|

|

|

Petroleum production tax

|

| |

20. The Principal Act is amended in Part 24 by inserting the following Chapter after Chapter 3:

|

|

| |

“Chapter 4

|

|

| |

Petroleum production Tax

|

|

| |

Interpretation and application (Chapter 4)

|

|

| |

696G. (1) In this Chapter—

|

|

| |

‘cumulative field costs’, in relation to a relevant period of a company in respect of a taxable field, means the aggregate of field costs—

|

|

| |

(a) for that relevant period, and

|

|

| |

(b) for any preceding relevant period;

|

|

| |

‘cumulative field gross revenue’, in relation to a relevant period of a company in respect of a taxable field, means the aggregate of the gross revenues—

|

|

| |

(a) for that relevant period, and

|

|

| |

(b) for any preceding relevant period,

|

|

| |

less the aggregate petroleum production tax payable by the company in respect of the same taxable field for all preceding relevant periods;

|

|

| |

‘eligible expenditure’, in relation to a relevant period of a company in respect of a taxable field, means the aggregate of the amounts of—

|

|

| |

(a) all expenditure, including exploration and development expenditure wholly and exclusively incurred by the company in the carrying on of petroleum activities for the relevant period in respect of a taxable field,

|

|

| |

(b) all expenditure, including exploration and development expenditure wholly and exclusively incurred by the company in the carrying on of petroleum activities in respect of any preceding relevant period where such expenditure was not previously allowed as a deduction in computing petroleum production tax, and

|

|

| |

(c) all abandonment expenditure where an allowance may be claimed by reference to the provisions of section 695;

|

|

| |

‘field costs’, in relation to a relevant period of a company in respect of a taxable field, means the aggregate of all expenditure, including exploration expenditure, development expenditure and transportation expenditure, wholly and exclusively incurred by the company in the carrying on of petroleum activities in respect of that taxable field;

|

|

| |

‘gross revenue’ means all sales of petroleum extracted for a relevant period from a taxable field including any amounts derived from the assignment, disposal or sale of any assets, interests, options or rights attaching to or related to a taxable field;

|

|

| |

‘net income’, in relation to a relevant period of a company in respect of a taxable field, means the gross revenue less eligible expenditure incurred in respect of that taxable field;

|

|

| |

‘petroleum production tax’ has the meaning given to it by section 696H;

|

|

| |

‘relevant period’ means an accounting period or part of an accounting period which commences on or after 18 June 2014;

|

|

| |

‘R factor’ in relation to a relevant period of a company in respect of a taxable field, means an amount determined by the formula—

|

|

| |

A

|

|

| |

B

|

|

| |

where—

|

|

| |

A is the cumulative field gross revenue of the company in respect of the taxable field in relation to that relevant period, and

|

|

| |

B is the cumulative field costs of the company in respect of the taxable field in relation to that relevant period;

|

|

| |

‘specified licence’ means—

|

|

| |

(a) an exploration licence (other than a licence arising from the exercise of a licensing option issued prior to 18 June 2014),

|

|

| |

(b) a reserved area licence, or

|

|

| |

(c) a licensing option,

|

|

| |

that is granted on or after 18 June 2014;

|

|

| |

‘taxable field’ means an area which was the subject of a specified licence and which is now the subject of a petroleum lease;

|

|

| |

‘transportation expenditure’ means expenses incurred wholly and exclusively on the transportation of petroleum via pipeline from the taxable field to a place where it is first landed in the State or if produced on a platform, from the wellhead to the carrier if the carrier serves as the point of export.

|

|

| |

(2) In this Chapter, section 684 shall apply subject to the modification that the section shall be read, as if references to expenditure and activities carried on under a licence within the meaning of section 684, are references to expenditure and activities carried on under a specified licence and to any other necessary modifications.

|

|

| |

(3) For the purposes of applying this Chapter—

|

|

| |

(a) where a part of an accounting period of a company is a relevant period, all amounts referable to the accounting period shall be apportioned, on the basis of the proportion which the length of the relevant period bears to the length of the accounting period of the company, for the purpose of ascertaining any amount required to be taken into account in respect of the relevant period, and

|

|

| |

(b) expenditure incurred on or after 18 June 2014 by a company in an area which is not a taxable field but which subsequently becomes a taxable field (or part of such a field) shall be treated as if it had been incurred by the company on the day on which the area first becomes a taxable field (or part of such a field).

|

|

| |

Charge to petroleum production tax

|

|

| |

696H. (1) (a) An additional duty (in this Chapter referred to as a ‘petroleum production tax’) shall be charged for each taxable field in a relevant period of a company and the amount so charged shall be an amount calculated in accordance with paragraph (b).

|

|

| |

(b) The amount calculated in accordance with this paragraph shall be the greater of—

|

|

| |

(i) 5 per cent of the gross revenue less transportation expenditure,

|

|

| |

or

|

|

| |

(ii) (I) 10 per cent of the net income, where the R factor in relation to a taxable field is equal to 1.5,

|

|

| |

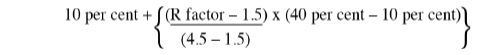

(II) an amount determined by the formula—

|

|

| |

|

|

| |

multiplied by the net income, where the R factor in relation to a taxable field is greater than 1.5 and less than 4.5, or

|

|

| |

(III) 40 per cent of the net income, where the R factor in relation to a taxable field is equal to or greater than 4.5.

|

|

| |

(2) For the purpose of calculating petroleum production tax for a relevant period, section 696 shall apply as if the provisions of that section were extended to petroleum related assets.

|

|

| |

(3) No charge to profit resource rent tax under section 696C shall apply to a taxable field to which this section applies.

|

|

| |

Petroleum production tax and corporation tax

|

|

| |

696I. In computing the amount of profits or gains to be charged to corporation tax a company shall be entitled to claim a deduction in respect of any petroleum production tax payable in respect of any taxable field for that relevant period.

|

|

| |

Provisions relating to groups

|

|

| |

696J. (1) Where eligible expenditure in respect of a taxable field is incurred by a company (in this section referred to as the ‘first company’), and

|

|

| |

(a) another company is a wholly-owned subsidiary of the first company, or

|

|

| |

(b) the first company is, at the time the eligible expenditure is incurred, a wholly-owned subsidiary of another company (in this section referred to as the ‘parent company’),

|

|

| |

then, the expenditure or so much of it as the first company specifies, may at the election of that company be deemed to be eligible expenditure in respect of the taxable field incurred—

|

|

| |

(i) in the case referred to in paragraph (a), by such other company (being a wholly-owned subsidiary of the first company) as the first company specifies, and

|

|

| |

(ii) in the case referred to in paragraph (b), by the parent company or by such other company (being a wholly-owned subsidiary of the parent company) as the first company specifies.

|

|

| |

(2) Where under subsection (1) eligible expenditure incurred by a first company is deemed to have been incurred by another company (in this subsection referred to as the ‘other company’)—

|

|

| |

(a) the expenditure shall be deemed to have been incurred by the other company at the time at which the expenditure was actually incurred by the first company, and

|

|

| |

(b) in the application of this Chapter the expenditure shall be deemed—

|

|

| |

(i) to have been incurred by the other company for the purposes of determining the cumulative field costs of that company, and

|

|

| |

(ii) not to have been incurred by the first company for the purposes of determining the cumulative field costs of that company.

|

|

| |

(3) The same expenditure shall not be taken into account in relation to the determination of cumulative expenditure for more than one taxable field by virtue of this section.

|

|

| |

(4) Subsection (5) of section 694 applies for the purposes of subsection (1) as it applies for the purposes of that subsection.

|

|

| |

Returns

|

|

| |

696K. (1) In this section ‘prescribed form’ means a form prescribed by the Revenue Commissioners or a form used under the authority of the Revenue Commissioners.

|

|

| |

(2) A company carrying on petroleum activities in a taxable field shall, in addition to the return required to be delivered under section 959I, prepare and deliver to the Collector-General on or before the specified return date, within the meaning of Part 41A, for the relevant period a full and true statement in a prescribed form of the details required by the form in respect of—

|

|

| |

(a) the amounts constituting the aggregate of the cumulative field costs for each field,

|

|

| |

(b) the amounts constituting the aggregate of the cumulative field gross revenue for each field,

|

|

| |

(c) the breakdown of the amounts specified in paragraphs (a) and (b), and

|

|

| |

(d) the amount of petroleum production tax payable in respect of each field,

|

|

| |

and of such further particulars in relation to this Chapter as may be required by the prescribed form.

|

|

| |

(3) A statement required under this section shall be made by electronic means and the relevant provisions of Chapter 6 of Part 38 shall apply.

|

|

| |

(4) An officer of the Revenue Commissioners may make such enquiries or take such actions within his or her powers as he or she considers necessary for the purposes of determining the accuracy or otherwise of any details or particulars contained in the statement referred to in subsection (2).

|

|

| |

(5) Subsection (5) of section 959I and subsections (2) and (3) of section 959O shall apply to a statement required to be delivered under this section as they apply to a return required to be delivered under Chapter 3 of Part 41A, and for that purpose a reference in those subsections to a return, other than a reference to the specified return date for the chargeable period, shall be construed as a reference to a statement under this section.

|

|

| |

(6) Section 1052 shall apply to a failure by a person to deliver a statement under this section or the details or particulars referred to in subsection (2) as it applies to a failure to deliver a return referred to in section 1052.

|

|

| |

(7) Section 1077E shall apply to an incorrect statement delivered under this section as it applies to an incorrect return or statement of a kind mentioned in any of the provisions specified in column 1 of Schedule 29.

|

|

| |

Payment of tax

|

|

| |

696L. Petroleum production tax appropriate to a relevant period is due and payable on or before the day on which a company carrying on petroleum activities in a taxable field is required to deliver a return, under section 959I, for that relevant period.

|

|

| |

Collection and general provisions

|

|

| |

696M. (1) The provisions of Part 41A relating to—

|

|

| |

(a) assessments to corporation tax, and

|

|

| |

(b) the collection and recovery of corporation tax,

|

|

| |

shall apply in relation to petroleum production tax as they apply to corporation tax charged otherwise than under this Chapter.

|

|

| |

(2) Section 1080 shall apply, with any necessary modifications, to any tax due and payable under this section as if it was an amount of corporation tax due and payable for the relevant period.

|

|

| |

(3) (a) Subject to paragraph (b), a company aggrieved by an assessment made on the company under this Chapter may appeal the assessment to the Appeal Commissioners, in accordance with section 949I, within the period of 30 days after the date of the notice of assessment.

|

|

| |

(b) Where, in accordance with this section, a company is required to make a return and account for petroleum production tax to the Collector-General, no appeal lies against an assessment until such time as the company makes the return and pays or has paid the amount of the petroleum production tax payable on the basis of that return.”.

|