| |

SCHEDULES.

FIRST SCHEDULE.

|

| |

Sections 43

,

44

,

49

,

50

,

51

,

52

.

|

| |

EXCISE LIQUOR LICENCES.

|

| |

A.—Manufacturers’ Licences.

|

| | |

Licence to be taken out annually.

|

Duty.

|

Corresponding existing Licence.

|

|

1. Spirits:—

|

|

|

|

(a) By a distiller of spirits.

|

Duty specified in Scale 1

|

Licence for manufacture of spirits under 6 Geo. 4, c. 81, s. 2.

|

|

(b) By a rectifier or compounder of spirits.

|

15l. 15s.

|

|

|

2. Beer:—

|

|

|

|

By a brewer of beer for sale.

|

Duty specified in Scale 2

|

Licence on which duty is payable under 43 & 44 Vict. c. 20, s. 10.

|

|

By a brewer of beer other than a brewer for sale.

|

If he is the occupier of a house of an annual value exceeding ten pounds and not exceeding fifteen pounds, and brews solely for his own domestic use, 9s.

|

Licence on which duty is payable under 43 & 44 Vict. c. 20, s. 10; 44 & 45 Vict. c. 12, s. 14; or 48 & 49 Vict. c. 51, s. 5.

|

|

|

In any other case, 4s

|

|

|

3. Sweets:—

|

|

|

|

By a maker for sale of sweets.

|

5l. 5s. - - - -

|

Licence on which duty is payable under 6 Edw. 7. c. 20, s. 7.

|

|

| |

Scale 1.

|

| |

Spirit Distiller's Licence.

|

| | |

|

|

|

|

Duty.

|

|

Number of gallons computed at proof of spirits distilled during the preceding year—

|

£ s. d.

|

|

Not exceeding 50,000 gallons - - - - -

|

10 0 0

|

|

Exceeding 50,000 gallons, for the first 50,000 gallons -

|

10 0 0

|

|

For every further 25,000 gallons or fraction of 25,000 gallons - - - - - - - -

|

10 0 0

|

|

| |

Scale 2.

|

| |

Licence to Brewer for Sale.

|

| | |

|

Duty.

|

|

Number of barrels brewed during the preceding year—

|

£ s. d.

|

|

Not exceeding 100 barrels - - - - - -

|

1 0 0

|

|

Exceeding 100 barrels—

|

|

|

For the first 100 barrels - - - - - -

|

1 0 0

|

|

For every further 50 barrels or fraction of 50 barrels -

|

0 12 0

|

|

| |

For the purposes of this scale, barrels may be taken at the option of the brewer either to be bulk barrels or standard barrels, and a standard barrel shall be taken to be 36 gallons of beer of an original gravity of 1055 degrees.

|

| |

Provisions applicable to Manufacturers’ Licences.

|

| |

Wholesale dealing authorised.

|

| |

43 & 44 Vict. c. 24.

|

| |

1. A manufacturer's licence, except in the case of a licence to a brewer not for sale, authorises not only the manufacture of the liquor to which it applies in accordance with the licence, but also wholesale dealing (subject in the case of a spirit manufacturer's licence to the provisions of the Spirits Act, 1880) in any such liquor which is the produce of the manufacture of the holder of the licence at the premises where the liquor is manufactured, and elsewhere by the manufacturer or a servant or agent of the manufacturer if the liquor is supplied to the purchaser direct from the premises where it is manufactured.

|

| |

Licence not required in certain cases.

|

| |

2. The occupier of a house of an annual value not exceeding eight pounds may brew beer solely for his own domestic use without taking out a manufacturer's licence.

|

| |

Provision as to duty in case of new distilleries or breweries which have not been in working for a full year.

|

| |

3. The duty on a manufacturer's licence granted in respect of a distillery or brewery in respect of which such a licence has not been in force at any time during the preceding year or in respect of which a licence has been in force but no spirits have been distilled or beer brewed under the licence during the preceding year, as the case may be, shall be the minimum duty payable under Scales 1 or 2, as the case may be, and where a manufacturer's licence has not been in force for a full year, the number of proof gallons distilled or the number of barrels brewed during the preceding year shall, for the purpose of payment of duty in the following year, be deemed to be a number bearing the same proportion to the number actually distilled or brewed as the whole year bears to the time for which the licence has been in force.

|

| |

4. For the purpose of the duties under Scales 1 and 2 the preceding year shall be taken to be the year ending the thirtieth day of June or such other day as the Commissioners may fix either generally or as respects any particular manufacturer.

|

| |

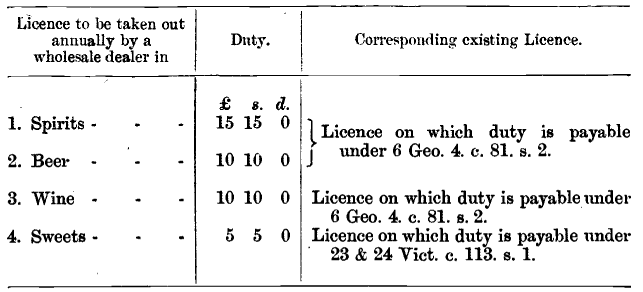

B.—Wholesale Dealers’ Licences.

|

| |

|

| |

Provisions applicable to Wholesale Dealers’ Licences.

|

| |

Retail sale not authorised.

|

| |

1. A wholesale dealer's licence authorises sale at any one time to one person of liquor in the following quantities, namely:—

|

| |

(a) In the case of spirits, wine, or sweets in any quantity not less than two gallons, or not less than one dozen reputed quart bottles; and

|

| |

(b) In the case of beer or cider in any quantity not less than four-and-a-half gallons, or not less than two dozen reputed quart bottles ;

|

| |

but not in any less quantities.

|

| |

Authority to manufacturers to sell wholesale.

|

| |

2. A wholesale dealer's licence need not be taken out by the holder of a manufacturer's licence so far as respects the sale of liquor being the produce of the manufacturer of the holder of the manufacturer's licence at the premises where the liquor is manufactured, and elsewhere by the manufacturer or a servant or agent of the manufacturer, if the liquor is supplied to the purchaser direct from the premises where it is manufactured.

|

| |

Sale of sweets authorised by wine dealer's licence.

|

| |

3. A person holding the licence to be taken out by a wholesale dealer in wine may deal wholesale in sweets as well as wine without taking out any further wholesale dealer's licence.

|

| |

Reduced duty where retailer's licence is taken out as well.

|

| |

4. Where a wholesale dealer's licence for the sale of any liquor is taken out by a person who is the holder of a licence authorising him to sell the same liquor by retail, the duty payable on the wholesale dealer's licence shall be reduced by fifty per cent. Provided that this provision shall not operate so as to reduce the total amount payable for the wholesale dealer's licence and the retailer's licence for any liquor below that payable for the wholesale dealer's licence alone.

|

| |

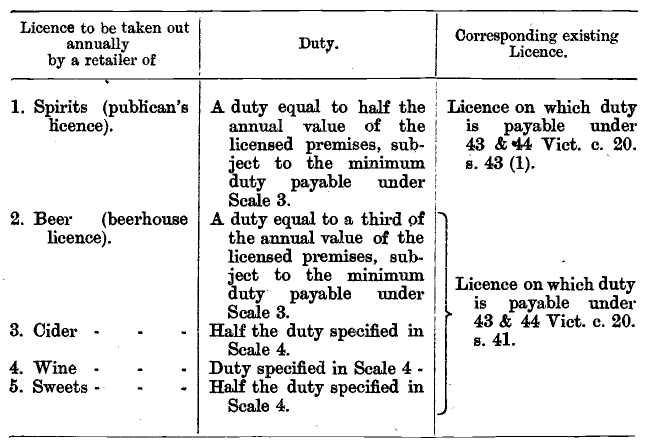

C.—Retailers’ Licences.

|

| |

I.—On-Licences.

|

| |

|

| |

Scale 3.

|

| |

Section 45

.

|

| |

Minimum Duty payable for Publican's and Beerhouse Licences.

|

| |

There shall be a minimum duty payable on the publican's licence and the beerhouse licence respectively, as shown in the following scale and where the annual value of any licensed premises is less than the annual value to which the minimum duty corresponds, duty shall be charged as if the premises were of that annual value.

|

| | |

Population.

|

Minimum Duty.

|

|

Publican's Licence.

|

Beerhouse Licence.

|

|

In Great Britain—

|

£ s.

|

£ s.

|

|

In areas which are not urban areas, and in urban areas with a population of less than 2,000 -

|

5 0

|

3 10

|

|

In urban areas with a population of—

|

|

|

|

2,000 and less than 5,000 - - - -

|

10 0

|

6 10

|

|

5,000 ” ” 10,000 - - - -

|

15 0

|

10 0

|

|

10,000 ” ” 50,000 - - - -

|

20 0

|

13 0

|

|

50,000 ” ” 100,000 - - - -

|

30 0

|

20 0

|

|

100,000 or above - - - - - -

|

35 0

|

23 10

|

|

In Ireland—

|

|

|

|

In areas which are not urban areas, and in urban areas with a population of less than 10,000 -

|

5 0

|

3 10

|

|

In urban areas with a population of 10,000 or above - - - - - - - -

|

7 10

|

4 0

|

|

| |

8 Edw. 7. c. clxiv.

|

| |

For the purposes of this scale an urban area means any county borough, borough, or other urban district; and the administrative county of London shall be deemed to be a single urban area; and population shall be calculated according to the last published census for the time being. The boroughs of Burslem, Hanley, Longton, and Stoke-upon-Trent, and the urban districts of Fenton and Tunstall, which, in pursuance of the Borough of Stoke-on-Trent Order, 1908, as confirmed by the Local Government Board's Provisional Order Confirmation (No. 3) Act, 1908, are, as from the thirty-first day of March nineteen hundred and ten, to form (subject to certain provisions as to differential rating and other matters to have effect for a period of twenty years) one borough to be called the borough of Stoke-upon-Trent, shall, notwithstanding anything contained in that Order, continue for the period of twenty years from the said date to be separate urban areas for the purposes of this scale.

|

| |

Scale 4.

|

| |

Wine Retailer's On-Licence.

|

| | |

|

Duty.

|

|

Annual value of licensed premises—

|

£ s. d.

|

|

Under 30l. - - - - - - - -

|

4 10 0

|

|

30l. and under 50l. - - - - - - - -

|

6 0 0

|

|

50l. ” 100l. - - - - - - - -

|

9 0 0

|

|

100l. and over - - - - - - - -

|

12 0 0

|

|

| |

II.—Off-Licences.

|

| | |

Licence to be taken out annually by retailer of

|

Duty.

|

Corresponding existing Licence.

|

|

1. Spirits - -

|

Duty specified in Scale 5.

|

As respects England, the additional retail licence on which duty is payable under 24 & 25 Vict. c. 21. s. 1.

|

|

|

|

As respects Scotland, licence on which duty is payable under 16 & 17 Vict. c. 67. s. 8.

|

|

|

|

As respects Ireland, licence on which duty is payable under 6 Geo. 4. c. 81. s. 2, and 8 & 9 Vict. c. 64. s. 1.

|

|

|

|

Additional liqueur licence on which duty is payable under 11 & 12 Vict. c. 121. s. 10.

|

|

2. Beer - -

|

Duty specified in Scale 6.

|

As respects England, the beer retailer's licence and the additional beer dealer's retail licence on which duty is payable under 43 & 44 Vict. c. 20. s. 41.

|

|

|

|

As respects Scotland, licence on which duty is payable under 16 & 17 Vict. c. 67. s. 8.

|

|

|

|

As respects Ireland, dealer's additional retail licence on which duty is payable under 43 & 44 Vict. c. 20. s. 41.

|

|

3. Cider - -

|

2l. - - -

|

Licence on which duty is payable under 43 & 44 Vict. c. 20. s. 41.

|

|

4. Wine - -

|

Duty specified in Scale 7.

|

As respects England and Ireland, licence on which duty is payable under 43 & 44 Vict. c. 20. s. 41.

|

|

|

|

As respects Scotland, licence on which duty is payable under 39 & 40 Vict. c. 16. s. 4.

|

|

|

|

Licence as a dealer in wine, on which duty is payable under 6 Geo. 4. c. 81. s. 2, so far as such a licence authorises sale by retail.

|

|

5. Sweets - -

|

2l. - - -

|

Licence on which duty is payable under 43 & 44 Vict. c. 20. s. 41.

|

|

| |

Scale 5.

|

| |

Spirit Retailer's Off-Licence.

|

| | |

|

Duty.

|

|

Annual value of licensed premises—

|

£

|

s.

|

d.

|

|

Not exceeding 10l. - - - -

|

10

|

0

|

0

|

|

Exceeding 10l. and not exceeding 20l. - -

|

11

|

10

|

0

|

|

” 20l. ” ” 30l. - -

|

14

|

0

|

0

|

|

” 30l. ” ” 50l. - -

|

15

|

0

|

0

|

|

” 50l. ” ” 75l. - -

|

16

|

0

|

0

|

|

” 75l. ” ” 100l. - -

|

17

|

10

|

0

|

|

” 100l. ” ” 250l. - -

|

19

|

0

|

0

|

|

” 250l. ” ” 500l. - -

|

30

|

0

|

0

|

|

” 500l. - - - - -

|

50

|

0

|

0

|

|

| |

Scale 6.

|

| |

Beer Retailer's Off-Licence.

|

| | |

|

Duty.

|

|

Annual value of licensed premises—

|

£

|

s.

|

d.

|

|

Not exceeding 10l. - - - -

|

1

|

10

|

0

|

|

Exceeding 10l. and not exceeding 20l. - -

|

2

|

0

|

0

|

|

” 20l. ” ” 30l. - -

|

2

|

10

|

0

|

|

” 30l. ” ” 50l. - -

|

3

|

0

|

0

|

|

” 50l. ” ” 75l. - -

|

3

|

10

|

0

|

|

” 75l. ” ” 100l. - -

|

4

|

0

|

0

|

|

” 100l. ” ” 250l. - -

|

4

|

10

|

0

|

|

” 250l. ” ” 500l. - -

|

7

|

0

|

0

|

|

” 500l. - - - - -

|

10

|

0

|

0

|

|

| |

Scale 7.

|

| |

Wine Retailer's Off-Licences.

|

| | |

|

Duty.

|

|

Annual value of licensed premises—

|

£

|

s.

|

d.

|

|

Not exceeding 20l. - - - -

|

2

|

10

|

0

|

|

Exceeding 20l. but not exceeding 30l. - -

|

3

|

0

|

0

|

|

” 30l. ” ” 50l. - -

|

3

|

10

|

0

|

|

” 50l. ” ” 75l. - -

|

4

|

0

|

0

|

|

” 75l. ” ” 100l. - -

|

4

|

10

|

0

|

|

” 100l. ” ” 250l. - -

|

5

|

0

|

0

|

|

” 250l. ” ” 500l. - -

|

7

|

0

|

0

|

|

” 500l. - - - - -

|

10

|

0

|

0

|

|

| |

Provisions applicable to Retailers’ Licences.

|

| |

General.

|

| |

Meaning of sale by retail.

|

| |

1. A retailer's licence authorises sale at any one time to one person of liquor in the following quantities, namely,—

|

| |

(a) in the case of spirits, wine, or sweets, in any quantity not exceeding two gallons or not exceeding one dozen reputed quart bottles; and

|

| |

(b) in the case of beer or cider, in any quantity not exceeding four and a half gallons or not exceeding two dozen reputed quart bottles ;

|

| |

but not in any larger quantities.

|

| |

Restriction on holding of retailers’ off-and on-licences.

|

| |

2. A retailer's off-licence shall not be granted to the holder of a retailer's on-licence if the off-licence authorises the sale of any liquor which the holder of the on-licence is not authorised to sell by retail under his on-licence, and any retailer's off-licence granted in contravention of this provision shall be void.

|

| |

Sale of cider under beer licence.

|

| |

3. A person holding the licence to be taken out by a retailer of beer may sell by retail cider as well as beer without taking out any further retailer's licence.

|

| |

Sale of sweets under wine licence.

|

| |

4. A person holding the licence to be taken out by a retailer of wine may sell by retail sweets as well as wine without taking out any further retailer's licence.

|

| |

Provisions applicable to Retailers’ On-Licences.

|

| |

Sale off authorised as well as sale on.

|

| |

1. A retailer's on-licence authorises sale by retail of the liquor to which the licence extends for consumption either on or off the premises.

|

| |

Sale of any liquor under publican's licence.

|

| |

2. A person holding the on-licence to be taken out by a retailer of spirits may sell by retail beer, cider, wine, and sweets, as well as spirits, without taking out any further retailer's licence.

|

| |

Option to pay duty in accordance with annual compensation value in certain cases.

|

| |

3. Where it is shown to the satisfaction of the Commissioners that the annual value of the premises exceeds five hundred pounds, a retailer's on-licence may be granted at the option of the licence holder on payment of an amount equal to one-third of the annual licence value as certified for the purposes of this Act, and where that amount has not been certified for the purpose of the register to be prepared under this Act, the licence holder may require that amount to be so certified:

|

| |

Provided that—

|

| |

(a) the duty payable in pursuance of this provision shall not be less than two hundred and fifty pounds in the case of fully-licensed premises, or in the case of a beerhouse one hundred and sixty-six pounds thirteen shillings and fourpence; and

|

| |

(b) where the annual licence value has not been certified, the licence shall be granted on a provisional payment of the minimum duty payable under this provision, or of one-fifth of the full duty, whichever is the higher, and, upon the annual licence value being certified, the duty shall be adjusted by the return of any over-payment or by the recovery, as a debt to His Majesty, of any sum by which the amount paid falls short of the amount which is found to be payable.

|

| |

This provision shall apply to premises, whatever their annual value, if they are structurally adapted for use as an hotel and are bonâ fide so used, and it is shown to the Commissioners that it is impracticable to obtain a reduction of duty in respect of the premises under the provisions of this Act enabling such a reduction to be obtained for hotels in certain cases, owing to the fact that visitors resort to the place where the premises are situated only during certain seasons of the year. In such a case, the minimum amount of duty payable shall instead of two hundred and fifty pounds be thirty pounds in the case of premises of an annual value not exceeding one hundred pounds, and in any other such case fifty pounds.

|

| |

Condition attached to theatre licence.

|

| |

4. The maximum amount of duty payable in respect of a retailer's on-licence granted to the proprietor or occupier of premises adapted to be and bonâ fide used only for any of the following purposes, namely, for judicial or public administrative purposes or as a theatre or place of public or private entertainment, or as public gardens, picture galleries, or exhibitions, or for any similar purpose to which the holding of the licence is merely auxiliary, shall, in the case of a theatre the annual value of which does not exceed two thousand pounds, be twenty pounds, and in any other case be fifty pounds, but it shall be a condition of any such licence that intoxicating liquor is not sold under the licence except while the premises are open and being used, and to persons bonâ fide using the premises, for the said purposes.

|

| |

Maximum duty in respect of refreshment rooms.

|

| |

5. The maximum amount of duty payable in respect of a retailer's on-licence granted to the proprietor or occupier of premises adapted to be and bonâ fide used as refreshment rooms at a railway station shall be fifty pounds.

|

| |

Provision as to duty where premises include a place of public entertainment.

|

| |

6. Where any premises include a music hall or other similar place of public entertainment (herein-after referred to as a place of entertainment), a retailer's on-licence may be granted, at the option of the licence holder, on payment of a duty of fifty pounds, together with such sum as would be payable as duty under this Act on the part of the premises not used as the place of entertainment if that part were a separate set of premises, but it shall be a condition of any such licence that intoxicating liquor is not sold under the licence in the place of entertainment except whilst that place is open and being used, and to persons bonâ fide using that place, as a place of entertainment.

|

| |

Provisions applicable to Retailers’ Off-Licences.

|

| |

Restriction to sale off.

|

| |

1. A retailer's off-licence authorises the sale by retail of the liquor to which the licence extends for consumption off the premises only.

|

| |

Minimum quantity of spirits to be sold.

|

| |

2. A person holding the off-licence to be taken out by a retailer of spirits may not sell spirits in open vessels, or in. England in any quantity less than one reputed quart bottle.

|

| |

Minimum quantity of wine to be sold.

|

| |

3. A person holding the off-licence to be taken out by a retailer of wine may not sell wine in open vessels or in England or Ireland in any quantity less than one reputed pint bottle.

|

| |

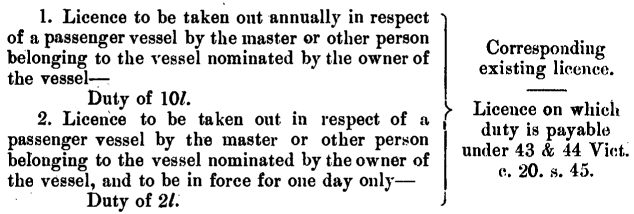

D.—Passenger Vessel Licences.

|

| |

|

| |

Provisions applicable to Passenger Vessel Licences.

|

| |

Authority to sell.

|

| |

1. A passenger vessel licence granted in respect of any vessel authorises the sale by retail while the vessel is engaged in carrying passengers of any intoxicating liquor on the vessel to passengers for consumption on the vessel.

|

| |

Authority to sell tobacco.

|

| |

2. A passenger vessel licence authorises the sale of tobacco as well as the sale of intoxicating liquor.

|

| |

Transfer of licence in ordinary cases.

|

| |

3. In the event of any person to whom a passenger vessel's licence has been granted ceasing to be master of the vessel or to belong to the vessel, the licence may be transferred to any person who is for the time being master of the vessel or is for the time being a person belonging to the vessel and nominated by the owner of the vessel for the purpose.

|

| |

Transfer of licence on sale or lease of vessel.

|

| |

4. In the event of the transfer of the vessel to some other owner, the licence granted under this section shall cease to have effect as respects that vessel, but may, in that event and in the event of the loss of the vessel, be transferred, on the application of the owner of the vessel, to the master of some other vessel belonging to him or to some person belonging to such other vessel and nominated by the owner for the purpose.

|

| |

Jurisdiction.

|

| |

5. For the purpose of giving jurisdiction, any sale of liquor on a passenger vessel shall be deemed to have taken place either where it has actually taken place or in any place in which the vessel may be found.

|

| |

E.—Railway Restaurant Car Licences.

|

| |

Licence to be taken out annually in respect of a railway restaurant car by the railway company or other person owning the car—

|

| |

Duty of 1l.

|

| |

Provisions applicable to Railway Restaurant Car Licences.

|

| |

1. A licence for a railway restaurant car may be granted without the production of a justice's licence or certificate.

|

| |

Authority to sell.

|

| |

2. A railway restaurant car licence granted in respect of a car in which passengers can be supplied with meals authorises the sale by retail to passengers on the car of any intoxicating liquor for consumption on the car.

|

| |

F.—Occasional Licences.

|

| |

Occasional licences granted under section thirteen of the Revenue Act, 1862 (25 & 26 Vict. c. 22), section twenty of the Revenue Act, 1863 (26 & 27 Vict. c. 33), and section five of the Revenue Act, 1864 (27 & 28 Vict. c. 18).

|

| |

Duties:—

|

| |

(a) Sale of any intoxicating liquor—per day, 10s.

|

| |

(b) Sale of beer or wine only—per day, 5s.

|

| |

Provisions applicable to Occasional Licences.

|

| |

Extension to United Kingdom.

|

| |

27 & 28 Vict. c. 18.

|

| |

An occasional licence may be granted under section five of the Revenue Act, 1864, for the sale of beer only, in Scotland and Ireland as well as in England, and for the sale of wine only, in Scotland as well as in England and Ireland; and any provisions relating to occasional licences shall apply accordingly.

|