| |

Notice of the making of this Statutory Instrument was published in

|

| |

“Iris Oifigiúil” of 27th September, 2011.

|

| |

In exercise of the powers conferred on it by section 32D of the

Central Bank Act 1942

(as inserted by the

Central Bank Reform Act 2010

) the Central Bank Commission hereby makes the following regulations which will be effective upon approval of the Minister for Finance:

|

| |

1. In these Regulations:

|

| |

“credit union” has the meaning given by the

Credit Union Act 1997

;

|

| |

“due date” is the date specified either in a levy notice (which will not be less than 28 days from the date of issue of a levy notice), the date referred to in Regulation 3(b), or a date otherwise referred to in these Regulations as being the latest date by which the required levy contribution must be paid;

|

| |

“levy contribution” is the amount determined as being due and owing which is calculated in accordance with the Schedule hereto;

|

| |

“supplementary levy contribution” is any supplementary levy determined as being due and owing, in addition to the levy contribution, in accordance with Schedule hereto;

|

| |

“levy notice” means a notice sent by the Bank in accordance with Regulation 3;

|

| |

“levy period” means the period prescribed in the Schedule hereto in respect of which regulated entities are obliged to pay the required levy contributions;

|

| |

“regulated entities” means persons who are subject to regulation under the designated enactments and designated statutory instruments (including financial service providers whose business is subject to regulation by an Authority that performs functions in an EEA country that are comparable to the functions performed by the Bank under a designated enactment or designated statutory instrument) and also includes former regulated entities who were regulated for part of the levy period and “regulated entity” shall be construed accordingly;

|

| |

2. (a) All persons who are, or have been, regulated entities shall pay the required levy contribution, and supplementary levy contribution (if applicable), to the Bank for each levy period in which they are, or have been, subject to regulation by the Bank. Where a regulated entity has been subject to regulation by the Bank for part of a levy period only, then the required levy contribution shall be calculated by reference to the number of days of such levy period for which the entity was regulated and any supplementary levy contribution levy contribution shall be calculated on the basis set out in the Schedule. However, where a regulated entity becomes subject to regulation by the Bank for the first time during the levy period referred to in the Schedule, it shall not be required to pay a levy contribution or supplementary levy contribution for that levy period unless specified in the Schedule.

|

| |

(b) The required levy contribution and supplementary levy contribution shall consist of the amount specified in, or calculated in accordance with, the second column of the relevant section of the Schedule as applies to the category or categories for that regulated entity.

|

| |

(c) If a regulated entity ceases to be a regulated entity during the levy period, it must pay the Bank forthwith any required levy contribution and supplementary levy contribution then due but unpaid. If the Bank has not, at the time of revocation by the Bank of an authorisation of that regulated entity, set the levy for that particular levy period, the regulated entity must pay to the Bank a levy contribution which has been calculated by reference to those Regulations in force during the previous levy period. Any supplementary levy contribution due for such levy period will be notified to the entity concerned in accordance with Regulation 3(a).

|

| |

(d) The Bank shall determine the appropriate category in the Schedule that shall apply to a regulated entity.

|

| |

(e) Where in the reasonable opinion of the Bank the obligation of a regulated entity to pay a required levy contribution or supplementary levy contribution would be likely to make that regulated entity insolvent, or, where the regulated entity is a sole trader, bankrupt, the Bank may waive the obligation of that regulated entity under these Regulations to pay a required levy contribution or supplementary levy contribution.

|

| |

(f) A regulated entity is required to pay the levies prescribed in the Schedule hereto whether or not a levy notice has been issued by the Bank under Regulation 3.

|

| |

3. (a) The Bank may send to a regulated entity a levy notice specifying the required levy contribution assessed by the Bank to be payable by that regulated entity for the levy period and the due date for submission of payment of the levy contribution. A levy notice specifying the supplementary levy contribution will issue to a regulated entity which is subject to a supplementary levy pursuant to the Schedule.

|

| |

(b) Where a levy notice has not been received by a regulated entity within 5 weeks of the date of these Regulations, then the 28th day after such date shall be the due date for the payment of the required levy contribution by such regulated entity. The levy contribution in these circumstances will be calculated by such regulated entity by reference to the Schedule hereto and shall be paid by such regulated entity to the Bank by the due date referred to in this Regulation.

|

| |

(c) The Bank may require a regulated entity in writing to make an assessment, on the basis of the information in the possession of the regulated entity, of the amount of the required levy contribution to be paid by that regulated entity for the levy period and to make a return to the Bank of such assessment. The Bank may indicate what information in respect of what periods any required assessment may be based upon. Where a regulated entity is required to make an assessment and return under this paragraph, the assessment and return must be made within such period, not less than 7 days, as the Bank may require, or where a requirement was made before the coming into force of these Regulations, within 7 days from the making of these Regulations.

|

| |

4. The required levy contributions and supplementary levy contributions shall be paid by direct bank transfer or equivalent instantaneous transfer of funds to the bank account specified in the levy notice or as is otherwise specified by the Bank.

|

| |

5. (a) A regulated entity or former regulated entity may appeal to the Bank, no later than 21 days following the date of a levy notice, to change the amount of the levy assessed for that regulated entity where it considers that the amount assessed is incorrect. Any such appeals must be in writing and shall set out the grounds of the appeal in detail and must be accompanied by the amount of required levy contribution that is not in dispute. Where relevant the appeal should include any supporting documentation or representations.

|

| |

(b) The Bank, following consideration of any such appeal, shall advise the regulated entity or former regulated entity concerned in writing of the decision and the reasons therefor and, where appropriate, details of any further payment required by the regulated entity and the due date applicable in relation to such payment.

|

| |

6. Without prejudice to any other remedy available to the Bank, where a required levy contribution or supplementary levy contribution has not been received by the due date interest shall accrue thereon in accordance with the provisions of the European Communities (Late Payment in Commercial Transactions) Regulations 2002 (

S.I. No. 388 of 2002

) or any amending or replacing legislation.

|

| |

7. Every sum payable by a regulated entity under these Regulations, including interest, for or on account of the Bank shall be recoverable by the Bank from that person as a simple contract debt in a court of competent jurisdiction.

|

| |

8. (a) Each regulated entity shall keep full and true records of all transactions which affect their liability under these Regulations and any related returns made.

|

| |

(b) A record kept by a person pursuant to paragraph (a) and, in the case of any such record that has been given by the person to another person, any copy thereof that is in the power or control of the first-mentioned person shall be retained by that person for a period of 6 years from the date of the last transaction to which the record relates, provided that this Regulation shall not apply to records of a company that have been disposed of in accordance with

section 305

(1) of the

Companies Act 1963

.

|

| |

(c) No person shall, in purported compliance with a provision of these Regulations, provide an answer or explanation, make a statement or produce or deliver any return, certificate, balance sheet or other document which is false in a material particular.

|

| |

(d) A regulated entity that—

|

| |

i) fails to comply with any requirement under these Regulations to make an assessment;

|

| |

ii) fails to maintain records in accordance with these Regulations;

|

| |

iii) in breach of paragraph (c) of this Regulation provides any answer or explanation, or makes a statement or produces or delivers any return, certificate, balance sheet or other document that is false; or

|

| |

iv) otherwise fails to comply with a provision of these Regulations thereby failing to pay, or preventing the collection of, any or all of the required levy contribution or supplementary levy contribution or thereby preventing a full and proper assessment of their liability under these Regulations,

|

| |

may be assessed by the Bank in accordance with Category L of the Schedule hereto to determine a levy contribution or otherwise assessed in accordance with these Regulations, and the Bank may issue a levy notice to such a regulated entity, or former regulated entity, without prejudice to other actions which might be determined necessary or appropriate by the Bank in such circumstances.

|

| |

(e) In the event of a regulated entity being assessed pursuant to paragraph (d) of this Regulation any monies already paid by the regulated entity in purported compliance with these Regulations shall be credited against such sum as is determined by the Bank as being due and owing by such regulated entity in a levy notice issued following such assessment.

|

| |

9. A notice authorised by these Regulations to be served on a regulated entity by the Bank may be served—

|

| |

(a) if the person is an individual—

|

| |

(i) by delivering it to that person, or

|

| |

(ii) by sending it by post addressed to that person at the persons usual or last known place of residence or business, or

|

| |

(iii) by leaving it for that person at that place,

|

| |

(b) if the person is a body corporate or an unincorporated body of persons, by sending it to the body by post to, or addressing it to and leaving it at, in the case of a company, its registered office (within the meaning of the

Companies Act 1963

) and, in any other case, its principal place of business.

|

| |

(c) in all cases, by email or by facsimile by transmitting it to that persons last known email address or facsimile number evidenced in either case by a valid sent receipt.

|

| |

10. The Bank may exercise any of the powers and perform any of the functions and duties imposed on the Bank by these Regulations through or by any of the officers or employees of the Bank.

|

| |

11. The Central Bank Act 1942 (Sections 33J and 33K) Regulations 2004 (

S.I. No. 447 of 2004

) are hereby revoked.

|

| |

|

| |

Signed for and on behalf of the CENTRAL BANK COMMISSION,

|

| |

16 September 2011.

|

| |

MATTHEW ELDERFIELD,

|

| |

Deputy Governor (Financial Regulation).

|

| |

SCHEDULE

|

| |

Levy Period: 1 January 2011 to 31 December 2011

|

| |

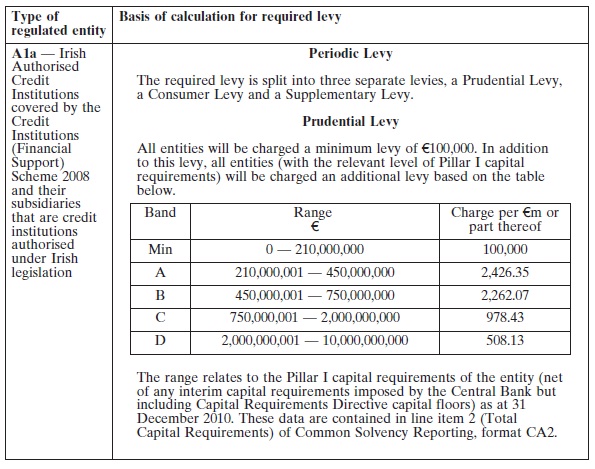

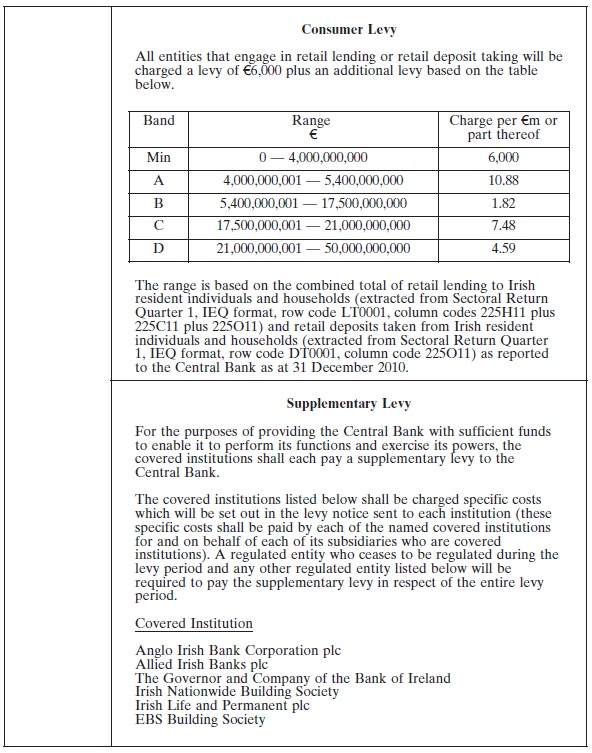

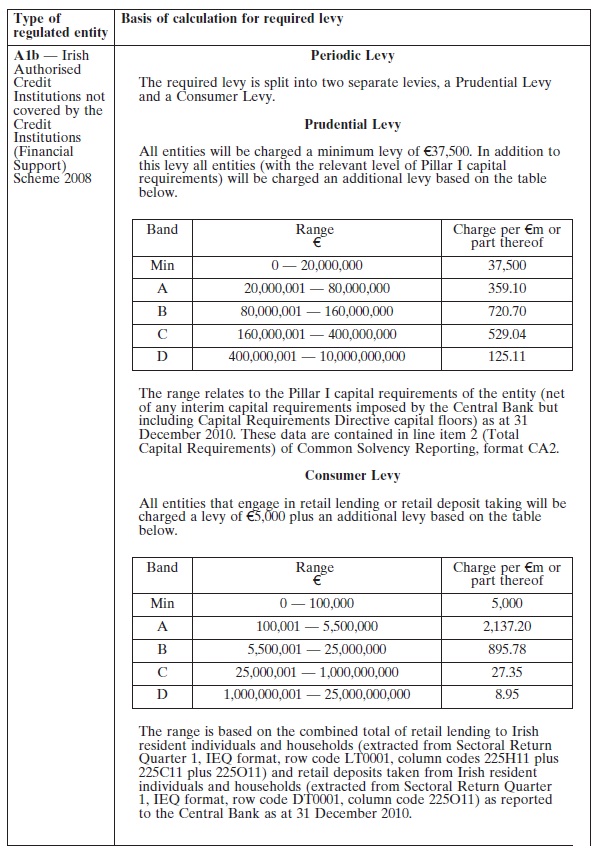

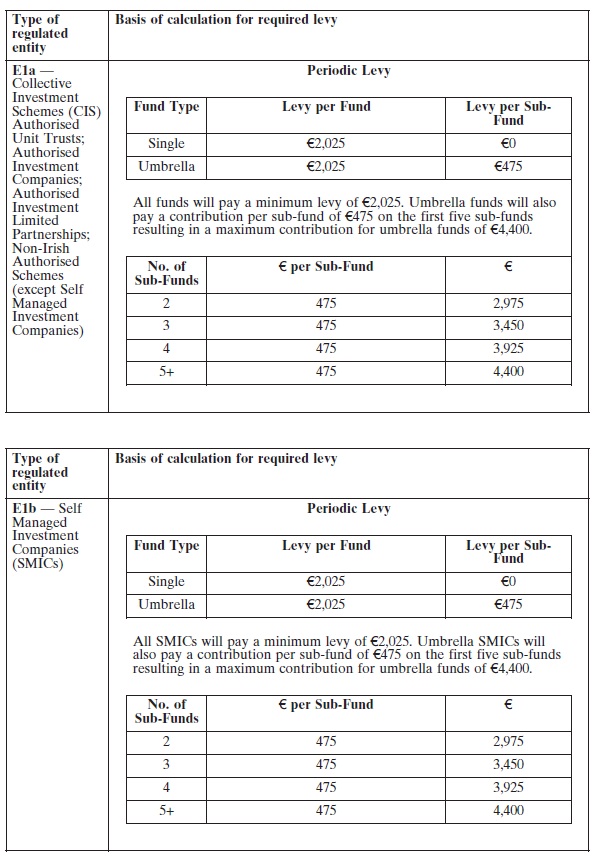

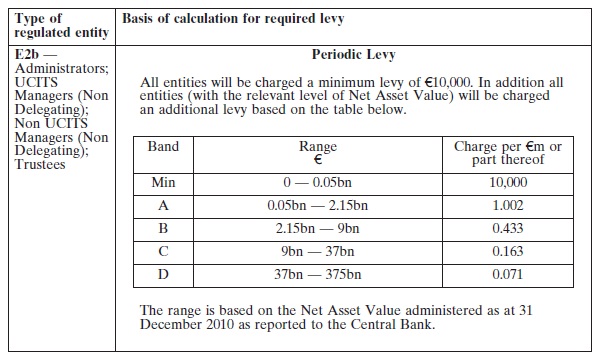

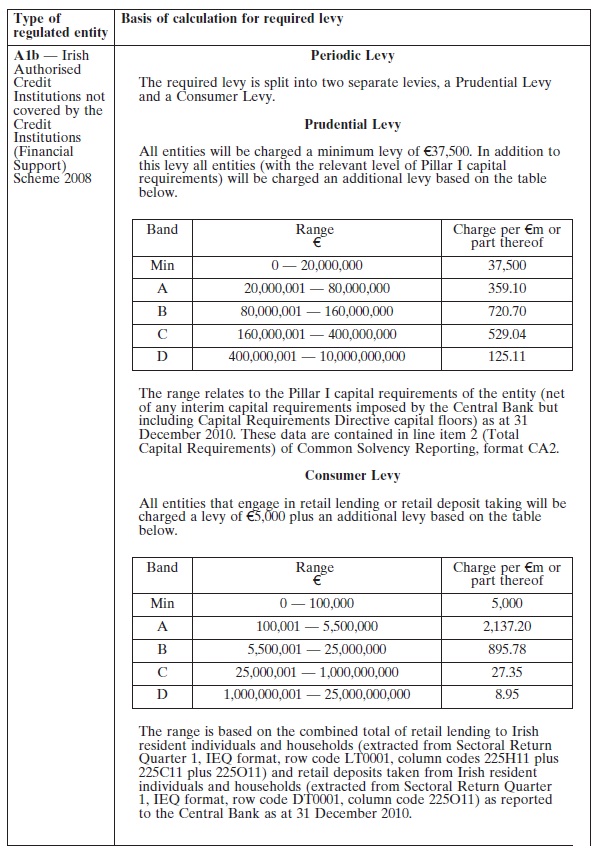

CATEGORY A

|

| |

Credit Institutions

|

| |

|

| |

|

| |

|

| |

|

| |

CATEGORY B

|

| |

Insurance Undertakings

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

B1 — Life Companies with Irish Head Office and Life Insurance Undertakings authorised in another non-EEA state operating in Ireland

|

|

Periodic LevyThe required levy is split into two separate levies, the Prudential Levy and the Consumer Levy.

Prudential Levy

All entities will be charged a minimum levy of €7,500. In addition to this amount, all entities will be charged a variable levy based on a percentage of their gross global premium income reported in the “Global Business” Form 2, Line 9, Column 1 of the statutory annual return received from life insurance companies for 2009. Minimum levy: €7,500

Variable levy: 0.006407% of gross global premium income.

Consumer Levy

All entities that engage in the writing of Irish risk business will be charged a minimum levy of €1,000. In addition to this amount all entities will be charged a variable levy based on gross global premium income written on Irish risk business reported in the “Irish Risk Business” Form 2, Line 9, Column 1 of the statutory annual return received from life insurance companies for 2009.

Minimum levy: €1,000

Variable levy: 0.002821% of gross global premium income written on Irish risk business.

|

|

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

B2 — Life Insurance Undertakings authorised in another EEA state operating in Ireland on a branch basis

|

|

Periodic Levy

Branches are not subject to a prudential charge as prudential supervision is the responsibility of the home member state regulator.

Consumer Levy

All entities that engage in the writing of Irish risk business will be charged a minimum levy of €1,000. In addition to this levy all entities will be charged a variable levy based on gross premium income written on Irish risk business.

Minimum levy: €1,000

Variable levy: 0.002821% of gross premium income written on Irish risk business.

|

|

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

B3 — Life Insurance Undertakings authorised in another EEA state operating in Ireland on a cross border basis

|

|

Periodic Levy

Entities undertaking cross border business are not subject to a prudential charge as prudential supervision is the responsibility of the home member state regulator.

Consumer Levy

Entities carrying out business in Ireland on a cross border basis are required to pay a minimum levy of €1,000. In addition to this amount all entities are required to pay a variable levy based on gross premium income written on Irish risk business.

Minimum levy: €1,000

Variable levy: 0.002821% of gross premium income written on Irish risk business.

Entities operating in Ireland on a cross border basis are obliged to determine the levy they are due to pay by reference to the details above and remit the appropriate levy to the Central Bank.

|

|

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

B4 — Non-Life Companies with Irish Head Office

|

|

Periodic Levy

The required levy is split into two separate levies, a Prudential Levy and a Consumer Levy.

Prudential Levy

All entities will be charged a minimum levy of €6,000. In addition to this amount, all entities will be charged a variable levy based on a percentage of their gross global premium income reported in the ‘Total Business’ Form 1, Line 2, Column 1 of the statutory annual return received from non-life insurance companies for 2009.

Minimum levy: €6,000

Variable levy: 0.03322% of gross global premium income.

Consumer Levy

All entities that engage in the writing of Irish risk business will be charged a minimum levy of €1,250. In addition to this amount, all entities will be charged a variable levy based on gross premium income written on Irish risk business reported in the “Irish Risk Business” Form 1, Line 2, Column 1 of the statutory annual return received from non-life insurance companies for 2009.

Minimum levy: €1,250

Variable levy: 0.009978% of gross premium income written on Irish risk business.

|

|

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

B5 — Non-Life Insurance Undertakings authorised in another EEA state operating in Ireland on a branch basis

|

|

Periodic LevyBranches are not subject to a prudential charge as prudential supervision is the responsibility of the home member state regulator.

Consumer Levy

All entities that engage in the writing of Irish risk business will be charged a minimum levy of €1,250. In addition to this amount, all entities will be charged a variable levy based on gross premium income written on Irish risk business.

Minimum levy: €1,250

Variable levy: 0.009978% of gross premium income written on Irish risk business.

|

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

B6 — Non-Life Insurance Undertakings authorised in another EEA state operating in Ireland on a cross border basis

|

|

Periodic Levy

Entities undertaking cross border business are not subject to a prudential charge as prudential supervision is the responsibility of the home member state regulator.

Consumer Levy

Entities carrying out business in Ireland on a cross border basis are required to pay a minimum levy of €1,250. In addition to this amount, all entities are required to pay a variable levy based on gross premium income written on Irish risk business. Minimum levy: €1,250

Variable levy: 0.009978% of gross premium income written on Irish risk business.

Entities operating in Ireland on a cross border basis are obliged to determine the levy they are due to pay by reference to the details above and remit the appropriate levy to the Central Bank.

|

|

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

B7 — Reinsurance Undertakings with Irish Head Office

|

|

Prudential Levy

Reinsurance undertakings carrying out business in Ireland are required to pay a prudential levy.

All entities will be charged a minimum levy of €7,500. In addition to this levy they will be charged a variable levy based on a percentage of the combined total of gross premium written (Profit and Loss Technical Accounts, Line 1 and 2) and gross technical reserves (taken from Balance Sheet, Technical Provision — Sum of Unearned Premiums plus Claims Outstanding plus Long Term Provisions plus Other Technical Provisions) reported in audited accounts for the financial year ended 2009.

Minimum levy: €7,500

Variable levy: 0.002229% of the combined total of gross premium written and gross technical reserves.

|

|

|

| |

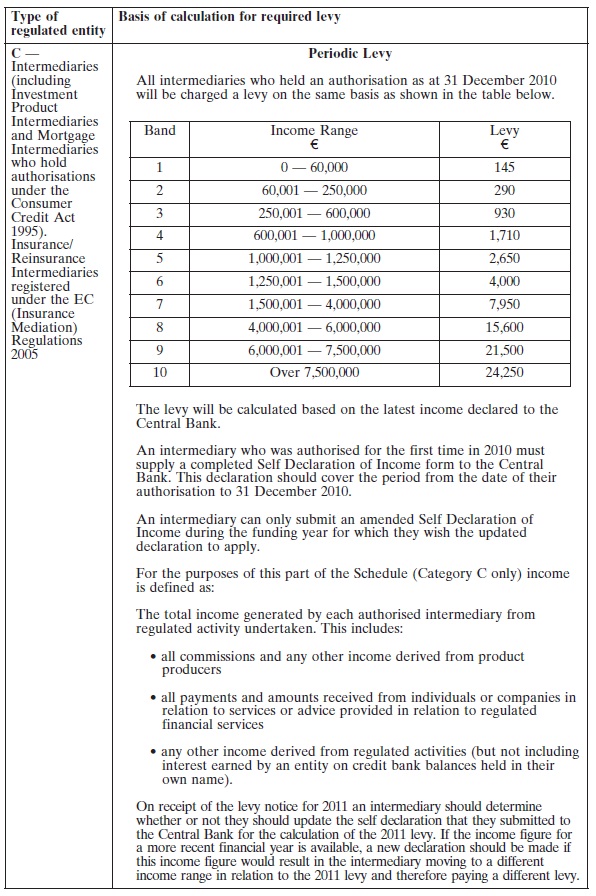

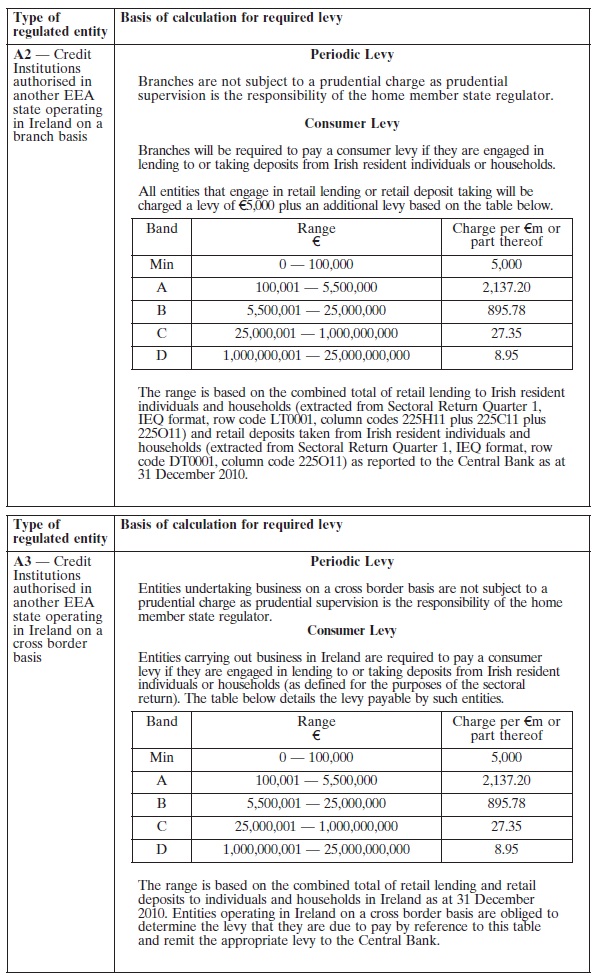

CATEGORY C

|

| |

Intermediaries

|

| |

|

| |

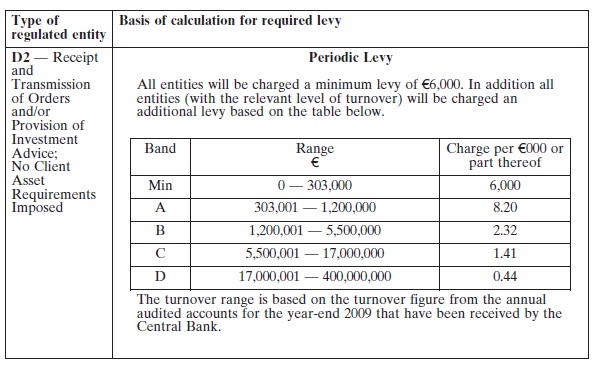

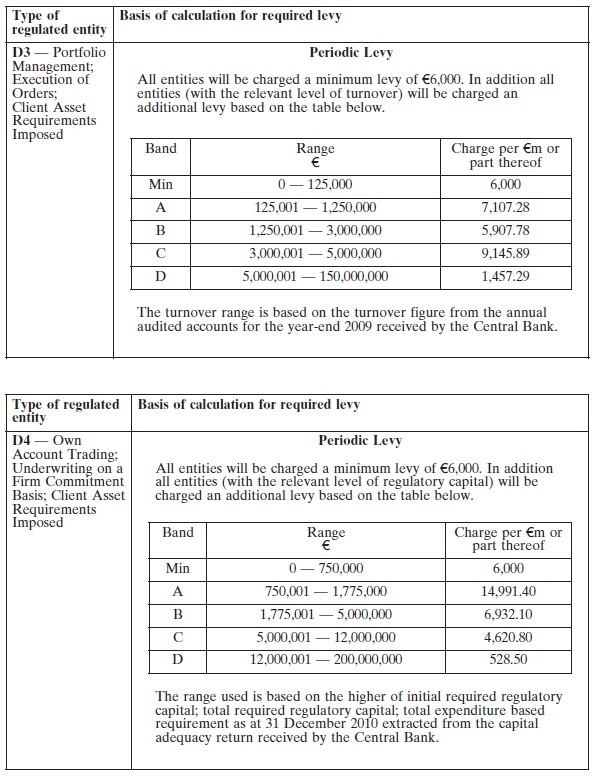

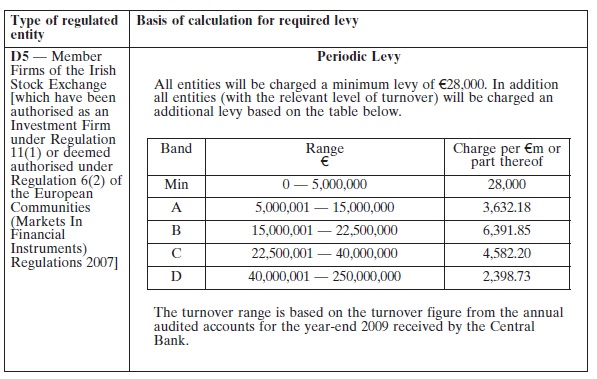

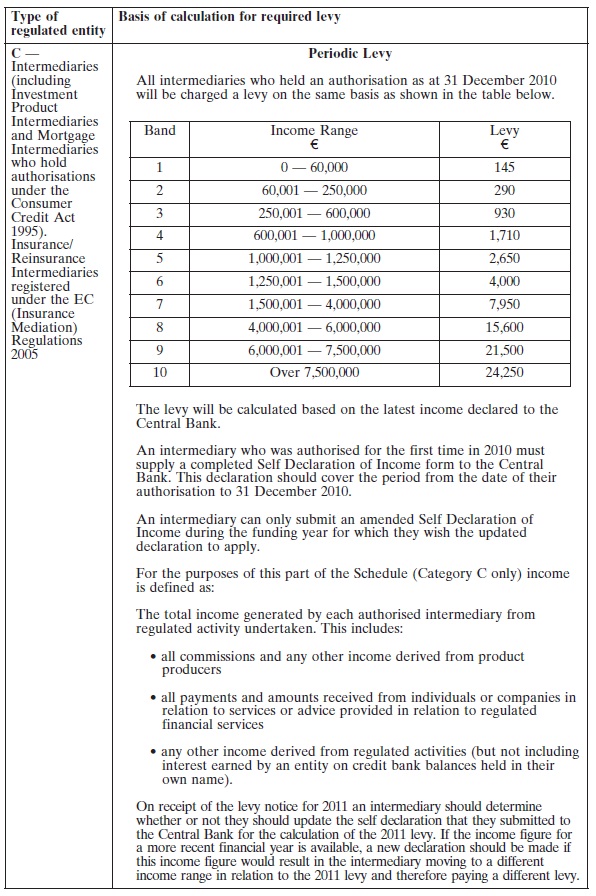

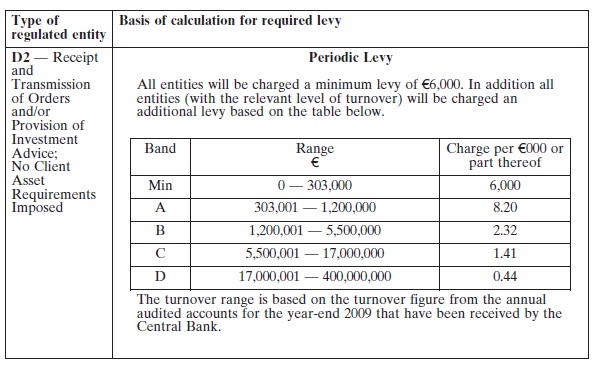

CATEGORY D

|

| |

Investment Firms(other than Investment Product Intermediaries)

|

| |

(Firms regulated under the provisions of either the

Investment Intermediaries Act, 1995

or the European Communities (Markets in Financial Instruments) Regulations 2007)

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

D1 — Designated Fund Managers

|

|

Periodic Levy

A flat rate levy of €2,600 is payable by designated fund managers.

|

|

|

| | |

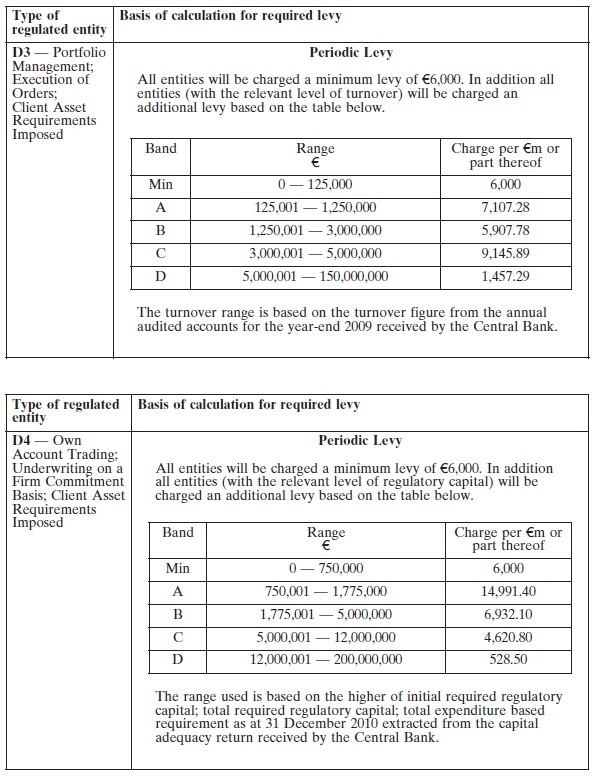

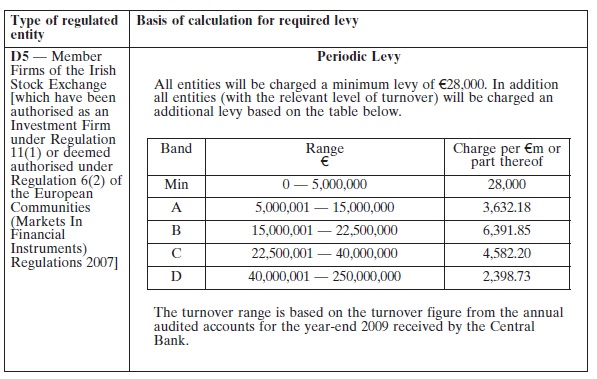

Note: In determining which of the Categories D2–D6 an entity is categorised into, consideration is given to the most senior element of their authorisation. Therefore if the authorisation of an entity allows it to be categorised as D2 or D3, it would be categorised as D3 because “Portfolio Management” is viewed as a more senior type of authorisation than “Receipt and Transmission of Orders”.

The figure used as the tariff base in Categories D2, D3 and D5 is the turnover figure from the audited accounts for the financial year-end 2009. If the reporting period for an entity’s audited accounts year-end 2009 is greater or less than twelve months, their accounting period and turnover will be pro-rated to a twelve-month period.

If a firm was newly authorised in 2009, (i.e. the relevant year for the tariff data for the 2011 levy period) the turnover figure will be extracted from the audited accounts for 2009, if available. If audited accounts for the financial period-end 2009 were not prepared, the turnover figure from the first set of audited accounts produced, pro-rated for the period of operation in 2009, will be used.

If a firm was newly authorised in 2010, the turnover that will be used to calculate the levy is the turnover figure for the period from authorisation to 31 December 2010 as reported by the firm as part of the Capital Adequacy Return.

|

|

| |

|

| |

|

| |

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

D6 — Firms authorised under the

Investment Intermediaries Act 1995

that are not captured in any other levy category for the purpose of these Regulations

|

|

Periodic Levy

A flat rate levy of €2,600 is payable.

|

|

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

D7 — Operation of Multi-Lateral Trading Facilities

|

|

Periodic Levy

A flat rate levy of €74,433 is payable.

|

|

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

D8 — Clearing Member Firms

|

|

Periodic Levy

A flat rate levy of €220,500 is payable.

Clearing Member Firms authorised in 2011 will be liable for a pro-rata levy based on the number of days for which the authorisation is held in 2011.

|

|

|

| |

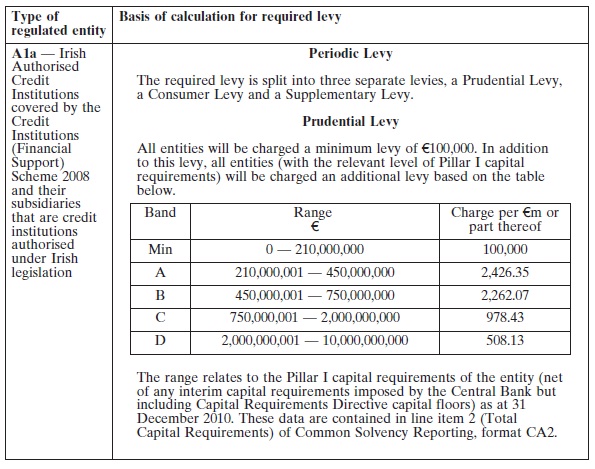

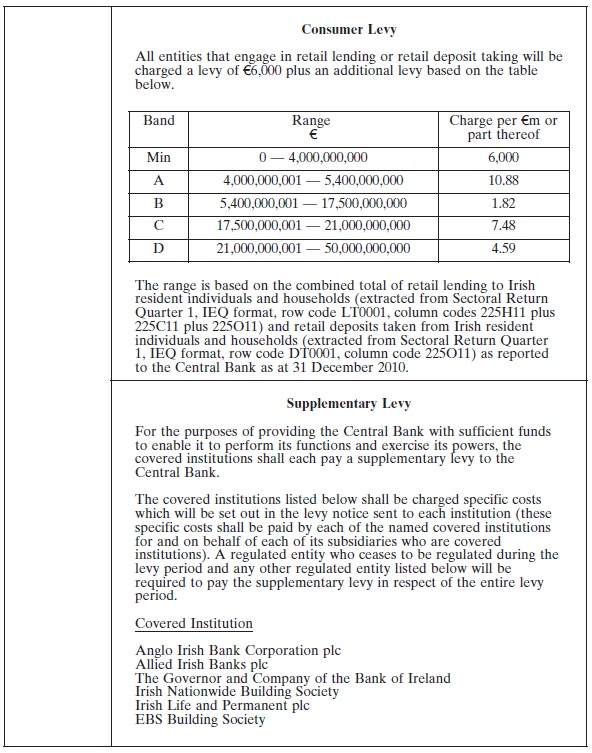

CATEGORY E

|

| |

Collective Investment Schemes and other Service Providers

|

| |

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

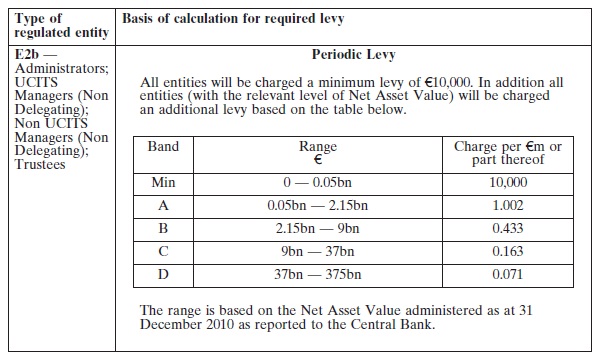

E2a — Non UCITS Managers (Delegating)

|

|

Periodic Levy

The levy for Non UCITS Managers (Delegating) is €2,050.

|

|

|

| |

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

E2c — UCITS Managers (Delegating)

|

|

Periodic Levy

The levy for UCITS Managers (Delegating) is €6,000.

|

|

|

| |

CATEGORY F

|

| |

Credit Unions

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

F — Credit Unions

|

Periodic Levy

The required levy from individual credit unions will be assessed as 0.01% of total assets reported in the annual returns setting out their balance sheet as at 30 September 2010, provided that the total levy collected or recovered from credit unions does not exceed the total costs incurred by the Central Bank in performing the functions and exercising the powers of the Central Bank under the

Credit Union Act 1997

.

|

|

| |

CATEGORY G

|

| |

Moneylenders

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

G — Moneylenders

|

Periodic Levy

A minimum levy of €1,250 will be charged for each Moneylender. In addition a variable levy based on a percentage charge on the total value of loans outstanding per the application for authorisation submitted in 2010 will also be charged. The maximum levy payable by a Moneylender is €45,000. This levy will cover Moneylenders’ operation in all Court Districts.Minimum levy: €1,250

Variable levy: 0.3296% of total value of loans outstanding Maximum levy: €45,000

|

|

| |

CATEGORY H

|

| |

Approved Professional Bodies

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

H — Approved Professional Bodies

|

Periodic Levy

Each Approved Professional Body will be charged €14,800.

|

|

| |

CATEGORY I

|

| |

Exchanges/Markets

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

I — Exchanges/Markets

|

Periodic Levy

Any Exchange/Market regulated by the Central Bank shall pay the following levy in accordance with their applicable authorised status:Regulated market authorised under the European Communities (Markets in Financial Instruments) Regulations 2007 €195,750

|

|

| |

CATEGORY J

|

| |

Bureaux de Change and Money Transmitters

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

J1 — Bureaux de Change

|

Periodic Levy

The minimum levy payable by a Bureau de Change is €2,000.In addition a variable levy based on a percentage charge on income, as at 31 December 2010, as declared to the Central Bank will also be charged.Minimum levy: €2,000

Variable levy: 0.6336% of declared income as at 31 December 2010.

|

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

J2 — Money Transmitters

|

Periodic Levy

The minimum levy payable by a Money Transmitter is €1,600.In addition a variable levy based on a percentage charge on income, as at 31 December 2009, as declared to the Central Bank will also be charged.Minimum levy: €1,600

Variable levy: 0.512% of declared income as at 31 December 2009.

|

|

| |

CATEGORY K

|

| |

E-Money Providers

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

K — E-Money Providers

|

Periodic LevyEach E-Money Provider will be required to pay a levy of €1,000.

|

|

| |

CATEGORY L

|

| |

Default Assessments

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

L — Regulated entities falling within Regulation 8(d)

|

Periodic LevyEach regulated entity falling within Regulation 8(d) shall pay a flat rate levy of €3,600.

|

|

| |

CATEGORY M

|

| |

Retail Credit Firms and Home Reversion Firms

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

M1 — Retail Credit Firms

|

Periodic Levy

The minimum levy payable by a Retail Credit Firm is €1,000.In addition, a variable levy based on a percentage charge on the value of outstanding loans, as declared to the Central Bank for 31 December 2010, will also be charged.

Minimum levy: €1,000

Variable levy: 0.003207% of value of outstanding loans as at 31 December 2010

|

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

M2 — Home Reversion Firms

|

Periodic Levy

The minimum levy payable by a Home Reversion Firm is €1,000.

In addition a variable levy based on a percentage charge on income, as at 31 December 2010, as declared to the Central Bank will also be charged.

Minimum levy: €1,000

Variable levy: 0.647% of income as at 31 December 2010

|

|

| |

CATEGORY N

|

| |

Payment Institutions

|

| | |

Type of regulated entity

|

Basis of calculation for required levy

|

|

N — Payment Institutions

|

Periodic Levy

The minimum levy payable by a Payment Institution is €1,500.

In addition, a variable levy based on a percentage charge on the Regulatory Capital Requirement for 2010, a variable levy based on a percentage charge on income for 2010 and a flat rate levy based on the number of agents will also be charged.

Minimum levy: €1,500

Variable levy: 2.2% of Regulatory Capital Requirement for 2010

Variable levy: 0.067% of income for 2010

Flat Rate Levy: €300,000 for agent numbers in excess of 1,000.

Payment Institutions authorised in 2011 will be liable for a pro-rata levy based on the number of days for which the authorisation is held in 2011.

|

|