Finance Act 2019

|

Amendment of section 132 of Finance Act 1992 (charge of excise duty) | ||

|

50. (1) Section 132 of the Finance Act 1992 is amended, in subsection (3) — | ||

(a) by substituting the following paragraph for paragraph (a): | ||

“(a) in case the vehicle the subject of the registration or declaration concerned is a category A vehicle— | ||

(i) in respect of the CO2 emissions of the vehicle— | ||

(I) by reference to Table 1 to this subsection, or | ||

(II) where— | ||

(A) the level of CO2 emissions cannot be confirmed by reference to the relevant EC type-approval certificate, EC certificate of conformity or vehicle registration certificate issued in another Member State, and | ||

(B) the Commissioners are not satisfied of the level of CO2 emissions by reference to any other document produced in support of the declaration for registration, | ||

at the rate of an amount equal to the highest percentage specified in Table 1 to this subsection of the value of the vehicle or €720, whichever is the greater, | ||

and | ||

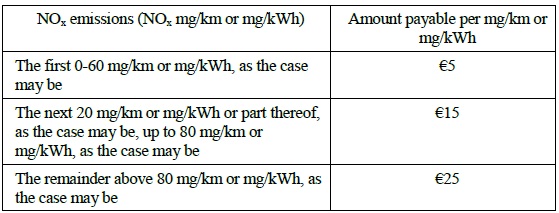

(ii) in respect of the NOx emissions of the vehicle— | ||

(I) by reference to— | ||

(A) Table 2 to this subsection, and | ||

(B) the unit of measurement used in the relevant EC type-approval certificate, EC certificate of conformity, vehicle registration certificate issued in another Member State or other document produced in support of the declaration for registration, as the case may be, | ||

subject to a maximum of €4,850 in respect of vehicles designed to use heavy oil as a propellant and €600 in respect of all other vehicles, or | ||

(II) where— | ||

(A) the level of NOx emissions cannot be confirmed by reference to the relevant EC type-approval certificate, EC certificate of conformity or vehicle registration certificate issued in another Member State, and | ||

(B) the Commissioners are not satisfied of the level of NOx emissions by reference to any other document produced in support of the declaration for registration, | ||

at the rate €4,850 in respect of vehicles designed to use heavy oil as a propellant and €600 in respect of all other vehicles.”, | ||

(b) by deleting paragraph (aa), | ||

(c) by deleting Table 1 to that subsection, | ||

(d) by designating Table 2 to that subsection as Table 1 to that subsection, and | ||

(e) by inserting the following Table after Table 1 (as that table has been designated under paragraph (d)): | ||

“Table 2 | ||

| ||

”. | ||

(2) Subsection (1) shall come into operation on 1 January 2020. |