Finance Act 2019

|

Amendment of Chapter 1 of Part 2 of, and Schedules 2 and 2A to, Finance Act 1999 (mineral oil tax) | ||

|

40. (1) The Finance Act 1999 is amended with effect as on and from 9 October 2019— | ||

(a) in section 96(1B), by substituting “A is the amount to be charged per tonne of CO2 emitted, being €26 in the case of petrol, aviation gasoline, and heavy oil used as a propellant or for air navigation or for private pleasure navigation, and €20 in the case of each other description of mineral oil in Schedule 2A” for “A is the amount, €20, to be charged per tonne of CO2 emitted”, | ||

(b) by substituting the following schedule for Schedule 2: | ||

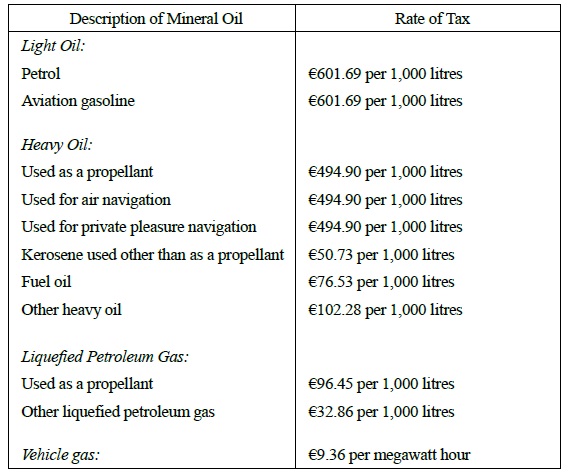

“SCHEDULE 2 | ||

Rates of Mineral Oil Tax | ||

(With effect as on and from 9 October 2019) | ||

| ||

”. | ||

(c) by substituting the following schedule for Schedule 2A: | ||

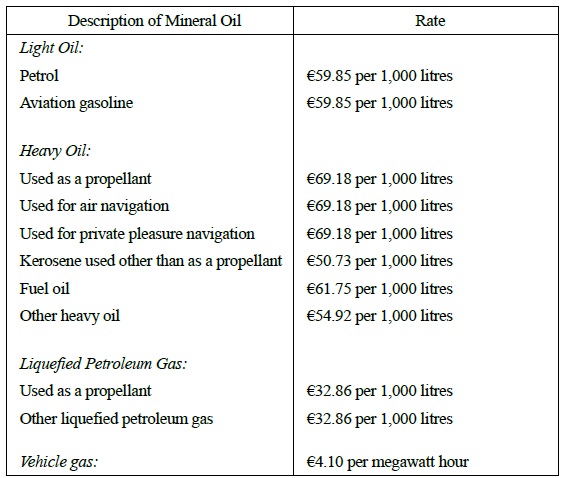

“SCHEDULE 2A | ||

Carbon Charge | ||

(With effect as on and from 9 October 2019) | ||

| ||

”. | ||

(2) The Finance Act 1999 is further amended with effect as on and from 1 May 2020— | ||

(a) in section 96(1B) (as amended by subsection (1)(a)), by substituting “A is the amount, €26, to be charged per tonne of CO2 emitted” for “A is the amount to be charged per tonne of CO2 emitted, being €26 in the case of petrol, aviation gasoline, and heavy oil used as a propellant or for air navigation or for private pleasure navigation, and €20 in the case of each other description of mineral oil in Schedule 2A”, | ||

(b) in section 96(1C), by substituting “€0.026” for “€0.02”, | ||

(c) in section 98(1), by substituting— | ||

(i) “€71.32” for “€56.31”, and | ||

(ii) “€48.06” for “€38.44”, | ||

(d) by substituting the following schedule for Schedule 2 (as amended by subsection (1)(b)): | ||

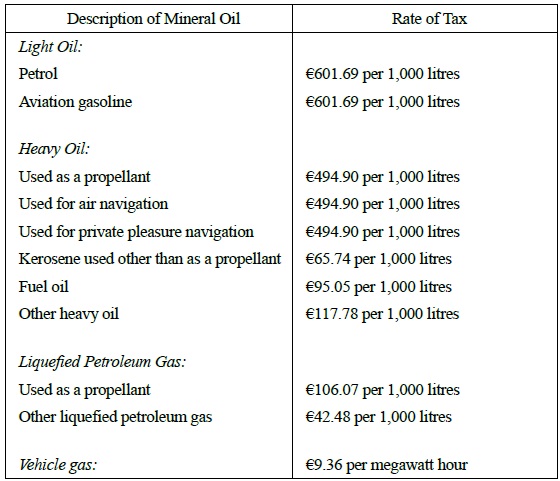

“SCHEDULE 2 | ||

Rates of Mineral Oil Tax | ||

(With effect as on and from 1 May 2020) | ||

| ||

”. | ||

and | ||

(e) by substituting the following schedule for Schedule 2A (as amended by subsection (1)(c)): | ||

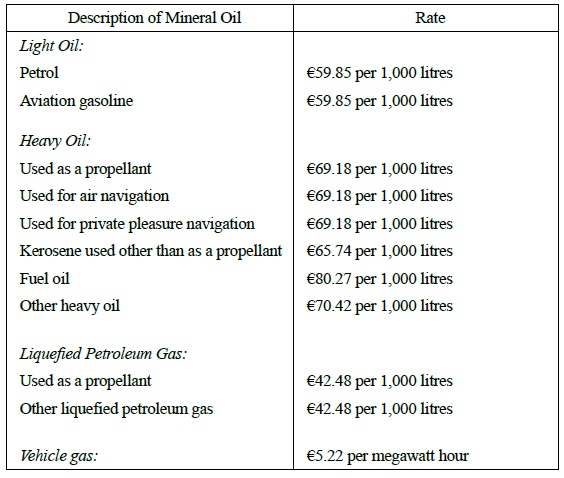

“SCHEDULE 2A | ||

Carbon Charge | ||

(With effect as on and from 1 May 2020) | ||

| ||

”. |