S.I. No. 830/2005 - Land Purchase Annuities Redemption Scheme Regulations 2005

Land Purchase Annuities Redemption Scheme Regulations 2005 | ||||||||

The Minister for Agriculture and Food, in exercise of the powers conferred on her by section 3 of the Land Act 2005 (No. 24 of 2005), with the consent of the Minister for Finance, hereby make the following Regulations: 1. These Regulations may be cited as the Land Purchase Annuities Redemption Scheme Regulations 2005. 2. The scheme, (in these Regulations referred to as the “Land Purchase Annuities Redemption Scheme”) the terms and conditions of which are set out in Schedule 1 to these Regulations, is established. 3. The form set out in Schedule 2 to these Regulations is prescribed as the form to be used by a person who wishes to apply to redeem a land purchase annuity in accordance with the Land Purchase Annuities Redemption Scheme the terms and conditions of which are set out in Schedule 1 to these Regulations | ||||||||

|

Schedule 1 Land Purchase Annuities Redemption Scheme | ||||||||

1. The Land Purchase Annuities Redemption Scheme (“the Scheme”) applies to a person in possession of land which is subject to a land purchase annuity. | ||||||||

2. The Scheme commences on the 1st day of January 2006 and terminates on the 30th day of June 2006 in accordance with paragraph 5. | ||||||||

3. A person may not apply to redeem a land purchase annuity under this Scheme unless- | ||||||||

(a) that person is a person to whom the Scheme applies, and | ||||||||

(b) there are no arrears due in respect of the land purchase annuity concerned. | ||||||||

4. A person to whom this Scheme applies may apply to redeem a land purchase annuity in accordance with the terms of this Scheme by remitting an application form to the Minister not later than 30 June 2006 in accordance with the provisions of paragraph 5 together with a single payment of 75 per cent of the redemption price of the annuity. | ||||||||

5. The application form referred to in paragraph 4 may be remitted to the Minister for Agriculture and Food- | ||||||||

(a) by lodging that form together with the amount required to redeem the land purchase annuity under this scheme at a financial institution in the State which processes giro payment forms not later than the time specified in respect of the close of business for that branch of the financial institution concerned on 30 June 2006; | ||||||||

or, | ||||||||

(b) by sending or delivering that form together with the amount required to redeem the annuity under this scheme to: | ||||||||

Collection Branch | ||||||||

Department of Agriculture and Food, | ||||||||

Michael Davitt House, | ||||||||

Castlebar, | ||||||||

County Mayo, | ||||||||

so that that such form and payment is received at that place not later than 5.00 p.m. on 30 June 2006; | ||||||||

6. The onus of proving that an application form and required payment were delivered or lodged before the relevant time referred to in paragraph 5 shall lie with the person applying to redeem the land purchase annuity. | ||||||||

7. Where payment of the sum required to redeem the land purchase annuity under this scheme is made by way of cheque, or other instrument of payment, but value is not received by the Minister on first presentation of the cheque or other instrument, the payment shall be treated as if it had not been made. | ||||||||

8. A person remitting the application form and making the necessary payment to redeem the land purchase annuity under this Scheme in accordance with paragraphs 4 and 5, shall be deemed to have redeemed the land purchase annuity. | ||||||||

9. A person who discharges all the arrears due in respect of the land purchase annuity prior to or at the same time as payment of the sum required to discharge the land purchase annuity under this Scheme shall be deemed, for the purposes of paragraph 3 to be a person entitled to apply to redeem a land purchase annuity under this scheme. | ||||||||

10. Where there are arrears due in respect of a land purchase annuity and paragraph 9 does not apply and by virtue of paragraph 3 a person is not entitled to apply to redeem the land purchase annuity under this scheme but a payment in respect of the amount other than arrears required to redeem the land purchase annuity is made, the land purchase annuity shall not be treated as having been redeemed under this scheme, and the payment received shall, to the extent of the amount of the payment made, be treated and applied firstly as a payment in respect of arrears and secondly as a part payment of the redemption price of the land purchase annuity. | ||||||||

11. In this scheme- | ||||||||

“redemption price of the annuity” means the amount which, but for the existence of this scheme, a person would as of 1 January 2006 be required to pay to redeem the land purchase annuity; | ||||||||

“application form” means the application form set out in Schedule 2 on which appears the reference number of the Department of Agriculture and Food relating to the land purchase annuity concerned. | ||||||||

|

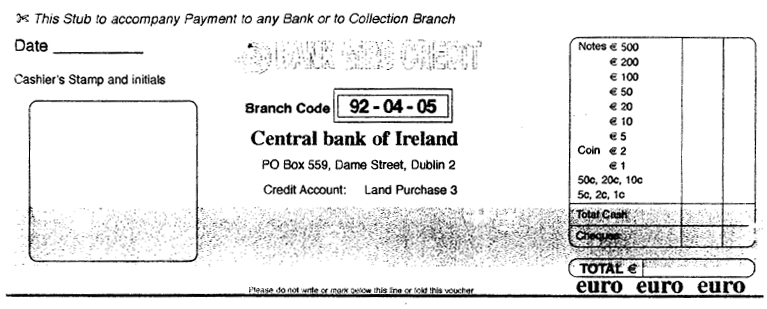

SCHEDULE 2 | ||||||||

Application form to be used by a person who wishes to redeem a land purchase annuity under the Land Purchase Annuities Redemption Scheme | ||||||||

| ||||||||

| ||||||||

The Minister for Finance consents to the making of the foregoing Regulations. | ||||||||

| ||||||||

|

EXPLANATORY NOTE | ||||||||

(This note is not part of the Instrument and does not purport to be a legal interpretation) | ||||||||

These Regulations provide for a scheme whereby a land purchase annuity (provided there are no arrears outstanding) may be redeemed at 75% of the nominal redemption price if paid in a lump sum not later than 30th June 2006. |