S.I. No. 542/2003 - Stamp Duty (Particulars to be Delivered) (Amendment) Regulations 2003

The Revenue Commissioners, in exercise of the powers conferred on them by section 12 of the Stamp Duties Consolidation Act 1999 (No. 31 of 1999), hereby make the following regulations: 1. These Regulations may be cited as the Stamp Duty (Particulars to be Delivered) (Amendment) Regulations 2003. 2. These Regulations shall have effect in relation to any instrument executed on or after 5 December 2003. 3. In these Regulations— | ||||||||||||||||||||||||||||||||||||||

“particulars to be delivered” means the particulars to be delivered for the purposes of section 12 of the Stamp Duties Consolidation Act 1999 (No. 31 of 1999); | ||||||||||||||||||||||||||||||||||||||

“Principal Regulations” means the Stamp Duty (Particulars to be Delivered) Regulations 1995 ( S.I. No. 144 of 1995 ). 4. The Principal Regulations are amended— | ||||||||||||||||||||||||||||||||||||||

(a) in Regulation 6 by substituting the following for paragraph (2): | ||||||||||||||||||||||||||||||||||||||

“(2) In the first-mentioned form the reference to ‘Tax No.’ means— | ||||||||||||||||||||||||||||||||||||||

(a) in the case of an individual who has a number known as the Personal Public Service (PPS) number, such number; | ||||||||||||||||||||||||||||||||||||||

(b) in the case of any other person, the reference number stated on any return form or notice of assessment issued to that person by an officer of the Revenue Commissioners.”, | ||||||||||||||||||||||||||||||||||||||

(b) by substituting the following for Regulation 7: | ||||||||||||||||||||||||||||||||||||||

“7. The particulars to be delivered shall be presented— | ||||||||||||||||||||||||||||||||||||||

(a) at any of the following offices of the Revenue Commissioners at which the stamp known as ‘particulars Delivered’ is impressed: | ||||||||||||||||||||||||||||||||||||||

(i) The Stamp Duty Office, Dublin Stamping District, Stamping Building Dublin Castle, Dublin 2; | ||||||||||||||||||||||||||||||||||||||

(ii) The Stamp Duty Office, Cork North West District, Government Offices Sullivans Quay, Cork; | ||||||||||||||||||||||||||||||||||||||

(iii) The Stamp Duty Office, Galway County District, Custom House, Flood Street Galway; | ||||||||||||||||||||||||||||||||||||||

or | ||||||||||||||||||||||||||||||||||||||

(b) at any other office of the Revenue Commissioners as directed by them or by any officer acting on their behalf.”, | ||||||||||||||||||||||||||||||||||||||

and | ||||||||||||||||||||||||||||||||||||||

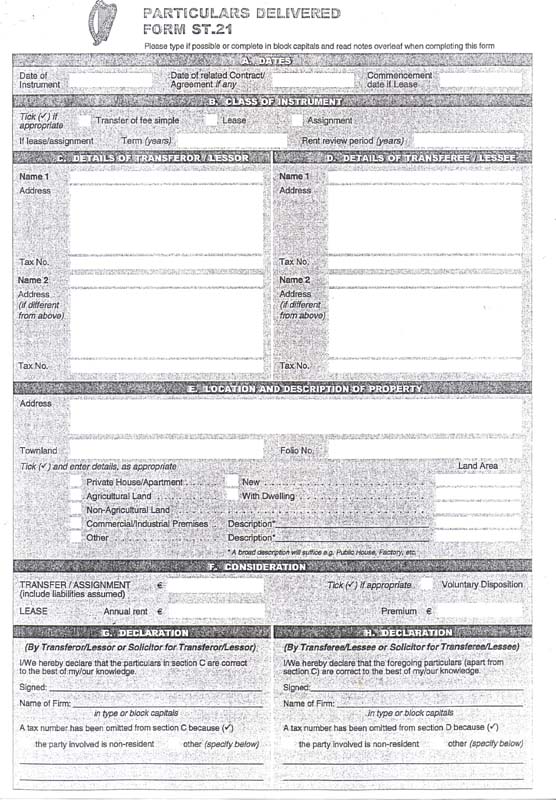

(c) by substituting the form in the Schedule to these Regulations for the form in the Schedule to the Principal Regulations. | ||||||||||||||||||||||||||||||||||||||

|

SCHEDULE | ||||||||||||||||||||||||||||||||||||||

Regulation 6. | ||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

Notes on Completion of Form ST.21 | ||||||||||||||||||||||||||||||||||||||

This form should be completed in duplicate and submitted by the transferee or lessee or solicitor for the transferee or lessee. | ||||||||||||||||||||||||||||||||||||||

[A word-processed facsimile may be used provided it contains all of the details requested in broadly the same order and layout.] | ||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

|

Explanatory Note | ||||||||||||||||||||||||||||||||||||||

(This note is not part of the Instrument and does not purport to be a legal interpretation.) | ||||||||||||||||||||||||||||||||||||||

These Regulations, which affect instruments executed on or after 5 December 2003, amend the Stamp Duty (Particulars to be Delivered) Regulations 1995 ( S.I. No. 144 of 1995 ), and provide that particulars to be delivered are to be presented at any one of three Revenue offices which has a stamping service for impressing the ‘Particulars Delivered’ stamp or at any other office of the Revenue Commissioners as directed by the Revenue Commissioners or by any officer acting on their behalf. In addition, minor changes have been made to the Particulars Delivered Form ST. 21 and all references to “Revenue Social Insurance (RSI number” in the 1995 Regulations have been replaced by “Personal Public Service (PPS number”. | ||||||||||||||||||||||||||||||||||||||