S.I. No. 650/2022 - Animal Health and Welfare (Fur Farming Compensation Scheme) Regulations 2022

Notice of the making of this Statutory Instrument was published in | ||

“Iris Oifigiúil” of 23rd December, 2022. | ||

I, CHARLIE McCONALOGUE, Minister for Agriculture, Food and the Marine, in exercise of the powers conferred on me by section 7 1D (3) (inserted by section 7 of the Animal Health and Welfare and Forestry (Miscellaneous Provisions) Act 2022 (No. 4 of 2022)) of the Animal Health and Welfare Act 2013 (No. 15 of 2013), hereby make the following regulations: | ||

Citation and commencement | ||

1. (1) These Regulations may be cited as the Animal Health and Welfare (Fur Farming Compensation Scheme) Regulations 2022. | ||

(2) These Regulations come into operation on 9 December 2022. | ||

Interpretation | ||

2. In these Regulations— | ||

“Act” means the Animal Health and Welfare Act 2013 ; | ||

“Applicant” means a licensee under the Musk Rats Act 1933 who has made an application for compensation under Part 12A of the Act by completing the application form set out in the schedule to these Regulations and submitting same together with any required information to the Minister in accordance with these Regulations; | ||

“Breeding Stock” means the stock of breeding males and females as set out in the statutory balance sheet relating to the financial year immediately preceding 1 January 2021; | ||

“breeding stock value” means the cost of each breeding animal as set out in the statutory balance sheet ending prior to 1 January 2021 multiplied by the quantity of breeding animals; | ||

“Income losses” means a loss (if any) of income to a fur farming business as calculated in accordance with either or both Regulation 4(1)(b) and Regulation 4(3); | ||

“net book value” is the closing valuation of a specified trading asset or assets or of a particular class or description of specified trading assets calculated solely by reference to accumulated cost less accumulated depreciation as set out in the statutory balance sheet relating to the financial year immediately preceding 1 January 2021 with any adjustments that, in the opinion of the assessor are reasonable to take account of, due to subsequent events occurring after such filing but before the commencement of these Regulations; | ||

“Non-income losses” means a loss in value of the specified trading assets and breeding stock of a fur farming business as calculated in accordance with Regulation 4(1)(a); | ||

“realisable value” means the monetary value achieved through the sale of a specified trading asset or breeding stock animal of an applicant’s fur farming business, or, in the event of no sale or a dispute over the adequacy of a monetary value (if any) achieved following a sale, as may be determined by the assessor under these Regulations; | ||

“specified trading assets” means equipment, plant and other machinery, buildings and other structures including fixtures and fittings, but excludes land, used for the purpose of the fur farming of mink before the commencement of these Regulations; | ||

“unrealised profits” means the average annual trading earnings of the applicant’s fur farming business, as determined by the assessor before taking into account interest, tax, depreciation and amortisation costs, and included in the annual financial statements ending in the 5 years immediately preceding 1 January 2021, multiplied by a factor of 5. | ||

Applications for Compensation from Musk Rats Act 1933 licensees | ||

3. (1) Subject to paragraph (2), a licensee may make an application for compensation under Part 12A of the Act by completing the application form set out in the Schedule to these Regulations and submitting same together with any required information to the Minister no later than 18 months from the date of the appointment of an assessor by the Minister. | ||

(2) An application for compensation under these Regulations may be submitted to the Minister in stages in accordance with each section of the application form set out in the Schedule provided that all stages of the application are completed and submitted no later than 18 months from the date of the appointment of an assessor by the Minister. | ||

(3) At the request of an applicant made before the expiration of the period referred to in paragraphs (1) and (2), the Minister may, if he or she is satisfied that there are exceptional circumstances for doing so, extend that period once only by such further period not exceeding 6 months. | ||

(4) Applications for compensation shall be determined by way of an assessment to be carried out in accordance with the Act and these Regulations by an Assessor appointed by the Minister under section 71E of the Act. | ||

Compensation for income and non-income losses | ||

4. (1) Subject to paragraph (2) compensation is payable with respect to the following categories of income and non-income losses incurred by the applicant as a direct result of the prohibition of fur farming: | ||

(a) an amount that represents the difference between the aggregate net book value of the specified trading assets and breeding stock value of the applicant’s fur farming business and the realisable value (if any) of same where the realisable value is lower than the aggregate net book value of the specified trading assets and breeding stock value of the applicant’s fur farming business; | ||

(b) if the unrealised profits of the applicant’s fur farming business exceed the aggregate net book value of the specified trading assets and breeding stock value, an additional amount equal to that difference. | ||

(2) Where an assessor forms the opinion that the net book value of a specified trading asset or assets or of a particular class or description of specified trading assets has: | ||

(a) been calculated otherwise than by reference to accumulated cost less accumulated depreciation, or | ||

(b) has been arrived at following an upward revaluation of the asset for the purpose of increasing the amount of compensation payable under these Regulations, | ||

he or she may, for the purpose of determining an application for compensation under these Regulations, make any adjustments to the closing valuation of the asset or assets as set out in the statutory balance sheet relating to the financial year immediately preceding 1 January 2021 that, in the opinion of the assessor, are necessary to accurately reflect the value of the asset or assets when calculated solely by reference to accumulated cost less accumulated depreciation. | ||

(3) In addition to compensation payable under paragraph (1) of this Regulation, compensation is also payable to an applicant for lost income opportunity of an amount equal to 6 per cent of the average of annual revenue generated from the sale of mink pelts in the four accounting years ending before 1 January 2020 multiplied by three. | ||

Compensation for costs incurred | ||

5. (1) Compensation is payable with respect to the following costs actually incurred by an applicant as a direct result of the prohibition of fur farming: | ||

(a) if the applicant has paid a lump sum in accordance with section 19 of the Act of 1967 to a redundant worker, an amount equal to the amount of that lump sum; | ||

(b) an amount for the costs incurred in disposing of the breeding mink; | ||

(c) an amount to reimburse an applicant for reasonable fees for professional services that are necessarily incurred following the making of these Regulations or in the preparation of an application for compensation under these Regulations the total amount of which shall not exceed €30,000; | ||

(d) an amount to reimburse an applicant for fees paid to a chartered accountant or a public relations professional or both for professional services provided to an applicant in preparing any representations to the Minister in respect of proposals to prohibit the fur farming of mink made on behalf of the applicant during the 12 month period immediately before the date of enactment of the Animal Health and Welfare and Forestry (Miscellaneous Provisions) Act 2022 (No. 4 of 2022) and ending on the date immediately preceding the date of the making of these Regulations, which amount shall, in total, not exceed €25,000; | ||

(e) subject to the maximum amounts specified in paragraph (2), an amount to reimburse an applicant for the demolition and clean-up costs incurred in the removal of buildings, specialised fencing or other structures formerly used for mink farming situated on an applicant’s land that have no other reasonable use and such amounts may include - | ||

(i) fees incurred for the preparation of tender documents for demolition and clean-up work; | ||

(ii) fees incurred for surveys required to undertake demolition and waste segregation; | ||

(iii) fees incurred for planning permission if required in relation to any demolition or clean-up work; | ||

(iv) fees incurred for the preparation of health and safety files and appointment of project supervisors for demolition and clean-up works; | ||

(v) hygienic cleaning of the fixtures, fittings and ancillary structures of the structure that is to be demolished; | ||

(vi) disposal of any wastewater produced due to hygienic cleaning of structure that is demolished; | ||

(vii) safe removal of fixtures and fittings within the structure that is demolished; | ||

(viii) safe removal of roofing, building frame, walls, flooring and foundations, as applicable of the building, fence or structure that is demolished, | ||

(ix) safe removal of ancillary effluent pipe work, rainwater disposal pipes, water supply pipes and electrical cables to the structure that is demolished; | ||

(x) demolition and infilling of any slurry or effluent transfer tanks; | ||

(xi) segregation, removal and disposal of the material resulting from the demolition, and | ||

(xii) levelling of the ground of the underlying area of the building or structure that is demolished. | ||

(f) for buildings that are not being demolished, an amount, subject to the maximum amounts specified in paragraph (2), to reimburse an applicant for the costs incurred in the repurposing of buildings formerly used for mink farming that are situated on an applicant’s land; | ||

(g) an amount for costs incurred in disposing of excess mink feedingstuffs remaining on an applicant’s farm following the commencement of Part 2 of the Animal Health and Welfare and Forestry (Miscellaneous Provisions) Act 2022 (No. 4 of 2022). | ||

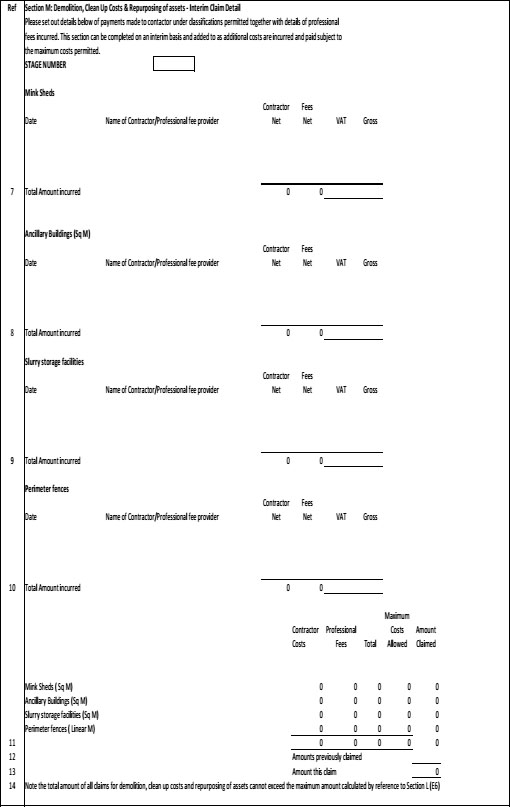

(2) Subject to paragraph 3 the maximum amount of compensation allowed under paragraph (1)(e) and (f) is: | ||

(a) €100 per square metre of the ground floor area of the buildings or structures used to house mink (“mink sheds”) being repurposed or demolished, | ||

(b) €195 per square metre of the ground floor area of ancillary buildings used exclusively for the mink farming business being repurposed or demolished, | ||

(c) €148 per square metre of the ground floor area of slurry storage facilities being repurposed or demolished, and | ||

(d) €96 per linear metre for specialised perimeter fencing used to secure the mink house compound being repurposed or demolished based on the length of these structures. | ||

(3) The Minister may, if satisfied that there are exceptional circumstances for doing so, adjust the maximum amount of compensation allowed under paragraph (1)(e) and (f) by way of amending Regulation. | ||

(4) Applications for compensation under paragraph (1)(e) and (f) may be submitted to the Minister in stages subject to a maximum number of 4 stages. | ||

(5) “demolished” includes, in paragraphs (a), (b) and (c) of paragraph (2), the demolishment of all overground and underground ancillary services and tanks relating to the structures. | ||

6. (1) To qualify for compensation under paragraph (1)(e) and (f) an applicant shall: | ||

(a) seek a detailed planned scope of works for assets which are to be demolished or repurposed from a firm of Chartered Quantity Surveyors, | ||

(b) using the scope of works, seek proposals from at least three qualifying contractors in the form of a tender which must be submitted for prior approval by the Minister or an assessor appointed by the Minister in accordance with the Act, and | ||

(c) submit the details, terms, conditions and costs of the proposed contractor selected by the applicant in the tender process for prior approval by the Minister or an assessor appointed by the Minister in accordance with the Act. | ||

Training Fund | ||

7. (1) Subject to paragraphs (2) and (3), compensation is payable with respect to costs actually incurred by an applicant in establishing a training fund for the benefit of redundant workers. | ||

(2) Compensation payable under paragraph (1) shall not exceed 30 per cent of the average annual payroll cost of the applicant’s fur farming business in the five financial years immediately preceding 1 January 2021 and excluding costs associated with employers PRSI contributions, pension costs and statutory directors. | ||

(3) Compensation shall only be payable for establishing a training fund where an applicant can demonstrate to the satisfaction of the assessor that the training fund established by the applicant has been distributed among redundant workers in a manner proportionate with their respective salaries. | ||

Advance payment to an applicant | ||

8. (1) The Minister may, at his discretion, make an advance payment to an applicant in respect of any particular income loss, non-income loss or type of cost where the Minister is satisfied that the applicant has an entitlement to recover an amount of compensation under the particular category of income loss, non-income loss or cost in relation to which advance payment is sought and that it is appropriate in all the circumstances to make an advance payment of compensation to the applicant. | ||

(2) An applicant may request an advance payment of compensation under paragraph 1 by writing to the Minister and setting out the reason for seeking the advance payment and providing any available information to support that request. | ||

(3) Where an advance payment is made under paragraph (1) the Minister shall recover the amount of any advance payment made to an applicant by deducting the amount of that advance payment from any compensation payment to be made to the applicant following a determination of the applicants claim by an assessor in accordance with the Act and these Regulations. | ||

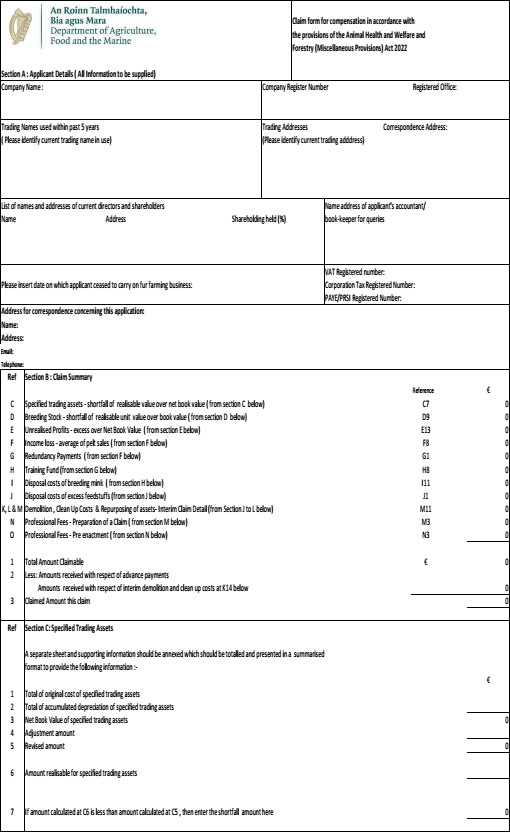

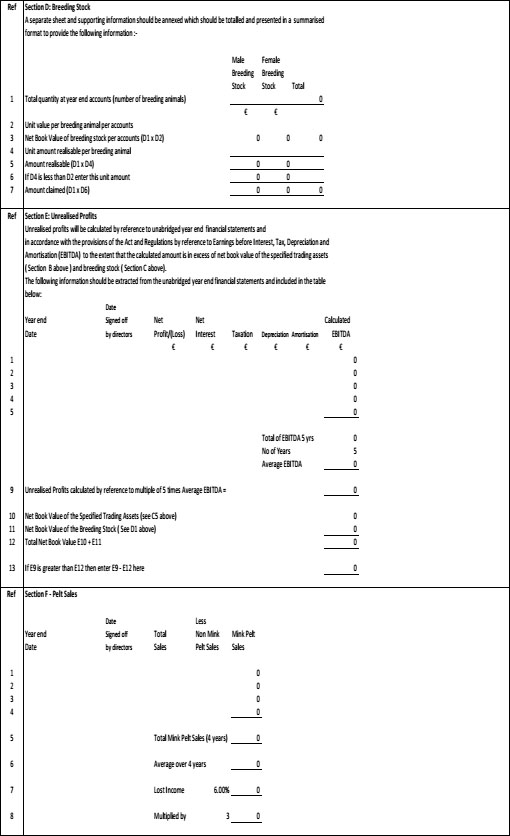

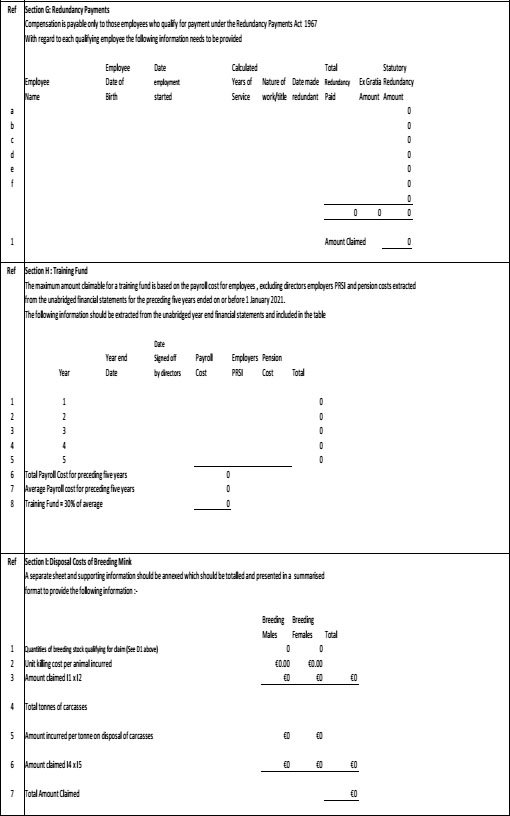

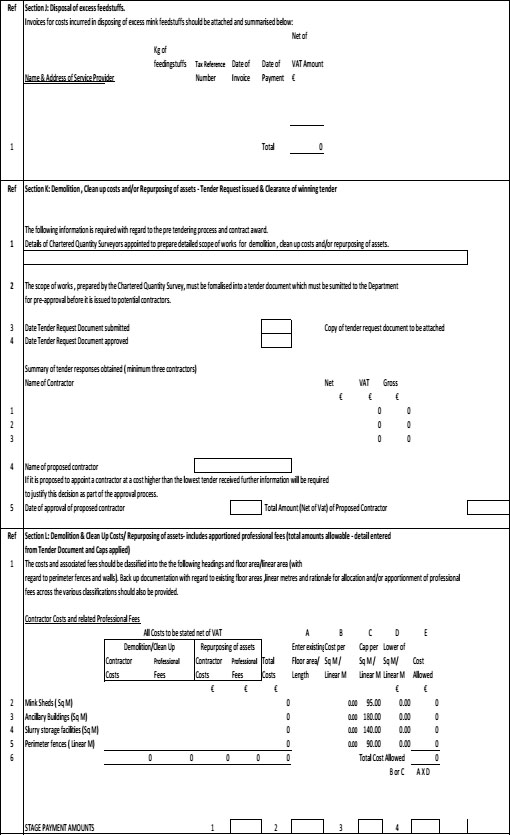

SCHEDULE | ||

Regulation 3(1) | ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

GIVEN under my Official Seal, | ||

8 December, 2022. | ||

CHARLIE MCCONALOGUE, | ||

Minister for Agriculture, Food and the Marine. | ||

EXPLANATORY NOTE | ||

(This note is not part of the Instrument and does not purport to be a legal interpretation) | ||

These Regulations are made under section 7 1D (3) (inserted by section 7 of the Animal Health and Welfare and Forestry (Miscellaneous Provisions) Act 2022 (No. 4 of 2022) of the Animal Health and Welfare Act 2013 (No. 15 of 2013) and provide for a scheme of compensation for licensees under the Musk Rats Act of 1933 affected by the prohibition on fur farming. |