Finance Act 2020

|

Amendment of Chapter 1 of Part 2 of, and Schedules 2 and 2A to, Finance Act 1999 (mineral oil tax) | ||

|

27. (1) The Finance Act 1999 is amended with effect as on and from 14 October 2020— | ||

(a) in section 96(1B), by substituting “A is the amount to be charged per tonne of CO2 emitted, being €33.50 in the case of petrol, aviation gasoline, and heavy oil used as a propellant or for air navigation or for private pleasure navigation, and €26 in the case of each other description of mineral oil in Schedule 2A” for “A is the amount, €26, to be charged per tonne of CO2 emitted”, | ||

(b) by substituting the following schedule for Schedule 2: | ||

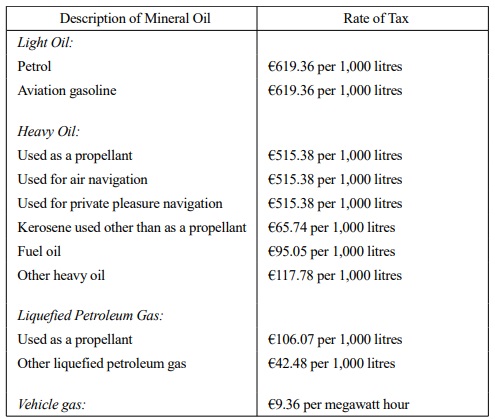

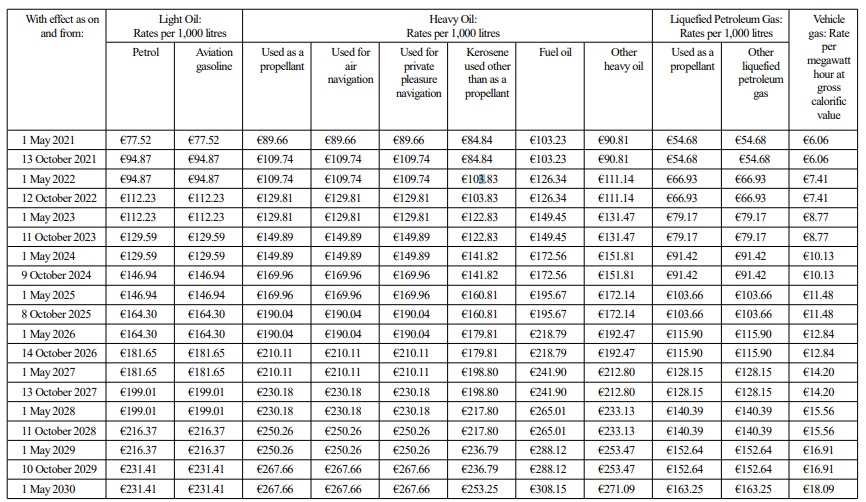

“SCHEDULE 2 | ||

Rates of Mineral Oil Tax | ||

(With effect as on and from 14 October 2020) | ||

| ||

”, | ||

and | ||

(c) by substituting the following schedule for Schedule 2A: | ||

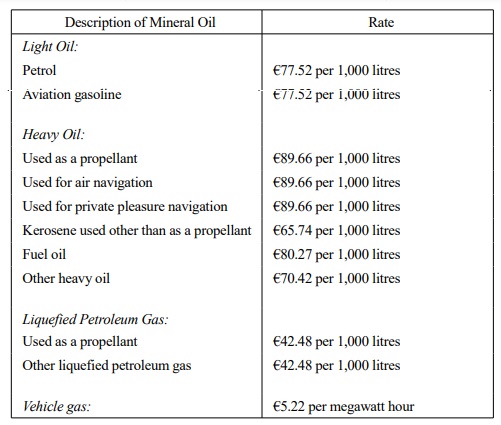

“SCHEDULE 2A | ||

Carbon Charge | ||

(With effect as on and from 14 October 2020) | ||

| ||

”, | ||

(2) The Finance Act 1999 is further amended with effect as on and from 1 May 2021— | ||

(a) in section 96— | ||

(i) by substituting the following for subsection (1A): | ||

“(1A) (a) Where a rate is specified in Schedule 2A for any description of mineral oil, that rate, referred to in this Chapter as the ‘carbon charge’, is included in the rate of tax specified in Schedule 2 for that description of mineral oil. | ||

(b) The rate of tax per 1,000 litres specified for each description of mineral oil, other than vehicle gas in Schedule 2A, is in proportion to the emissions of CO2 from the combustion of the description of mineral oil concerned. | ||

(c) The rate of tax per megawatt hour at gross calorific value specified for vehicle gas in Schedule 2A is in proportion to the emissions of CO2 from the combustion of natural gas.”, | ||

and | ||

(ii) by deleting subsections (1B) and (1C), | ||

(b) in section 98(1) — | ||

(i) by substituting “rate specified in the Table to this subsection” for “rate, for heavy oil of €71.32 per 1,000 litres, and for liquefied petroleum gas of €48.06 per 1,000 litres”, and | ||

(ii) by inserting the following table to that subsection: | ||

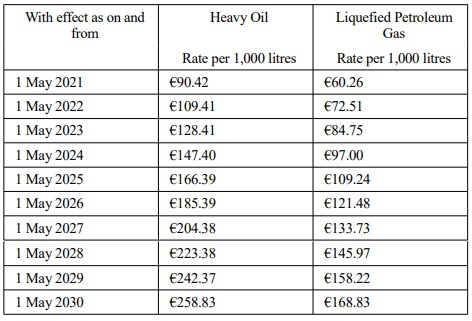

“TABLE | ||

| ||

”, | ||

(c) by substituting the following schedule for Schedule 2 (amended by subsection (1)(b)): | ||

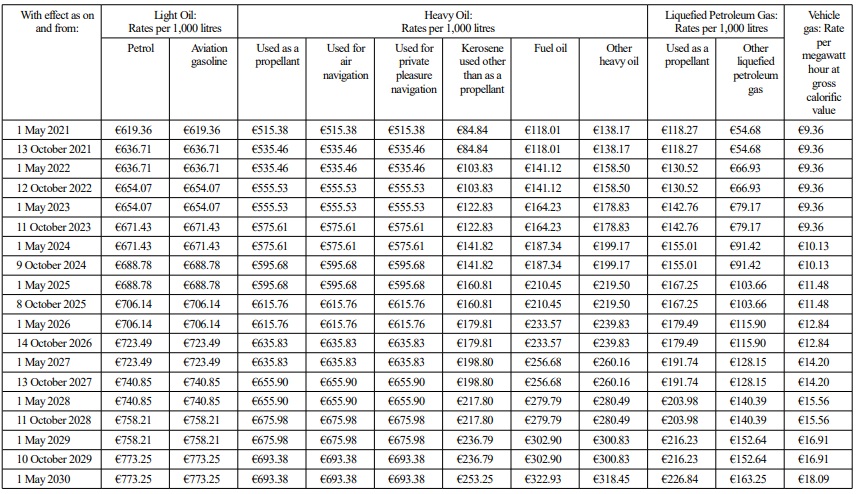

“SCHEDULE 2 | ||

Rates of Mineral Oil Tax | ||

| ||

”, | ||

and | ||

(d) by substituting the following schedule for Schedule 2A (amended by subsection (1)(c)): | ||

“SCHEDULE 2A | ||

Carbon Charge | ||

| ||

”, |