Finance Act 2021

|

Residential zoned land tax | ||

|

80. (1) The Principal Act is amended— | ||

(a) by the insertion of the following Part after Part 22: | ||

“PART 22A | ||

Residential zoned land tax | ||

Chapter 1 | ||

Interpretation | ||

Interpretation | ||

653A. (1) In this Part— | ||

‘Act of 1990’ means the Building Control Act 1990 ; | ||

‘Act of 2000’ means the Planning and Development Act 2000 ; | ||

‘building’ has the same meaning as it has in the Act of 1990; | ||

‘certificate of compliance on completion’ means a certificate of compliance provided for under section 6(2)(a)(i) of the Act of 1990 relating to the completion of a building; | ||

‘commencement notice’ means a notice referred to in section 6(2)(k) of the Act of 1990; | ||

‘designated liable person’ shall be construed in accordance with section 653V; | ||

‘development’ has the same meaning as it has in Chapter 1 of Part 22; | ||

‘draft map’ has the meaning assigned to it by section 653C(1); | ||

‘final map’ has the meaning assigned to it by section 653K; | ||

‘gross floor space’, in relation to a building, means the area ascertained by the internal measurement of the floor space on each floor of the building, including internal walls and partitions; | ||

‘land which satisfies the relevant criteria’ shall be construed in accordance with section 653B; | ||

‘liability date’, in respect of a year, means 1 February in that year; | ||

‘liable person’ has the meaning assigned to it by section 653P; | ||

‘local authority’ means a local authority for the purposes of the Local Government Act 2001 ; | ||

‘local authority consent’ means— | ||

(a) a notice sent in accordance with the procedure outlined in article 84(1) of the Planning and Development Regulations 2001 ( S.I. No. 600 of 2001 ) in respect of local authority own development, as prescribed under section 179 of the Act of 2000 and article 80(1) of those Regulations, to indicate that, as the case may be, the local authority will carry out the proposed development or carry out the proposed development subject to variations or modifications, or | ||

(b) where paragraph (d) or (e) of section 179(6) of the Act of 2000 applies, an approval granted by An Bord Pleanála in accordance with section 175 or 177AE, as the case may be, of that Act; | ||

‘market value’ has the same meaning as it has in the Capital Gains Tax Acts; | ||

‘Minister’ means the Minster for Finance; | ||

‘permission regulations’ means regulations made under section 33, 37I, 43, 172(2), 174, 177N or 177AD of the Act of 2000; | ||

‘personal data’ has the same meaning as it has in Regulation (EU) 2016/679 of the European Parliament and of the Council of 27 April 201640 ; | ||

‘planning application’ means an application for permission for the development of land made in accordance with, and required by, permission regulations; | ||

‘planning permission’ means a permission granted under section 34, 37, 37G, 170, or 177K of the Act of 2000; | ||

‘planning permission period’, in relation to a grant of planning permission, means the appropriate period (within the meaning of section 40 of the Act of 2000), including that period as extended in accordance with section 42 of the Act of 2000 (or that section as modified in accordance with section 42B of the Act of 2000); | ||

‘residential property’ has the same meaning as it has in the Finance (Local Property Tax) Act 2012 ; | ||

‘relevant site’ has the meaning assigned to it by section 653O; | ||

‘residential development’ has the same meaning as it has in section 644A; | ||

‘residential zoned land tax’ has the meaning assigned to it by section 653Q; | ||

‘return date’, in respect of a year, means 23 May in that year; | ||

‘revised map’ has the meaning assigned to it by section 653M; | ||

‘self-assessment’ means an assessment by a liable person, or by a person acting under the authority of a liable person, of the amount of residential zoned land tax payable by the liable person in respect of a relevant site in relation to a liability date; | ||

‘site’ means any area of land identified on a map by a local authority; | ||

‘supplemental map’ has the meaning assigned to it by section 653F; | ||

‘TIN’ means a tax reference number (within the meaning of section 891B) or a TIN (within the meaning of section 891F); | ||

‘vacant or idle land’ means land which, having regard only to development (within the meaning of the Act of 2000) which is not unauthorised development (within the meaning of the Act of 2000), is not required for, or integral to, the operation of a trade or profession being carried out on, or adjacent to, the land; | ||

‘valuation date’ shall be construed in accordance with section 653R. | ||

(2) In this Part, other than in subsection (1) and section 653AF(1)(a), a reference to a planning permission shall be construed as including a reference to a local authority consent. | ||

Chapter 2 | ||

Zoned serviced residential development land | ||

Criteria for inclusion in map | ||

653B. In this Part, a reference to land which satisfies the relevant criteria is a reference to land that— | ||

(a) is included in a development plan, in accordance with section 10(2)(a) of the Act of 2000, or local area plan, in accordance with section 19(2)(a) of the Act of 2000, zoned— | ||

(i) solely or primarily for residential use, or | ||

(ii) for a mixture of uses, including residential use, | ||

(b) it is reasonable to consider may have access, or be connected, to public infrastructure and facilities, including roads and footpaths, public lighting, foul sewer drainage, surface water drainage and water supply, necessary for dwellings to be developed and with sufficient service capacity available for such development, and | ||

(c) it is reasonable to consider is not affected, in terms of its physical condition, by matters to a sufficient extent to preclude the provision of dwellings, including contamination or the presence of known archaeological or historic remains, | ||

but which is not land— | ||

(i) that is referred to in paragraph (a)(i) and, having regard only to development (within the meaning of the Act of 2000) which is not unauthorised development (within the meaning of the Act of 2000), is in use as premises, in which a trade or profession is being carried on, that is liable to commercial rates, that it is reasonable to consider is being used to provides services to residents of adjacent residential areas, | ||

(ii) that is referred to in paragraph (a)(ii), unless it is reasonable to consider that the land is vacant or idle, | ||

(iii) that it is reasonable to consider is required for, or is integral to, occupation by— | ||

(I) social, community or governmental infrastructure and facilities, including infrastructure and facilities used for the purposes of public administration or the provision of education or healthcare, | ||

(II) transport facilities and infrastructure, | ||

(III) energy infrastructure and facilities, | ||

(IV) telecommunications infrastructure and facilities, | ||

(V) water and wastewater infrastructure and facilities, | ||

(VI) waste management and disposal infrastructure, or | ||

(VII) recreational infrastructure, including sports facilities and playgrounds, | ||

(iv) that is subject to a statutory designation that may preclude development, or | ||

(v) on which the derelict sites levy is payable in accordance with the Derelict Sites Act 1990 . | ||

Draft map - preparation | ||

653C. (1) A local authority shall prepare, in respect of its functional area, a map in draft form (in this Part referred to as a ‘draft map’)— | ||

(a) indicating land that, based on the information available to it, it considers to be land satisfying the relevant criteria one month prior to the date specified in subsection (2), and | ||

(b) specifying— | ||

(i) the date on which, based on the information available to it, it considers that land referred to in paragraph (a) first satisfied the relevant criteria, where that date is after 1 January 2022, and | ||

(ii) the total area, in hectares, of land referred to in paragraph (a). | ||

(2) A local authority shall, not later than 1 November 2022— | ||

(a) publish a draft map on the website maintained by it, and | ||

(b) make a copy of the draft map available for inspection at its offices. | ||

(3) A local authority shall publish, not later than 1 November 2022, a notice in accordance with subsection (4) in one or more newspapers circulating in its functional area. | ||

(4) The notice referred to in subsection (3) shall include the following: | ||

(a) a statement that a draft map, prepared under this section, has been published on the website maintained by the local authority and is available for inspection at its offices; | ||

(b) a statement that the map has been prepared under this section for the purposes of identifying land that is to be subject to the residential zoned land tax; | ||

(c) the text of section 653B; | ||

(d) a statement that residential properties, notwithstanding that they may be included on the draft map, shall not be chargeable to the residential zoned land tax; | ||

(e) a statement that— | ||

(i) submissions on the draft map may be made in writing to the local authority concerned not later than 1 January 2023, regarding— | ||

(I) either the inclusion in or exclusion from the final map of specific sites, or | ||

(II) the date on which a site first satisfied the relevant criteria, | ||

and | ||

(ii) any such written submissions received by the date referred to in subparagraph (i), other than such elements of a submission which may constitute personal data, shall be published on the website maintained by the local authority concerned not later than 11 January 2023; | ||

(f) where land is included in a development plan or local area plan in accordance with section 10(2)(a) or 19(2)(a) of the Act of 2000 zoned— | ||

(i) solely or primarily for residential use, or | ||

(ii) for a mixture of uses, including residential use, | ||

a statement that a person may, in respect of land that such a person owns, make a submission to the local authority requesting a variation of the zoning of that land. | ||

(5) The form of the notice referred to in subsection (3) shall be prepared by the Minister for Housing, Local Government and Heritage in consultation with the Minister for Finance. | ||

Draft map - submissions | ||

653D. (1) A person may, not later than 1 January 2023, make a submission in writing, on a draft map published in accordance with section 653C(2), regarding— | ||

(a) the inclusion in, or exclusion from, the final map of a site, or | ||

(b) the date on which a site first satisfied the relevant criteria, | ||

by sending the submission, together with the person’s name and address, to the local authority concerned. | ||

(2) A local authority shall publish, not later than 11 January 2023, on the website maintained by it, the submissions (other than such elements of a submission which may constitute personal data), if any, received by it in accordance with subsection (1). | ||

(3) Where a submission under subsection (1) is made by the owner of a site, the submission shall be accompanied by a map prepared by Ordnance Survey Ireland at a scale at which the site can be accurately identified. | ||

(4) Where a submission under subsection (1) is made by the owner of the site, that person shall have available such evidence as is necessary to prove their ownership of the site, and in determining whether section 653E applies to a submission, the local authority may request that such evidence is provided to the local authority. | ||

Draft map - determinations on exclusions and date | ||

653E. (1) Where a submission is made in accordance with section 653D by the owner of a site seeking— | ||

(a) the exclusion of a site from a final map, on the basis that the land constituting the site does not satisfy the relevant criteria, or | ||

(b) a change to the date specified in the map as the date on which land constituting a site first satisfied the relevant criteria, | ||

the local authority shall— | ||

(i) evaluate the submission, | ||

(ii) determine whether or not— | ||

(I) the site constitutes land satisfying the relevant criteria, or | ||

(II) the date specified in the map as the date on which the land constituting the site first satisfied the relevant criteria should be changed, | ||

and | ||

(iii) not later than 1 April 2023, notify the owner concerned in writing of its determination. | ||

(2) Before making a determination under subsection (1), a local authority may, where it considers it to be necessary for the purposes of making the determination, within 21 days from the date referred to in 653D(1), request further information from the owner of the site, Irish Water, the National Roads Authority or from a person referred to in article 28 of the Planning and Development Regulations 2001. | ||

(3) Where a local authority requests information under subsection (2), the person requested shall provide that information to the local authority within 21 days of receipt of the request. | ||

(4) Submissions may be made in writing to a local authority after 1 January 2023 in respect of a draft map, where exceptional circumstances arise and the local authority consents to the submission after that date. | ||

(5) A notification referred to in subsection (1) shall— | ||

(a) include the reasons for the determination made under that subsection, and | ||

(b) state that the owner may, within one month of receipt of the notification, appeal the determination under section 653J, by notice in writing, specifying the grounds for the appeal, to An Bord Pleanála. | ||

Supplemental map - preparation | ||

653F. (1) Where a submission is made in accordance with section 653D by a person seeking the inclusion of a site on a final map, on the basis that the site constitutes land satisfying the relevant criteria, the local authority shall evaluate the submission. | ||

(2) Where a local authority considers that— | ||

(a) sites in respect of which submissions referred to in subsection (1) have been made, or | ||

(b) based on the information available to it one month prior to the date referred to in subsection (3), other sites not included in the draft map previously published by the local authority, | ||

constitute lands satisfying the relevant criteria, the local authority shall prepare, in respect of its functional area, a further map in draft form (in this Part referred to as a ‘supplemental map’)— | ||

(i) indicating that, based on the information available to the local authority, the lands constituting such sites are considered by the local authority to be lands satisfying the relevant criteria, and | ||

(ii) specifying— | ||

(I) the date on which, based on the information available to it, it considers that land referred to in paragraph (i) first satisfied the relevant criteria, where that date is after 1 January 2022, and | ||

(II) the total area, in hectares, of land referred to in paragraph (i). | ||

(3) A local authority shall, not later than 1 May 2023— | ||

(a) publish a supplemental map on the website maintained by it, and | ||

(b) make a copy of the supplemental map available for inspection at its offices. | ||

(4) A local authority shall publish, not later than 1 May 2023, a notice in accordance with subsection (5) in one or more newspapers circulating in its functional area. | ||

(5) The notice referred to in subsection (4) shall include the following: | ||

(a) a statement that a supplemental map, prepared under this section, identifying additions to the draft map previously published by the local authority, has been published on the website maintained by the local authority and is available for inspection at its offices; | ||

(b) a statement that the map has been prepared under this section for the purposes of identifying land that is to be subject to the residential zoned land tax; | ||

(c) the text of section 653B; | ||

(d) a statement that residential properties, notwithstanding that they may be included on the supplemental map, shall not be chargeable to the residential zoned land tax; | ||

(e) a statement that— | ||

(i) submissions on the supplemental map, regarding— | ||

(I) the exclusion from the final map of specific sites, or | ||

(II) the date on which land constituting a site first satisfied the relevant criteria, | ||

may be made in writing to the local authority concerned not later than 1 June 2023, and | ||

(ii) any such written submissions received by the date referred to in subparagraph (i) shall, other than such elements of a submission which may constitute personal data be published on the website maintained by the local authority concerned not later than 11 June 2023. | ||

(6) The form of the notice referred to in subsection (5) shall be prepared by the Minister for Housing, Local Government and Heritage in consultation with the Minister for Finance. | ||

Supplemental map - submissions | ||

653G. (1) A person may, not later than 1 June 2023, make a submission on a supplemental map published in accordance with section 653F regarding— | ||

(a) the exclusion from the final map of a site, or | ||

(b) the date on which the land constituting a site first satisfied the relevant criteria, | ||

by sending the submission, together with the person’s name and address, to the local authority in writing. | ||

(2) A local authority shall publish, not later than 11 June 2023, on the website maintained by it, the written submissions (other than such elements of a submission which may constitute personal data), if any, received by it in accordance with subsection (1). | ||

(3) Where a submission under subsection (1) is made by the owner of a site, the submission shall be accompanied by a map prepared by Ordnance Survey Ireland at a scale at which the site can be accurately identified. | ||

(4) Where a submission under subsection (1) is made by the owner of the site, that person shall have available such evidence as is necessary to prove their ownership of the site, and in determining whether section 653H applies to a submission, the local authority may request that such evidence is provided to the local authority. | ||

Supplemental map - determinations on exclusions and date | ||

653H. (1) Where a submission is made in accordance with section 653G by the owner of a site seeking— | ||

(a) the exclusion of a site from a final map, on the basis that the land constituting the site does not satisfy the relevant criteria, or | ||

(b) a change to the date specified in the map as the date on which the land constituting a site first satisfied the relevant criteria, | ||

the local authority shall— | ||

(i) evaluate the submission, | ||

(ii) determine whether or not— | ||

(I) the site constitutes land satisfying the relevant criteria, or | ||

(II) the date specified in the map as the date on which the land constituting a site first satisfied the relevant criteria should be changed, | ||

and | ||

(iii) not later than 1 August 2023, notify the owner concerned, in writing, of its determination. | ||

(2) Before making a determination under subsection (1), a local authority may, where the local authority considers it to be necessary for the purposes of making the determination, within 21 days of receipt of the submission concerned, request further information from the owner of the site, Irish Water, the National Roads Authority or from a person referred to in article 28 of the Planning and Development Regulations 2001. | ||

(3) Where a local authority requests information under subsection (2), the person requested shall provide that information to the local authority within 21 days of receipt of the request. | ||

(4) Submissions may be made in writing to a local authority after 1 June 2023 in respect of a supplemental map, where exceptional circumstances arise and the local authority consents to the submission after that date. | ||

(5) A notification referred to in subsection (1) shall— | ||

(a) include the reasons for the determination made under that subsection, and | ||

(b) state that the owner may, within one month of receipt of the notification, appeal the determination under section 653J, by notice in writing, specifying the grounds for the appeal, to An Bord Pleanála. | ||

Zoning submissions | ||

653I. (1) A person, who is the owner of such lands, may make a submission in writing— | ||

(a) before 1 January 2023, to a local authority on a draft map published in accordance with section 653C, or | ||

(b) before 1 June 2023, to a local authority on a supplemental map published in accordance with section 653F, | ||

requesting a change to the zoning of lands included in the draft map or supplemental map, as the case may be. | ||

(2) Subject to subsection (3), a local authority shall publish, on a website maintained by it, the written submissions if any, received by it in accordance with subsection (1). | ||

(3) Subsection (3A) of section 13 of the Act of 2000 shall apply in respect of the publication of a submission under subsection (2) as if the submission were a submission received by a local authority under that section. | ||

(4) Where a submission is made in accordance with subsection (1), the local authority shall— | ||

(a) evaluate the submission, and | ||

(b) consider whether to propose to make a variation under section 13 of the Act of 2000. | ||

Appeal | ||

653J. (1) An owner who is aggrieved with the determination of a local authority under section 653E may, not later than 1 May 2023, appeal that determination, by notice in writing, specifying the grounds for the appeal, to An Bord Pleanála. | ||

(2) An owner who is aggrieved with the determination of a local authority under section 653H may, not later than 1 September 2023, appeal that determination, by notice in writing, specifying the grounds for the appeal, to An Bord Pleanála. | ||

(3) In considering an appeal of a determination referred to in subsection (1) or (2), An Bord Pleanála— | ||

(a) shall consider the determination concerned, | ||

(b) shall consider the grounds for appeal set out in the notice of appeal, and | ||

(c) may, within 21 days of receipt of the appeal, where An Bord Pleanála considers it to be necessary for the purposes of making a decision, request further information from the owner of the site, the local authority, Irish Water, the National Roads Authority or from a person referred to in article 28 of the Planning and Development Regulations 2001. | ||

(4) Where An Bord Pleanála requests information under subsection (3)(c), the person requested shall provide that information to An Bord Pleanála within 21 days of receipt of the request. | ||

(5) On completion of its considerations of the matters referred to in paragraphs (a) and (b) of subsection (3) and the information, if any, provided pursuant to a request under paragraph (c) of that subsection, An Bord Pleanála shall make a decision on the appeal as soon as practicable in all the circumstances of the case, and in any case— | ||

(a) where the appeal is an appeal referred to in subsection (1), not later than 16 weeks from the date of the notice of appeal, or | ||

(b) where the appeal is an appeal referred to in subsection (2), not later than 8 weeks from the date of the notice of appeal, | ||

which may be a decision to— | ||

(i) confirm the determination of the local authority, | ||

(ii) set aside the determination of the local authority and allow the appeal, or | ||

(iii) confirm the determination of the local authority in part and set aside the determination of the local authority and allow the appeal in part. | ||

(6) An Bord Pleanála shall notify the appellant and the local authority concerned of the decision under subsection (5) as soon as practicable after it is made. | ||

Final map | ||

653K. A local authority shall— | ||

(a) taking into account the inclusion of sites in the supplemental map prepared by it, | ||

(b) having given due consideration to the submissions, if any, received by it in accordance with sections 653D and 653G, | ||

(c) reflecting the determinations, if any, made under section 653E and 653H or, where any such determination has been appealed under section 653J, the decision in the appeal relating to that determination, | ||

(d) reflecting changes to the zoning of land as a result of— | ||

(i) a review of the development plan concerned carried out under section 11 of the Act of 2000, | ||

(ii) the variations, if any, made to the development plan concerned under section 13 of the Act of 2000, or | ||

(iii) the making or amendment of a local area plan under section 20 of the Act of 2000, | ||

since the publication by the local authority of a draft map in accordance with section 653C, as a result of which the land is no longer land which satisfies the relevant criteria, | ||

make such revisions to the draft map as it considers appropriate and publish, no later than 1 December 2023, a map (in this Part referred to as a ‘final map’)— | ||

(I) identifying the land satisfying the relevant criteria within its functional area, and | ||

(II) specifying— | ||

(A) the date on which land identified on the map first satisfied the relevant criteria, where that date is after 1 January 2022, and | ||

(B) the total area, in hectares, of land identified on the map. | ||

Effect of appeal or judicial review | ||

653L. Where— | ||

(a) an appeal made under section 653J, or | ||

(b) a judicial review of a determination made by a local authority under section 653E or 653H or a decision of An Bord Pleanála under section 653J, | ||

is not determined on the date that is 30 days prior to the date on which the final map is required to be published under this Chapter, the area of land to which the appeal or judicial review, as the case may be, relates shall be included on the final map. | ||

Revision of final maps | ||

653M. (1) Each local authority shall, by 31 January in each year, commencing in 2025, revise the final map previously published by it under this Chapter and publish that final map as so revised (in this Part referred to as a ‘revised map’). | ||

(2) Sections 653C to 653E and sections 653J to 653L shall apply for the purposes of the revision of a final map under subsection (1), subject to the following modifications: | ||

(a) the references in subsections (2) and (3) of section 653C to 1 November 2022 shall be construed as references to 1 February in the year immediately prior to the year concerned; | ||

(b) the notice published under section 653C(4) shall include a statement that the proposed inclusions and proposed exclusions are subject to submissions received, and that owners who support the proposed exclusion of their land should make a submission in support of such exclusion; | ||

(c) the reference in section 653C(4)(e)(i) to 1 January 2023 shall be construed as a reference to 1 April in the year immediately prior to the year concerned; | ||

(d) the reference in section 653C(4)(e)(ii) to 11 January 2023 shall be construed as a reference to 11 April in the year immediately prior to the year concerned; | ||

(e) section 653C(4)(f) shall not apply; | ||

(f) the reference in section 653D(1) to 1 January 2023 shall be construed as a reference to 1 April in the year immediately prior to the year concerned; | ||

(g) the reference in section 653D(2) to 11 January 2023 shall be construed as a reference to 11 April in the year immediately prior to the year concerned; | ||

(h) the draft map shall identify any land which was on the final map previously published by the local authority under this Chapter that it is proposed to include or exclude from the revised map; | ||

(i) the reference in section 653E(1)(iii) to 1 April 2023 shall be construed as a reference to 1 July in the year immediately prior to the year concerned; | ||

(j) the reference in section 653J(1) to 1 May 2023 shall be construed as a reference to 1 August in the year immediately prior to the year concerned. | ||

Receipt of information by Revenue Commissioners | ||

653N. Where it comes to the attention of the Revenue Commissioners that land— | ||

(a) within the functional area of a local authority, and | ||

(b) which the Revenue Commissioners consider satisfies the relevant criteria, | ||

is not included in the map most recently published by the local authority under this Chapter— | ||

(i) the Revenue Commissioners shall notify the local authority that such land has come to its attention, and | ||

(ii) the local authority shall take the information notified to it under paragraph (i) into account when preparing a revision of its final map in accordance with section 653M. | ||

Relevant site | ||

653O. (1) In this Part, subject to subsection (2), ‘relevant site’ means a site which— | ||

(a) is not a residential property, and | ||

(b) is included in the final map most recently published under section 653K or 653M, as the case may be, by the local authority in whose functional area the site is situated. | ||

(2) So much of a site as does not form part of a residential property, within the meaning of the Finance (Local Property Tax) Act 2012 , by virtue only of section 2A(4) of that Act, shall not be a relevant site. | ||

(3) Where, subsequent to it becoming a relevant site, planning permission is granted in respect of a portion of the site, that portion of the site (referred to in this section as a ‘new relevant site’) shall, from the date on which planning permission is granted, for the purposes of this Part, be treated as a separate relevant site to the remainder of the site of which it forms a portion. | ||

(4) Where subsection (3) applies, subject to sections 653AG and 653AH, a new relevant site shall have the same liability date and valuation date as the relevant site of which it forms a portion (in this subsection referred to as the ‘original site’), but the market value of that original site and any amount charged on that original site under section 653Q(4) shall be apportioned between the original site and the new relevant site or if there is more than one new relevant site, each new relevant site, on a just and reasonable basis. | ||

(5) Where in relation to a relevant site to which section 653AH applies, a certificate of compliance on completion is lodged with a local authority in respect of the completion of residential development on the relevant site and that certificate is in respect of— | ||

(a) the completion of development of the whole of a relevant site, that site shall cease, on the lodging of the certificate of compliance on completion, to be a relevant site, or | ||

(b) the completion of development of part of the relevant site, then subsections (3) and (4) shall apply such that that part of the site shall immediately prior to the lodging of the certificate of compliance on completion be treated as a new relevant site, and that new relevant site shall cease, on the lodging of the certificate of compliance on completion, to be a relevant site. | ||

Liable persons | ||

653P. (1) For the purposes of this Part— | ||

‘liable person’, in respect of a relevant site, is, subject to section 653V and 653AI, the owner of that site on the liability date; | ||

‘owner’, in relation to land, means— | ||

(a) in relation to land that is registered land within the meaning of the Registration of Title Act 1964 , the person registered as, or deemed to be registered as, the owner of the land under that Act, | ||

(b) in relation to all other land, a person, other than a mortgagee not in possession, who, whether in his or her own right or as trustee or agent for any other person, is entitled to receive the rack rent of the land or, where the land is not let at a rack rent, would be so entitled if it were so let, or | ||

(c) a person who holds any estate, interest or right in accordance with which that person may carry out development on or to the land. | ||

(2) The absence of documentary evidence, or the disputing by or on behalf of a person (in this subsection referred to as the ‘disputant’) of the existence of documentary evidence, of title to a relevant site shall, not of itself preclude— | ||

(a) the making of an assessment to residential zoned land tax in relation to the relevant site or, as the case may be, the making of an assessment to such tax on the disputant in relation to the relevant site, or | ||

(b) the making of a finding that a person or, as the case may be, the disputant is, for the purposes of this Part, a liable person in relation to the relevant site. | ||

Chapter 3 | ||

Residential zoned land tax | ||

Charge to residential zoned land tax | ||

653Q. (1) Subject to the provisions of this Part, there shall be charged and levied annually on the liability date a tax to be known as the ‘residential zoned land tax’— | ||

(a) in respect of a relevant site which constitutes land satisfying the relevant criteria on 1 January 2022, for each year commencing with the year 2024, and | ||

(b) in respect of a relevant site which constitutes land first satisfying the relevant criteria after 1 January 2022, for each year commencing with the third year following the year in which the land satisfies the relevant criteria. | ||

(2) The residential zoned land tax shall be payable in relation to a relevant site on or before the return date in the year in respect of which the tax is charged and shall, where there is a liable person in respect of the relevant site, be so payable by the liable person. | ||

(3) Where more than one person is a liable person in relation to a relevant site on or before the return date, those persons shall be jointly and severally liable for the residential zoned land tax payable in respect of the relevant site. | ||

(4) Any residential zoned land tax or interest referred to in section 653Y which is due and owing shall be and remain a charge on the land to which it relates. | ||

Amount of residential zoned land tax | ||

653R. (1) The valuation date in relation to a relevant site shall, subject to sections 653AG and 653AH be— | ||

(a) in respect of the year in which the residential zoned land tax first applies to a liable person in respect of the relevant site, the liability date, and | ||

(b) for each successive 3-year period thereafter, 1 February in the year following the third year of the 3-year period. | ||

(2) The amount of residential zoned land tax to be charged in respect of a relevant site shall be the amount represented by A in the formula— | ||

A = B x C | ||

where— | ||

B is the market value of a relevant site on the valuation date, and | ||

C is the rate of 3 per cent. | ||

Chapter 4 | ||

Pay and file obligations | ||

Obligation to register | ||

653S. (1) Where a site in respect of which a person is an owner is— | ||

(a) a relevant site, or | ||

(b) a site that would be a relevant site but for section 653O(2), | ||

the person shall register as the owner of the site and, for this purpose, shall— | ||

(i) send to the Revenue Commissioners a statement, in the form specified by the Revenue Commissioners, of particulars relating to the person and the site, or | ||

(ii) include the particulars specified in the form referred to in paragraph (i) in a return made under this Part. | ||

(2) The Revenue Commissioners shall establish and maintain a register of the information provided to them under subsection (1). | ||

(3) The Revenue Commissioners may assign a unique identification number to each site on the register referred to in subsection (2). | ||

(4) Where the Revenue Commissioners assign a unique identification number to a site under subsection (3), they shall notify the liable person in respect of the site. | ||

Obligation on liable person to prepare and deliver return | ||

653T. (1) A liable person shall prepare and deliver to the Revenue Commissioners, on or before the return date, a return and self-assessment in the form prescribed by the Revenue Commissioners for that purpose. | ||

(2) Without prejudice to the generality of subsection (1), the Revenue Commissioners may prescribe the following information to be included in a return referred to in that subsection: | ||

(a) in respect of a relevant site— | ||

(i) the address, | ||

(ii) the unique identifier, or identifiers, allocated to the site under the Registration of Title Act 1964 , | ||

(iii) the market value, | ||

(iv) the valuation date relevant to the return, and | ||

(v) the area, in hectares; | ||

(b) the name of the local authority in whose functional area a site is situated; | ||

(c) in respect of a liable person or designated liable person, as the case may be— | ||

(i) the person’s name, | ||

(ii) the person’s TIN, | ||

(iii) the nature of the person’s ownership interest in the site, | ||

(iv) the person’s address for correspondence, and | ||

(v) where there is more than one owner in relation to a relevant site, the information referred to in paragraphs (i) to (iv) in respect of each owner; | ||

(d) the unique identification number issued by the Revenue Commissioners under section 653S(3), where such a number has been issued; | ||

(e) details of any exemption from, abatement or deferral of, or repayment of residential zoned land tax, including of any claims made in accordance with section 653AD, 653AE, 653AF, 653AH or 653AI. | ||

(3) Notwithstanding section 851A, the Revenue Commissioners shall publish the information referred to in paragraphs (a) and (b) of subsection (2) on the website maintained by them. | ||

One return in respect of jointly owned relevant site | ||

653U. (1) Where 2 or more persons are liable persons in relation to a relevant site, the designated liable person in relation to the site shall prepare and deliver the return referred to in section 653T(1). | ||

(2) The preparation and delivery of a return referred to in subsection (1)— | ||

(a) shall operate to satisfy the obligation of the other liable person, or liable persons, as the case may be, under section 653T, and | ||

(b) shall bind the other liable person, or liable persons. | ||

(3) Where— | ||

(a) more than one return is delivered in respect of a relevant site, and | ||

(b) one of the returns is delivered by the designated liable person, | ||

the Revenue Commissioners shall notify the person who is not the designated liable person that a return has been delivered by the designated liable person. | ||

(4) Where— | ||

(a) more than one return is prepared and delivered in respect of a relevant site, and | ||

(b) there is no designated liable person in relation to the relevant site, | ||

the Revenue Commissioners shall designate a person to be the designated liable person in accordance with section 653V and subsection (2) shall apply accordingly. | ||

Designated liable person | ||

653V. (1) In this section ‘specified class of person’ means a class of person specified in the Table to this section. | ||

(2) This section has effect for the purpose of determining who shall be the designated liable person for the purposes of section 653U(1). | ||

(3) Subject to subsections (4) and (5), for the purposes of section 653U(1), the designated liable person shall be— | ||

(a) if only one of the specified classes of person is applicable in the circumstances concerned, the person who falls within that specified class, or | ||

(b) if more than one of the specified classes of person are applicable in the circumstances concerned, the person who falls within whichever of those applicable classes is the class that appears, in the Table to this section, before the other applicable class or classes. | ||

(4) Notwithstanding subsection (3), for the purposes of section 653U(1) the designated liable person shall, if the Revenue Commissioners exercise the power under subsection (5), be the person specified by them in the exercise of that power. | ||

(5) The Revenue Commissioners may specify in writing that one of the liable persons, referred to in section 653U(1), in relation to a relevant site shall be the designated liable person if either— | ||

(a) they are of the opinion that it would be more appropriate that that person be the designated liable person than the person who would otherwise fall to be treated as the designated liable person by virtue of the operation of subsection (3), or | ||

(b) the application of subsection (3) does not, in the circumstances concerned, result in the determination of a designated liable person. | ||

Table 1 | ||

Classes of person | ||

1. The liable person who is nominated by joint election of all the other persons who are liable persons in relation to the relevant site, being a person whose name, address and TIN are notified in writing to the Revenue Commissioners. | ||

2. If the relevant site is jointly owned and the joint owners are married to each other or civil partners of each other, as the case may be, the assessable spouse or civil partner where an election under section 1018 or 1031D has effect. | ||

3. If the relevant site is jointly owned and the joint owners are partners in a partnership, the precedent partner (within the meaning of section 1007). | ||

4. The liable person with the highest total income (within the meaning of section 3(1)). | ||

5. If the relevant site is jointly owned and any of the joint owners are not resident or not ordinarily resident in the State, as the case may be, a liable person who is resident or ordinarily resident in the State. | ||

Preparation and delivery of return by person acting under authority | ||

653W. (1) Notwithstanding section 653T, a return may be prepared and delivered by a person acting under the authority of a liable person. | ||

(2) Where a return is prepared and delivered by a person acting under the authority of a liable person, this Chapter shall apply as if the return had been prepared and delivered by the liable person. | ||

(3) Anything required or allowed to be done by a liable person under this Chapter may be done by a person acting under a liable person’s authority. | ||

Assessments, enquiries and appeals | ||

653X. (1) Sections 959Y, 959Z, 959AA, 959AC, 959AD and 959AE shall apply to residential zoned land tax, subject to the following modifications: | ||

(a) a reference to a ‘person’ or a ‘chargeable person’ shall be construed as a reference to a ‘liable person’; | ||

(b) a reference to a ‘chargeable period’ shall be construed as a reference to a ‘year’; | ||

(c) a reference to ‘amount of income, profits or gains, or, as the case may be, chargeable gains’ shall be construed as including a reference to the market value of a relevant site; | ||

(d) a reference to a ‘return’ shall be construed as including a return required under this Part; | ||

(e) for the purposes of sections 653AG and 653AH, in section 959AA(1)(ii), ‘after the end of 4 years commencing at the end of the year in which a certificate of completion is lodged’ shall be substituted for ‘after the end of a period of 4 years commencing at the end of the chargeable period for which the return is delivered’. | ||

(2) A person aggrieved by an assessment or an amended assessment, as the case may be, made on that person pursuant to the provisions referred to in subsection (1), as applied subject to the modifications referred to in that subsection, may, within 30 days after the date of the notice of assessment— | ||

(a) in respect of matters relating to the market value of a relevant site, appeal the assessment or amended assessment in the manner prescribed by section 33 of the Finance (1909-1910) Act 1910 , (as amended by the Property Values (Arbitration and Appeals) Act 1960 ), and so much of Part I of that Act as relates to appeals shall apply to an appeal under this subsection, or | ||

(b) in respect of all other matters, appeal the assessment or the amended assessment to the Appeal Commissioners in accordance with section 949I. | ||

Interest on overdue tax | ||

653Y. (1) Any amount of residential zoned land tax shall carry interest from the date when the tax becomes due and payable until payment for any day or part of a day during which the amount remains unpaid, at a rate of 0.0219 per cent. | ||

(2) Subsections (3) to (5) of section 1080 shall apply in relation to interest payable under subsection (1) as they apply in relation to interest payable under section 1080. | ||

Transfer of relevant site | ||

653Z. (1) For the purpose of this Part, ‘sale’ includes, in relation to a relevant site, the transfer of the relevant site by a liable person to another person— | ||

(a) in consequence of— | ||

(i) the exercise of a power under any enactment to compulsorily acquire land, or | ||

(ii) the giving of notice of intention to exercise the power referred to in subparagraph (i), | ||

(b) for no consideration or consideration which is significantly less than the market value of the relevant site at the time of its transfer, or | ||

(c) entering into a lease, or an agreement for lease, the term of which is indefinite or exceeds 35 years. | ||

(2) A liable person who proposes to sell a relevant site shall, before the completion of the sale of the relevant site, pay to the Revenue Commissioners the residential zoned land tax and accrued interest, if any, which is due and payable in respect of that relevant site. | ||

(3) A liable person who proposes to sell a relevant site shall— | ||

(a) seek to agree any penalty due in respect of residential zoned land tax before the date of completion of the sale of the relevant site, and | ||

(b) pay— | ||

(i) a penalty determined in accordance with this Act before the date of completion of the sale of the relevant site, or | ||

(ii) where a penalty has been agreed before that date, that penalty, | ||

before that date. | ||

(4) The Revenue Commissioners shall provide a liable person, or a person acting on behalf of the liable person in connection with a sale of a relevant site, with— | ||

(a) confirmation of any unpaid residential zoned land tax, penalties and accrued interest at the date of the sale of a relevant site, or | ||

(b) confirmation that there are no outstanding amounts payable, | ||

as the case may be, in such form and manner as the Revenue Commissioners may decide. | ||

(5) A liable person who proposes to sell a relevant site shall, before the completion of the sale of the relevant site, prepare and deliver to the Revenue Commissioners, or have prepared and delivered on behalf of the liable person, a return in such form as the Revenue Commissioners may prescribe for that purpose. | ||

(6) Without prejudice to the generality of subsection (5), the Revenue Commissioners may prescribe the following information to be included in a return referred to in that subsection: | ||

(a) in respect of a relevant site— | ||

(i) the date of acquisition, | ||

(ii) the market value, at the date of acquisition, | ||

(iii) the market value, at the most recent valuation date, if a valuation date has occurred since the date of acquisition, | ||

(iv) the proposed date of sale, and | ||

(v) the proposed consideration on the sale; | ||

(b) in respect of a liable person or designated liable person (as determined in accordance with section 653V)— | ||

(i) the person’s name, | ||

(ii) the person’s TIN, | ||

(iii) the nature of the person’s ownership interest in the site, | ||

(iv) the person’s address for correspondence, | ||

(v) confirmation as to whether that person and the purchaser are connected persons (within the meaning of section 10), and | ||

(vi) where there is more than one owner in relation to a relevant site, the information referred to in subparagraphs (i) to (v) in respect of each owner; | ||

(c) in respect of the purchaser of the relevant site— | ||

(i) the person’s name, | ||

(ii) the person’s TIN, | ||

(iii) the person’s address for correspondence, and | ||

(iv) where there is more than one purchaser in relation to a relevant site, the information referred to in subparagaphs (i) to (iii) in respect of each purchaser; | ||

(d) the unique identification number issued by the Revenue Commissioners under section 653S(3), where one has been issued. | ||

Appointment of an expert | ||

653AA. (1) The Revenue Commissioners may, in relation to any amount of tax or exemption, deferral or abatement of residential zoned land tax included in a return required under section 653T, consult with any person (in this section referred to as an ‘expert’) who, in their opinion, may be of assistance in ascertaining— | ||

(a) the market value of a relevant site, | ||

(b) the suitability of any building for use as a dwelling, | ||

(c) the yards, gardens and other lands, which are suitable for occupation and enjoyment with a dwelling, | ||

(d) whether works on a relevant site, for which a commencement notice has been lodged, have permanently ceased, | ||

(e) the area in square metres of the relevant site which is included within a planning permission and is being developed for dwellings and the total area of the relevant site in square metres, | ||

(f) where a development on a relevant site is partially completed on the last day of the planning permission period relating to the development, the percentage of the development completed on that day, and | ||

(g) the total gross floor space for all of the buildings comprised in the development to which a planning permission for a relevant site relates and the total gross floor space of the dwellings to which the planning permission relates. | ||

(2) The Revenue Commissioners may authorise in writing any of their officers to exercise any powers to perform any acts or discharge any functions conferred by this section. | ||

(3) In this section, ‘authorised officer’ means an officer of the Revenue Commissioners authorised under subsection (2). | ||

(4) Notwithstanding any obligation as to secrecy or other restriction on the disclosure of information imposed by, or under, the Tax Acts or any other statute or otherwise, but subject to subsection (5), an authorised officer may disclose to an expert any detail in a liable person’s return under this Part which they consider necessary for the purposes of such consultation. | ||

(5) Before disclosing information to an expert under subsection (4), an authorised officer shall give the liable person in relation to the relevant site concerned a notice in writing of— | ||

(a) the officer’s intention to disclose information to an expert, | ||

(b) the information that the officer intends to disclose, and | ||

(c) the identity of the expert with whom the officer intends to consult. | ||

(6) Where a liable person who has received a notice under subsection (5) shows to the authorised officer’s satisfaction, within 30 days from the date of the notice, that disclosure of such information to that expert could prejudice the liable person’s trade or business, the authorised officer shall not disclose the information. | ||

(7) Where, on the expiry of the period referred to in subsection (6), it is not shown to the satisfaction of an authorised officer that disclosure could prejudice the trade or business of the liable person concerned, the authorised officer may decide to disclose the information and may disclose the information on the expiry of a further period of 30 days after giving notice in writing of the authorised officer’s decision to disclose the information. | ||

(8) A liable person aggrieved by an authorised officer’s decision under subsection (7) may appeal the decision to the Appeal Commissioners, in accordance with section 949I, within the period of 30 days after the date of that decision. | ||

(9) Section 911 shall apply for the purposes of this Part subject to the following modifications: | ||

(a) a reference to an authorised person shall be construed as a reference to an expert or an authorised officer, | ||

(b) a reference to ascertaining the value of an asset shall be construed as a reference to ascertaining the matters specified in subsection (1), and | ||

(c) a reference to reporting the value of an asset shall be construed as a reference to reporting the matters specified in subsection (1). | ||

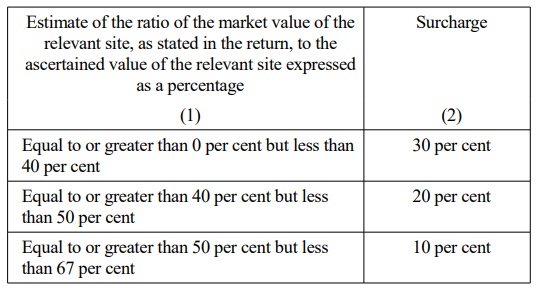

Surcharge for undervaluation of the relevant site | ||

653AB. (1) In this section ‘ascertained value’, in relation to a relevant site, means the market value. | ||

(2) Where— | ||

(a) a return is received in respect of a relevant site, and | ||

(b) the estimate of the ratio of the market value of the relevant site, as stated in the return, to the ascertained value of the relevant site expressed as a percentage, is within any of the percentage bands specified in column (1) of the Table to this section, | ||

the amount of residential zoned land tax payable in relation to the relevant site shall be increased by an amount (in this section referred to as the ‘surcharge’) equal to the corresponding percentage, set out in column (2) of that Table opposite the relevant percentage band in column (1), of that amount of tax. | ||

(3) Interest is payable under section 653Y on any surcharge as if the surcharge were residential zoned land tax, and the surcharge and any interest on that surcharge is chargeable and recoverable as if the surcharge and that interest were part of the residential zoned land tax. | ||

(4) Where the amount of residential zoned land tax payable in relation to the relevant site is increased in accordance with subsection (2), the Revenue Commissioners shall issue a notice in writing of the amount of the surcharge to the liable person concerned. | ||

(5) Any person aggrieved by the imposition on that person of a surcharge under this section in respect of a relevant site may appeal to the Appeal Commissioners, in accordance with section 653X, within the period of 30 days after the date of the notice, referred to in subsection (4), of the amount of that surcharge, against the imposition of such surcharge on the grounds that, having regard to all the circumstances, there were sufficient grounds on which that person might reasonably have based that person’s estimate of the market value of the asset. | ||

Table | ||

| ||

| ||

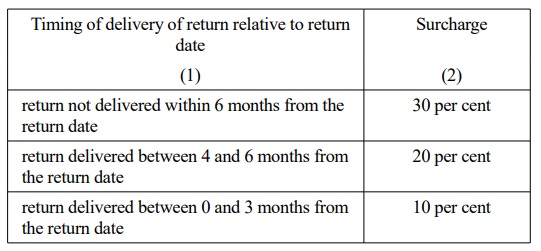

Surcharge for late return of the relevant site | ||

653AC. (1) Where a liable person fails to deliver a return in respect of a relevant site on or before the return date in a year, the amount of residential zoned land tax which would have been payable if such a return had been delivered on or before the return date shall be increased by an amount (in this section referred to as the ‘surcharge’), equal to the percentage, specified in column (2) of the Table, opposite the timing of the delivery of the return relative to the return date, specified in column (1) of the Table. | ||

(2) Interest is payable under section 653Y on any surcharge as if the surcharge were residential zoned land tax, and the surcharge and any interest on that surcharge is chargeable and recoverable as if the surcharge and that interest were residential zoned land tax. | ||

| ||

Table | ||

| ||

| ||

Chapter 5 | ||

Abatements | ||

Repayment of tax on site not suitable for development | ||

653AD. (1) This section applies in respect of a site where, subsequent to the publication of a final map, a local authority, following consultation with any person referred to in article 28 of the Planning and Development Regulations 2001, determines that, on the basis of information available at that time to the local authority, the site or part of the site is affected, in terms of its physical condition, by matters to a sufficient extent to preclude the provision of dwellings, including contamination or the presence of archaeological or historic remains. | ||

(2) Where a local authority makes a determination under subsection (1), it shall notify, in writing, the liable person in respect of the site as soon as practicable of its determination. | ||

(3) A notification under subsection (2) shall specify the date from which the site or part of the site concerned is determined by the local authority concerned to have been affected in the manner referred to in subsection (1). | ||

(4) Where this section applies in respect of a site, the site (or where only part of the site is affected in the manner described in subsection (1), the part of the site so affected), shall, notwithstanding the inclusion of the site in a final map, not be a relevant site from the date specified in accordance with subsection (3). | ||

(5) Subject to subsection (6), where a person has paid residential zoned land tax in respect of a site in respect of which this section applies, the person may make a claim for repayment of the tax. | ||

(6) Where a person has paid residential zoned land tax in respect of a site in respect of which this section applies and part only of the site is affected in the manner described in subsection (1), the person may make a claim for repayment of that part of that tax which was attributable to the part of the site so affected, and the amount of that tax which can be claimed shall be determined by the following formula: | ||

C = T x (Apart/Atotal) | ||

where— | ||

C is the amount of tax which can be claimed in accordance with this subsection, | ||

T is the total amount of residential zoned land tax paid in respect of the site, | ||

Apart is the area, in square metres, of the part of the site affected in the manner described in subsection (1), and | ||

Atotal is the total area, in square metres, of the site. | ||

Deferral of tax on appeals under section 653J | ||

653AE. (1) This section applies where, in relation to a site— | ||

(a) an appeal under section 653J has been made but not been determined, | ||

(b) an application for judicial review of— | ||

(i) a determination made by a local authority under section 653E or 653H, or | ||

(ii) a decision of An Bord Pleanála under section 653J, | ||

has been made but not determined, or | ||

(c) a submission has been made under section 653I, but no variation has been made to the development plan as a consequence of that submission, | ||

one month prior to the publication of a final map under section 653K or a revised map under section 653M, as the case may be, in which the site is included. | ||

(2) Where— | ||

(a) this section applies, and | ||

(b) either— | ||

(i) the appeal referred to in paragraph (a) of subsection (1) or the judicial review referred to in paragraph (b) of that subsection is determined in favour of the owner of the site by the liability date in the year of publication of the final map or revised map, as the case may be, or | ||

(ii) the development plan is varied by the liability date in the year of publication of the map or revised map, as the case may be, such that the site no longer satisfies the relevant criteria, | ||

the site shall be treated for the purposes of this Part as not being a relevant site from the date of the making of the appeal, the date of the application for judicial review or the date of the submission under section 653I, as the case may be. | ||

(3) Where a site ceases to be a relevant site in accordance with subsection (2), the liable person in relation to the site may make a claim for the repayment of all residential zoned land tax paid by that liable person in respect of the land that arose from the date of the making of the appeal, of the application for judicial review or of the submission under section 653I, as the case may be. | ||

(4) Where— | ||

(a) this section applies, and | ||

(b) either— | ||

(i) the appeal referred to in paragraph (a) of subsection (1) or the judicial review referred to in paragraph (b) of that subsection has not been determined by a return date, or | ||

(ii) a process has commenced under section 13 of the Act of 2000 in relation to a variation of the development plan concerned, which would, if made, affect the zoning of the site, but that process has not concluded by a return date, | ||

a liable person in relation to the site may, in a return made under this Part, make a claim to defer payment of the residential zoned land tax payable in respect of the site until such time as the appeal or judicial review is determined or the process concluded, as the case may be. | ||

(5) Where a liable person makes a claim under subsection (4) and the appeal is determined in favour of the person, or the development plan is varied such that the site is not a relevant site, as the case may be, residential zoned land tax deferred pursuant to the claim shall not be due and payable. | ||

(6) Where a liable person makes a claim under subsection (4) and the appeal or judicial review, as the case may be, is not determined in favour of the liable person or the development plan is not varied such that the site is a relevant site, as the case may be, the liable person shall amend each return in which such a claim was made, and pay any tax and interest due accordingly. | ||

(7) Where a liable person makes a claim under subsection (4) and sells their interest in the relevant site before the appeal or judicial review, as the case may be, is determined or the process under section 13 of the Act of 2000 in relation to the variation of the development plan concerned has concluded, the liable person shall amend each return in which such claim was made, and pay any tax and interest due accordingly. | ||

Deferral of tax during appeals | ||

653AF. (1) In this section ‘relevant appeal’ means— | ||

(a) an appeal to An Bord Pleanála in respect of a grant of planning permission, | ||

(b) an application for judicial review of a decision of a local authority or An Bord Pleanála in respect of a planning permission, or | ||

(c) an appeal of a determination of a judicial review referred to in paragraph (b), | ||

where the appeal or application, as the case may be, has not been made by— | ||

(i) the applicant or the owner of the land on which the development to which the planning permission relates is to be carried out, or | ||

(ii) a person connected (within the meaning of section 10) with the applicant or the owner. | ||

(2) This section applies where a planning permission has been granted, but the development concerned cannot commence because the decision to grant the planning permission is subject to a relevant appeal which has not been determined at a liability date. | ||

(3) Where this section applies and the relevant appeal concerned is subsequently determined such that the grant of planning permission is upheld, the liable person may make a claim for the repayment of all residential zoned land tax paid by that liable person in respect of the site to which the planning permission relates that arose from the date on which the relevant appeal was first made until the date on which the grant of planning permission was upheld. | ||

(4) At a return date after the date on which a relevant appeal was made but before the relevant appeal has been determined, a liable person may make a claim to defer payment of the residential zoned land tax in respect of the site to which the planning permission relates until such time as the relevant appeal is determined, and— | ||

(a) where the relevant appeal is determined such that the grant of planning permission is upheld, the tax so deferred shall no longer be due and payable, | ||

(b) where the relevant appeal is determined such that the grant of planning permission is overturned, the liable person shall amend each return in which such a claim was made, and pay any tax and interest due accordingly, or | ||

(c) where the owner sells the property before the relevant appeal is determined, the liable person shall amend each return in which such claim was made, and pay any tax and interest due accordingly. | ||

Sites developed wholly or partly for purpose other than residential development | ||

653AG. (1) This section applies to a relevant site— | ||

(a) which comprises land included in a development plan, in accordance with section 10(2)(a) of the Act of 2000, or local area plan, in accordance with section 19(2)(a) of the Act of 2000, zoned for a mixture of uses, including residential use, and | ||

(b) in respect of development on which planning permission has been granted, where that development consists either wholly or partly of development for a purpose other than residential development. | ||

(2) Subject to subsection (6), where, in respect of a relevant site to which this section applies, a commencement notice has been lodged with a local authority in respect of development under the planning permission concerned, so much of the site as is being developed for a purpose other than residential development shall, from the date of the commencement notice, or where more than one commencement notice is lodged, from the date of the first commencement notice in respect of which works comprising substantial activity commence within the timeframe specified in the notice, cease to be treated as a relevant site. | ||

(3) Where the development to which the planning permission referred to in subsection (1) relates consists of both residential development and other development— | ||

(a) the market value of the relevant site concerned shall be apportioned, in accordance with subsection (4), between the portion of the site that is allocable to the residential development (in this section referred to as the ‘liable part of the relevant site’) and the portion allocable to the other development, and | ||

(b) the market value of the liable part of the relevant site so apportioned shall, for the purposes of section 653R, be treated as the market value of the relevant site on the liability date immediately following the date on which the commencement notice, or the first such notice, as the case may be, referred to in subsection (2) is lodged. | ||

(4) The market value of the liable part of the relevant site shall be determined by the formula— | ||

A x (B/C) | ||

where— | ||

A is the market value of the relevant site on the day before the date on which the commencement notice, or the first such notice, as the case may be, referred to in subsection (2) is lodged, | ||

B is, in accordance with the planning permission, the portion of the gross floor space for all of the development, to which the planning permission referred to in subsection (1) relates, which comprises dwellings, and | ||

C is the total gross floor space for all of the development to which the planning permission referred to in subsection (1) relates. | ||

(5) Where the market value of the liable part of a relevant site is determined in accordance with subsection (4) then, for the purposes of section 653R, at the liability date immediately following the submission of the commencement notice concerned, the liable part of the relevant site shall be treated as having a valuation date falling on the same day as that liability date. | ||

(6) Where there is no substantial activity in relation to that part of a relevant site to which this section applies which is being developed for a purpose other than residential development within a reasonable period of time from the date of the commencement notice, or the first commencement notice in respect of which works comprising substantial activity commence within the timeframe specified in the notice, as the case may be, referred to in subsection (2) that is lodged with the local authority, that part of the site which is being developed for a purpose other than residential development shall not, subject to this Part, cease to be treated as a relevant site until such time as works comprising substantial activity on that part of the site are commenced. | ||

(7) A liable person in relation to a relevant site to which this section applies shall— | ||

(a) within 30 days of the date on which the commencement notice, or the first such notice, as the case may be, referred to in subsection (2) is lodged, make a declaration to the Revenue Commissioners, in such form and containing such information as they may prescribe, that this section applies to the relevant site, and | ||

(b) maintain and have available such records as may reasonably be required for the purposes of determining whether the requirements of this section are met. | ||

Deferral of residential zoned land tax in certain circumstances | ||

653AH. (1) This section applies where— | ||

(a) a planning permission has been granted in respect of development on a relevant site, | ||

(b) all or part of the development consists of residential development (and such portion of the development as consists of residential development on the relevant site shall be referred to in this section as ‘relevant residential development’), and | ||

(c) a commencement notice, in respect of the development, has been lodged with the local authority in whose functional area the relevant site is situated. | ||

(2) Where more than one commencement notice is lodged with a local authority in respect of a development, the reference in subsection (1)(c) to a commencement notice shall be construed as a reference to the first commencement notice lodged with the local authority in whose functional area the relevant site is situated that is in respect of the commencement of substantial activity in relation to the development. | ||

(3) Subject to subsections (5) and (7), where this section applies, so much of any residential zoned land tax arising in respect of a liability date in relation to a relevant site after the submission of the commencement notice referred to in subsection (1)(c) which relates to relevant residential development shall, notwithstanding section 653Q(2), not be due and payable until the earliest to occur of— | ||

(a) the date on which the works (within the meaning of the Act of 2000) on the relevant site permanently cease where, on that date, certificates of compliance on completion in respect of all of the relevant residential development have not been lodged with the local authority concerned, | ||

(b) the date on which there is a change in the ownership of the relevant site, where such a change occurs prior to certificates of compliance on completion having been lodged with the local authority concerned in respect of all of the relevant residential development, and | ||

(c) the date of expiry of the planning permission period for the planning permission, where, on that date, certificates of compliance on completion in respect of all of the relevant residential development to which the planning permission relates have not been lodged with the local authority concerned. | ||

(4) Residential zoned land tax which, by virtue of subsection (3), is not due and payable until the earliest to occur of the events referred to in paragraphs (a), (b) and (c) of that subsection, shall, in relation to the relevant site, be referred to in this section as ‘deferred residential zoned land tax’. | ||

(5) The amount of residential zoned land tax which— | ||

(a) arises in respect of a liability date that falls after the lodgement of a commencement notice and up to the earliest to occur of the events referred to in paragraphs (a), (b) and (c) of subsection (3), and | ||

(b) relates to a relevant residential development, | ||

shall be— | ||

(i) where the development referred to in subsection (1)(a) consists of residential development only, the amount of all residential zoned land tax arising in respect of the relevant site, or | ||

(ii) where the development referred to in subsection (1)(a) consists of residential development and development other than residential development, the amount represented by A in the formula— | ||

A = B x C | ||

where— | ||

B is, on the valuation date applicable to the liability date, the market value of that part of the relevant site which, having regard to the planning permission referred to in subsection (1), is being used for residential development (referred to in this section as the ‘qualifying part of the relevant site’) and subsection (6)(a) shall apply for the purpose of determining the market value of the qualifying part of the relevant site on the first liability date after the date on which the commencement notice referred to in subsection (1)(c) is lodged, and | ||

C is the rate of 3 per cent. | ||

(6) Where subsection (5)(ii) applies— | ||

(a) the market value of the qualifying part of a relevant site on the first liability date after the commencement notice referred to in subsection (1)(c) is lodged, (represented by ‘B’ in the formula contained in subsection (5)(ii)), shall be computed in the same manner as the market value of the ‘liable part of the relevant site’ (within the meaning of section 653AG) is computed under section 653AG(4), and | ||

(b) for the purposes of section 653R— | ||

(i) so much of the relevant site to which residential zoned land tax continues to apply shall be treated as having a valuation date falling on the same day as the first liability date after the commencement notice referred to in subsection (1)(c) is lodged and, where section 653AG(2) applies in relation to that portion of the site which is being developed for a purpose other than residential development, the market value on that valuation date shall be the market value determined in accordance with paragraph (a), and | ||

(ii) the valuation date referred to in subparagraph (i) shall continue to apply until 1 February in the year immediately following the earliest to occur of the events referred to in paragraphs (a), (b) and (c) of subsection (3). | ||

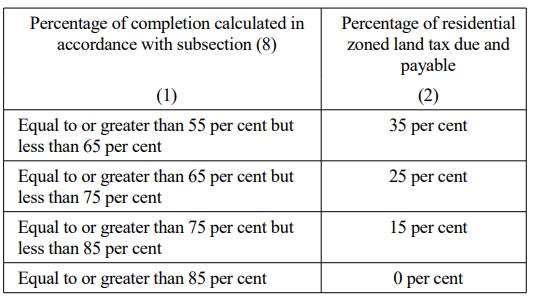

(7) Notwithstanding subsection (3), where, in relation to a relevant site referred to in subsection (1)— | ||

(a) one or more certificates of compliance on completion are lodged with a local authority in respect of all of the relevant residential development in advance of the expiry of the planning permission period relating to that site, then, on the making of a claim by the liable person, the amount of the deferred residential zoned land tax shall no longer be due and payable, or | ||

(b) on the expiry of the planning permission period, one or more certificates of compliance on completion are lodged with a local authority in respect of part only of the relevant residential development and the percentage of completion, calculated in accordance with subsection (8), is within any of the percentages specified in column (1) of the Table to this section, then, on the making of a claim by the liable person, the percentage of the deferred residential zoned land tax relating to the relevant site which is due and payable shall be the percentage, set out in column (2) of that Table, opposite the relevant percentage of completion in column (1). | ||

(8) For the purposes of subsection (7)(b) and column (1) of the Table to this section, the percentage of completion of relevant residential development on a relevant site at the expiry of a planning permission period shall be the amount, expressed as a percentage, represented by A in the formula— | ||

A = (B/C) x 100 | ||

where— | ||

B is the total gross floor space of the relevant residential development which is completed at the expiry of the planning permission period, and | ||

C is, in accordance with the planning permission, the total gross floor space of the relevant residential development. | ||

(9) A claim referred to in subsection (7) shall be made in such form and contain such particulars as the Revenue Commissioners may prescribe. | ||

(10) This section only applies if a return referred to in section 653T is delivered to the Revenue Commissioners in respect of each liability date to which this section refers notwithstanding the application of subsection (2). | ||

| ||

Table | ||

| ||

Chapter 6 | ||

Death cases | ||

Death | ||

653AI. (1) For the purposes of this Part, ‘personal representative’ has the same meaning as in Chapter 1 of Part 32 and personal representatives shall be treated as being a single continuing body of persons (distinct from the persons who may from time to time be the personal representatives). | ||

(2) Sections 1047(1) and 1048 shall apply in respect of residential zoned land tax as they apply in respect of income tax, subject to the following modifications: | ||

(a) a reference to ‘income tax’ shall be construed as a reference to ‘residential zoned land tax’; | ||

(b) a reference to ‘profits or gains’ shall be construed as including a reference to the market value of a relevant site; | ||

(c) a reference to ‘Income Tax Acts’ shall be construed as a reference to ‘Part 22A’. | ||

(3) On the death of a liable person in relation to a site (referred to in this section as the ‘deceased person’), a personal representative shall, for the purposes of this Part, be deemed to be the liable person in relation to the site immediately after the death of the deceased person and until such time as— | ||