the amount of duty paid at the present rate.

|

|

| |

4. Allowance under Section 1 (2) of the Revenue Act, 1903.

|

| | |

|

£

|

s.

|

d.

|

£

|

s.

|

d.

|

|

Allowance to a refiner on molasses - the cwt.

|

0

|

0

|

5

|

0

|

1

|

0

|

|