Finance Act 2019

|

Benefit-in-kind: emissions-based calculations | ||

|

6. ((1) Section 121 of the Principal Act is amended— | ||

(a) in subsection (2)(b)(iv) by substituting “2022” for “2021”, | ||

(b) in subsection (2)(b)(vi) by substituting “2022” for “2021”, | ||

(c) in subsection (3) by inserting the following after paragraph (b): | ||

“(c) This subsection is subject to subsection (4A) for the year of assessment 2023 and subsequent years.”, | ||

(d) in subsection (4), by inserting the following after paragraph (c): | ||

“(d) This subsection is subject to subsection (4A) for the year of assessment 2023 and subsequent years.”, | ||

and | ||

(e) by inserting the following after subsection (4): | ||

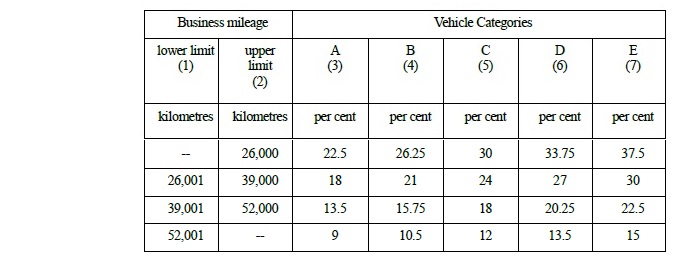

“(4A) (a) For the year of assessment 2023 and subsequent years, the cash equivalent of the benefit of a car shall be an amount determined by the formula— | ||

Original market value x A | ||

where— | ||

A is a percentage, based on vehicle categories as set out in Table B to this subsection, determined in accordance with column (3), (4), (5), (6) or (7), as the case may be, of Table A to this subsection. | ||

(b) In Table A to this subsection, any percentage shown in column (3), (4), (5), (6) or (7), as the case may be, shall be the percentage applicable to any business mileage for a year of assessment which— | ||

(i) exceeds the lower limit (if any) shown in column (1), and | ||

(ii) does not exceed the upper limit (if any) shown in column (2), | ||

opposite the mention of that percentage in column (3), (4), (5), (6) or (7), as the case may be. | ||

(c) Where a car in respect of which this section applies in relation to a person for a year of assessment is made available to the person for part only of that year, the cash equivalent of the benefit of that car as respects that person for that year shall be an amount which bears to the full amount of the cash equivalent of the car for that year (ascertained under paragraph (a)) the same proportion as that part of the year bears to that year. | ||

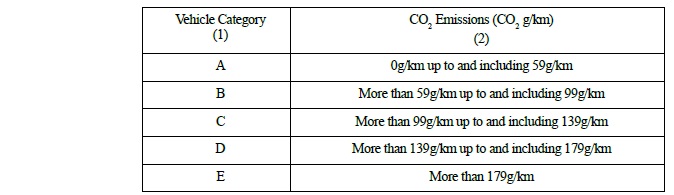

(d) For the purposes of this section, the vehicle categories set out in column (1) of Table B to this subsection refer to a car whose CO2 emissions, determined by virtue of section 130 of Finance Act 1992 , are set out in the corresponding entry in column (2) of Table B to this subsection. | ||

TABLE A | ||

| ||

| ||

TABLE B | ||

| ||

”. | ||

(2) Section 121A of the Principal Act is amended— | ||

(a) in subsection (2)(b)(iv) by substituting “2022” for “2021”, | ||

(b) in subsection (2)(b)(vi) by substituting “2022” for “2021”, | ||

(c) by substituting the following for subsection (3): | ||

“(3) The cash equivalent of the benefit of a van— | ||

(a) for a year of assessment, other than a year of assessment referred to in paragraph (b), shall be 5 per cent of the original market value of the van, and | ||

(b) for the year of assessment 2023 and subsequent years of assessment, shall be 8 per cent of the original market value of the van.”, | ||

(d) in subsection (4) by deleting “paragraph (b) of subsection (3),”, and | ||

(e) by inserting the following after subsection (4): | ||

“(5) Where a van in respect of which this section applies in relation to a person for a year of assessment is made available to the person for part only of that year, the cash equivalent of the benefit of that van as respects that person for that year shall be an amount which bears to the full amount of the cash equivalent of the van for that year (ascertained under subsection (3)) the same proportion as that part of the year bears to that year.”. | ||

(3) The Finance (No. 2) Act 2008 is amended in section 6(1) by deleting paragraphs (b)(ii), (c)(iii) and (e). |