S.I. No. 48/2015 - Credit Guarantee Scheme 2015.

ARRANGEMENT OF SCHEME | ||

Contents | ||

1. Citation | ||

2. Commencement | ||

3. Definitions | ||

4. Overview of the Credit Guarantee Scheme | ||

4.1. Objectives of the Credit Guarantee Scheme | ||

4.2. Facility and Guarantee Term | ||

4.3. Loan Values | ||

4.4. Eligible Credit | ||

4.5. Ineligible Credit | ||

4.6. Portfolio Approach | ||

4.7. Premium Charge | ||

4.8. De Minimis State Aid | ||

Exceptions to the €200,000 State Aid Limit | ||

4.9. Operator | ||

4.10. Data Protection Act | ||

4.11. Marketing and Promotion | ||

5. Accreditation of Lenders to the Scheme | ||

Legal Agreement | ||

Accreditation Process | ||

Strategic Positioning | ||

Lending Policies and Procedures | ||

Additionality | ||

Regulatory Matters | ||

Allocation of Guarantee Portfolio | ||

6. Operational Matters | ||

6.1. Target Borrowers | ||

6.2. Eligible Sector and Activity | ||

6.3. Verification of Borrower’s State Aid | ||

6.4. Restrictions on Exporting | ||

6.5. Arrangement Fees and Margin | ||

6.6. Payment of the Scheme Premium | ||

Introduction | ||

Premium Value | ||

Payment Arrangements | ||

Non-payment of the Premium | ||

6.7. Borrowers Moving Between Lenders | ||

6.8. Drawdown and Repayment | ||

Capital Repayment Moratoriums | ||

Tranche Drawdowns | ||

Repayment Frequency | ||

Changes to the Term | ||

6.9. Scheme Security | ||

7. Scheme Eligibility Restrictions | ||

7.1. Business Sector restrictions | ||

Aquaculture (Fish Farming) | ||

Primary Agriculture | ||

Banking, Finance and Associated Services | ||

Coal | ||

Formal Education | ||

Insurance and Associated Services | ||

Owning and Dealing in Property | ||

Public administration, national defence, and compulsory social security | ||

7.2. International Issues | ||

Restrictions on Exporting | ||

Protectionism | ||

Foreign Ownership and Registration | ||

7.3. Acquisitions, Buy-Outs and Share Purchases | ||

8. General Scheme Application Process | ||

9. Managing the Scheme Facility after it is Guaranteed | ||

9.1. Transfers of Scheme Facilities between Lenders | ||

Introduction | ||

Practical Arrangements | ||

9.2. Refinancing of Non-Scheme Debt from another Lender | ||

10. Demands and Recoveries | ||

10.1. Overview | ||

10.2. Key Stages in the Demands and Recoveries Process | ||

(a) Demand on Borrower | ||

(b) Pursue Borrower for Repayment/Recovery of Outstanding Exposure | ||

(c) Recoveries Procedures (via security realisation or recovery procedures) | ||

Practical Application | ||

Use of Debt Collection Agents | ||

Sale of Outstanding Debts to a Third Party | ||

Cessation of Recovery Procedures | ||

Recovery Costs | ||

(d) Apportion Recovery Proceeds | ||

Step 1 — Categorise Debt | ||

Step 2 — Apply Proceeds from the Scheme’s Linked Collateral and Personal guarantees | ||

Step 3 — Prior/Simultaneous Commercial Debt | ||

Step 4 — Scheme Debt and post-Scheme Commercial debt | ||

(e) Claim on the Guarantee | ||

Claim Process | ||

Timing Rules for Making a Guarantee Claim | ||

Demand Invoice | ||

Portfolio Limits | ||

First and Second Reviews | ||

Settlement of Demand | ||

(f) Subsequent Procedures and Recoveries | ||

Further Recoveries | ||

Recoveries Statement | ||

Treatment of Regular Repayment Plans | ||

Incorrect Calculations and Losses | ||

11. Other Conditions | ||

11.1. The Claim Limit | ||

11.2. Lending Limits | ||

The amount the Lender is Allowed to claim under the Guarantee | ||

Change of ownership occurs within the Lender Organisation | ||

Termination of Scheme Legal Agreement | ||

12. Auditing and Reporting | ||

Introduction | ||

Audit Objectives and Risks to be Examined | ||

Audit Grades | ||

Evidence Required to Provide Substantial Assurance | ||

12.1. Claim Audit | ||

Introduction | ||

Documentation to be provided by the Lender to the Auditor | ||

The Claim Audit Appraisal | ||

12. 2.Annual Reports | ||

Non-Compliance with Scheme Rules | ||

S.I. No. 48 of 2015 | ||

CREDIT GUARANTEE SCHEME 2015 | ||

Notice of the making of this Statutory Instrument was published in | ||

“Iris Oifigiúil” of 13th February, 2015. | ||

I, GERALD NASH, Minister of State at the Department of Jobs, Enterprise and Innovation, in exercise of the powers conferred on me by section 5 of the Credit Guarantee Act 2012 (No. 26 of 2012) and the Jobs, Enterprise and Innovation (Delegation of Ministerial Functions) Order 2014 S.I. No. 545 of 2014 , with the consent of the Minister for Public Expenditure and Reform and the Minister for Finance hereby make the following Scheme. | ||

1. Citation: | ||

This Scheme may be cited as the Credit Guarantee Scheme 2015. | ||

2. Commencement: | ||

This Scheme comes into operation on the day of its making. | ||

3. Definitions | ||

In this Scheme | ||

“Department” means the Department of Jobs, Enterprise and Innovation; | ||

“Guaranteed Rate” means the proportion of the principal amount of any guaranteed Scheme Facility which is protected by the Scheme Guarantee. For this Scheme it is set at 75%; | ||

“Portfolio Accepted Lending” means the total value of Accepted lending undertaken within a calendar year in connection with which the Lender may call upon the Scheme Guarantee, so long as it does not exceed the Lender’s Portfolio Base Lending Limit without the Department’s permission; | ||

“Portfolio Claim Limit” means the total value against which Guarantee Claims may be made by a Lender arising from defaults of their Scheme Facilities in any one year’s Portfolio. The Portfolio Claim Limit is therefore linked to the year of Acceptance of the Facility and not to the year in which the claim arises; and | ||

“Portfolio Default Limit” means the proportion of the overall total of a Lender’s guaranteed Scheme Facilities (Portfolio Accepted Lending) in any one year’s Portfolio which is protected by the Guarantee Scheme. This is the maximum percentage of default in the scheme that will be covered. For this Scheme it is set at 10%. | ||

4. Overview of the Credit Guarantee Scheme | ||

4.1 Objectives of the Credit Guarantee Scheme | ||

The Scheme provides a State guarantee through the Minister to accredited Lenders of 75% on eligible individual loans or other debt facilities supported by the Scheme (a “Scheme Facility”) to viable Micro, Small and Medium-sized Enterprises (SMEs) within the meaning of Section 3 of the Credit Guarantee Act 2012 . The Guarantee is paid by the Minister (the “Guarantor”) to the Lender on the unrecovered outstanding principal balance on a Scheme Facility in the event of a Borrower defaulting on the Scheme Facility repayments. The purpose of the Scheme is to encourage additional bank lending to SMEs, not to substitute for conventional lending, and to support refinancing of bank lending, where banks are exiting the Irish SME Credit market. | ||

All decision-making at the level of the individual Scheme Facility will be fully devolved to the participating Lenders. | ||

The Scheme is intended to address specific market failures that prevent lending to some commercially viable businesses by providing a level of guarantee to banks against losses on qualifying Scheme Facilities. Target groups are commercially viable SME businesses, i.e. SME businesses that can demonstrate repayment capacity for the additional credit facilities, but that do not secure credit facilities due to either or both of the following two market inefficiencies: | ||

“Pillar 1”) Insufficient collateral for the additional facilities or in the case where an SME is seeking to refinance due to its bank exiting the Irish SME credit market there is insufficient collateral available to support this refinancing, and | ||

“Pillar 2”) Growth / expansionary SMEs which due to their sectors, markets or business model are perceived as a higher risk under current credit risk evaluation practices. | ||

4.2 Facility and Guarantee Term | ||

Scheme Facilities will run for whatever term is deemed to be commercially appropriate by the Lender. However, irrespective of the term of the facility, the maximum period for which the Guarantee is available on the facility is seven years, from the date of acceptance by the Borrower. | ||

The Scheme will be for individual calendar years. | ||

4.3 Loan Values | ||

Scheme guarantees may be provided for any eligible facility value from €10,000 to €1million, although the Lender has discretion to only use the Scheme within part of this range if it chooses to do so, e.g. to align their use of the Scheme with their own SME lending product segmentation. | ||

Applicants may apply for more than one Scheme Facility during the life of the Scheme so long as the aggregate of the initial value of all facilities provided does not exceed €1million under the Scheme. Once €1million of facilities has been provided, the Applicant is ineligible to apply for any additional Scheme funding, even when the original €1million has been repaid. | ||

4.4 Eligible Credit | ||

The Scheme is designed to be able to be used to support a range of debt instruments appropriate to the borrowing needs of SMEs in both segments (“Pillar 1” and “Pillar 2”) of the Irish economy. New Borrowers seeking funding facilities for working capital or investment purposes are eligible, as well as borrowers seeking to refinance loans where its bank is exiting the Irish SME credit market. These facilities can be either unsecured or partially secured. | ||

Demand loans, term loans and performance bonds will be covered by the Scheme. Lenders will also be entitled to make the case for the inclusion of other types of debt instrument, with such cases then considered by the Department. | ||

4.5 Ineligible Credit | ||

Overdrafts, leasing, trade finance and credit cards are currently outside the scope of the Scheme. | ||

4.6 Portfolio Approach | ||

The State will enter into an agreement with each Lender and will accredit the Lender to participate. For each calendar year that the Scheme runs, all of an accredited Lender’s Scheme Facilities accepted by Borrowers in that year will be treated as a separate Portfolio of that Lender. | ||

The guarantee will be given to each Lender on the sum of those Scheme Facilities accepted by Borrowers in each year of the Scheme (the Lender’s annual Portfolio value, the Portfolio Accepted Lending) rather than individually (loan-by-loan basis). The decision to approve loans under the Scheme is at the discretion of the Lender, provided the Borrowers meet the eligibility criteria. | ||

A Portfolio Default Limit will be set at a value of 10% of the aggregate value of Scheme Facilities accepted in each year (portfolio) for each Lender (or the Portfolio Base Lending Limit, if it is lower), thereby capping the State’s exposure at a guaranteed 75% of the Portfolio Claim Limit. Once a Lender’s defaults in any of their portfolios have reached that portfolio’s Portfolio Claim Limit, any further losses from Scheme Facilities in that portfolio must be borne by the Lender and will not be eligible to have 75% of them reclaimed from the Minister. | ||

4.7 Premium Charge | ||

In return for the guarantee, Borrowers will be required to pay the Guarantor a premium of 2% on the annual outstanding contracted principal balance of the Scheme Facility, assessed and collected by the Scheme’s operator over the term of the guarantee. These payments must be made in advance either annually or in instalments (quarterly and half yearly), and the first drawdown is conditional on these payments being up-to-date on the date of the drawdown. | ||

4.8 De Minimis State Aid | ||

The assistance provided through the Scheme, like many Government-backed business support activities, is regarded as a State Aid and is governed according to the European Commissions De Minimis State Aid rules. The Aid attributable to the provision of a Scheme Facility contributes towards the rolling three-fiscal-year De Minimis limit (usually €200,000 — see exceptions below for certain business sectors) to which SMEs are subject. Therefore the Aid arising from any Scheme Facility, in conjunction with all other De Minimis State Aid received by the Applicant in this or the previous two fiscal years, must not cause the applicant’s particular limit to be exceeded. | ||

Exceptions to the €200,000 State Aid Limit | ||

Primary agricultural production (i.e. farming) is excluded from the Scheme. Value-adding downstream processing and marketing activities are regarded as being “industrial” and so are eligible for the Scheme and subject to the €200,000 limit. | ||

A lower limit of €100,000 applies to Scheme Facilities provided for roadtransport businesses, with a specific additional prohibition on the purchase of road freight transport vehicles to be used for hire and reward. | ||

A lower limit of €30,000 applies to Scheme Facilities provided to businesses involved in the production, processing and marketing of fisheries products. There is a specific additional prohibition on the construction or acquisition of fishing vessels or their modernisation to increase capacity or efficiency, with the exception of safety-related improvements. | ||

Irrespective of the thresholds identified above, any restrictions on sectoral eligibility as prescribed by the Guarantor take precedence for the purpose of determining entitlement to use the Scheme. | ||

4.9 Operator | ||

The Department shall contract with a third-party service provider, the “Operator”, in accordance with Section 7 of the Credit Guarantee Act 2012 to manage the overall operation of the Scheme. | ||

4.10 Data Protection Act | ||

The Department, its Operator and the Lender will agree in the bilateral guarantee agreement that in respect of confidential information that constitutes personal data that they will follow the requirements of the Data Protection Act 1988 and the Data Protection (Amendment) Act 2003 . The Lender, Operator and the Department must take every step to ensure that only information about Borrowers relevant to the operation of the Scheme is collected and retained, and that this information is held securely. | ||

4.11 Marketing and Promotion | ||

If the Lender decides to promote their participation in the Scheme through their own publicity material, such as printed brochures, press advertising or website content, the Lender undertakes to ensure that all details regarding the Scheme are at all times as up to date and accurate as possible. | ||

5. Accreditation of Lenders to the Scheme | ||

Legal Agreement | ||

In order to participate in the Scheme, participating Lenders will have certain responsibilities and obligations. These requirements will be described formally in a standard agreement which each Lender enters into bilaterally with the Minister, following an accreditation process. | ||

The subject of the legal agreement which will be entered into by the Minister with each individual bank will be in accordance with the terms and conditions laid down in: | ||

1. The Credit Guarantee Act 2012 , | ||

2. This Scheme, | ||

3. The Scheme Operating Manual, and | ||

4. The data reporting requirements, to include for each Facility: size, term, sectoral and geographic distribution, purpose of debt, etc. | ||

Lenders will also be required to provide to the Operator all information necessary to administer the Scheme throughout the lifetime of the Scheme. | ||

Accreditation Process | ||

Lenders will be required to provide all requested information to allow the Operator, on behalf of the Minister, perform an accreditation process focusing on the detail and appropriateness of the prospective Lender and their systems in the following areas: | ||

Strategic Positioning | ||

A review of the Lender’s finance products, where the Lender organisation fits in the SME financing landscape and the extent to which it is targeting specific market sectors. | ||

Lending Policies and Procedures | ||

The Lender will be required to attest that their credit, security and recoveries policies and procedures, and their standard documentation and ancillary business support services applied to Guarantee Scheme debt will be similar to those applied to other non-Scheme SME loans. | ||

Additionality | ||

A detailed consideration of how the Lender will use the Scheme to support lending over and above that currently being achieved. To demonstrate an understanding of the additionality principle, Lenders will be requested to provide examples of where the Scheme could have been used in the past — i.e. examples of viable lending applications that were declined specifically due to the circumstances the Scheme is intended to address. | ||

Regulatory Matters | ||

In addition to the core eligibility criteria set out above, the Lender will be required to attest that the following 4 matters are supervised by its regulatory authority and that the Lender meets the requirements of that regulatory authority in terms of: | ||

1. Legal Structure and Governance | ||

Consideration of the legal form, ownership, regulation and governance procedures, | ||

2. Management | ||

Competence, suitability and probity of the management team and the board of directors, | ||

3. Performance | ||

The organisation’s objectives and performance, including financial appraisal and peer comparison, where appropriate, and | ||

4. Availability of Capital | ||

The Lender’s current and future funding sources. | ||

Allocation of Guarantee Portfolio | ||

The Lender will be required to estimate the likely volume of loans that it will make under the guarantee Scheme and apply for an allocation to the Operator, following the accreditation process. | ||

6. Operational Matters | ||

The Operator is responsible for all matters related to the day-to-day running of the Scheme, and will be the point of contact for the Lenders. The Department will not be involved in day-to-day matters of an operational nature. | ||

6.1 Target Borrowers | ||

The Applicant may not be a customer in difficulty. | ||

The Applicant SME (or Applicant’s group) must employ fewer than 250 persons. | ||

The Applicant (or Applicant’s group) must have an annual turnover not exceeding €50 million and/or an annual balance sheet total not exceeding €43 million. | ||

The source of the turnover and balance sheet figures should be the latest management or statutory accounts, whichever is deemed appropriate according to each Lender’s normal credit assessment criteria. | ||

For start-ups, or businesses which have traded for less than 12 months, the turnover and balance sheet figures examined should be those forecast for the first 12 months of trading. | ||

Where the Applicant is a company within a larger group, the turnover is treated on an aggregated basis for the whole group of companies. In such instances the latest consolidated group accounts should normally be used (unless the Lender’s credit assessment process dictates otherwise). | ||

There is no requirement to “group” applications with common directors, but Lenders should follow their normal commercial practices with regard to treatment of such connections. | ||

6.2 Eligible Sector and Activity | ||

The Scheme Facility must be used to support activity with an eligible purpose in an eligible sector. Details on eligibility restrictions are found below. Once the stated eligibility rules are met, the Applicant will be eligible for a Scheme Facility if: | ||

• the Lender would be prepared to offer the Applicant a non-Scheme Facility if full collateral was available or if it is a growth / expansionary SME, which due to its sector, markets or business model, is perceived as a higher risk under current credit risk evaluation practices, | ||

• the Lender believes that the Applicant has a viable business plan and that the Scheme Facility can be repaid, and | ||

• the Lender believes a demand loan, term loan or performance bond is the appropriate debt instrument to use in terms of the Applicant raising finance. | ||

Each Lender must assess viability according to their normal credit assessment criteria. The decision of the Lender is final in terms of assessing viability. The Lender will normally undertake this assessment prior to considering the Scheme eligibility criteria. If the Lender deems the Applicant’s proposal is not serviceable, the proposal will not be viable irrespective of the existence of the Scheme. | ||

Where the business has existing facilities, but is seeking to invest in an emerging sector, this would be eligible under “Pillar 2” of the Scheme, provided the new loan application is perceived by the Lender as a higher risk under current credit risk evaluation practices. If it is a new loan it is considered additional credit. If it is a consolidation or restructuring of an old loan, it is not considered additional credit and is therefore ineligible, unless the situation is where the SME is seeking refinancing to allow it move from a bank that is exiting the Irish SME credit market. | ||

6.3 Verification of Borrower’s State Aid | ||

As part of the lending process the Lender must ask the Applicant for the necessary information to enable the Lender to establish whether or not receipt of a Scheme Facility will result in the Applicant breaching the €1million lifetime Scheme limit or the rolling three-fiscal-year1 €200,000 (or lower) De Minimis State Aid limit. This information must be made available from the Borrower in the completed and signed ‘Borrower Scheme Application Form’. The Lender may accept the Applicant’s declaration as being sufficient confirmation of this point. However, should the Lender have any reason to believe that the Applicant may in fact be in breach of the limits, there is a duty upon the Lender to investigate and, if necessary, reject the application. | ||

Where a Borrower is found to be in breach of the limits once the Scheme Facility has been drawn, the Lender must inform the Operator immediately. If the breach cannot be remedied, it will be a commercial decision for the Lender whether to permit the facility to continue from that point without the guarantee, or to make a Demand on the Borrower. | ||

6.4 Restrictions on Exporting | ||

As the Scheme will operate under the De Minimis State Aid rules, it cannot be used to specifically support export-related activities. This does not mean, however, that because a business exports it is ineligible from receiving a Scheme-backed facility. It is the purpose to which the funds borrowed will be put which is the determinant. | ||

A Scheme Facility may not be provided to support a transaction where the amount of funding required is explicitly linked to a quantity of goods or value of services being exported. Therefore a facility to provide working capital specifically in support of export sales will be ineligible because working capital requirements are usually driven by sales. | ||

6.5 Arrangement Fees and Margin | ||

The Lender may charge an arrangement fee and interest rate margin for the Scheme Facility as per the Lender’s normal charging procedure. | ||

6.6 Payment of the Scheme Premium | ||

Introduction | ||

The Scheme Premium is the amount of money the Borrower pays to the Minister as a contribution towards the costs of the Minister providing the Scheme. As such it is analogous with an arrangement fee payable for the provision of a facility and not an insurance premium paid to give the Borrower protection against their inability to repay a facility which has been provided. The first drawdown on a Scheme Facility is conditional on the Premium payments being up-to-date on the date of the drawdown. | ||

The Borrower pays 2% per annum on the annual outstanding contracted principal balance of the Scheme Facility. The Borrower is provided with a premium schedule as part of their facility documentation. Premiums are recalculated if the repayment profile is changed. Premium payments cease if a Borrower repays early. | ||

Premium Value | ||

The premium payable to the Department is 2% per annum (for the term of the Guarantee) on the annual outstanding contracted principal balance of the Scheme Facility. The premium is payable in advance to the Operator and shall be calculated, on the annual outstanding contracted principal balance of the Scheme Facility. The Operator shall hold the premium in a trust account for the Minister. | ||

This amount will be set out in the Premium Payment Schedule accompanying the Scheme Facility Letter. The documentation will explain how much is due and the frequency. | ||

Payment Arrangements | ||

Payment is collected from the Borrower by the Lender before their first Drawdown, and paid into an Operator Premium account held in trust for the Minister. The Lender will monitor receipts and reconcile those receipts against records of Guaranteed Scheme Facilities provided by the Lender until the first Drawdown. | ||

Non-payment of the Premium | ||

Prior to the 1st Drawdown: | ||

• By the date of the first Drawdown, the Lender will collect all Premium payments due as a condition precedent and pay this amount into the Operator’s Premium account held in trust for the Minister, | ||

• No funds will be made available for Drawdown by the Borrower until the Lender has confirmed that the Premium payments have been made to the Operator’s Premium account held in trust for the Minister, and | ||

• If the Premium payments are not made within 6 months of the date of the Acceptance of the Facility Scheme, the Guarantee expires. | ||

After the first Drawdown: | ||

• Premium payments due will be collected by the Operator, | ||

• In the event of a Borrower failing to pay a Premium, the Operator will contact the Borrower regarding the non-payment of the premium charge and determine the future course of action, | ||

• The Lender will be advised by the Operator in a timely manner that the Borrower has failed to make a payment and the actions agreed, and | ||

• The above process will be repeated as necessary. | ||

The Lender has the option to debit the Borrower’s account, if permissible, and credit the Operator Premium account held in trust for the Minister, or pay the premium from the Lender’s funds on behalf of the Borrower if it believes that this is the most expedient way in which to resolve the matter. The Operator must be informed of the circumstances when the latter option is chosen. | ||

If the overdue Premium payment is not paid within six months of the due date then the Guarantee will lapse. To avoid this the Lender must either ensure that the Premium has been paid, or alternatively (on non-payment) register the Borrower as being in default within the stated payment period to initiate the process leading to making a Guarantee Claim. | ||

6.7 Borrowers Moving Between Lenders | ||

Due to differing credit assessment and risk appetite between Lenders it is possible that one Lender may refuse to provide a Scheme Facility while another Lender will be willing to do so. Extending that principle, if an SME were seeking to move their banking relationship it is possible that the new Lender will only be willing to continue to provide a comparable level of term debt by way of a Scheme Facility, irrespective of whether or not the previous Lender had provided a Scheme Facility. However, there is also a need to ensure that the Scheme is not used as a mechanism for transferring existing commercial risk to the State or as an incentive by a Lender seeking to attract customers from a competitor. Therefore: | ||

• If Lender A had previously provided a facility without need for the Guarantee but Lender B is only willing to provide an equivalent facility with the benefit of the Guarantee then this is not permissible, unless Lender A is a bank that is exiting the Irish SME credit market. | ||

• If Lender A has previously provided a Scheme Facility and Lender B is similarly willing to provide an equivalent facility with the benefit of the remaining term of the Guarantee then this is permissible and, for State Aid purposes, the “like for like” facility provided by Lender B does not constitute additional assistance to the Borrower. Lender B must inform the Operator of the “like for like” nature of the Facility with details of the reduced guarantee period (the remaining guarantee period of the original facility from Lender A). | ||

• If Lender A had previously provided a Scheme Facility but Lender B is willing to provide an equivalent facility without requiring the benefit of the Guarantee then this is permissible. | ||

6.8 Drawdown and Repayment | ||

The guarantee starts on the date of the Borrower signing the Scheme Facility agreement, regardless of the timing or number of drawdowns in tranches that has been agreed by the Lender and the Borrower. However, the first drawdown is conditional on the Premium payments being up-to-date at the time of the Drawdown. | ||

Capital Repayment Moratoriums | ||

Capital Repayment Moratoriums are permissible but are at the discretion of the Lender and must comply with the Lender’s standard credit procedures. However, the maximum period for which the Guarantee is available is seven years. | ||

Tranche Drawdowns | ||

The Lender can agree to allow the Borrower to draw down the Scheme Facility gradually, as and when it is needed. However, in the event of gradual drawdown, the first tranche must be drawn down within six months of the Scheme Facility being accepted, or within the standard timeframe applied by the Lender, whichever is shorter. It should be noted that the Scheme Guarantee term runs from the acceptance of the facility by the Borrower, and is not affected by delayed drawdowns. | ||

It is the Lender’s responsibility to keep accurate records of the outstanding balance of the Scheme Facility, including any tranche drawdowns and lump sum repayment which may have occurred. | ||

Repayment Frequency | ||

Capital repayment frequency can be monthly, quarterly, six-monthly, annually or as the Lender deems appropriate. The Lender could also provide a Scheme Facility with a bullet repayment at the end of the term of the Scheme Facility — however, the maximum period for which the Guarantee is available is seven years. The Lender’s normal credit criteria will apply in all instances. | ||

Changes to the Term | ||

If the scheduled final date for repayment of the Scheme Facility is likely to change within the term of the Guarantee, this must be recorded by the Lender and reported to the Operator. | ||

Early repayment of a Scheme Facility is permissible. Early repayment charges are subject to the Lender’s normal charging criteria. No further Scheme Premiums will be collected after the repayment has occurred, and no refund of Premiums already paid will be made. | ||

6.9 Scheme Security | ||

When determining eligibility by “Pillar 1” of the Scheme, the Lender must investigate all available security and either charge or discount as unavailable this security, according to its normal credit and security assessment procedures. | ||

Security may be defined as all business or, if appropriate, personal assets which a Lender would look to as security for business borrowing in the normal course of business: | ||

• For sole traders and partnerships, Lenders will investigate the personal assets of the individuals owning the business (as per normal commercial practice). | ||

• For a limited company, potential security would include all standard business security (for example, fixed charges, debentures, corporate guarantees) plus personal guarantees from directors/shareholders/third parties as appropriate. | ||

Personal guarantees may be supported or unsupported, as deemed appropriate by the Lender. | ||

Unsupported personal guarantees from a director/shareholder are frequently viewed as a means of demonstrating personal commitment from the Borrower and a Lender is entitled to request this security, if to do so is consistent with the Lender’s normal commercial lending criteria. | ||

For supported personal guarantees, Lenders can look to any personal asset of the personal guarantor. | ||

Lenders will make Borrowers aware that in the event of default, the Borrower remains liable for 100% of the outstanding Scheme Facility debt and that normal recovery and enforcement procedures (against the Borrower or personal guarantor) will be pursued by the Lender before any demand is made on the Scheme guarantee. The provisions of the Scheme Guarantee does not remove any liability for the borrowing from the Borrower or any personal guarantor. | ||

Having examined all potentially available security, the Lender will have one of three security scenarios: | ||

• The Lender believes the Borrower has sufficient additional security available to secure the borrowing requirement. By definition, the borrowing requirement can be funded via a standard commercial facility and the Scheme may not be used. | ||

• The Lender believes the Borrower has no additional security available to secure the borrowing requirement. Consequently, the borrowing requirement cannot be funded by a standard commercial facility. In these circumstances, the Scheme can be used to support the full borrowing requirement. | ||

• The Lender believes the Borrower has some but insufficient additional security to fully secure the borrowing requirement. In these circumstances, the Scheme may be used in one of two ways as follows: | ||

a) To support the full borrowing requirement. The Lender will charge all (additional) available security to support the Scheme borrowing (listed as new or additional security in the Scheme Facility Letter), in which case this additional security will be known as “Linked Collateral” for the Scheme purposes. In the event of Borrower default, any proceeds realised from this Linked Collateral must be used to repay the outstanding Scheme borrowings in priority to any other outstanding debt, or | ||

b) The Lender could use the additional available security to facilitate an additional borrowing facility on normal commercial terms, with any funding shortfall thereafter funded via a wholly unsecured Scheme Facility. | ||

The Lender has complete discretion on which funding structure to adopt. | ||

Whenever “Pillar 1” of the Scheme is used for eligibility of a Scheme Facility (‘Insufficient collateral for the additional facilities’), the Lender must be able to confirm that it would lend to the Borrower but for the lack of available security. | ||

The existence of the Scheme should not be seen by Borrowers or their advisors as a mechanism for putting personal assets beyond consideration. | ||

7. Scheme Eligibility Restrictions | ||

The Scheme is designed to be used as widely as possible. Nevertheless, as a result of the De Minimis State Aid regulations, certain restrictions must be applied with regard to certain industrial sectors and to export activity. Adherence to the Central Bank of Ireland Code of Conduct for Business lending to Small and Medium Enterprises, 2012 (as revised) is expected at all times. | ||

7.1 Business Sector restrictions | ||

Aquaculture (Fish Farming) | ||

Activities related to the production, processing and marketing of fisheries products are eligible for the Scheme but because there is a lower State Aid limit for aquaculture of €30,000 the maximum permissible Scheme Facility value will be significantly lower than the €1million maximum. | ||

Note that the Scheme is not allowed to be used when the facility would be in support of the construction or acquisition of fishing vessels or their modernisation to increase capacity (expressed in terms of tonnage or power) or efficiency, with the exception of safety-related improvements. | ||

Primary Agriculture | ||

Primary production in agriculture is excluded from the scope of the Scheme in the light of particular restrictions under the De Minimis State Aid rules and because the specific market failures identified do not apply in these sectors. | ||

Banking, Finance and Associated Services | ||

Any activity that involves granting of finance or a financial service to clients is ineligible, such as banking, deposit taking and building societies; companies involved in granting loans, mortgages, hire purchase or credit services; mortgage brokers that are attached to banks; venture capitalists; seed corn finance companies and stockbrokers. | ||

Accountants, auditors, management service companies such as bookkeeping firms, tax advisers, management consultants, business advisers and companies that provide support to small firms on financial matters without actually supplying funds are eligible. | ||

Coal | ||

All activities in the coal sector are ineligible. | ||

Formal Education | ||

Formal education is ineligible. | ||

Businesses offering courses that lead to vocational qualifications and skills (i.e. those skills and qualifications directly usable in a job) are eligible, as are nursery schools, day schools and playgroups for young children and sports coaching. | ||

Insurance and Associated Services | ||

Companies and societies primarily engaged in transacting all types of insurance business are not eligible. | ||

Insurance agents and brokers that do not provide insurance themselves and that are independent of insurance companies are eligible. | ||

Owning and Dealing in Property | ||

Land and estate owners, property investment companies and those that derive their income from owning and letting property are not eligible, nor is dealing in land or property for speculative gain. | ||

Building firms that buy land or property to develop or refurbish and who employ the building workers themselves or sub-contract the work are eligible. | ||

Public administration, national defence, and compulsory social security | ||

All publicly owned bodies and companies, including their 100% subsidiaries, are ineligible. | ||

An exception to this is where the State has a controlling interest (but not 100% interest) in a company in which it holds share capital as result of investment by a venture capital fund, whereby public funds are invested alongside private funds. | ||

7.2 International Issues | ||

Restrictions on Exporting | ||

As the Scheme will operate under the De Minimis State Aid rules, it cannot be used to specifically support export-related activities. This does not mean, however, that because a business exports it is ineligible from receiving a Scheme-backed facility. It is the purpose to which the funds borrowed will be put which is the determinant. | ||

A Scheme Facility may not be provided to support a transaction where the amount of funding required is explicitly linked to a quantity of goods or value of services being exported. Therefore a facility to provide working capital specifically in support of export sales will be ineligible because working capital requirements are usually driven by sales. | ||

Lenders need to consider whether the funding is in support of dedicated export activities and that the decisive factor is the presence of an intention to promote exports. Activities which would be ineligible in this context include, for example, the financing of: | ||

• an advertising campaign outside Ireland, | ||

• an individual export order or series of orders, | ||

• the manufacture of a product which is only available to customers in an overseas market, | ||

• the establishment of a representative office outside Ireland or the appointment of an overseas agent, and | ||

• the setting up of a distribution network overseas. | ||

Activities not directly related to specific exports are eligible, including: | ||

• participation in trade fairs, | ||

• feasibility studies or consultancy support to facilitate the launch of a new or existing product into a new market, and | ||

• specific activities (e.g. generic product development, equipment purchase or facilities enhancement activities) within the Irish operations of a business, irrespective of the current composition of market(s) into which the business sells. | ||

This spending does not necessarily have to take place in Ireland. | ||

Protectionism | ||

The De Minimis rules are also designed to prevent protectionism. The Scheme therefore cannot be used if provision of the finance is being made conditional on the use of domestically produced goods or services in preference to imports. | ||

Foreign Ownership and Registration | ||

Companies that are registered outside Ireland are eligible to use the Scheme provided they are trading in Ireland and the funding guaranteed under the Scheme is used in connection with a business activity in Ireland. | ||

Where a company has Irish ownership but is registered abroad, it is eligible to apply for the Scheme provided it is trading in Ireland and the funding guaranteed under the Scheme is used in connection with a business activity in Ireland. | ||

7.3 Acquisitions, Buy-Outs and Share Purchases | ||

The Scheme is designed to stimulate economic growth and all Scheme lending is intended to add economic value to the borrowing businesses. Share transfers (including purchases of minority interests, share buy-backs and corporate acquisitions effected via the purchase of a business’s trade and assets) do not in themselves introduce new funds into a business and are often motivated by personal gain. | ||

Share transfers may, however, impact on corporate control, and if this is of clear benefit to the business, then the Scheme may be used in support of the transaction. The Lender must inform the Operator of all such cases, and must be prepared to defend any decision to the auditor, who under paragraph 12 is an independent auditor selected by the operator. | ||

Lenders must prepare a file note justifying the use of the Scheme, where appropriate. | ||

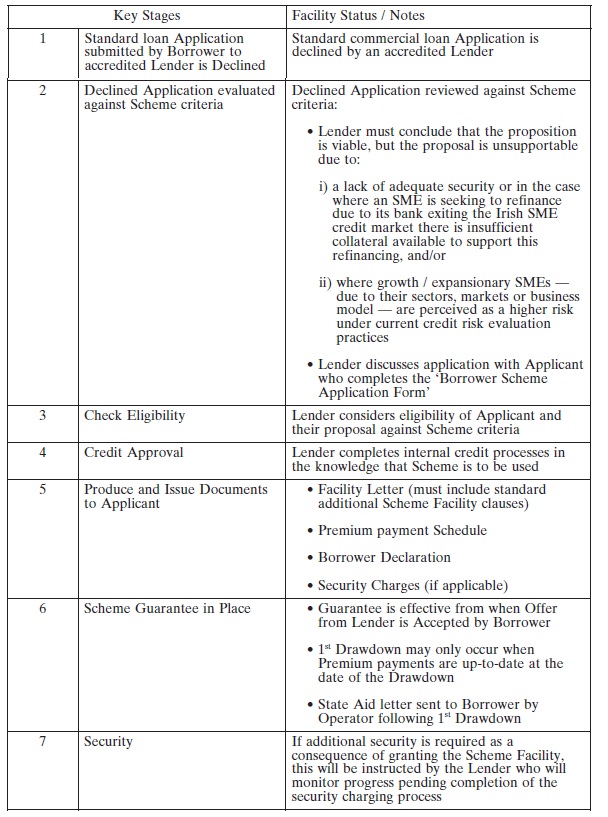

8. General Scheme Application Process | ||

| ||

Note that adherence to the Central Bank of Ireland Code of Conduct for Business Lending to Small and Medium-sized Enterprises, 2012 (as revised) is expected at all times. | ||

9. Managing the Scheme Facility after it is Guaranteed | ||

9.1 Transfers of Scheme Facilities between Lenders | ||

Introduction | ||

Often when switching Lender, a business will need to negotiate new borrowings from Lender B (to which the business is moving) specifically in order to repay existing lending provided by Lender A (which the business is leaving). It is possible in such cases that the original lending provided by Lender A is a Scheme Facility and the new lending from Lender B to replace it also satisfies the Scheme eligibility criteria. | ||

The Scheme eligibility rules require that no business (or group) can have Scheme facilities over €1million during the lifetime of the Scheme and De Minimis State Aid rules specify that no business (or group) may receive more than €200,000 of State Aid in any rolling three-fiscal-year period. The implication is that re-applying for a comparable Scheme Facility would count towards the €1 million Scheme lifetime limit and €200,000 rolling three year State Aid limit. | ||

The practical arrangements described below are therefore intended to ensure that the presence of the Scheme does not act as a barrier to the freedom of businesses to switch between Lenders. | ||

These arrangements apply specifically in connection with Lender B providing a Scheme Facility to a switching Borrower which previously had a Scheme Facility from Lender A, in order for the Borrower to be able to fully repay the balance of that facility to Lender A. | ||

The Borrower is therefore limited to a Scheme Facility provided by Lender B which is for a value not exceeding the outstanding capital balance of the previous facility from Lender A at the point of switching, which itself may not exceed the original value of the facility when first provided by Lender A. | ||

For the avoidance of doubt, no outstanding interest, early redemption penalties or other charges may be added to the replacement Scheme-backed facility provided by Lender B. | ||

Any additional borrowing requirements identified by Lender B at the time of switching or thereafter, in connection with which the use of the Scheme may be appropriate, must be considered as a separate transaction. | ||

The original Scheme Facility offered by Lender A was guaranteed for either 7 years from the date of its Acceptance or the term of the Scheme Facility, whichever was shorter. If this Scheme Facility is switched to a new Lender, the Guarantee will still expire on the same date as before, and the new Lender must inform the Operator of this date. | ||

Once the Scheme Facility at Lender A has been repaid by the new Scheme Facility at Lender B, the amount of the original Facility is removed from Lender A’s Portfolio Accepted Lending for that Portfolio and their Portfolio Claim Limit recalculated. | ||

Practical Arrangements | ||

For Lender A: | ||

On receipt of the funds from Lender B the facility will be reported as Repaid. | ||

Lender A now has no further entitlement to claim against the Guarantee in respect of the transferred Scheme Facility, and Lender A’s Portfolio Accepted Lending (for the year that the Facility was Accepted in) is reduced by the original amount of the Scheme Facility, and their Portfolio Claim Limit recalculated. | ||

For Lender B: | ||

The fact that the switching Borrower had previously been provided with a Scheme Facility by Lender A does not remove the requirements for Lender B to undertake their normal commercial due diligence and to establish that it remains appropriate to provide the Borrower with a Scheme Facility on this occasion. | ||

Each case will be treated as a new application and processed in the usual manner, except that the Guarantee will only run to the original expiry date with Lender A (i.e. either 7 years from the date of the original acceptance of the facility with Lender A or the term of the facility with Lender A, whichever was the shorter) and will not be eligible for a potential 7 years from the date of acceptance with Lender B. This effective guarantee expiry date will be notified to the Operator. | ||

Lenders should expect that a sample of such cases will be audited in future cycles of Lender audits. | ||

It will be of assistance to Lender B if, at the time of application, the Borrower is able to provide a copy of the Information Declaration applicable to their previous borrowing from Lender A, and their existing Premium schedule. | ||

9.2 Refinancing of Non-Scheme Debt from another Lender | ||

Credit assessment and risk appetite will vary between Lenders and it is natural for Borrowers to consider alternative sources of finance. However, the Scheme is not to be used by a Lender as a mechanism for building market share by acquisition. Therefore, when taking on a new customer’s existing debt, use of the Scheme is not appropriate unless the potential new customer is seeking to refinance where their bank is exiting the Irish SME credit market. Therefore it is not permissible for one accredited Lender to use the Scheme to take on existing non-Scheme debt that has previously been provided by another institution, whether or not that institution is an accredited Lender, unless that institution is exiting the Irish SME credit market. | ||

10. Demands and Recoveries | ||

10.1 Overview | ||

The key stages in the Demands and Recoveries process are as follows: | ||

a) Demand on Borrower, | ||

b) Pursue Borrower for Repayment/Recovery of Outstanding Exposure, | ||

c) Recoveries Procedures (via security realisation or recovery procedures), | ||

d) Apportion Recovery Proceeds, | ||

e) Claim on the Guarantee, and | ||

f) Subsequent Procedures and Recoveries. | ||

10.2 Key Stages in the Demands and Recoveries Process | ||

(a) Demand on Borrower | ||

“Demand on the Borrower” is defined as occurring when the Lender makes a formal demand in writing to the Borrower for repayment of the outstanding borrowing. This does not include periods of negotiation prior to the Lender issuing the formal demand. | ||

The date and value of the Demand on the Borrower must be notified to the Operator within 10 business days of the Demand being made and a copy of the Demand attached. The Operator will acknowledge receipt and notify the Lender of the latest date for submitting a claim. | ||

The amount notified to the Operator will be the total outstanding principal balance of the Scheme Facility. It is noted that the Demand on the Borrower may cover other outstanding facilities in addition to the Scheme Facility, in which case Scheme and non-Scheme debts will be separately itemised. | ||

Once Demand on the Borrower has occurred it is acknowledged that further Premiums will not be paid. | ||

Following Demand on the Borrower the Lender will continue to follow their normal practices for the management of non-performing facilities, such as those relating to the charging of interest, although it should be understood that the Scheme Guarantee only applies to the outstanding principal and not accrued interest in the case of demand loans, term loans and performance bonds. | ||

(b) Pursue Borrower for Repayment/Recovery of Outstanding Exposure | ||

The existence of the Scheme Guarantee does not alter the Borrower’s liability in respect of their indebtedness to the Lender. The Borrower is always liable for 100% of the outstanding exposure. Therefore Lenders will pursue Borrowers for repayment of all outstanding exposure on Scheme Facilities (“Scheme Exposure” or “Scheme Debt”) via their normal recoveries procedures. | ||

The Scheme guarantee is provided to the Lender (not to the Borrower) as an alternative form of security which may be called upon by the Lender in the event that the Borrower fails to meet either their repayment obligations or Scheme premium payment obligations within the 7 years of accepting the Scheme Facility (or the Term of the Facility, if it is shorter). There is a responsibility on Lenders when using the Scheme to make clear to Borrowers that the Scheme Guarantee does not remove or reduce the Borrower’s liability to the Lender. | ||

Where only Scheme Debt exists (i.e. no other exposure exists, or such exposure has been repaid successfully) and security remains available, the Lender will pursue that security in order to reduce or eliminate the outstanding Scheme Debt before making a Claim against the Scheme Guarantee. | ||

(c) Recoveries Procedures (via security realisation or recovery procedures) | ||

Practical Application | ||

Realisations from Secured (i.e. formally charged) business or personal assets in relation to Scheme Debt (i.e. “Linked Collateral”) | ||

The Lender will first pursue recovery of charged business and/or personal assets, including: | ||

For unincorporated businesses, security realisations from charged business or personal assets or from third party security or guarantees, and | ||

For limited companies, security realisations from business or personal assets in relation to personal guarantees (if applicable). For example, from debentures, fixed asset charges and mortgages plus any other standard business-related security. | ||

Realisations from Secured (i.e. formally charged) business or personal assets in relation to other Lender Commercial Debt | ||

The Lender will follow their normal security realisation procedures in relation to security charged in support of other non-Scheme debt (“Lender Commercial Debt”). | ||

If all Lender Commercial Debt has been repaid from security proceeds and only Scheme Debt remains, surplus security proceeds will be used to repay outstanding Scheme Debt. | ||

Recoveries from Unsecured Business or Personal Assets, or any other Unsecured Recoveries, including: | ||

• Any repayments (lump sum, ad-hoc or regular repayments) made to the Lender on a voluntary basis by the Borrower, | ||

• Any payments made to the Lender following legal proceedings against the Borrower, | ||

• Any bankruptcy or insolvency proceedings (including Individual or Company Voluntary Arrangements), and | ||

• The proceeds of enforcement action against the Borrower which the Lender pursues towards recovery of the debt. | ||

All of the above are expected to be treated as eligible recoveries according to normal Lender security realisation procedures. | ||

Recovery Procedures against Unsecured Sole Traders and Partners and/or Personal Guarantors in relation to Scheme Debt | ||

It is recognised that Lenders will usually pursue sole traders, partners and guarantors where personal liability exists for outstanding indebtedness. The extent to which this is undertaken will be in line with the Lender’s normal practice. | ||

Use of Debt Collection Agents | ||

Where it is the Lender’s normal commercial practice to use the services of a Debt Collection Agent it should continue to do so. | ||

Sale of Outstanding Debts to a Third Party | ||

If a Lender sells any outstanding Scheme Debt to a Debt Collection Agent or any other Third Party, the proceeds received will be classed as a recovery and any such proceeds will be used to reduce outstanding Scheme exposure. | ||

Cessation of Recovery Procedures | ||

The Lender will follow its normal commercial practices in terms of recovery and enforcement procedures. The presence of the Scheme Guarantee should not cause the Lender to be either more lenient or more rigorous in carrying out such procedures. This approach extends to the point at which a Lender ceases the pursuit of Borrowers when no further repayment is likely or possible, and to circumstances in which it is decided not to attempt to make a recovery. It is in the Lender’s interest to ensure that the justification for any decision not to pursue a recovery or to cease pursuing a recovery is recorded so as to be available for the Scheme Auditors if required. | ||

Recovery Costs | ||

Lenders are permitted to deduct from the recovery proceeds all reasonable costs incurred in realising the value of the recovery. A note of the costs associated with the recovery will be held on file for review by the Operator and the Scheme Auditor. | ||

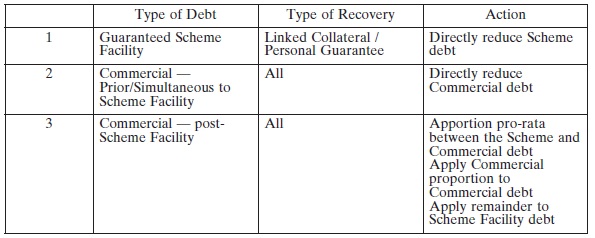

(d) Apportion Recovery Proceeds | ||

The following steps explain how to apportion recoveries. | ||

Step 1 — Categorise Debt | ||

There are several different types of debt, and all Borrower debt must be categorised into one of the following types: | ||

1. Scheme debt, each part of which was: | ||

• Created through a Scheme Facility, | ||

• Within the Scheme Guarantee period at time of Demand on Borrower, and | ||

• Within the Lender’s Portfolio Claim Limit for the relevant Portfolio. | ||

2. Commercial Debt | ||

• Accepted prior to or simultaneous to the Scheme debt, or | ||

• Accepted after the Scheme debt (post-scheme). | ||

For Scheme debt, identify the Portfolio each Scheme Facility belongs to so that the correct Portfolio limits can be applied. | ||

For practical purposes, “Commercial Debt issued simultaneous to the Scheme Debt” means where the new Commercial and Scheme Debt were issued as part of the same funding package to the Borrower (it would therefore be expected that the facility letter for each would have the same or very similar date, even if drawdown does not occur at the same time). Typically, such funding lines will be “marked as available” on or around the same date as the Scheme Debt. | ||

Where Commercial Debt is offered (or existing limits are increased) alongside Scheme Debt, it is the net amount of such new or increased facilities which is treated as simultaneous debt for the purposes of the recovery provisions. | ||

Where the Borrower had a prior (to Scheme Debt) overdraft then the value of this prior Commercial debt is deemed to be capped at the overdraft limit at the time that the Scheme Debt was offered. If at default the overdraft balance is higher than that limit, irrespective of whether or not the overdraft limit had subsequently been increased, then this additional overdraft balance ranks as post-Scheme Commercial Debt. | ||

Step 2 — Apply Proceeds from the Scheme’s Linked Collateral and Personal guarantees | ||

Linked Collateral is any new security that is specifically listed in the Scheme Facility Letter as being attributable in whole or in part (in which case the proportion will be explicitly stated) to the Scheme Facility. | ||

Any recoveries from Linked Collateral (subject to the explicit proportion listed above, if “in part”) must be used to repay Scheme Debt first, along with any personal guarantees for the Scheme debt. | ||

Step 3 — Prior/Simultaneous Commercial Debt | ||

Any Commercial Debt issued prior to or simultaneous to the Scheme Debt ranks ahead of Scheme Debt for the allocation of remaining recovery proceeds, and so all remaining recoveries must be applied against such debt first. | ||

Step 4 — Scheme Debt and post-Scheme Commercial debt | ||

Once all prior/simultaneous Commercial Debt has been fully repaid, if there still remains a surplus of recovery funds, it will be apportioned pro rata between any remaining Scheme Debt and any Commercial Debt issued after the Scheme Debt, according to the following formula: | ||

| ||

Where: | ||

• A is the current outstanding value of Scheme Debt, | ||

• B is the current outstanding value of Commercial Debt, and | ||

• C is the value of remaining recovery funds available. | ||

Deduct the appropriate proportion of the remaining recovery funds from the outstanding Scheme Debt balance to give the reduced outstanding Scheme Debt balance, and deduct the remainder from the outstanding Commercial debt. | ||

In summary the Recoveries allocation prior to a Guarantee claim is: | ||

| ||

Note the Following Exception | ||

If there is other Commercial Debt which is backed by a specific legal charge and the charge does not include an “all monies & liabilities” clause then that debt will be repaid in accordance with that charge and any surplus monies remaining are repaid to the Borrower. | ||

(e) Claim on the Guarantee | ||

The Scheme provides the Lender with a guarantee equivalent to 75% of the outstanding value of any individual facility, after recovery proceeds have been applied, subject to the Portfolio Claim Limit. | ||

Claim Process | ||

The Lender will make each Guarantee Claim individually. | ||

The Guarantee Claim will not include any interest that has accrued and which is outstanding on the Scheme Facility. | ||

Where a defaulting Scheme Facility is covered by any form of Business Loan Repayment Insurance, any payments received under that insurance will be claimed and applied to the outstanding balance as a recovery prior to any Guarantee Claim. Any cancellation costs or other charges relating to the insurance cannot be added to the amount of the Claim. | ||

If, while the recovery process remains incomplete, the Lender chooses to place and hold recovery funds from Linked Collateral in a suspense account, such recoveries will not be applied to the outstanding balance of a Scheme Facility until they are released from the suspense account. In the event that they are not released until after the Guarantee Claim has been made then they will be treated as a post-claim recovery. | ||

Timing Rules for Making a Guarantee Claim | ||

A Guarantee Claim must be made within 6 months of completion of / stopping the recovery process, or within 24 months of Demand on Borrower, whichever is the sooner. However, if the Recovery process is still ongoing after 18 months from the Demand on Borrower, a Claim may be made even though the process is still continuing. | ||

Note that a Guarantee Claim is not to be a substitute for a Lender following their normal recovery procedures. Where no security is available a Lender will follow its normal recoveries processes and then make a Guarantee Claim. | ||

Demand Invoice | ||

The Lender will notify each Guarantee Claim to the Operator individually according to agreed procedures. | ||

Payment of Guarantee Claims will be made quarterly following production by the Lender of the “Demand Invoice” which may be submitted to the Operator quarterly covering periods ending 31 March, 30 June, 30 September and 31 December. | ||

Each Demand Invoice will be presented on the Lender’s letterhead or other official stationery and will contain the following information: | ||

• The date on which it is being submitted, | ||

• A unique reference number assigned by the Lender, | ||

• The period/quarter to which it refers, | ||

• A name and contact details for queries, and | ||

• The total number and value of the Demands listed on the Invoice. | ||

For each Facility for which settlement of the Guarantee Claim is being sought the following information is required: | ||

• Facility Reference Number, | ||

• Business Name, | ||

• Amount being Claimed, and | ||

• Schedule detailing the Recovery process and apportionment of Recovery proceeds. | ||

Only one Demand Invoice may be submitted for each quarter and should be submitted as soon as possible after the end of the quarter to which it refers. Any Scheme Facilities omitted from a Demand Invoice in error should be included on the following quarters Invoice. | ||

Portfolio Limits | ||

All valid Claims are checked against the stored total of approved Claims for their Portfolio, to ensure that their respective Portfolio Claim Limit will not be exceeded. | ||

Where the stored total is already equal to the Portfolio Claim Limit, then the Claim cannot be approved. | ||

Where the stored total will not exceed the Portfolio Claim Limit by the approval of the Claim, the Claim is approved and the stored total of approved Claims updated. | ||

Where the stored total is less than the Portfolio Claim Limit but this Claim will put the total over the Portfolio’s Claim Limit, the Claim is approved for the amount remaining between the stored total and the limit (the amount that will make the stored total equal to the limit). | ||

Where a Claim is declined, it does not count against its Portfolio’s Claim Limit. | ||

First and Second Reviews | ||

The Operator notifies Lenders in writing whether individual Claims against the Guarantee are approved or otherwise. Where the appraisal concludes that there is insufficient evidence to prove eligibility, reasons will be provided and the Lender will be given the opportunity to address the issues raised in a second review. | ||

It is intended that first and second reviews are completed within the quarter following the quarter in which the Claim is made on the Guarantee. Any Claims that are approved in a second review are to be re-submitted on the next Demand Invoice. | ||

Settlement of Demand | ||

The Operator will make payment to the Lender for approved Claims within 30 days of receipt of a valid Demand Invoice. However, if any Scheme Facilities included on a Demand Invoice are not settled then the Operator will advise the Lender of the reason. It is then the Lenders responsibility to resolve the reasons for non-settlement and to resubmit on the next quarters Demand Invoice. | ||

The results of the demands and recoveries received each quarter will be “netted off” by the Operator and the Operator will make a payment within 30 days to the Lender for the net amount, or in the event that recoveries are higher than approved claims in any one quarter, the Operator will request the Lender to remit an electronic payment to the Operator’s Scheme Account within 30 days for the difference. | ||

(f) Subsequent Procedures and Recoveries | ||

Further Recoveries | ||

Once a Guarantee Claim has been made the Lender is still obliged to be mindful of further potential recoveries. Whilst there is no backstop date for recoveries to be made, Lenders will apply their normal commercial judgement to decide when it is appropriate to cease recovery activity. | ||

Where any further recoveries do occur, the calculations for apportioning the proceeds of the recoveries across the Borrower’s debts are re-processed using the new total amount of recoveries, and the same debt positions as existed at the time of the first claim. | ||

Any “difference” between the above re-calculated amounts and the recovery amounts applied previously is then allocated against each of the debt types, and any Guaranteed portion (75% of any resulting “difference” to be allocated against the Scheme Facility debt) must be refunded to the Department (thus repaying the overpayment on the initial Guarantee claim, instead of applying it again against the Scheme debt). | ||

Any interest (on Commercial Debt and Scheme Debt), accrued after a claim has been made on the Scheme guarantee, may not be deducted from any subsequent recovery proceeds. | ||

Whenever there is a Post-Settlement Recovery, the recovery amount will be documented on a Recoveries Statement submitted to the Operator according to the same timetable as the Demand Invoice, and the Lender’s Portfolio position regarding their Portfolio Claim Limit adjusted accordingly. | ||

Note that more than one Recovery may be made for an individual Scheme Facility. | ||

Recoveries Statement | ||

On a quarterly basis, all repayments and recoveries will be reported to the Operator on a Recoveries Statement which will accompany payment of those recoveries to the Minister. | ||

Each Recoveries Statement will be presented on the Lender’s letterhead or other official stationery and will contain the following information: | ||

• The date on which it is being submitted, | ||

• A unique reference number or other identifier assigned by the Lender, | ||

• The quarter to which it refers, | ||

• A name and contact details for queries, and | ||

• The total number and value of the recoveries covered by the Recoveries Statement. | ||

For each Scheme facility against which a recovery has been made and payment is due to the Minister: | ||

• The Facility reference number, | ||

• The business name, and | ||

• The amount recovered. | ||

Only one Recoveries Statement may be submitted for each quarter and will be submitted as soon as possible after the end of the quarter to which it refers. Any Scheme Facilities omitted from a Recoveries Statement in error will be included on the following quarters Recoveries Statement. | ||

Treatment of Regular Repayment Plans | ||

It is recognised that there will be situations where repayment programmes may be agreed with Borrowers which involve very small monthly repayments. To help reduce administration, where small regular payments are concerned, repayments may be aggregated and reported on the Recoveries Statement less frequently, subject to being reported at least annually. | ||

Incorrect Calculations and Losses | ||

If the Lender erroneously over-claims then the Lender must repay the excess amount at the next quarterly invoicing point after becoming aware of the error. | ||

If the Lender erroneously under-claims then it should claim the balance due at the next quarterly invoicing point after becoming aware of the error. | ||

11. Other Conditions | ||

11.1 The Claim Limit | ||

There is a “Portfolio Default Limit” (10%) set in the Scheme, which is the maximum percentage of default in a portfolio that is covered by the guarantee. The guarantee will cover 10% of the lower of the Portfolio Accepted Lending or the Portfolio Base Lending Limit, and this maximum amount covered is the “Portfolio Claim Limit”. | ||

The Lender can claim up to 75% (the Guaranteed Rate) of the outstanding principal amount of any individual Scheme Facility, subject to the cap on total claims on a Portfolio of 75% of its Portfolio Claim Limit. | ||

The “Portfolio” in this instance refers to all facilities accepted under the Scheme in the same calendar year. Although the Scheme may run for several years, a Lender will have a new Portfolio in each calendar year for that year’s Scheme Facilities, each with its own claim limit. | ||

In numerical terms, (where the Portfolio Accepted Lending is capped at the Lender’s Portfolio Base Lending Limit) a Lender’s Portfolio Claim Limit is capped at: | ||

Guarantee Rate x Portfolio Accepted Lending x Portfolio Default Limit | ||

With a Guarantee rate of 75% and a Portfolio Default Limit of 10%, this will have the effect of setting the Portfolio Claim Limit at 7.5% (75% x 10%). For a given portfolio of lending, although each facility in the portfolio would carry a 75% guarantee, the ability of the Lender to make claims under the guarantee is limited by the overall 7.5% Portfolio Claim Limit. The actual default rate on a portfolio determines the extent to which the Lender and Guarantor covers overall losses on the portfolio. | ||

11.2 Lending Limits | ||

Each Lender will request a “Portfolio Base Lending Limit”, which is the maximum level of Accepted facilities the Lender can make in each Portfolio Year for which the Scheme operates. Each Lender can continue to make Offers under the Scheme until the end of each Portfolio Year, with all offers Accepted in that year being part of that Portfolio year (and subject to its Portfolio Base Lending Limit), and all such offers accepted in the following year becoming part of the following year’s Portfolio (and only Guaranteed if the Scheme is also running in the following year). | ||

Lenders have leeway to lend above their Portfolio Base Lending Limit throughout the duration of the Scheme up to a maximum of 105% of the Portfolio Base Lending Limit in any one Portfolio year and all Scheme Facilities will continue to have the benefit of the Guarantee at 75% on an individual facility basis. However, if the total Portfolio Accepted Lending of a Lender in any calendar year does exceed the allocated Portfolio Base Lending Limit by any amount, the Portfolio Claim Limit for the Lender will (unless the Department agrees otherwise) still be linked to its original Portfolio Base Lending Limit. In other words, the Portfolio Claim Limit will not (unless the Department agrees otherwise) be increased if the Lender ends up with a Portfolio Accepted Lending higher than their Portfolio Base Lending Limit. | ||

In the eventuality of the Lender anticipating that it will or appears likely to exceed its Portfolio Base Lending Limit by more than 5% (e.g. its Portfolio Accepted Lending to be more than 105% of its current Portfolio Base Lending Limit), notification in writing needs to be made by the Lender to the Operator. Discussions will then take place as to how best to manage the possibility of excess lending occurring. | ||

If the final Portfolio Accepted Lending of the Lender is below their Portfolio Base Lending Limit, the resultant Portfolio Claim Limit for the Lender will be based upon the actual Portfolio Accepted Lending position reached at the close of the Portfolio year rather than the Portfolio Base Lending Limit. | ||

The amount the Lender is Allowed to claim under the Guarantee | ||

For each of their Portfolios a Lender is allowed to claim up to 7.5% of the Portfolio’s total Accepted position (its Portfolio Accepted Lending) or their Portfolio Base Lending Limit of that year, whichever is the lesser amount. | ||

Increases in its Portfolio Base Lending Limit | ||

The Lender may be able to lend more money than originally agreed for a specific period if: | ||

• the Lender formally asks the Operator for permission to provide more Scheme facilities by making a Specific Lending Limit Proposal, saying exactly how much more the Lender would like to lend, and | ||

• the Specific Lending Limit Proposal sets out in detail why the Lender wants to provide more facilities and includes a business plan explaining the specific purposes for which the extra lending will be utilised. | ||

The Lender can provide more lending for a number of reasons, including: | ||

• enabling the Lender to help more Businesses, | ||

• targeting particular types of Business, | ||

• targeting particular regions in Ireland, or | ||

• targeting high growth Businesses. | ||

The Operator may ask the Lender for more information. The Operator will then, with the Department’s permission write to the Lender to say whether or not the Lender can provide more lending under the Scheme, and under what conditions. This ability to provide more lending under the Scheme is known as the Specific Lending Limit. | ||

Transfer of Lender’s Rights and Responsibilities under the Scheme Legal Agreement to another Entity | ||

Any proposed transfer can only occur with the prior written consent of the Operator. Lenders will contact the Operator at the earliest opportunity if such a transfer were being contemplated. | ||

Change of ownership occurs within the Lender Organisation | ||

A change in shareholding in a Lender does not change its legal personality and, therefore, there is no impact on the Scheme Legal Agreement with regard to the on-going operation of existing facilities. However, the Operator may consider it necessary to re-accredit the Lender following change of ownership if it is expected that the change of ownership may substantively alter the Lender’s SME lending activities. | ||

Termination of Scheme Legal Agreement | ||

Either the Lender or the Department can terminate the Scheme Legal Agreement by giving notice in writing. Neither party needs to provide any reason for doing so. Once the Scheme Legal Agreement has come to an end the Lender is no longer entitled to provide new Scheme Facilities. The (former) Lender retains the ability to claim under the Guarantee for existing Scheme Facilities provided up to the date of termination. | ||

12. Auditing and Reporting | ||

Introduction | ||

An audit of the Lender’s Scheme activities may be carried out at any time in order to ensure the Lender is operating the Scheme correctly and the lending undertaken through the Scheme is appropriate. Auditing is carried out by an independent external auditor selected by the Operator to undertake the role. | ||

The Lender shall provide all reasonable assistance to the auditor in carrying out the audit, including provision of all relevant documentation in relation to individual facilities and the investigation of enquiries raised by the auditor during the audit process. A senior representative of the Lender must be available to discuss the audit findings prior to the publication of the Audit Report. | ||

All correspondence between the Lender and the Operator regarding Scheme Facilities in their Portfolios will be kept by the Lender and the Operator, and made available to the Auditors. | ||

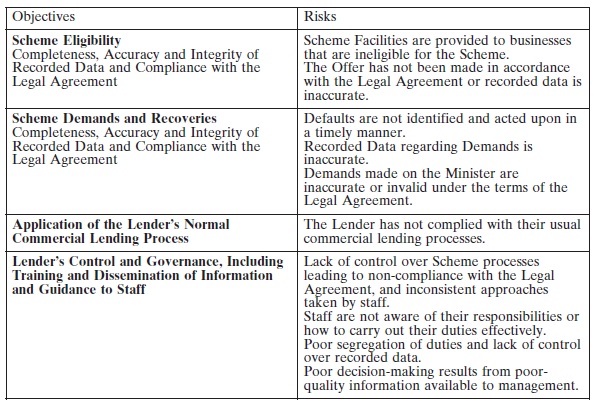

Audit Objectives and Risks to be Examined | ||

Audits are likely to focus on the following Objectives and Risks: | ||

| ||

Audit Grades | ||

The audit as a whole, and each of the four key objective areas, are graded according to the level of assurance obtained by applying the control framework to the Lender as follows: | ||

Substantial Key objectives are met satisfactorily with few minor lapses. | ||

Adequate Operation could be stronger in some areas with few systemic weaknesses or few significant control issues, but with limited impact on the overall operation of the Scheme. | ||

Limited Fundamental systemic failures or control weaknesses rendering operation of the Scheme by the Lender as unreliable. | ||

Evidence Required to Provide Substantial Assurance | ||

A Substantial assurance grade is only possible if the Lender can demonstrate to the Auditor that the Objectives are being met. Lenders are therefore encouraged to be especially careful to ensure that facility files are complete with all appropriate evidence to be able to support each Scheme Facility. | ||

Eligibility The Lender needs to provide evidence that, according to their normal commercial lending criteria, the proposition is viable, but that either (“Pillar 1”) the absence or inadequacy of security makes the proposal unsupportable or in the case where an SME is seeking to refinance due to its bank exiting the Irish SME credit market there is insufficient collateral available to support this refinancing, and/or (“Pillar 2”) it is for an SME which due to its sector, markets or business model is perceived as a higher risk under their current credit risk evaluation practices. | ||

Where any decisions are marginal, additional evidence should be evident which gives a persuasive and robust argument that use of the Scheme is appropriate. An example may be where the Lender has provided a Scheme Facility to a loss-making enterprise. | ||

Monitoring The auditor is likely to seek evidence that monitoring of any Scheme Facility is being undertaken as per the Scheme Facility agreement. | ||

Demands and Recoveries The Lender will seek to provide full details of the circumstances of a claim and clear evidence as to the calculation of a claim. Where relevant, evidence should be provided detailing attempts to make recoveries. | ||

Documentation It is imperative that documentation proving eligibility and Demands is available at audit. Where cases are borderline the Lender will make efforts to provide additional documentation to justify the use of the Scheme. In some circumstances, additional documentation will need to be provided when Demand on Borrower occurs shortly following drawdown (see Claim Audit below). | ||