| |

RAILWAY COMPANIES (ACCOUNTS AND RETURNS) ACT 1911

[1 & 2 Geo. 5. Ch. 34.]

|

| |

ARRANGEMENT OF SECTIONS.

|

| |

|

| |

CHAPTER 34.

|

| |

An Act to amend the Law with respect to the Accounts and Returns of Railway Companies. [16th December 1911.]

|

| |

BE it enacted by the King's most Excellent Majesty, by and with the advice and consent of the Lords Spiritual and Temporal, and Commons, in this present Parliament assembled, and by the authority of the same, as follows:

|

|

|

Yearly accounts and returns in form in First Schedule to be furnished to Board of Trade.

|

1.—(1) Every railway company shall annually prepare accounts and returns in accordance with the form set out in the First Schedule to this Act, and shall submit their accounts to their auditors in that form.

|

|

| |

(2) The accounts and returns shall be signed by the officer of the company responsible for the correctness of the accounts or returns, or any part thereof, and, in the case of an incorporated railway company, by the chairman or deputy chairman of the directors of the company, and shall be made up for the year ending the thirty-first day of December, or such other day as the Board of Trade may fix in the case of any company or class of companies to meet the special circumstances of that company or class of companies.

|

|

| |

(3) Every railway company shall forward six copies of the accounts and returns to the Board of Trade not later than sixty days after the expiration of the year for which the accounts and returns are made up, and, in the case of an incorporated railway company, shall forward a copy of the accounts and returns to any shareholder or debenture holder of the Company who applies for a copy.

|

|

| |

(4) If any railway company fails to prepare or forward, in accordance with this section, such accounts and returns as are thereby required, the company shall be liable on summary conviction to a fine not exceeding five pounds for every day during which the default continues.

|

|

| |

(5) If any account or return prepared and forwarded under this section is false in any particular to the knowledge of any person who signs the account or return or any part thereof, that person shall be liable on conviction on indictment to imprisonment with or without hard labour for a term not exceeding one year, or to a fine not exceeding one hundred pounds, and on summary conviction to a fine not exceeding fifty pounds.

|

|

|

Filing of certain accounts by Registrar of Companies.

29 & 30 Vict. c. 108.

|

2.—(1) A copy of the accounts numbered 1 (a), 1 (b), 1 (c), 3, and 18 in Part I. of the First Schedule to this Act, as forwarded to the Board of Trade in pursuance of this Act, shall be filed by the Registrar of Companies in England, and, if any part of the railway of a company is situated in Scotland or Ireland, also by the Registrar of Companies in Scotland or Ireland, as the case may be, and for that purpose the Board of Trade shall, on receiving copies of accounts and returns under this Act from a railway company furnish one of those copies to any Registrar by whom accounts are to be filed under this section.

|

|

| |

(2) Any person may inspect the accounts filed by any Registrar of Companies in pursuance of this section on paying a fee of one shilling for each inspection as regards each railway company, and any person may require a copy or extract of any of those accounts to be certified by or on behalf of the Registrar on paying for the copy or extract such fee as the Board of Trade may appoint not exceeding sixpence for each folio of a certified copy or extract, or in Scotland for each sheet of two hundred words.

|

|

| |

(3) The provisions of the Railway Companies Securities Act, 1866, requiring half-yearly accounts in connexion with loan capital shall cease to have effect, and in section fourteen of that Act (which relates to the declaration to be made on mortgage deeds and debenture stock certificates) “the officer responsible for the correctness of the declaration” shall be substituted for the “company's registered officer.”

|

|

|

Alteration of First Schedule by Board of Trade.

|

3.—(1) The Board of Trade may by order, made under this section, alter or add to the First Schedule to this Act in such manner as they think fit; and, on any such alteration or addition being made, this Act shall be construed as if those alterations or additions were made in the First Schedule thereto.

|

|

| |

(2) When the Board propose to make any such alteration or addition, they shall publish in the London, Edinburgh, and Dublin Gazettes, notice of the proposal and of the place where copies of the proposed alterations or additions may be obtained, and of the time, not being less than one month, within which any objection or suggestion made with respect to the alterations or additions by or on behalf of persons affected must be lodged with the Board, and shall take such other steps as they think best adapted for giving information with respect to those matters to persons affected.

|

|

| |

(3) The Board of Trade shall consider any objection or suggestion made by or on behalf of persons appearing to them to be affected, which is lodged within the required time, and give to any person lodging any such objection or suggestion an opportunity of communicating with the Board on the matter.

|

|

| |

(4) Not less than one month and not more than three months after the expiration of the time within which objections must be lodged, notice may be given to the Board of Trade, by or on behalf of railway companies whose aggregate capital is not less than one third of the total aggregate capital of all railway companies in the United Kingdom, that the companies are not satisfied with the mode in which any objection lodged by a railway company has been dealt with, and in that case, unless the notice is withdrawn, the order of the Board shall be provisional only, and shall not take effect unless it is confirmed by Parliament.

|

|

| |

(5) The Board of Trade may submit to Parliament a Bill for confirming any order made by them which requires to be so confirmed, and if, while any such Bill is pending in either House of Parliament, a petition is presented against any order comprised therein, the Bill, so far as it relates to the order, shall be referred to a Select Committee, or, if the two Houses of Parliament think fit so to order, to a joint committee of those Houses, and the petitioner shall be allowed to appear and oppose as in the case of Private Bills.

|

|

| |

(6) The Board of Trade shall (in addition to the powers given to them under the foregoing provisions of this section) have power on the application of any company, to make as respects that company any special variation in the form of the accounts and returns set out in the First Schedule to this Act which appears to the Board to be required for the purpose of adapting the form to the particular circumstances of that company.

|

|

|

Removal of obligation to prepare half-yearly accounts.

|

4.—(1) A railway company shall not be under any obligation to prepare or to submit to their shareholders or auditors, statements of accounts or balance sheets, or to hold ordinary general meetings more than once a year, and anything which under any special Act is authorised or required to be done at a general meeting of a railway company to be held at any specified time may be done at the annual general meeting of the company at whatever time held:

|

|

| |

Provided that nothing in this provision shall relieve a railway company of any obligation to prepare half-yearly accounts in cases where those accounts are required in connexion with any guarantee of dividend under any such statutory provisions.

|

|

| |

(2) The directors of an incorporated railway company may, if it appears to them that the profits of the company are sufficient, declare and pay an interim dividend for the first half of any year, notwithstanding that the accounts are not audited for the half-year, and that a statement of accounts and balance sheet for the half-year is not submitted to the shareholders, and may close their register and books of transfer before the date on which the interim dividend is declared in the same manner and for the same time and subject to the same provisions as they may close their register or books before the date on which their ordinary dividend is declared or before the date of their ordinary meeting.

|

|

| |

(3) Any statutory provisions affecting the railway company shall be read with the modifications necessary to bring them into conformity with this section.

|

|

|

Saving for power to call for returns under 34 & 35 Vict. c. 78 and 51 & 52 Vict. c. 25.

|

5. Nothing in this Act shall affect or limit any obligations imposed upon a railway company or any powers or rights conferred upon the Board of Trade by section nine of the Regulation of Railways Act, 1871, as amended by section thirty-two of the Railway and Canal Traffic Act, 1888, but the returns required of a railway company by those sections shall only be made at the instance of the Board of Trade and at such times as the Board of Trade may direct.

|

|

|

Definitions and supplemental.

8 Edw. 7. c. 69.

|

6.—(1) In this Act—

|

|

| |

the expression “railway company” means any company or person working a railway under lease or otherwise, and the expression “railway” means a railway authorised by special Act ;

|

|

| |

the expression “special Act” includes any certificate or order having the force of an Act, and the expression “statutory provisions” includes the provisions of any such certificate or order ;

|

|

| |

the expression “Registrar of Companies” means the officer performing the duty of the registration of companies under the Companies (Consolidation) Act, 1908, in England, Scotland, or Ireland, as the case may be ;

|

|

| |

the expression “shareholder” means the holder of any share or part of any stock or other capital of a railway company which is not raised by means of borrowing or has not the character of borrowed money, and the expression “debenture holder” means the holder of any debenture or part of any debenture stock or other capital of a railway company which is raised by means of borrowing or has the character of borrowed money.

|

|

| |

(2) Where any light railway company or other railway company are exempted by virtue of any special Act from the operation of sections nine and ten of the Regulation of Railways Act, 1871, as respects their railway or any part of their railway, that company shall, so far as regards that railway or part of the railway, be exempt from the obligation to prepare, submit, and forward accounts and returns under this Act; and the Board of Trade may exempt any company or authority from that obligation if they are satisfied that the business of a railway company is merely subsidiary to the main business carried on by the company or authority, and that the company or authority are under an obligation to prepare their accounts in a form prescribed by the Board of Trade or to present them to Parliament.

|

|

| |

(3) Where a railway is being managed or worked by a joint committee or other body representing two or more railway companies and the receipts and expenditure of that railway are separately treated under Abstract J. in the accounts and returns prepared and forwarded by the several companies whom the committee or body represents, the committee or body shall, for the purpose of the provisions of this Act with respect to accounts and returns, be deemed to be a separate railway company.

|

|

|

Repeal, short title, and commencement.

|

7.—(1) The Acts specified in the Second Schedule to this Act are hereby repealed to the extent mentioned in the third column of that schedule.

|

|

| |

(2) This Act may be cited as the Railway Companies (Accounts and Returns) Act, 1911, and shall come into operation on the first day of January nineteen hundred and thirteen.

|

| |

SCHEDULES.

FIRST SCHEDULE.

|

| |

Sections 1

,

2

,

3

.

|

| |

TABLE OF CONTENTS.

|

| |

Part I

.

|

| |

Financial Accounts.

|

| | |

No. 1 (a).

|

Nominal Capital authorised, and created by the Company.

|

|

No. 1 (b).

|

Nominal Capital authorised, and created by the Company jointly with some other Company.

|

|

No. 1 (c).

|

Nominal Capital authorised, and created by some other Company on which the Company either jointly or separately guarantees fixed dividends.

|

|

No. 2.

|

Share Capital and Stock created, as per Statement No. 1 (a), showing the proportion issued.

|

|

No. 3.

|

Capital raised by Loans and Debenture Stock.

|

|

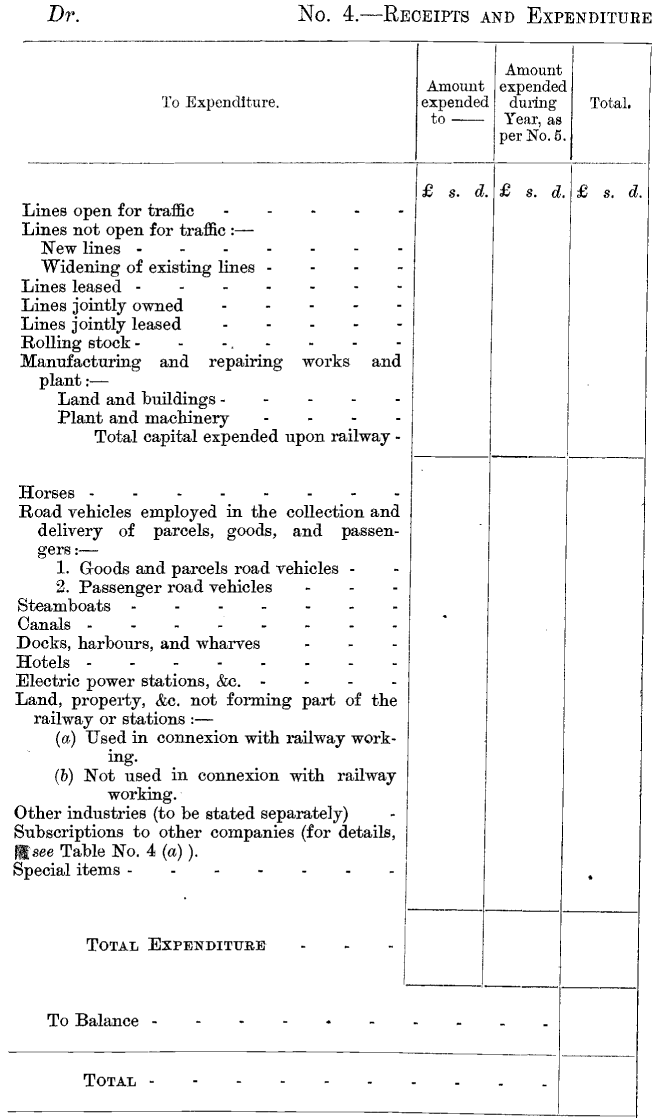

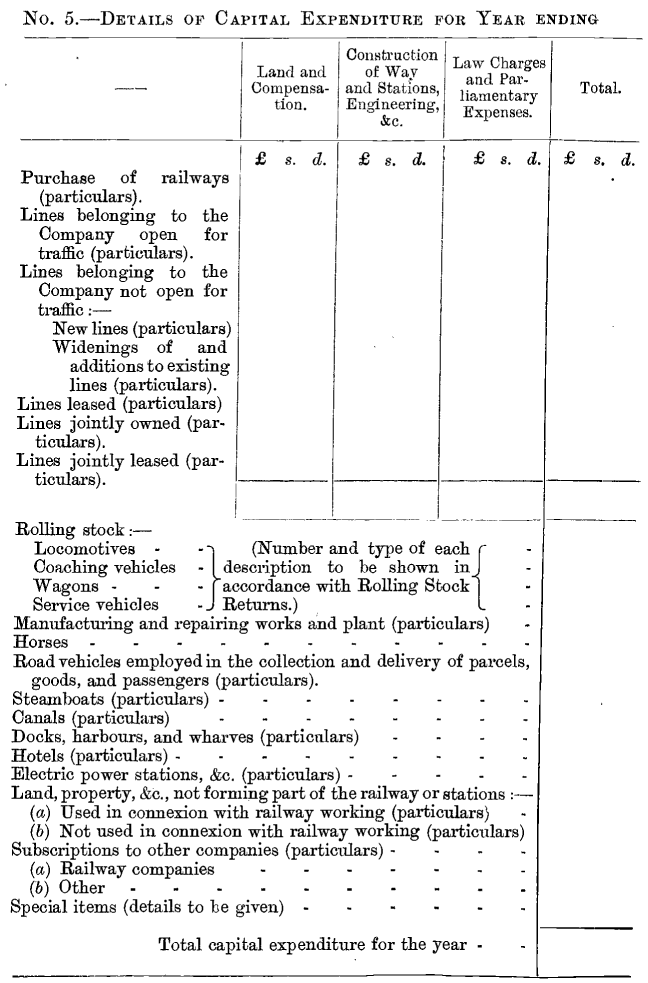

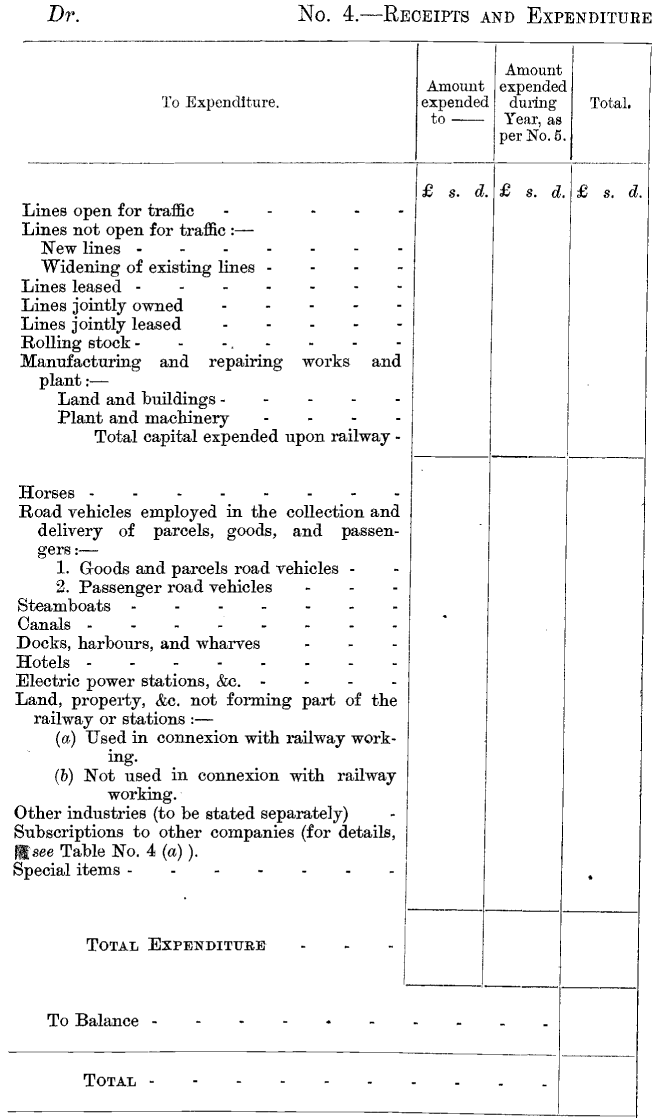

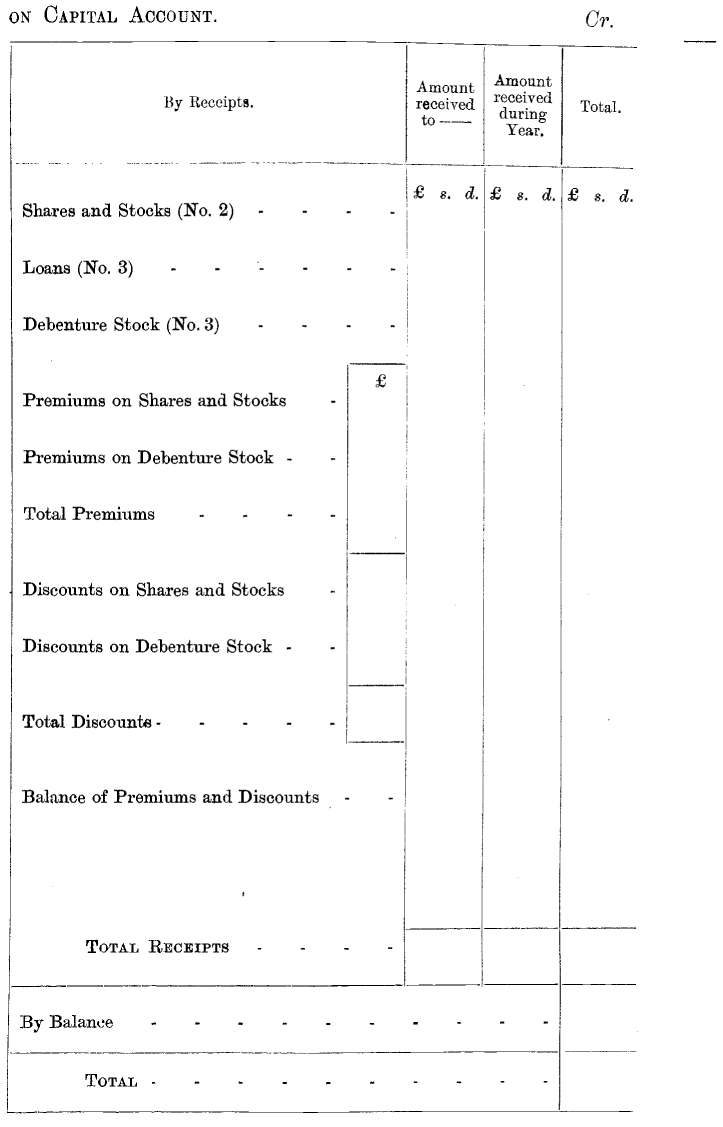

No. 4.

|

Receipts and Expenditure on Capital Account.

|

|

No. 4 (a).

|

Subscriptions to other Companies.

|

|

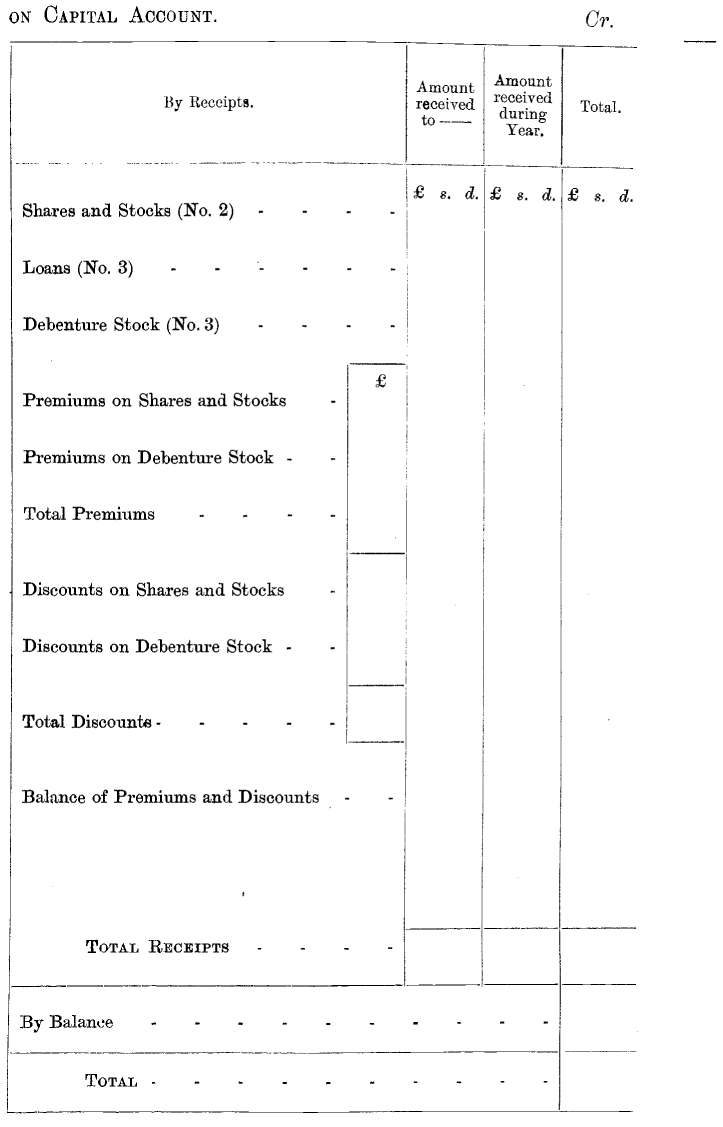

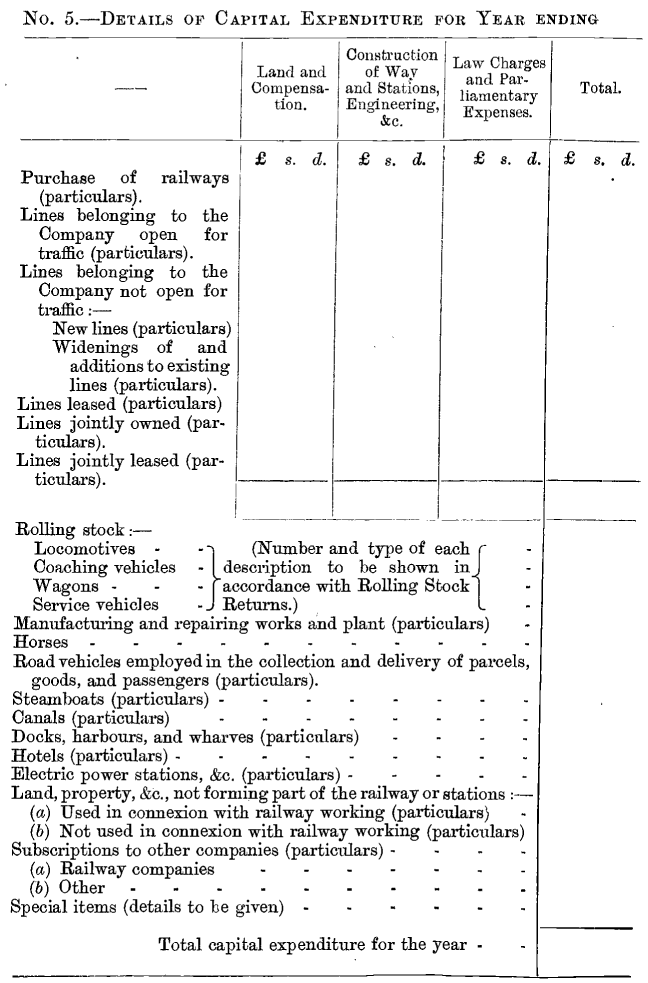

No. 5.

|

Details of Capital Expenditure for year ending

|

|

No. 6.

|

Estimate of further Expenditure on Capital Account.

|

|

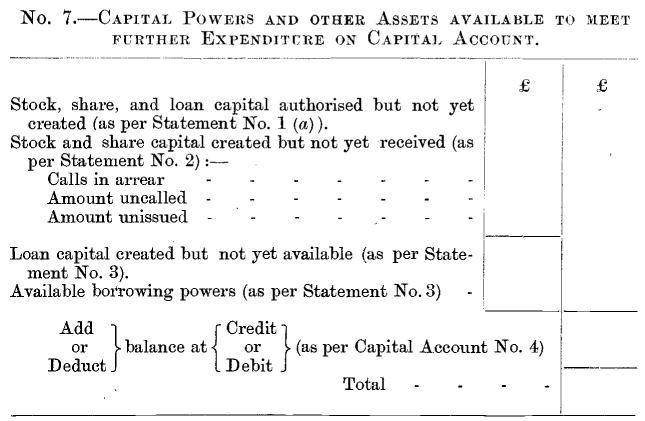

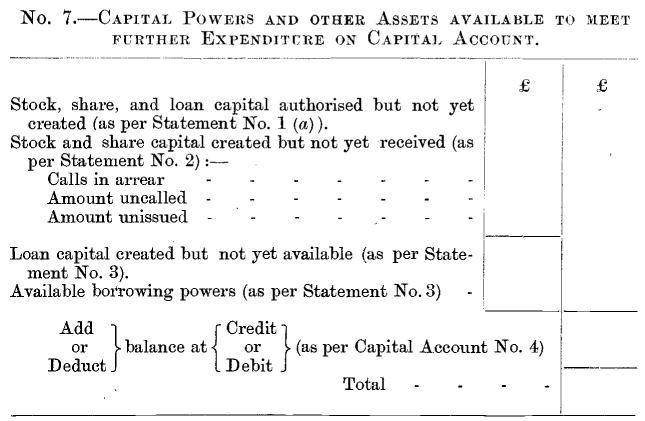

No. 7.

|

Capital Powers and other Assets available to meet further Expenditure on Capital Account.

|

|

No. 8.

|

Revenue Receipts and Expenditure of the whole Undertaking.

|

|

No. 9.

|

Proposed Appropriation of Net Income.

|

|

No. 9 (a).

|

Statement of Interim Dividends paid.

|

|

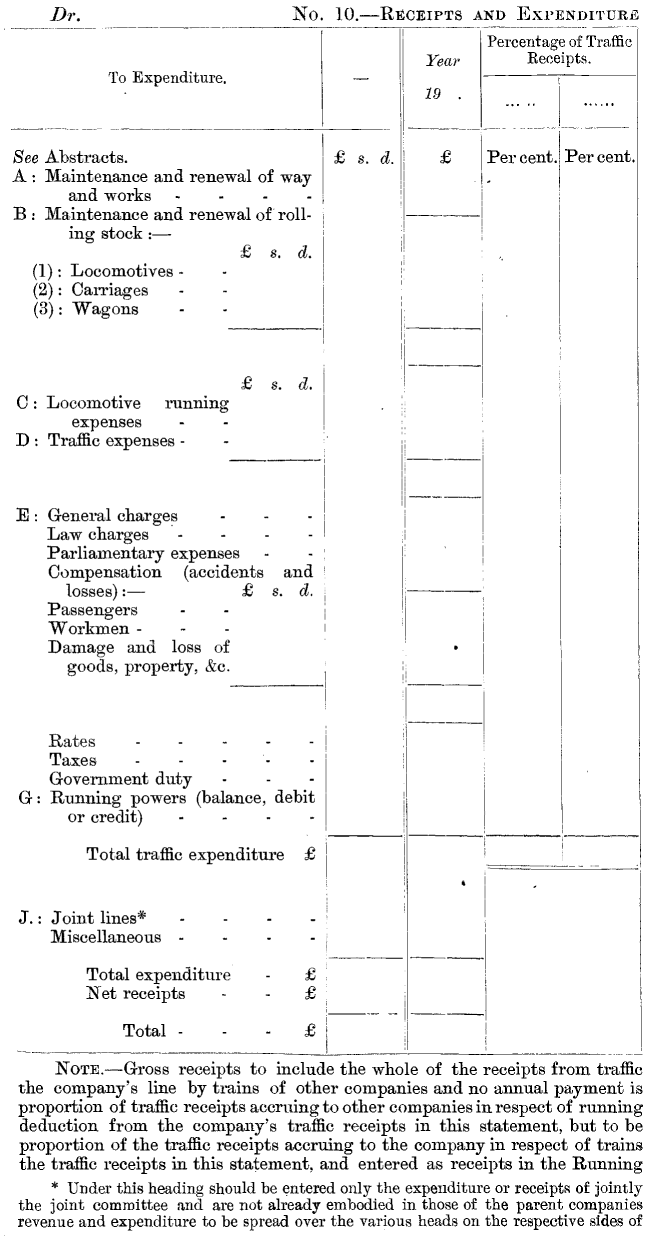

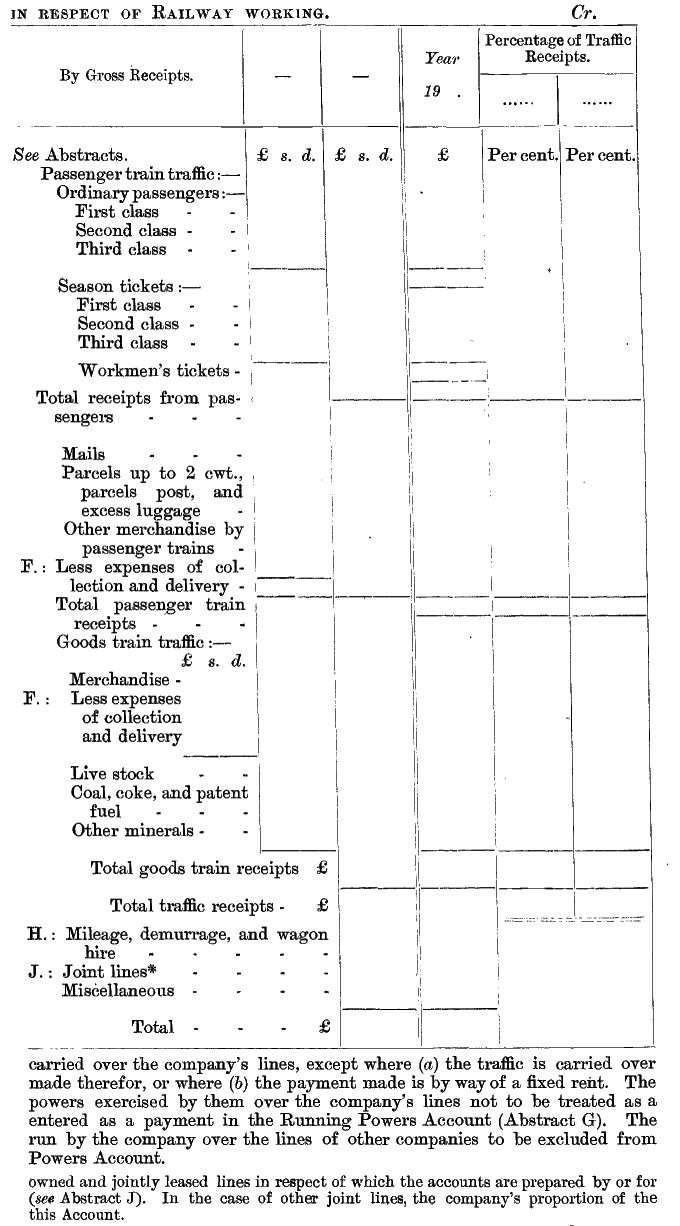

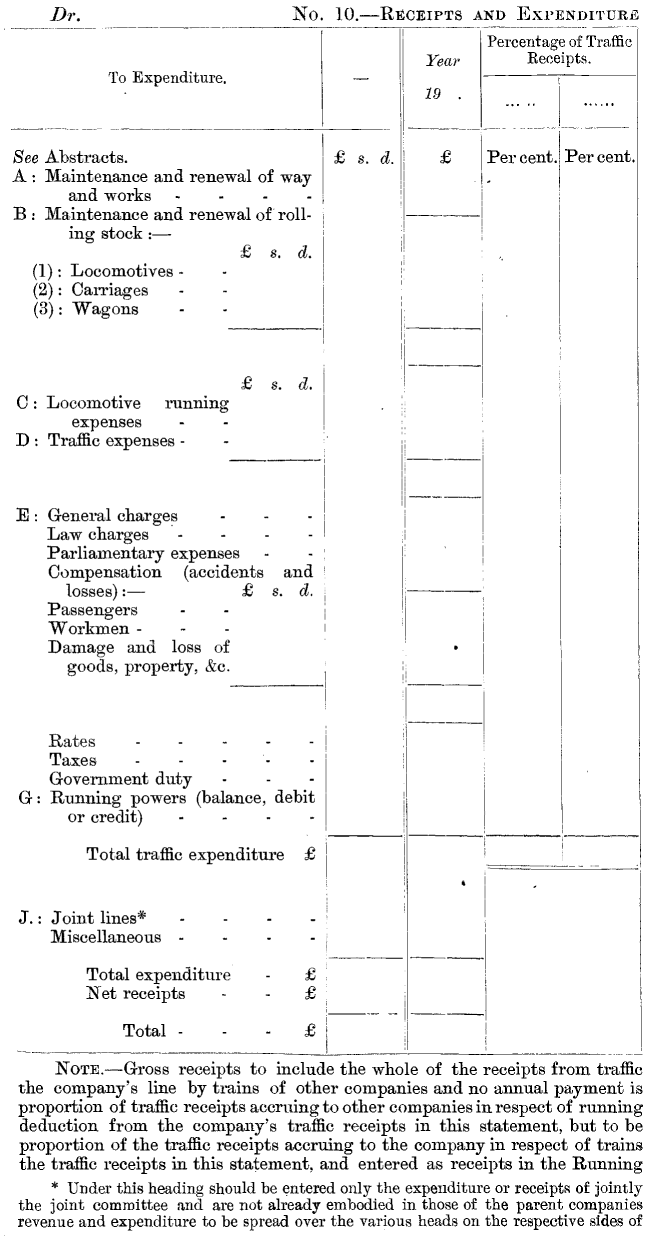

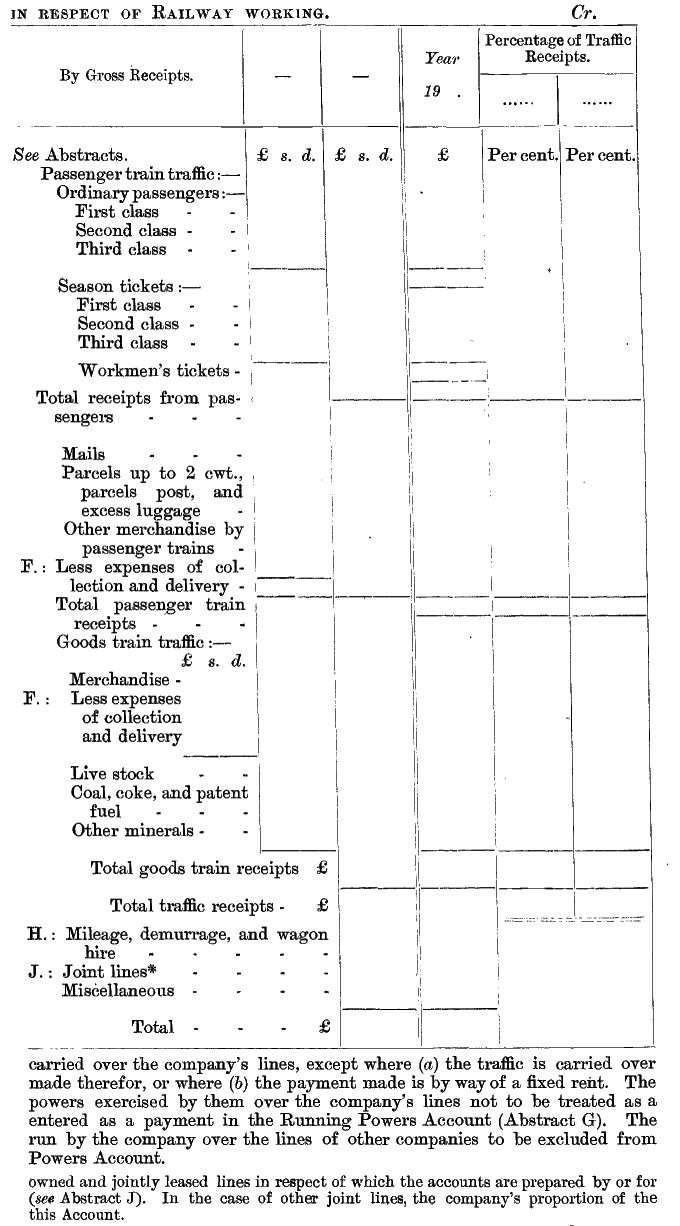

No. 10.

|

Receipts and Expenditure in respect of Railway working.

|

|

|

Abstract A.—Maintenance and Renewal of Ways and Works.

|

|

|

Abstract B.—Maintenance and Renewal of Rolling Stock—

|

|

|

(1) Locomotives.

|

|

|

(2) Carriages.

|

|

|

(3) Wagons.

|

|

|

Abstract C.—Locomotive Running Expenses.

|

|

|

Abstract D.—Traffic Expenses.

|

|

|

Abstract E.—General Charges.

|

|

|

Abstract F.—Expenses of Collection and Delivery of Parcels and Goods.

|

|

|

Abstract G.—Running Powers. Receipts and Payments in respects of Running Power Expenses.

|

|

|

Abstract H.—Mileage, Demurrage, and Wagon Hire.

|

|

|

Abstract J.—Jointly owned and jointly leased Lines. Receipts and Expenditure.

|

|

No. 11.

|

Receipts and Expenditure in respect of Omnibuses and other Passenger Vehicles not running on the Railway.

|

|

No. 12.

|

Receipts and Expenditure in respect of Steamboats.

|

|

No. 13.

|

Receipts and Expenditure in respect of Canals.

|

|

No. 14.

|

Receipts and Expenditure in respect of Docks, Harbours, and Wharves.

|

|

No. 15.

|

Receipts and Expenditure in respect of Hotels, and of Refreshment Rooms and Cars where catering is carried on by the Company.

|

|

No. 16.

|

Receipts and Expenditure in respect of other Separate Businesses carried on by the Company.

|

|

No. 17.

|

Electric Power and Light Account.

|

|

No. 18.

|

General Balance Sheet.

|

|

| |

Part II

.

|

| |

Statistical Returns.

|

| | |

I.

|

Mileage of Lines—

|

|

|

(A).—Mileage of Lines open for Traffic.

|

|

|

(B).—Mileage of Lines authorised but not open for Traffic.

|

|

|

(C).—Mileage of Lines run over by the Company's Engines.

|

|

II.

|

Rolling Stock—

|

|

|

(A)—Steam Locomotives and Tenders.

|

|

|

(B)—Rail Motor Vehicles.

|

|

|

(C)—Trains worked by Electric Power.

|

|

|

(D)—Coaching Vehicles (other than Electric).

|

|

|

(E)—Merchandise and Mineral Vehicles.

|

|

|

(F)—Railway Service Vehicles, and Horses for Shunting.

|

|

III.

|

Horses and Road Vehicles employed in the Collection and Delivery of Parcels, Goods, and Passengers.

|

|

IV.

|

Steamboats.

|

|

V.

|

Canals.

|

|

VI.

|

Docks, Harbours, and Wharves.

|

|

VII.

|

Hotels.

|

|

VIII.

|

Land, Property, &c., not forming part of the Railway or Stations.

|

|

IX.

|

Other Industries (if any).

|

|

X.

|

Maintenance and Renewal of Ways and Works (Abstract A).

|

|

XI.

|

Maintenance and Renewal of Rolling Stock (Abstract B).

|

|

XII.

|

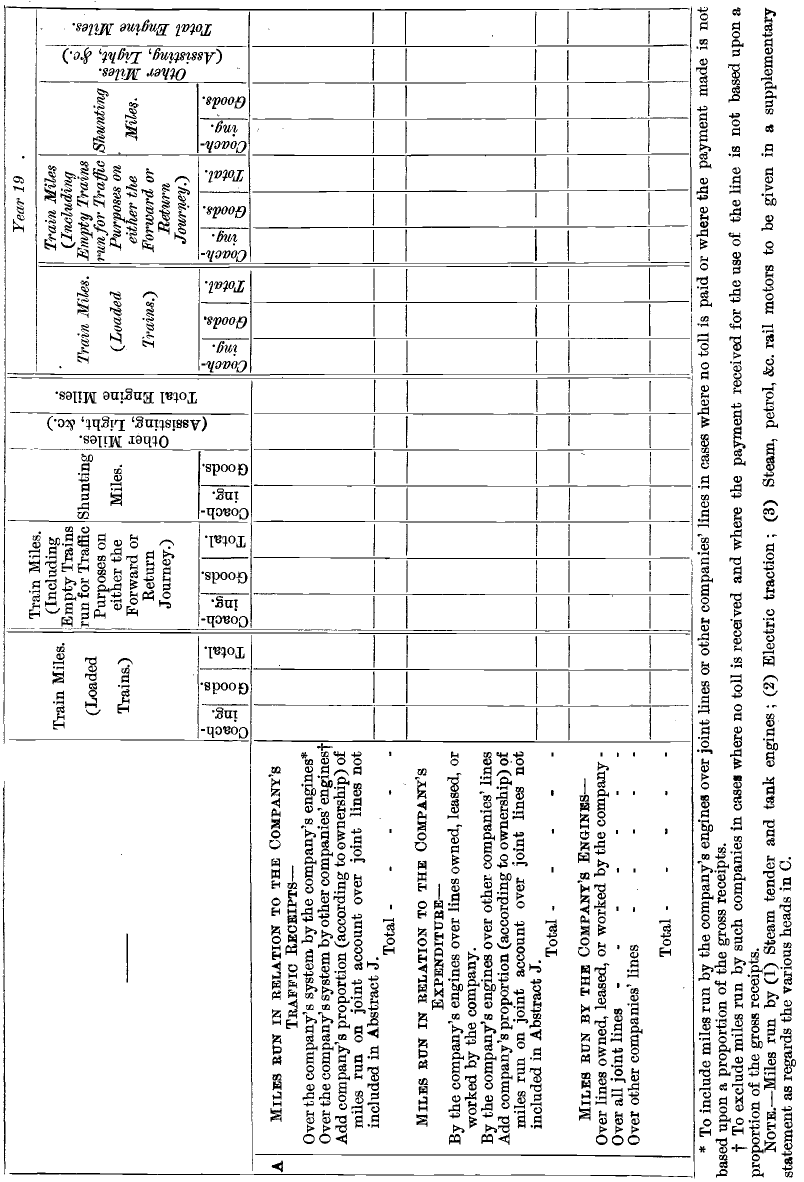

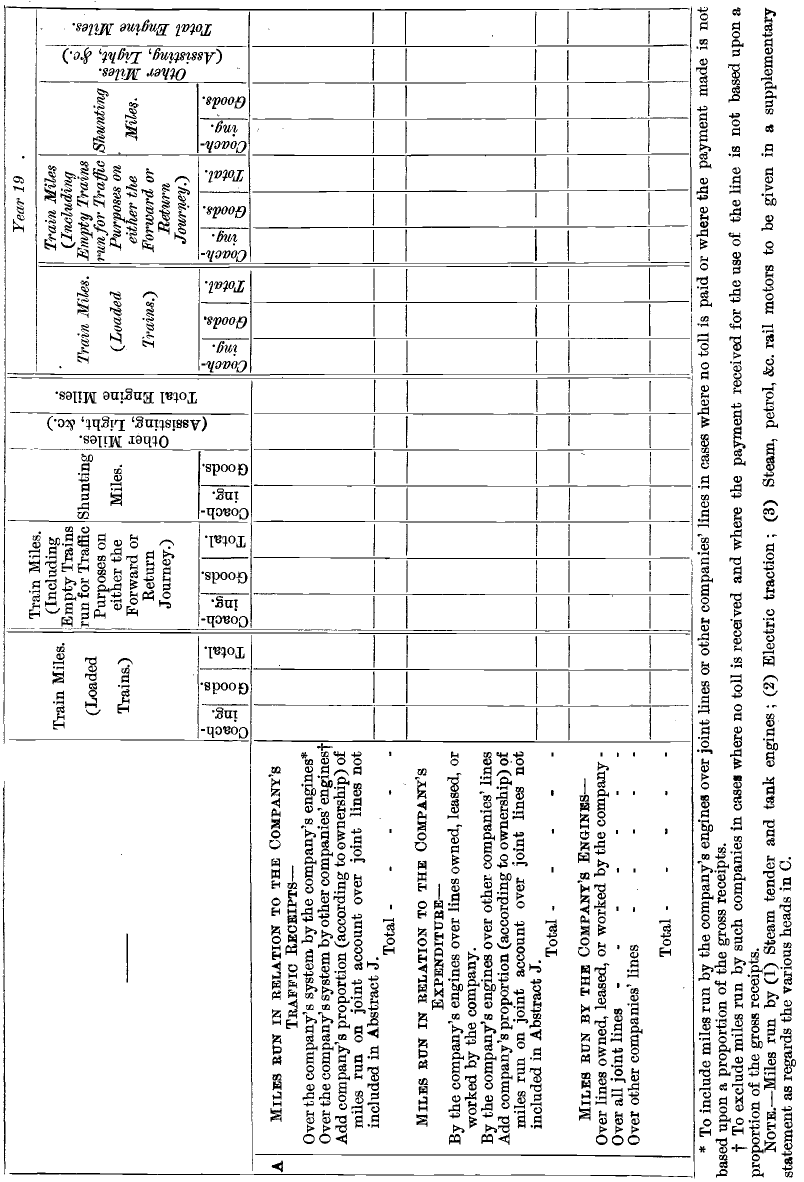

Engine Mileage.

|

|

XIII.

|

Passenger Traffic and Receipts.

|

|

XIV.

|

Goods Traffic and Receipts.

|

|

XV(A).

|

Tonnage of the Principal Classes of Minerals and Merchandise carried by Goods Trains.

|

|

XV(B).

|

Number of Live Stock carried by Goods Trains.

|

|

XVI.

|

Summary of Financial Results secured in comparison with those for past Years.

|

|

|

Certificates of the Responsible Officers as to the Upkeep of the whole of the Companies’ Property.

|

|

|

Auditor's Certificate.

|

|

|

Index.

|

|

|

Map.

|

|

| |

FORM OF ACCOUNTS AND STATISTICAL RETURNS.

|

| |

Part I.

Financial Accounts.

|

| |

(Nos. 1 to 7, Capital Accounts.)

|

| |

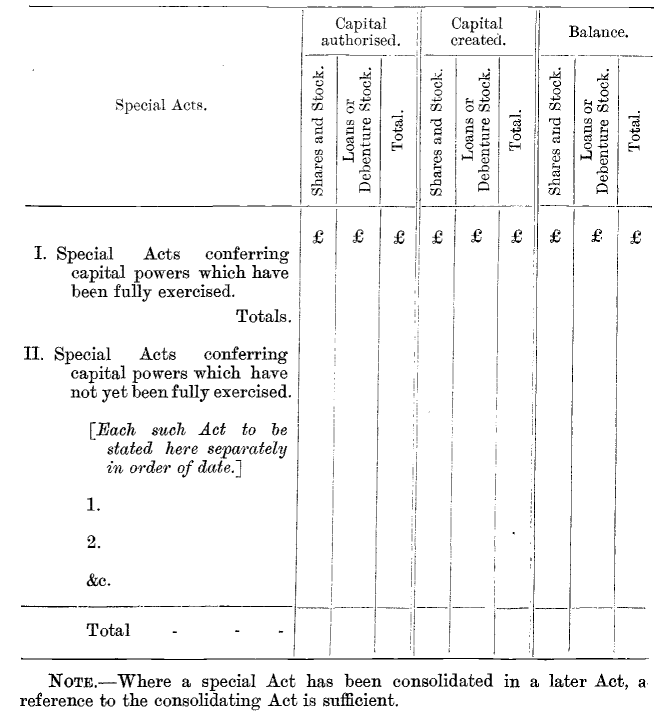

No. 1 (a).—Nominal Capital authorised, and created by the Company.

|

| |

|

| |

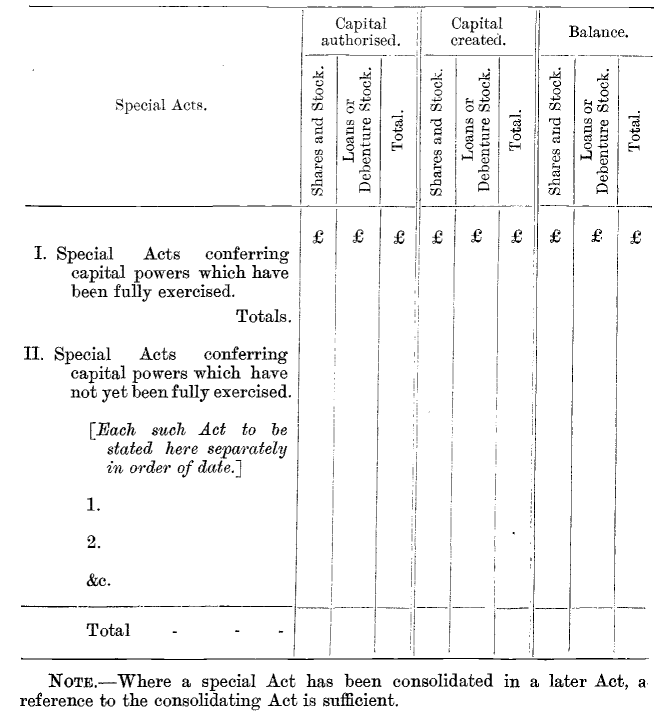

No. 1 (b).—Nominal Capital authorised, and created by the Company jointly with some other Company.

|

| | |

Special Acts.

|

Capital authorised.

|

Capital created.

|

Balance.

|

|

Shares and Stock.

|

Loans or Debenture Stock.

|

Total.

|

Shares and Stock.

|

Loans or Debenture Stock.

|

Total.

|

Shares and Stock.

|

Loans or Debenture Stock.

|

Total.

|

|

|

£

|

£

|

£

|

£

|

£

|

£

|

£

|

£

|

£

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

No. 1 (c).—Nominal Capital authorised, and created by some other Company on which the Company either jointly or separately guarantees fixed Dividends.

|

| | |

Special Acts.

|

Capital authorised.

|

Capital created.

|

Balance.

|

|

Shares and Stock.

|

Loans or Debenture Stock.

|

Total.

|

Shares and Stock.

|

Loans or Debenture Stock.

|

Total.

|

Shares and Stock.

|

Loans or Debenture Stock.

|

Total.

|

|

|

£

|

£

|

£

|

£

|

£

|

£

|

£

|

£

|

£

|

|

[Note.—It should be stated in each case whether the dividend is guaranteed jointly with some other company or companies (the names of which should be given) or separately.]

|

|

|

|

|

|

|

|

|

|

|

| |

No. 2.—Share Capital and Stock created, as per Statement

|

| |

No. 1 (a), showing the proportion issued.

|

| | |

Description.

|

Amount created.

|

Amount issued.

|

Nominal additions to or deductions from Capital.

|

Amount on which Dividend is payable.

|

Amount which does not rank for Dividend until a future date.

|

Calls in arrear.

|

Amount uncalled.

|

Amount unissued.

|

|

|

£

|

£

|

£

|

£

|

£

|

£

|

£

|

£

|

|

[Each class of shares and stock to be stated in order of date of creation, with the preferential or fixed dividends, if any, to which it is entitled, and any other conditions attached to it.]

|

|

|

|

|

|

|

|

|

|

Total - - -

|

|

|

|

|

|

|

|

|

|

| |

Note.—A column to be provided where necessary between “amount created” and “amount issued” to show “additional stock issued to provide authorised money.”

|

| |

No. 3.—Capital raised by Loans and Debenture Stock.

|

| | |

—

|

Raised by Loans.

|

Raised by issue of Debenture Stocks.

|

Total raised by Loans or Debenture Stocks.

|

|

At per cent.

|

At per cent.

|

At per cent.

|

At per cent.

|

Total Loans.

|

Amount of Stock.

|

Nominal Additions or Deductions on Conversion.

|

Existing Amount of Stock.

|

|

At per cent.

|

At per cent.

|

At per cent.

|

Total Debenture Stock.

|

|

|

£

|

£

|

£

|

£

|

£

|

£

|

£

|

£

|

£

|

£

|

£

|

£

|

|

Existing at

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Existing at

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Decrease

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total amount authorised to be raised by loans and debenture stocks in respect of capital created as per Statement No. 1 (a).

|

|

|

|

£

|

|

|

Less—Amount created but not yet available - - -

|

|

|

|

Reduction of borrowing power in respect of interest paid out of capital.

|

|

|

|

Capitalised value of rentcharges, annuities, or fen duties, in accordance with section 5 of the Lands Clauses Consolidation Acts Amendment Act, 1860.

|

|

|

|

Other deductions, if any - - - -

|

|

|

|

Total deductions - -

|

|

|

|

Total amount raised by loans and debenture stock as above - -

|

|

|

|

|

|

Balance being available borrowing powers at - -

|

|

|

| |

|

| |

|

| |

No. 4 (a).—Subscriptions to other Companies.

|

| | |

Name.

|

Amount.

|

Nature of Security or Investment.

|

|

|

£

|

|

|

(a) Railway companies -

|

—

|

—

|

|

(b) Other - - - -

|

—

|

—

|

|

| |

|

| |

No. 6.—Estimate of further Expenditure on Capital Account.

|

| | |

Expenditure to date on Principal Works in Progress.

|

—

|

Estimated further Expenditure.

|

|

During the Year ending

|

Subsequently until completion.

|

Total.

|

|

£

|

|

£

|

£

|

£

|

|

|

Purchase of railways (particulars) -

|

|

|

|

|

|

Lines belonging to the Company open for traffic (particulars).

|

|

|

|

|

|

Lines belonging to the Company not open for traffic:—

|

|

|

|

|

|

New lines (particulars) - -

|

|

|

|

|

|

Widenings of and additions to existing lines (particulars).

|

|

|

|

|

|

Lines leased (particulars) - -

|

|

|

|

|

|

Lines jointly owned (particulars) -

|

|

|

|

|

|

Lines jointly leased (particulars) -

|

|

|

|

|

|

Rolling stock - - - - -

|

|

|

|

|

|

Manufacturing and repairing works and plant.

|

|

|

|

|

|

Steamboats - - - - -

|

|

|

|

|

|

Canals - - - - - -

|

|

|

|

|

|

Docks, harbours, and wharves - -

|

|

|

|

|

|

Hotels - - - - - -

|

|

|

|

|

|

Electric power stations, &c. - -

|

|

|

|

|

|

Subscriptions to other companies -

|

|

|

|

|

|

Special items - - - - -

|

|

|

|

|

|

Miscellaneous - - - - -

|

|

|

|

|

|

Total - - - -

|

|

|

|

|

|

Works not yet commenced and in abeyance - - -

|

|

|

| |

|

| |

(Nos. 8 to 18, Revenue Accounts.)

|

| |

No. 8.—Revenue Receipts and Expenditure of the whole Undertaking.

|

| | |

See Statement.

|

—

|

Gross Receipts.

|

Expenditure.

|

Net Receipts.

|

Year 19.

|

|

Gross Receipts.

|

Expenditure.

|

Net Receipts.

|

|

|

|

£

|

s.

|

d.

|

£

|

s.

|

d.

|

£

|

s.

|

d.

|

£

|

£

|

£

|

|

10

|

Railway -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

|

Omnibuses and other passenger vehicles not running on the railways.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12

|

Steamboats -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

Canals - -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14

|

Docks, harbours, and wharves.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15

|

Hotels, and refreshment rooms and cars where catering is carried on by the company.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16

|

Other separate businesses carried on by the company (in detail).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total - £

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Miscellaneous Receipts (Net):—

|

|

|

|

|

Rents from houses and lands - -

|

|

|

|

|

Rents from hotels - - - -

|

|

|

|

|

Other rents, including lump-sum tolls

|

|

|

|

|

Interest and dividends from investments in other companies (in detail).

|

|

|

|

|

Transfer fees - - - - -

|

|

|

|

|

General interest - - - -

|

|

|

|

|

Special items - - - - - -

|

|

|

|

|

Total net income - -

|

|

|

|

|

| |

No. 9.—Proposed Appropriation of Net Income.

|

| | |

—

|

—

|

Year 19.

|

|

|

£

|

s.

|

d.

|

£

|

|

Balance brought forward from last year's account -

|

|

|

|

Net income (as per Statement No. 8) - - -

|

|

|

|

Appropriation from Reserve - - - -

|

|

|

|

Total - - - - -

|

|

|

|

Deduct—Interest, rentals and other fixed charges (to be stated by each company in order of priority):—

|

£

|

s.

|

d.

|

|

|

|

Interest on superannuation and other funds.

|

|

|

|

|

Rentcharges (or feu duties) and annuities.

|

|

|

|

|

Chief rents, wayleaves, &c., including lump-sum tolls.

|

|

|

|

|

Interest on loans - - - -

|

|

|

|

|

Interest on debenture stocks (details)

|

|

|

|

|

Rent of and guaranteed interest on leased and worked lines.

|

|

|

|

|

Interest on Lloyd's bonds - -

|

|

|

|

|

General interest - -

|

|

|

|

|

Special items (if any) - - -

|

|

|

|

|

Total - - -

|

|

|

|

|

Balance after payment of fixed charges.

|

|

|

|

Appropriation to reserve and other special purposes:—

|

£

|

s.

|

d.

|

|

|

|

(Details)

|

|

|

|

|

Total - - -

|

|

|

|

|

Dividends on guaranteed and preference stocks:—

|

|

|

|

|

(Details)

|

|

|

|

|

Total - - -

|

|

|

|

|

Balance available for dividends on ordinary stock:—

|

£

|

s.

|

d.

|

|

|

|

(Details)

|

|

|

|

|

Total - - -

|

|

|

|

|

| |

No. 9 (a).—Statement of Interim Dividends paid.

|

| | |

|

£

|

s.

|

d.

|

£

|

|

Balance available for dividends, Year 19 - -

|

|

|

|

Deduct:—

|

£

|

s.

|

d.

|

|

|

|

Interim dividends paid (particulars) -

|

|

|

|

|

Undivided balance at 31st December, carried to balance sheet.

|

|

|

|

| |

|

| |

|

| |

Abstract A.—Maintenance and Renewal of Way and Works.

|

| | |

—

|

—

|

—

|

Year 19.

|

|

Superintendence:—

|

£

|

s.

|

d.

|

£

|

s.

|

d.

|

£

|

|

Salaries - - - -

|

|

|

|

|

Office expenses - - - -

|

|

|

|

|

Maintenance of roads, bridges and works:—

|

|

|

|

|

Earthworks - - - -

|

|

|

|

|

Bridges, tunnels, culverts, retaining walls, and other works.

|

|

|

|

|

Roads and fences - - - -

|

|

|

|

|

Maintenance of permanent way:—

|

|

|

|

|

Renewal of running lines:—

|

|

|

|

|

Wages - - - -

|

|

|

|

|

Materials - - - -

|

|

|

|

|

Engine power and wagon repairs -

|

|

|

|

|

Repair of running lines and sidings:—

|

|

|

|

|

Wages - - - -

|

|

|

|

|

Materials - - - -

|

|

|

|

|

Engine power and wagon repairs - - - -

|

|

|

|

|

|

|

|

|

|

Maintenance of signalling - - - -

|

|

|

|

|

Maintenance of telegraphs - - - -

|

|

|

|

|

Maintenance of stations and buildings:—

|

|

|

|

|

Stations, depôts, and offices - - - -

|

|

|

|

|

Engine sheds - - - -

|

|

|

|

|

Carriage sheds - - - -

|

|

|

|

|

Locomotive workshops - - -

|

|

|

|

|

Carriage workshops - - - -

|

|

|

|

|

Wagon workshops - - -

|

|

|

|

|

Other buildings - - - -

|

|

|

|

|

Total - - - - - £

|

|

|

|

| |

Note.—When any sum is transferred to or from a depreciation fund or suspense account, the net sum to be stated.

|

| |

Abstract B.—Maintenance and Renewal of Rolling Stock.

|

| |

(1.)—Locomotives.

|

| | |

—

|

—

|

—

|

Year 19.

|

|

Superintendence:—

|

£

|

s.

|

d.

|

£

|

s.

|

d.

|

£

|

|

Salaries - - - -

|

|

|

|

|

Office expenses - - - -

|

|

|

|

|

Complete renewals:—

|

|

|

|

|

|

|

|

|

Wages - - - -

|

|

|

|

|

Materials - - - -

|

|

|

|

|

Repairs and partial renewals:—

|

|

|

|

|

|

|

|

|

Wages - - - -

|

|

|

|

|

Materials - - - -

|

|

|

|

|

Purchase of new locomotives - -

|

|

|

|

|

|

|

|

|

Workshop expenses:—

|

|

|

|

|

|

|

|

|

Repair and renewals of machinery and plant.

|

|

|

|

|

|

|

|

|

Other expenses - - - - -

|

|

|

|

|

|

|

|

|

Total - - - - - £

|

|

|

|

|

|

| |

(2.)—Carriages.

|

| | |

—

|

—

|

—

|

Year 19.

|

|

Superintendence:—

|

£

|

s.

|

d.

|

£

|

s.

|

d.

|

£

|

|

Salaries - - - -

|

|

|

|

|

Office expenses - - - -

|

|

|

|

|

Complete renewals:—

|

|

|

|

|

|

|

|

|

Wages - - - -

|

|

|

|

|

Materials - - - -

|

|

|

|

|

Repairs and partial renewals:—

|

|

|

|

|

|

|

|

|

Wages - - - -

|

|

|

|

|

Materials - - - -

|

|

|

|

|

Purchase of new carriages - -

|

|

|

|

|

|

|

|

|

Workshop expenses:—

|

|

|

|

|

|

|

|

|

Repair and renewals of machinery and plant.

|

|

|

|

|

|

|

|

|

Other expenses - - - - -

|

|

|

|

|

|

|

|

|

Total - - - - - £

|

|

|

|

|

|

| |

Note.—When any sum is transferred to or from a depreciation fund or suspense account, the net sum to be stated.

|

| |

(3.)—Wagons.

|

| | |

—

|

—

|

—

|

Year 19.

|

|

Superintendence:—

|

£

|

s.

|

d.

|

£

|

s.

|

d.

|

£

|

|

Salaries - - - -

|

|

|

|

|

Office expenses - - - -

|

|

|

|

|

Complete renewals:—

|

|

|

|

|

|

|

|

|

Wages - - - -

|

|

|

|

|

Materials - - - -

|

|

|

|

|

Repairs and partial renewals:—

|

|

|

|

|

|

|

|

|

Wages - - - -

|

|

|

|

|

Materials - - - -

|

|

|

|

|

Purchase of new wagons - -

|

|

|

|

|

|

|

|

|

Workshop expenses:—

|

|

|

|

|

|

|

|

|

Repair and renewals of machinery and plant.

|

|

|

|

|

|

|

|

|

Other expenses - - - - -

|

|

|

|

|

|

|

|

|

Total - - - - - £

|

|

|

|

|

|

| |

Note.—When any sum is transferred to or from a depreciation fund or suspense account, the net sum to be stated.

|

| |

Abstract C.—Locomotive Running Expenses.

|

| | |

—

|

—

|

—

|

Year 19.

|

|

Superintendence:—

|

£

|

s.

|

d.

|

£

|

s.

|

d.

|

£

|

|

Salaries - - - -

|

|

|

|

|

Office expenses - - - -

|

|

|

|

|

Steam train working:—

|

|

|

|

|

Wages connected with the running of locomotive engines.

|

|

|

|

|

Fuel - - - - - - -

|

|

|

|

|

Water - - - - - -

|

|

|

|

|

Lubricants - - - - -

|

|

|

|

|

Other stores, including clothing -

|

|

|

|

|

Miscellaneous - - - - -

|

|

|

|

|

Electric train working:—

|

|

|

|

|

Wages of motormen - - - -

|

|

|

|

|

Electric current - - - -

|

|

|

|

|

Lubricants - - - -

|

|

|

|

|

Other stores, including clothing -

|

|

|

|

|

|

|

|

|

|

Total - - - - - £

|

|

|

|

| |

Note.—Any other form of power to be shown separately with correponding details.

|

| |

Abstract D.—Traffic Expenses.

|

| | |

—

|

—

|

—

|

Year 19.

|

|

Salaries and wages:—

|

£

|

s.

|

d.

|

£

|

s.

|

d.

|

£

|

|

Superintendence - - - -

|

|

|

|

|

Stationmasters and clerks - -

|

|

|

|

|

Signalmen and gatemen - - - -

|

|

|

|

|

Ticket collectors, policemen, porters, &c. - - - -

|

|

|

|

|

Guards - - - -

|

|

|

|

|

Fuel, lighting, water, and general stores - - -

|

|

|

|

Clothing - - - -

|

|

|

|

Printing, advertising, stationery, stamps, and tickets

|

|

|

|

Wagon covers, &c. - - - - - - - -

|

|

|

|

Expenses of joint stations and junctions - - - - - - -

|

|

|

|

Cleansing, lubricating, and lighting of vehicles - - - -

|

|

|

|

Shunting expenses (other than mechanical) - - - -

|

|

|

|

Working of stationary engines, hoists, cranes, &c. -

|

|

|

|

Coal, &c. tipping expenses - - - -

|

|

|

|

Railway Clearing House expenses - - - -

|

|

|

|

Miscellaneous expenses - - - - -

|

|

|

|

Total - - - - £

|

|

|

|

| |

Abstract E.—General Charges.

|

| | |

—

|

—

|

Year 19.

|

|

|

£

|

s.

|

d.

|

£

|

|

Directors’ fees voted by shareholders - - -

|

|

|

|

Fees paid to and expenses of directors on joint committees not included in Abstract J. - -

|

|

|

|

Auditors and public accountants (fees, clerkage, and expenses) - - - - - - -

|

|

|

|

Salaries of secretary, general manager, accountant, and clerks - - - - - - - -

|

|

|

|

Office expenses, ditto - - - - - -

|

|

|

|

Rating expenses - - - - - - - -

|

|

|

|

Fire insurance - - - - - -

|

|

|

|

Superannuation and benevolent funds, pensions, &c.

|

|

|

|

*Subscriptions and donations - - - -

|

|

|

|

Miscellaneous expenses - - - - - -

|

|

|

|

Total - - - - £

|

|

|

|

| |

* Amounts contributed to institutions not directly controlled by the Company, and not for the exclusive benefit of the Company's servants.

|

| |

Abstract F.—Expenses of Collection and Delivery of Parcels and Goods.

|

| | |

—

|

—

|

Year 19.

|

|

|

£

|

s.

|

d.

|

£

|

|

Salaries and wages - - - -

|

|

|

|

Rent, rates, and taxes - - - -

|

|

|

|

Maintenance of horses - - - -

|

|

|

|

Maintenance of horse vehicles - - - -

|

|

|

|

Maintenance of motors - - - - - -

|

|

|

|

Amounts paid for hired cartage - - - -

|

|

|

|

Miscellaneous - - - - - - -

|

|

|

|

Total - - - - - - - -

|

|

|

|

Amount charged to passenger train traffic

|

|

|

|

Amount charged to goods traffic - -

|

|

|

|

| |

Note.—The division of expenditure to be based as far as possible on actual figures.

|

| |

Abstract G.—Running Powers.

|

| |

Receipts and Payments in respect of Running Power Expenses.

|

| | |

—

|

Receipts.*

|

Payments †

|

Balance.

|

Year 19.

|

|

Receipts.*

|

Payments.†

|

Balance.

|

|

|

£

|

£

|

£

|

£

|

£

|

£

|

|

Passenger train traffic -

|

|

|

|

|

|

|

|

Goods train traffic - -

|

|

|

|

|

|

|

|

Total - -

|

|

|

|

|

|

|

|

| |

* Receipts are the sums received by a company in respect of trains run by it over the lines of other companies.

|

| |

† Payments are the sums paid by a company in respect of trains run by other companies over its lines.

|

| |

Abstract H.—Mileage, Demurrage, and Wagon Hire.

|

| | |

—

|

Receipts.

|

Expenditure.

|

Balance.

|

Year 19.

|

|

Receipts.

|

Expenditure.

|

Balance.

|

|

|

£

|

s.

|

d.

|

£

|

s.

|

d.

|

£

|

s.

|

d.

|

£

|

£

|

£

|

|

Mileage and demurrage:—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Passenger train vehicles.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goods train vehicles.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hire of:—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Passenger train vehicles.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goods train vehicles.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total - -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Abstract J.—Jointly Owned and Jointly Leased Lines.

|

| |

Receipts and Expenditure.

|

| | |

—

|

Name of Joint Line.

|

Name of Joint Line.

|

Name of Joint Line.

|

Total.

|

Year 19.

|

|

Total.

|

|

|

£ s. d.

|

£ s. d.

|

£ s. d.

|

£ s. d.

|

£ s. d.

|

£ s. d.

|

£ s. d.

|

£ s. d.

|

£

|

|

Gross receipts:—

|

|

|

|

|

|

|

|

|

|

|

(Details to follow Statement No. 10).

|

|

|

|

|

|

|

|

|

|

|

Total receipts

|

|

|

|

|

|

|

|

|

|

|

Total receipts, Company's proportion.

|

|

|

|

|

|

|

|

|

|

|

Expenditure:—

|

|

|

|

|

|

|

|

|

|

|

(Details to follow Statement No. 10).

|

|

|

|

|

|

|

|

|

|

|

Total expenditure

|

|

|

|

|

|

|

|

|

|

|

Total expenditure, Company's proportion.

|

|

|

|

|

|

|

|

|

|

|

| |

Note.—In this abstract should be entered only the receipts and expenditure of jointly owned and jointly leased lines in respect of which the accounts are prepared by or for the Joint Committee, and are not embodied under their respective headings in the accounts of the parent companies.

|

| |

No. 11.—Receipts and Expenditure in respect of Omnibuses and other Passenger Vehicles not running on the Railway.

|

| | |

Dr.

|

Cr.

|

|

To Expenditure.

|

—

|

Year 19.

|

By Gross Receipts.

|

—

|

Year 19.

|

|

|

£ s. d.

|

£

|

|

£ s. d.

|

£

|

|

Maintenance of horses.

|

|

|

Passengers - -

|

|

|

|

Maintenance of horse vehicles.

|

|

|

Hire of vehicles -

|

|

|

|

Maintenance of motors.

|

|

|

Miscellaneous -

|

|

|

|

Maintenance of buildings.

|

|

|

|

|

|

|

Traffic expenses -

|

|

|

|

|

|

|

Miscellaneous - -

|

|

|

|

|

|

|

Total expenditure

|

|

|

|

|

|

|

Balance - -

|

|

|

|

|

|

|

Total - -

|

|

|

Total - -

|

|

|

|

| |

Note.—When any sum is transferred to or from a depreciation fund or suspense account, the net sum to be stated.

|

| |

No. 12.—Receipts and Expenditure in respect of Steamboats.

|

| | |

Dr.

|

Cr.

|

|

To Expenditure.

|

—

|

Year 19.

|

By Gross Receipts.

|

—

|

Year 19.

|

|

|

£ s. d.

|

£

|

|

£ s. d.

|

£

|

|

Salaries and wages -

|

|

|

Passengers - -

|

|

|

|

Fuel - - -

|

|

|

Parcels - -

|

|

|

|

Stores, lubricants, water, &c.

|

|

|

Mails - - -

|

|

|

|

Repairs - - -

|

|

|

Merchandise -

|

|

|

|

Harbour fees and light dues.

|

|

|

Live stock - -

|

|

|

|

Miscellaneous - -

|

|

|

Miscellaneous -

|

|

|

|

Working expenses

|

|

|

|

|

|

|

Depreciation and insurance.

|

|

|

|

|

|

|

Total expenditure

|

|

|

|

|

|

|

Balance - -

|

|

|

|

|

|

|

Total - -

|

|

|

Total - -

|

|

|

|

| |

No. 13.—Receipts and Expenditure in respect of Canals.

|

| | |

Dr.

|

Cr.

|

|

To Expenditure.

|

—

|

Year 19.

|

By Gross Receipts.

|

—

|

Year 19.

|

|

|

£ s. d.

|

£

|

|

£ s. d.

|

£

|

|

Superintendence -

|

|

|

Tolls - - -

|

|

|

|

Wages of toll clerks, lock-keepers, &c.

|

|

|

Freight as carriers

|

|

|

|

Maintenance of canal

|

|

|

Canal dock dues -

|

|

|

|

Water supply - -

|

|

|

Wharfage and cranage.

|

|

|

|

Auxiliary tramway expenses.

|

|

|

Rents (net receipts)

|

|

|

|

Traffic expenses as carriers.

|

|

|

Miscellaneous -

|

|

|

|

Rates - - -

|

|

|

|

|

|

|

Taxes - - -

|

|

|

|

|

|

|

Miscellaneous - -

|

|

|

|

|

|

|

Total expenditure

|

|

|

|

|

|

|

Balance - -

|

|

|

|

|

|

|

Total - -

|

|

|

Total - -

|

|

|

|

| |

No. 14.—Receipts and Expenditure in respect of Docks, Harbours, and Wharves.

|

| | |

Dr.

|

Cr.

|

|

To Expenditure.

|

—

|

Year 19.

|

By Gross Receipts.

|

—

|

Year 19.

|

|

|

£ s. d.

|

£

|

|

£ s. d.

|

£

|

|

Superintendence -

|

|

|

Harbour dues -

|

|

|

|

Maintenance - -

|

|

|

Light dues - -

|

|

|

|

Dredging - -

|

|

|

Dock dues:—

|

|

|

|

On ships - -

|

|

|

|

|

|

|

Wages not included in above.

|

|

|

On goods - -

|

|

|

|

Rates - - -

|

|

|

On passengers -

|

|

|

|

Wharf and pier dues.

|

|

|

|

|

|

|

Taxes - - -

|

|

|

|

|

|

|

Cranage and other services.

|

|

|

|

|

|

|

Miscellaneous - -

|

|

|

|

|

|

|

Graving docks -

|

|

|

|

|

|

|

Total expenditure

|

|

|

Rents - - -

|

|

|

|

Balance - -

|

|

|

Miscellaneous -

|

|

|

|

Total - -

|

|

|

Total - -

|

|

|

|

| |

Note.—When any sum is transferred to or from a depreciation fund or suspense account, the net sum to be stated.

|

| |

No. 15.—Receipts and Expenditure in respect of Hotels, and of Refreshment Rooms and Cars where catering is carried on by the Company.

|

| | |

Dr.

|

|

|

|

|

Cr.

|

|

To Expenditure.

|

—

|

Year 19 .

|

By Gross Receipts.

|

—

|

Year 19 .

|

|

|

£ s. d.

|

£

|

|

£ s. d.

|

£

|

|

Salaries and wages -

|

|

|

Total receipts from hotels and from sale of provisions, &c. in refreshment rooms and cars.

|

|

|

|

Provisions, wines, and spirits consumed.

|

|

|

|

|

|

|

*Repairs and maintenance of hotels and refreshment rooms, and of fittings, furniture, &c. of refreshment cars.

|

|

|

|

|

|

|

Heating and lighting of hotels and refreshment rooms.

|

|

|

|

|

|

|

Rents - - -

|

|

|

|

|

|

|

Rates in respect of hotels.

|

|

|

|

|

|

|

Taxes in respect of hotels.

|

|

|

|

|

|

|

Miscellaneous -

|

|

|

|

|

|

|

Total expenditure

|

|

|

|

|

|

|

Balance - -

|

|

|

|

|

|

|

Total - -

|

|

|

Total - -

|

|

|

|

| |

Note.—When any sum is transferred to or from a depreciation fund or suspense account, the net sum to be stated.

|

| |

* To include in the case of hotels and refreshment rooms expenditure on buildings, furniture, and plant.

|

| |

No. 16.—Receipts and Expenditure in respect of other Separate Businesses carried on by the Company.

|

| |

No. 17.—Electric Power and Light Account.

|

| | |

—

|

—

|

—

|

Year 19.

|

—

|

—

|

—

|

Year 19.

|

|

|

£ s. d.

|

£ s. d.

|

£

|

|

Number of Units.

|

£ s. d.

|

Number of Units.

|

|

|

Superintendence:

|

|

|

|

|

|

|

|

|

|

Salaries - -

|

|

|

|

|

|

|

|

|

|

Office expenses -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current supplied:—

|

|

|

|

|

|

Total Superintendence.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For traction

|

|

|

|

|

|

Generation:—

|

|

|

|

” power -

|

|

|

|

|

|

Maintenance of buildings.

|

|

|

|

” lighting

|

|

|

|

|

|

Maintenance of plant, machinery, and tools.

|

|

|

|

To other consumers.

|

|

|

|

|

|

Maintenance of feeders, cables, and accessories.

|

|

|

|

|

|

|

|

|

|

Salaries and wages.

|

|

|

|

|

|

|

|

|

|

Fuel, including carriage, &c.

|

|

|

|

|

|

|

|

|

|

Oil, waste, water, and stores.

|

|

|

|

|

|

|

|

|

|

Special items -

|

|

|

|

|

|

|

|

|

|

Total generation.

|

|

|

|

|

|

|

|

|

|

Distribution:—

|

|

|

|

|

|

|

|

|

|

Maintenance of feeders, mains, and apparatus.

|

|

|

|

|

|

|

|

|

|

Maintenance of meters, switches, fuses, lamps, &c.

|

|

|

|

|

|

|

|

|

|

Salaries and wages.

|

|

|

|

|

|

|

|

|

|

Royalties, &c., payable for use of patents.

|

|

|

|

|

|

|

|

|

|

Rents payable -

|

|

|

|

|

|

|

|

|

|

Rates - - -

|

|

|

|

|

|

|

|

|

|

Taxes - - -

|

|

|

|

|

|

|

|

|

|

Special charges:—

|

|

|

|

|

|

|

|

|

|

(To be enumerated).

|

|

|

|

|

|

|

|

|

|

£

|

|

|

|

Tota -

|

|

|

|

|

|

| |

Note.—When any sum is transferred to or from a depreciation fund or suspense account, the net sum to be stated.

|

| |

No. 18.—General Balance Sheet.

|

| | |

Dr.

|

|

|

|

|

Cr.

|

|

——

|

—

|

Year 19 .

|

——

|

—

|

Year 19 .

|

|

To capital account, balance at credit thereof, as per Account No. 4.

Amount due to bankers.

Temporary loans and calls paid in advance.

Lloyd's bonds

Unpaid interest and dividends.

Interest and dividends payable or accruing and provided for.

Amount due to railway companies and committees.

Amount due to railway clearing houses.

Savings bank -

Superannuation and other provident funds.

Accounts payable

Liabilities accrued

Miscellaneous accounts.

Special items (to be detailed).

Fire insurance fund.

Depreciation funds:—

Railway - -

Steamboats (including insurance fund).

Other bus nesses.

General reserve fund. £ s. d.

Balance available for dividends and reserve as per Account No. 9.

Less interim dividends paid as per Statement No. 9 (a).

| | |

|

£ s. d.

|

£

|

By capital account, balance at debit thereof as per Account No. 4.

£ s. d.

Cash at bankers and in hand.

Cash on deposit at interest.

| | |

Investments in Consols and Government securities.

Investments in stocks and shares held by the Company, not charged as capital expenditure.

Investment of superannuation and other provident funds.

Stock of stores and materials.

Outstanding traffic accounts.

Amount due by railway companies and committees.

Amount due by railway clearing houses.

Amount due by Postmaster-General.

Accounts receivable.

Miscellaneous accounts.

Suspense accounts (if any) to be enumerated.

Special items (to be detailed).

|

£ s. d.

|

£

|

|

|

|

|

|

|

|

|

| |

Part II.

Statistical Returns.

|

| |

I.—Mileage of Lines.

|

| |

(A.)—Mileage of Lines Open for Traffic.

|

| | |

——

|

Running Lines.

|

Sidings reduced to Single Track.

|

Total of Single Track, including Sidings.

|

Year 19.

|

|

Length of Road. First Track.

|

Second Track.

|

Third Track.

|

Fourth Track.

|

Over Four Tracks (reduced to Single Track).

|

Total Miles (reduced to Single Track).

|

Total of Single Track, including Sidings.

|

|

|

M. Ch.

|

M. Ch.

|

M. Ch.

|

M. Ch.

|

M. Ch.

|

M. Ch.

|

M. Ch.

|

M. Ch.

|

M. Ch.

|

|

Lines owned by Company:

Main and principal lines:—

(Details) -

|

|

|

|

|

|

|

|

|

|

|

Total of main and principal lines.

Minor and branch lines (summarised by districts):—

(Details) -

|

|

|

|

|

|

|

|

|

|

|

Total -

|

|

|

|

|

|

|

|

|

|

|

Lines jointly owned (Company's share of ownership):

As enumerated in Abstract J.:—

(Details) -

|

|

|

|

|

|

|

|

|

|

|

Total -

Other joint lines

|

|

|

|

|

|

|

|

|

|

|

Total lines jointly owned.

|

|

|

|

|

|

|

|

|

|

|

Total miles of lines owned and Company's share of lines jointly owned.

Ditto ditto year 19.

|

|

|

|

|

|

|

|

|

|

|

| |

(A.)—Mileage of Lines Open for Traffic—continued.

|

| | |

—

|

Running Lines.

|

Sidings reduced to Single Track.

|

Total of Single Track, including Sidings.

|

Year 19.

|

|

Length of Road. First Track.

|

Second Track.

|

Third Track.

|

Fourth Track.

|

Over Four Tracks (reduced to Single Track).

|

Total Miles (reduced to Single Track).

|

Total of Single Track, including Sidings.

|

|

|

M. Ch.

|

M. Ch.

|

M. Ch.

|

M. Ch.

|

M. Ch.

|

M. Ch.

|

M. Ch.

|

M. Ch.

|

M. Ch.

|

|

Lines leased or worked:

By the Company:—

(Details) -

|

|

|

|

|

|

|

|

|

|

|

Total -

Jointly with other Companies (Company's share):

As enumerated in Abstract J.:—

(Details) -

|

|

|

|

|

|

|

|

|

|

|

Total -

Other jointly leased or worked lines.

|

|

|

|

|

|

|

|

|

|

|

Total miles of lines leased or worked and Company's share of lines jointly leased or worked.

|

|

|

|

|

|

|

|

|

|

|

Grand Total

Ditto ditto year 19.

|

|

|

|

|

|

|

|

|

|

|

| |

(B.)—Mileage of Lines authorised but not open for Traffic.

|

| | |

——

|

Miles authorised.

|

Miles constructed and not open for traffic.

|

Miles under Construction.

|

Miles not commenced, or in abeyance.

|

|

Length of Road.

|

Length of Road.

|

Length (including Sidings) reduced to Single Track.

|

Length of Road.

|

Length of Road.

|

|

Lines owned by the Company:—

New lines:

(Details) - - -

|

m. ch.

|

m. ch.

|

m. ch.

|

m. ch.

|

m. ch.

|

|

Total - - -

Ditto, year 19 -

|

|

|

|

|

|

|

Widenings and additions:

(Details) - - -

Total - - -

|

|

|

|

|

|

|

Ditto, year 19 -

|

|

|

|

|

|

|

Joint Lines (Company's Share of Ownership):—

New lines - - -

Ditto, year 19 -

Widenings and additions

Ditto, year 19 -

|

|

|

|

|

|

|

| |

(C.)—Mileage of Lines run over by the Company's Engines.

|

| | |

——

|

m. ch.

|

Year 19 . M. Ch.

|

|

Lines owned by the company - - - -

|

|

|

|

” partly owned - - - - - -

|

|

|

|

” leased, or worked by the company - - -

|

|

|

|

” leased, or worked jointly - - - -

|

|

|

|

” over which the company exercises running powers - - - - - - -

|

|

|

|

Total - - - - - - -

|

|

|

|

| |

II.—Rolling Stock.

|

| |

(A.)—Steam Locomotives and Tenders.

|

| | |

——

|

—

|

Year 19.

|

|

Description.

|

Number.

|

Number.

|

|

Tender engines:—

|

|

|

|

(Wheel types to be stated) - - - -

|

|

|

|

Tank engines:—

|

|

|

|

(Wheel types to be stated) - - - -

|

|

|

|

Tenders - - - - - - - - -

|

|

|

|

| |

(B.)—Rail Motor Vehicles.

|

| | |

—

|

—

|

—

|

Year 19.

|

|

——

|

Number.

|

Carrying Capacity.

|

Number.

|

Carrying Capacity.

|

|

|

|

Seats.

|

|

Seats.

|

|

Steam power - - -

|

|

|

|

|

|

Petrol power - - -

|

|

|

|

|

|

Other power (self-contained)

|

|

|

|

|

|

Total - -

|

|

|

|

|

|

| |

(C.)—Trains worked by Electric Power.

|

| | |

——

|

—

|

—

|

Year 19.

|

|

——

|

Number

|

Carrying Capacity.

|

Number.

|

Carrying Capacity.

|

|

Details to be filled in, as instructed by the Board of Trade from time to time, by individual companies with regard to the various systems in use -

|

|

Seats.

|

|

Seats.

|

|

| |

(D.)—Coaching Vehicles (other than Electric).

|

| | |

——

|

Number

|

Seats or Berths.

|

Year 19.

|

|

1st Class.

|

2nd Class.

|

3rd Class.

|

Total.

|

Number.

|

Seats or Berths, Total.

|

|

Passenger Carriages.

Carriages of uniform class

Composite carriages -

Restaurant cars - -

Miscellaneous - - -

|

|

|

|

|

|

|

|

|

Total - -

|

|

|

|

|

|

|

|

|

Sleeping

|

|

|

|

|

|

|

|

|

Total passenger carriages

|

|

|

|

|

|

|

|

|

Other Coaching Vehicles.

|

|

|

|

|

|

|

|

|

Post Office vans - -

Luggage, parcel and brake vans - - - -

Carriage trucks - -

Horse boxes - - -

Miscellaneous - - -

|

|

|

|

|

|

|

|

|

Total other coaching vehicles - - -

|

|

|

|

|

|

|

|

|

Total coaching vehicles -

|

|

|

|

|

|

|

|

|

| |

(E.)—Merchandise and Mineral Vehicles.

|

| | |

——

|

—

|

Year 19.

|

|

Number.

|

Number.

|

|

Open wagons:

|

|

|

|

Under 8 tons - - - - - - - -

8 and up to 12 tons - - - - -

Over 12 and up to 20 tons - - - -

Over 20 tons (other than special) - - -

|

|

|

|

Covered wagons:

|

|

|

|

Under 8 tons - - - - - - - -

8 and up to 12 tons - - - - -

Over 12 and up to 20 tons - - - -

Over 20 tons - - - - - - - -

|

|

|

|

Mineral wagons (to be shown by companies owning separate mineral stock):

Under 8 tons - - - - - - - -

8 and up to 12 tons - - - - -

Over 12 and up to 20 tons - - - -

Over 20 tons - - - - - - - -

|

|

|

|

Special wagons (for loads of exceptional dimensions and weight) - - - - - - -

|

|

|

|

Cattle trucks - - - - - - - -

Rail and timber trucks (including twin trucks) -

Brake vans - - - - - - - - -

Miscellaneous - - - - - - - -

|

|

|

|

Total - - -

|

|

|

|

| |

(F.)—Railway Service Vehicles, and Horses for Shunting.

|

| | |

——

|

Number.

|

Year 19.

|

|

Number.

|

|

Gasholder trucks - - - - - - - -

Locomotive coal wagons - - - - -

Ballast wagons - - - - - - - -

Mess and tool vans - - - - - - -

Breakdown cranes - - - - - - - -

Travelling cranes - - - - - - - -

Miscellaneous - - - - - - - -

|

|

|

|

Total - - - - -

|

|

|

|

Horses for Shunting - - - - - - -

|

|

|

|

| |

III.—Horses and Road Vehicles employed in the Collection and Delivery of Parcels, Goods, and Passengers.

|

| | |

——

|

Number.

|

Year 19.

|

|

Number.

|

|

Goods and Parcels Road Vehicles—

Road motors for goods and parcels - - -

Horse wagons and carts - - - - -

Miscellaneous - - - - - - - -

|

|

|

|

Total - - - - -

|

|

|

|

Passenger Road Vehicles—

Road motors - - - - - - - -

Tramcars - - - - - - - -

Omnibuses - - - - - - - -

Cabs - - - - - - - - -

Miscellaneous - - - - - - - -

|

|

|

|

Total - - - - -

|

|

|

|

Horses for Road Vehicles - - - -

|

|

|

|

| |

IV.—Steamboats.

|

| | |

—

|

Date of Construction.

|

Indicated Horse-Power.

|

Registered Tonnage.

|

|

Steamboats over 250 tons net -

(Name of each to be given.)

|

|

|

Tons.

|

|

Total - - - -

Do. Year 19 -

|

Number.

|

|

|

|

|

Number.

|

Total Horse-Power.

|

Total Registered Tonnage.

|

|

Steamboats of 250 tons net and under - - - - -

|

|

|

|

|

Grand Total - -

Do. Year 19 -

|

|

|

|

|

| |

V.—Canals.

|

| | |

Name.

|

Length in Miles.

|

|

|

|

|

Total Length - -

|

|

|

| |

VI—Docks, Harbours, and Wharves.

|

| |

|

| |

VII.—Hotels.

|

| |

|

| |

VIII.—Land, Property, &c., not forming part of the Railway or Stations.

|

| | |

Land.

|

Acreage.

|

Year 19.

|

|

Acreage.

|

|

Agricultural land - - - - - - - -

|

|

|

|

Urban and suburban land - - - - -

|

|

|

|

| | |

Houses.

|

Number.

|

Year 19.

|

|

Number.

|

|

Labouring class dwellings - - - - -

|

|

|

|

Houses and cottages for companies’ servants - -

|

|

|

|

Other houses and cottages - - - - -

|

|

|

|

| |

IX.—Other Industries (if any).

|

| |

[The Form to be in the Discretion of the Company.]

|

| |

X.—Maintenance and Renewal of Way and Works (Abstract A).

|

| | |

——

|

—