S.I. No. 1/2020 - Betting Duty and Betting Intermediary Duty (Amendment) Regulations 2020

Notice of the making of this Statutory Instrument was published in | ||

“Iris Oifigiúil” of 14th January, 2020. | ||

The Revenue Commissioners, in exercise of the powers conferred on them by section 77 of the Finance Act 2002 (No.5 of 2002), hereby make the following regulations: | ||

Citation and commencement | ||

1. (1) These Regulations may be cited as the Betting Duty and Betting Intermediary Duty (Amendment) Regulations 2020. | ||

(2) These Regulations come into operation with immediate effect. | ||

Interpretation | ||

2. In these Regulations, “Principal Regulations” means the Betting Duty and Betting Intermediary Duty Regulations 2015 ( S.I. No. 341 of 2015 ). | ||

Amendment of Regulation 2 of Principal Regulations | ||

3. Regulation 2 (1) of the Principal Regulations is amended by inserting the following definitions: | ||

“ ‘aid’ has the same meaning as it has under section 64 of the Act of 2002; | ||

‘Commission Regulation (EU) No. 1407/2013’ has the same meaning as it has under section 64 of the Act of 2002; | ||

‘relief’ means relief provided for under section 68A of the Act of 2002;” | ||

Insertion of new Regulation 2A into Principal Regulations | ||

4. The Principal Regulations are amended by inserting after Regulation 2 the following: | ||

“Reliefs | ||

2A. (1) Subject to subsection (2), relief under section 68A of the Act of 2002 may be claimed in an accounting period in respect of the betting duty or betting intermediary duty payable in that accounting period. | ||

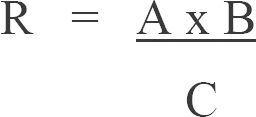

(2) The maximum amount of relief under section 68A of the Act of 2002 that may be claimed for each accounting period of a calendar year shall be determined by the following formula – | ||

| ||

where – | ||

R is the maximum amount of relief that may be claimed in an accounting period of a calendar year, | ||

A is the maximum amount of relief that may be claimed in a calendar year under section 68A(1) of the Act of 2002, | ||

B is the total number of days of carrying on the business of a bookmaker, remote bookmaker or remote betting intermediary during the accounting period to which the betting duty or betting intermediary duty payable relates, and | ||

C is the total number of days in the calendar year in which the relief is being claimed. | ||

(3) Notwithstanding subsection (2), where all or part of the relief that may be claimed in an accounting period has not been claimed in that period, the amount of relief not claimed may be carried into the next accounting period and aggregated with the amount of relief that may be claimed in that accounting period. | ||

(4) Subsection (3) does not apply to the final accounting period of a calendar year.”. | ||

Amendment of Regulation 3 of Principal Regulations | ||

5. Regulation 3 of the Principal Regulations is amended – | ||

(a) by inserting after paragraph (2) the following: | ||

“(2A) A bookmaker, remote bookmaker or remote betting intermediary shall, for the purpose of section 68A of the Act of 2002, declare on their return – | ||

(a) the amount of relief under that section claimed in the accounting period to which the return relates, | ||

(b) the amount of aid received during the previous two calendar years and the current calendar year, and | ||

(c) whether the conditions laid down in Commission Regulation (EU) No. 1407/2013 are satisfied.”, | ||

(b) in paragraph (6) – | ||

(i) by substituting for subparagraphs (b) and (c) the following: | ||

“(b) details of the number and value of all bets accepted by a remote bookmaker that are liable to betting duty and the amount of duty payable on these bets, | ||

(c) details of the number and value of commissions liable to betting intermediary duty on betting intermediary transactions accepted by a remote betting intermediary and the amount of duty payable on these commissions,”, | ||

and | ||

(ii) by inserting after subparagraph (c) the following: | ||

“(d) the amount of relief claimed in the accounting period to which the return relates, and | ||

(e) the amount of any other aid received during the previous two calendar years and the current calendar year.”. | ||

Amendment of Regulation 8 of Principal Regulations | ||

6. Regulation 8 of the Principal Regulations is amended by inserting after paragraph (5) the following: | ||

“(6) A bookmaker, remote bookmaker or remote betting intermediary shall keep a record of all relief claimed in each accounting period in such a manner that such relief claimed can be identified to the satisfaction of the Commissioners. | ||

(7) A bookmaker, remote bookmaker or remote betting intermediary shall keep a record of all aid received in such a manner that such aid received can be identified to the satisfaction of the Commissioners.”. | ||

Amendment of Regulation 9 of Principal Regulations | ||

7. Regulation 9 of the Principal Regulations is amended by inserting after paragraph (3) the following: | ||

“(3A) Notwithstanding paragraph (3), records to be kept under Regulation 8 (6) and 8 (7) shall be retained by the bookmaker, remote bookmaker or remote betting intermediary for a period of 10 years from the date on which relief was claimed.”. | ||

GIVEN under my hand, | ||

8 January 2020 | ||

NIALL CODY, | ||

Revenue Commissioner. | ||

EXPLANATORY NOTE | ||

(This note is not part of the Instrument and does not purport to be a legal interpretation.) | ||

These Regulations lay down arrangements for determining the amount of relief from betting duty and betting intermediary duty, provided for under section 68A of the Finance Act 2002 , that may be claimed in an accounting period. They also set out the arrangements for claiming the relief and records to be kept in respect of the relief claimed by bookmakers, remote bookmakers and remote betting intermediaries. |