S.I. No. 607/2004 - Taxes Consolidation Act 1997 (Qualifying Urban Renewal Areas) (Dun Laoghaire, County Dublin) Order 2004

Taxes Consolidation Act 1997 (Qualifying Urban Renewal Areas) (Dun Laoghaire, County Dublin) Order 2004 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

I, Charlie McCreevy, Minister for Finance, in exercise of the powers conferred on me by section 372B (as amended by section 26 of the Finance Act 2004 (No. 8 of 2004)), of the Taxes Consolidation Act 1997 (No. 39 of 1997), the Minister for the Environment, Heritage and Local Government having made a recommendation to me pursuant to that section, hereby order as follows: 1. This Order may be cited as the Taxes Consolidation Act 1997 (Qualifying Urban Renewal Areas) (Dun Laoghaire, County Dublin) Order 2004. 2. (1) In this Order — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“Act” means the Taxes Consolidation Act 1997 (No. 39 of 1997); | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

“classification” shall be construed in accordance with Schedule 3. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) A classification set out in column (1) of Schedule 3 shall be construed by reference to the matter in column (3) of that Schedule opposite the mention of the classification concerned. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) In this Order — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) a reference to a Schedule is to a Schedule to this Order, unless it is indicated that reference to some other Order or enactment is intended, and | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

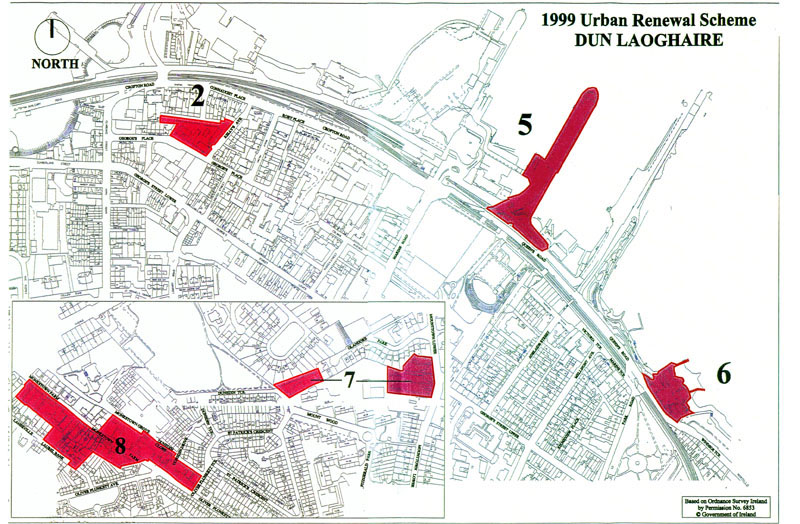

(b) a reference to a paragraph is a reference to a paragraph of the provision in which the reference occurs, unless indicated that reference to some other provision is intended. 3. (1) Subject to paragraphs (2) and (3), the areas specified in Schedule 1, being areas marked on the map of parts of the town of Dun Laoghaire, County Dublin annexed to this Order, (which areas are shaded pink and delineated with a red line on that map and are within the boundary of the area to which the Dun Laoghaire Integrated Area Plan relates) are, as respects the buildings and structures within such areas, designated as qualifying areas pursuant to section 372B of the Act. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) Subject to paragraph (3), the designation of the areas designated by paragraph (1) shall apply only for the purposes of the sections of the Act specified in column (3) of Schedule 2 opposite the mention of the areas concerned. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) The designation of the areas referred to in paragraphs (1) and (2) shall apply only in respect of the classification of — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) the purposes, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) the categories of building or structure, or | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(c) the type of expenditure | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

specified in column (4) of Schedule 2 opposite the mention of the section concerned of the Act at that reference number. 4. (1) The qualifying period relating to the areas designated as qualifying areas by this Order shall, as respects sections 372C and 372D, be construed as a reference to the period commencing on 1 July 1999 and ending on 31 December 2002, or where section 372A(1A) applies, ending on 31 July 2006. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) The qualifying period relating to the areas designated as qualifying areas by this Order shall, as respects section 372AR, be construed as a reference to the period commencing on 1 March 1999 and ending on 31 December 2002, or where section 372AL(2) applies, ending on 31 July 2006. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Subject to paragraphs (4) and (5), the qualifying period relating to the areas designated as qualifying areas by this Order shall, as respects section 372AP, be construed as a reference to the period commencing on 1 March 1999 and ending on 31 December 2002, or where section 372AL(2) applies, ending on 31 July 2006. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(4) Subject to paragraph (5), the qualifying period relating to the areas designated as qualifying areas by this Order shall, as respects section 372AP, and classifications of expenditure 9A and 9B, (which relate to that section) be construed as a reference to the period — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) commencing on 5 December 2001 and ending on 31 December 2002, or where section 372AL(2) applies, ending on 31 July 2006, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) where subsection (9) or (10) of section 372AP applies, commencing on 1 March 1999 and ending on 31 December 2002, or where section 372AL(2) applies, ending on 31 July 2006. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(5) Paragraph (4)(b) shall not apply unless — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a) a contract for the purchase of the house had not been evidenced in writing by any person prior to 5 December 2001, but | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(b) a contract for the purchase of the house was evidenced in writing on or before 1 September 2002. 5. The Taxes Consolidation Act, 1997 (Qualifying Urban Renewal Areas) (Dun Laoghaire) Order, 2002 ( S.I. No. 232 of 2002 ) is hereby revoked. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SCHEDULE 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(Areas designated as qualifying areas for purposes specified in Schedule 2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Areas 2, 5, 6, 7, 8. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SCHEDULE 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SCHEDULE 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(Explanation of Classifications in column (4) of Schedule 2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

EXPLANATORY NOTE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(This note is not part of the Instrument and does not purport to be a legal interpretation). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

This order provides for the designation of certain areas in Dun Laoghaire, County Dublin as qualifying areas for the purposes of the Urban Renewal Scheme. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Under this scheme relief is available in respect of expenditure incurred in the qualifying period on the construction or refurbishment of certain industrial and commercial buildings or structures located in qualifying areas. Relief is also available for expenditure incurred in the qualifying period on the construction, conversion or refurbishment of residential accommodation which is situated in such areas. The relief(s) which apply in relation to each area and the qualifying period which applies in relation to each relief is as specified in this order. The numbering system used in the order in relation to classifications of expenditure etc. follows closely the numbering system used in the booklet “Incentives Recommended by Expert Panel on Urban Renewal” previously issued by the Department of the Environment, Heritage and Local Government. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The incentives, which were originally introduced in the Finance Act 1998 , are now contained in Chapters 7 and 11 of Part 10 of the Taxes Consolidation Act 1997 . | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Notwithstanding this Order, by virtue of section 372B(4) of the Taxes Consolidation Act 1997 and section 11 of the Urban Renewal Act 1998 , no relief from income tax or corporation tax may be granted under the Urban Renewal Scheme in respect of the construction, conversion or refurbishment of a building, structure or house within a qualifying area unless the relevant local authority, in whose functional area the qualifying area is located, has certified that the construction, conversion or refurbishment is consistent with the objectives of the Integrated Area Plan in relation to that area. |